Bio-Based Polyethylene Terephthalate Market By Type(From Biomass, From Bio-Based Precursors), By Manufacturing Process(Extrusion, Injection Molding, Other), By Application(Bottles, Foam, Other), By End-User(Packaging, Consumer Goods), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

7039

-

Jul 2023

-

189

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

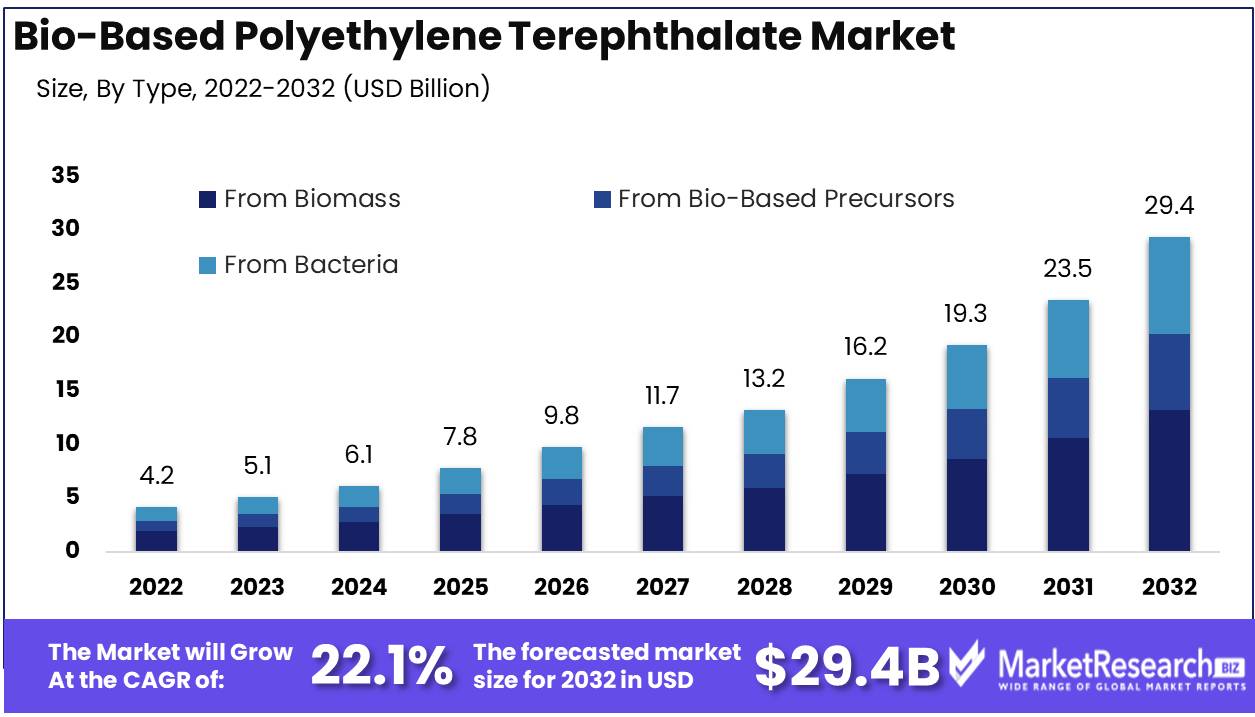

Bio-Based Polyethylene Terephthalate Market size is expected to be worth around USD 29.4 Bn by 2032 from USD 4.2 Bn in 2022, growing at a CAGR of 22.1% during the forecast period from 2023 to 2032.

Bio-based PET also referred to as renewable PET, is derived from renewable resources like maize, sugarcane, and beet pulp. It is a sustainable replacement for conventional PET, which is derived from fossil fuels. The objective of the bio-based PET market is to reduce greenhouse gas emissions, reduce dependence on nonrenewable resources, and promote a circular economy. This market intends to revolutionize industries by offering sustainable packaging solutions, decreasing carbon footprints, and fostering a greener future.

The significance and benefits of bio-based PET are numerous. It offers a significant reduction in carbon emissions as its primary benefit. Bio-based PET reduces reliance on fossil fuels, a significant contributor to greenhouse gas emissions, by using renewable resources. In addition, bio-based PET is recyclable and can be used to construct a closed-loop system in which the material is reused or repurposed after its initial application. This contributes to a circular economy and waste reduction.

The growth and prominence of the bio-based PET market have been propelled by notable innovations. Companies have been investing in research and development to enhance the properties and efficacy of bio-based PET, making it a viable alternative to conventional PET. To meet industry demands, innovations include enhancing its durability, strength, and thermal resistance. These developments have paved the way for the pervasive adoption of bio-based PET across numerous industries.

Across industries, substantial investments and incorporation of bio-based PET into products and services have been observed. Specifically, the packaging industry has adopted this sustainable material due to shifting consumer preferences and government regulations. Numerous prominent companies have integrated bio-based PET into their product lines, resulting in increased demand and market growth.

Driving factors

Increasing Demand for Eco-Friendly and Sustainable Packaging

The bio-based polyethylene terephthalate market (PET) is experiencing significant growth due to the rising demand for sustainable and eco-friendly packaging materials. As consumers become more environmentally conscious, there is a growing preference for products derived from renewable resources and with a lower environmental impact.

Growing awareness of the negative effects of conventional plastic packaging on the environment is one of the most important factors propelling this rising demand. The production of conventional plastics using fossil fuels results in the emission of greenhouse gases and contributes to global warming. In addition, the improper disposal of plastic waste has led to land and water pollution.

Growth of the Beverage and Food Industries

The growth of the beverage and food industries is further propelling the bio-based PET market. These industries are significant consumers of packaging materials and are always seeking innovative and sustainable packaging solutions. The increasing demand for packaged food and beverages, particularly in rapidly developing economies, has led to an increase in the production and consumption of bio-based PET.

Bio-Based PET Production Technologies

Another important factor propelling its market growth is advancements in bio-based production technologies. Researchers and industry professionals are continually attempting to enhance the efficacy and scalability of bio-based PET production processes. This has led to the development of new methods and technologies that permit the production of bio-based PET at a lower cost and with a smaller environmental footprint.

Expanding Focus on Reducing Carbon Footprint

The increasing emphasis on carbon footprint reduction across industries has provided a significant boost to the bio-based PET market. As part of their sustainability initiatives, governments and regulatory agencies actively promote the use of bio-based materials. As part of their corporate social responsibility initiatives, many businesses are also embracing sustainability and actively seeking eco-friendly packaging solutions, such as bio-based PET.

Restraining Factors

Cost Considerations in Relation to Conventional PET

Comparing the potential cost of bio-based PET to that of conventional PET is one of the most significant obstacles to the expansion of PET production. The production of bio-based PET requires complex manufacturing processes and renewable feedstock, which are typically more expensive than petroleum-based materials. In addition, conventional PET is currently more cost-effective due to economies of scale in its production. With technological advancements and increased demand, bio-based PET production can attain economies of scale, resulting in reduced costs and enhanced competitiveness.

Restricted Access to Bio-based PET Feedstock

The limited availability of bio-based PET feedstock is an additional issue that must be resolved. A sustainable and abundant supply of feedstock, such as plant-based sugars or agricultural refuse, is required for the production of bio-based PET. However, the availability and scalability of these feedstocks can be affected by a number of variables, such as climate change, land use, and competition from other industries. To assure a stable supply chain for bio-based PET, investments in R&D and collaborations with agricultural sectors are crucial. Implementing efficient agricultural methods and investigating alternative feedstock sources can assist in overcoming this constraining factor.

Type Analysis

Biomass dominates the bio-based polyethylene terephthalate market pet.

In recent years, the bio-based polyethylene terephthalate market (PET) has undergone a significant shift, with an increased emphasis on sustainability and the use of renewable resources. The From Biomass segment has emerged as the market's dominant growth-driving force, becoming one of the market's key participants.

Biomass refers to the production of bio-based PET from biomass sources such as maize, sugarcane, and other organic substances. This process entails converting these biomass sources into bio-based intermediates, which are subsequently utilized to produce PET resin. The use of biomass as a feedstock offers several advantages over traditional fossil fuel-based sources, including a reduction in greenhouse gas emissions and a lower reliance on limited resources.

The adoption of From Biomass has been especially prevalent in emerging economies, where accelerated economic growth has created a greater demand for sustainable and eco-friendly products. As these economies continue to expand, the demand for PET and other plastic products is expected to rise, driving the demand for sustainable alternatives.

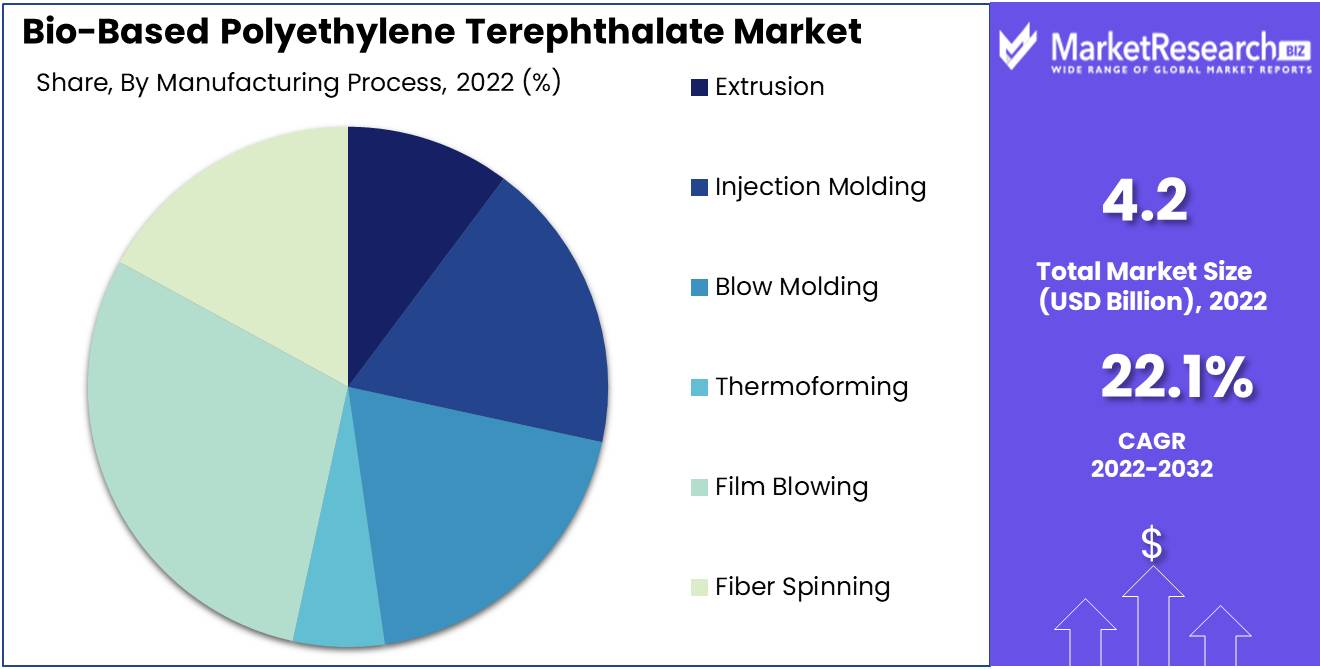

Manufacturing Process Analysis

Film Blowing dominates the bio-based polyethylene terephthalate pet market.

Film Blowing has emerged as the dominant manufacturing technique in the Bio-Based PET market. The process of film blowing entails the extrusion of molten PET through a narrow slit, which is then cooled and solidified to form a thin, flexible film. This film has a wide range of applications, including packaging, agriculture, and construction.

Economic development in emerging economies has created a greater demand for packaging materials and other plastic products, which has driven the adoption of Film Blowing. As these economies continue to expand, there is a growing demand for lightweight, cost-effective, and environmentally favorable flexible packaging solutions. These requirements are satisfied by film blowing, making it an attractive option for manufacturers and end-users.

In the packaging industry, in particular, consumer trends and behaviors have also influenced the adoption of Film Blowing. Increasing consumer demand for convenience and usability in packaging has led to a shift toward flexible packaging solutions. Film blowing provides numerous benefits in terms of product protection, storage life, and aesthetics, making it a popular option among manufacturers and consumers.

Application Analysis

Bottles Segment Dominates the bio-based polyethylene terephthalate PET Market.

The Bottles Segment of the bio-based PET market has emerged as the dominant application. Bio-based PET bottles have a number of advantages over traditional petroleum-based PET bottles, including lower carbon emissions and less reliance on finite resources. The Bottles Segment includes a vast array of products, including water bottles, beverage bottles, and containers for personal care products.

The adoption of the Bottles Segment has been driven by economic growth in emergent economies, where rising disposable incomes and shifting lifestyle preferences have led to an increase in demand for packaged beverages and personal care products. As these economies continue to expand, the demand for bio-based PET bottles is expected to increase, driven by factors such as sustainability, convenience, and a concentration on healthier lifestyles.

Trends and behaviors of consumers have also played a significant role in driving the Bottles Segment's adoption. Increasingly, consumers search for products that reflect their values and promote sustainable practices. This has led to a shift in consumer preference for bio-based PET bottles, which are perceived to be more environmentally beneficial and safer for human health than traditional plastic bottles.

Key Market Segments

By Type

- From Biomass

- From Bio-Based Precursors

- From Bacteria

By Manufacturing Process

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

- Film Blowing

- Fiber Spinning

By Application

- Bottles

- Foam

- Pressure Sensitive Adhesive Tape

- Substrate in Thin Film Solar Cells

- Cosmetics

By End-User

- Packaging

- Consumer Goods

- Automotive

Growth Opportunity

Utilizing Sustainability Initiatives to Penetrate Emerging Markets

The expansion of bio-based PET into emerging markets with sustainability initiatives represents an additional growth opportunity. These markets, which are characterized by rapid population growth and growing environmental concerns, provide a substantial customer base for sustainable packaging solutions. By targeting these markets and positioning bio-based PET as an eco-friendly alternative to conventional plastics, companies can gain a competitive edge and access new revenue streams.

Collaboration with Packaging Manufacturers and Brand Owners

Collaboration with brand proprietors and packaging manufacturers is essential for promoting the market adoption of bio-based PET. Companies can create a demand-pull effect that promotes the ubiquitous use of bio-based PET by partnering with influential brands that prioritize sustainability. In addition, close collaboration with packaging manufacturers enables the creation of innovative and customized packaging solutions made from bio-based PET, thereby enhancing its market potential.

Expansion of Applications for Bio-Based PET in Diverse Industries

Another growth opportunity is presented by the diversification of bio-based PET applications across industries. While packaging remains the primary use for bio-based PET, the automotive, textile, and consumer products industries have unrealized potential. Companies that investigate and invest in these new applications can take advantage of the rising demand for sustainable materials and expand their market reach.

Raising consumer awareness and educating them on bio-based packaging

Raising consumer awareness and educating them on the advantages of bio-based packaging is a crucial aspect of unleashing the growth potential of bio-based PET. Many consumers are still unaware of the environmental consequences of conventional plastics and the alternatives that are available. By engaging in educational campaigns and promoting the benefits of bio-based packaging, companies can increase consumer demand and adjust market preferences toward sustainable options.

Latest Trends

Bio-based PET Demand in the Beverage and Personal Care Industries

The beverage and personal care industries play a vital role in propelling the demand for PET bottles and containers made from bio-based materials. Consumers are becoming more aware of the environmental impact of traditional plastic packaging. This awareness has increased the demand for bio-based alternatives in these industries. With a substantially smaller carbon footprint than traditional PET, bio-based PET offers comparable performance characteristics. In addition, bio-based PET is recyclable, making it an ideal material for businesses committed to minimizing their environmental impact.

Use of biobased PET for food packaging

The food packaging industry is another significant sector where bio-based PET is making an impression. With rising food safety and sustainability concerns, there is a growing demand for packaging materials that can preserve product freshness while minimizing environmental impact. These criteria are met by bio-based PET, which provides a sustainable and dependable solution for food packaging. It is an excellent choice for preserving food quality and extending shelf life due to its superior barrier properties. In addition, the use of bio-based PET in food packaging reduces reliance on fossil fuels, thereby contributing to a greener and more sustainable future.

An increase in initiatives and partnerships promoting bio-based PET

The rapid development of the bio-based PET market can be partially attributed to the numerous partnerships and initiatives promoting its use. Diverse industry actors, including packaging manufacturers, beverage companies, and environmental organizations, have joined forces to promote the adoption of bio-based PET and increase public awareness of its benefits. These partnerships seek to educate consumers, collaborate on research and development, and establish a sustainable bio-based PET supply chain. Through collaborative efforts, the industry is striving to increase the adoption of bio-based PET, thereby ensuring its continued growth and impact.

Adoption of Bio-based PET in Models of the Circular Economy

In recent years, the concept of a circular economy has garnered considerable traction, highlighting the importance of minimizing waste and maximizing resource efficiency. In accordance with the principles of a circular economy, bio-based PET is a renewable and recyclable alternative to traditional polymers. By incorporating bio-based PET into models of the circular economy, we can reduce our reliance on fossil fuels and increase the use of sustainable materials. This integration ensures that bio-based PET continues to be an essential component of a circular economy, thereby contributing to the long-term sustainability of our planet.

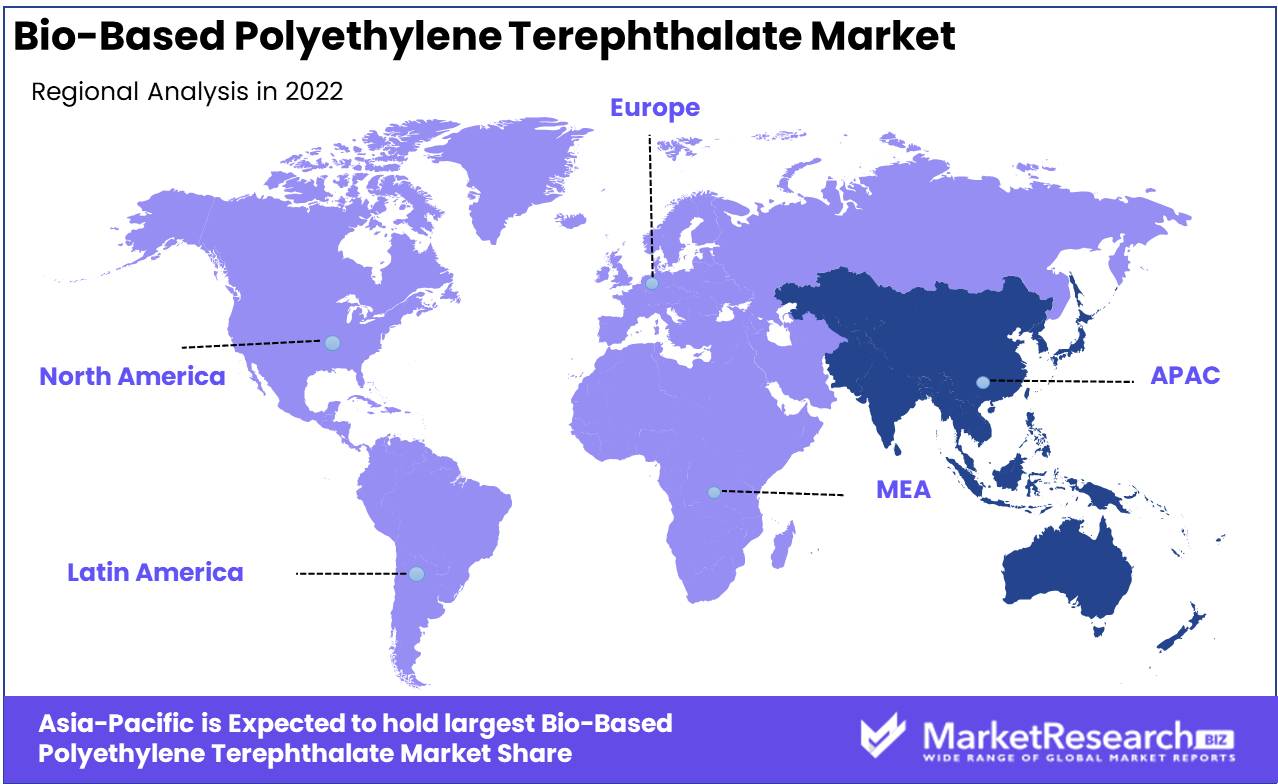

Regional Analysis

Asia-Pacific Region Dominates the Bio-based Polyethylene Terephthalate (PET) Market

The Asia-Pacific region has emerged as the market leader for bio-based polyethylene terephthalate (PET) worldwide. This region has witnessed a significant transition towards sustainable and eco-friendly materials due to its rapid economic growth, rising population, and increasing environmental concerns. PET, or polyethylene terephthalate, is a type of polyester extensively used in the packaging industry due to its superior mechanical properties, transparency, and recyclability.

In recent years, demand for bio-based PET has increased due to its reduced carbon footprint and renewable nature. In contrast to conventional PET, which is derived from fossil fuels, Bio-Based PET is made from renewable resources like sugarcane, maize, and other agricultural feedstocks. The Asia-Pacific region has embraced this eco-friendly alternative, leading to a surge in the production and consumption of bio-based PET.

The vast availability of feedstock in the Asia-Pacific region is one of the primary reasons for the region's bio-based PET market dominance. Countries with vast agricultural resources, such as China, India, Thailand, and Indonesia, are suitable for bio-based PET production. The abundance of sugarcane and other agricultural commodities provides a dependable and affordable resource for the production of bio-based PET.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Avery Dennison Corporation in the United States is a prominent player in the bio-based PET market. Utilizing bio-based films and adhesives for a variety of applications, the company emphasizes sustainable solutions. Avery Dennison Corporation has established itself as a leading provider of sustainable packaging solutions for industries such as food and beverage, personal care, and logistics by offering a vast array of products.

Dupont, another prominent player in the bio-based PET market, takes pride in its innovative and advanced materials. Utilizing its expertise in polymer science and materials engineering, the company offers an array of bio-based PET products. Dupont's commitment to sustainability is demonstrated by its efforts to develop eco-friendly alternatives to conventional PET, thereby reducing the environmental impact of packaging and other applications.

Dow, a household name in the chemical industry, is an active participant in the bio-based PET market. The company is committed to developing sustainable materials, such as PET polymers made from bio-based sources. Dow's emphasis on research and development enables the company to innovate and produce products that not only satisfy market demands but also contribute to a sustainable future. Their commitment to sustainability distinguishes them in this extremely competitive market.

3M, a renowned manufacturer of a wide variety of products, has also made significant advances in the bio-based PET market. The company provides innovative solutions for a variety of industries with a strong emphasis on sustainability. Customers have eco-friendly options without sacrificing efficacy thanks to 3M's Bio-based PET films and adhesives. The company's commitment to sustainable practices positions them as a dominant market player.

Top Key Players in the bio-based polyethylene terephthalate Pet Market

- AVERY DENNISON CORPORATION (U.S.)

- Dupont (U.S.)

- Dow (U.S.)

- 3M (U.S.)

- H.B. Fuller Company (U.S.)

- Sealed Air (U.S.)

- SABIC (Saudi Arabia)

- Arkema (France)

- LyondellBasell (Netherlands)

- Exxon Mobil Corporation (U.S.)

- Mitsui Chemicals Inc.

- (Japan)

- Braskem (Brazil)

- TotalEnergies (France)

- Novamont SpA (Italy)

- SOLVAY (Belgium)

- DAIKIN (Japan)

- Biome Bioplastics (UK)

- PTT Global Chemical Public Company Limited (Thailand)

- KURARAY CO. Ltd. (Japan)

Recent Development

- In 2023, BASF, one of the world's largest chemical companies, is preparing for a game-changing surge by announcing plans to launch an innovative line of bio-based PET. BASF intends to redefine industry standards by introducing a more environmentally friendly solution, which represents a significant breakthrough in the field of sustainable materials.

- In 2022, DuPont, a company renowned for its expertise in developing high-performance polymers, made an important announcement. The company announced plans to expand its already remarkable bio-based PET portfolio, demonstrating its commitment to sustainability.

- In 2021, Nestlé, the world's largest food and beverage company, announced plans to launch a new line of beverage bottles made from bio-based PET. This innovative strategy is consistent with Nestlé's commitment to reducing its environmental footprint and enhancing the overall sustainability of its packaging.

Report Scope

Report Features Description Market Value (2022) USD 4.2 Bn Forecast Revenue (2032) USD 29.4 Bn CAGR (2023-2032) 22.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(From Biomass, From Bio-Based Precursors), By Manufacturing Process(Extrusion, Injection Molding, Other), By Application(Bottles, Foam, Other), By End-User(Packaging, Consumer Goods) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AVERY DENNISON CORPORATION (U.S.), Dupont (U.S.), Dow (U.S.), 3M (U.S.), H.B. Fuller Company (U.S.), Sealed Air (U.S.), SABIC (Saudi Arabia), Arkema (France), LyondellBasell (Netherlands), Exxon Mobil Corporation (U.S.), Mitsui Chemicals Inc., (Japan), Braskem (Brazil), TotalEnergies (France), Novamont SpA (Italy), SOLVAY (Belgium), DAIKIN (Japan), Biome Bioplastics (UK), PTT Global Chemical Public Company Limited (Thailand), KURARAY CO. Ltd. (Japan) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AVERY DENNISON CORPORATION (U.S.)

- Dupont (U.S.)

- Dow (U.S.)

- 3M (U.S.)

- H.B. Fuller Company (U.S.)

- Sealed Air (U.S.)

- SABIC (Saudi Arabia)

- Arkema (France)

- LyondellBasell (Netherlands)

- Exxon Mobil Corporation (U.S.)

- Mitsui Chemicals Inc.

- (Japan)

- Braskem (Brazil)

- TotalEnergies (France)

- Novamont SpA (Italy)

- SOLVAY (Belgium)

- DAIKIN (Japan)

- Biome Bioplastics (UK)

- PTT Global Chemical Public Company Limited (Thailand)

- KURARAY CO. Ltd. (Japan)