Breast Implants Market By Product Type (Silicone Implant, Form-stable Implant, Saline Implant, Structured Saline Implant), By Application (Reconstructive Surgery, Cosmetic Surgery), By End-user (Hospital, Cosmetology Clinic), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

36953

-

May 2023

-

184

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

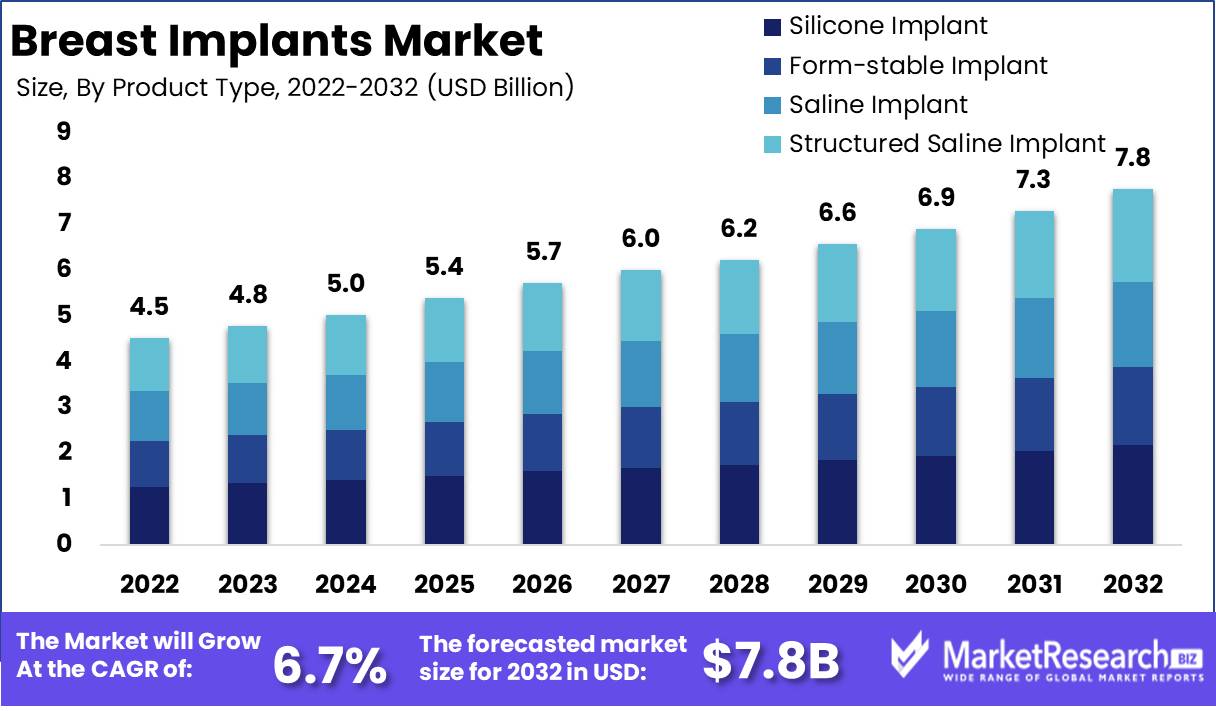

Breast Implants Market size is expected to be worth around USD 7.8 Bn by 2032 from USD 4.5 Bn in 2022, growing at a CAGR of 6.7% during the forecast period from 2023 to 2032.

Breast implantation, a popular cosmetic surgery procedure, attracts women worldwide. Breast implants satisfy many deep-seated cravings by skillfully enhancing breast size and shape. Breast augmentation is a common cosmetic surgery operation.

As patients increasingly seek to achieve their desired physical appearances and boost their self-esteem, the popularity of breast augmentation procedures continues to climb, reflecting the enduring appeal of this cosmetic surgery option. According to the latest data from the American Society of Plastic Surgeons, there were an estimated 300,000 breast augmentation procedures performed in the United States in 2022. This means that approximately 300,000 breast implants were placed in the US in 2022, marking a 4% growth since 2019.

The breast implants market is surging due to a combination of factors. Growing aesthetic concerns, driven by the desire for enhanced self-esteem, are boosting demand for breast augmentation. Technological advancements, like cohesive gel implants, are enhancing safety and attracting both patients and surgeons.

For Instance, in a groundbreaking development, researchers from Queen's University Belfast have introduced a new era in breast cancer management with the creation of personalized 4D printed "smart" implants. This pioneering technology marks the first-ever application of 4D printing in the manufacturing of breast cancer implants.

To tackle ethical concerns, the breast implant industry is emphasizing transparency, clarity, and accountability. As patients increasingly seek a sense of control, there is a growing demand for comprehensive information about the intricacies of the implantation process. This includes a thorough understanding of expected outcomes, potential hidden issues, and the nuances of post-procedural care. Surgeons are also expected to provide detailed explanations of implant materials and procedures to potential recipients, building a strong foundation of patient satisfaction and knowledge.

Driving factors

Market Momentum

The breast implant market is experiencing significant growth and innovation. Various factors are reshaping the market, leading to advancements in breast enhancement and reconstruction surgeries. These procedures have gained societal acceptance, especially among social media influencers. Advances in implant materials and design technology have improved the safety and appearance of breast implants, benefiting both patients and surgeons.

Influence of Social Acceptance

Another significant factor influencing the growing market is the increased awareness surrounding Breast Cancer Diagnostics and prophylactic mastectomy. Post-mastectomy reconstruction surgeries are seen as a way to promote emotional and social well-being. With higher incomes, there has been an increase in spending on cosmetic surgeries, which has further contributed to the breast implant market's growth. Economic growth has made these procedures more accessible to a broader range of people.

Fashion Industry Is A Major Catalyst

The fashion industry has shown a strong interest in breast implants, contributing to the growing popularity of these surgeries among women. There is a widespread trend of people openly sharing their surgical experiences on social media platforms. Additionally, the increasing number of breast cancer survivors seeking reconstruction procedures has boosted the demand for breast implants. The availability of innovative breast implant designs and materials provides patients with a wide range of options to choose from.

Healthcare Accessibility and Success Rates

Another factor driving market growth is the improvement in healthcare systems and increased access to medical services. With the expansion of medical facilities, more people are considering breast implant surgeries as a viable option. The eighth factor contributing to the market's growth is the proven success and safety of these surgeries, which are convincing more individuals to opt for them. Lastly, the availability of insurance coverage for such procedures and the growth of medical tourism in emerging economies are additional factors propelling the market's expansion.

Restraining Factors

High expense of breast implant procedures

One of the main factors limiting the breast implant market is the high cost associated with the procedure. Breast implant surgeries are typically considered cosmetic and are not covered by health insurance. Depending on factors like the surgeon's experience, location, the materials used, and other variables, these surgeries can range from $5,000 to $10,000. For many women, the steep expense of breast implants can be a significant barrier, especially when they have to pay for the procedure out of pocket.

Risk of complications and adverse effects from breast implants

The risk of complications and adverse effects associated with breast implants is another significant factor restraining the breast implant market. Several hazards are associated with breast implant surgeries, including pain, infection, hemorrhage, and altered sensation. In certain instances, implants may rupture, necessitating their removal or replacement, which incurs additional costs for the patient. There may also be fatal long-term hazards, such as capsular contracture and breast implant-associated anaplastic large cell lymphoma (BIA-ALCL).

Strict regulations on the materials and designs of breast implants

The stringent regulations on breast implant materials and designs are an additional factor restraining the Breast Implants Market. The FDA has established stringent guidelines for the manufacture and use of breast implants in the United States. Manufacturers of breast implants must adhere to these standards, which raises production costs and effects the implants' affordability. Due to the risks associated with breast implants, the FDA has also imposed restrictions on the use of specific materials and designs, limiting the options available to women who desire to undergo breast implant surgery.

By Product Type Analysis

The silicone implants segment is the largest and most dominant segment in the breast implant market. Silicone implants, which are made up of silicones gel, have been in use since the 1960s. These implants are widely accepted due to their natural feel and look. The silicone implants market is driven by increasing medical tourism, an aging population, and the rise in breast reconstruction surgeries. The adoption of silicone implants has increased in emerging economies due to economic development and rising disposable income.

The consumer trend and behavior towards silicone implants have been influenced by the availability of different breast implant sizes, the safety profile of silicone implants, and advancements in surgical techniques. Patients are seeking a more natural look and feel, which silicone implants offer compared to saline implants. The silicone implants segment is expected to register the fastest growth rate over the forthcoming years due to various factors such as increasing disposable income, growing medical tourism, a rise in the aesthetic consciousness of individuals, and consumer readiness for surgical procedures.

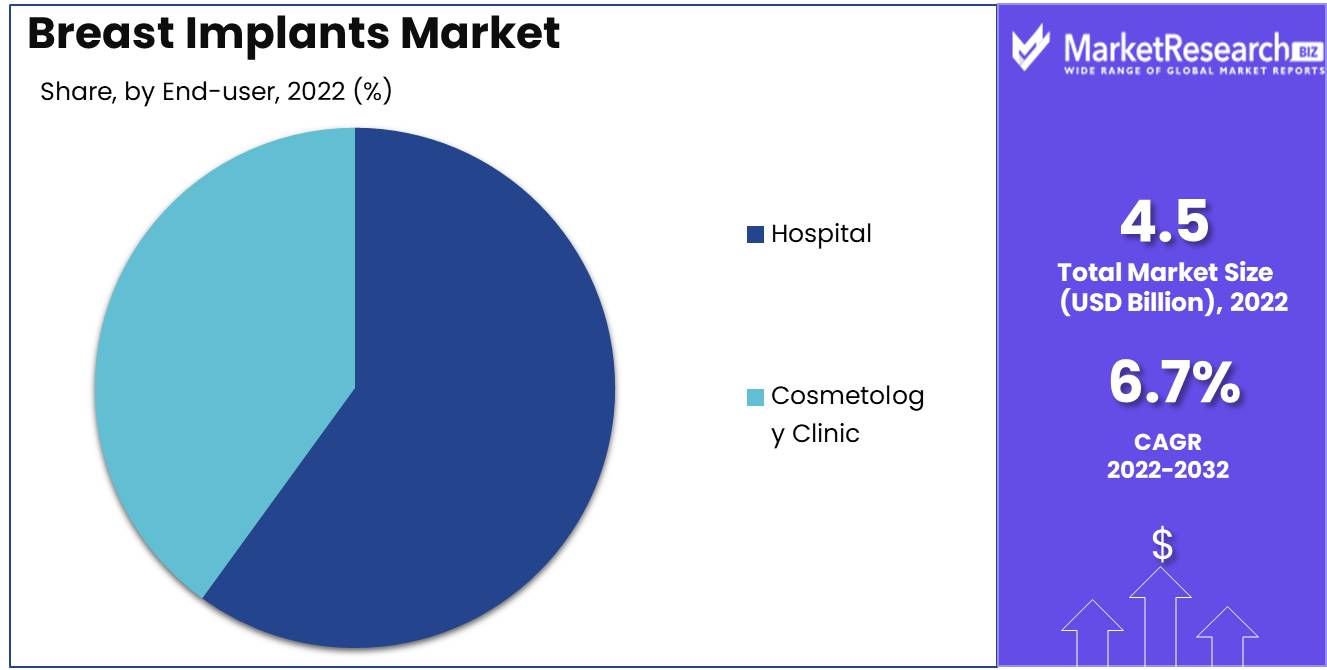

By End-User Analysis

The hospitals segment dominates the breast implant market due to the complexity of breast implant surgeries, requiring specialized medical care and surgical expertise. Hospitals offer a safe, sterile environment necessary for these procedures, leading to their dominance in the market. The hospitals segment is expected to grow due to advancements in medical infrastructure and increased medical tourism. Additionally, the rise in the incidence of breast cancer and the need for breast reconstruction surgeries is expected to boost the demand for hospitals offering breast implant surgeries.

Consumers prefer hospitals for breast implant surgeries as they offer a safe and sterile environment that is necessary for these procedures. Hospitals also offer the necessary expertise and equipment required for breast implant surgeries, leading consumers to consider them a reliable option. The hospitals segment is expected to register the fastest growth rate over the forthcoming years due to factors such as increasing medical tourism, rising awareness of the benefits of breast implant surgeries, and favorable medical infrastructure.

Key Market Segments

By Product Type:

- Silicone Implant

- Form-stable Implant

- Saline Implant

- Structured Saline Implant

By Application:

- Reconstructive Surgery

- Cosmetic Surgery

By End-user:

- Hospital

- Cosmetology Clinic

Growth Opportunity

Minimal Invasive Techniques

Breast implant surgery has come a long way since the traditional, invasive techniques. Due to their lower risk and speedier recovery time, minimally invasive procedures are gaining popularity. These procedures involve making smaller incisions and inserting the implant with specialized instruments, resulting in less scarring and a more natural look. This trend has led to an increase in the demand for breast implants, as an increasing number of women are willing to undertake the procedure due to its decreased risk and recovery time.

Customized Breast Implant Treatments

One difficulty associated with breast implants is that no two women are identical. Each woman's body has distinct requirements and characteristics that must be addressed prior to the procedure. There is a growing trend toward personalized breast implant solutions to address this issue. These solutions involve using advanced technologies such as 3D imaging and modeling to construct implants tailored to the specific needs of each woman. This individualized approach produces a more natural-looking and comfortable implant that fits the patient's body better.

Adoption of Technology for 3D Printing

In the field of plastic surgery, 3D printing is a relatively new technology, but it is already gathering traction. This technology enables the construction of implants and prosthetics that are more precise and closely match the anatomical structure of the patient. Using 3D printing technology, surgeons can construct customized breast implants that suit the patient's body more naturally. This technology also expedites production and reduces the risk of complications resulting from inadequately fitting implants. As the use of 3D printing in healthcare continues to grow, we can anticipate the availability of more personalized and accurate breast implants.

Next-Generation Materials with Enhanced Durability and Safety

Concerns about the safety of breast implants have been voiced over the years, resulting in the development of safer, more durable implant materials. Currently available materials are more resistant to perforation and discharge, thereby enhancing the safety of breast implants. Next-generation materials, such as silicone gel and cohesive gel, have a more natural sensation and are extremely durable. With further research and technological advances, we can anticipate safer and more durable materials.

Market Expansion in Emerging Economies with Expanding Healthcare Infrastructure

The Breast Implants Market is expanding and expanding its reach beyond developed nations. In emerging economies such as Brazil, India, and China, the cosmetic surgery industry has expanded significantly. A rise in the demand for cosmetic procedures, such as breast implants, has also been attributed to the growing middle class in these nations. The healthcare infrastructure in these nations has vastly improved, making it simpler for women to obtain the procedure. As the demand for cosmetic surgery in these nations continues to rise, breast implants will gain popularity.

Latest Trends

Gummy Bear Implants

Stepping into the limelight are the gummy bear implants, a newer generation silicone-based implant taking a front seat in the aesthetic market. Bearing an uncanny resemblance to the squishy candy, these implants are composed of a sturdy silicone gel that retains its integrity, regardless of being sectioned. The resilience of the gummy bear implant, its uncanny ability to mimic the texture and heft of natural breast tissue, sets it distinctly apart from its predecessors.

Their ascension to popularity pivots on their eerily natural aesthetic and tactile experience. Their endowment of a more genuine breast-like feel has empowered patients with enhanced comfort and self-assurance. Further boasting a sturdier design, gummy bear implants offer a diminished risk of rupture, paving the way for a less maintenance-intensive future.

The Fat Transfer Phenomenon

Navigating the vast seas of augmentation options, there's an alternative route to the silicon trail that is capturing significant attention. The process, known as fat transfer breast augmentation, takes on a more organic approach, by relocating adipose tissue from less desirable locations to the chest area, thereby enhancing size and shape.

This revolutionary approach, capitalizing on the patient's own body fat for augmentation purposes, has seen an explosive surge in popularity. As a compelling substitute for implants, it stands as a beacon of natural, risk-reduced enlargement options. Utilizing the patient's body as both the donor and recipient has been a testament to the safety and effectiveness of this novel approach.

The Small Implant Movement

Historically, the narrative of breast augmentation centered around the adage the bigger, the better, however, that script is currently being rewritten. A rising chorus of women are finding their voice in advocating for smaller implants, ushering in a new era of breast augmentation that aligns more harmoniously with their body frame.

The appeal of petite implants lies in their power to subtly enhance one's appearance, allowing for an adaptation that aligns with the patient's lifestyle and aesthetic preference. Additionally, the trade-off of size for safety and reduced maintenance requirements offers an irresistible advantage that fuels this trending preference.

Exploring Explantation

Despite the long lifespan intended for breast implants, an undercurrent of dissatisfaction and complications has spurred a noticeable influx in the demand for implant removal and explant surgeries.

Surgery dedicated to implant removal has been on the rise, focusing on the eradication of breast implants. Explant surgery, on the other hand, delves a step further, targeting both the implant and the surrounding scar tissue. As awareness about potential complications of breast implants spreads, these procedures are steadily gaining traction.

Advanced Imaging

The medical technology landscape has seen a drastic shift in recent years, providing plastic surgeons with game-changing tools like advanced imaging technology. This revolutionary tool has made strides into the domain of breast implant procedures, revolutionizing the preoperative planning phase.

This cutting-edge technology enables the generation of precise 3D breast images, facilitating simulation of varying implant sizes, shapes, and materials. Patients can now preview the possible outcomes of their surgeries, promoting a more tailored preoperative strategy and ultimately enhancing the success of patient outcomes.

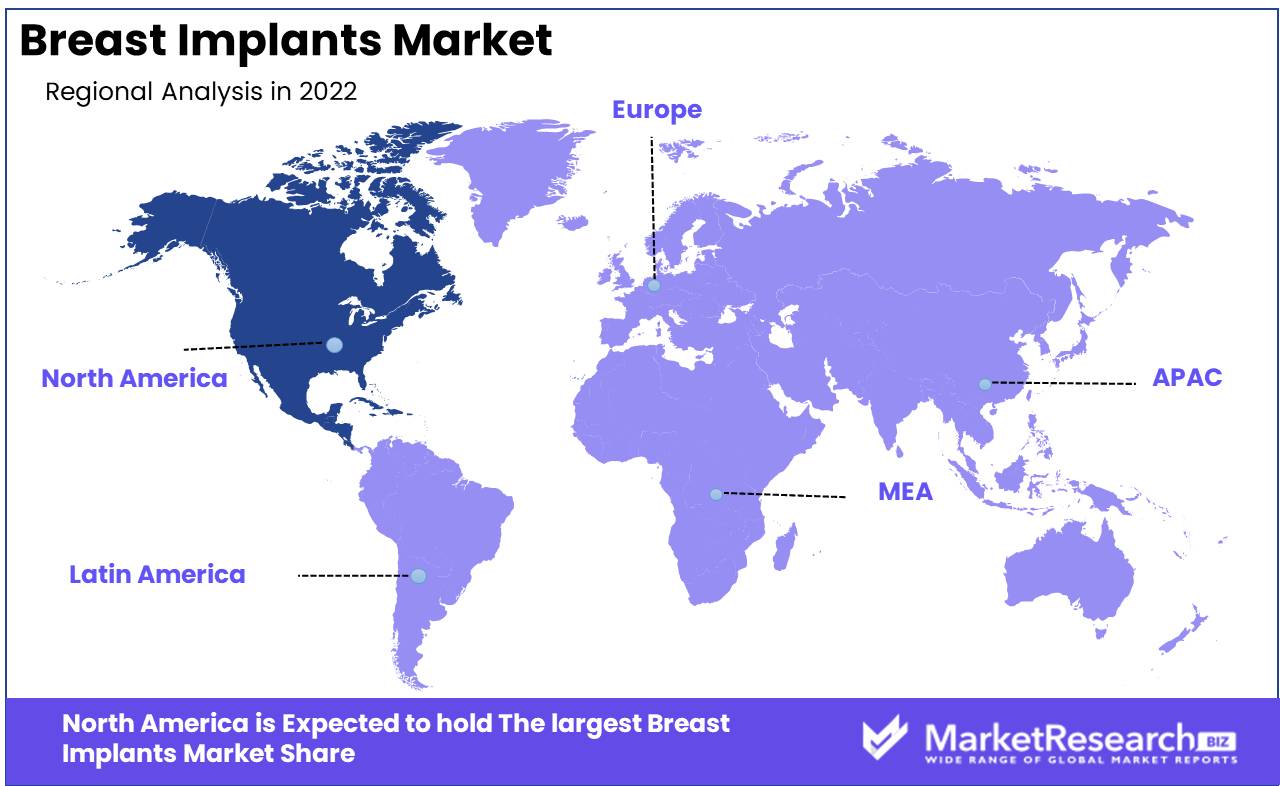

Regional Analysis

At present, the breast implants market in North America is dominated by the United States, owing to high awareness, the availability of advanced healthcare facilities, and a high disposable income. This market segment is growing rapidly, with more individuals opting for breast augmentation surgeries. According to recent statistics, an estimated 300,000 women in the United States undergo breast augmentation procedures annually, making it the most sought-after cosmetic surgery in the country. The vast majority of these surgeries are performed on women between the ages of 18 and 34.

One reason for the growing popularity of breast implant surgeries in North America is the increasing awareness surrounding them. With the widespread availability of information on the internet, potential patients are now better informed about the benefits and risks of the procedure. Another factor driving the rise of breast implant surgeries is the availability of advanced healthcare facilities that specialize in cosmetic procedures. Many of these facilities have state-of-the-art medical equipment and highly trained surgeons who specialize in breast augmentation surgeries.

The increasing disposable income of individuals in North America is another reason for the growth of breast implants market in the region. With higher average incomes, more individuals are able to afford cosmetic procedures such as breast augmentation surgeries, which can be quite expensive.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The breast implant market is a highly competitive industry dominated by several main participants. These corporations manufacture, distribute, and market silicone and saline breast implants used in breast augmentation surgery. Allergan, Mentor Worldwide (a Johnson & Johnson company), Sientra, and GC Aesthetics are some of the leading participants in the breast implant market. All of these organizations have a global presence and conduct extensive research and development to enhance the quality and safety of their breast implants.

Allergan, a subsidiary of AbbVie, is the current market leader in breast implants. The company offers an extensive selection of silicone and saline implants under the Natrelle brand. Additionally, Allergan places a significant emphasis on innovation, with ongoing research and development programs aimed at enhancing the efficacy and safety of its products.

Mentor Worldwide, a Johnson & Johnson subsidiary, is another prominent participant in the breast implant industry. Under its MemoryGel and Mentor brands, the company provides a selection of silicone and saline-based breast implants. Sientra is a relatively new market participant that has rapidly established a substantial market presence. The company specializes in the manufacture of highly cohesive silicone implants and has a solid reputation for safety and quality.

Top Key Players in Breast Implant Market

- Church and Dwight Co.Inc

- Doc Johnson Enterprises

- LELO

- LUVU BRANDS

- Reckitt Benckiser Group plc.

- GC Aesthetics

- Mentor Worldwide LLC

- Sientra Inc.

- Polytech Health & Aesthetics GmbH

- Laboratoires Arion

- AbbVie Inc.

- Ideal Implant Inc.

- Guangzhou Wanhe Plastic Materials Co. Ltd.

- Hansbiomed Co. Ltd.

- CollPlant Biotechnologies Ltd.

- Establishment Labs Holdings Inc.

Recent Development

- In July 2023, Sientra, in partnership with Clarion Medical Technologies, has launched its High-Strength Cohesive Silicone Gel Breast Implants in Canada. Sientra is the first new silicone gel breast implant manufacturer to gain approval from Health Canada in nearly two decades.

- In April 2023, CollPlant entered into a joint development and commercialization agreement with Stratasys. Stratasys is a leader in additive manufacturing, making them an ideal partner for this transformative initiative. The collaboration combines CollPlant's rhCollagen-based bio-inks with Stratasys' P3 technology-based bioprinter.

- In January 2022, FDA approved the MENTOR® MemoryGel BOOST™ Breast Implant demonstrates ongoing advancements in breast aesthetics, providing surgeons and patients with exciting new possibilities. This innovative implant combines Mentor's proprietary highly cohesive gel, an advanced implant shell design, and precise fill ratios.

- In October 2022, GC Aesthetics announces the CE approval of the LUNA xt™ Anatomical Breast Implant, setting a milestone as the first breast implant in the world to receive approval under the new European Medical Device Regulation. It introduces a unique micro-textured surface, ensuring optimal response to both surgeon and patient requirements in breast reconstruction procedures.

- In July 2021, Korea-based biotech startup Plcoskin, in collaboration with Yonsei University and LipoCoat, has received $1.7 million in funding over the next three years from Eurostar 2, a European joint technology development program. The company has earned recognition as a promising overseas bio company and is seeking approval from US FDA and European CE MDR.

Report Scope

Report Features Description Market Value (2022) USD 4.5 Bn Forecast Revenue (2032) USD 7.8 Bn CAGR (2023-2032) 6.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type: Silicone Implant, Form-stable Implant, Saline Implant, Structured Saline Implant

By Application: Reconstructive Surgery, Cosmetic Surgery

By End-user: Hospital, Cosmetology ClinicRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Church and Dwight Co. Inc, Doc Johnson Enterprises, LELO, LUVU BRANDS, Reckitt Benckiser Group plc., GC Aesthetics, Mentor Worldwide LLC, Sientra Inc., Polytech Health & Aesthetics GmbH, Laboratoires Arion, AbbVie Inc., Ideal Implant Inc., Guangzhou Wanhe Plastic Materials Co. Ltd., Hansbiomed Co. Ltd., CollPlant Biotechnologies Ltd., Establishment Labs Holdings Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Church and Dwight Co.Inc

- Doc Johnson Enterprises

- LELO

- LUVU BRANDS

- Reckitt Benckiser Group plc.

- GC Aesthetics

- Mentor Worldwide LLC

- Sientra Inc.

- Polytech Health & Aesthetics GmbH

- Laboratoires Arion

- AbbVie Inc.

- Ideal Implant Inc.

- Guangzhou Wanhe Plastic Materials Co. Ltd.

- Hansbiomed Co. Ltd.

- CollPlant Biotechnologies Ltd.

- Establishment Labs Holdings Inc.