Zero Emission Vehicle (ZEV) Market By Vehicle Type(Fuel Cell Electric Vehicle (FCEV), Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV)), By Application(Commercial Vehicle, Passenger Vehicle, Two Wheelers), By Price(Mid-Priced, Luxury), By Top Speed(Less Than 100 MPH, 100 to 125 MPH, More Than 125 MPH), By Source of Power(Gasoline, Diesel, CNG, Others) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42811

-

Feb 2022

-

174

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Zero Emission Vehicle (ZEV) Market Size, Share, Trends Analysis

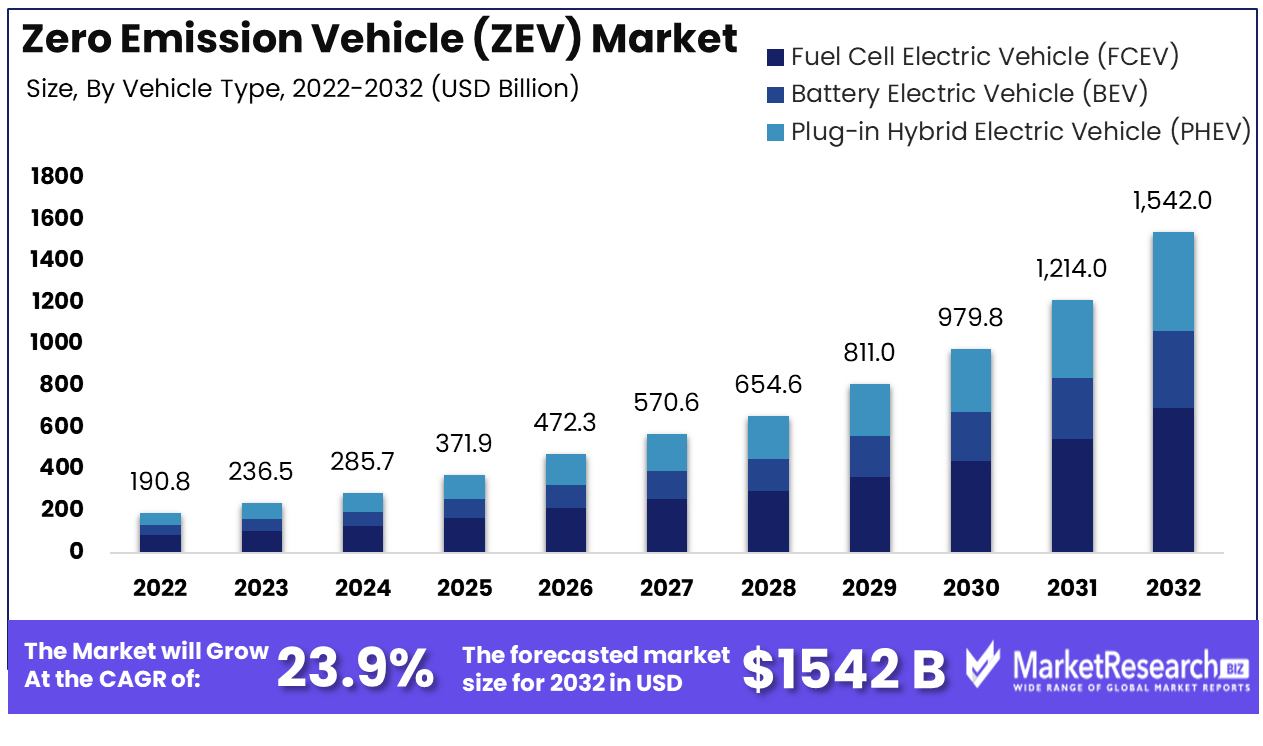

The zero-emission vehicles market was valued at USD 190.84 billion in 2022. It is expected to reach USD 1542.0 billion by 2032, with a CAGR of 23.9% during the forecast period from 2023 to 2032.

The surge in demand for electric vehicles and advanced technologies are some of the main driving factors for the zero-emission vehicle market expansion. Zero-emission vehicles are those vehicles that do not produce any harmful gas from their internal combustion. These are light-duty vehicles that do not require to work on petrol or diesel.

Battery-driven vehicles or hydrogen-based vehicles are the two most commonly used zero-emission vehicles. The launch of ZEVs has helped to decrease air pollution and global warming. Due to this reason, many countries are taking initiatives to standardize the production and usage of the vehicle. Zero-emission vehicles provide several benefits that can enhance the driving experience such as requiring less maintenance but providing high-quality performance, having great efficiency, and causing zero impact to the environment.

Several countries are creating awareness of the use of zero-emission vehicles to bring about notice regarding the concern of global warming and the surge in pollution. Vehicles that require electricity, solar energy, and wind energy are environmentally friendly and do not pollute the ecosystem. Due to the surge in population, there is a high demand for car purchases and other modes of transportation. This increases the need for fossil fuel consumption. Petroleum, coal, and natural gasses are limited renewable sources due to continuous usage for transportation purposes it will become extinct soon.

To save the environment from these consequences the usage of natural resources such as solar, wind, and electric energy should be implemented. There are different types of zero-emission vehicles under the state and federal standardization programs such as the fully automated battery EV, hydrogen fuel electric vehicles, and plug-in electric hybrid vehicles which are environment-friendly and cost-effective.

The surge in economic policies and business economics will help in the adoption of electric trucks in the market. There will be a rapid growth in the sales of battery electric and fuel cell electric commercial vehicles.

According to an article which was published by BCG in 2022, about 32% of new commercial vehicles will be sold in 2030 which will be battery electric, and 19% fuel cell electric in Europe. Likewise, the US will have 21% battery EV and 4% fuel cell electric, and China 15% battery EV and 5% fuel cell electric.

Additionally, according to the UK Department of Transport in 2023, the government will launch all the new cars to be zero emission by 2035 which offers clarity to vehicle manufacturers and secures UK jobs.

Net zero emission will enable the drivers to have an advantage from the rapidly growing charging infrastructure, which has already witnessed a significant growth of 43% from last year. The demand for these zero-emission vehicles will increase due to their high-end demand in the automotive industry which will help in market expansion in this forecast period.

Driving Factors

Demand for Natural Resources Boosts ZEV Market

Rising demand for natural resources to power electric vehicles is driving the growth of the Zero Emission Vehicles (ZEVs) market. As energy production shifts away from fossil fuels and more environmentally sustainable forms of production, lithium, cobalt, and nickel resources used for battery production on ZEV batteries grow increasingly important to their market growth.

Demand for electric vehicles has steadily been rising over time due to global commitments towards cutting carbon emissions and encouraging sustainable transportation solutions. Resource extraction for production shows evidence of market expansion as more eco-conscious customers adopt them for transportation needs.

R&D Investment Spurs ZEV Innovation

Research and development (R&D) investments are at the core of innovation and market expansion for zero-emission vehicles (ZEV). R&D efforts focus on battery technology advancement, energy efficiency improvements, and production cost reduction - ultimately making ZEVs more accessible and attractive to a broader audience.

Investment in R&D efforts have yielded numerous advancements such as longer battery lives, shorter charging times, and enhanced vehicle performance; as technological innovations progress further the ZEV market should experience sustained expansion thanks to R&D investments being put forth on an ongoing basis by R&D efforts within research & development efforts being committed from within its realms.

Government Incentives Stimulate ZEV Adoption

Governmental support through funding and tax benefits is significantly shaping the zero-emission vehicle market's growth. Government initiatives, including subsidies, grants, and tax incentives, are lowering the cost barrier for consumers and manufacturers, encouraging the adoption and production of ZEVs.

These policies are instrumental in creating a favorable economic environment for ZEVs, aligning with broader governmental goals of reducing greenhouse gas emissions and promoting sustainable transportation. The continuous governmental backing, both financially and through policy, indicates a strong market potential for ZEVs, as these vehicles become increasingly integral to national and global strategies for environmental sustainability.

Restraining Factors

Limited Availability of Charging Infrastructure Restrains ZEV Market Growth

The growth of the zero-emission vehicle (ZEV) market is significantly hampered by the limited availability of charging infrastructure. One of the primary concerns for potential ZEV buyers is the accessibility and convenience of charging stations, particularly for long-distance travel.

In many regions, the charging infrastructure is not sufficiently developed to support widespread ZEV adoption, creating range anxiety among consumers. This lack of widespread and easily accessible charging points makes it challenging for individuals to consider ZEVs as viable alternatives to conventional vehicles, thereby limiting the market expansion of ZEVs.

High Cost of Manufacturing Limits ZEV Market Expansion

Zero Emission Vehicles (ZEVs) manufacturing costs also present a major obstacle to their market expansion. ZEVs - particularly electric vehicles (EVs) - typically utilize advanced components, including lithium-ion batteries, electric motors, and sophisticated power management systems.

Unfortunately, these components often incur higher production costs compared to internal combustion engine vehicles and consequently result in higher retail prices of ZEVs which make them less accessible in price-sensitive markets. Unfortunately, until manufacturing costs decrease through technological advancement or economies of scale this cost barrier will prevent widespread adoption of ZEVs by consumers alike.

Zero-Emission Vehicle (ZEV) Market Segmentation Analysis

By Vehicle Type

Fuel Cell Electric Vehicles (FCEVs) currently dominate the zero-emission vehicle market. FCEVs are powered by hydrogen, converting it into electricity to run the motor. FCEVs boast the key advantages of quick refueling and longer driving range, similar to conventional gasoline vehicles, making them particularly suitable for both personal and commercial usage. Their growth can be seen thanks to advances in hydrogen fuel cell technology as well as investments made into infrastructure for hydrogen refueling as well as supportive policies from government bodies aimed at decreasing carbon emissions. Despite the dominance, high costs and infrastructure challenges remain significant barriers to mass adoption.

Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) also hold substantial shares in the ZEV market. BEVs are popular in the personal vehicle sector due to their simplicity and growing charging infrastructure. In contrast, PHEVs offer a combination of electric propulsion with an internal combustion engine, serving as a transitional technology towards full electrification.

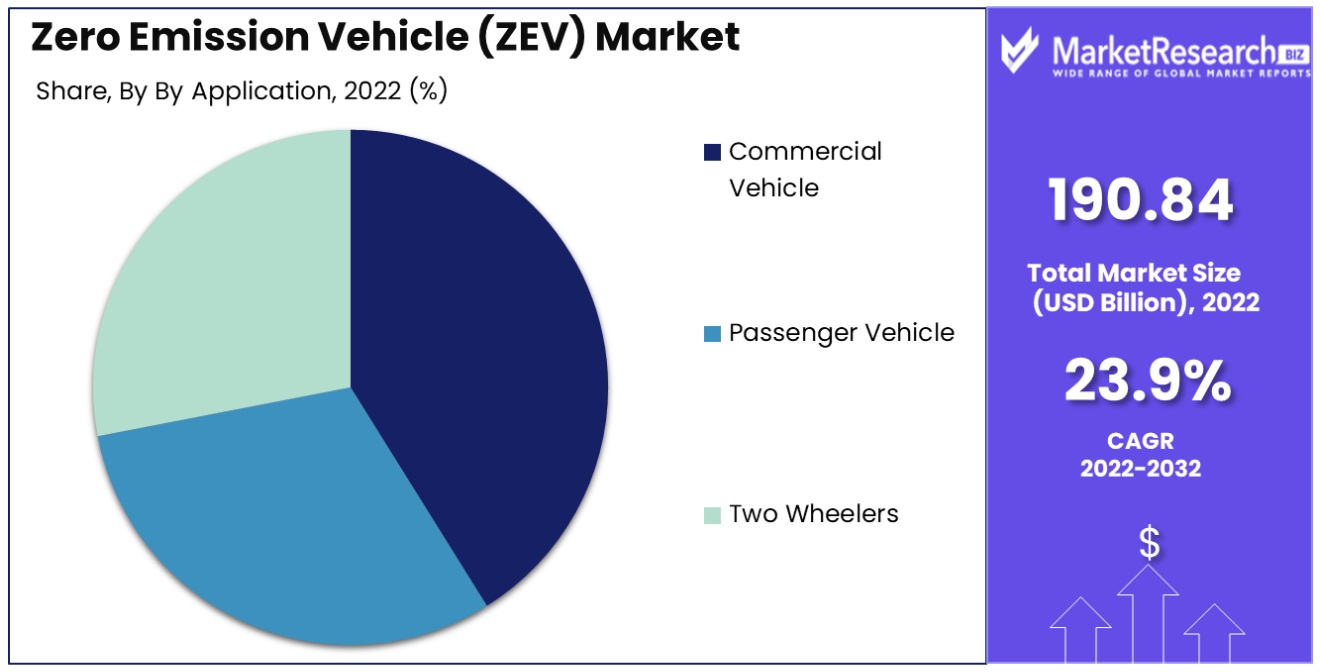

By Application

Commercial Vehicles represent the dominant application in the ZEV market. This trend is driven by the increasing need for sustainable and cost-effective transportation solutions in the logistics and public transport sectors. Businesses are progressively adopting ZEVs to reduce their carbon footprint and operational costs. The adoption is further bolstered by regulatory incentives and the emerging trend of green logistics.

Passenger Vehicles and Two-wheelers also contribute significantly to the ZEV market. The passenger vehicle segment is witnessing rapid growth due to consumer demand for environmentally friendly options and government incentives. Two-wheelers, especially in urban areas, are becoming increasingly popular due to their efficiency and lower operational costs.

By Price

The Mid-Priced segment leads the ZEV market, as manufacturers strive to make zero-emission technologies accessible to a broader consumer base. Mid-priced ZEVs strike a balance between affordability, performance, and range, appealing to a wide demographic looking for sustainable and cost-effective transportation. The expansion of this segment is crucial for mass adoption, relying on continued advancements in technology to reduce costs further.

Luxury ZEVs, while a smaller segment, are significant in driving technological advancements and market interest. They often introduce cutting-edge features and superior performance, gradually trickling down these innovations to the broader market.

By Vehicle Drive Type

All-wheel drive (AWD) has emerged as the dominant segment in the zero-emission vehicle (ZEV) market. This preference is largely due to the enhanced performance, stability, and safety AWD systems offer, which are particularly beneficial in electric and hybrid vehicles known for their instant torque delivery. AWD systems distribute power to all four wheels, improving traction and handling, which is especially advantageous in adverse weather conditions.

As consumers become more environmentally conscious while still desiring high-performance vehicles, the demand for AWD ZEVs continues to rise. However, advancements in technology and design continue to improve the efficiency and appeal of Front front-wheel drive and rear-wheel drive options, making them popular choices for those seeking more affordable and energy-efficient alternatives.

By Top Speed

The segment of ZEVs with a top speed of 100 to 125 MPH is currently dominating the market. Vehicles in this speed range offer a balance between the practical needs of everyday driving and the desire for higher performance, making them a popular choice among a broad range of consumers. These vehicles are sufficiently fast for highway driving and most travel needs, providing an attractive option for those looking to transition to zero-emission transportation without compromising on performance.

Meanwhile, ZEVs with a top speed of less than 100 MPH are typically more affordable and focus on efficiency, catering to city drivers and those prioritizing economy over speed. Conversely, ZEVs with a top speed of more than 125 MPH are generally positioned in the luxury or performance segment, offering cutting-edge technology and exceptional performance but at a higher price point.

Zero-Emission Vehicle (ZEV) Market Industry Segments

By Vehicle Type

- Fuel Cell Electric Vehicle (FCEV)

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Application

- Commercial Vehicle

- Passenger Vehicle

- Two Wheelers

By Price

- Mid-Priced

- Luxury

By Vehicle Drive Type

- All Wheel Drive

- Front Wheel Drive

- Rear Wheel Drive

By Top Speed

- Less Than 100 MPH

- 100 to 125 MPH

- More Than 125 MPH

By Source of Power

- Gasoline

- Diesel

- CNG

- Others

Growth Opportunities

Electrification of Commercial Vehicles Accelerates Growth in Zero Emission Vehicle Market

The electrification of commercial vehicles presents a significant growth opportunity for the zero-emission vehicle (ZEV) market. As environmental regulations become stricter and awareness of carbon emissions from transportation increases, there is a growing push towards adopting electric commercial vehicles.

This shift is evident in sectors like public transportation, logistics, and freight, where electric buses, vans, and trucks are increasingly being deployed. This trend towards electrification in commercial transportation is expanding the scope of the ZEV market, as manufacturers innovate to meet the specific needs of these vehicles, including range, load capacity, and charging infrastructure.

Increasing Use of Renewable Energy Sources Fuels Zero Emission Vehicle Market Expansion

Renewable energy sources are driving the growth of the zero-emission vehicle market. As electricity generation becomes cleaner with greater shares coming from green sources like solar and wind power, so does their environmental impact - making zero-emission vehicles increasingly appealing to environmentally aware consumers and organizations looking to lower their carbon footprint.

Furthermore, increasing the use of renewables in power grids bolsters sustainability benefits associated with ZEVs, driving market expansion as their environmental advantages become clearer over time.

Zero-Emission Vehicle (ZEV) Market Regional Analysis

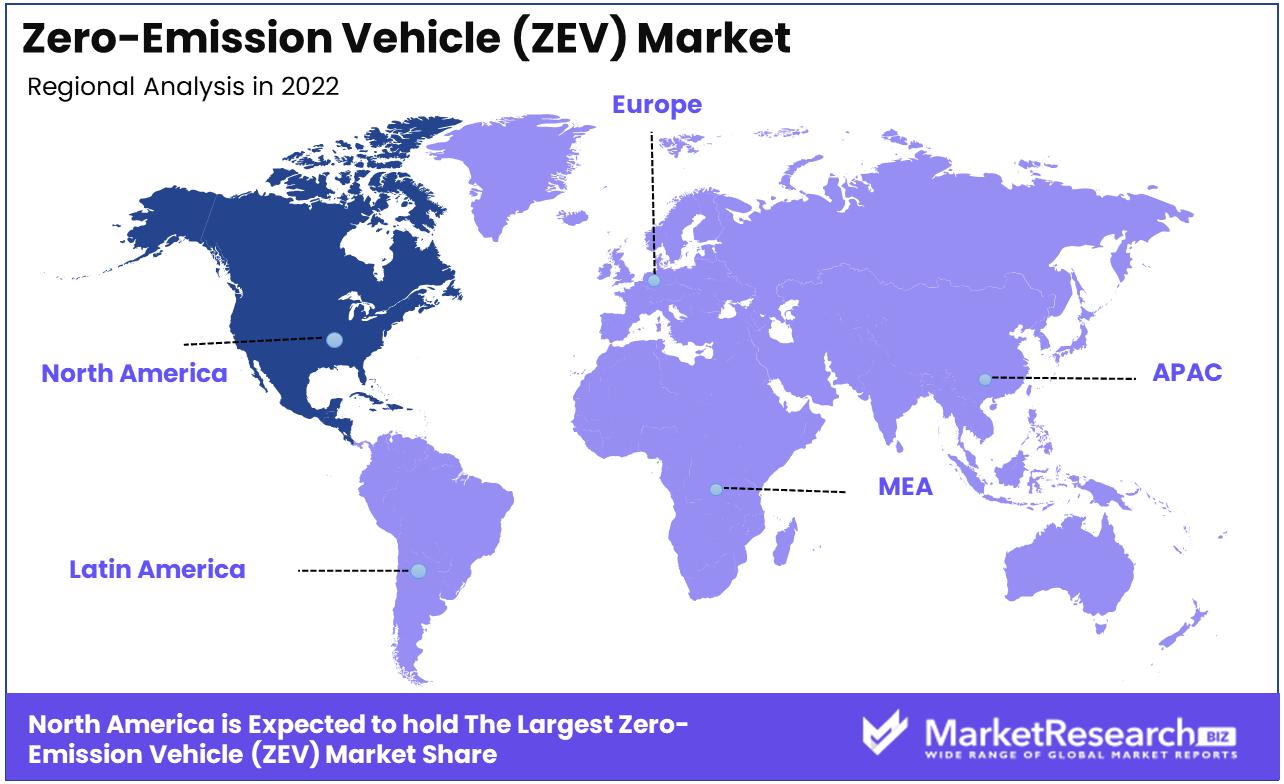

North America Dominates with 50.9% Market Share in Zero Emission Vehicle (ZEV) Market

North America boasts an overwhelming 50.9% share in the Zero Emission Vehicle (ZEV) market due to a robust automotive industry, technological developments, and supportive governmental policies. Particularly notable in North America has been an upsurge in electric vehicle (EV) adoption due to increasing environmental awareness as well as state incentives promoting ZEVs; leading global automotive manufacturers investing heavily in ZEV technology such as electric or hydrogen fuel cell vehicles also contribute significantly.

Canada's initiatives toward decreasing greenhouse gas emissions while supporting sustainable transportation solutions only further solidify North America's market dominance in ZEV markets like this region's dominance in ZEV markets such as these regions' dominance within their markets.

The market dynamics in North America are shaped by the growing consumer preference for eco-friendly vehicles, coupled with advancements in battery technology and charging infrastructure. The region's focus on reducing dependency on fossil fuels and mitigating climate change impacts fuels the demand for ZEVs. Moreover, collaborations between governments, automotive manufacturers, and technology companies are pivotal in driving innovation and accessibility in the ZEV market.

Europe: Pioneering Sustainability and Emission Reductions

Europe's ZEV market is driven by the region's pioneering efforts in sustainability and stringent emission reduction targets. European countries have implemented aggressive policies and incentives to promote the adoption of electric and hydrogen vehicles. The strong presence of automotive manufacturers committed to electrification and the region's advanced charging infrastructure support market growth.

Asia-Pacific: Rapid Expansion with Technological Innovation

In Asia-Pacific, the ZEV market is rapidly expanding, fueled by technological innovation and increasing environmental concerns. Countries like China and Japan are leading in EV adoption, backed by government policies and investments in charging infrastructure. The region's focus on reducing air pollution and commitment to sustainable transportation solutions contribute to the dynamic growth of the ZEV market.

Zero-Emission Vehicle (ZEV) Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Zero-Emission Vehicle (ZEV) Market Key Player Analysis

In the Zero Emission Vehicle (ZEV) market, an area pivotal to the shift towards sustainable mobility, the listed companies are influential in driving innovation and consumer adoption. Tesla, a leader in this space, has set high standards in electric vehicle (EV) technology and market appeal, significantly influencing industry trends.

Nissan and BMW are also key players, offering a range of electric models and contributing to the market's diversity. Hyundai, Kia, and Chevrolet have made significant strides in making ZEVs more accessible and affordable, broadening the market base. Toyota and Volkswagen, with their hybrid and electric models, have a considerable impact due to their global presence and commitment to electrification. Fiat and BYD, while having varying market shares, contribute to the market with unique offerings, highlighting the industry's evolving dynamics and consumer choices. Each company, with its strategic approach, plays a distinct role in shaping the ZEV market's trajectory toward a more sustainable automotive future.

Zero-Emission Vehicle (ZEV) Market Industry Key Players

- Fiat

- Hyundai

- BMW

- Kia

- Chevrolet

- Toyota

- BYD

- Tesla

- Nissan

- Volkswagen

Zero-Emission Vehicle (ZEV) Market Recent Development

- In 2023, the UK government and industry jointly funded £89 million for cutting-edge net-zero technology development. This initiative aimed to establish the UK as a leader in zero-emission vehicle technology while creating jobs and boosting the economy.

- In December 2022, the Canadian government confirmed its plans to regulate gas-powered vehicle sales, including passenger vehicles, pickup trucks, and SUVs, with changes taking place over the next decade.

- In September 2023, Toyota unveiled the prototype of the hydrogen fuel cell electric Hilux at its vehicle plant in Derby, England. This marks a significant milestone in Toyota's journey towards a zero-carbon future.

- In 2023, BMW has been actively involved in the development of hydrogen fuel cell technology since 2000. BMW launched the BMW iX5 Hydrogen pilot fleet in February. This FCEV has a total of 401 horsepower, a top speed of over 112 MPH, and a driving range of 504 kilometers (313 miles). BMW's iX5 Hydrogen completed an intensive hot-weather test in Dubai, performing well despite extreme temperatures.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Billion Forecast Revenue (2033) USD 13.5 Billion CAGR (2024-2032) 23.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type(Fuel Cell Electric Vehicle (FCEV), Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV)), By Application(Commercial Vehicle, Passenger Vehicle, Two Wheelers), By Price(Mid-Priced, Luxury), By Vehicle Drive Type(All Wheel Drive, Front Wheel Drive, Rear Wheel Drive), By Top Speed(Less Than 100 MPH, 100 to 125 MPH, More Than 125 MPH), By Source of Power(Gasoline, Diesel, CNG, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Fiat, Hyundai, BMW, Kia, Chevrolet, Toyota, BYD, Tesla, Nissan, Volkswagen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Fiat

- Hyundai

- BMW

- Kia

- Chevrolet

- Toyota

- BYD

- Tesla

- Nissan

- Volkswagen