Bond Market Report By Type (Government Bonds, Municipal Bonds, Corporate Bonds, Supranational Bonds), By Maturity (Short-Term Bonds [Less than 5 years], Medium-Term Bonds [5-10 years], Long-Term Bonds [More than 10 years]), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48273

-

July 2024

-

321

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

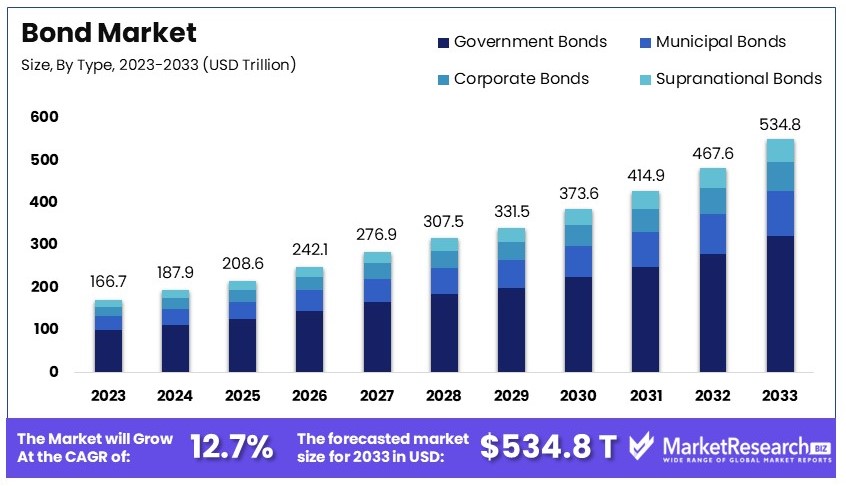

The Global Bond Market size is expected to be worth around USD 534.8 Trillion by 2033, from USD 166.7 Trillion in 2023, growing at a CAGR of 12.7% during the forecast period from 2024 to 2033.

The bond market, also known as the debt or fixed-income market, is a financial arena where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This market is instrumental for governments, municipalities, and corporations to acquire capital by borrowing from investors who are compensated via periodic interest payments and the return of the bond's principal at maturity.

Bonds vary by type, including government bonds, municipal bonds, corporate bonds, and more, each offering different risk and return profiles. This market is crucial for strategic portfolio management, offering diversification, income generation, and safety compared to stocks. For executives and product managers, understanding the bond market's dynamics is essential for making informed investment decisions and capital funding strategies.

The bond market is poised for significant developments in 2024, influenced by various economic and policy factors. As of mid-2024, the U.S. corporate bond market has seen issuance reach $1,061.0 billion, marking a 25.3% year-over-year increase, while trading volumes have risen to an average daily volume of $50.1 billion, an 18.0% increase from the previous year. Outstanding corporate bonds in the U.S. now total $10.9 trillion, up by 3.0% year-over-year.

Government regulations and monetary policies play a crucial role in shaping the bond market. The Federal Reserve's shift towards cutting interest rates is expected to significantly impact bond yields and returns. Historically, periods following rate cuts have seen high-quality fixed-income securities, such as intermediate-duration bonds, outperform other fixed-income investments. This trend is likely to continue as the Fed aims to control inflation, which has been on a downward trajectory towards its 2% target.

Investment strategies are also adapting to these changes. Investors are encouraged to consider intermediate-duration bonds, agency and non-agency securitized bonds, and investment-grade corporate bonds. These sectors are anticipated to offer attractive returns due to their current valuations and the expected rate cuts.

Government initiatives and investments are also crucial. For instance, the European Central Bank's reduction of its balance sheet has increased the availability of government bonds, influencing market liquidity and pricing. Additionally, partnerships and acquisitions, such as Beiersdorf AG's acquisition of Chantecaille Beaute Inc., highlight the strategic moves within the financial sector aimed at enhancing market presence and product offerings.

Key Takeaways

- Market Value: The Bond Market was valued at USD 166.7 trillion in 2023 and is expected to reach USD 534.8 trillion by 2033, with a CAGR of 12.7%.

- Product Analysis: Government Bonds dominated with 60%; these bonds form the backbone of stable investment portfolios.

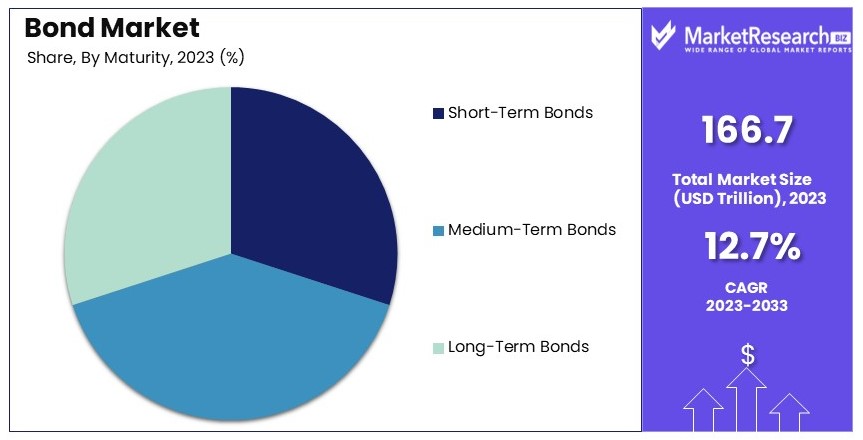

- End User Analysis: Medium-Term Bonds (5-10 years) dominated with 35%; they offer a balanced risk-return profile for investors.

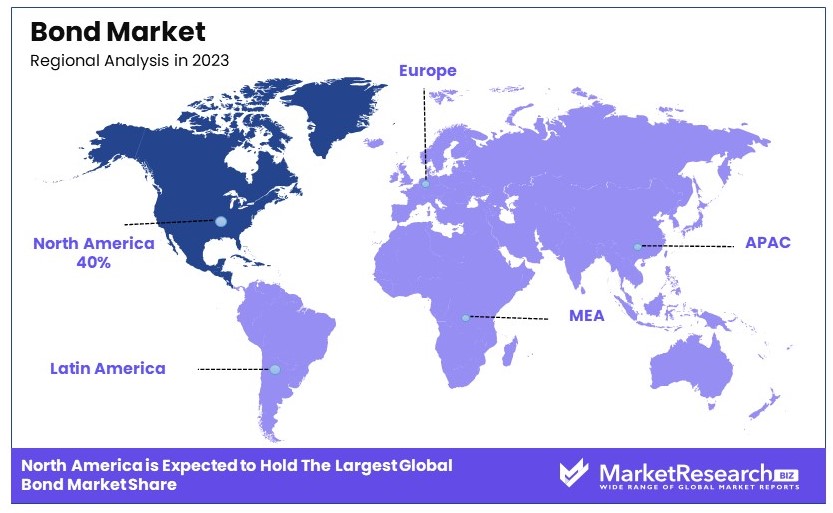

- Dominant Region: North America at 40%; it is the most significant market due to its stable economic structure.

- Analyst Viewpoint: The bond market shows high competitiveness and moderate saturation, with future growth driven by economic stability and interest rate fluctuations.

- Growth Opportunities: Players can stand out by innovating in green and sustainable bonds, and enhancing liquidity in emerging market bonds.

Driving Factors

Low Interest Rate Environment Drives Market Growth

The sustained low interest rate environment, as implemented by central banks globally to foster economic growth, has significantly influenced the bond market. Central banks, like the Federal Reserve, maintained benchmark interest rates near zero from 2020 to early 2022, pushing investors to seek higher yields from bonds due to the lower returns on savings accounts and other low-risk investments.

As a result, both individual and institutional investors have increased their capital allocation to bonds. This shift has directly contributed to the expansion of the bond market, with more funds flowing into bond investments across various sectors. The strategy to maintain low rates not only stimulates the economy but also strategically channels investments into the bond market, reinforcing its growth trajectory.

Flight to Safety During Economic Uncertainty Drives Market Growth

Bonds, particularly government bonds, are traditionally seen as a sanctuary during economic disturbances. The market volatility triggered by events such as the COVID-19 pandemic in 2020 led to a notable increase in bond investments. Investors, aiming to safeguard their assets from the erratic stock market, heavily favored bonds.

This behavior underscores the bond market's role as a reliable haven during crises. The surge in demand during such periods often results in significant market growth, as was evidenced by the substantial inflow into bond funds in 2020. This pattern not only demonstrates the market's capacity to absorb shocks but also highlights its critical stabilizing function in investors' portfolios during tumultuous times.

Corporate Debt Issuance Drives Market Growth

The issuance of corporate bonds serves as a vital mechanism for companies to manage finances, including funding operations and expansions or refinancing existing debts. Leveraging the low interest rate environment, corporations find it economically viable to issue bonds at a lower cost. A prominent example is Apple Inc., which issued $14 billion in bonds in February 2021, taking advantage of the favorable borrowing costs.

This strategy not only aids the corporations in securing capital but also enriches the bond market by increasing the available supply of corporate bonds. The continual growth in corporate debt issuance reflects a robust bond market, capable of supporting varied corporate financing needs while contributing to the overall market expansion.

Restraining Factors

Rising Interest Rate Environment Restrains Market Growth

As interest rates climb, the bond market faces significant headwinds. This increase causes bond prices to fall, resulting in potential capital losses for bondholders. The relationship between rising interest rates and declining bond values can deter new investors and prompt current investors to sell their holdings.

For instance, in 2022, as the Federal Reserve escalated interest rates to counter inflation, a notable sell-off occurred in the bond market. This shift led to the Bloomberg U.S. Aggregate Bond Index recording its worst performance year, clearly illustrating the direct impact of rising interest rates on market dynamics.

Inflationary Pressures Restrains Market Growth

Inflation acts as a critical constraint on the bond market by diminishing the real value of returns from bonds. Fixed-income securities, like bonds, are especially susceptible to inflation because their fixed payments lose purchasing power over time. The inflation spike in 2021-2022 pushed many investors to reassess the attractiveness of bonds.

As real yields—nominal yields adjusted for inflation—turned negative, the appeal of holding bonds diminished. This scenario underscores how high inflation can severely limit the growth of the bond market by making bonds an unattractive investment option relative to other assets.

Type Analysis

Government Bonds dominate with 60% due to their high security and stability.

The bond market is segmented by various types, including Government Bonds, Municipal Bonds, Corporate Bonds, and Supranational Bonds. Among these, Government Bonds emerge as the dominant sub-segment, holding a 60% share. This predominance is primarily due to the perceived safety and low credit risk associated with government-backed securities. Investors often turn to government bonds, especially in times of economic uncertainty, as these bonds are less likely to default compared to corporate or municipal bonds.

Government Bonds are deemed a secure investment, drawing substantial interest from conservative investors who prioritize capital preservation. The issuance of these bonds by sovereign entities to finance government spending further assures investors of their legitimacy and safety. This segment's strength is crucial in stabilizing the bond market, providing a reliable option for risk-averse investors.

Conversely, the other segments in the bond market, such as Municipal Bonds, Corporate Bonds, and Supranational Bonds, also play significant roles. Municipal Bonds, issued by local or state governments, are pivotal for funding public projects like schools, roads, and hospitals. Although they offer tax-free income in many regions, their market share is smaller due to the higher risk of default compared to government bonds.

Corporate Bonds are issued by companies and are favored for their higher yields compared to government securities, attracting investors seeking greater returns. However, this comes at the cost of higher risk, depending on the issuing company's creditworthiness.

Supranational Bonds, issued by international organizations, contribute to global financial projects and development programs. These bonds support international efforts and often carry a supranational guarantee, making them relatively safe compared to corporate bonds but less popular than government and municipal bonds.

Maturity Analysis

Medium-Term Bonds (5-10 years) dominate with 35% due to their balanced risk and return profile.

In the bond market, bonds are also segmented by their maturity: Short-Term Bonds (less than 5 years), Medium-Term Bonds (5-10 years), and Long-Term Bonds (more than 10 years). Medium-Term Bonds lead this category with a 35% market share. This segment’s attractiveness is linked to its moderate investment horizon, offering a balanced mix of risk and return that appeals to a broad spectrum of investors.

Medium-Term Bonds provide a middle ground between the lower yield of short-term bonds and the higher risk associated with long-term bonds. They are particularly appealing to investors looking for reasonable returns without the extended commitment required by longer maturities. These bonds also offer sufficient time for interest accrual, making them an attractive option for income-focused investors.

Short-Term Bonds, while offering less risk due to their shorter duration, typically yield lower returns. They are preferred by investors who require liquidity and have a low tolerance for interest rate fluctuations. These bonds cater to a niche market that prioritizes safety and quick access to invested capital.

Long-Term Bonds, with maturities extending beyond ten years, are sought by investors willing to lock in their capital for extended periods for higher yields. However, they carry a higher risk, particularly from interest rate changes over time, which can significantly impact their pricing and attractiveness.

Key Market Segments

By Type

- Government Bonds

- Municipal Bonds

- Corporate Bonds

- Supranational Bonds

By Maturity

- Short-Term Bonds (Less than 5 years)

- Medium-Term Bonds (5-10 years)

- Long-Term Bonds (More than 10 years)

Growth Opportunities

Green Bonds Offer Growth Opportunity in the Bond Market

The surge in interest towards green finance reflects a broader shift towards sustainable investment practices. By financing projects that have positive environmental impacts, green bonds tap into the growing investor demand for responsible and sustainable investment opportunities. In October 2021, the European Union’s issuance of €12 billion in green bonds marked a significant step in funding eco-friendly initiatives.

This not only supports the transition to sustainability but also boosts the market size and diversity of available bonds. The preference for investments that also yield environmental benefits is becoming a cornerstone in modern financial markets. This trend underscores the bonds’ potential to secure substantial capital while fostering global sustainability efforts, likely ensuring their continued expansion and relevance.

Emerging Market Bonds Offer Growth Opportunity in the Bond Market

Emerging market bonds are increasingly appealing to investors seeking avenues for higher returns amidst global low-interest rate environments. The growth potential in emerging economies, such as India and Brazil, is considerably high, providing lucrative yield opportunities compared to mature markets. The inflow of foreign investments into these countries' bond markets enhances liquidity and financial stability, creating a more robust investment landscape.

This not only benefits local economies by facilitating capital inflows but also offers global investors diversification benefits. The trend towards globalization of investment portfolios, coupled with the quest for higher yields, continues to propel the attractiveness of emerging market bonds, making them a critical component of growth-oriented investment strategies.

Trending Factors

Rise of ESG-Linked Bonds Are Trending Factors in the Bond Market

The expansion of ESG-linked bonds, encompassing not just environmental but also social and governance themes, is reshaping the bond market. Issuers like Enel are pioneering with bonds that directly link financial returns to ESG performance, such as renewable energy targets. Introduced in 2019, these bonds offer an innovative approach to incentivizing companies towards achieving specific sustainability goals.

As societal expectations shift towards greater corporate responsibility, the appeal of ESG-linked bonds grows, aligning investor returns with progressive ESG reporting software. This trend not only broadens the market’s scope but also enhances its appeal to a new generation of socially conscious investors, fostering a dynamic environment for growth and innovation in bond structures.

Increased Retail Investor Participation Are Trending Factors in the Bond Market

The bond market is witnessing a significant transformation with increased participation from retail investors, thanks to the advent of user-friendly investment platforms like Robinhood. This trend democratizes access to a market once dominated by institutional players, expanding the investor base and potentially increasing market liquidity and stability.

Retail investors bring new capital and diversity to the bond market, contributing to its depth and resilience. As technology continues to break down barriers to investment, retail involvement is expected to grow, injecting fresh dynamics into the bond market. This shift not only broadens the demographic of bond investors but also enhances the overall vibrancy and inclusivity of the market, fostering a more robust and accessible investment landscape.

Regional Analysis

North America Dominates with 40% Market Share in the Bond Market

North America's 40% market share in the global bond market can primarily be attributed to the robust financial infrastructure, high economic stability, and the presence of major global financial centers such as New York and Toronto. Additionally, the region's advanced regulatory frameworks foster a secure investment environment, attracting both domestic and international investors. The liquidity of North American bond markets, supported by substantial trading volumes, further underpins this dominance.

The performance of the bond market in North America is significantly influenced by its economic policies, interest rate decisions by the Federal Reserve, and macroeconomic stability. The region's ability to maintain a stable political environment also plays a crucial role in its market dynamics, ensuring a lower risk for bond investors. Furthermore, technological advancements in trading systems and financial products innovation continue to enhance market efficiency and accessibility.

Regional Market Share and Growth Statistics

- Europe: Holding approximately 30% of the market share, Europe's bond market is driven by its diversified investor base and strong governmental bond issuances.

- Asia Pacific: Representing about 20% of the global market, Asia Pacific is witnessing rapid growth due to increasing economic development and financial market reforms.

- Middle East & Africa: This region accounts for around 5% of the market share, with growth fueled by expanding economic diversification away from oil dependence.

- Latin America: Latin America maintains a 5% share, with potential growth hindered by economic volatility but supported by increasing foreign investment flows.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The bond market is crucial for funding government, corporate, and other institutional needs. Key players such as J.P. Morgan Chase & Co., Goldman Sachs, Citigroup, and Barclays dominate through extensive underwriting and trading activities, providing market stability and liquidity with their global reach and vast financial resources.

Asset management firms like BlackRock, PIMCO, Vanguard, and Fidelity Investments manage large portfolios, affecting bond prices and yields with their investment decisions, thereby shaping market trends and investor sentiment. Corporate issuers like Apple Inc., AT&T Inc., Berkshire Hathaway, and General Electric issue bonds to finance operations, expansion, and acquisitions. Their financial health and credit ratings influence investor confidence and market rates.

These players drive innovation in bond offerings, including green bonds and other ESG (Environmental, Social, and Governance) investments, and shape market strategies through technological advancements and financial products. The bond market activities of these key players are indicators of broader economic health, with interest rates and bond yields reflecting economic trends influenced by their investment and issuance activities. They significantly impact institutional and retail investor behavior through their market strategies and product offerings.

Additionally, their operations are subject to regulatory scrutiny, impacting market practices and investor protection measures. In summary, key players in the bond market, including financial giants, asset management firms, and major corporate issuers, significantly influence market dynamics, trends, and investor behavior, ensuring market stability and reflecting broader economic conditions.

Market Key Players

- Apple Inc.

- AT&T Inc.

- Berkshire Hathaway

- General Electric

- J.P. Morgan Chase & Co.

- Goldman Sachs

- Citigroup

- Barclays

- BlackRock

- PIMCO (Pacific Investment Management Company)

- Vanguard

- Fidelity Investments

- Other key players

Recent Developments

- J.P. Morgan is actively engaged in green and sustainable bonds. Recently, it supported major transactions in renewable energy, contributing to a robust annual revenue of approximately $123 billion in 2023. The firm has expanded its green economy banking team to further drive decarbonization efforts.

- Asian Development Bank (ADB) focuses on developing bond markets in Asia, especially through sustainable bonds. In 2023, ADB enhanced market liquidity and promoted green bond issuance, supporting its mission to foster regional economic stability. ADB's annual income is around $2 billion.

Report Scope

Report Features Description Market Value (2023) USD 166.7 Trillion Forecast Revenue (2033) USD 534.8 Trillion CAGR (2024-2033) 12.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Government Bonds, Municipal Bonds, Corporate Bonds, Supranational Bonds), By Maturity (Short-Term Bonds [Less than 5 years], Medium-Term Bonds [5-10 years], Long-Term Bonds [More than 10 years]) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Apple Inc., AT&T Inc., Berkshire Hathaway, General Electric, J.P. Morgan Chase & Co., Goldman Sachs, Citigroup, Barclays, BlackRock, PIMCO (Pacific Investment Management Company), Vanguard, Fidelity Investments, Other key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Apple Inc.

- AT&T Inc.

- Berkshire Hathaway

- General Electric

- J.P. Morgan Chase & Co.

- Goldman Sachs

- Citigroup

- Barclays

- BlackRock

- PIMCO (Pacific Investment Management Company)

- Vanguard

- Fidelity Investments

- Other key players