Global Pet Bottles Market By Capacity Analysis (less than 500 ml, 500 ml to 1000 ml, 1000 ml to 2000 ml, More than 2000 ml), By Application Analysis (Food and beverages, Consumer Goods, Automotive, Textile, Photovoltaic Modules) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

8542

-

May 2023

-

166

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

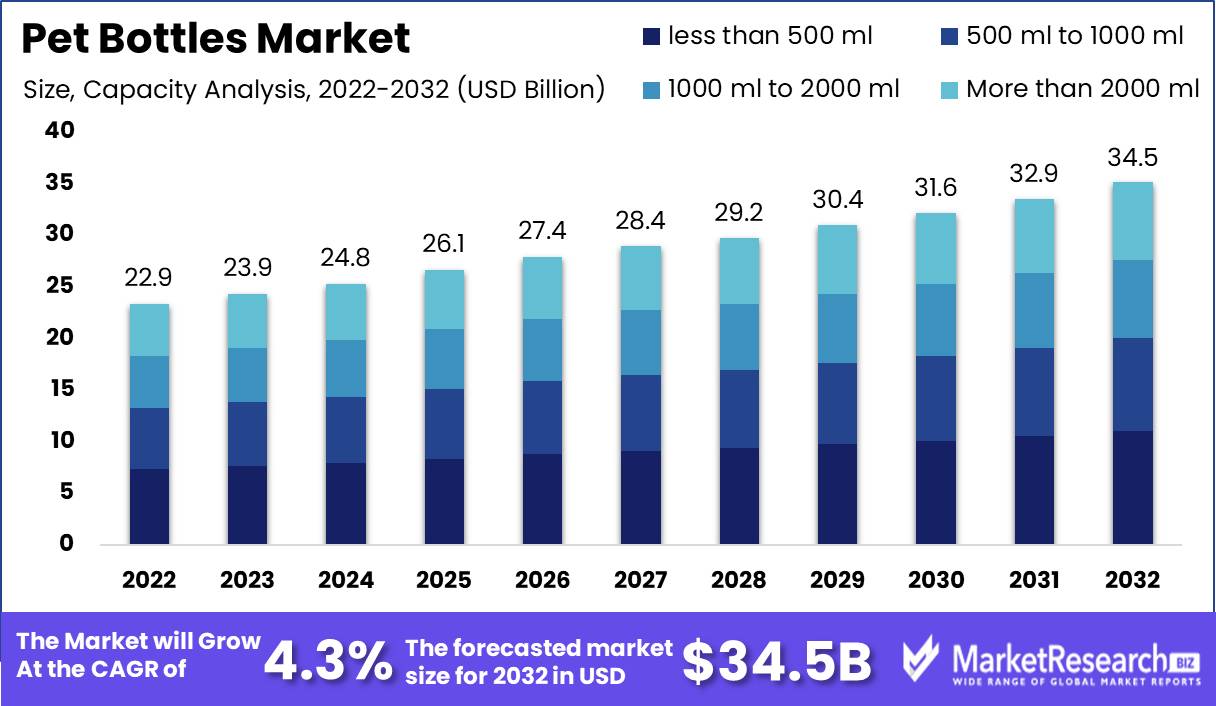

Global Pet Bottles Market size is expected to be worth around USD 34.5 Bn by 2032 from USD 22.9 Bn in 2022, growing at a CAGR of 4.3% during the forecast period from 2023 to 2032.

PET bottles, those ubiquitous vessels that have seamlessly incorporated into our daily lives, have transcended their humble beginnings to become an indispensable aspect of contemporary life. These vessels, fashioned from Polyethylene terephthalate, or PET, are emblematic of the larger PET bottles market, which defies conventional packaging standards as it expands.

Let's begin by unraveling the complex tapestry of the PET bottles market. This market is intricately interwoven with the very fabric of our consumer-driven society, manifesting as a complex amalgamation of production, distribution, and sale. It aims to provide a packaging solution that is economically viable, environmentally sound, and secure, catering to the pressing requirements of both manufacturers and discerning consumers.

It is lightweight and durable, and effortlessly traverses immense distances, enhancing manufacturers' logistical prowess. As a result of its 100 percent recyclable nature, it arises as a phoenix of environmental awareness amidst a wasteland of plastic waste. Moreover, within its polymer confines, it emanates an aura of safety, devoid of toxic constituents and malevolent chemicals, thereby ensuring the safety of its precious cargo.

Innovation reigns supreme in the domain of PET bottles. Limits are obliterated, obstacles disintegrate, and development surges forward. Manufacturers are attempting to forge a bond between the past and the future by fortifying these bottles with ever-increasing quantities of recycled material, which is a remarkable achievement.

When delving into the history of the PET bottles market, it is impossible to ignore the massive influx of investments that has propelled its rapid evolution. Reputational waves have reached the ears of major beverage conglomerates, prompting them to implement PET bottles into their product lines. Other industries soon followed suit, inspired by the potential of this burgeoning market.

As it emerges from its infancy, the PET bottles market transforms into a formidable force propelled by a variety of forces. The foremost of these is the escalating chorus of environmental consciousness, which resonates with consumers' yearning for sustainable, eco-friendly alternatives. The clamor for eco-friendly products reverberates throughout the halls of our collective conscience, inciting an insatiable desire for packaging solutions that reflect our values.

However, despite the radiance of development, there are shadows on the horizon. Ethical concerns surround the use of PET bottles, threatening to discredit their virtuous appearance. Unfortunately, the market seeks redemption by adopting a position of openness, explicability, and responsibility.

As we traverse the vast extent of the PET bottles market, it becomes clear that its tentacles reach far beyond the realm of commerce. This dynamic domain's business applications permeate numerous industries and leave an indelible impact on the landscape. Manufacturers use PET bottles to package their products, heralding in a new era of efficiency and cost savings. Thus unfolds the epic saga of PET bottles, which is marked by perplexity and explosiveness. It is a testament to human ingenuity, an ode to the pursuit of sustainability, and a rallying cry against the advancing darkness of environmental degradation.

Driving factors

Packaged Water and Carbonated Drinks Drive PET Bottle Demand Growth:

Increasing demand for packaged water and carbonated beverages has led to a surge in demand for PET bottles, which is a significant factor. In addition, rising environmental awareness and the need for eco-friendly packaging solutions have led consumers to prefer PET bottles over other packaging materials.

PET Bottles Are Highly Successful in the Food and Beverage Industry:

In addition, the growth of the food and beverage industry has had a positive impact on the pet bottle market. PET bottles are widely used in the industry, and their affordability and resilience make them a desirable option. The increasing use of PET bottles in pharmaceuticals, personal care, and domestic products has also contributed to the industry's growth.

Technological Advances and Changing Lifestyles Drive Demand for Lightweight and Durable PET Bottles:

Technological advancements in PET bottle manufacturing processes have made it possible to produce bottles that are both lightweight and durable, contributing to the growth of the industry. In addition, the growth of urbanization and the evolution of consumer lifestyles have led to an increase in demand for on-the-go packaging solutions, thereby accelerating the market expansion of PET bottles.

Future of the PET Bottle Market Determined by Regulatory Changes and Emerging Technologies:

While the pet bottle market is anticipated to continue its growth trajectory, there may be regulatory changes that could have an impact on the industry. Any emerging technologies aimed at reducing environmental impact could have a positive impact on the PET bottle market. However, alternative packaging materials such as paper and glass, which are gaining popularity among consumers, are potential disruptors that could have an impact on the competitive landscape.

Demand for Eco-Friendly PET Bottle Packaging Is Fueled by Shifting Consumer Behavior:

In addition, emerging trends or changes in consumer behavior may have an impact on the pet bottle market. For instance, rising disposable incomes and shifting consumer preferences could result in a transition toward eco-friendly premium packaging solutions. To remain competitive in the pet bottle market as the industry continues to develop, market participants must maintain vigilance and adjust to shifting trends.

Restraining Factors

Overcoming Challenges & Ensuring Future Growth Restraining Factors in the PET Bottles Market:

As a prominent supplier of PET bottles to clients around the world, we are familiar with the market dynamics and myriad challenges faced by PET bottle manufacturers in the current market environment. While PET bottles are popular due to their lightweight, low cost, and versatility, the pet bottle market faces significant challenges from a number of restraining factors.

Alternative Packaging Solutions Available:

The availability of alternative packaging options is one of the most important factors restraining the PET bottles market. The growing emphasis on sustainable development has increased consumer demand for eco-friendly and biodegradable packaging alternatives. As a consequence, a significant number of manufacturers are switching from PET bottles to bio-based plastics, glass, and metal packaging alternatives.

Manufacturers must adopt innovative technologies and prioritize sustainable development to surmount this challenge. By investing in research and development, manufacturers are able to create new eco-friendly packaging materials that meet consumer demand and adhere to environmentally conscious business practices.

Strict Rules Regarding the Use of Plastics:

The increasing focus of regulatory authorities on the use of plastics is another significant factor restraining the PET bottle market. Due to environmental concerns, governments around the world are instituting stringent regulations on the use of plastics, causing manufacturers to face obstacles in importing, exporting, and packaging their products.

To surmount this obstacle, manufacturers must continuously monitor regulatory framework changes and adapt accordingly. To remain ahead of regulatory trends, manufacturers can also focus on eco-friendly packaging solutions, such as biodegradable plastics or paper-based packaging.

Questions Regarding the Safety of PET Bottles:

The safety of PET bottles is an important factor for both purchasers and consumers. Consumers and manufacturers are investigating alternative packaging options due to concerns about the potential dangers of using PET bottles for hot or acidic beverages.

Manufacturers must invest in research and development to guarantee the safety of PET bottles in order to meet this challenge. New technologies, such as barrier coatings and multilayer structures, can improve the safety and durability of PET bottles.

Fluctuations in Raw Material Prices:

The price of basic materials, such as crude oil, is a major factor restraining the market for PET bottles. Raw material price fluctuations can have a significant impact on the profitability and pricing strategies of manufacturers, resulting in diminished market competitiveness.

To surmount this obstacle, manufacturers must routinely monitor and forecast fluctuations in the prices of raw materials. By regularly analyzing the market, they can identify market trends and adjust their pricing strategies accordingly.

Competition from Glass and Metal Packaging Solutions

While PET bottles are ubiquitous, they are up against stiff competition from glass and metal packaging alternatives. As a result of their superior aesthetics, durability, and perceived quality, glass, and metal packaging products are frequently preferred by luxury brands. To surmount this difficulty, manufacturers must continually innovate and improve the quality, design, and style of PET bottles.

By Capacity Analysis

In recent years, the market for PET (Polyethylene terephthalate) bottles has experienced significant growth, with a particular emphasis on the less than 500 ml segment. It is anticipated that this segment will dominate the market in the future years, as larger sizes become less popular. This transition in demand has been influenced by a number of factors, such as shifting consumer preferences and economic growth in emerging economies.

The less than 500 ml segment dominates the PET bottles market, comprising approximately 60% of the total market share. This segment is popular due to its affordability and convenience. PET bottles are commonly used for packaged water, carbonated drinks, juices, and other non-alcoholic beverages. These bottles are appropriate for single-person consumption and portability due to their diminutive size.

The adoption of the less than 500 ml segment is predominantly driven by economic growth in developing nations. The rise of the middle class in these economies has led to a rise in disposable income, which has in turn increased the demand for convenience products. The growth of e-commerce has also contributed to the adoption of PET bottles, which are simple to transport and deliver.

The adoption of the less-than-500-ml segment is also heavily influenced by consumer trends and behavior. Today's consumers place a greater emphasis on health and wellness, and the reduced sizes of PET bottles assist them in portion control.

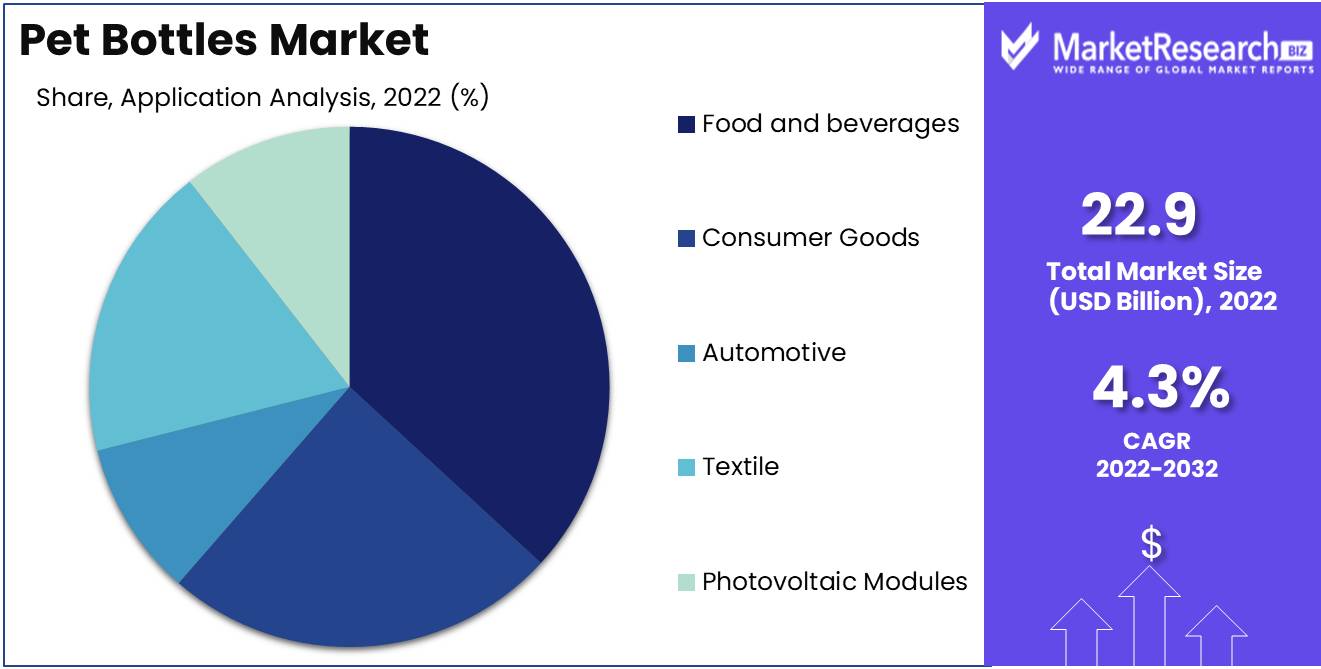

By Application Analysis

The food and beverage segment dominates the PET bottles market, comprising approximately 70% of the market share. In the food and beverage industry, PET bottles are in high demand due to their ability to maintain product freshness and quality.

The economic development of emerging societies also plays a significant role in the segment's adoption. As the middle class in these economies continues to expand, packaged food products with prolonged shelf lives are in greater demand. The growth of organized retail, which includes supermarkets and hypermarkets, has also contributed to the expansion of the food and beverage segment.

In addition to consumer trends and behavior, the adoption of the food and beverage segment is also influenced by these factors. In the juices and beverages market, the trend toward healthy eating and drinking habits is propelling demand for PET bottles.

Key Market Segments

By Capacity Analysis

- less than 500 ml

- 500 ml to 1000 ml

- 1000 ml to 2000 ml

- More than 2000 ml

By Application Analysis

- Food and beverages

- Consumer Goods

- Automotive

- Textile

- Photovoltaic Modules

Growth Opportunity

Demand for Eco-Friendly Packaging Solutions Drives Market Growth:

The demand for sustainable packaging solutions, the expansion of the e-commerce industry, the rising demand for PET bottles in the cosmetics and personal care industry, the rising demand for lightweight and compact packaging solutions, and the rising demand for PET bottles in the dairy and dairy products industry all contribute to this growth.

The Environmentally Responsible Packaging Option:

Due to a growing awareness of the environmental impact of single-use plastics, sustainable packaging solutions are currently in high demand. PET bottles are an excellent answer to this demand because they are recyclable and can be reused multiple times without compromising the quality of the product they contain. Therefore, PET bottles are ideal for consumers who are environmentally conscious and wish to purchase responsibly packaged products.

Demand for Robust PET Bottle Packaging Is Boosted by the E-commerce Boom:

With the expansion of the e-commerce industry comes an increase in the demand for packaging that can withstand the rigors of transportation. Due to their durability and resistance to impact, PET bottles are an excellent option here. In addition, they provide excellent transportation protection against moisture and other environmental factors.

PET Bottles Gain Ground in the Cosmetics Industry Due to their Versatility and Low Cost:

PET bottles are gaining popularity in the cosmetics and personal care industry due to their adaptability, affordability, and design versatility. They are lightweight and can be molded into various shapes and sizes, making them ideal for travel-sized products.

Industry-Wide Surge in Demand for Lightweight and Compact Packaging Solutions:

In a number of industries, such as food and beverage, healthcare, and cosmetics, lightweight and compact packaging solutions are becoming increasingly essential. PET bottles are an excellent option for these industries due to their lightweight, portability, and small footprint.

PET Bottles Dominate the Packaging Industry for Dairy and Dairy Products:

Lastly, the dairy and dairy products industry is experiencing significant expansion, and PET vessels are gaining popularity in this sector. Due to their durability, resistance to impact, and ability to obstruct light, PET bottles are ideal for milk packaging and other dairy products.

Latest Trends

Unique PET Bottle Designs and Shapes:

Due to their lightweight and durability, PET bottles have been a mainstay in the beverage industry for decades. However, as market competition increases, companies are introducing innovative and creative designs to distinguish their products. Because they are simpler to stack, transport, and store than traditional round bottles, square and rectangular PET bottles have gained popularity.

Additionally, the addition of hand grips to PET bottles has made them simpler for consumers to carry and manipulate, particularly when they are full. Companies are also experimenting with different hues and textures to increase the aesthetic allure of these bottles.

Change to the Utilization of Recycled PET Bottles:

Companies have begun transitioning towards the use of recycled PET (rPET) bottles to lessen their carbon footprint in response to the growing concern for environmental sustainability. Used PET bottles are collected, sorted, and cleaned before being ground into small particles for reintroduction into the manufacturing process.

Producing rPET bottles requires less energy, water, and basic materials, resulting in numerous benefits. According to studies, the manufacturing of rPET bottles reduces greenhouse gas emissions by as much as 70 percent compared to traditional PET bottles, making them environmentally friendly alternatives.

Creation of Bio-based PET Bottles:

In the packaging industry, the development of bio-based PET bottles has acquired momentum in recent years. In contrast to conventional PET bottles produced from fossil fuels, bio-based PET bottles are made from renewable resources like sugarcane or cornstarch. In addition to possessing the same properties as conventional PET bottles, these bottles are also biodegradable.

Traditional PET bottles can take hundreds of years to decompose in landfills, but bio-based PET bottles decompose within weeks, making them a more environmentally friendly option. As the world continues to shift toward sustainable living, bio-based PET bottles are becoming an increasingly popular option among consumers and a significant market trend in the PET bottle industry.

Increasing Demand for PET Bottles with Dispensing Functions:

Consumers' desire for convenience in their daily activities has led to the development of PET bottles with dispensing features. The flip-top caps or pump dispensers on these bottles make it simple to dispense the liquid inside. In the personal care and home cleaning product industry, where users must dispense the desired quantity of product, they are particularly popular.

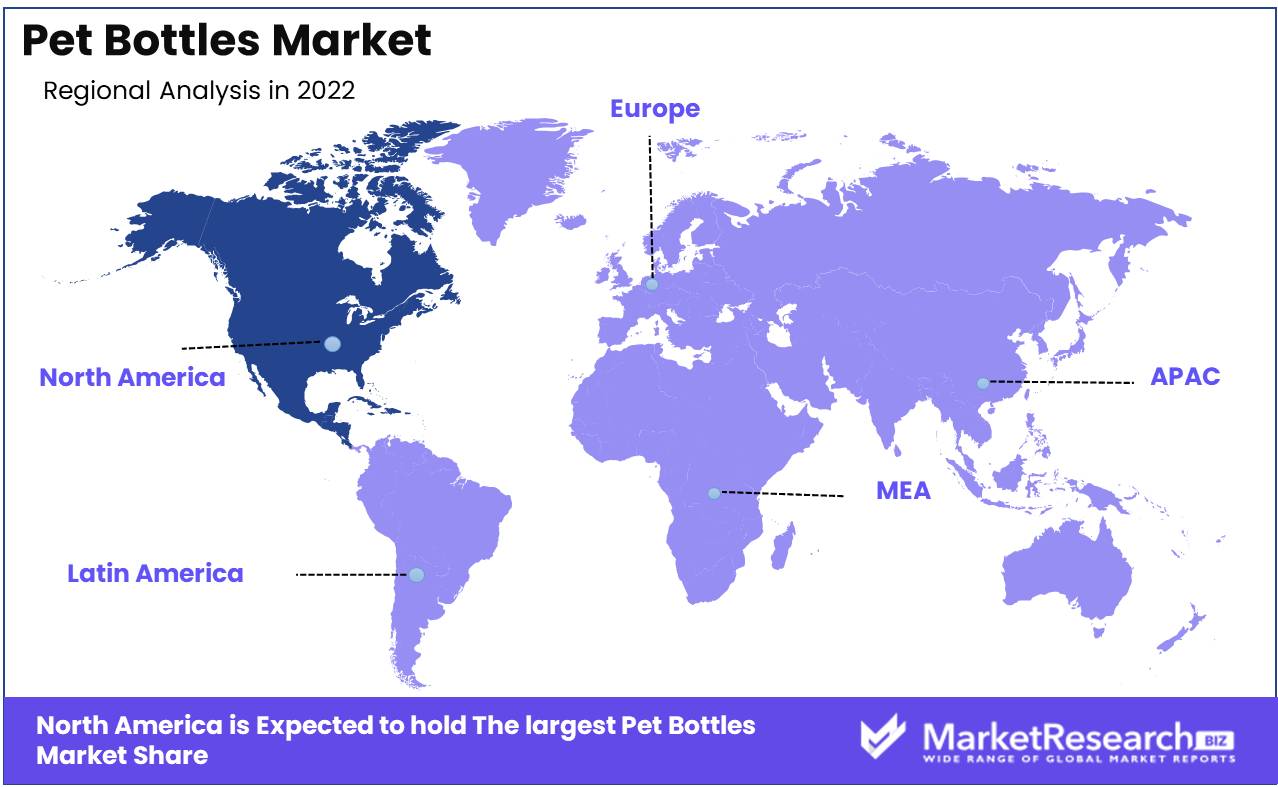

Regional Analysis

North America has played a crucial role in the PET bottle market's growth as the polyethylene terephthalate (PET) industry has expanded rapidly over the years. Because of the growth of the food and beverage industry and the high demand for bottled water, North America is anticipated to hold a sizeable share of the PET bottles market.

In recent years, there has been a global transition toward the use of plastic bottles as packaging for a variety of products, including beverages, foods, and pharmaceuticals. This shift has created an exceptional opportunity for the PET bottles market to expand, and North America is among the primary regions.

PET bottles are an ideal packaging option for a variety of food and beverage items. They are lightweight, durable, and provide superior protection for the contents while extending their expiration life. These qualities have contributed to the popularity of PET bottles, and the growth of the food and beverage industry has indirectly contributed to the expansion of the PET bottles market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In recent years, the pet bottle market has experienced tremendous expansion. The expansion of this market has been fuelled by the rising demand for packaged beverages and foods. Amcor, Berry Global Inc., Gerresheimer AG, Huhtamaki Oyj, Silgan Holdings Inc., Plastipak Holdings Inc., ALPLA Werke Alwin Lehner GmbH & Co KG, Resilux NV, RETAL Industries Ltd., and Koksan Pet Plastik are the key players in the pet bottles market at present.

Amcor is a leading player in the pet bottle market, offering a diverse selection of products to food and beverage, healthcare, and other industries. Berry Global Inc. is another prominent player in this market with a diverse product portfolio that caters to a variety of industries, including the wine and spirits, dairy, and personal care sectors.

Gerresheimer AG is a global provider of pharmaceutical and healthcare industries with glass and plastic packaging solutions. While Huhtamaki Oyj is a company situated in Finland that offers innovative packaging solutions for food, beverages, and other consumer goods.

The food, beverage, and personal care markets are served by Silgan Holdings Inc.'s extensive selection of metal, plastic, and composite closures. Plastipak Holdings Inc. is a pioneering innovator in the packaging industry, providing solutions for diverse markets including food, beverages, and domestic goods.

Top Key Players in Pet Bottles Market

- RETAL Industries Ltd.

- Plastipak Holdings, Inc.

- Resilux NV

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Esterform Packaging Limited

- Koksan Pet Plastik

- Taiwan Hon Chuan Enterprise Co., Ltd.

- PDG Plastiques S.A.S

- Zhongfu Enterprise Co Ltd.

- Alpha Packaging

Recent Development

- In January 2021, Amcor is not the only company to announce eco-friendly packaging initiatives.

- In October 2020, 100% recycled PET bottles will be used for the company's primary brands in the Netherlands and Norway.

- In June 2020, Nestle, the largest food and beverage company in the world, announced that it would invest in new technology to produce PET plastic that is food-grade recycled for use in its packaging.

- In August 2019, Indorama Ventures, a prominent producer of petrochemicals, made a significant step toward sustainability by acquiring Sorepla Industrie, a French company specializing in PET plastic recycling.

- In April 2019, another beverage colossus, PepsiCo, announced that its LIFEWTR brand in the United States would begin using 100% rPET bottles.

Report Scope:

Report Features Description Market Value (2022) USD 22.9 Bn Forecast Revenue (2032) USD 34.5 Bn CAGR (2023-2032) 4.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Capacity Analysis (less than 500 ml, 500 ml to 1000 ml, 1000 ml to 2000 ml, More than 2000 ml), By Application Analysis (Food and beverages, Consumer Goods, Automotive, Textile, Photovoltaic Modules) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape RETAL Industries Ltd., Plastipak Holdings, Inc., Resilux NV, ALPLA Werke Alwin Lehner GmbH & Co KG, Esterform Packaging Limited, Koksan Pet Plastik, Taiwan Hon Chuan Enterprise Co., Ltd., PDG Plastiques S.A.S, Zhongfu Enterprise Co Ltd., Alpha Packaging Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- RETAL Industries Ltd.

- Plastipak Holdings, Inc.

- Resilux NV

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Esterform Packaging Limited

- Koksan Pet Plastik

- Taiwan Hon Chuan Enterprise Co., Ltd.

- PDG Plastiques S.A.S

- Zhongfu Enterprise Co Ltd.

- Alpha Packaging