Aniline Market By Technology(Vapour-Phase Process, Liquid-Phase Process), By Application(Methylene Diphenyl Diisocyanate (MDI) Production, Rubber-processing Chemicals), By End-use Industry(Building & Construction, Rubber Products, Consumer Goods), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

10777

-

Nov 2023

-

150

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

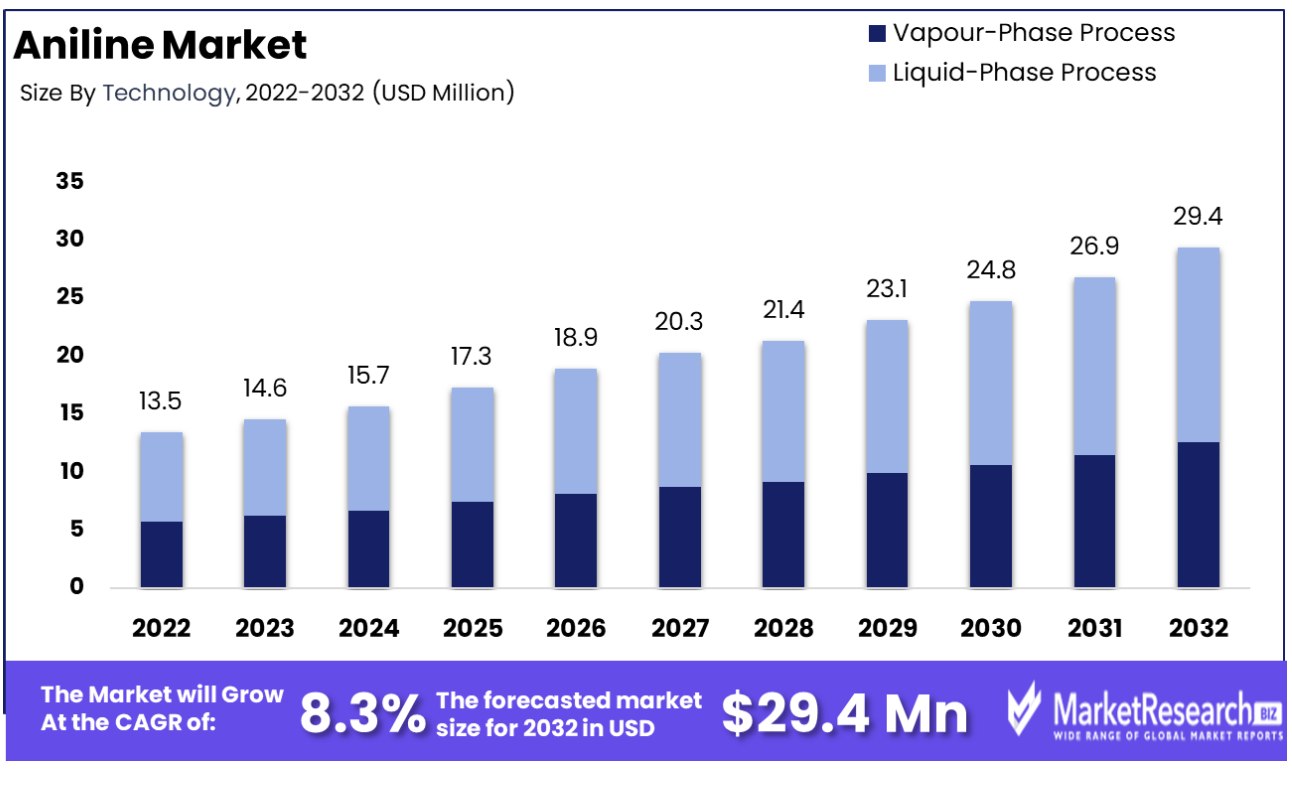

Aniline market size reached 13.5 Billion in 2022. It is projected to reach 29.67 Billion by 2032, displaying a significant CAGR of 8.3% during the forecast period of 2023 to 2032. The increasing requirement for rubber products, predominantly in the tire manufacturing sector, and the rising environmental issues are among the main driving factors for the market expansion.

Moreover, the push towards sustainable and renewable sources of rubber, such as synthetic rubber emphasizes the importance of chemical factors, including aniline. This helps to line up well with environmental issues and sustainability ingenuity, making Aniline a preferred option for modern rubber manufacturing methods.

For example, aniline is a highly reactive chemical which allows it to actively participate in chemical reactions for rubber synthesis. As in the production of neoprene, a type of synthetic rubber used in several applications like wetsuits and gaskets, aniline plays a significant role in it. Aniline serves as an important building rock, contributing to the creation of neoprene’s structure, allowing it with good resistance towards oil, chemical, and heat temperatures.

According to the U.S. Energy Information Administration (EIA), it is observed that a significant portion of the energy consumed in the average American household (approximately 51%) is devoted to heating and cooling spaces annually. The intensity of this energy consumption is shaped by various factors, including the home's geographical setting, its dimensions and architectural design, and the specific types of heating or cooling equipment and fuels utilized.

The integration of rigid polyurethane foam, renowned for its superior insulation properties, emerges as a viable solution for stabilizing indoor temperatures and diminishing sound levels. This application is poised to have a favorable impact on the expansion of the aniline market, given that rigid polyurethane foam represents a primary application segment for aniline. Methylene diphenyl diisocyanate (MDI), a critical component in the production of polyurethane foams, relies heavily on aniline as a raw material, underscoring aniline's significance in the polymer industry.

Aniline-based compounds work as precursors for generating light-emitting diodes (LEDs), liquid crystal displays (LCDs), and other electronic products. With consumer electronics becoming more advanced and pervasive, the requirement for specific materials, such as aniline will likely see a significant trend in the coming future.

Rapid urbanization globally is driving the demand for aniline, especially in developing regions where the construction and automotive sectors are booming. Innovations and advancements in aniline manufacturing processes, focusing on efficiency and environmental compliance, are pivotal for meeting the growing global demand.

Aniline derivatives are used as effective laminating agents in various industrial processes, contributing to the manufacturing of layered composite materials. Aniline is instrumental in pharmaceuticals, contributing to the synthesis of various medicines, and highlighting its versatility beyond industrial applications. The aniline market's growth is closely tied to its suppliers, with a concentration in regions rich in chemical manufacturing expertise and raw material availability.

Aniline Market Dynamics

The Surge in MDI Utilization Accelerates Aniline Consumption

The aniline market is experiencing substantial growth, primarily fueled by the rising demand for Methylene Diphenyl Diisocyanate (MDI) in various industries, including coatings, adhesives & sealants, and elastomers. The versatility and superior properties of MDI-based products, such as thermal insulation and energy efficiency, drive their adoption.

The increasing construction activities worldwide and the need for energy-efficient solutions have elevated the demand for MDI, subsequently propelling the aniline market forward. The trend is further bolstered by the push for green buildings and energy-efficient appliances, where MDI plays a critical role.

Green Chemistry Innovations and Bio-based Alternatives Propel Aniline Industry Towards Sustainable Future

Aniline, primarily used in the manufacture of polyurethane and other industrial chemicals, is subject to stringent regulatory oversight to minimize ecological impact. Modern production methodologies are increasingly adopting green chemistry principles, aiming to reduce harmful emissions and enhance energy efficiency.

The global market size of USD 11.5 Billion for synthetic and bio-based aniline is poised for substantial growth, driven by increasing eco-consciousness and demand for sustainable chemical alternatives.

Additionally, the industry is progressively exploring bio-based aniline sources, offering a more sustainable alternative to traditional petroleum-derived aniline. These advancements reflect a growing commitment to environmental stewardship, aligning aniline production with global sustainability objectives and adhering to evolving environmental standards and practices.

Polyurethane Proliferation Propels Aniline Prospects

Aniline's market growth is integrally linked to the burgeoning demand for polyurethane foams, which are ubiquitous in furniture, bedding, automotive interiors, and insulation materials. The versatility of polyurethane, ranging from rigid to flexible foams, makes it a material of choice across various applications. As urbanization and income levels rise, especially in developing regions, there is a concomitant increase in the construction of commercial and residential buildings as well as automotive production, both major consumers of rigid polyurethane foams.

Aniline's Integration in Gasoline Development Ignites Market Demand

Aniline is gaining momentum as a solvent and an anti-knock ingredient in the formulation of reformat gasoline. The compound's efficacy in enhancing the octane rating of fuels makes it valuable in the fuel additives market. As environmental regulations become more stringent, there is a shift towards cleaner-burning gasoline formulations, which often incorporate aniline as an anti-knock agent to meet the required standards.

Customization in the Motorcycle Industry Offers Growth Opportunities for Aniline Market

The bespoke demand for aniline within the motorcycle industry is opening new avenues for market expansion. Customized colors and finishes are increasingly popular in motorcycle manufacturing, with aniline serving as a critical input for creating durable and vibrant hues.

This trend aligns with the broader personalization wave sweeping through various consumer segments. With the global motorcycle market projected to expand, reaching a market size of USD 129.3 billion by 2028, the spillover effect on aniline demand is poised to be substantial, offering lucrative prospects for producers who can cater to this niche yet growing demand segment.

Aniline as a Dye in Fashion Offers Market Expansion Potential

The escalating utilization of aniline as a coloring agent in apparel, especially jeans, signals a market expansion opportunity. The global denim market, expected to reach USD 64.1 billion by 2025, heavily relies on aniline-based dyes for creating iconic indigo and other specialty colors.

As fashion trends evolve and consumer demand for sustainable yet vibrant clothing increases, airline manufacturers are presented with a chance to penetrate deeper into this market. The adoption of aniline dyes aligns with the industry’s pivot towards eco-friendly solutions, as newer aniline formulations boast reduced environmental impact while delivering the desired aesthetic appeal.

Toxicity of Aniline Restrains Market Growth

Exposure to aniline is known to cause severe health hazards to humans, including methemoglobinemia and other disorders, which leads to stringent regulatory controls.

High Volatility in Raw Material Prices Restrains Market Growth

The high volatility of these prices, influenced by unpredictable changes in crude oil markets and supply chain inconsistencies, can lead to instability in aniline production costs. This volatility complicates forecasting and financial planning for producers, who may pass increased costs onto consumers or reduce production during periods of higher raw material costs.

Aniline Market Segmentation Analysis

Technology Insights

The vapor-phase process dominates the technology segment for aniline production, primarily due to its cost-effectiveness and efficiency in large-scale operations. It is favored for its high yields and purity of the final product.

The liquid-phase process, while less dominant, serves niche applications where specific product qualities are desired or where production scale does not justify the vapor-phase investment. It continues to have relevance for specialized aniline production and in regions where the technological transfer of vapor-phase processes is not feasible.

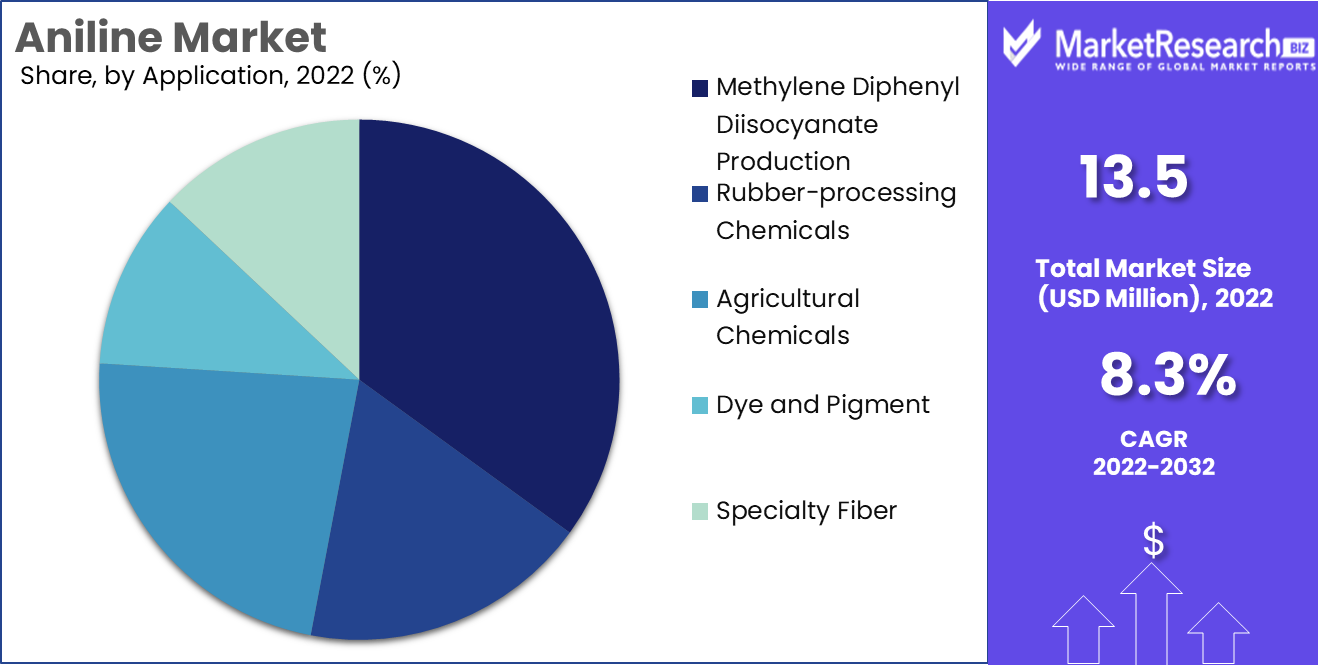

Application Insights

The dominance is attributed to MDI's critical role in producing polyurethane foams, which are integral in various industries. The construction boom and the increasing demand for insulating foams drive the need for MDI, with energy efficiency regulations further bolstering growth.

The remaining applications—rubber-processing chemicals, agricultural chemicals, pigments and dyes manufacturing, and specialty fibers—are essential for the diversification of the aniline market. While these segments represent a smaller share, their steady growth is driven by the expansion of the global rubber industry, advancements in agricultural productivity, the fashion industry's demand for new pigments and dyes, and the development of specialty fibers for technical applications.

End-use Insights

The building and construction industry stands as the preeminent end-use segment for aniline, mainly through the consumption of MDI-based polyurethane products. The increasing stringency of energy regulations promotes insulation applications, leading to significant market demand. Urbanization and infrastructure development are critical drivers for this segment's expansion.

Other important end-use segments include rubber products, consumer goods, automotive, packaging, and agriculture. Each sector utilizes aniline-derived products to enhance material properties like durability and thermal insulation. The automotive industry's recovery and growth, evolving consumer goods markets, and technological innovations in packaging and agricultural products contribute cumulatively to the broader aniline market landscape.Aniline Industry Segments

By Technology

- Vapour-Phase Process

- Liquid-Phase Process

By Application

- Methylene Diphenyl Diisocyanate (MDI) Production

- Rubber-processing Chemicals

- Agricultural Chemicals

- Dye and Pigment

- Specialty Fiber

By End-use Industry

- Building & Construction

- Rubber Products

- Consumer Goods

- Automotive

- Packaging

- Agriculture

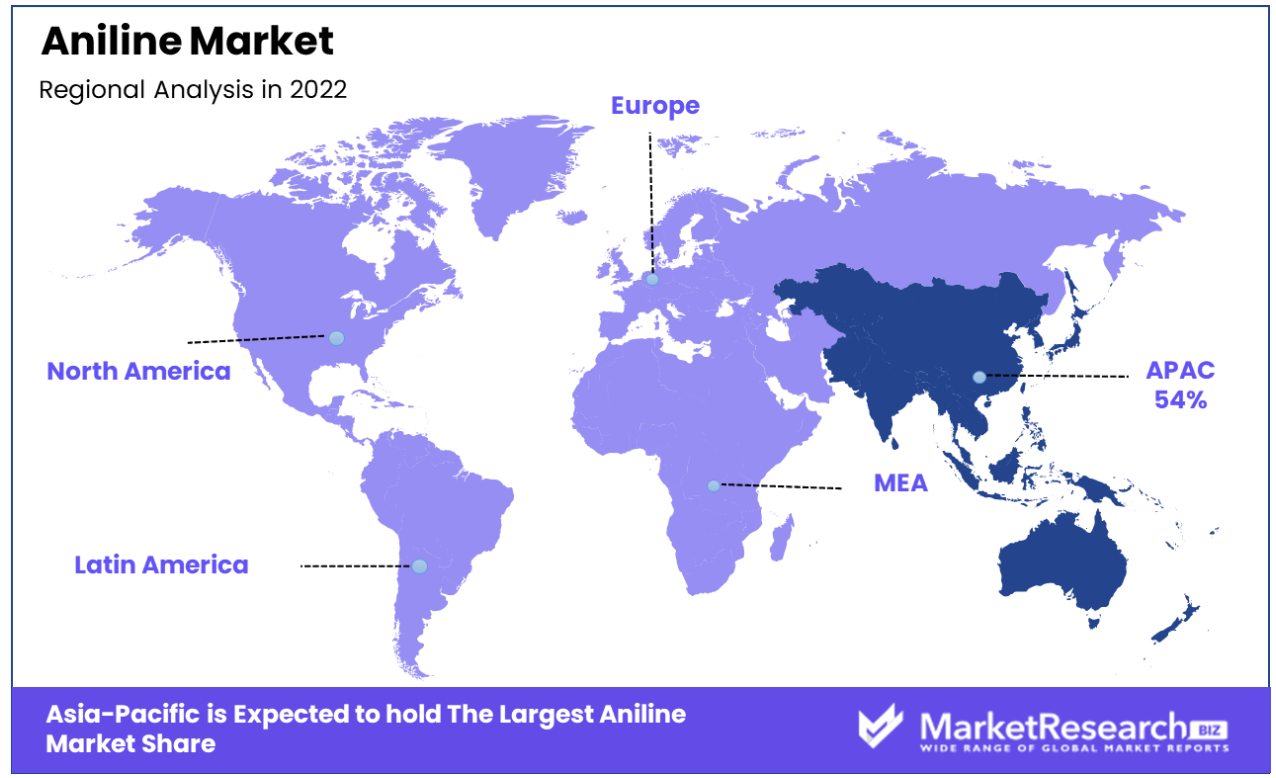

Aniline Market Regional Analysis

Asia-Pacific Dominates with 54% Market Share in Aniline Industry

Asia-Pacific's commanding 54% share in the aniline market is primarily influenced by its robust manufacturing base, particularly in countries like China and India. This region benefits from an abundance of raw materials, which significantly reduces import dependency and operational costs. Additionally, favorable government policies promoting industrial growth, coupled with lower labor costs, have catalyzed the expansion of chemical industries. Moreover, the presence of key players like Sinopec Corp., BASF Corporation, and Wanhua Chemical Group in this region enhances its market stature, ensuring a steady supply chain and innovation in aniline production technologies.

Europe holds a significant share of the aniline market, driven by its advanced manufacturing capabilities and stringent environmental regulations. The region's focus on sustainable practices has led to the development of eco-friendly aniline production methods. Europe's diverse industrial base, encompassing automotive, pharmaceutical, and aerospace sectors, necessitates a steady supply of aniline, underpinning its market position. Companies like Bayer AG and LANXESS play a pivotal role in the European aniline market, contributing to its innovative and compliant industry practices.

North America, This region's market share is bolstered by its advanced chemical industry, high technological adoption, and stringent safety regulations. The presence of major corporations like Dow Chemical Company and Huntsman Corporation underscores the region's commitment to innovation in chemical manufacturing. North America's stringent regulatory landscape ensures that aniline production aligns with environmental and health standards, thereby maintaining market integrity and consumer trust.

Aniline Industry by Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Aniline Market Key Player Analysis

The mentioned companies range from large multinational corporations to specialized chemical manufacturers. They play pivotal roles in shaping market trends through their innovative production techniques, expansive product portfolios, and strategic market positioning.

The prominent players include Sinopec from Asia-Pacific and BASF Corporation from Europe, exemplifying the diversity and global reach of this sector. Sinopec Corp., a Chinese giant, is renowned for its expansive production capabilities and market influence in Asia, while Germany's BASF Corporation stands as a beacon of innovation and sustainability in the European chemical industry. These companies, among others, are instrumental in shaping the global aniline market dynamics through their regional dominance and global strategies.

Aniline Industry Key Players

- BASF Corporation

- Sinopec Corp.

- Huntsman International LLC

- Mitsubishi Chemical Corporation

- Covestro AG

- Jilin Connell Chemical Industry Co. Ltd

- Wanhua Chemical Group Co. Ltd

- Shandong Jinling Chemical Co., Ltd

- Yantai Wanhua Polyurethane Co Ltd, DuPont

- Mitsubishi Chemical Corporation

- Sumitomo Chemical

- Arrow Chemical Group

- EMCO Dyestuff

- GNFC

- Narmada Chematur Petrochemicals Limited

- Tosoh Corporation

- Volzhsky Orgsintez JSC

- Ei Dupont De Nemours

Recent Development

- In 2022, a team of researchers from the University of California, Berkeley developed a new method for producing aniline from biomass. The method uses a catalytic process to convert sugars from biomass into aniline in high yields.

- In January 2022, Maire Tecnimont's subsidiary, Tecnimont, secured a €250 million EPC contract from Covestro to build a new aniline plant in Antwerp, Belgium. The project will boost aniline production at Covestro's Antwerp site, focusing on high-tech polymer materials and sustainable solutions. Completion is expected by 2024, featuring cutting-edge technologies for safety and energy efficiency.

- In 2022, A team of researchers at the Chinese Academy of Sciences discovered how to use lithium hydride to facilitate the hydrogenolysis of anilines to arenes. This work provides a new strategy for C-N bond activation and may help the design and development of new materials or catalysts for HDN as well as other important chemical transformations.

Report Scope

Report Features Description Market Value (2022) USD 13.5 Billion Forecast Revenue (2032) USD 29.4 Billion CAGR (2023-2032) 8.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology(Vapour-Phase Process, Liquid-Phase Process), By Application(Methylene Diphenyl Diisocyanate (MDI) Production, Rubber-processing Chemicals, Agricultural Chemicals, Dye and Pigment, Specialty Fiber), By End-use Industry(Building & Construction, Rubber Products, Consumer Goods, Automotive, Packaging, Agriculture) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BASF Corporation, Sinopec Corp., Huntsman International LLC, Mitsubishi Chemical Corporation, Covestro AG, Jilin Connell Chemical Industry Co. Ltd, Wanhua Chemical Group Co. Ltd, Shandong Jinling Chemical Co., Ltd, Yantai Wanhua Polyurethane Co Ltd, DuPont, Mitsubishi Chemical Corporation, Sumitomo Chemical, Arrow Chemical Group, EMCO Dyestuff, GNFC, Narmada Chematur Petrochemicals Limited, Tosoh Corporation, Volzhsky Orgsintez JSC, Ei Dupont De Nemours Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BASF Corporation

- Sinopec Corp.

- Huntsman International LLC

- Mitsubishi Chemical Corporation

- Covestro AG

- Jilin Connell Chemical Industry Co. Ltd

- Wanhua Chemical Group Co. Ltd

- Shandong Jinling Chemical Co., Ltd

- Yantai Wanhua Polyurethane Co Ltd, DuPont

- Mitsubishi Chemical Corporation

- Sumitomo Chemical

- Arrow Chemical Group

- EMCO Dyestuff

- GNFC

- Narmada Chematur Petrochemicals Limited

- Tosoh Corporation

- Volzhsky Orgsintez JSC

- Ei Dupont De Nemours