Agrochemicals Market By Type (fertilizers and pesticides), By crop (cereals and grains, oilseeds and pulses, plantation crops), By vegetables (pesticide, pyrethroids, organophosphates), By fertilizer (phosphatic, and potassic), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

24230

-

Oct 2023

-

181

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

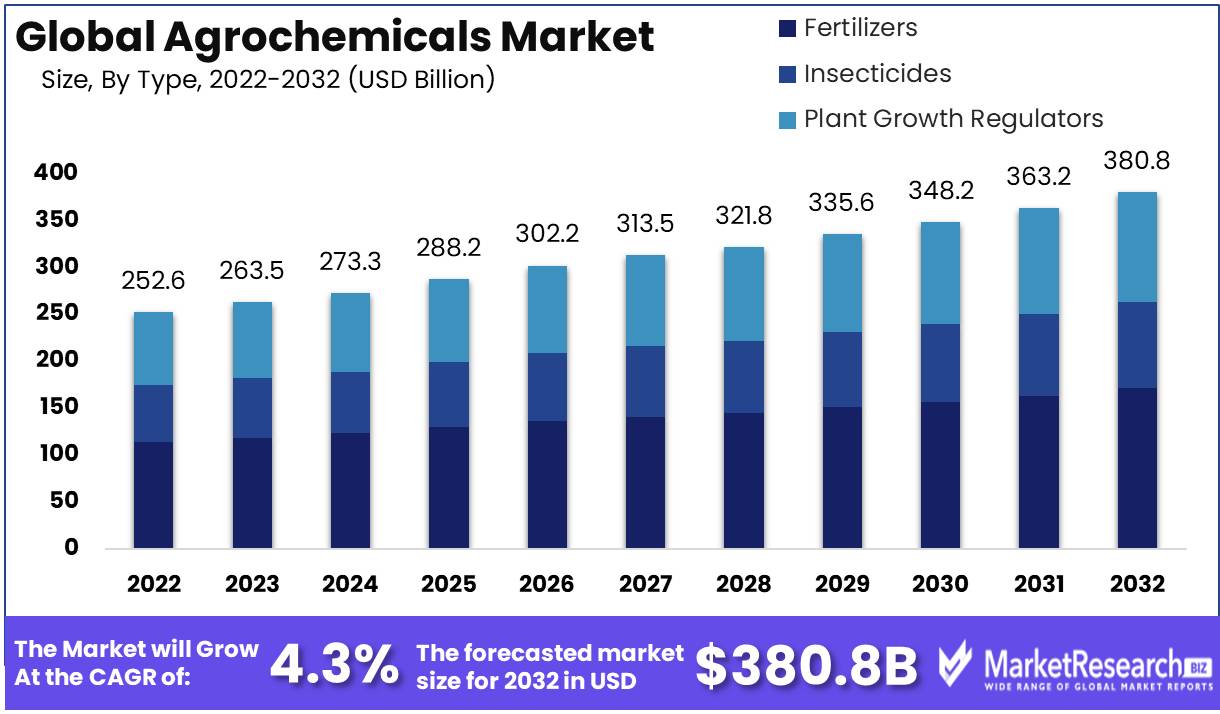

Agrochemicals Market size is expected to be worth around USD 380.8 Bn by 2032 from USD 252.6 Bn in 2022, growing at a CAGR of 4.3% during the forecast period from 2023 to 2032.

The Agrochemicals Market is currently one of the most rapidly expanding sectors in the globe. Agrochemicals are becoming more and more crucial due to the rising demand for food and the need for agricultural protection. In this blog post, we will provide a comprehensive summary of the Agrochemicals Market. The Agrochemicals Market report provides an analysis of the industry's size, growth rate, and leading market players. Also included in the report is a segmentation analysis by product type, application, and region.

The Agrochemicals Market is the market for the production, distribution, and sale of chemicals used in agriculture. These substances consist of fertilizers, pesticides, herbicides, and fungicides. The objective of the Agrochemicals Market is to provide solutions to the challenges of contemporary agriculture, such as plant diseases, parasites, and vegetation. It is difficult to exaggerate the significance of the Agrochemicals Market. It plays a crucial role in ensuring that there is sufficient sustenance to sustain the world's expanding population.

The Agrochemicals Market has witnessed a number of noteworthy innovations. New, more effective, and less harmful to the environment crop protection chemicals have been developed. In addition, biotechnology has been incorporated into agricultural products, resulting in genetically modified crops with increased resistance to pests and diseases. There are moral concerns regarding the use of agrochemicals. This includes their effects on the environment, human health, and animal welfare.

Companies are expected to provide complete disclosure of the chemicals used in their products, as well as their potential impact on the environment and human safety. In addition, an increasing number of businesses are employing policies that promote the responsible use of agrochemicals, such as the reduction of their use and the implementation of sustainable production practices.

The Agrochemicals Market is undergoing a significant transformation with a growing emphasis on sustainability and responsible practices. In recent years, there has been a heightened focus on arable land, agricultural land, and land management in North America. Companies operating in this sector are now required to be more transparent about the chemicals used in their products and their potential environmental and human safety implications. This shift towards transparency is not only driven by regulatory demands but also by changing consumer preferences and a heightened awareness of environmental concerns.

Furthermore, the technology landscape in the agrochemicals industry is evolving rapidly, with a strong emphasis on developing alternative nitrogen sources and sustainable production practices. This not only presents a business opportunity for companies willing to innovate but also underscores the importance of having a robust business plan that aligns with these changing dynamics.

Driving Factors

Rising Population and Food Demand

The Agrochemicals market is experiencing significant growth due to the increasing global population and the subsequent rise in food demand. As the population grows, the pressure on farmers to enhance their yields and productivity increases, driving the demand for agrochemicals. These chemical solutions play a crucial role in improving crop productivity and enabling farmers to meet the growing food requirements.

Modern Farming with GMOs

The adoption of modern farming techniques, such as precision farming, and the utilization of genetically modified crops are major drivers of the Agrochemicals market. These practices contribute to increased productivity and yield, further augmenting the demand for agrochemicals. Precision farming techniques allow farmers to accurately apply agrochemicals, optimizing their effectiveness and reducing wastage, while genetically modified crops are engineered to withstand pests and diseases, necessitating the use of agrochemicals for enhanced protection.

Government Subsidies and Initiatives

Government initiatives and subsidies aimed at farmers play a significant role in driving the growth of the Agrochemicals market. Governments worldwide provide incentives and support to farmers to encourage them to adopt agrochemicals and modern farming techniques. These initiatives promote increased usage of agrochemicals, foster innovation in the sector, and contribute to market expansion.

Improved Agrochemical Formulations

Technological advancements in agrochemical formulations are propelling market growth by enhancing the effectiveness of these chemical solutions. Continuous research and development efforts lead to the development of new and advanced formulations that improve crop protection and yield. The improved efficacy of agrochemicals drives the demand for these products in the market, as farmers seek more effective solutions for pest and disease management.

Precision and Mechanized farming

The adoption of precision farming techniques and increased farm mechanization positively impact the Agrochemicals market. Precision farming allows farmers to apply agrochemicals accurately, optimizing their usage and reducing waste. The ability to precisely target pests and diseases enhances the efficiency and effectiveness of agrochemicals. Additionally, farm mechanization enables farmers to increase productivity and reduce labor requirements, driving the demand for agrochemicals in mechanized farming systems.

Restraining Factors

Influencing Elements of the Agrochemicals Market

The agrochemicals market is a vital component of the agricultural industry because it provides effective methods for enhancing crop yields and quality. However, there are a number of factors inhibiting the expansion of this market. In this article, we will examine the numerous factors influencing the agrochemicals market and the industry's response to these factors.

Strict Governmental Requirements

Increasing government regulations regarding environmental protection and health hazards is one of the most significant factors influencing the agrochemicals market. Government agencies are instituting stringent guidelines to ensure the safe use of agrochemicals as they have become more aware of the risks associated with their use. This has resulted in increased costs for manufacturers and distributors, who must now comply with a vast array of regulations. This has also resulted in the introduction of new, more stringent regulations targeting particular chemicals, which can impact their market availability.

Impact of Agrochemicals on the Environment

The increasing concern over the environmental impact of agrochemicals is another factor that is bearing on the agrochemicals market. Concerns have been expressed by numerous environmental agencies and advocacy organizations regarding their negative impact on the environment and biodiversity. The excessive use of agrochemicals has resulted in soil and water contamination, which can be detrimental to ecosystems and human health. This has led to increased scrutiny and pressure on manufacturers and farmers to employ environmentally favorable and sustainable practices.

Expensive Agrochemicals

Over the past decade, agricultural inputs have become more expensive, and the agrochemicals market has followed suit. Farmers, particularly small-scale farmers, may not be able to afford the price of inputs due to the high price of agrochemicals. This has led to a decrease in demand for these products and an increase in demand for affordable alternatives. In addition, the high cost of agrochemicals has led to an increase in counterfeit products and the importation of substandard products onto the market, resulting in a decline in output quality and crop yields.

Lack of Skilled Labor in Agriculture

The lack of competent personnel in the agriculture industry is another factor restraining the Agrochemicals Market. Young people are less interested in pursuing careers in agriculture, resulting in a shortage of competent labor. This has increased labor costs for producers and decreased their output. In addition, the rising demand for skilled labor has increased production costs, which impacts the profitability of agrochemicals.

Increasing Acceptance of Organic Farming Methods

The increasing prevalence of organic agricultural practices is a further factor restraining the agrochemicals market. Increasingly, consumers are concerned about the potential health risks associated with the use of agrochemicals in food production. This has increased the demand for organic and natural food products, which contain no synthetic ingredients. This trend has led to a greater emphasis on sustainable agriculture practices, which are less harmful to the environment and do not rely on chemical inputs.

Type Analysis

Agrochemicals Market Segment Dominates Fertilizers Segment. In recent years, the use of agrochemicals has become an essential tool in the agriculture industry, with fertilizers being one of the most widely used varieties. Due to its capacity to increase crop productivity and yield, the fertilizers segment currently dominates the agrochemicals market. Fertilizers supply crops with vital nutrients, such as nitrogen, phosphorus, and potassium, which are essential for plant growth and development. Additional nitrogen has played a crucial role in this dominance.

Fertilizers dominate the agrochemicals industry because of ammonium nitrate and consumer behavior. Fertilizer demand is rising as consumers realize the benefits of fertilizing their crops. Since organic farming uses natural fertilizers to boost crop output, fertilizer consumption has increased. Fertilizers will increase quickest in the agrochemicals sector. Population increase, organic farming, and fertilizer awareness have contributed to this growth. Active ingredient in fertilizers is a significant factor here.

Application Analysis

Agrochemicals Market Segment Dominates Cereals & Grains Segment. Cereals and grains are among the most widely cultivated commodities worldwide; consequently, the cereals and grains segment currently dominates the agrochemicals market. These commodities are used extensively in numerous industries, such as food, animal feed, and biofuels, and serve as the primary source of nutrition for numerous nations. Utilizing agrochemicals, such as pesticides, and herbicides, has become indispensable for the successful cultivation of cereals and grains. The largest share in this dominance belongs to cereals and grains.

Consumer habits and behavior help cereals and grains dominate the agrochemicals business. Agrochemicals are in high demand as cereal and grain consumption rises. Cereal and grain output has increased as consumers choose healthier meals like whole grains. Cereals and grains are predicted to expand the quickest in the agrochemicals industry. Due to population increase, improved eating habits, and the organic agricultural sector, food and animal feed demand is rising. Pesticide product plays a significant role in this context.

Key Market Segments

By Type

- Fertilizers

- Nitrogenous Fertilizer

- Phosphatic Fertilizer

- Potassic Fertilizer

- Pesticides

- Insecticides

- Herbicides

- Fungicides

- Other Pesticides

- Plant Growth Regulators

By Application

- Cereal & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other Applications

Growth Opportunity

Precision Farming Technique Adoption

Due to the increasing adoption of precision agricultural techniques, the complementary mode agrochemicals market is expanding. Precision agriculture enables producers to maximize resource utilization, decrease expenses, and increase crop yields. The increasing demand for agrochemicals that complement precision agricultural techniques, such as targeted fertilization and pest control, is propelling market expansion.

Interest in Organic and Sustainable Farming

The increasing demand for sustainable and organic agricultural practices is driving the expansion of the agrochemicals market and capital income. Consumers are concerned about the environmental impact of conventional agricultural practices and are pursuing alternatives. This has resulted in an increase in the demand for agrochemicals derived from natural sources, such as healthy-growth biopesticides and biofertilizers, which are viewed as safer and more environmentally favorable.

Creation of New and Original Agrochemical Formulations

The development of new and novel agrochemical formulations is a major growth driver in the agrochemicals market. Manufacturers are investing in R&D to create products that are more efficient, environmentally sustainable, and safer for consumers. These developments result in the creation of specialized formulations tailored to specific crops and environmental conditions, allowing for more effective control of pests and diseases, and modes of action.

Emphasis on soil fertility and quality

Improving the fertility and character of the soil is a key focus of the agrochemicals market, thereby propelling its expansion. Agrochemicals play an essential role in enhancing soil health, boosting crop yields, and promoting plant health, and plant growth. They provide options to optimize nutrient availability, improve soil structure, and decrease soil erosion. Through the use of agrochemicals, producers can accomplish sustainable soil management practices and maximize agricultural output.

Demand for Biopesticides and Biofertilizers

The expansion of the agrochemicals market is being driven by the rising demand for biopesticides and biofertilizers. Derived from natural sources, biopesticides and biofertilizers provide effective pest and disease control with minimal environmental impact. They provide sustainable alternatives to conventional chemical-based solutions, in accordance with the growing preference for eco-friendly agricultural practices, commercial contracts, and joint ventures.

Latest Trends

Integrated Pest Management Techniques

Integrated Pest Management (IPM) is one of the key trends in the agrochemicals market. The increasing adoption of IPM techniques is driven by the need for sustainable and environmentally friendly agricultural practices. IPM aims to reduce the use of pesticides and mitigate their environmental impact while maintaining crop yields. It is an ongoing trend that emphasizes the importance of adequate plant nutrients.

Innovative new seed technologies

The development of new and innovative seed technologies is another ongoing trend influencing the agrochemicals market. In recent years, seed technology has advanced swiftly, and novel seedlings that are resistant to pests, diseases, and drought are being developed. These new seedlings enable producers to produce greater yields with fewer resources, resulting in greater profitability. Seed technology is a key driver of change in the industry.

Natural and Biobased Agrochemicals

Natural and bio-based agrochemicals, which include bio fungicides, bio insecticides, bioherbicides, and biostimulants, among others, are gaining popularity in the agrochemicals market. These products are derived from natural, non-synthetic sources and are considered safer for human and environmental health. They are a vital nutrient in the quest for more sustainable agriculture.

Drones and Other Technologies for Precision Agriculture

Changes in the agrochemicals market are also influenced by precision agriculture technologies. Drones and other precision agriculture tools are used to monitor crop health, predict yields, and optimize fertilizer and chemical applications. These precision farming technologies are reducing waste and enhancing efficiency, which will ultimately result in higher yields and greater profitability. Precision agriculture is a future trend shaping the industry.

Sustainable and Eco-Friendly Agriculture

In the agrochemicals market, there is a growing emphasis on sustainable and environmentally favorable agricultural practices. Consumers are increasingly aware of the environmental impact of agricultural practices, and sustainable agriculture is becoming a key trend. This shift in consumer demand is causing an increase in the demand for environmentally favorable products and influencing how producers manage their crops and use agrochemicals. Sustainable agriculture is another key driver of change in the industry.

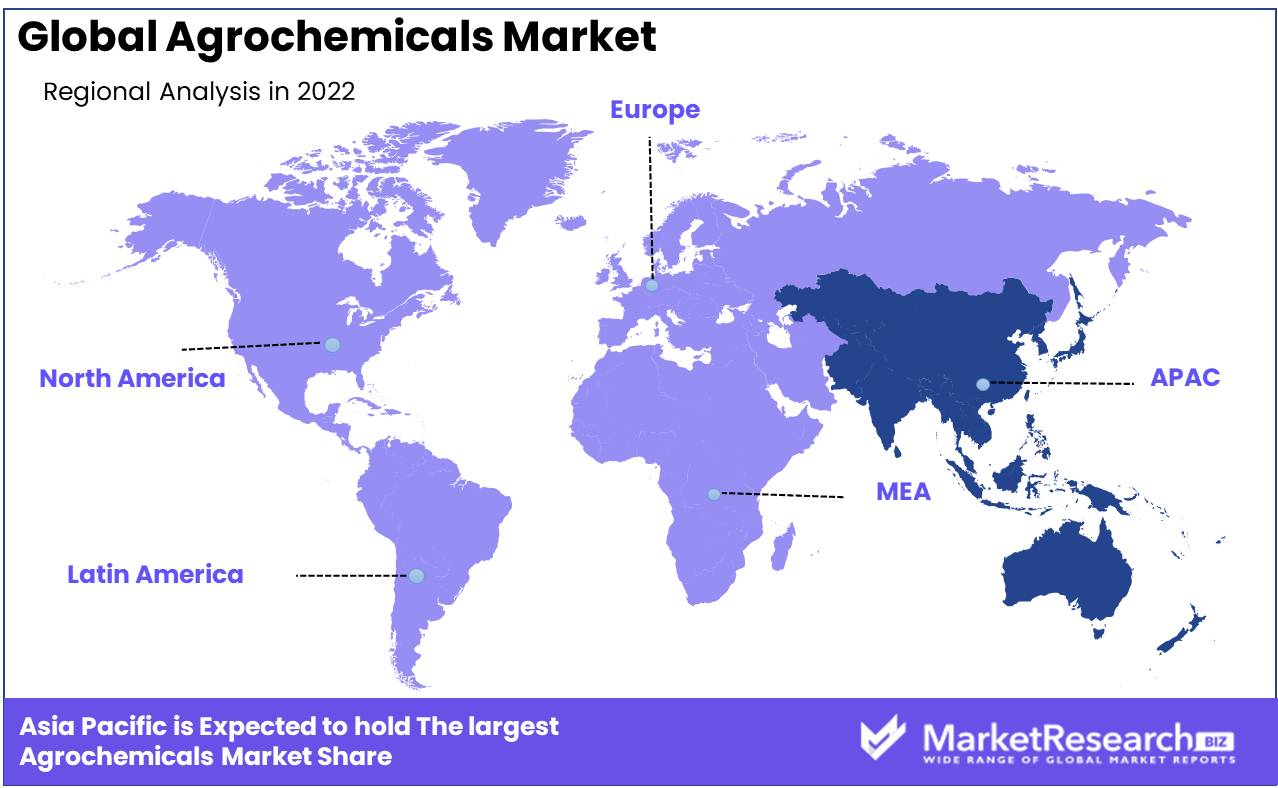

Regional Analysis

Asia Pacific has become a significant Agrochemicals Market. This expansion is fuelled by the presence of major agrochemical firms, the adoption of modern agricultural techniques, and an increasing emphasis on sustainable agriculture. In this article, we delve deeper into the factors propelling the growth of the Asia Pacific agrochemical market, as well as the repercussions for the industry as a whole.

Adoption of modern agricultural techniques is one of the main growth drivers for the Asia Pacific agrochemical market. Precision agriculture, which involves the use of technology to maximize crop yields while minimizing the use of inputs such as fertilizers and pesticides, is becoming increasingly popular among farmers in the United States and Canada.

Several technological advancements, including GPS systems and drone technology, facilitate precision agriculture in the Asia Pacific region. Farmers can now map their fields with unprecedented accuracy and monitor crop growth in real time. This enables them to make on-the-fly adjustments to their farming practices, ensuring that they use the appropriate quantity of inputs at the appropriate time.

Precision agriculture has been a game-changer for the agricultural industry, allowing producers to increase yields while decreasing expenses. The application of technology has also resulted in the creation of new, more targeted pesticides and fertilizers that can be administered with greater precision and in smaller quantities. This is beneficial for both the environment and the bottom line. Major agrochemical corporations' presence in Asia Pacific has also contributed to the expansion of the agrochemical industry. Companies such as Monsanto, Syngenta, and Dow Chemical have made substantial investments in research and development in the region.

Another crucial factor fueling the expansion of the Asia Pacific agrochemical market is sustainable agriculture. Farmers are under increasing pressure to employ sustainable agricultural practices due to growing concerns about food safety, environmental impact, and climate change. This has resulted in a shift away from conventional agricultural practices, which heavily relied on chemical inputs, and towards more sustainable methods. Utilizing eco-friendly agricultural techniques, such as crop rotation, cover cropping, and integrated pest management, is essential to sustainable agriculture.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global agrochemicals market is extremely competitive, with a small number of major players. These entities are involved in the development and production of a vast array of agricultural inputs, including pesticides, herbicides, and fertilizers. In a highly competitive industry, companies with high levels of technological innovation, brand recognition, and robust distribution channels tend to be the most successful.

Syngenta AG is a global leader in the agrochemicals market, providing a comprehensive spectrum of crop protection products to meet the requirements of farmers worldwide. The company's research and development division's commitment to innovation is a key benefit and a major contributor to its success in this market.

BASF SE is another significant participant in the agrochemicals market, offering an extensive selection of premium agricultural inputs. The company is well-known for its commitment to sustainable development and has established its market position by offering a diverse product line and focusing on the consumer.

This placement emphasizes that Bayer AG, DowDuPont Inc., and FMC Corporation are not just participants but also major players in the agrochemicals market, highlighting their significant role in the industry.

Top Key Players in Agrochemicals Market

- Makhteshim Agan Industries Ltd

- Agrium Inc.

- Mosaic Company

- Indian Farmers Fertiliser Cooperative

- Potash Corp. SAS. Inc.

- Nufarm Ltd.

- Sumitomo Chemical

- Dow Agrosciences LLC.

- BASF SE

- Israel Chemicals Ltd.

- K+S AG

- E.I. Du Pont De Nemours & Company

- Sociedad Quimica Y Minera De Chile SA

- Yara International ASA

- Dow Chemical Limited

- Monsanto Company

- Adama

- Bayer AG

Recent Development

In 2021, Syngenta announced one of the most significant developments in the agrochemicals market. The company announced its intention to invest $2 billion over the next five years in sustainable agriculture. This move is anticipated to have a significant impact on the market, as sustainable agriculture gains importance in the modern world.

In 2021, Corteva Agriscience launched a new herbicide dubbed Enlist E3 soybeans, which was another significant development in the agrochemicals market. This product is designed to assist farmers in weed management in their fields and is anticipated to be a market leader in the future years.

In 2020, BASF made a significant acquisition in the agrochemicals market, acquiring a substantial portion of the seed and nonselective herbicide industries. This action is anticipated to strengthen the company's market position and help it remain competitive in the coming years.

In 2020, The Union Cabinet of India also made a significant move by authorizing the formation of a new entity that will concentrate on research and development in the agrochemicals market. This action is anticipated to stimulate innovation and industry expansion.

In 2019, A California couple was finally awarded $2 billion in damages from Monsanto. This decision was a major setback for the company and highlights the mounting concerns regarding the use of certain chemicals in the agrochemicals industry.

Report Scope

Report Features Description Market Value (2022) USD 252.6 Bn Forecast Revenue (2032) USD 380.8 Bn CAGR (2023-2032) 4.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type, fertilizers and pesticides, crop, cereals and grains, oilseeds and pulses, plantation crops, hydroponics and fruits, vegetables, pesticide, pyrethroids, organophosphates, bio-pesticides and neonicotinoids, fertilizer, phosphatic, nitrogenous and potassic) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Makhteshim Agan Industries Ltd, Agrium Inc., Mosaic Company, Indian Farmers Fertiliser Cooperative, Potash Corp. SAS. Inc., Nufarm Ltd., Sumitomo Chemical, Dow Agrosciences LLC., BASF S.E., Israel Chemicals Ltd., K+S AG, E.I. Du Pont De Nemours & Company, Sociedad Quimica Y Minera De Chile SA, Yara International ASA, Dow Chemical Limited, Monsanto Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - Fertilizers

-

-

- Makhteshim Agan Industries Ltd

- Agrium Inc.

- Mosaic Company

- Indian Farmers Fertiliser Cooperative

- Potash Corp. SAS. Inc.

- Nufarm Ltd.

- Sumitomo Chemical

- Dow Agrosciences LLC.

- BASF S.E.

- Israel Chemicals Ltd.

- K+S AG

- E.I. Du Pont De Nemours & Company

- Sociedad Quimica Y Minera De Chile SA

- Yara International ASA

- Dow Chemical Limited

- Monsanto Company