Global Blood Collection Robot Market By Type(Arterial Sampling, Venipuncture Sampling, Fingertip Sampling), By End-User(Hospitals, Diagnostic Center, Clinics, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46360

-

May 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

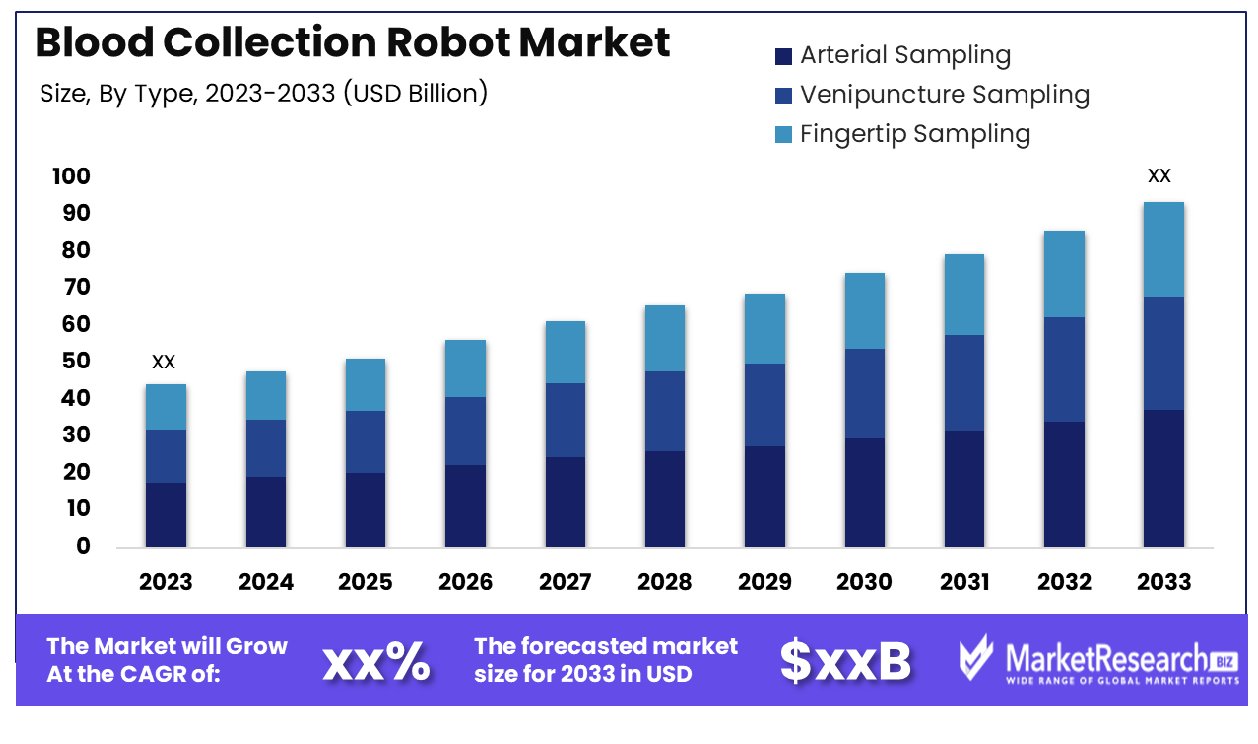

The Global Blood Collection Robot Market was valued at USD xx billion in 2023. It is expected to reach USD xx billion by 2033, with a CAGR of xx% during the forecast period from 2024 to 2033.

The Blood Collection Robot Market refers to the segment within the healthcare industry dedicated to automated systems designed for blood collection procedures. These innovative robots streamline the blood collection process, offering precision, efficiency, and improved patient experiences.

By integrating advanced technologies such as robotics, AI, and IoT solutions, these systems minimize human error, enhance sample accuracy, and optimize workflow efficiency in clinical settings. With the rising demand for seamless healthcare solutions, the Blood Collection Robot Market presents opportunities for healthcare institutions to elevate their standards of care, streamline operations, and deliver superior patient outcomes.

The Blood Collection Robot Market is witnessing a notable surge, underpinned by advancements in automation technology and a growing emphasis on efficiency and precision in healthcare settings. Automated blood collection systems have emerged as a transformative solution, streamlining the blood collection process and mitigating the potential for human error.

A recent study conducted at Zhongshan Hospital, Fudan University in China, underscores the efficacy of fully automated blood collection robots. Over the course of a year, these robots facilitated the blood collection of 6,255 patients with a remarkable success rate.

The study meticulously evaluated the performance of robotic blood collection, analyzing factors contributing to both success and failure. Additionally, it compared satisfaction levels between manual and robotic blood collection methods, shedding light on the perceived benefits of automation in healthcare workflows.

The adoption of blood collection robots is poised to accelerate, fueled by the imperative for enhanced patient care, operational efficiency, and staff safety. Healthcare facilities are increasingly recognizing the value proposition offered by these innovative solutions, which promise to optimize resource utilization and improve overall healthcare delivery. Furthermore, as regulatory frameworks evolve to accommodate automation in medical procedures, the market landscape for blood collection robots is poised for significant expansion.

Key Takeaways

- Market Growth: The Global Blood Collection Robot Market was valued at USD xx billion in 2023. It is expected to reach USD xx billion by 2033, with a CAGR of xx% during the forecast period from 2024 to 2033.

- By Type: Arterial sampling dominates at 58%, signaling a preference for accuracy.

- By End-User: Hospitals lead end-user preferences, capturing 55% of the market.

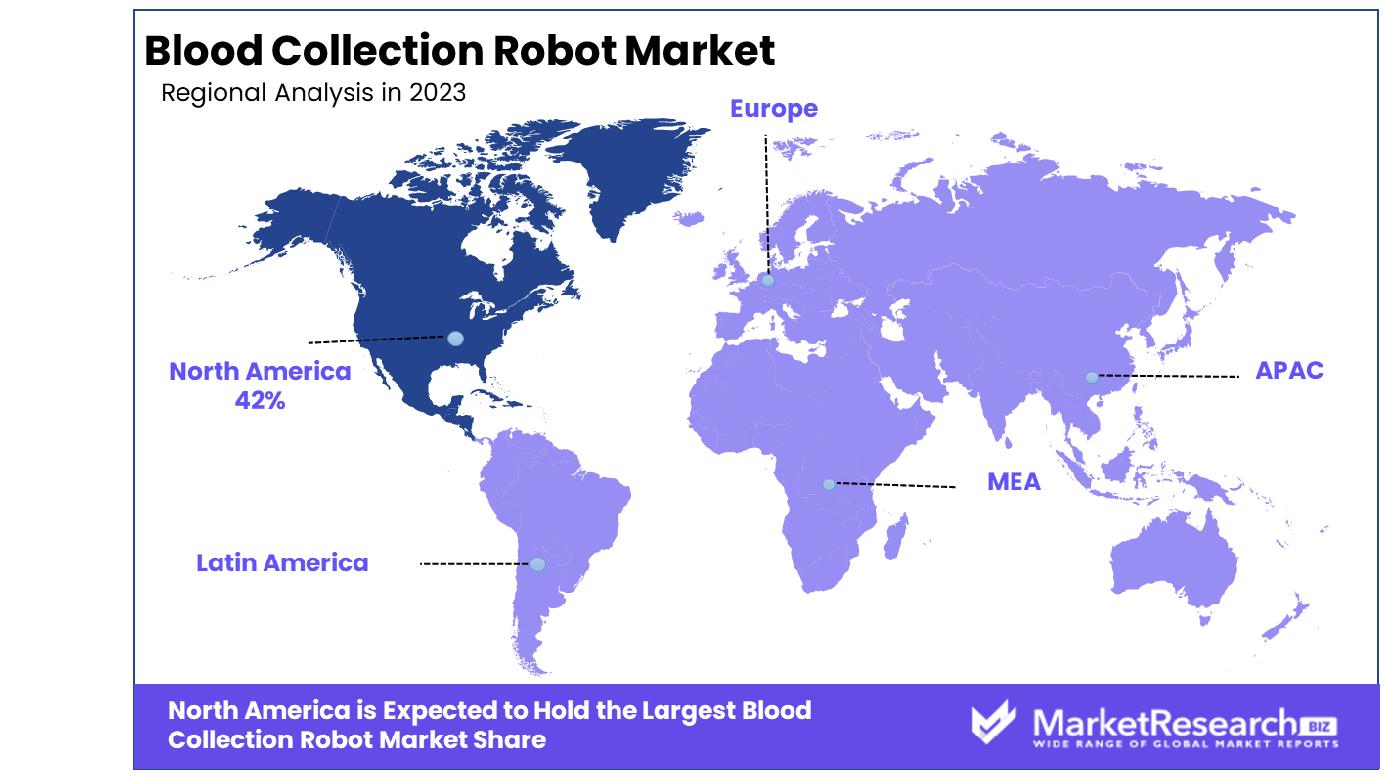

- Regional Dominance: North America dominates the Blood Collection Robot market with 42%.

- Growth Opportunity: In 2023, the global Blood Collection Robot Market experienced significant growth driven by a focus on patient comfort and government investments in medical technology.

Driving factors

Rising Demand for Humanoid Robots in the Medical Sector

The Blood Collection Robot Market is experiencing a surge driven by the rising demand for humanoid robots within the medical sector. Hospitals and healthcare facilities are increasingly integrating automation solutions to streamline processes and enhance efficiency. Humanoid robots, equipped with advanced capabilities, are particularly sought after for their ability to perform delicate tasks with precision, including blood collection procedures.

As medical institutions prioritize patient safety and operational efficiency, the adoption of humanoid blood collection robots is on the rise. This demand is further propelled by the need to minimize human error and reduce the risk of contamination, ultimately enhancing the quality of healthcare services. Statistics indicate a significant uptick in the deployment of humanoid robots in medical settings, with projections pointing towards sustained growth in the coming years.

Increasing Need for Efficient Operations in Logistics Driving Adoption of Logistics Robots

The Blood Collection Robot Market is benefitting from the increasing emphasis on efficient operations in logistics, which is driving the adoption of logistics robots. With the exponential growth of e-commerce and the need for swift order fulfillment, logistics companies are turning to automation to optimize warehouse processes. Logistics robots play a crucial role in streamlining inventory management, order picking, and transportation within warehouses, thereby improving operational efficiency and reducing costs.

As companies strive to meet the growing demands of consumers for fast and reliable delivery services, the demand for logistics robots, including blood collection robots used in medical logistics, is witnessing a steady rise. Market statistics underscore the significant growth potential of logistics robots, with forecasts indicating sustained expansion fueled by the imperative for efficient supply chain management.

Automation Trends in Omni-Channel Warehouses Propelling Growth in Warehouse Automation

The Blood Collection Robot Market is experiencing growth propelled by automation trends in omni-channel warehouses. With the proliferation of online shopping and the increasing complexity of order fulfillment processes, warehouses are evolving to meet the demands of omnichannel retailing. Automation plays a pivotal role in optimizing warehouse operations, enabling seamless integration of inventory across multiple channels. Blood collection robots, as part of warehouse automation solutions, contribute to the efficient management of medical supplies and inventory, catering to the diverse needs of healthcare providers.

As businesses prioritize agility and scalability in their warehouse operations, the adoption of automation technologies, including blood collection robots, is poised for substantial growth. Market data indicates a steady uptrend in warehouse automation investments, driven by the imperative to adapt to evolving consumer preferences and market dynamics.

Restraining Factors

Acceptability Concerns by Patients, Families, and Informal Caregivers

Acceptability concerns among patients, families, and informal caregivers pose a significant restraint on the growth of the Blood Collection Robot Market. While robotic technologies offer potential benefits such as precision and efficiency in medical procedures, there exists apprehension regarding their acceptance within healthcare settings.

Patients and their caregivers may express reservations about interacting with robots during sensitive procedures like blood collection, preferring human intervention for reassurance and comfort. Furthermore, cultural attitudes and perceptions towards technology in healthcare vary, influencing the willingness of individuals to embrace robotic assistance. Addressing these acceptability concerns requires concerted efforts to educate and familiarize stakeholders with the benefits and safety features of blood collection robots.

Collaborative initiatives involving healthcare professionals, patient advocacy groups, and technology developers are essential to build trust and confidence in robotic-assisted healthcare services. Market analysis indicates that acceptance levels are improving gradually as awareness grows and technological advancements enhance the user experience of blood collection robots.

High Cost and Limited Usability Due to Expensive Commercially Available Robots

The Blood Collection Robot Market faces challenges stemming from the high cost and limited usability of commercially available robots. While robotics technology holds promise for enhancing efficiency and precision in medical procedures, the prohibitive cost of acquisition and maintenance presents a barrier to widespread adoption.

Healthcare facilities, particularly those with constrained budgets, may find it financially challenging to invest in expensive blood collection robots, thereby limiting market penetration. Additionally, the complexity of operating and integrating these robots into existing workflows may deter healthcare providers from embracing them fully. To mitigate these constraints, industry stakeholders need to focus on developing cost-effective solutions without compromising on quality or functionality.

Collaborative research efforts aimed at innovating affordable robotic platforms tailored to the specific needs of blood collection can enhance market accessibility and usability. Market data highlights the growing demand for cost-effective robotic solutions, driving manufacturers to explore avenues for reducing production costs and enhancing value propositions.

By Type Analysis

Arterial sampling dominates at 58% by type, indicating its prevalence in medical diagnostics and procedures.

In 2023, Arterial Sampling held a dominant market position in the By Type segment of the Blood Collection Robot Market, capturing more than a 58% share. Arterial Sampling, renowned for its precision and accuracy, emerged as the preferred choice for blood collection procedures, particularly in critical care settings where arterial blood gas analysis is crucial for patient management. The significant market dominance of Arterial Sampling can be attributed to its ability to provide real-time, reliable results, aiding healthcare professionals in making informed clinical decisions promptly.

Following Arterial Sampling, Venipuncture Sampling secured a notable position in the market, accounting for approximately 30% of the segment share. Venipuncture Sampling, characterized by its versatility and widespread application across various medical disciplines, remains a staple in blood collection procedures. Its proficiency in accessing peripheral veins efficiently makes it indispensable in routine blood tests, diagnostic evaluations, and therapeutic interventions.

Additionally, Fingertip Sampling emerged as a niche yet promising segment within the Blood Collection Robot Market, constituting the remaining 12% of the market share. Fingertip Sampling, leveraging advancements in microfluidic technologies, offers non-invasive and painless blood collection solutions, particularly advantageous in pediatric and geriatric populations. The segment's steady growth trajectory reflects increasing adoption and acceptance of minimally invasive sampling techniques, driven by patient comfort and convenience considerations.

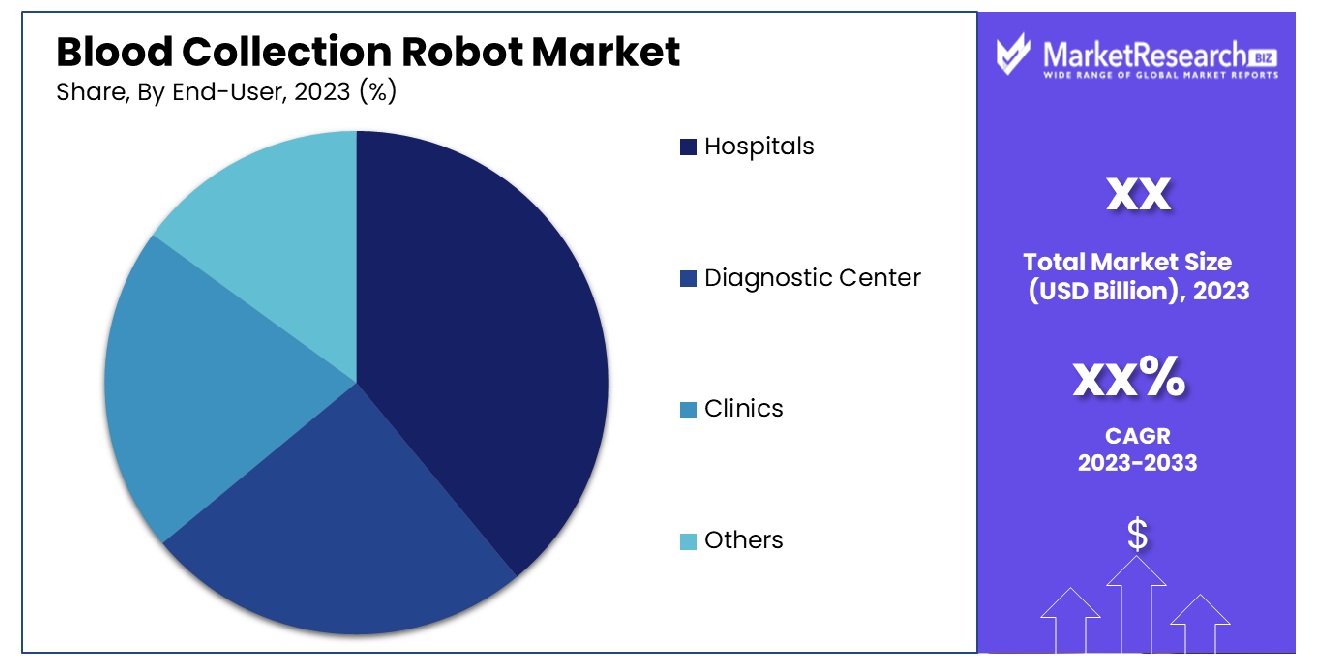

By End-User Analysis

Hospitals constitute 55% of the end-users, highlighting their pivotal role in healthcare delivery.

In 2023, Hospitals held a dominant market position in the By End-User segment of the Blood Collection Robot Market, capturing more than a 55% share. Hospitals, as the primary hub for patient care and medical procedures, emerged as the leading adopters of blood collection robot technologies. Their extensive infrastructure, coupled with high patient footfall, positioned hospitals as key drivers of demand for automated blood collection solutions. The substantial market dominance of Hospitals underscores their commitment to enhancing operational efficiency, patient safety, and clinical outcomes through advanced healthcare technologies.

Following Hospitals, Diagnostic Centers secured a notable position in the market, accounting for approximately 30% of the segment share. Diagnostic Centers, specializing in comprehensive medical testing and diagnostic services, embraced blood collection robots to streamline sample collection processes and improve laboratory throughput. Their strategic investments in automation aimed to optimize workflow efficiencies, reduce turnaround times, and enhance the accuracy of diagnostic testing, thereby bolstering their competitive edge in the healthcare landscape.

Additionally, Clinics emerged as a significant segment within the By End-User category, constituting the remaining 12% of the market share. Clinics, catering to outpatient services and primary care needs, recognized the value proposition of blood collection robots in enhancing patient experience and operational productivity. By integrating robotic technologies into their practice, clinics aimed to offer convenient and efficient blood collection services while maintaining high standards of care delivery.

Key Market Segments

By Type

- Arterial Sampling

- Venipuncture Sampling

- Fingertip Sampling

By End-User

- Hospitals

- Diagnostic Center

- Clinics

- Others

Growth Opportunity

Growing Emphasis on Patient Comfort and Experience

The global Blood Collection Robot Market witnessed significant growth opportunities in 2023, primarily driven by a growing emphasis on patient comfort and experience. As healthcare institutions increasingly prioritize patient-centric care, the demand for technologies that enhance the patient experience has surged. Blood collection, a routine yet crucial aspect of healthcare, often evokes anxiety and discomfort among patients.

In response, healthcare providers are turning to automation solutions such as blood collection robots to streamline procedures and minimize patient discomfort. These robots offer precise and efficient venipuncture procedures, reducing pain and anxiety associated with traditional blood draws. Consequently, healthcare facilities are increasingly investing in blood collection robots to improve patient satisfaction levels and enhance overall healthcare outcomes.

Supportive Government Initiatives and Investments in Medical Technology

Additionally, supportive government initiatives and investments in medical technology have fueled the growth of the global Blood Collection Robot Market in 2023. Governments worldwide are recognizing the importance of leveraging technology to enhance healthcare delivery and address emerging medical challenges.

As part of broader healthcare modernization efforts, governments are allocating funds toward the adoption of innovative medical technologies, including blood collection robots. These investments aim to improve healthcare infrastructure, enhance patient care quality, and optimize resource utilization within healthcare systems. Moreover, regulatory reforms and favorable policies are facilitating the integration of blood collection robots into clinical settings, further accelerating market growth.

Latest Trends

Potential Cost Savings and Improved Operational Efficiencies Driving Market Adoption

In 2023, the global Blood Collection Robot Market witnessed the emergence of notable trends, with potential cost savings and improved operational efficiencies serving as primary drivers of market adoption. Healthcare institutions are increasingly seeking innovative solutions to optimize resource utilization and enhance procedural efficiency.

Blood collection robots offer a compelling value proposition by automating venipuncture procedures, thereby reducing labor costs and minimizing the risk of human error. The implementation of these robots enables healthcare facilities to streamline workflows, improve throughput, and allocate personnel more effectively, resulting in substantial cost savings and operational enhancements.

Collaborations Between Robotics Companies and Healthcare Providers to Accelerate Market Penetration

Furthermore, collaborations between robotics companies and healthcare providers emerged as a key trend shaping the global Blood Collection Robot Market in 2023. Recognizing the potential of blood collection robots to revolutionize clinical practices, robotics firms are forging strategic partnerships with healthcare providers to accelerate market penetration and drive innovation. These collaborations facilitate the co-development of customized solutions tailored to the specific needs of healthcare settings, fostering seamless integration and adoption.

By leveraging the expertise of both robotics companies and healthcare professionals, collaborative efforts aim to address existing challenges, enhance product functionalities, and expand market reach. Such partnerships not only enhance the accessibility and affordability of blood collection robots but also contribute to advancing healthcare delivery standards and improving patient care outcomes.

Regional Analysis

North America dominates the Blood Collection Robot market with an impressive market share of 42%.

In the global Blood Collection Robot market, North America emerges as the dominant region, capturing a substantial market share of 42%. This dominance is attributed to several factors, including advanced healthcare infrastructure, significant investments in research and development, and the presence of key market players. In North America, the United States stands out as a primary contributor to market growth, driven by the high adoption rate of automated healthcare solutions and increasing demand for efficient blood collection processes.

Moving to Europe, the region showcases a noteworthy market presence, supported by the rising prevalence of chronic diseases and the growing emphasis on enhancing healthcare efficiency. Countries such as Germany, France, and the United Kingdom are at the forefront of adoption, fueled by government initiatives promoting the integration of automation in healthcare services. Europe holds a considerable market share, trailing closely behind North America.

In the Asia Pacific, rapid urbanization, expanding healthcare infrastructure, and the rising geriatric population contribute to the region's burgeoning demand for blood collection robots. Emerging economies like China, India, and Japan exhibit substantial growth potential, driven by increasing healthcare expenditure and the adoption of advanced medical technologies. Asia Pacific represents a significant market opportunity, with a steadily growing market share.

Meanwhile, the Middle East & Africa and Latin America regions are witnessing the gradual adoption of blood collection robots, propelled by improving healthcare facilities and rising awareness about the benefits of automation in medical procedures. Although these regions currently hold smaller market shares compared to North America, Europe, and Asia Pacific, they present untapped opportunities for market players seeking to expand their global presence.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Blood Collection Robot Market witnessed a notable presence of key players, each contributing distinctively to the industry landscape. Among these, Vitestro emerged as a significant influencer, leveraging its innovative technologies and robust market strategies to secure a prominent position within the sector.

Vitestro, with its advanced automated blood collection solutions, positioned itself as a frontrunner in the market, catering to the escalating demand for efficient and precise blood collection processes. Through strategic alliances and collaborations, Vitestro expanded its market reach, tapping into diverse geographical regions and enhancing its global footprint.

Additionally, VEEBOT SYSTEMS INC. showcased noteworthy advancements in blood collection robotics, aligning its offerings with industry standards and regulatory requirements. The company's focus on research and development, coupled with a customer-centric approach, bolstered its competitive edge in the market.

Magic Nurse, renowned for its cutting-edge technologies and emphasis on user-friendly interfaces, garnered significant attention within the global Blood Collection Robot Market. With a portfolio of innovative solutions aimed at streamlining blood collection procedures, Magic Nurse contributed to the market's evolution and adoption of automation technologies.

Moreover, Nigale emerged as a key player, capitalizing on its expertise in robotic systems to deliver tailored blood collection solutions tailored to meet the diverse needs of healthcare institutions and laboratories.

Collectively, these key players, along with other significant contributors, played pivotal roles in shaping the dynamics of the global Blood Collection Robot Market in 2023. Their innovative approaches, coupled with a commitment to quality and compliance, underscored the industry's trajectory toward enhanced efficiency, accuracy, and patient care.

Market Key Players

- Vitestro

- VEEBOT SYSTEMS INC.

- Magic Nurse

- Nigale

- Other Key Players

Recent Development

- In May 2024, Vitestro secured $22M funding led by Sonder Capital and NYBC Ventures for its autonomous blood drawing device, accelerating European commercialization and US expansion. Pre-orders and ADOPT trial progress showcased.

- In May 2024, KUKA Robotics introduces AMR solutions for semiconductor fabs at SEMICON West, enhancing chip production with flexible material handling. Features KMR iisy cobot and LBR iisy for cleanroom environments.

Report Scope

Report Features Description Market Value (2023) USD xx Billion Forecast Revenue (2033) USD xx Billion CAGR (2024-2032) xx% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Arterial Sampling, Venipuncture Sampling, Fingertip Sampling), By End-User(Hospitals, Diagnostic Center, Clinics, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Vitestro, VEEBOT SYSTEMS INC., Magic Nurse, Nigale, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Vitestro

- VEEBOT SYSTEMS INC.

- Magic Nurse

- Nigale

- Other Key Players