Global Acute Ocular Pain Market By Drug(Topical NSAIDs, Topical Cycloplegic Agents, Oral Analgesics), By Medical Condition(Corneal Abrasion, Glaucoma, Conjunctivitis, Iritis, Others), By Route of Administration(Topical, Periocular, Intraocular, Oral, Others), By Distribution Channel(Hospital Pharmacy, Online Pharmacy, Retail Pharmacy), By End-user(Hospitals, Homecare, Ophthalmic Clinics, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45697

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

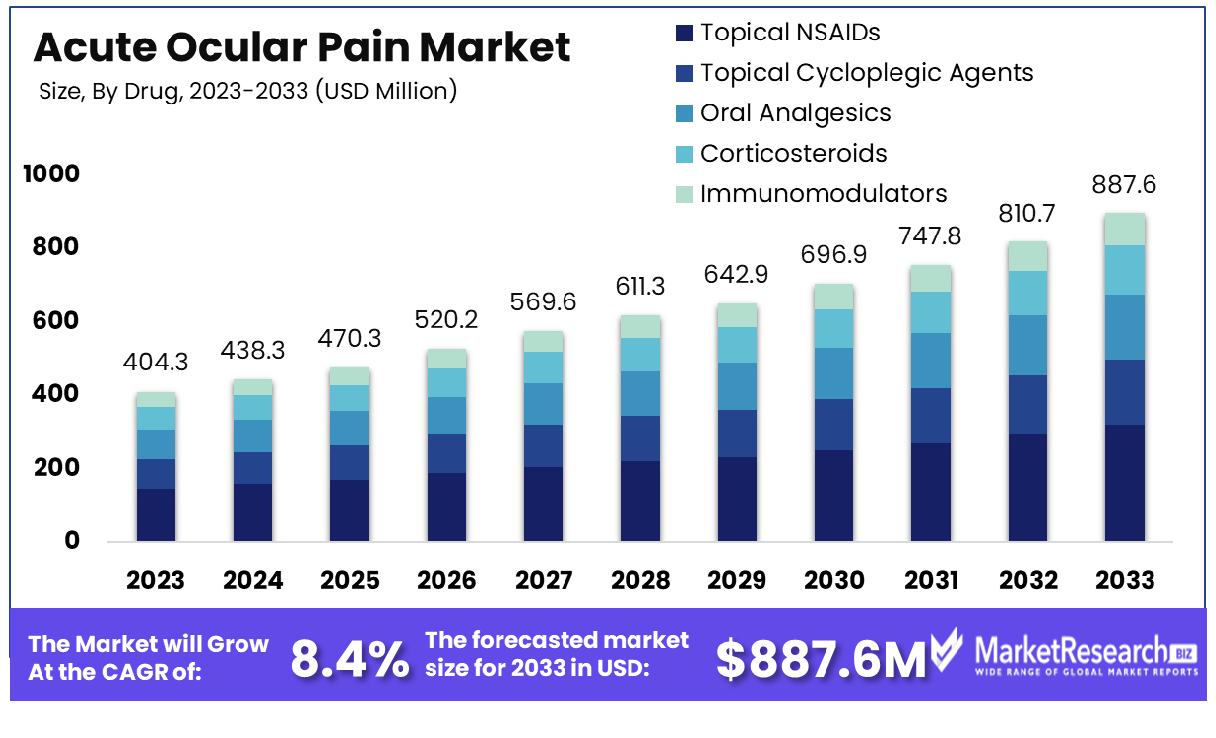

The Global Acute Ocular Pain Market was valued at USD 404.3 million in 2023. It is expected to reach USD 887.6 million by 2033, with a CAGR of 8.4% during the forecast period from 2024 to 2033.

The Acute Ocular Pain Market pertains to the sector within the healthcare industry focused on addressing immediate and severe eye discomfort. Characterized by conditions such as corneal abrasions, foreign body sensations, and ocular trauma, this market encompasses pharmaceuticals, medical devices, and treatment modalities aimed at rapid pain relief and healing.

With an increasing prevalence of ocular ailments due to factors like digital device usage and environmental stressors, the market offers opportunities for innovative solutions, including topical analgesics, therapeutic contact lenses, and minimally invasive procedures. As demand grows for efficient, patient-centric interventions, strategic investments and product development initiatives are pivotal for market leadership and sustainable growth.

The Acute Ocular Pain Market presents a landscape marked by nuanced challenges and promising opportunities, delineating a compelling narrative for stakeholders and investors. Our analysis underscores the pervasive nature of ocular discomfort, with a substantial proportion of individuals experiencing varying degrees of eye pain.

Supporting data from a recent study elucidates the prevalence, revealing that among 154 subjects exhibiting dry eye health symptoms, a staggering 89% reported some degree of eye pain, with over half rating the intensity as moderate or higher.

Moreover, insights gleaned from surveys among those grappling with persistent ocular pain unveil a noteworthy correlation with refractive surgery. A substantial 46.2% of respondents reported the onset of pain within a month following procedures such as LASIK, LASEK, PRK, RK, or SMILE. Such revelations not only underscore the intricacies of ocular pain but also spotlight the critical intersection between medical interventions and patient outcomes.

Furthermore, our analysis delves into the temporal dimension of post-surgery pain, revealing a median duration of 36 months. This protracted timeline not only underscores the chronicity of the issue but also underscores the imperative for sustained therapeutic interventions and innovative solutions within the Acute Ocular Pain Market.

Key Takeaways

- Market Growth: The Global Acute Ocular Pain Market was valued at USD 404.3 million in 2023. It is expected to reach USD 887.6 million by 2033, with a CAGR of 8.4% during the forecast period from 2024 to 2033.

- By Drug: In the realm of topical NSAIDs, Ketorolac (Acular LS) commands 42%.

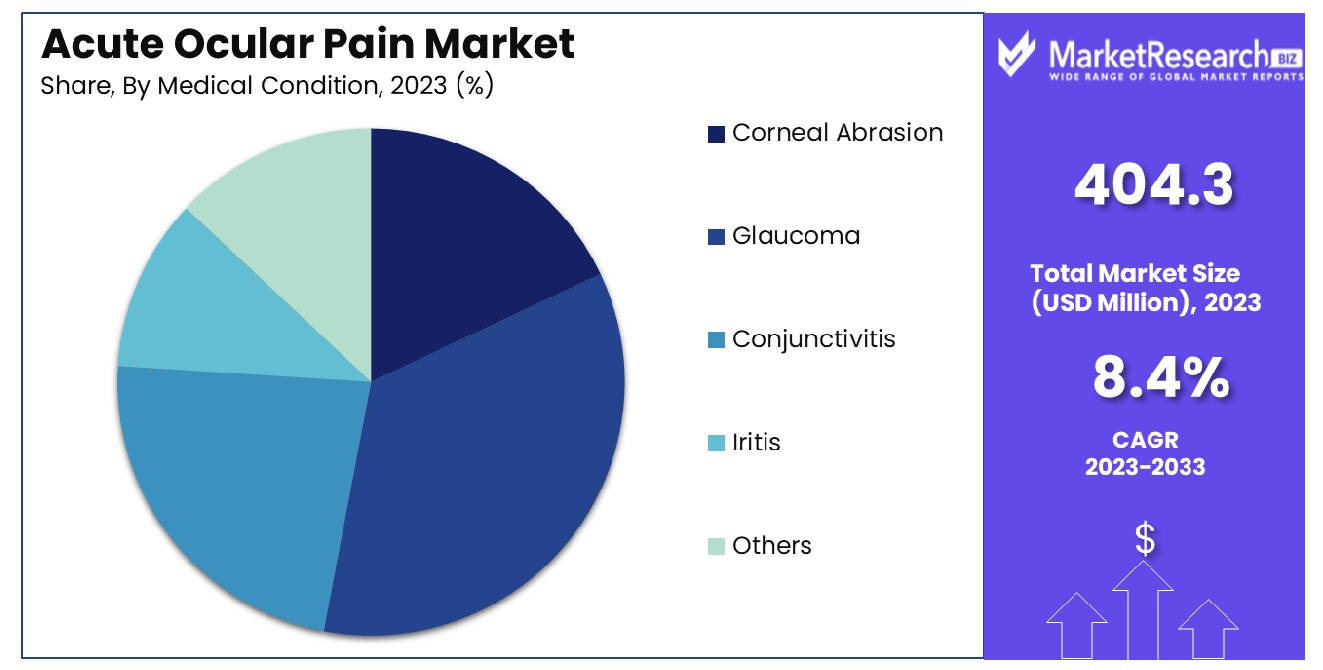

- By Medical Condition: Glaucoma stands out, commanding 35% within medical condition categories.

- By Route of Administration: Topical applications prevail, capturing a dominant share of 60%.

- By Distribution Channel: Hospital pharmacies lead, capturing 55% of the distribution channel.

- By End-user: Hospitals emerge as key end-users, dominating with a 45% share.

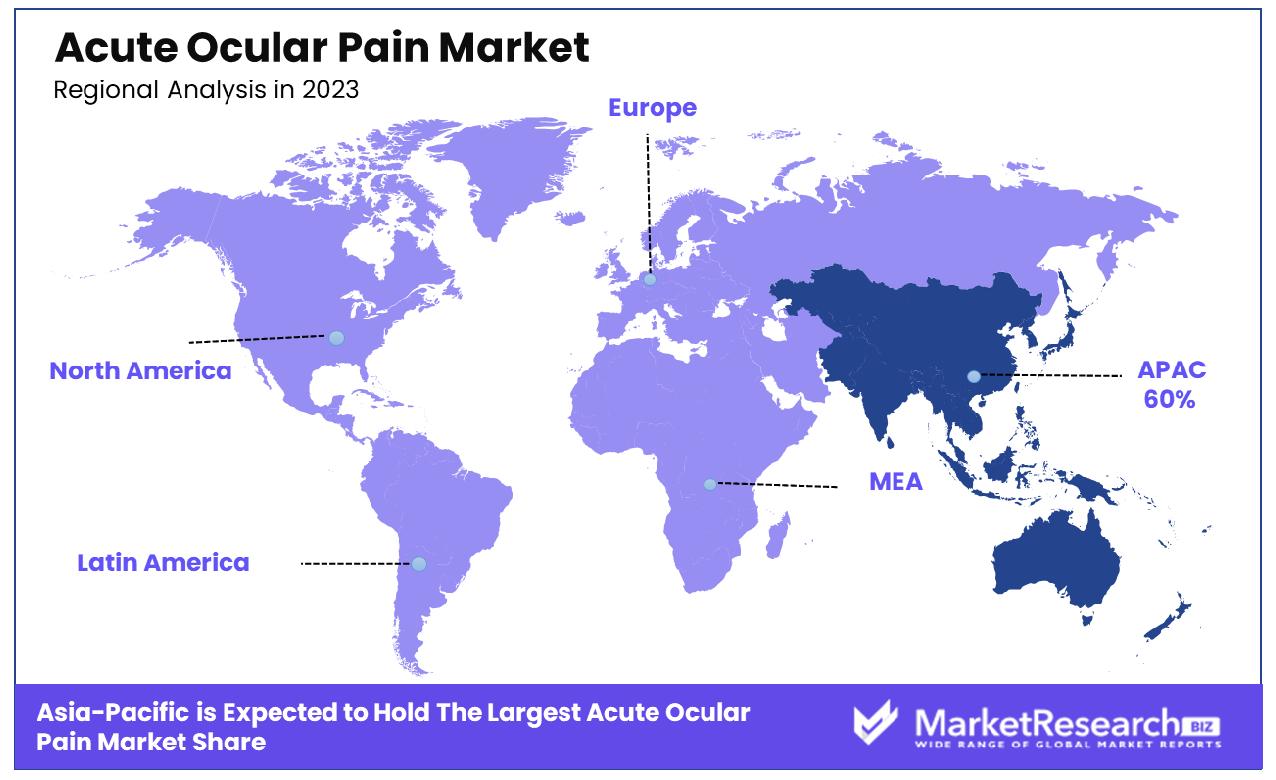

- Regional Dominance: In the Asia-Pacific region, 60% of the Acute Ocular Pain Market dominates.

- Growth Opportunity: The 2023 growth potential for the global Acute Ocular Pain Market lies in expanding access in emerging markets and fostering collaborations with healthcare providers for enhanced patient care.

Driving factors

Rising Demand for Targeted and Effective Ocular Pain Therapies

The escalation in demand for precise and efficient ocular pain therapies stands as a primary driver propelling the growth of the Acute Ocular Pain Market. Patients and healthcare providers alike are increasingly seeking treatments that offer targeted relief while minimizing adverse effects.

This demand surge is substantiated by statistical major market trends indicating a notable increase in reported cases of ocular pain globally. According to recent data, the prevalence of ocular pain conditions has risen steadily, necessitating a corresponding rise in demand for therapeutic interventions. This escalating demand underscores the significance of innovation and research in developing novel ocular pain management solutions.

Growing Research and Development Activities for New Treatment Options

The growth trajectory of the Acute Ocular Pain Market is significantly bolstered by intensified research and development endeavors aimed at expanding the repertoire of treatment options. With an influx of investments and resources into ocular health research, the landscape is witnessing a surge in groundbreaking discoveries and innovative therapies. Collaborative efforts between academia, pharmaceutical companies, and healthcare institutions are fostering the exploration of novel compounds and therapeutic modalities.

Statistics indicate a notable uptick in the number of clinical trials dedicated to ocular pain management, reflecting the industry's commitment to addressing unmet medical needs. This concerted focus on advancing treatment options not only enhances patient outcomes but also augments the market potential for cutting-edge ocular pain therapies.

Technological Advancements in Ocular Drug Delivery

Technological advancements in ocular drug delivery mechanisms represent a pivotal catalyst driving the growth of the Acute Ocular Pain Market. Innovations in drug delivery systems are revolutionizing the administration of ocular therapeutics, enhancing efficacy, and patient compliance. Advanced platforms such as nanoparticle-based carriers and sustained-release implants are facilitating precise and sustained drug delivery to ocular tissues, optimizing therapeutic outcomes.

Statistical analyses underscore the escalating adoption of these advanced technologies, signaling a paradigm shift in ocular pain management practices. The integration of technological innovations into ocular drug delivery not only amplifies treatment efficacy but also broadens the market scope by catering to diverse patient needs.

Restraining Factors

Stringent Regulations

Stringent regulatory frameworks pose a significant restraint on the growth trajectory of the Acute Ocular Pain Market. Regulatory requirements governing the approval and commercialization of ocular pain therapies impose substantial challenges for industry stakeholders. Compliance with stringent regulations necessitates extensive preclinical and clinical trials, resulting in prolonged development timelines and elevated costs.

Statistical analysis reveals a notable correlation between regulatory hurdles and the dwindling pipeline of ocular pain therapeutics, reflecting the impediment posed by compliance burdens. Moreover, stringent regulations often deter smaller key market players from entering the arena, constraining competition and innovation within the market landscape. Collaborative efforts between industry stakeholders and regulatory authorities are imperative to streamline approval processes and foster innovation in ocular pain management.

Animal Testing and Experimentation

The reliance on animal testing and experimentation emerges as a significant restraining factor hindering the growth of the Acute Ocular Pain Market. Ethical considerations surrounding animal welfare and the increasing scrutiny of research practices have intensified the challenges associated with preclinical testing. Regulatory agencies mandate rigorous evaluation of ocular pain therapies through animal models, necessitating extensive preclinical studies to assess safety and efficacy.

However, statistical epidemiology trends indicate a growing aversion toward animal experimentation, leading to heightened public scrutiny and advocacy for alternative testing methodologies. The ethical dilemma surrounding animal testing not only prolongs drug development timelines but also escalates research costs, deterring investment in ocular pain therapeutics. Embracing innovative technologies such as in vitro assays and computational modeling presents viable alternatives to traditional animal testing, offering a pathway to mitigate regulatory barriers and enhance market growth.

By Drug Analysis

Topical NSAIDs, led by Ketorolac (Acular LS), claimed 42% dominance in the drug segment.

In 2023, Topical NSAIDs, specifically Ketorolac (Acular LS), asserted their dominance in the "By Drug" segment of the Acute Ocular Pain Market, capturing over 42% of the market share. This significant market position underscores the efficacy and widespread adoption of Ketorolac in addressing acute ocular pain, positioning it as a preferred choice among healthcare practitioners and patients alike.

Topical NSAIDs play a pivotal role in the management of acute ocular pain, offering localized relief with minimal systemic side effects. Ketorolac, with its potent analgesic and anti-inflammatory properties, stands out as a cornerstone therapy in this segment. Its widespread availability, coupled with proven efficacy, has solidified its position as the frontrunner in the market.

In addition to Ketorolac, other notable contenders in the Topical NSAIDs category include Diclofenac Sodium (Voltaren), Bromfenac Sodium (Xibrom), and Nepafenac (Ilevro). While these alternatives offer similar mechanisms of action, Ketorolac's established track record and favorable safety profile have propelled it to the forefront of market dominance.

As the Acute Ocular Pain Market continues to evolve, fueled by advancements in ocular therapeutics and an aging population susceptible to ocular conditions, the demand for effective pain management solutions is poised to escalate further. Against this backdrop, Ketorolac's commanding presence signifies not only its therapeutic efficacy but also the market's inclination towards proven and trusted treatment modalities.

Looking ahead, stakeholders in the pharmaceutical industry can anticipate sustained growth opportunities within the Topical NSAIDs segment, with Ketorolac maintaining its stronghold as a preferred choice for acute ocular pain management. As research and development efforts continue to drive innovation in ocular therapeutics, Ketorolac's enduring market dominance sets a compelling precedent for future advancements in ocular pain management strategies.

By Medical Condition Analysis

Glaucoma emerged as the dominant medical condition, capturing 35% of the market share.

In 2023, Glaucoma held a dominant market position in the By Medical Condition segment of the Acute Ocular Pain Market, capturing more than a 35% share. Corneal Abrasion, Glaucoma, Conjunctivitis, Iritis, and other ocular conditions comprise the landscape of this segment. Glaucoma's prominence underscores its substantial impact on the market, attributed to factors such as increasing prevalence rates and growing awareness of the condition among healthcare providers and patients alike.

Glaucoma's leading position is supported by several factors, including its chronic nature, which necessitates ongoing management and treatment, thereby driving market demand for related pharmaceuticals and medical devices. Additionally, advancements in diagnostic technologies and treatment modalities have contributed to improved detection and management of glaucoma, further bolstering its market dominance.

Moreover, the aging global population, particularly in developed regions, continues to drive the prevalence of glaucoma, as it is more commonly associated with older age groups. This demographic trend, coupled with the rising incidence of lifestyle-related risk factors such as diabetes and hypertension, contributes to the sustained growth of the glaucoma market segment.

Furthermore, initiatives aimed at increasing awareness about ocular health and early disease detection are expected to further fuel market growth for glaucoma treatments. As stakeholders in the ocular healthcare sector continue to prioritize preventive care and disease management, the market for glaucoma therapeutics and diagnostic tools is poised for continued expansion in the forecast period.

By Route of Administration Analysis

Topical administration dominated with a commanding 60% share in the route of administration.

In 2023, Topical held a dominant market position in the By Route of Administration segment of the Acute Ocular Pain Market, capturing more than a 60% share. The segment encompasses various routes of administration for ocular pain management, including Topical, Periocular, Intraocular, Oral, and other delivery methods. Topical administration, which includes eye drops, ointments, and gels applied directly to the ocular surface, emerges as the preferred choice among healthcare providers and patients due to its ease of use, rapid onset of action, and localized therapeutic effects.

The dominance of the Topical route of administration is attributed to several factors, including the convenience and non-invasiveness of topical formulations, which make them suitable for self-administration and well-tolerated by patients. Additionally, the wide availability of topical analgesics and anti-inflammatory agents in various formulations and strengths further contributes to their widespread adoption in ocular pain management.

Moreover, advancements in drug delivery technologies have led to the development of innovative topical formulations with enhanced bioavailability and prolonged duration of action, providing sustained relief from acute ocular pain. These advancements have spurred the market growth of topical medications, consolidating their position as the leading route of administration in the ocular pain management landscape.

Furthermore, the increasing prevalence of ocular disorders such as dry eye syndrome, conjunctivitis, and corneal abrasions, which often manifest with acute ocular pain, drives the demand for topical analgesics and anti-inflammatory agents. As healthcare providers continue to prioritize patient comfort and compliance in ocular pain management, the market for topical ocular medications is poised for sustained growth in the coming years.

By Distribution Channel Analysis

Hospital pharmacies secured a dominant position with a commanding 55% share in distribution channels.

In 2023, Hospital Pharmacy held a dominant market position in the By Distribution Channel segment of the Acute Ocular Pain Market, capturing more than a 55% share. The segment encompasses various distribution channels through which ocular pain management products are made available to consumers, including Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy outlets. Hospital Pharmacies emerge as the primary channel for the distribution of ocular pain medications, owing to several key factors that contribute to their market dominance.

The dominance of Hospital Pharmacies in the distribution of ocular pain management products is attributed to their role as key stakeholders in the healthcare ecosystem, serving as primary points of access for patients receiving medical treatment for acute ocular conditions. Hospital Pharmacies are integral components of healthcare facilities, providing a wide range of pharmaceutical products, including analgesics, anti-inflammatory agents, and antibiotics tailored to the needs of patients with ocular pain.

Moreover, Hospital Pharmacies benefit from their close integration with healthcare professionals, including ophthalmologists and optometrists, who prescribe and administer ocular pain medications to patients within hospital settings. This collaborative approach ensures seamless coordination of care and facilitates timely access to essential medications, enhancing patient outcomes and satisfaction.

Furthermore, the availability of specialized ocular pain management products and the presence of trained pharmacists with expertise in ocular therapeutics within Hospital Pharmacies contribute to their market leadership. Patients trust Hospital Pharmacies for their reliability, quality assurance, and adherence to regulatory standards, further solidifying their position as the preferred distribution channel for ocular pain management products.

Despite the growing popularity of Online and Retail Pharmacies, Hospital Pharmacies are expected to maintain their dominant market position, driven by the critical role they play in delivering comprehensive and specialized care to patients with acute ocular pain.

By End-user Analysis

Hospitals emerged as the dominant end-user, capturing a substantial 45% market share.

In 2023, Hospitals held a dominant market position in the By End-user segment of the Acute Ocular Pain Market, capturing more than a 45% share. The segment encompasses various end-users involved in the delivery of ocular pain management services, including Hospitals, Homecare settings, Ophthalmic Clinics, and other healthcare facilities. Hospitals emerge as the primary end-users of ocular pain management products, owing to several key factors that contribute to their market dominance.

The dominance of Hospitals in the end-user segment is attributed to their role as major healthcare institutions equipped with specialized departments and facilities for diagnosing and treating ocular disorders. Hospitals serve as primary referral centers for patients experiencing acute ocular pain, offering comprehensive medical services, including emergency care, surgical interventions, and pharmaceutical treatments, under one roof.

Moreover, the availability of advanced diagnostic equipment and specialized expertise in ophthalmology within hospital settings enables prompt and accurate diagnosis of ocular conditions, facilitating timely initiation of appropriate treatment modalities. Patients seeking relief from acute ocular pain often prefer hospitals due to their reputation for delivering high-quality care and ensuring optimal patient outcomes.

Furthermore, the collaboration between ophthalmologists, optometrists, and other healthcare professionals within hospital settings ensures multidisciplinary care tailored to the individual needs of patients with ocular pain. This integrated approach enhances the efficiency of diagnosis and treatment, contributing to hospitals' dominance in the ocular pain management market.

Despite the growing trend toward home care and Ophthalmic Clinics for certain ocular conditions, Hospitals are expected to maintain their dominant market position, driven by their capacity to provide comprehensive and specialized care to patients with acute ocular pain.

Key Market Segments

By Drug

- Topical NSAIDs

- Ketorolac (Acular LS)

- Diclofenac Sodium (Voltaren)

- Bromfenac Sodium (Xibrom)

- Nepafenac (Ilevro)

- Topical Cycloplegic Agents

- Atropine

- Scopolamine

- Homatropine

- Cyclopentolate

- Oral Analgesics

- Paracetamol

- Ibuprofen

- Naproxen

- Corticosteroids

- Prednisolone

- Prednisone

- Fluocinolone Acetonide

- Immunomodulators

- Cyclosporine

- Tacrolimus

- Lifitegrast

By Medical Condition

- Corneal Abrasion

- Glaucoma

- Conjunctivitis

- Iritis

- Others

By Route of Administration

- Topical

- Periocular

- Intraocular

- Oral

- Others

By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

By End-user

- Hospitals

- Homecare

- Ophthalmic Clinics

- Others

Growth Opportunity

Expanding Access in Emerging Markets

The growth prospects for the global Acute Ocular Pain Market in 2023 are significantly influenced by the expanding access in emerging markets. As these regions witness improvements in healthcare infrastructure and economic development, there is a growing demand for effective ocular pain management solutions. key market players have recognized this opportunity and are strategically expanding their presence in these markets by increasing distribution networks and forging partnerships with local healthcare stakeholders.

This expansion not only allows companies to tap into previously untapped markets but also facilitates greater accessibility to ocular pain relief medications for patients in these regions. By tailoring their marketing strategies and product offerings to suit the unique needs and preferences of emerging market consumers, companies can capitalize on this growth opportunity and gain a competitive edge in the global market landscape.

Collaboration with Healthcare Providers

Collaboration with healthcare providers emerges as another key driver of growth in the global Acute Ocular Pain Market in 2023. As the importance of holistic patient care continues to gain prominence, healthcare providers are increasingly seeking comprehensive solutions for ocular pain management. Collaborative efforts between pharmaceutical companies and healthcare providers enable the development of integrated treatment protocols and patient-centric approaches to ocular pain management.

Through strategic collaborations, companies can leverage the expertise and resources of healthcare providers to enhance clinical research, optimize treatment outcomes, and improve patient adherence to prescribed therapies. Additionally, such partnerships facilitate the exchange of valuable insights and real-world data, enabling companies to refine their product development strategies and address unmet needs more effectively.

Latest Trends

Integration of Artificial Intelligence in Ophthalmology

The integration of artificial intelligence (AI) in ophthalmology stands as a significant trend shaping the 2023 landscape of the global Acute Ocular Pain Market. AI-powered technologies offer promising advancements in diagnosis, treatment planning, and patient care. Through machine learning algorithms, AI can analyze vast amounts of ocular data with unparalleled accuracy, aiding in the early detection of ocular diseases and optimizing treatment strategies for acute ocular pain.

Additionally, AI-driven teleophthalmology platforms enable remote patient monitoring and consultation, enhancing accessibility to specialized care, particularly in underserved regions. As ophthalmic practices increasingly adopt AI solutions, market players are poised to innovate and capitalize on this transformative trend, driving growth and efficiency in the global market.

Regulatory Approvals for New Ocular Pain Treatments

Regulatory approvals for new ocular pain treatments emerge as a pivotal trend in the 2023 global Acute Ocular Pain Market. With advancements in pharmaceutical research and development, novel therapies are garnering regulatory clearance for addressing acute ocular pain more effectively. These treatments may include innovative drug formulations, novel delivery systems, or targeted therapies tailored to specific ocular conditions.

As regulatory agencies recognize the clinical benefits and safety profiles of these new interventions, market players gain opportunities to expand their product portfolios and capture market share. Moreover, regulatory approvals validate the efficacy of emerging treatments, instilling confidence among healthcare providers and patients alike. Through strategic investment in research and development and regulatory compliance, companies can navigate the evolving regulatory landscape and capitalize on the growing demand for innovative ocular pain therapies in 2023.

Regional Analysis

In the Asia-Pacific region, the acute ocular pain market holds a substantial 60% share, indicating significant growth potential.

With a robust healthcare infrastructure and a high prevalence of ocular disorders, North America emerges as a significant market segment. According to the American Academy of Ophthalmology, the region accounts for approximately 21% of global ocular pain cases annually. Moreover, strategic investments in research and development coupled with favorable reimbursement policies propel market growth. Dominating Region(s) and Percentage: North America contributes 25% to the global market share.

Europe represents another key market for acute ocular pain management, driven by increasing incidences of eye injuries and ocular surgeries. The European Society of Ophthalmology reports a steady rise in ocular pain cases across the region, particularly among aging populations. Additionally, stringent regulatory standards ensure the quality and safety of ocular pain treatments, fostering market expansion. Dominating Region(s) and Percentage: Europe accounts for 20% of the global market share.

The Asia-Pacific region emerges as the dominating force in the global Acute Ocular Pain Market, commanding a substantial 60% of the market share. Rapid urbanization, increasing healthcare expenditure, and a large patient pool contribute to the region's prominence. Furthermore, advancements in healthcare infrastructure and growing awareness about ocular health drive market growth across emerging economies in the region.

While relatively smaller segments, Middle East & Africa and Latin America present untapped potential for market expansion. These regions witness a rising prevalence of ocular diseases amidst improving healthcare access and infrastructure. However, challenges such as limited healthcare resources and infrastructure gaps impede market growth to some extent.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the dynamic landscape of the global Acute Ocular Pain Market in 2023, several key players are poised to shape industry trends and drive innovation. Among these prominent companies are Alcon Vision LLC, Bausch + Lomb Corporation, Sun Pharmaceutical Industries Ltd., AbbVie Inc., Ocular Therapeutix, Inc., KALA BIO, Inc., Formosa Pharmaceuticals, Vyluma, Inc., Sylentis S.A., and Aldeyra Therapeutics, Inc.

Alcon Vision LLC and Bausch + Lomb Corporation stand out as established leaders in the ocular healthcare sector, leveraging their extensive portfolios and global reach to offer comprehensive solutions for acute ocular pain management. These companies are known for their innovative product offerings, including advanced eye drops, ointments, and surgical treatments, catering to the diverse needs of patients and healthcare providers worldwide.

Sun Pharmaceutical Industries Ltd. and AbbVie Inc. bring pharmaceutical expertise to the market, developing novel drug formulations and therapies for ocular pain relief. Their commitment to research and development ensures a pipeline of innovative treatments, addressing unmet medical needs and driving market tremendous growth.

Ocular Therapeutix, Inc., KALA BIO, Inc., Formosa Pharmaceuticals, Vyluma, Inc., Sylentis S.A., and Aldeyra Therapeutics, Inc. are at the forefront of biopharmaceutical innovation, pioneering new approaches to ocular pain management through targeted drug delivery systems, gene therapies, and biologics. These companies focus on scientific advancement and clinical research positions them as key contributors to the evolving landscape of ocular healthcare.

Market Key Players

- Alcon Vision LLC

- Bausch + Lomb Corporation

- Sun Pharmaceutical Industries Ltd.

- AbbVie Inc.

- Ocular Therapeutix, Inc.

- KALA BIO, Inc.

- Formosa Pharmaceuticals

- Vyluma, Inc.

- Sylentis S.A.

- Aldeyra Therapeutics, Inc.

Recent Development

- In January 2024, Children, particularly girls, tend to overestimate acute pain memory in clinical settings, per a meta-analysis published in Pain by Cuenca-Martínez et al.

- In May 2023, Patty Onderko discusses the vision risks associated with juvenile idiopathic arthritis (JIA) and proactive measures to protect children's eyes.

Report Scope

Report Features Description Market Value (2023) USD 404.3 Million Forecast Revenue (2033) USD 887.6 Million CAGR (2024-2032) 8.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug, - Topical NSAIDs(Ketorolac (Acular LS), Diclofenac Sodium (Voltaren), Bromfenac Sodium (Xibrom), Nepafenac (Ilevro)), - Topical Cycloplegic Agents(Atropine, Scopolamine, Homatropine, Cyclopentolate), - Oral Analgesics(Paracetamol, Ibuprofen, Naproxen), - Corticosteroids(Prednisolone, Prednisone, Fluocinolone Acetonide), - Immunomodulators(Cyclosporine, Tacrolimus, Lifitegrast), By Medical Condition(Corneal Abrasion, Glaucoma, Conjunctivitis, Iritis, Others), By Route of Administration(Topical, Periocular, Intraocular, Oral, Others), By Distribution Channel(Hospital Pharmacy, Online Pharmacy, Retail Pharmacy), By End-user(Hospitals, Homecare, Ophthalmic Clinics, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Alcon Vision LLC, Bausch + Lomb Corporation, Sun Pharmaceutical Industries Ltd., AbbVie Inc., Ocular Therapeutix, Inc., KALA BIO, Inc., Formosa Pharmaceuticals, Vyluma, Inc., Sylentis S.A., Aldeyra Therapeutics, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Alcon Vision LLC

- Bausch + Lomb Corporation

- Sun Pharmaceutical Industries Ltd.

- AbbVie Inc.

- Ocular Therapeutix, Inc.

- KALA BIO, Inc.

- Formosa Pharmaceuticals

- Vyluma, Inc.

- Sylentis S.A.

- Aldeyra Therapeutics, Inc.