Global Agricultural Tractors Market By Type (Utility Tractors, Row Crop Tractors, and Other ) By Power Outlook (Less than 40 HP, 41 to 100 HP, and More ), By Drive Type, By Operations, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

20793

-

April 2023

-

177

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

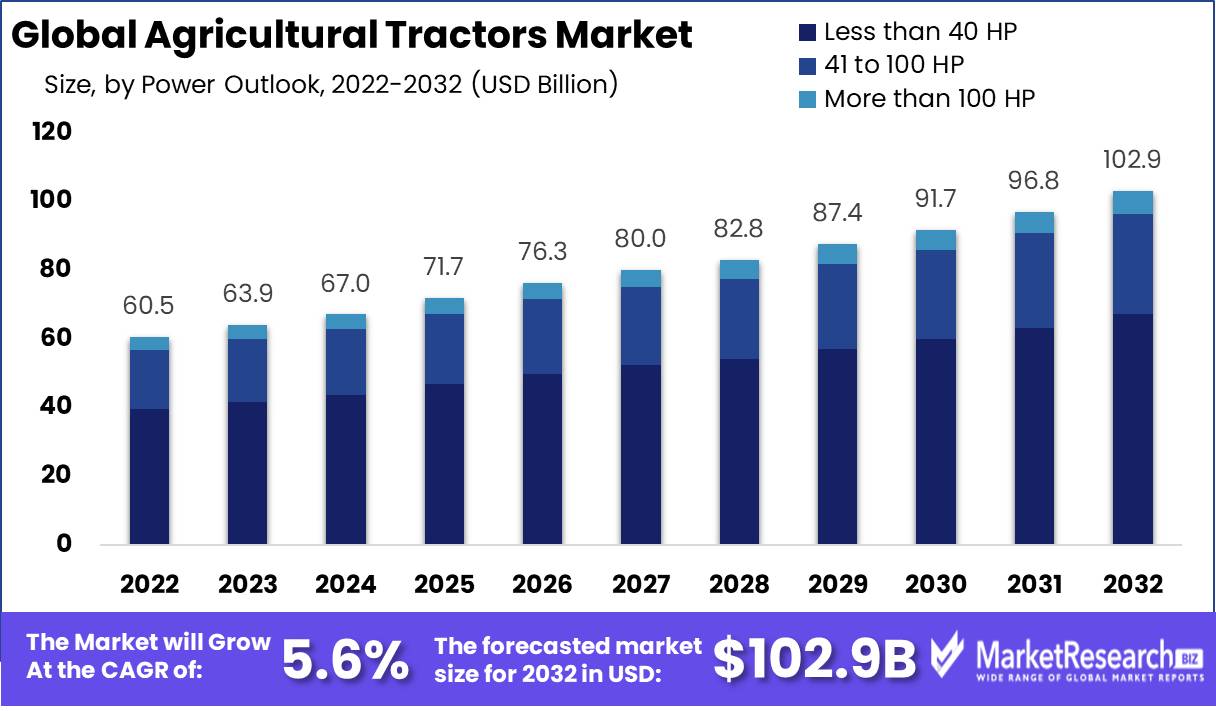

Global Agricultural Tractors Market size is expected to be worth around USD 102.5 Bn by 2032 from USD 60.5 Bn in 2022, growing at a CAGR of 5.6%. during the forecast period from 2023 to 2032.

The rising demand for small Tractorss for small farms and technological advancements like the blending of telematics is likely to boost the growth of the agricultural Tractorss market. The rapid development of mechanization is anticipated to boost the growth of the market over the next eight years. Furthermore, it is anticipated that the market could experience expansion due to the movement of farm workers into cities, resulting in a shortage of labor. The short production stoppage and disruption to the supply chain due to the COVID-19 epidemic slowed demand for the product.

Driving Factors

The world's population is growing rapidly, resulting in rising food demand. Agricultural Tractors Market play an important role in modern farming techniques, helping in various jobs such as plowing, planting, harvesting, and tilling. The need to boost agricultural productivity to meet the growing food need is driving the demand for agricultural Tractorss. The shift from conventional, manual, labor-intensive farming to mechanized farming is a significant driver for the agricultural Tractors market.

Tractorss offer significant advantages in terms of efficiency, productivity, and reduced labor dependency. Agricultural Tractorss are becoming more advanced with technological innovations. Modern Tractorss are equipped with features such as GPS navigation, precision farming technologies, telematics, and automated systems. These advancements enhance productivity, accuracy, and efficiency in farming operations, driving the demand for technologically advanced Tractorss.

Restraining Factors

The global agricultural Tractors market faces various impediments that hinder its growth and expansion. First and foremost, stringent government regulations and emissions standards restricting traditional diesel-powered Tractorss have led manufacturers to invest in alternative fuel technologies like electric or hybrid Tractorss that are still under development. Second, the high cost of agricultural machinery such as Tractorss presents a major barrier for small-scale farmers in developing nations, particularly when starting their business ventures.

Additionally, rural areas often lack infrastructure, such as proper roads and storage facilities that enable effective use of Tractorss and can limit their accessibility. Economic uncertainty, trade tensions, and fluctuating commodity prices may discourage farmers from purchasing new Tractorss and hamper market demand. Such obstacles challenge the global agricultural Tractors market, necessitating creative solutions and strategic adaptations for sustainable expansion.

By Type Analysis

The Agricultural Tractors Market orchard-type Tractors segment is anticipated to grow at the fastest level during the forecast period. Orchard Tractorss are specialized Tractorss used in fruit orchards and vineyards. They are designed with narrow profiles, low ground clearance, and compact dimensions to maneuver between tight rows and avoid damaging crops. Orchard Tractorss often come with specialized attachments and features for tasks like pruning, spraying, and harvesting in orchard environments.

By Power Outlook Analysis

Agricultural Tractors Market under-40 HP segment was responsible for more than 65.2% market share in terms of volume by 2022. The growth rate is attributable to the low price as well as the compact size and more convenience that is offered by Tractorss less than 40HP for all farming tasks. These machines are used primarily within the Asia Pacific region, where the majority of farms are less than 10 hectares in size and are the preferred choice of most farmers from the region. Additionally, the electrification of Tractorss in the smaller than 40 HP range is expected to increase in speed in the coming years.

The 40-100 HP range is anticipated to show an impressive CAGR over the forecast time. This is due to the increase in demand for these Tractorss in advanced markets like the U.S., Japan, and Germany. The rise in income, the technologically-savvy farmers, and established after-sales support are expected to increase the expansion of this segment over the forecast time. The growing demand for Tractorss with high power for farms with more than 10 hectares is likely to become a longer-term driver, propelling the segment during the forecast time.

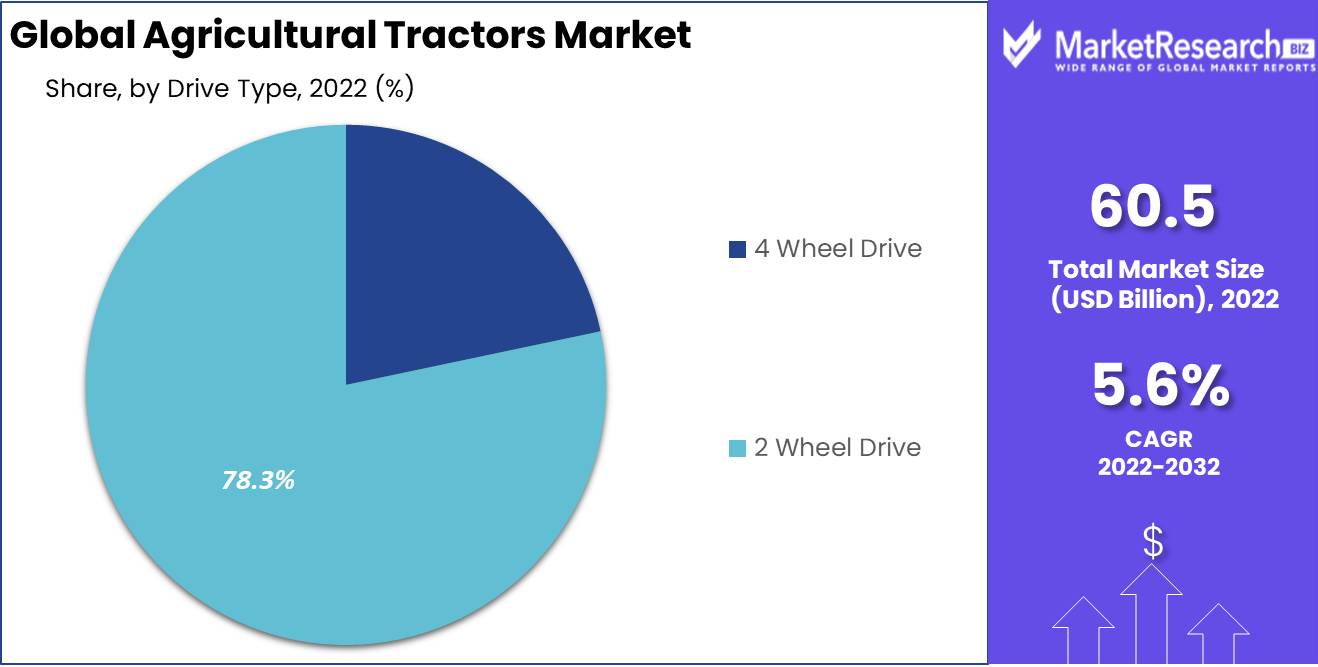

By Drive Type Analysis

The Agricultural Tractors Market 2Wheel Drive segment held more than 78.3% market share in the volume of 2022. It is also predicted to grow at the fastest rate over the forecast time. Low initial costs and improved maneuverability are the long-term factors that are expected to drive the demand for the 2WD market, especially within the Asia Pacific market. 2WDs are the most sought-after Tractorss by farmers with a middle income in India. However, an increase in diesel costs has increased the operating costs of farmers and is expected to be among the biggest concerns over the forecast period.

By Operation Analysis

The Agricultural Tractors Market is segmented by manual and automatic Tractorss by operational proficiency. Manual Tractors vehicles are predicted to dominate the majority of the market. The cause for this is manual Tractorss are easier to handle, are less frequent to maintain, and have lower costs. In the upcoming years, the demand for manual Tractorss is predicted to grow significantly. Farmers can use a variety of manual Tractorss, as they are less expensive than autonomous Tractorss. The Agricultural Tractors Market segment for autonomous Tractorss is expected to grow in the next few years.

To diversification of their product offerings, companies are investing heavily in the production of electrically-propelled autonomous Tractorss. The development of an electric-powered autonomous Tractors is likely to be driven by government-sponsored initiatives in order to cut carbon emissions.

Market Key Segmentation

By Type

- Utility Tractorss

- Row Crop Tractorss

- Orchard Type Tractorss

- Other Types

By Power Outlook

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

By Drive Type

- 4 Wheel Drive

- 2 Wheel Drive

By Operations

- Automatic Tractors Vehicle

- Manual Tractors Vehicle

Growth Opportunity

The integration of advanced technologies in agricultural Tractorss presents a significant growth opportunity. Precision farming technologies, such as GPS navigation, auto-steering, and telematics, enhance operational efficiency, accuracy, and productivity. Ongoing advancements in connectivity, data analytics, and automation will likely drive the adoption of technologically advanced Tractorss, providing growth opportunities for manufacturers.

The Agricultural Tractors Market increasing focus on sustainability and environmental concerns creates a demand for more eco-friendly Tractorss. Manufacturers can seize opportunities by developing and promoting Tractorss powered by alternative fuels, such as electric, hybrid, or biofuels. Sustainable practices and eco-friendly features, including reduced emissions and improved fuel efficiency, are becoming important considerations for farmers and agricultural stakeholders.

The Agricultural Tractors Market adoption of precision farming practices and automation in agriculture is on the rise. Agricultural Tractors Market equipped with advanced technologies for variable rate application, autonomous operation, and real-time data collection and analysis can help farmers optimize resources, reduce costs, and increase productivity. Manufacturers that provide Tractorss with integrated precision farming and automation capabilities can tap into this growth opportunity.

Latest Trends

Rising adoption of precision farming techniques, which uses advanced technologies such as GPS, sensors, and data analytics to optimize farming practices. Tractorss equipped with precision agriculture features can provide accurate and efficient field operations, leading to improved productivity and reduced costs.Popularity of Autonomous or self-driving Tractorss is incraesing in the agricultural sector.

These type of Tractorss enabled with advanced technologies like GPS, sensors, and artificial intelligence to operate without human intervention. Autonomous Tractorss are beneficial such as increased productivity, reduced labor costs, and improved efficiency.The popularity for electric and hybrid Tractorss is on the peak due to increasing concerns over environmental sustainability and fuel efficiency. Electric and hybrid Tractorss produce fewer emissions and offer least operating costs compared to conventional Tractorss. Technological advancements in battery technology is the major factor behind the adoption of electric and hybrid Tractorss.

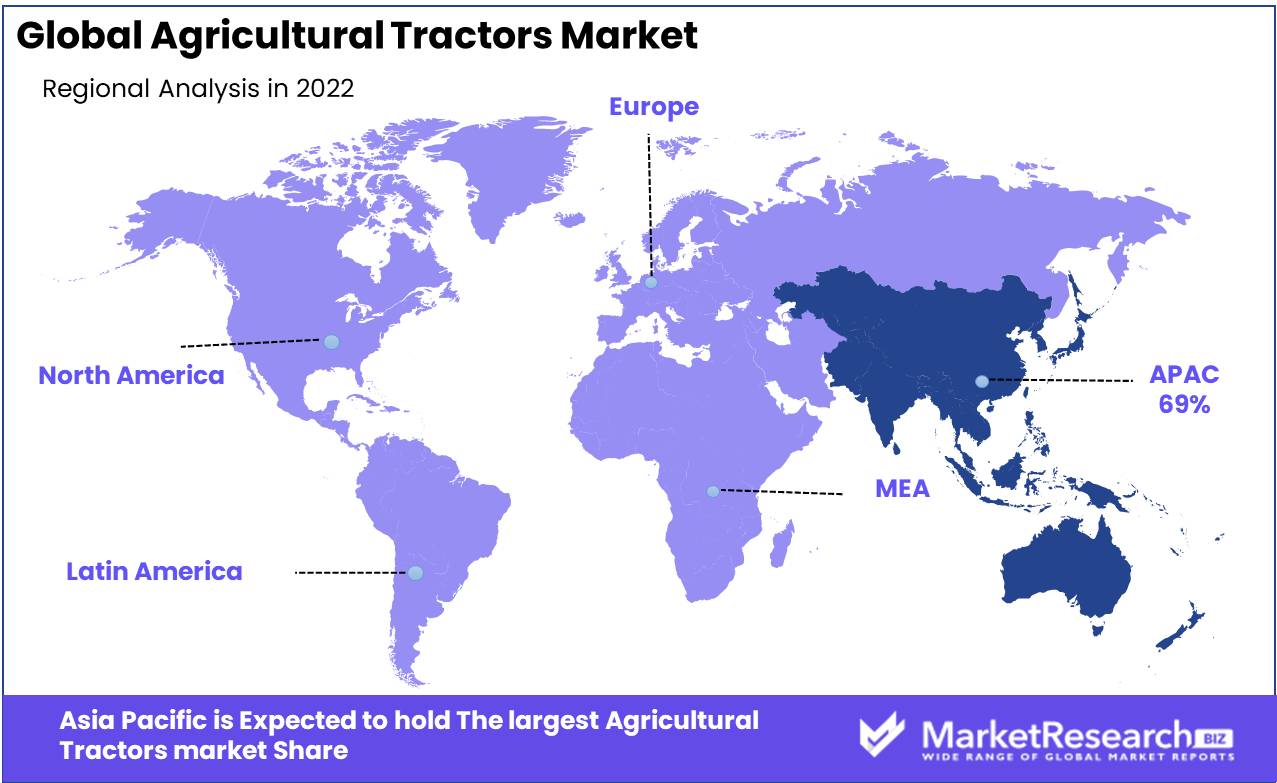

Regional Analysis

Asia Pacific led the Global Agricultural Tractors Market with a share of 69% in 2022. It is projected to increase at the fastest CAGR over the forecast period while maintaining the top position. Growth is fueled mainly by India and China. India was the leader of the APAC market, accounting for more than 54% of the market in 2022. In India, the sales of products were about 800 thousand units in 2022. The ease of loan access, the attractive Minimum Support Price (MSP), and better monsoon conditions are predicted to be favorable for the growth of the market in 2022.

Europe is predicted to expand at a moderate rate with respect to volume during 2023. The increase is due to the growing demand for large farm Tractorss, specifically from Italy, Greece, and Lithuania. Additionally, the huge demand for autonomous Tractorss is anticipated to boost regional market growth during the forecast time. On the other hand, a lengthy waiting time when purchasing a new Tractors due to delays in production is expected to hinder market growth during the forecast time.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The shortage of skilled workers and expensive raw materials, and the supply of semiconductors are a few short-term problems confronting OEMs. In addition, due to the low inventories, dealers and OEMs are unable to meet the demands of consumers. However, strategic initiatives, like collaborations and new ideas, are expected to help overcome these bottlenecks in the next few years.

Top Key Players in Agricultural Tractors Market

- Deere & Company

- SAME DEUTZ-FAHR Group

- Kutoba Corporation

- McCormick International

- Mahindra Group

- Yanmar

- Farmtac

- Massey Ferguson

- Escorts Group

- Kubota

- Other Key Players

Recent Developments

- November 20, 2022: VST Tillers Tractorss Ltd and ZETOR TractorsS disclosed two best-in-class Tractors models during the CII Agro Tech India 2022 exhibition. These category Tractorss of 45 HP and 50 HP were jointly designed by VST & ZETOR at their India and Czech Republic plants.

- July 20, 2021: New Holland North America instigated the T7 Heavy-duty Tractors equipped with PLM Intelligence as an addition to its range of agricultural Tractorss. The new Tractors aims to assist farmers in becoming more productive by allowing multi-tasking in various transportation and field applications.

- June 20, 2022: Solis Yanmar company launched three new Tractors models in the category below 30 HP for Turkish farms to export from India

Report Scope

Report Features Description Market Value (2022) US$ 60.5 Bn Forecast Revenue (2032) US$ 102.5 Bn CAGR (2023-2032) 5.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Utility Tractorss, Row Crop Tractorss, Orchard Type Tractorss, and Other Types; Power Outlook- Less than 40 HP, 41 to 100 HP, and More than 100 HP; Drive Type- 4 Wheel Drive and 2 Wheel Drive; By Operations- Automatic Tractors Vehicle and Manual Tractors Vehicle Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Deere & Company, SAME DEUTZ-FAHR Group, Kutoba Corporation, McCormick International, Mahindra Group, Yanmar, Farmtac, Massey Ferguson, Escorts Group, Kubota, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Deere & Company

- SAME DEUTZ-FAHR Group

- Kutoba Corporation

- McCormick International

- Mahindra Group

- Yanmar

- Farmtac

- Massey Ferguson

- Escorts Group

- Kubota

- Other Key Players