Blinds And Shades Market Report By Type (Blinds [Venetian Blinds, Vertical Blinds, Roller Blinds, Other Blinds], Shades [Cellular Shades, Roman Shades, Pleated Shades, Roller Shades, Other Shades]), By Application (Residential, Commercial, Industrial, Others), By Installation (New Construction, Retrofit), By Technology (Automatic, Manual), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48671

-

July 2024

-

325

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

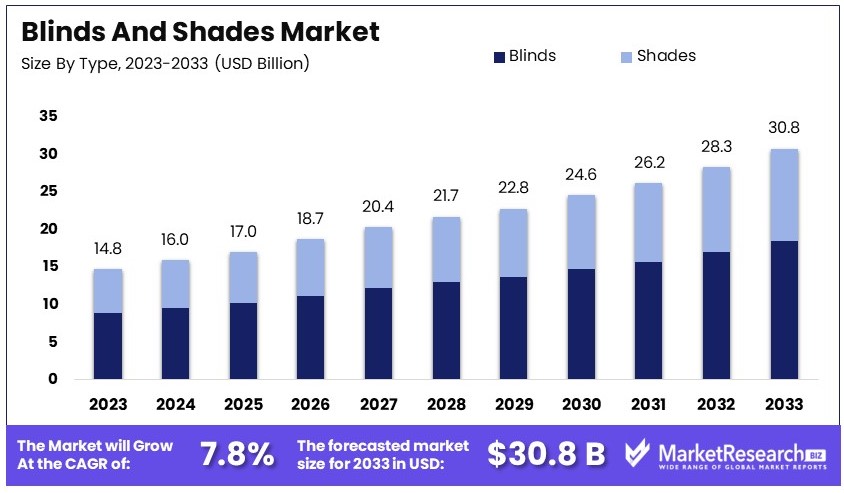

The Global Blinds And Shades Market size is expected to be worth around USD 30.8 Billion by 2033, from USD 14.8 Billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

The Blinds and Shades Market involves the production and distribution of window coverings, which provide light control, privacy, and aesthetic appeal for residential and commercial settings. Products range from manual blinds to automated shades, featuring materials like fabric, wood, and synthetic polymers.

This market responds to trends in interior design and consumer preferences for smart home technologies. Growth factors include rising urbanization and the increasing importance of energy-efficient and smart living solutions, catering to a diverse clientele seeking both functionality and style in window treatments.

The blinds and shades market is experiencing notable growth, driven by increasing consumer preference for energy-efficient and sustainable home improvement solutions. North America, in particular, stands out due to its dynamic market conditions. Key players like Hunter Douglas N.V. are spearheading advancements with a strong focus on sustainability. Their strategic initiatives include developing products that enhance energy efficiency, aligning with the growing consumer demand for eco-friendly options.

Government incentives play a crucial role in stimulating market growth. These incentives are designed to encourage homeowners to invest in energy-efficient home improvements. A significant development in this regard is the federal tax credit introduced in January 2023. Hunter Douglas announced this credit for their Duette Honeycomb Shades, underscoring the emphasis on energy-saving products.

The market's trajectory is further supported by technological innovations. Companies are integrating smart home technologies with traditional blinds and shades, enhancing convenience and functionality. This trend is particularly prevalent in urban areas where smart home adoption is higher.

Additionally, the increasing awareness of the environmental impact of household products is prompting consumers to opt for sustainable materials. This shift is encouraging manufacturers to invest in recyclable and biodegradable materials, further propelling market growth.

Overall, the blinds and shades market is poised for substantial growth. The combination of technological advancements, government incentives, and consumer demand for sustainable products creates a robust framework for future expansion. This environment not only supports current market players but also presents lucrative opportunities for new entrants.

Key Takeaways

- Market Value: The Blinds and Shades Market was valued at USD 14.8 billion in 2023 and is expected to reach USD 30.8 billion by 2033, with a CAGR of 7.8%.

- Type Analysis: Roller Blinds dominate with 35%, favored for their versatility and ease of use.

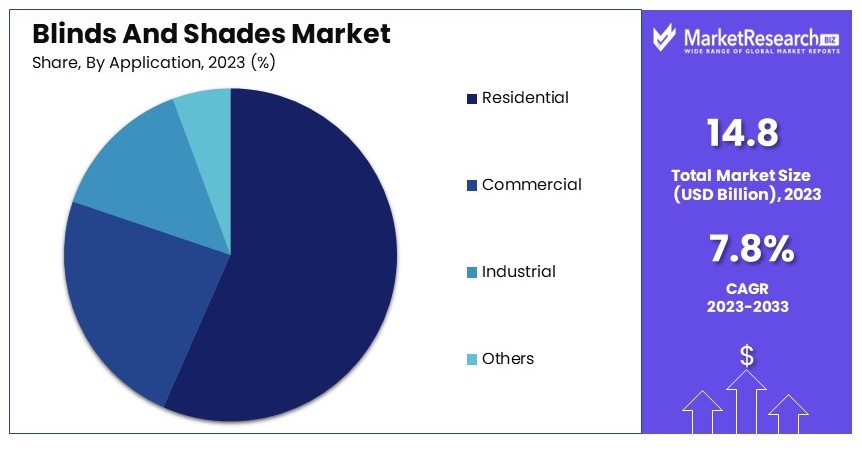

- Application Analysis: Residential applications lead with 60%, driven by increasing home renovations.

- Installation Analysis: Retrofit installations dominate with 70%, indicating high demand for home improvement.

- Technology Analysis: Manual technology leads with 80%, preferred for cost-effectiveness.

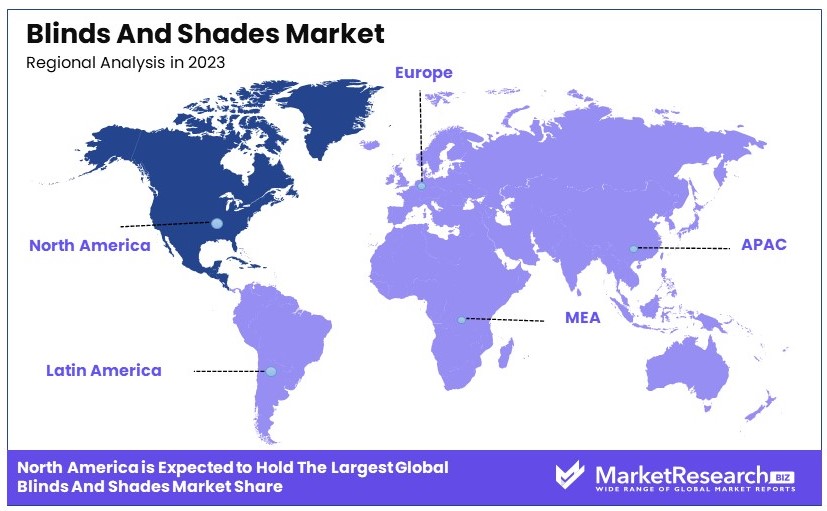

- Dominant Region: North America leads with 36%, driven by high consumer spending on home décor.

- Analyst Viewpoint: The market shows steady growth with moderate competition, expected to rise with smart home integration.

- Growth Opportunities: Key players can capitalize on smart blinds and shades technology and expand their product range to boost market share.

Driving Factors

Rising Demand for Energy-Efficient Window Coverings Drives Market Growth

The increasing focus on energy conservation is a significant driver for the blinds and shades market. As energy costs escalate, both homeowners and businesses are turning to energy-efficient window coverings to curb their heating and cooling expenses. Blinds and shades, particularly those designed with insulating features like cellular shades, effectively manage heat gain and loss through windows.

These products, known for their honeycomb-shaped cells, trap air and provide superior insulation, which can significantly reduce energy consumption. The growing awareness of energy efficiency not only boosts the demand for such specialized window coverings but also positions blinds and shades as essential elements in modern energy-saving home and office strategies.

Urbanization and Increasing Construction Activities Fuel Market Expansion

Urbanization and the resulting increase in construction activities are pivotal in driving the demand for blinds and shades. As cities expand and new residential and commercial buildings rise, the need for effective window coverings also grows. Blinds and shades are critical for privacy, controlling natural light, and enhancing the aesthetic appeal of the spaces.

The construction boom, especially in metropolitan areas with a proliferation of high-rise buildings, has escalated the demand for customized blinds and shades that can accommodate a variety of window sizes and styles. This trend not only supports market growth but also diversifies the product offerings in the blinds and shades industry.

Growing Emphasis on Interior Design and Home Décor Stimulates Market Demand

An increasing interest in interior design and home décor among consumers with rising disposable incomes is significantly influencing the blinds and shades market. Today, consumers are not just looking for practicality in window coverings but also style and innovation that complement their living spaces.

The popularity of home automation technologies has further spurred the integration of motorized and automated blinds and shades, enhancing convenience and functionality. These trends underline the blinds and shades as not just functional tools for privacy and light control but as integral components of home aesthetics and modern lifestyle, driving further growth in the market.

Restraining Factors

Competition from Alternatives Restrains Blinds and Shades Market Growth

Competition from alternative window coverings limits the growth of the blinds and shades market. Automatic curtains, drapes, and shutters often compete directly with blinds and shades. These alternatives can be seen as more affordable or easier to install.

For example, in some cultures, curtains and drapes are preferred for their aesthetic appeal and perceived value. This preference can reduce the demand for blinds and shades. Additionally, shutters may be favored for their durability and classic look. The availability and popularity of these alternatives create significant competition, slowing market growth for blinds and shades.

Environmental Concerns Restrain Blinds and Shades Market Growth

Environmental concerns impact the growth of the blinds and shades market. While the industry is developing eco-friendly products, materials like polyvinyl chloride (PVC) raise environmental issues. Consumers and businesses focusing on sustainability may choose other window coverings perceived as more eco-friendly.

For example, natural materials like bamboo or organic cotton for curtains are often seen as better for the environment. This shift in consumer preference towards sustainable products limits the market expansion for traditional blinds and shades made from less eco-friendly materials.

Type Analysis

Roller Blinds dominate with 35% due to their simplicity, versatility, and affordability.

In the blinds and shades market, the Type segment is crucial, with roller blinds leading due to their simplicity, versatility, and affordability. Roller blinds are favored for both residential and commercial applications because they offer an uncluttered look and are available in a wide range of materials and designs, which makes them suitable for various decor styles and functional needs.

Venetian blinds are also significant, particularly appreciated for their adjustable slats that offer precise control over light and privacy. Vertical blinds hold a key place in commercial settings, especially in office environments or large windows, due to their ease of operation and effective light management.

Other types of blinds include Roman and pleated styles, which provide aesthetic appeal but are often more expensive and require more maintenance. These styles are preferred in settings where decor takes precedence over functionality.

The shades market is similarly segmented with options like cellular shades, which are known for energy efficiency due to their layered design that traps air and provides insulation. Roman shades offer a traditional look with soft fabric folds, while pleated shades are lightweight and easy to install, making them practical for casual settings.

The "other shades" category includes innovative and niche products like smart shades, which can be integrated with home automation systems. This segment is growing rapidly as consumers increasingly value convenience and connectivity in their home environments.

Application Analysis

Residential dominates with 60% due to the growing demand for customized home decor solutions.

Application areas for blinds and shades include residential, commercial, and industrial, with the residential sector taking the lead. This dominance is fueled by the increasing interest in home improvement and personalized interior design, driven by trends in home decor and the desire for more comfortable and aesthetically pleasing living spaces.

Commercial applications are also significant, particularly in office buildings, hotels, and other public spaces where functionality and durability are priorities. Blinds and shades in commercial settings are often selected for their ability to control light and enhance energy efficiency, contributing to reduced operational costs.

Industrial applications, though less common, are important in spaces that require specialized solutions, such as factories or workshops where light control and safety are paramount.

The "others" category includes niche markets like healthcare facilities and educational institutions, where blinds and shades are used for both functionality and aesthetics. These segments are expected to grow as more institutions recognize the benefits of having controllable natural light environments.

Installation Analysis

Retrofit dominates with 70% due to the ease of integration into existing structures without the need for major renovations.

Installation types in the blinds and shades market are categorized into new construction and retrofit. Retrofit installations lead the market because they allow homeowners and businesses to upgrade their window treatments without the need for extensive renovations. This option is particularly attractive in older buildings where replacing window treatments can offer an immediate improvement in both aesthetics and energy efficiency.

New construction installations are also significant, especially in rapidly developing regions where new residential and commercial buildings are being constructed. These installations allow for the integration of blinds and shades into the building design from the start, often using more modern and energy-efficient models.

The growth in new construction installations is tied closely to real estate development trends and the economic climate, which influences construction activity levels.

Technology Analysis

Manual blinds and shades dominate with 80% due to their cost-effectiveness and lower need for maintenance.

Technology types in the blinds and shades market include automatic and manual. Manual blinds and shades continue to dominate due to their affordability and simplicity. They are easy to install and maintain, making them the go-to choice for both residential and commercial properties.

Automatic or motorized blinds and shades are gaining popularity, particularly in the high-end residential and commercial sectors, due to their convenience and the increasing integration of smart home technologies. These products offer enhanced functionality, such as remote operation and integration with home automation systems, appealing to tech-savvy consumers and modern workplaces.

The growth of automatic blinds and shades is driven by advancements in technology and a decrease in prices over time, making these products more accessible to a broader audience.

Distribution Channel Analysis

Offline channels dominate with 65% due to the preference for physical product inspection and immediate purchase.

Distribution channels for blinds and shades include online and offline outlets such as supermarkets/hypermarkets, specialty stores, and multi-brand stores. Offline sales channels dominate the market because many consumers prefer to inspect the quality and operation of blinds and shades in person before making a purchase. These channels also offer the advantage of immediate takeaway and often provide installation services, adding value for the customer.

Online channels are growing rapidly, however, as consumers become more comfortable with purchasing home decor products online, driven by the convenience and often lower prices available through online retailers. Online stores are expanding their market share by offering a wider range of products and improved customer support services, including augmented reality tools that help consumers visualize products in their homes before purchase.

Supermarkets and hypermarkets provide accessibility and convenience, particularly for consumers looking for more budget-friendly or standard options. Specialty stores are important for those seeking customized solutions or high-end products, often offering a higher level of customer service and expertise. Multi-brand stores appeal to consumers who appreciate the ability to compare multiple brands and products in one location, making them a popular choice for those looking to make informed purchasing decisions.

Key Market Segments

Type

- Blinds

- Venetian Blinds

- Vertical Blinds

- Roller Blinds

- Other Blinds

- Shades

- Cellular Shades

- Roman Shades

- Pleated Shades

- Roller Shades

- Other Shades

Application

- Residential

- Commercial

- Industrial

- Others

Installation

- New Construction

- Retrofit

Technology

- Automatic

- Manual

Distribution Channel

- Online

- Offline

- Supermarkets/Hypermarkets

- Specialty Stores

- Multi-Brand Stores

Growth Opportunities

Increased Focus on Smart Home Integration Offers Growth Opportunity

The integration of blinds and shades with smart home systems presents a significant growth opportunity. Smart blinds can be controlled remotely, scheduled to open or close at specific times, and integrated with other smart home devices.

This trend is driven by the growing popularity of smart home technologies and the desire for seamless home automation. Consumers appreciate the convenience and energy efficiency offered by smart blinds. As the smart home market expands, the demand for smart blinds and shades will increase, driving market growth.

Customization and Personalization Offers Growth Opportunity

The demand for personalized and customized blinds and shades is rising as consumers seek unique designs that fit their preferences and interior styles. This trend presents an opportunity for manufacturers to offer a wide range of customization options, including various materials, colors, patterns, and designs.

By catering to individual tastes, companies can differentiate their products and capture a larger market share. Providing customization enhances customer satisfaction and loyalty, driving growth in the blinds and shades market.

Trending Factors

Smart and Voice-Controlled Blinds Are Trending Factors

The integration of voice control technology with blinds and shades is a significant trend in the market. Consumers are increasingly embracing the convenience of voice-controlled devices. The ability to operate blinds and shades through voice commands adds an extra layer of ease and appeal.

This trend is driven by the widespread adoption of virtual assistants like Alexa, Siri, and Google Assistant. As more households adopt these technologies, the demand for voice-controlled blinds and shades is expected to grow, driving market expansion.

Motorized and Automated Blinds Are Trending Factors

Motorized and automated blinds are gaining popularity among consumers for their convenience and ease of operation. These blinds can be programmed to open or close at specific times or controlled remotely via smartphone apps or remote controls.

This trend is fueled by the increasing adoption of smart home technologies and the desire for seamless home automation. Motorized blinds offer enhanced comfort and energy efficiency, making them an attractive option for modern homes. As this trend continues, the market for motorized and automated blinds is poised for growth.

Regional Analysis

North America Dominates with 36% Market Share in the Blinds and Shades MarketNorth America's strong 36% market share in the blinds and shades industry can be attributed to several key factors. The region benefits from a robust housing market with high demand for home decor and renovation products. There is also a growing trend towards energy-efficient and smart home products, which include technologically advanced blinds and shades. The presence of major manufacturers and a wide distribution network further supports the market dominance.

The blinds and shades market in North America is influenced by consumer preference for aesthetic and functional home furnishings. The increase in residential construction and a rising interest in custom and premium home decor products drive the market. Additionally, the region's focus on sustainability supports the demand for eco-friendly materials in blinds and shades, aligning with global environmental trends.

The future influence of North America in the blinds and shades market is expected to remain strong. Continued growth in the housing market and consumer spending on home improvement are likely to drive further market expansion. Innovations in product design and integration of smart technology into blinds and shades are anticipated to attract more consumers, sustaining the region's market leadership.

Regional Market Shares and Dynamics:

Europe: Europe holds approximately 28% of the market. The region's market is driven by high demand for luxury and design-oriented home products. European consumers' strong focus on interior design aesthetics and energy efficiency also contributes to market growth.

Asia Pacific: Asia Pacific accounts for about 25% of the market. Rapid urbanization, increasing disposable incomes, and expansion of residential sectors in countries like China and India fuel the demand for blinds and shades. The region's growing middle class is particularly influential in driving market trends.

Middle East & Africa: The market share in the Middle East and Africa is around 6%. Although smaller, the market is growing due to increased construction activity and a rising emphasis on luxury residential and commercial properties.

Latin America: Latin America holds around 5% of the global market. Growth in this region is stimulated by improvements in economic conditions and increasing interest in home decor and renovation activities.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Blinds and Shades Market is influenced by several leading companies. Hunter Douglas N.V. and Springs Window Fashions, LLC are market leaders due to their extensive product ranges and strong global presence. They focus on innovation and high-quality materials.

Norman Window Fashions and The Shade Store are known for their custom solutions and excellent customer service. Their strategic focus on personalized products enhances their market positions.

Hillarys Blinds Limited and Lafayette Interior Fashions excel in the UK and European markets. They leverage strong regional distribution networks and innovative designs.

Comfortex Window Fashions and 3 Day Blinds LLC are recognized for their quick delivery and wide variety of products. Their strategies include expanding online sales and customer-centric approaches.

Budget Blinds, LLC and Levolor, Inc. are notable for their affordable and stylish window treatments. They focus on broadening their product lines and enhancing brand visibility.

Graber Blinds and Aluvert Blinds stand out for their durable and high-quality blinds. Their strong emphasis on customer satisfaction and reliability boosts their market influence.

Luxaflex Australia Pty Ltd. and Thomas Sanderson Ltd. are significant players in the Australian and UK markets, respectively. They prioritize innovation and sustainable materials.

MechoShade Systems, Inc. is known for its advanced shading solutions and focus on energy efficiency. Its strategic positioning in commercial markets enhances its market influence.

Overall, the market features a mix of global leaders and specialized firms, each contributing through innovation, quality, and strategic expansion.

Market Key Players

- Hunter Douglas N.V.

- Springs Window Fashions, LLC

- Norman Window Fashions

- The Shade Store

- Hillarys Blinds Limited

- Lafayette Interior Fashions

- Comfortex Window Fashions

- 3 Day Blinds LLC

- Budget Blinds, LLC

- Levolor, Inc.

- Graber Blinds

- Aluvert Blinds

- Luxaflex Australia Pty Ltd.

- Thomas Sanderson Ltd.

- MechoShade Systems, Inc.

Recent Developments

- January 2023 / Hunter Douglas: Hunter Douglas announced a promotion offering savings of up to $1,200 on qualified Duette Honeycomb Shades. This promotion is part of a federal tax credit initiative encouraging the purchase of energy-efficient products. This move aligns with the company's commitment to sustainability and energy efficiency.

- June 2024 / New Cord Safety Laws for Blinds and Shades: Starting in June 2024, new cord safety laws for blinds and shades will be implemented to prevent child strangulation. These regulations mandate the removal of free-hanging cords, tilt cords, inner cords, and multiple cord connectors. Homeowners and businesses are advised to switch to cordless or motorized blinds for enhanced safety, as over 200 incidents involving children have been reported.

Report Scope

Report Features Description Market Value (2023) USD 14.8 Billion Forecast Revenue (2033) USD 30.8 Billion CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Blinds [Venetian Blinds, Vertical Blinds, Roller Blinds, Other Blinds], Shades [Cellular Shades, Roman Shades, Pleated Shades, Roller Shades, Other Shades]), By Application (Residential, Commercial, Industrial, Others), By Installation (New Construction, Retrofit), By Technology (Automatic, Manual), By Distribution Channel (Online, Offline, Supermarkets/Hypermarkets, Specialty Stores, Multi-Brand Stores) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hunter Douglas N.V., Springs Window Fashions, LLC, Norman Window Fashions, The Shade Store, Hillarys Blinds Limited, Lafayette Interior Fashions, Comfortex Window Fashions, 3 Day Blinds LLC, Budget Blinds, LLC, Levolor, Inc., Graber Blinds, Aluvert Blinds, Luxaflex Australia Pty Ltd., Thomas Sanderson Ltd., MechoShade Systems, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Hunter Douglas N.V.

- Springs Window Fashions, LLC

- Norman Window Fashions

- The Shade Store

- Hillarys Blinds Limited

- Lafayette Interior Fashions

- Comfortex Window Fashions

- 3 Day Blinds LLC

- Budget Blinds, LLC

- Levolor, Inc.

- Graber Blinds

- Aluvert Blinds

- Luxaflex Australia Pty Ltd.

- Thomas Sanderson Ltd.

- MechoShade Systems, Inc