Abaca Fiber Market By Type (Fine Abaca Fiber, Rough Abaca Fiber), By Product (Pulp & paper, Fiber Craft, Cordage, Textile, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47639

-

June 2024

-

136

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

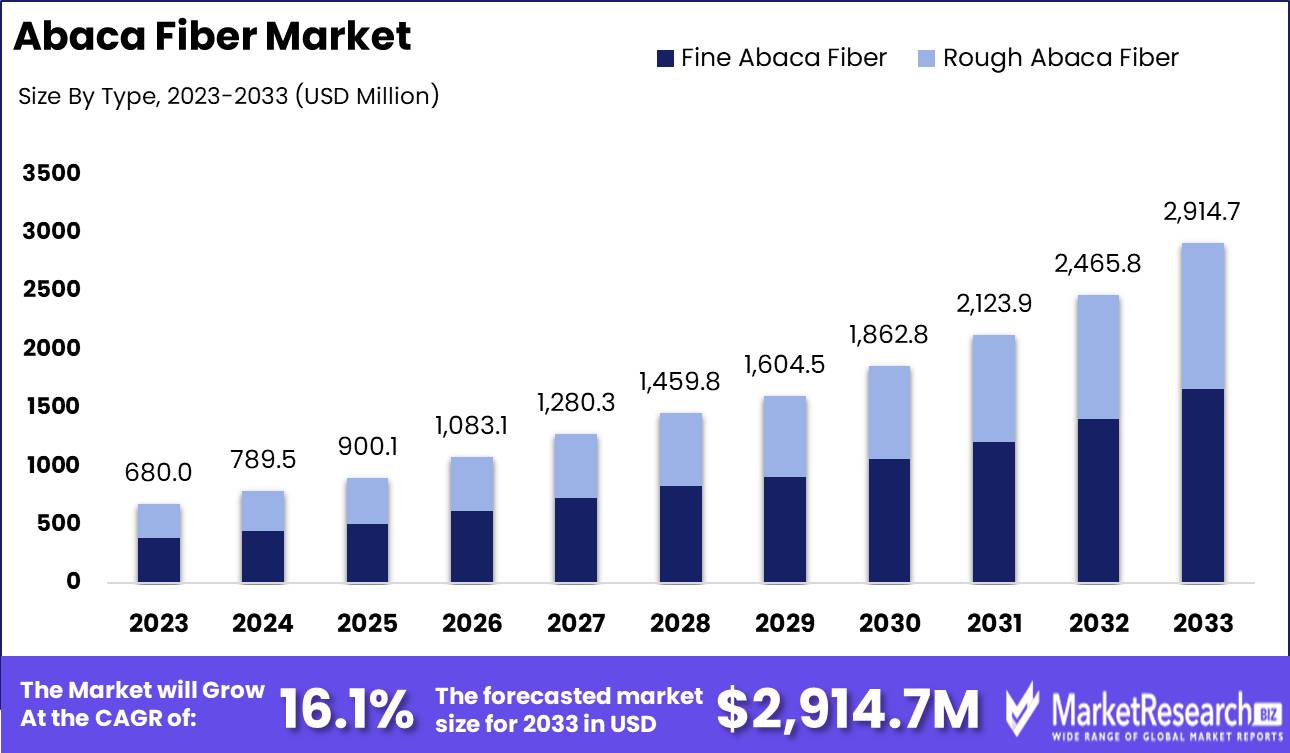

The Global Abaca Fiber Market was valued at USD 680 Mn in 2023. It is expected to reach USD 2914.7 Mn by 2033, with a CAGR of 16.1% during the forecast period from 2024 to 2033.

The Abaca Fiber Market refers to the global trade and industry surrounding the cultivation, processing, and utilization of fibers derived from the abaca plant, also known as Manila hemp. Abaca fibers are renowned for their exceptional strength, durability, and eco-friendly characteristics, making them a preferred choice in various industries such as textiles, paper, and cordage.

As sustainability and environmental consciousness continue to drive consumer preferences, the market for abaca fiber is experiencing steady growth, supported by its biodegradable nature and versatility. Key stakeholders in manufacturing, retail, and sustainability sectors are increasingly integrating abaca fiber into their product portfolios to meet evolving market demands.

The Abaca Fiber Market presents a compelling landscape poised for growth and innovation, driven by its unique properties and sustainable appeal. As the world's largest producer with 85% of global output originating from the Philippines, abaca fiber holds a dominant position in various industries including textiles, paper manufacturing, and cordage. Its chemical composition, notably rich in cellulose (76.6%), hemicellulose (14.6%), and lignin (8.4%), underscores its robustness and versatility, appealing to environmentally conscious consumers and industries alike.

The market's trajectory is shaped by increasing demand for eco-friendly materials and sustainable sourcing practices, aligning with global trends towards greener alternatives. Industries are leveraging abaca fiber for its superior strength-to-weight ratio, biodegradability, and resistance to saltwater, positioning it as a preferred choice in specialty applications such as marine and aerospace sectors. This trend is reinforced by strategic investments in research and development, aimed at enhancing production efficiencies and expanding application potentials.

Moving forward, stakeholders in manufacturing, retail, and sustainability sectors are poised to capitalize on these attributes, integrating abaca fiber into diverse product portfolios to meet evolving consumer preferences and regulatory standards.

Key Takeaways

- Market Value: The Global Abaca Fiber Market was valued at USD 680 Mn in 2023. It is expected to reach USD 2914.7 Mn by 2033, with a CAGR of 16.1% during the forecast period from 2024 to 2033.

- By Type: Fine Abaca Fiber is the dominating segment, capturing a significant share of 60% in the abaca fiber market.

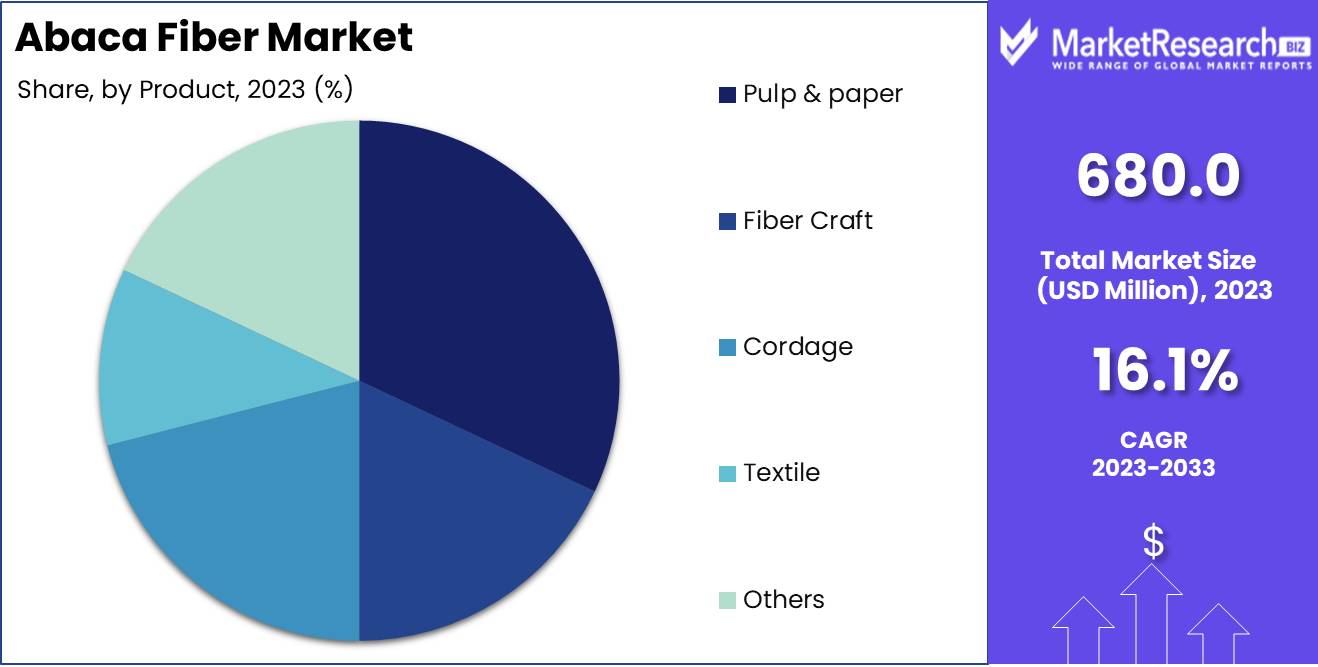

- By Product: Pulp & paper dominate the product segment, holding a substantial 45% market share.

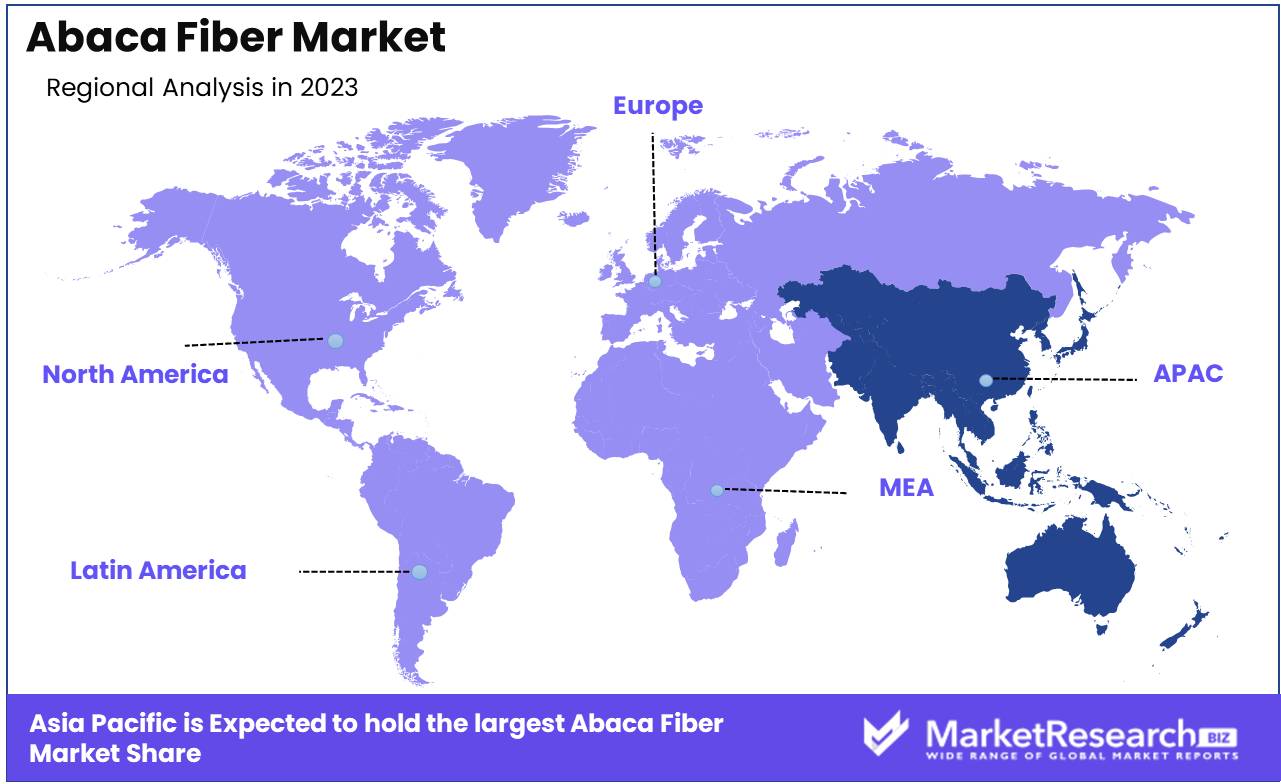

- Regional Dominance: Asia-Pacific dominates the abaca fiber market with a regional share of 85%, driven by the Philippines as the leading producer.

- Growth Opportunity: The abaca fiber market presents growth opportunities through innovation in sustainable farming practices and expanding applications in eco-friendly packaging solutions.

Driving factors

Technological Innovations in Processing

Advancements in processing technologies have significantly propelled the growth of the abaca fiber market. Modern processing methods, such as mechanical decortication and bio-extraction techniques, have enhanced the efficiency of fiber extraction, improving yield and quality. These technological improvements not only reduce labor costs but also minimize waste and environmental impact, making abaca fiber a more sustainable and cost-effective option.

The adoption of such advanced technologies has led to an increase in production capacity, enabling suppliers to meet rising global demand and explore new applications in various industries.

Superior Strength

Abaca fiber is renowned for its exceptional strength and durability, which surpasses that of many other natural fibers. This unique characteristic makes it highly sought after in applications requiring high tensile strength and resilience, such as in the production of ropes, specialty papers, and industrial textile.

The maritime and aerospace industries, for example, rely on abaca fiber for its robust performance under extreme conditions. This strong demand is a crucial driver for market growth, as industries continuously seek materials that offer enhanced performance and longevity.

Fashion Industry Embracement

The adoption of abaca fiber in the fashion industry has contributed significantly to market growth. As sustainability becomes a central concern, fashion brands are increasingly turning to eco-friendly materials like abaca fiber. Its biodegradability and minimal environmental footprint align with the industry's shift towards sustainable practices.

Abaca fiber's unique texture and natural appeal make it an attractive choice for high-end fashion and accessories. This trend is bolstered by consumer preference for sustainable fashion, driving demand and encouraging further innovation and adoption within the industry.

Restraining Factors

Stringent Environmental Regulations

Environmental regulations affecting farming practices play a significant role in shaping the abaca fiber market. Stricter regulations aimed at reducing deforestation and promoting sustainable agricultural practices have led to a more environmentally conscious approach to abaca farming. These regulations often mandate sustainable land use, proper waste management, and reduced use of chemical inputs, which can increase the operational costs for farmers but also improve the quality and sustainability of abaca fiber.

Compliance with these regulations ensures that abaca farming does not contribute to environmental degradation, thereby making the fiber more attractive to eco-conscious consumers and industries. Moreover, government incentives and support for sustainable farming practices can mitigate the cost burden on farmers, encouraging the production of eco-friendly abaca fiber. This alignment with environmental standards not only enhances the market's appeal but also secures its long-term viability by preserving natural resources.

Supply Fluctuations

Fluctuations in the supply of abaca fiber can significantly impact market stability and pricing. Factors such as weather conditions, pest infestations, and variations in farming practices can lead to inconsistent yields. For instance, adverse weather conditions like typhoons or droughts can severely affect abaca plantations, leading to lower production levels and supply shortages.

These supply fluctuations often result in price volatility, which can affect both producers and consumers. When supply is low, prices tend to increase, making abaca fiber less competitive compared to other natural and synthetic fibers. Conversely, periods of oversupply can lead to price drops, potentially reducing the profitability for farmers and discouraging investment in abaca cultivation.

By Type Analysis

Fine Abaca Fiber comprises 60% of the market share in the Abaca Fiber industry.

In 2023, Fine Abaca Fiber held a dominant market position in the Fine Abaca Fiber segment of the Abaca Fiber Market, capturing more than a 60% share. Fine Abaca Fiber is characterized by its superior quality and finer texture, making it highly sought after in industries such as textile manufacturing, paper production, and specialty paper products. Its strength, durability, and eco-friendly attributes have positioned it as the preferred choice among manufacturers aiming for high-performance materials with sustainable sourcing credentials.

Rough Abaca Fiber, on the other hand, accounted for the remainder of the market share in the Abaca Fiber Market in 2023. This segment is valued for its robustness and versatility, primarily used in applications that require sturdier materials such as ropes, cordage, handicrafts, and certain types of furniture and construction materials. Despite holding a smaller share compared to Fine Abaca Fiber, Rough Abaca Fiber continues to be a crucial component in various industries where resilience and natural fiber characteristics are paramount.

By Product Analysis

Pulp & Paper products utilize 45% of the Abaca Fiber market.

In 2023, Pulp & Paper held a dominant market position in the Pulp & Paper segment of the Abaca Fiber Market, capturing more than a 45% share. This segment is crucial for the production of specialty papers, including tea bags, currency paper, and high-quality stationery. The superior strength and durability of abaca fiber make it ideal for applications requiring robust paper products that withstand rigorous use while maintaining a sustainable sourcing profile.

Fiber Craft accounted for a significant portion of the market share in 2023, showcasing its versatility and appeal across various artisanal and decorative applications. This segment includes products such as handcrafted items, home décor, and artistic creations where the natural aesthetic and texture of abaca fiber are valued.

Cordage represented another substantial segment within the Abaca Fiber Market, catering primarily to industries requiring durable ropes and twines. Abaca fiber's exceptional tensile strength and resistance to saltwater make it indispensable for maritime and industrial applications, including fishing nets, marine rigging, and agricultural tying.

Textile applications also contributed significantly to the market landscape, harnessing abaca fiber's natural sheen, breathability, and moisture-wicking properties. In 2023, this segment saw growth driven by increasing demand for eco-friendly textiles in fashion and apparel.

Lastly, the Others category encompassed diverse applications of abaca fiber across niche industries and emerging markets. These include sectors such as automotive components, construction materials, and specialty packaging, where abaca's unique attributes contribute to innovative solutions and product differentiation.

Key Market Segments

By Type

- Fine Abaca Fiber

- Rough Abaca Fiber

By Product

- Pulp & paper

- Fiber Craft

- Cordage

- Textile

- Others

Growth Opportunity

Sustainable Land Management for Cultivation

In 2024, the global abaca fiber market is poised to benefit significantly from sustainable land management practices. As environmental regulations become more stringent, there is a growing emphasis on sustainable cultivation methods. Farmers adopting practices such as crop rotation, organic fertilization, and integrated pest management can enhance soil stabilization and increase the longevity of abaca plantations.

These practices not only ensure a steady and high-quality supply of abaca fiber but also align with the increasing consumer demand for eco-friendly products. The Philippines, which produces about 85% of the world's abaca, is seeing a shift towards more sustainable organic farming techniques, potentially boosting overall production and market stability.

Integration into Emerging Industries

The integration of abaca fiber into emerging industries presents a substantial growth opportunity for 2024. With its high tensile strength and biodegradable nature, abaca fiber is becoming increasingly popular in sectors such as automotive, aerospace, and construction. For instance, in the automotive industry, abaca fiber is being used to reinforce composite materials, contributing to lighter and more fuel-efficient vehicles.

The aerospace industry, too, is exploring abaca fiber for similar applications, given its durability and light weight. Additionally, the construction industry is incorporating abaca fiber into eco-friendly building materials, such as fiber-reinforced concrete and sustainable insulation products.

Latest Trends

Increasing Demand for Natural Fibers

In 2024, the global abaca fiber market is expected to experience a surge in demand driven by the increasing preference for natural fibers. Consumers and industries are gravitating towards sustainable and eco-friendly materials, propelling the demand for natural fibers such as abaca. This trend is influenced by a heightened awareness of environmental issues and the adverse impacts of synthetic fibers on the ecosystem.

Abaca fiber, known for its biodegradability and minimal environmental footprint, fits perfectly into this emerging narrative. The fashion industry, in particular, is seeing a notable shift towards natural fibers, with abaca being incorporated into eco-conscious clothing lines and accessories. This trend is likely to sustain its momentum, reinforcing the market's growth prospects.

Cordage in Industrial Applications

The use of abaca fiber in cordage for industrial applications is another significant trend for 2024. Due to its exceptional strength and durability, abaca fiber is ideal for manufacturing ropes, twines, and cables used in maritime, agricultural, and construction industries. The maritime sector, for instance, heavily relies on abaca ropes for their resistance to saltwater and rot, making them indispensable for fishing nets and mooring lines.

Similarly, the construction industry uses abaca cordage for various heavy-duty applications, benefiting from its high tensile strength. The increased investment in infrastructure projects worldwide further fuels the demand for strong, reliable cordage solutions, positioning abaca fiber as a preferred material.

Regional Analysis

Asia-Pacific dominates with 85% of global production, with the Philippines as the largest producer.

The Asia-Pacific region dominates the global abaca fiber market, commanding an impressive 85% share. This substantial market share can be attributed to the region's leading production capabilities, particularly in the Philippines, which is the world's largest producer of abaca fiber. The favorable climate conditions in the region, coupled with robust agricultural practices, contribute significantly to the high production output. Moreover, countries like Indonesia and Ecuador also contribute to the regional supply chain, further bolstering Asia-Pacific's position in the global market.

In North America, the abaca fiber market shows a steady growth trajectory driven by increasing demand for sustainable and eco-friendly materials across various industries. The region benefits from technological advancements in processing techniques, which enhance the quality and versatility of abaca fiber applications.

Europe's abaca fiber market is characterized by a growing adoption of natural fibers in industries such as automotive, textiles, and paper manufacturing. The region's stringent environmental regulations and consumer preference for sustainable products are key drivers of market growth.

The Middle East & Africa region is emerging as a niche market for abaca fiber, primarily driven by increasing investments in sustainable development initiatives. Countries in this region are exploring the use of abaca fiber in construction and packaging sectors to reduce dependency on synthetic materials.

Latin America's abaca fiber market is gaining traction owing to abundant availability of raw materials in countries like Ecuador and Costa Rica. The region is focusing on expanding its production capacities to meet the rising global demand for natural fibers.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Abaca Fiber Market is poised for dynamic growth, with several key players driving innovation and market expansion. Among these, Hartmannforbes Inc, Pulp Specialties Philippines, Inc., SAMATOA, Wigglesworth and Co. Limited, Dragon Vision Trading, Simor Abaca Products, Ching Bee Trading Corporation, Chandra Prakash and CO., Rhode Island, Wilhelm G. Clasen (GmbH and Co.) KG, Terranova Papers, Erin Rope Corporation, and Hermin Textile stand out as influential entities shaping the industry landscape.

Hartmannforbes Inc. exemplifies leadership in luxury abaca fiber products, emphasizing sustainable sourcing and artisanal craftsmanship. Their commitment to quality and eco-conscious practices resonates well in an increasingly environmentally aware market.

Pulp Specialties Philippines, Inc. holds a pivotal role as a major supplier of raw abaca fiber, supporting diverse applications from paper production to specialty textiles. Their extensive network and reliable supply chain contribute significantly to the market's stability and growth.

SAMATOA, known for its innovative approaches to abaca fiber processing, introduces advanced technologies that enhance fiber strength and versatility. Their contributions drive the expansion of applications into new industries such as automotive and construction.

Wigglesworth and Co. Limited brings a heritage of abaca expertise, combining traditional methods with modern efficiency to cater to global demand for high-performance fibers in various sectors.

Dragon Vision Trading and Simor Abaca Products contribute by fostering international trade and distribution networks, ensuring global accessibility to abaca fiber products while maintaining quality standards.

Ching Bee Trading Corporation and Chandra Prakash and CO. play integral roles in bridging regional markets, facilitating the flow of abaca fiber from production hubs to global manufacturers.

Rhode Island, Wilhelm G. Clasen (GmbH and Co.) KG, Terranova Papers, Erin Rope Corporation, and Hermin Textile each bring unique strengths, whether in technological innovation, product diversification, or market penetration, collectively driving the abaca fiber market towards a sustainable and prosperous future.

Market Key Players

- Hartmannforbes Inc

- Pulp Specialties Philippines, Inc.

- SAMATOA

- Wigglesworth and Co. Limited.

- Dragon Vision Trading

- Simor Abaca Products

- Ching Bee Trading Corporation

- Chandra Prakash and CO.

- Rhode Island

- Wilhelm G. Clasen (GmbH and Co.) KG

- Terranova Papers

- Erin Rope Corporation

- Hermin Textile

Recent Development

- In May 2024, Furukawa Plantations C.A. facing legal proceedings for alleged human rights abuses in Ecuadorian abaca plantations. UN experts advocate for justice and reparations amid ongoing lawsuits.

- In April 2024, Tadeco Maricris Brias continues to innovate with indigenous weaves like Tnalak and Dagmay, promoting sustainable practices and empowering over 600 local artisans in Mindanao, Philippines.

Report Scope

Report Features Description Market Value (2023) USD 680 Mn Forecast Revenue (2033) USD 2914.7 Mn CAGR (2024-2033) 16.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fine Abaca Fiber, Rough Abaca Fiber), By Product (Pulp & paper, Fiber Craft, Cordage, Textile, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hartmannforbes Inc, Pulp Specialties Philippines, Inc., SAMATOA, Wigglesworth and Co. Limited., Dragon Vision Trading, Simor Abaca Products, Ching Bee Trading Corporation, Chandra Prakash and CO., Rhode Island, Wilhelm G. Clasen (GmbH and Co.) KG, Terranova Papers, Erin Rope Corporation, Hermin Textile Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Hartmannforbes Inc

- Pulp Specialties Philippines, Inc.

- SAMATOA

- Wigglesworth and Co. Limited.

- Dragon Vision Trading

- Simor Abaca Products

- Ching Bee Trading Corporation

- Chandra Prakash and CO.

- Rhode Island

- Wilhelm G. Clasen (GmbH and Co.) KG

- Terranova Papers

- Erin Rope Corporation

- Hermin Textile