Agriculture Biotechnology Market By Organism Type (Plants, Animals, Microbes), By Application( Genetic Engineering, Vaccine Development, Transgenic Crops & Animals, and Others ), By Type (Hybrid Seeds, Transgenic Crops, Bio-pesticides, Bio-fertilizers), By Technology (Genetic Engineering, Tissue Culture and Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast Period 2024-2033

-

51027

-

Sept 2024

-

360

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

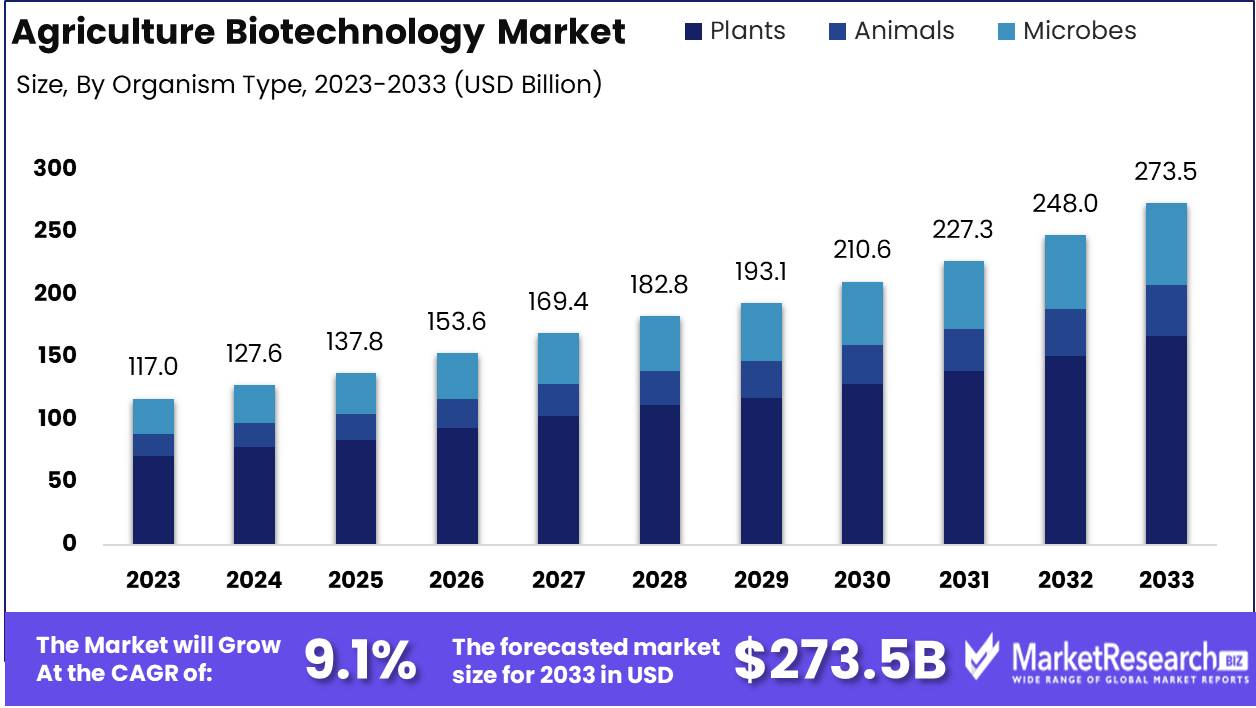

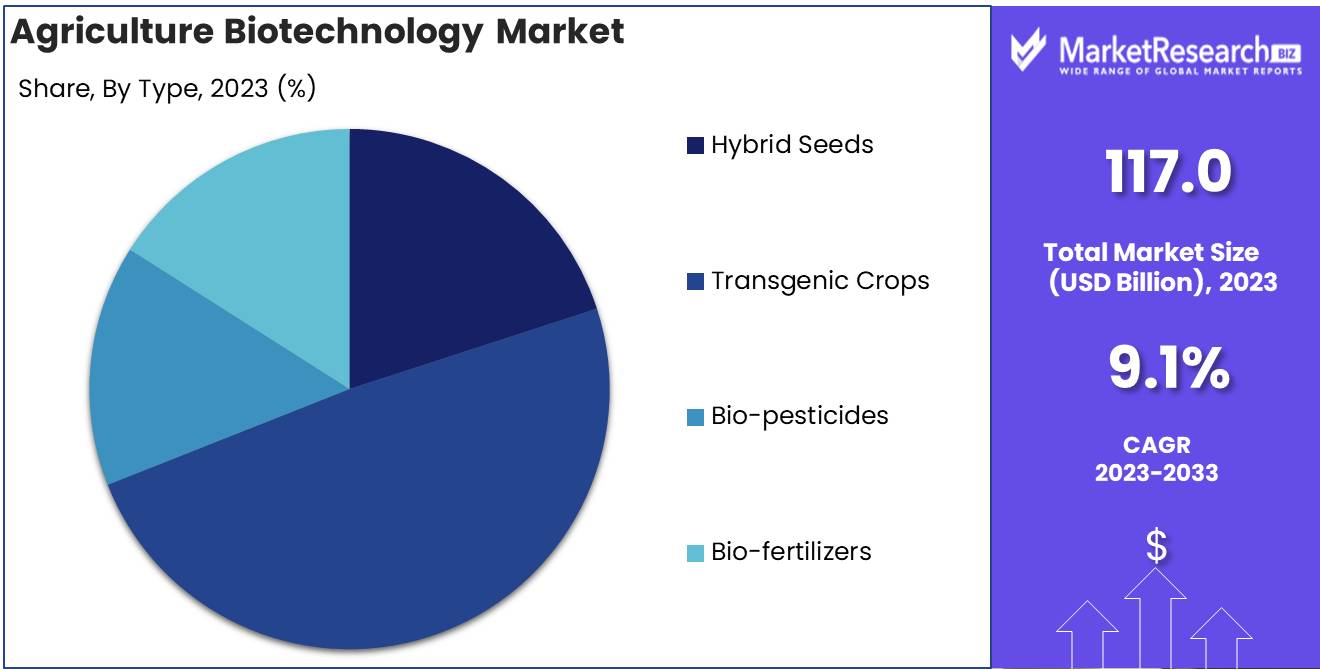

Agriculture Biotechnology Market was valued at USD 117.0 Billion in 2023. It is expected to reach USD 273.5 Billion by 2033, with a CAGR of 9.1% during the forecast period from 2024 to 2033.

The agriculture biotechnology market encompasses technologies and solutions aimed at improving crop production, enhancing plant resistance to pests, diseases, and environmental conditions, and optimizing agricultural sustainability. Key innovations include genetic modification, molecular breeding, and bio-pesticides, which enable higher crop yields, reduced chemical usage, and improved food security. This market plays a crucial role in addressing global challenges such as climate change, population growth, and resource scarcity. With increasing demand for sustainable agricultural practices, biotechnology is poised to transform traditional farming, fostering efficiency, resilience, and environmental stewardship across the agriculture sector.

The agricultural biotechnology market is poised for significant growth, driven by advancements in biotechnological tools, increased adoption of genetically modified (GM) crops, and the integration of cutting-edge technologies like artificial intelligence (AI) in farming practices. Major industry players such as Bayer and Syngenta are expanding their biologics portfolios through R&D, acquisitions, and strategic partnerships, a trend expected to continue as the demand for enhanced crop resilience and nutritional value rises. Moreover, the adoption of GM crops, which has already seen 2.15 billion hectares of biotech crops grown commercially between 1996 and 2016, is accelerating as these crops offer improved resistance to pests, higher yields, and adaptability to changing climates. Emerging technologies such as CRISPR and precision agriculture are becoming essential tools for developing crops that can withstand extreme weather conditions, ensuring food security amidst growing environmental challenges. AI, in particular, is enhancing decision-making processes for farmers by analyzing data to optimize resource use and predict weather patterns, contributing to higher efficiency and crop yields.

Recent innovations underscore the sector’s momentum. In May 2024, Fermbox Bio launched EN3ZYME, a cellulose enzyme cocktail designed to convert agricultural waste into ethanol, offering a cost-effective solution for biofuel production. Similarly, in June 2024, IPL Biologicals, in collaboration with Punjab Agricultural University, introduced Agenor, a bio-fungicide targeting issues faced by paddy farmers. These developments highlight the importance of partnerships and collaboration in addressing specific agricultural challenges. As the industry evolves, the convergence of biotechnology, AI, and collaborative innovation is expected to drive sustainable agricultural practices and meet the growing global demand for food and biofuel.

Key Takeaways

- Market Growth: The Agriculture Biotechnology Market was valued at USD 117.0 billion in 2023 and is projected to reach USD 273.5 billion by 2033, with a CAGR of 9.1% from 2024 to 2033.

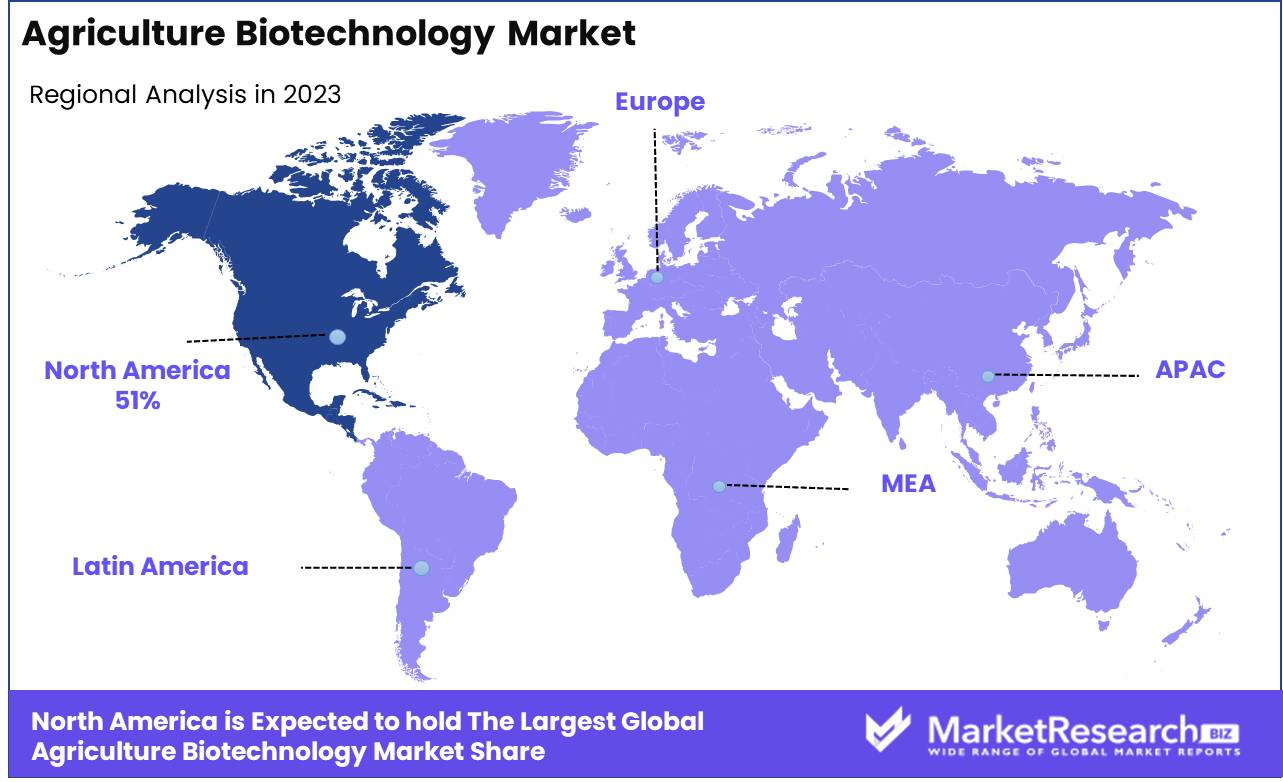

- Regional Dominance: North America dominates the market with a 51% market share, driven by strong investments in biotechnology research and regulatory advancements.

- By Type Analysis: Transgenic crops lead the market with 49% share, primarily due to their enhanced traits like pest resistance and drought tolerance.

- By Organism Type Analysis: Plants hold the dominant position 61% share, driven by widespread adoption of genetically modified crops globally.

- By Technology Analysis: Genetic Engineering dominates with 45% share, due to advancements in gene-editing tools like CRISPR-Cas9.

- By Application Analysis: Transgenic Crops & Animals lead the 56% share, fueled by increased demand for genetically modified crops to enhance yields.

-

Growth Opportunity: Biofuels and renewable energy present significant growth opportunities for the market, with biofuels derived from GM crops playing a critical role in the global shift towards cleaner energy solutions.

- Restraining Factor: Regulatory challenges continue to act as a restraint, slowing market entry and increasing operational costs for biotech innovations.

Driving factors

Advancements in Biotechnology Tools and Techniques

The rapid evolution of biotechnology tools, particularly in genomics, molecular biology, and bioinformatics, is a cornerstone for the accelerated growth of the agricultural biotechnology market. These advanced technologies facilitate precise gene editing methods such as CRISPR-Cas9, as well as synthetic biology approaches that enable the creation of engineered crops with novel traits. For instance, the application of bioinformatics allows for the analysis of vast amounts of genetic data, making it possible to identify specific traits linked to drought resistance or pest tolerance with greater accuracy and speed.

The integration of these tools enhances product development timelines, reduces R&D costs, and fosters innovation, leading to a surge in genetically modified crops that can better withstand climate change and increase yield. Furthermore, the convergence of synthetic biology and agricultural applications promises to push the boundaries of crop development, catering to rising food demands and advancing sustainable agricultural practices.

Improving Crop Resistance and Productivity

Improving crop resistance and productivity through agricultural biotechnology directly addresses the growing global demand for food, driven by population growth and changing climate conditions. Techniques like genetic engineering and marker-assisted selection allow for the development of crops that are resistant to diseases, pests, and environmental stresses such as drought, salinity, and extreme temperatures. These innovations not only reduce crop loss and enhance agricultural yields but also minimize the need for chemical inputs like pesticides, contributing to more sustainable farming practices.

As per recent estimates, crops with enhanced resistance traits have demonstrated yield improvements of 20-30%, with further growth expected as biotechnology adoption widens. This is particularly vital in regions facing heightened environmental challenges, where the resilience of crops could mean the difference between food scarcity and surplus. The development of genetically modified (GM) crops like Bt cotton, which is resistant to specific pests, has already significantly boosted agricultural output, especially in countries such as India and Brazil.

Restraining Factors

Regulatory Challenges: Slowing Market Growth and Increasing Costs for Biotech Innovations

Regulatory challenges present a significant barrier to the expansion of the agricultural biotechnology market. The commercialization of genetically modified organisms (GMOs) faces complex legislative frameworks that vary widely across different regions. These intricate regulations delay the approval of biotech products, impede global market access, and complicate operational strategies for companies looking to scale across borders. For instance, in the European Union (EU), GMO approval processes can take up to six years, compared to just 15-24 months in the United States, significantly slowing market entry for biotech firms.

Further complicating market dynamics, stringent labeling laws in several regions require biotech companies to clearly identify products containing GMOs. These laws, particularly prevalent in Europe, North America, and parts of Asia, raise operational costs and add complexities to distribution channels, creating additional barriers to market entry. For instance, in countries like the U.S., mandatory labeling of GMOs has been estimated to increase costs for food manufacturers by 0.1% to 10%, which in turn can raise prices for consumers and reduce the competitiveness of biotech crops.

Health and Environmental Concerns: Eroding Consumer Trust and Slowing Adoption

Health and environmental concerns continue to cast a shadow over the growth of agricultural biotechnology, primarily due to lingering uncertainty about the long-term effects of genetically modified crops. Despite extensive studies supporting the safety of GMOs, the skepticism among consumers and some regulatory bodies persists. This public hesitance is reflected in regulatory decisions and market behavior, with some regions opting for stringent laws or outright bans on GMOs. For example, a 2020 survey showed that approximately 48% of consumers in Europe were opposed to GMOs, reflecting a deep-rooted cultural and environmental resistance to these products.

One of the prominent concerns is the potential for genetically modified crops to contribute to antibiotic resistance, a critical public health issue. Some GMOs use antibiotic resistance genes as markers in the genetic modification process, leading to fears that their consumption could diminish the effectiveness of antibiotics in humans. Though the risk remains largely theoretical, this perception has led to regulatory scrutiny and consumer reluctance, slowing market penetration in key regions. In countries like Germany and Austria, such concerns have translated into stringent restrictions on GMO usage and importation.

Additionally, environmental concerns regarding biodiversity loss and the unintentional spread of modified genes to wild plant populations create further resistance among environmental groups. As environmental regulations tighten globally, particularly in the wake of climate change awareness, these concerns continue to present obstacles to biotech adoption.

By Organism Type Analysis

Plants Dominated the Agriculture Biotechnology Market in 2023 with a 61% Share

In 2023, Plants held a dominant market position in the By Organism Type segment of the Agriculture Biotechnology Market, capturing more than 61% of the total market share. This dominance is primarily driven by the widespread adoption of genetically modified (GM) crops, which offer enhanced traits such as pest resistance, drought tolerance, and improved nutritional value. The increasing global demand for higher agricultural productivity to meet the food needs of a growing population, alongside the adoption of advanced biotechnological techniques in plant breeding, has significantly contributed to the growth of this segment. Favorable government policies, especially in key agricultural markets, have further accelerated the commercialization of GM crops, solidifying the plants segment's leading position.

Animals represent another important segment within the market, as advancements in biotechnology have enabled the genetic modification of livestock for improved disease resistance, productivity, and reproductive efficiency. While smaller than the plants segment, biotechnology applications in animal agriculture are growing, particularly in areas such as animal vaccine development and breeding for enhanced traits.

The Microbes segment, though smaller, is gaining traction, driven by the increasing utilization of microorganisms for biofertilizers, biopesticides, and soil health enhancement. Microbial biotechnology plays a critical role in sustainable agriculture by reducing the reliance on chemical inputs, improving crop yield, and fostering eco-friendly farming practices. With growing emphasis on sustainable agriculture and soil health, this segment is expected to witness steady growth in the future.

By Application Analysis

Transgenic Crops & Animals Dominated the Agriculture Biotechnology Market in 2023 with a 56% Share

In 2023, Transgenic Crops & Animals held a dominant position in the By Application segment of the Agriculture Biotechnology Market, capturing more than 56% of the total market share. The transgenic crops & animals segment's strong market performance is largely driven by the increasing demand for genetically modified crops with enhanced traits, such as pest resistance and improved yield, alongside the growing use of genetically modified animals for research and agricultural productivity. The adoption of transgenic crops is also fueled by favorable regulatory frameworks in major agricultural markets and rising investments in biotechnology research.

Genetic Engineering remains a pivotal segment, contributing significantly to the market as it underpins most advancements within agricultural biotechnology. Genetic engineering techniques enable the development of crops with improved resistance to environmental stress, herbicides, and diseases, which are crucial for food security in light of global climate challenges. This segment is expected to see sustained growth with ongoing innovation in gene-editing technologies like CRISPR-Cas9.

The Vaccine Development segment represents a growing niche within agricultural biotechnology, where biotechnological advancements are leveraged to create vaccines for livestock and plants. The rise in zoonotic diseases and the need to protect agricultural yields from disease outbreaks have boosted research in this field, providing promising growth opportunities.

Although smaller in comparison, Antibiotic Development continues to be relevant, particularly as concerns over antibiotic resistance in both humans and animals rise. Biotechnology innovations are helping to create new and effective antibiotics for livestock, ensuring the health of farm animals and reducing the reliance on traditional antibiotics.

Flower Culturing represents a specialized application of biotechnology, with a focus on genetic modification to enhance the aesthetic qualities of ornamental plants. While its contribution to overall market value remains limited, the demand for genetically enhanced flowers, such as those with improved color, scent, and longevity, is growing steadily in niche markets.

Nutritional Supplements are an increasingly significant area of focus, as biotechnology is used to develop crops with enhanced nutritional content. Biofortification of crops, for instance, can address micronutrient deficiencies in populations reliant on staple crops, and this segment is poised for further expansion as global health concerns around malnutrition persist.

Finally, Biofuels are emerging as a key growth area within the agricultural biotechnology landscape, driven by the need for sustainable energy sources. Biotechnology advancements have enabled the development of genetically modified crops optimized for biofuel production, positioning this segment for future growth as global energy demands shift towards renewable resources.

By Type Analysis

Transgenic Crops Dominated the Agriculture Biotechnology Market in 2023 with a 49% Share

In 2023, Transgenic Crops held a dominant market position in the By Type segment of the Agriculture Biotechnology Market, capturing more than 49% of the total market share. The growth of this segment is largely driven by the increasing adoption of genetically modified (GM) crops designed to offer enhanced traits such as herbicide tolerance, pest resistance, and improved yield. The rising demand for agricultural productivity, along with the global push to address food security challenges, has led to widespread adoption of transgenic crops in major farming regions, particularly in North and South America. Additionally, regulatory approvals for new transgenic varieties in emerging markets have bolstered growth.

Hybrid Seeds followed closely as an important segment, contributing significantly to market revenue. Hybrid seeds, known for their high yield potential and disease resistance, remain crucial for farmers aiming to increase crop productivity. Although transgenic crops dominate, hybrid seeds maintain a strong market presence, particularly in regions where GM crops are either restricted or where traditional farming practices still prevail.

The Bio-pesticides segment is growing rapidly, as the agricultural sector increasingly shifts towards more sustainable and eco-friendly practices. Bio-pesticides, which are derived from natural materials such as plants, bacteria, and minerals, offer an effective alternative to chemical pesticides. Their rising popularity is driven by increasing consumer preference for organic produce and the need to reduce the environmental impact of farming.

Bio-fertilizers represent another key area of focus within agricultural biotechnology. These biologically derived fertilizers improve soil fertility and crop productivity while minimizing the environmental footprint. With growing concerns over soil degradation and the sustainability of conventional fertilizers, the demand for bio-fertilizers is increasing, positioning this segment for future growth as farmers seek sustainable solutions for soil health management.

By Technology Analysis

Genetic Engineering Dominated the Agriculture Biotechnology Market in 2023 with a 45% Share

In 2023, Genetic Engineering held a dominant market position in the By Technology segment of the Agriculture Biotechnology Market, capturing more than 45% of the total market share. This segment's dominance is primarily driven by the extensive application of genetic engineering techniques in the development of transgenic crops, which exhibit enhanced traits such as pest resistance, drought tolerance, and improved nutritional value. Genetic engineering remains the cornerstone of innovation in agriculture biotechnology, with advancements like CRISPR-Cas9 and other gene-editing tools opening new frontiers for crop and livestock improvement. The technology's ability to address critical agricultural challenges, including climate resilience and food security, has solidified its leading market position.

Tissue Culture follows as a significant contributor, widely used for the mass propagation of disease-free and genetically uniform plants. This technique is critical in enhancing crop production and maintaining genetic diversity, especially for high-value crops such as fruits, vegetables, and ornamental plants. Tissue culture's role in rapid plant multiplication has made it a key component in commercial agriculture.

Embryo Rescue is an essential technology in plant breeding, used primarily to produce viable plants from otherwise incompatible crosses. While its share is smaller than other technologies, it plays a crucial role in developing new hybrid varieties with improved traits, particularly in crops where traditional breeding methods are less effective.

Somatic Hybridization represents another specialized technology used to combine genetic material from different species or varieties to create new hybrids with desired characteristics. While its application is limited compared to genetic engineering or tissue culture, it remains an important tool in plant breeding programs focused on improving disease resistance and stress tolerance.

Molecular Diagnostics is increasingly gaining traction, as it allows for the early detection of plant and animal diseases, enabling farmers to take proactive measures to protect their yields. This technology is critical for ensuring crop and livestock health, particularly in large-scale farming operations where disease outbreaks can have devastating economic impacts.

The Vaccine segment, though smaller, is growing steadily with the rising demand for vaccines in animal agriculture to prevent disease outbreaks and ensure livestock health. Biotechnology has enabled the development of more effective and targeted vaccines, contributing to the productivity and sustainability of animal farming.

Other technologies, including advanced breeding techniques and biotechnological tools, contribute to the overall growth of the market, though their individual shares are smaller compared to the dominant segments.

Key Market Segments

By Organism Type

- Plants

- Animals

- Microbes

By Application

- Genetic Engineering

- Vaccine Development

- Transgenic Crops & Animals

- Antibiotic Development

- Nutritional Supplements

- Flower Culturing

- Biofuels

By Type

- Hybrid Seeds

- Transgenic Crops

- Bio-pesticides

- Bio-fertilizers

By Technology

- Genetic Engineering

- Tissue Culture

- Embryo Rescue

- Somatic Hybridization

- Molecular Diagnostics

- Vaccine

- Others

Growth Opportunity

Biofuels and Renewable Energy

The shift towards renewable energy sources presents a significant growth opportunity for the agriculture biotechnology market. As governments and industries across the globe emphasize sustainability and carbon reduction, biofuels derived from genetically modified crops are emerging as a key solution. Biotechnology can be used to engineer bioenergy crops that have higher biomass yields, are more resilient to environmental stresses, and require fewer inputs. This technology enables more efficient biofuel production, positioning agricultural biotechnology as a critical enabler in the global energy transition. In 2024, we can expect to see increased investment in the development of genetically engineered crops designed specifically for biofuel purposes, catering to the rising demand for alternative energy sources.

Rising Demand for Food Security

With the global population projected to surpass 9 billion by 2050, there is growing pressure to enhance agricultural productivity. Agricultural biotechnology offers the tools to significantly improve food production, enabling crops to better withstand pests, diseases, and climate challenges. Technologies such as genetic engineering and molecular diagnostics will continue to gain traction, helping farmers maximize yields and reduce crop losses. In 2024, the agriculture biotechnology market is poised to play a more prominent role in addressing food security concerns, particularly in regions facing food shortages and agricultural instability. The increasing adoption of transgenic crops, which can improve both productivity and nutritional content, will be a vital solution to feeding the world’s expanding population.

Latest Trends

Advancements in Genetic Engineering Techniques

One of the most transformative trends in agriculture biotechnology for 2024 is the rapid advancement of genetic engineering techniques, particularly the use of CRISPR-Cas9. This gene-editing technology is revolutionizing crop development by enabling precise modifications to plant DNA, allowing scientists to enhance traits such as nutritional content, shelf life, and resistance to pests and diseases. The adoption of CRISPR and similar techniques is expected to accelerate, as regulatory barriers ease and research institutions and biotech companies focus on creating crops tailored to specific regional and environmental needs. These innovations are crucial for addressing global food security, particularly in developing regions where climate change is making traditional farming practices less viable.

Biofuels and Renewable Energy

As the global focus on renewable energy intensifies, biofuels derived from genetically modified (GM) crops are becoming a key growth area in agricultural biotechnology. Crops engineered for higher biomass production and enhanced environmental resilience are proving essential for efficient biofuel production. This trend is driven by increasing government mandates for carbon reduction and corporate commitments to sustainability. In 2024, the agriculture biotechnology market is expected to see significant investments in bioenergy crop development. The potential for genetically modified bioenergy crops to support the global shift towards cleaner energy solutions highlights the critical role that agricultural biotechnology will play in meeting future energy demands while simultaneously supporting sustainable agricultural practices.

Regional Analysis

North America Dominating Region with 51% Market Share

North America leads the global agriculture biotechnology market, capturing 51% of the total market share. This dominance is primarily driven by strong investments in research and development, along with advanced biotechnological applications in agriculture, particularly in the United States and Canada. The US is at the forefront, contributing significantly to innovation and regulatory advancements in genetically modified crops and bio-pesticides. Government initiatives and support for biotech innovations, combined with a robust agricultural sector, further solidify North America’s leadership. Canada also plays a crucial role in the adoption of biotech crops, enhancing its market contribution.Europe is another key region in the agriculture biotechnology market, driven by strong regulatory frameworks and a focus on sustainability. Countries like Germany, France, and the UK are leading adopters of advanced biotech solutions aimed at increasing crop yields and resistance to pests. The region is also witnessing growing interest in precision farming technologies. However, stringent regulations concerning genetically modified organisms (GMOs) have somewhat constrained the market’s full potential. The European market is projected to grow steadily, with countries like Spain and the Netherlands contributing significantly to research and innovation in biotechnology.

The Asia Pacific region is emerging as a significant player in the agriculture biotechnology market, driven by rapid population growth and increased food demand. China and India are leading in the adoption of biotech crops and precision agriculture technologies to address food security concerns. Governments in these countries are increasingly supporting agricultural biotechnology innovations through policies aimed at enhancing crop productivity and sustainability. Other countries, such as Japan, South Korea, and Vietnam, are also contributing to the market growth with research initiatives and increased adoption of genetically modified seeds. The region is expected to witness high growth rates in the coming years.

Latin America, particularly Brazil and Mexico, is another promising market for agriculture biotechnology, owing to its large agricultural sector and favorable climate for biotech crop cultivation. Brazil, as one of the largest producers of soybeans and corn, has seen substantial adoption of genetically modified crops to improve yields and resist pests. Mexico is also playing a growing role in the regional market with government support and investments in biotech innovations aimed at enhancing crop resilience and productivity. The region’s favorable policies toward biotech crops contribute to its strong market presence.

The Middle East & Africa region, although still developing in terms of agriculture biotechnology adoption, shows potential for growth. Countries like Saudi Arabia and South Africa are investing in research and development to address food security issues through the adoption of genetically modified crops. South Africa, in particular, is a key player in the region with strong government support for biotech innovations in agriculture. The United Arab Emirates (UAE) is also making strides in biotechnology to improve agricultural practices in arid environments. Despite the challenges posed by climate and infrastructure, the region is expected to gradually increase its adoption of biotechnology solutions in agriculture.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The global agriculture biotechnology market in 2024 is characterized by a dynamic competitive landscape, driven by key players at the forefront of innovation, sustainability, and market expansion. Leading companies such as Bayer AG and Corteva are setting the pace with their advanced technological capabilities and strategic investments.

Bayer AG maintains its dominant position through a comprehensive portfolio of genetically modified (GM) seeds, crop protection products, and significant investments in R&D. By emphasizing sustainable farming practices and integrating advanced biotechnology solutions, Bayer continues to shape the future of agriculture, targeting higher crop yields and greater resilience.

Corteva is bolstering its market leadership through a focus on advanced biotech traits, seed technologies, and integrated crop protection. The company's innovation pipeline is geared toward meeting the global demand for enhanced agricultural productivity, driven by its expertise in genetic solutions and precision agriculture.

ADAMA and ChemChina are key players leveraging their extensive global distribution networks and a strong foundation in chemical crop protection. Their integrated approach combines chemical innovation with biotechnological advancements, helping farmers improve crop resilience and productivity. This dual strategy enables them to serve a diverse range of agricultural markets, particularly in regions with intensive farming practices.

As a leader in computational biology, Evogene Ltd. stands out for its focus on genomic solutions that drive precision agriculture and sustainable farming practices. Evogene’s platform leverages advanced data analytics to develop crops with optimized traits, offering a competitive edge in the biotech space by addressing the evolving challenges of modern agriculture.

European players such as KWS SAAT SE & Co. KGaA and Limagrain concentrate on seed technology and genetic crop improvements, with particular emphasis on cereals and vegetables. Their focus on breeding and biotech innovations caters to the growing demand for crop yield improvements and resistance to environmental stresses, positioning them as key contributors to Europe’s agriculture biotechnology sector.

Marrone Bio Innovations and Valent BioSciences LLC are at the forefront of biological solutions, focusing on bio-pesticides and bio-stimulants. As the demand for sustainable and organic farming practices rises, these companies are well-positioned to capture market share by providing environmentally friendly alternatives to traditional chemical inputs.

Asia-based firms such as MITSUI & CO., LTD and Nufarm are expanding their presence in high-growth markets across the Asia-Pacific region. These companies are focusing on advanced biotech solutions to meet the region's increasing demand for sustainable agriculture technologies. Their strategic investments and regional expertise allow them to capitalize on the rising need for crop protection and yield improvement in fast-growing economies.

Performance Plants Inc. is pioneering trait-based technologies aimed at enhancing drought resistance and efficiency in crops. By focusing on traits that improve resource use, such as water and nutrient efficiency, Performance Plants is helping farmers mitigate the effects of climate change, a critical concern for global agriculture.

Market Key Players

- Bayer AG

- ADAMA Ltd

- ChemChina

- Corteva

- Evogene Ltd.

- KWS SAAT SE & Co. KGaA

- Limagrain

- Marrone Bio Innovations

- MITSUI & CO., LTD

- Nufarm

- Performance Plants Inc.

- Valent BioSciences LLC

Recent Developments

- In January 2024, TuBiomics became a key player in developing plant and soil health products. The company focuses on sustainable solutions using natural chemistry-based approaches. This initiative is backed by the Nevada Governor’s Office of Economic Development, showing strong support for sustainable agriculture practices.

- In 2023, BASF announced breakthroughs in CRISPR-Cas9 technology to create crops with better traits. These include improved disease resistance and greater tolerance to drought. This development is aimed at tackling the challenges posed by climate change and ensuring food security.

- In 2023, Corteva introduced a new line of genetically modified soybeans designed to resist specific herbicides. This innovation helps farmers simplify weed management and increase crop yields, contributing to more efficient farming practices.

- In 2023, Monsanto, now part of Bayer, made progress in developing genetically engineered corn that can resist multiple pests and diseases. This advancement is expected to improve crop productivity and boost profitability for farmers.

Report Scope

Report Features Description Market Value (2023) USD 117.0 Bn Forecast Revenue (2033) USD 273.5 Bn CAGR (2024-2032) 29.1 Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Organism Type (Plants, Animals, Microbes), By Application( Genetic Engineering, Vaccine Development, Transgenic Crops & Animals, Antibiotic Development, Nutritional Supplements, Flower Culturing, Biofuels), By Type (Hybrid Seeds, Transgenic Crops, Bio-pesticides, Bio-fertilizers), By Technology (Genetic Engineering, Tissue Culture, Embryo Rescue, Somatic Hybridization, Molecular Diagnostics, Vaccine, Others)) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Bayer AG, ADAMA Ltd, ChemChina, Corteva, Evogene Ltd., KWS SAAT SE & Co. KGaA, Limagrain, Marrone Bio Innovations, MITSUI & CO., LTD, Nufarm, Performance Plants Inc., Valent BioSciences LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bayer AG

- ADAMA Ltd

- ChemChina

- Corteva

- Evogene Ltd.

- KWS SAAT SE & Co. KGaA

- Limagrain

- Marrone Bio Innovations

- MITSUI & CO., LTD

- Nufarm

- Performance Plants Inc.

- Valent BioSciences LLC