Global American Football Gear Market Analysis, Drivers, Restraints, Opportunities, Threats, Trends, Applications, and Growth Forecast to 2029

-

15203

-

May 2023

-

166

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

In American Football Gear Market Report a vast range of critical factors have been taken into consideration.

Revenue share of each segment and region and respective countries, key trends, revenue-driving factors, restraints, as well as opportunities in untapped regions and countries, and threats are to be included.

In the American Football Gear Market report, the company profiles of key players comprise detailed information, recent developments, strategies, acquisitions, mergers, etc.

The global American football gear market is segmented by product type, distribution channel, and regions and countries.

American Football Gear Market Overview:

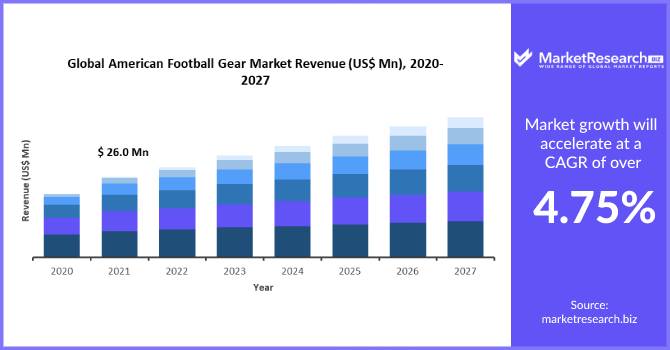

American Football Gear Market was valued at $24 million in 2020 & is projected to reach $34 million by 2030. It is expected to grow at a 5% CAGR between 2021 and 2030.

American football is the evolution of football/soccer and rugby brought together.

The very basic equipment usually worn by American football players includes a helmet, a mouth guard, shoulder pads, a pair of gloves and shoes, thigh pads, knee pads, a jockstrap, or compression shorts.

In addition, players also use a protective cup to avoid damage or impact to the genital area. In the US, American football has the highest fan base, and the sport is played in most educational institutions, schools, and colleges.

The National Football League (NFL) of the US organizes annual championships popularly known as The Super Bowl.

American Football Gear Market Dynamics:

American Football is the most popular sport in the US and has been gaining popularity in other parts of the world as well.

Young individuals and teens across the US, as well as Canada, participate in the sport, and safety is taken seriously owing to serious injuries some individuals have even been injured to the extent of being handicapped or incapacitated for long periods of time as a result.

Adoption of and preference for safety equipment and gear is high, and safety concerns and precautionary measures are among some of the key factors driving the market growth.

In addition, American football clubs award scholarships to student players who have the potential of becoming professional players. Demand for safety gear has also been witnessing an increase owing to the emergence and growing popularity of ‘flag football’.

This sport is an alternative version of the main game but includes the use of flags instead of the rugby ball. This game has been deemed safer, and it entails lesser physical contact on the field.

However, popularity is more in the US in North America, with a growing fan base in Canada, but not very much in terms of the sport being accepted in other countries around the world can be a factor restraining high potential growth in the future.

American Football Gear Market Regional Analysis:

Markets in North America and Europe account for the largest revenue share due to well-developed sports infrastructure in terms of gridirons and grounds and stadiums in countries in the region as well as a booming sports culture in the region.

American Football Gear Market Segment Analysis:

By Type:

Among the type segments, the team sports segment currently accounts for the largest revenue share in the North American market.

By Application:

Among the application segments, the helmet segment accounted for the highest revenue share last year, and the trend is expected to continue over the forecast period.

Global American Football Gear Market Segmentation:

By Type

- Team Sport

- Ball Game

Application

- Helmets

- Facemasks

- Shoulder Pads

- Cleats

- Gloves

- Pants

Attribute Report Details Market Size Ask For Market Size Growth Rate Ask For Growth Rate Key Companies Ask For Companies Report Coverage Revenue analysis, Competitive landscape, Key company analysis, Market Trends, Key segments, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis and more… Historical Data Period 2015-2020 Base Year 2022 Forecast Period 2022-2031 Region Scope North America, Europe, Asia-Pacific, South America, Middle East & Africa Country Scope United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa Revenue in US$ Mn -

-

- Gilbert International

- Optimum

- Blitz

- Razor

- Velocity

- KooGa

- Cutters Gloves

- Under Armour

- Nike

- Adidas

- Wilson

- XPROTEX