Global Atopic Dermatitis Treatment Market By Drug Class(Biologics, Calcineurin Inhibitors, PDE-4 Inhibitor, Corticosteroids, Others), By Route Of Administration(Topical, Injectable, Oral), By Distribution Channel(Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47024

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

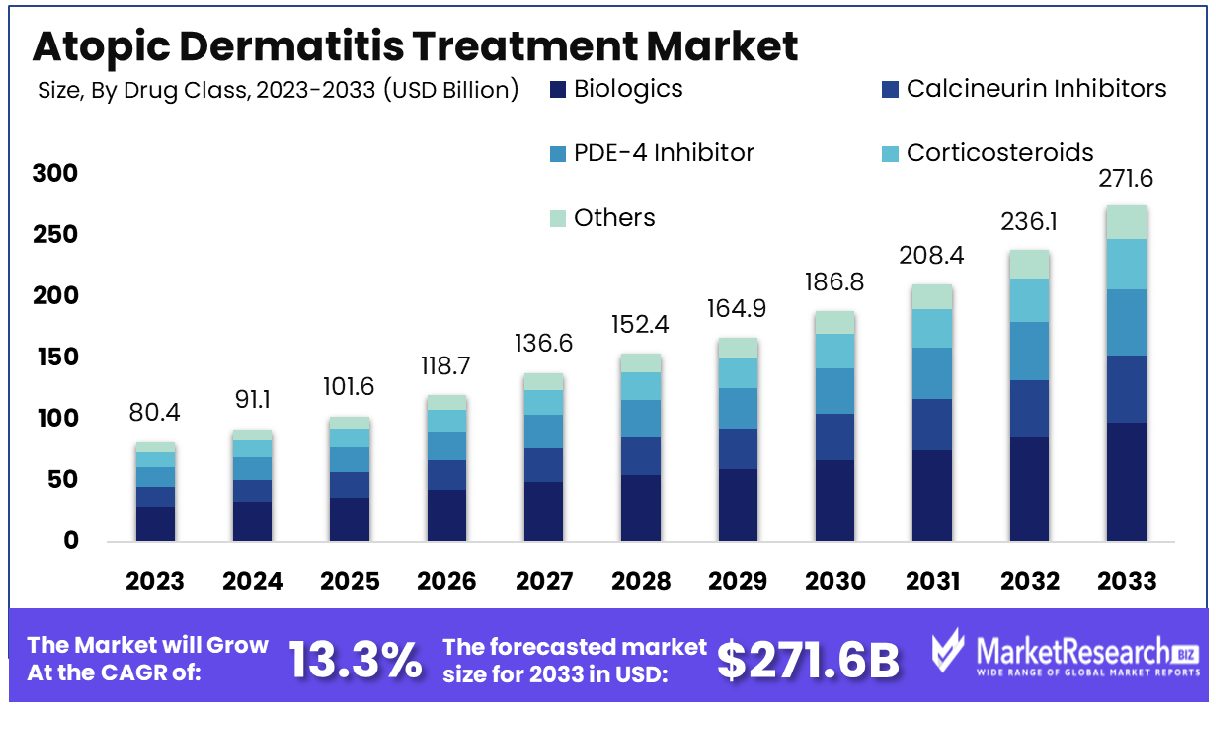

The Global Atopic Dermatitis Treatment Market was valued at USD 80.4 billion in 2023. It is expected to reach USD 271.6 billion by 2033, with a CAGR of 13.3% during the forecast period from 2024 to 2033.

The Atopic Dermatitis Treatment Market refers to the sector encompassing pharmaceuticals, therapies, and products aimed at addressing the needs of individuals suffering from atopic dermatitis, a chronic inflammatory skin condition. This market includes prescription medications, over-the-counter remedies, biologic therapies, and innovative topical solutions designed to alleviate symptoms such as itching, redness, and inflammation associated with atopic dermatitis.

With a focus on enhancing patient outcomes and quality of life, companies within this market continually research and develop novel treatments, leveraging cutting-edge technologies and scientific advancements to provide effective relief for patients, while also addressing the evolving demands of healthcare providers and payers.

The Atopic Dermatitis (AD) treatment market is experiencing steady growth, propelled by consistent prevalence and incidence rates over the past decade. From 2012 to 2021, the prevalence of AD remained stable at approximately 4%, with an annual incidence ranging between 5.7 to 5.8 per 1000 individuals. This stability underscores the enduring demand for effective treatment solutions within the dermatology sector.

Notably, the utilization of AD-related treatments is most pronounced in the initial year following diagnosis, indicating the acute need for immediate therapeutic intervention upon identification of the condition. Among pediatric healthcare, conventional treatments such as low-potency topical corticosteroids (41.8%), mid-potency topical corticosteroids (30.1%), high-potency topical corticosteroids (34.9%), and topical calcineurin inhibitors (10.8%) are commonly prescribed.

However, the emergence of newer therapies, exemplified by phosphodiesterase-4-inhibitors approved in 2019, presents a promising avenue for innovation within the market. Despite their nascent adoption rates (0.3% in children, 0.7% overall), these novel treatments signify a paradigm shift towards more targeted and efficacious therapeutic modalities.

The market's trajectory is underpinned by a dynamic interplay of factors including evolving treatment guidelines, advancements in pharmaceutical research, and heightened patient awareness. As stakeholders navigate this landscape, strategic considerations must encompass not only the efficacy and safety profile of treatments but also factors such as market access, reimbursement dynamics, and patient-centricity. By aligning commercial strategies with the evolving needs of patients and healthcare providers, stakeholders can capitalize on the burgeoning opportunities within the AD treatment market.

Key Takeaways

- Market Growth: The Global Atopic Dermatitis Treatment Market was valued at USD 80.4 billion in 2023. It is expected to reach USD 271.6 billion by 2033, with a CAGR of 13.3% during the forecast period from 2024 to 2033.

- By Drug Class: Biologics lead the drug class market with a dominant 43.2% share.

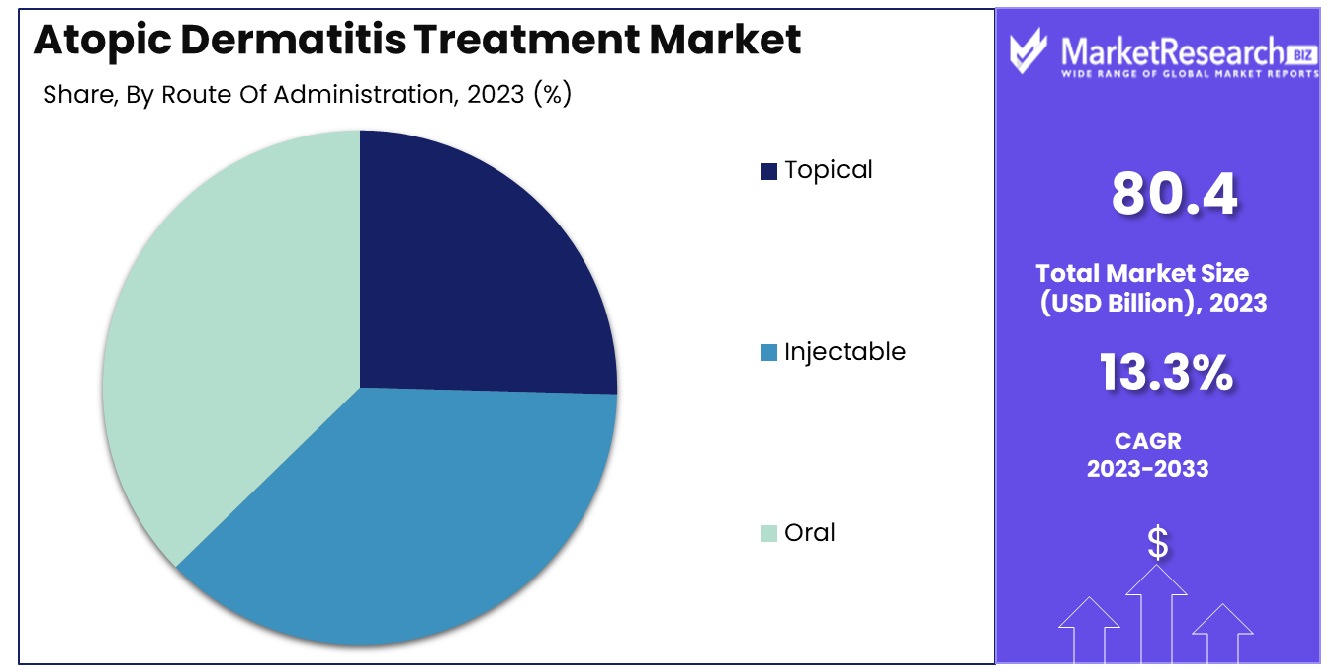

- By Route Of Administration: Injectable route of administration commands 48.1% market dominance.

- By Distribution Channel: Hospital pharmacies top distribution channel with 57.5% market share.

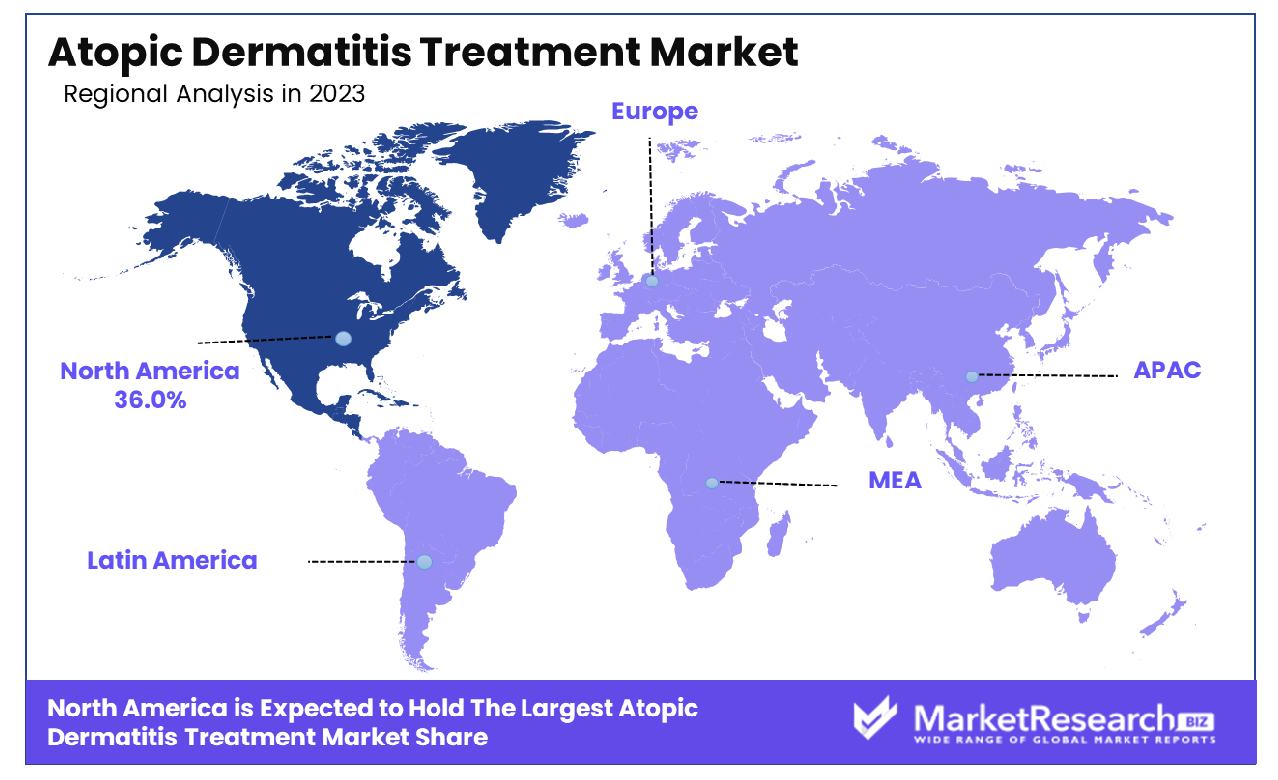

- Regional Dominance: In North America, the Atopic Dermatitis Treatment Market commands a 36.0% market share.

- Growth Opportunity: Advancements in botanical extraction technologies have enhanced dermatological treatments, offering potent solutions for atopic dermatitis. Innovative delivery formats like gummies and powders optimize therapeutic outcomes, fostering long-term skin health.

Driving factors

Surge in Demand for Plant-Based and Natural Products

The Atopic Dermatitis Treatment Market is experiencing a notable upswing, primarily propelled by the escalating demand for plant-based and natural products. Consumers are increasingly gravitating towards remedies sourced from botanicals due to their perceived safety and efficacy in managing skin conditions like atopic dermatitis. This shift is largely fueled by a growing awareness of the potential adverse effects associated with conventional pharmaceutical treatments, such as steroids, which have led individuals to seek gentler alternatives.

According to recent market analyses, the global demand for plant-based dermatological treatments has witnessed a significant uptick, with a projected compound annual growth rate (CAGR) of 6.8% from 2020 to 2027. This surge can be attributed to various factors, including consumers' preference for holistic wellness solutions, concerns regarding the environmental impact of synthetic ingredients, and a general inclination toward embracing natural remedies. As a result, market players are increasingly investing in research and development efforts to innovate botanical-based formulations tailored to address the specific needs of individuals suffering from atopic dermatitis.

Expansion of the Health and Wellness Industry

The burgeoning health and wellness industry is playing a pivotal role in driving the growth of the Atopic Dermatitis Treatment Market. As individuals become more proactive in managing their health and prioritizing self-care practices, there has been a corresponding surge in demand for skincare solutions that not only alleviate symptoms but also promote overall well-being. This trend is underpinned by a cultural shift towards preventive healthcare and a growing recognition of the interconnectedness between skin health and overall wellness.

Market research indicates that the health and wellness sector is experiencing robust expansion, with a projected market value exceeding $4.5 trillion by 2025. Within this landscape, skincare occupies a significant share, fueled by consumers' desire for products that address specific dermatological concerns while aligning with their broader health goals. Consequently, market players are leveraging this trend by developing innovative atopic dermatitis treatments that not only target symptom management but also nourish and fortify the skin barrier, thereby addressing the underlying factors contributing to the condition.

Influence of Cultural and Traditional Botanical Medicine Practices

The Atopic Dermatitis Treatment Market is also being shaped by the cultural and traditional use of botanicals in medicine. Across diverse cultures and regions, botanical remedies have long been integrated into healthcare practices, valued for their perceived therapeutic properties and minimal side effects. This rich heritage of botanical medicine has provided a foundation for the development of modern dermatological treatments, with researchers increasingly exploring the efficacy of traditional plant-based ingredients in managing skin disorders like atopic dermatitis.

Traditional botanical remedies, backed by centuries of empirical evidence, are gaining traction among consumers seeking alternatives to mainstream pharmaceuticals. Market insights reveal a growing interest in ethnomedicine and traditional healing practices, with consumers drawn to the holistic approach and cultural significance associated with botanical-based treatments. As a result, market dynamics are evolving to accommodate this trend, with pharmaceutical companies partnering with indigenous communities and integrating traditional knowledge into product development processes.

Restraining Factors

Impact of High Treatment Costs on Market Growth

The Atopic Dermatitis Treatment Market faces significant challenges due to the high costs associated with treatment, exerting a restraining influence on its growth trajectory. The expense of dermatological therapies, including prescription medications and topical treatments, poses a barrier to access for many individuals seeking relief from atopic dermatitis symptoms. Market analyses reveal that the cost burden of managing atopic dermatitis can be substantial, with expenditures on prescription medications alone averaging hundreds to thousands of dollars annually per patient.

The financial strain imposed by high treatment costs often leads to disparities in healthcare access, particularly among economically disadvantaged populations. Individuals with limited financial resources may forgo or delay seeking treatment, resulting in unmet medical needs and exacerbation of their dermatological condition. Moreover, the affordability of treatment options can significantly impact patients' adherence to prescribed regimens, further complicating disease management and impeding positive health outcomes.

Addressing the issue of high treatment costs requires a multifaceted approach, encompassing efforts to enhance affordability, expand insurance coverage, and promote the development of cost-effective treatment alternatives. Market stakeholders, including pharmaceutical companies, policymakers, and healthcare providers, must collaborate to implement strategies that mitigate financial barriers and improve access to essential atopic dermatitis therapies.

Challenges Arising from Lack of Treatment Adherence

The Atopic Dermatitis Treatment Market grapples with the challenge of inadequate adherence to treatment regimens, which undermines efforts to effectively manage the condition and achieve optimal outcomes for patients. Non-adherence, characterized by the failure to consistently follow prescribed treatment protocols, is a pervasive issue in healthcare, with significant implications for disease progression and healthcare resource utilization. Studies indicate that adherence rates among individuals with atopic dermatitis are suboptimal, with factors such as forgetfulness, treatment complexity, and perceived lack of efficacy contributing to non-compliance.

The consequences of poor treatment adherence extend beyond individual patients to encompass broader healthcare system challenges, including increased healthcare costs, disease exacerbations, and diminished quality of life. Market analyses underscore the need for targeted interventions aimed at improving adherence rates and fostering patient engagement in disease management. These interventions may encompass patient education initiatives, simplification of treatment regimens, and the integration of digital health technologies to facilitate monitoring and support.

Efforts to address the issue of treatment non-adherence are integral to optimizing outcomes in the Atopic Dermatitis Treatment Market. By enhancing patient adherence and fostering a collaborative approach to disease management, market stakeholders can mitigate the impact of this restraining factor and promote the sustainable growth of the market.

By Drug Class Analysis

Biologics hold a dominant market share of 43.2%, surpassing other drug classes significantly.

In 2023, Biologics held a dominant market position in the By Drug Class segment of the Atopic Dermatitis Treatment Market, capturing more than a 43.2% share. Biologics, with their targeted approach and efficacy in managing atopic dermatitis, emerged as the preferred choice among healthcare practitioners and patients alike. This significant market presence underscores the growing confidence in biologic therapies and their ability to address the complexities of atopic dermatitis effectively.

Following Biologics, Calcineurin Inhibitors constituted another substantial segment, demonstrating a notable presence in the market. With their immunomodulatory properties, Calcineurin Inhibitors have established themselves as a cornerstone in the treatment paradigm for atopic dermatitis. Their efficacy in managing inflammation and reducing the severity of symptoms has positioned them as indispensable therapeutic options for patients.

PDE-4 Inhibitors emerged as a promising segment within the Atopic Dermatitis Treatment Market, offering a novel approach to managing the condition. While still gaining traction compared to established therapies, PDE-4 Inhibitors have demonstrated potential in targeting specific pathways implicated in atopic dermatitis pathogenesis. As research continues to elucidate their mechanism of action and therapeutic benefits, PDE-4 Inhibitors are expected to witness steady growth and adoption in the market.

Corticosteroids, long-standing staples in the treatment of atopic dermatitis, maintained a significant presence in the market. Despite concerns regarding long-term use and adverse effects, corticosteroids remain widely prescribed for their potent anti-inflammatory properties and rapid symptom relief.

The 'Others' category encompassed a diverse range of treatment modalities, including emollients, antihistamines, and phototherapy, among others. While each subcategory within 'Others' contributed modestly to the market share, their collective impact underscores the multifaceted approach to managing atopic dermatitis, reflecting the need for personalized treatment strategies tailored to individual patient profiles.

By Route Of Administration Analysis

Injectable drugs lead in route of administration, capturing a substantial 48.1% market share.

In 2023, Injectables held a dominant market position in the By Route of Administration segment of the Atopic Dermatitis Treatment Market, capturing more than a 48.1% share. Injectable formulations have emerged as the preferred route of administration among healthcare providers and patients due to their convenience, efficacy, and targeted delivery of therapeutic agents directly into the affected areas. This substantial market share underscores the growing preference for injectable therapies in managing the complexities of atopic dermatitis.

Following Injectable, Topical formulations constituted another significant segment in the market. With their ease of application and localized action, topical treatments remain a cornerstone in the management of atopic dermatitis. Their ability to deliver medications directly to the skin surface allows for targeted relief of symptoms, making them an integral part of the treatment regimen for many patients.

Oral medications, while accounting for a smaller portion of the market share, maintained a notable presence in the Atopic Dermatitis Treatment Market. Oral formulations offer systemic relief and are often prescribed for moderate to severe cases of atopic dermatitis or in combination with other treatment modalities to achieve comprehensive disease management. Despite advancements in other routes of administration, oral therapies continue to play a significant role in addressing the diverse needs of patients with atopic dermatitis.

The dominance of Injectable formulations reflects the evolving treatment landscape and the increasing demand for innovative delivery mechanisms that offer both efficacy and convenience. As research and development efforts continue to focus on improving drug delivery technologies, Injectable therapies are poised to maintain their leading position in the Atopic Dermatitis Treatment Market, catering to the evolving needs of patients and healthcare providers alike.

By Distribution Channel Analysis

Hospital pharmacies emerge as the primary distribution channel, commanding a significant market share of 57.5%.

In 2023, Hospital Pharmacies held a dominant market position in the By Distribution Channel segment of the Atopic Dermatitis Treatment Market, capturing more than a 57.5% share. Hospital Pharmacies emerged as the primary distribution channel for atopic dermatitis treatments, owing to their extensive reach, specialized expertise, and close integration with healthcare institutions. This significant market share underscores the pivotal role of Hospital Pharmacies in facilitating access to essential medications for patients with atopic dermatitis.

Following Hospital Pharmacies, Retail Pharmacies constituted another substantial segment of the market. Retail Pharmacies serve as convenient points of access for patients seeking over-the-counter and prescription drugs medications for atopic dermatitis. Their widespread presence in local communities and accessibility to a diverse range of healthcare products make them integral to the distribution network for atopic dermatitis treatments.

Online Pharmacies, while accounting for a smaller portion of the market share, maintained a notable presence in the Atopic Dermatitis Treatment Market. The convenience and discretion offered by online platforms have contributed to their growing popularity among patients seeking alternative avenues for purchasing medications. Online Pharmacies cater to the evolving preferences of digitally savvy consumers, providing a seamless shopping experience and doorstep delivery of atopic dermatitis treatments.

The 'Others' category encompassed a variety of distribution channels, including specialty clinics, dermatology centers, and direct-to-consumer channels. While each subcategory within 'Others' contributed modestly to the market share, their collective impact underscores the diverse distribution landscape for atopic dermatitis treatments. As the market continues to evolve, stakeholders are likely to explore innovative distribution strategies to enhance accessibility and meet the evolving needs of patients with atopic dermatitis.

Key Market Segments

By Drug Class

- Biologics

- Calcineurin Inhibitors

- PDE-4 Inhibitor

- Corticosteroids

- Others

By Route Of Administration

- Topical

- Injectable

- Oral

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Growth Opportunity

Advancements in Extraction Technologies for Botanical Ingredients

The growth trajectory of the global Atopic Dermatitis Treatment Market in 2023 appears promising, largely driven by significant advancements in extraction technologies for botanical ingredients. These innovations have revolutionized the formulation of dermatological treatments, offering potent and efficacious solutions for managing atopic dermatitis. By harnessing cutting-edge extraction techniques, manufacturers can now procure high-quality botanical compounds with enhanced therapeutic properties, thus expanding the repertoire of treatment options available to patients.

These advancements have paved the way for the development of novel topical formulations enriched with natural extracts renowned for their anti-inflammatory and skin-soothing properties. Such formulations not only address the symptoms of atopic dermatitis but also promote skin health and resilience, aligning with the growing consumer preference for holistic skincare solutions.

Innovation in Delivery Formats, Such as Gummies or Powders

In tandem with advancements in botanical extraction technologies, the Atopic Dermatitis Treatment Market in 2023 is poised for growth due to innovative delivery formats, including gummies and powders. These unconventional formats offer a convenient and palatable alternative to traditional topical treatments, catering to diverse consumer preferences and lifestyles.

The introduction of gummies and powders not only enhances patient compliance but also ensures precise dosing, optimizing therapeutic outcomes. Moreover, these formats facilitate the incorporation of key nutrients and bioactive compounds that nourish and fortify the skin barrier, complementing the primary treatment approach and fostering long-term skin health. As such, the integration of innovative delivery formats underscores a pivotal growth opportunity within the global Atopic Dermatitis Treatment Market, driving accessibility and efficacy while catering to evolving consumer needs.

Latest Trends

Growing Popularity of Combination Therapies

The global Atopic Dermatitis Treatment Market in 2023 is witnessing a notable trend towards the adoption of combination therapies, driven by the quest for enhanced treatment outcomes. Recognizing the multifactorial nature of atopic dermatitis, healthcare practitioners and researchers are increasingly exploring the synergistic benefits of combining multiple therapeutic modalities. By integrating complementary approaches, such as topical corticosteroids, calcineurin inhibitors, and emollients, into comprehensive treatment regimens, clinicians aim to address the diverse manifestations of the disease and optimize symptom management.

The rationale behind combination therapies lies in their ability to target different pathogenic pathways simultaneously, thereby exerting a more profound and sustained therapeutic effect. Moreover, such approaches offer the flexibility to tailor treatment strategies according to the severity and individual characteristics of the patient's condition, fostering a personalized approach to care.

Emphasis on Personalized and Precision Medicine Approaches

Another discernible trend shaping the landscape of the Atopic Dermatitis Treatment Market in 2023 is the increasing emphasis on personalized and precision medicine approaches. In contrast to traditional one-size-fits-all treatment paradigms, personalized medicine endeavors to tailor therapeutic interventions to the unique genetic makeup, immune profile, and environmental triggers of each patient.

Advancements in genomic profiling, biomarker identification, and bioinformatics have paved the way for a more nuanced understanding of atopic dermatitis pathogenesis, enabling the identification of specific molecular targets for intervention. By leveraging this knowledge, healthcare providers can develop targeted therapies that address the underlying drivers of the disease, maximizing efficacy while minimizing adverse effects. Moreover, precision medicine approaches empower clinicians to predict treatment responses and optimize therapeutic outcomes, heralding a new era of individualized care in the management of atopic dermatitis.

Regional Analysis

In North America, the Atopic Dermatitis Treatment Market holds a substantial share of 36.0%.

In the Atopic Dermatitis Treatment Market, North America emerges as a dominant region, commanding a significant market share of 36.0%. This region's prominence is underscored by its robust healthcare infrastructure, high prevalence of atopic dermatitis cases, and a strong focus on research and development activities.

In North America, the market is characterized by a diverse range of treatment options, including biologic therapies, topical corticosteroids, and phototherapy, catering to the varied needs of patients. According to the American Academy of Dermatology, approximately 10-20% of children and 1-3% of adults in the United States are affected by atopic dermatitis, highlighting the substantial patient pool driving market growth in this region.

In Europe, the Atopic Dermatitis Treatment Market showcases steady growth, buoyed by increasing healthcare expenditure and rising awareness about the disease. The European Academy of Dermatology and Venereology reports a prevalence rate of 15-20% among children and 1-3% among adults in Europe. With a focus on evidence-based medicine and regulatory frameworks promoting innovation, Europe presents lucrative opportunities for market players to introduce novel therapeutics and expand their footprint.

The Asia Pacific region exhibits promising growth prospects in the Atopic Dermatitis Treatment Market, fueled by improving healthcare infrastructure, growing disposable incomes, and a rising burden of atopic dermatitis cases. According to a study published in the Indian Journal of Dermatology, Venereology, and Leprology, the prevalence of atopic dermatitis in Asia ranges from 0.2% to 24.6%, with variations observed across different countries. Market players are increasingly investing in product launches and strategic collaborations to capitalize on the untapped potential of this region.

In the Middle East & Africa and Latin America, the Atopic Dermatitis Treatment Market is witnessing gradual expansion, supported by increasing awareness initiatives, improving access to healthcare services, and rising demand for advanced treatment modalities. While the prevalence of atopic dermatitis in these regions varies, concerted efforts by healthcare organizations and governments to address dermatological disorders are expected to drive market growth in the coming years.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the competitive landscape of the global Atopic Dermatitis Treatment Market in 2023, several key players are making significant contributions to the advancement of therapeutic interventions and shaping industry dynamics. Among these prominent companies, Sanofi stands out as a leading innovator, leveraging its extensive expertise in biopharmaceuticals to develop cutting-edge treatments for atopic dermatitis. Sanofi's commitment to research and development is underscored by its pipeline of promising candidates, including biologics and small molecules, aimed at addressing the unmet needs of patients with atopic dermatitis.

AbbVie Inc. and Regeneron Pharmaceuticals, Inc. emerge as formidable contenders in the market, leveraging their collaborative efforts to pioneer biologic therapies that target specific immune pathways implicated in the pathogenesis of atopic dermatitis. With flagship products such as Dupixent® (dupilumab), developed in partnership with Sanofi, AbbVie, and Regeneron have revolutionized the treatment landscape for moderate-to-severe atopic dermatitis, offering patients a novel therapeutic option with demonstrated efficacy and safety.

Pfizer Inc., Eli Lilly and Company, and Novartis AG also command notable presence in the Atopic Dermatitis Treatment Market, with a diverse portfolio of dermatological products and ongoing research initiatives aimed at addressing the multifaceted nature of atopic dermatitis. These companies continue to invest in clinical trials and collaborations to expand their product offerings and enhance treatment outcomes for patients worldwide.

While these key players lead the forefront of innovation, emerging companies such as AnaptysBio, Inc. and LEO Pharma A/S are poised to disrupt the market with their novel approaches to atopic dermatitis treatment. As competition intensifies, strategic partnerships, acquisitions, and product differentiation will remain pivotal for companies to maintain their competitive edge and capitalize on the growing demand for effective atopic dermatitis therapies.

Market Key Players

- Sanofi

- AbbVie Inc.

- Regeneron Pharmaceuticals, Inc.

- Pfizer Inc.

- AnaptysBio, Inc.

- Incyte Corporation

- Eli Lilly and Company

- Novartis AG

- LEO Pharma A/S

- Astellas Pharma Inc.

- Bristol-Myers Squibb Company

- Galderma S.A.

- Dermira, Inc. (acquired by Eli Lilly and Company)

- Encore Dermatology, Inc.

- Medimetriks Pharmaceuticals, Inc.

Recent Development

- In March 2024, At the AAD 2024 meeting, Dr. Brian S. Kim highlighted the transformative impact of JAK inhibitors and systemic therapies on dermatologic care, emphasizing improved patient outcomes and quality of life.

- In March 2024, Leo Pharma, under CEO Christophe Bourdon, posted a 14% reduction in operating costs and a 7% revenue increase in 2023. Promising data on Adbry, delgocitinib, and TMB-001 were presented at AAD, signaling an accelerated innovation model.

Report Scope

Report Features Description Market Value (2023) USD 80.4 Billion Forecast Revenue (2033) USD 271.6 Billion CAGR (2024-2032) 13.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class(Biologics, Calcineurin Inhibitors, PDE-4 Inhibitor, Corticosteroids, Others), By Route Of Administration(Topical, Injectable, Oral), By Distribution Channel(Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Sanofi, AbbVie Inc., Regeneron Pharmaceuticals, Inc., Pfizer Inc., AnaptysBio, Inc., Incyte Corporation, Eli Lilly and Company, Novartis AG, LEO Pharma A/S, Astellas Pharma Inc., Bristol-Myers Squibb Company, Galderma S.A., Dermira, Inc. (acquired by Eli Lilly and Company), Encore Dermatology, Inc., Medimetriks Pharmaceuticals, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Sanofi

- AbbVie Inc.

- Regeneron Pharmaceuticals, Inc.

- Pfizer Inc.

- AnaptysBio, Inc.

- Incyte Corporation

- Eli Lilly and Company

- Novartis AG

- LEO Pharma A/S

- Astellas Pharma Inc.

- Bristol-Myers Squibb Company

- Galderma S.A.

- Dermira, Inc. (acquired by Eli Lilly and Company)

- Encore Dermatology, Inc.

- Medimetriks Pharmaceuticals, Inc.