Global Wood Plastic Composite Wpc Market By Product (Polyethylene, Polypropylene, Polyvinylchloride, Others), By Application(Building and Construction(Decking, Molding & siding, Fencing), Automotive Components, Industrial and Consumer Goods, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

6442

-

July 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

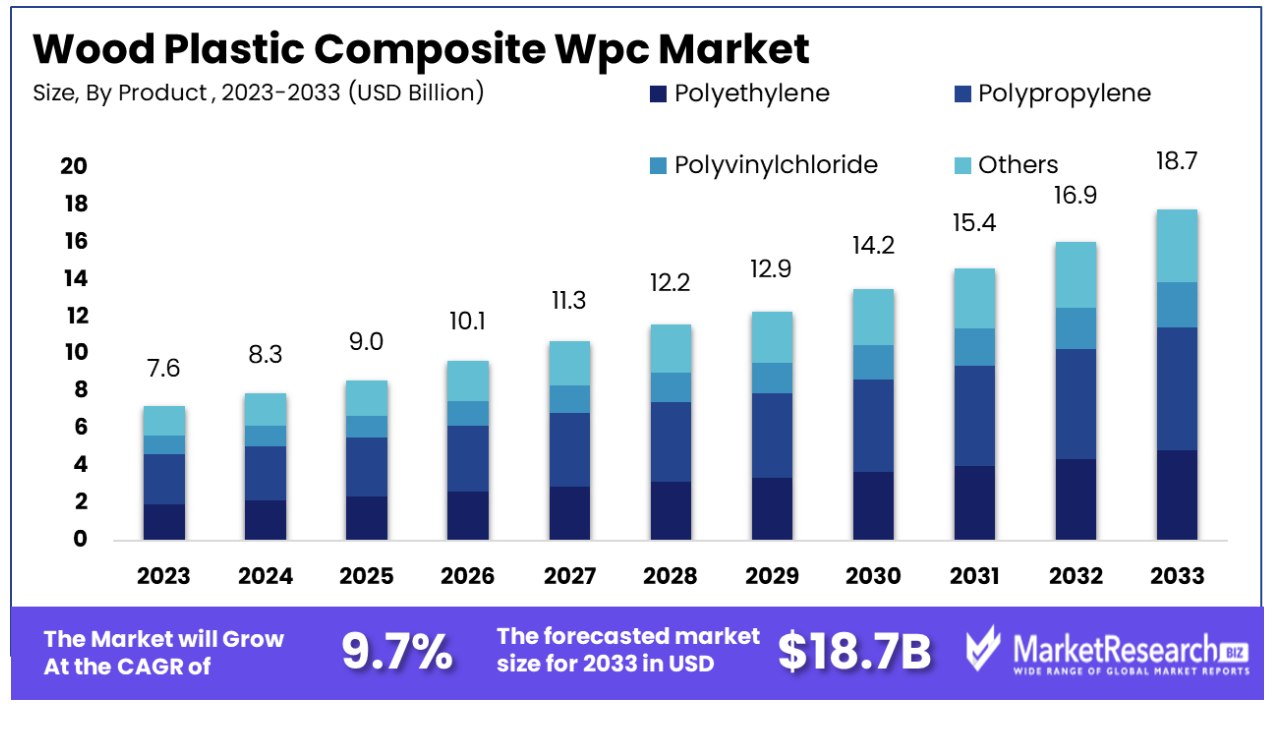

The Global Wood Plastic Composite WPC Market was valued at USD 7.6 billion in 2023. It is expected to reach USD 18.7 billion by 2033, with a CAGR of 9.7% during the forecast period from 2024 to 2033.

The Wood Plastic Composite (WPC) Market encompasses a dynamic segment of the construction and furnishing industry, characterized by the production of composite materials made from a blend of wood fibers and thermoplastics. WPC products offer notable advantages, including high durability, resistance to weathering, and low maintenance requirements, making them ideal for outdoor applications such as decking, fencing, and landscaping products.

As businesses increasingly prioritize sustainability, the demand for WPC is bolstered by its environmental credentials, notably its use of recycled materials and its biodegradable nature. The market appeals to executives and product managers seeking innovative, sustainable building solutions.

The Wood Plastic Composite (WPC) Market is positioned for robust growth, driven by the escalating demand for sustainable and durable materials in the construction and furnishing sectors. WPC, combining wood fibers and thermoplastics, offers superior durability and resistance against environmental factors, making it highly suitable for outdoor applications such as decks, fences, and landscaping products. Its adoption is particularly advantageous given its environmental credentials; notably, every ton of WPC can replace between 0.8 to 1 ton of wood, substantially reducing the demand for forestry and thereby curbing deforestation rates.

In regions such as China, the proliferation of WPC in industrial applications is evident, with an annual output of approximately 300 million WPC pallets and market holdings reaching around 1.45 billion pieces. This surge underscores the material's acceptance and growing preference over traditional wood, driven by its cost-effectiveness and lower environmental impact. Moreover, the shift towards green building material practices, coupled with increasing regulations promoting environmentally friendly materials, is likely to further propel the WPC market.

Key Takeaways

- Market Growth: The Global Wood Plastic Composite WPC Market was valued at USD 7.6 billion in 2023. It is expected to reach USD 18.7 billion by 2033, with a CAGR of 9.7% during the forecast period from 2024 to 2033.

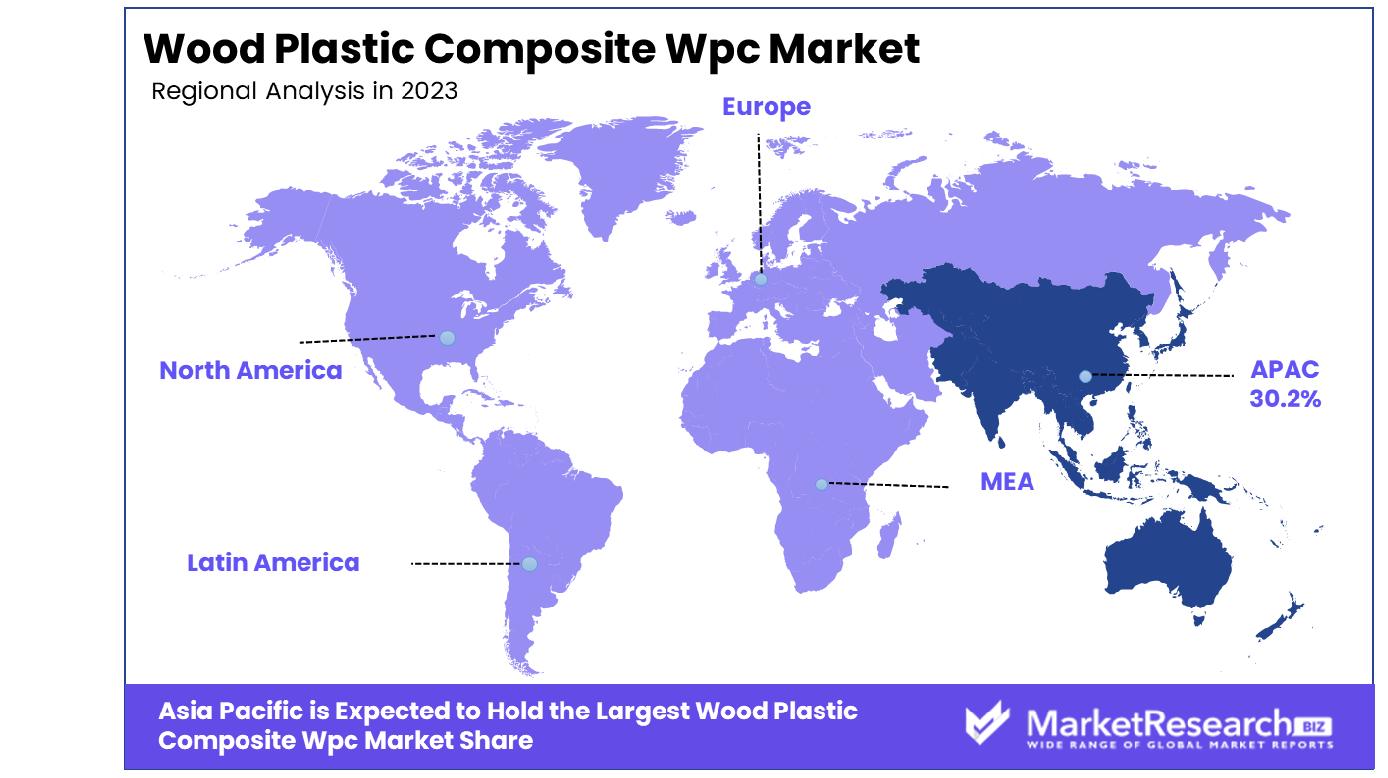

- Regional Dominance: Asia Pacific leads the WPC market with a 30.2% share.

- By Product: Polypropylene leads WPC products with a 12.5% market dominance.

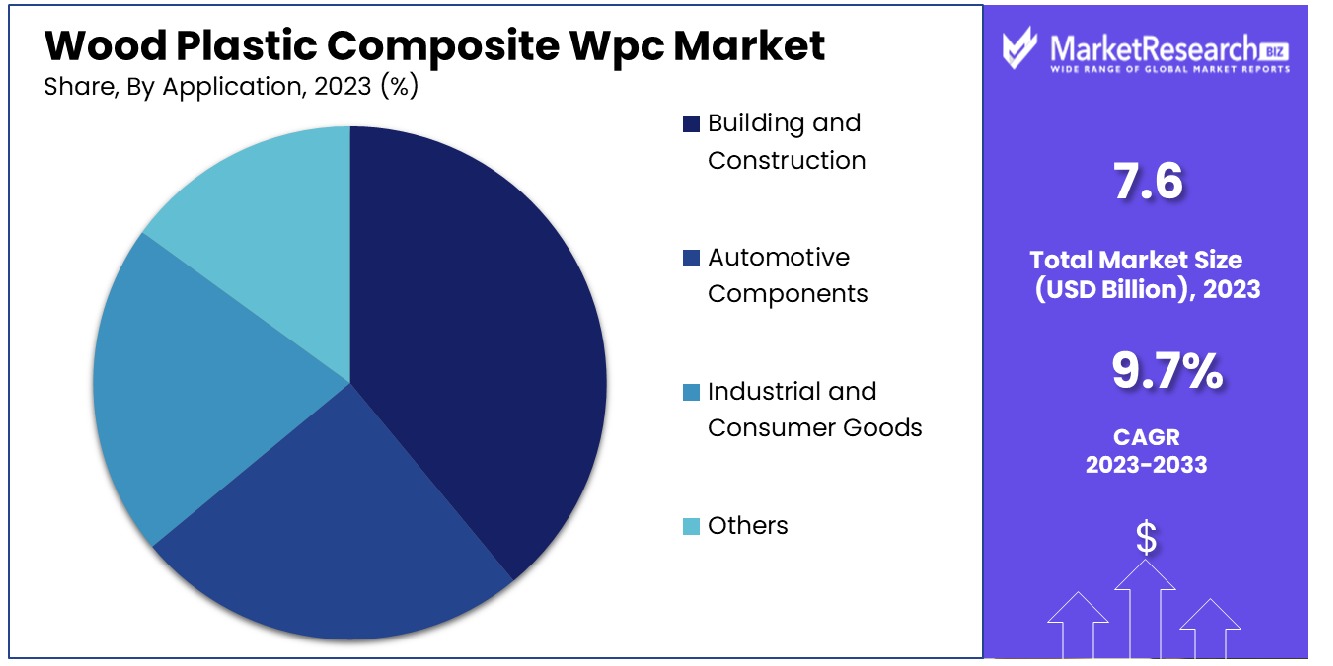

- By Application: Building and construction application holds 71.2% of the WPC market.

Driving factors

Sustainable and Low-Maintenance Solutions Drive Market Adoption

The Wood Plastic Composite (WPC) Market is experiencing significant growth driven by the increasing demand for sustainable and low-maintenance building materials. WPC offers a compelling alternative to traditional materials due to its durability and reduced maintenance requirements.

This is particularly appealing in the construction sector where long-term, cost-effective solutions are prized. The composites’ ability to resist weathering, decay, and pests, while requiring minimal upkeep compared to natural wood, directly addresses the market’s demand for more durable and sustainable building options.

Construction Boom Amplifies Market Expansion

A substantial rise in construction activities, especially in the residential and commercial sectors, serves as a catalyst for the expansion of the WPC market. As urbanization continues and infrastructural developments rise, the need for materials that offer both aesthetic appeal and functional benefits increases.

WPC’s versatility and adaptability make it suitable for a variety of construction applications, from decking to paneling, which is integral to its growing adoption in burgeoning construction projects globally.

Eco-Friendly Preferences Reshape Material Selection

The shift towards eco-friendly materials is profoundly reshaping the selection criteria within the building and construction industry. Increasingly, regulatory bodies and consumers are advocating for materials that have a lower environmental impact, which aligns perfectly with the properties of WPC. As noted earlier, every ton of WPC can replace up to one ton of wood, significantly reducing deforestation.

This environmental benefit, combined with WPC's recyclability, positions it as a preferable choice over traditional wood and plastics, thus driving its market growth. This preference is evidenced by robust production figures, such as those in China, where approximately 300 million WPC pallets are produced annually, indicating a strong market presence and increasing acceptance.

Restraining Factors

Raw Material Price Volatility Challenges Cost Stability

One of the significant restraining factors in the growth of the Wood Plastic Composite (WPC) Market is the volatility in raw material prices. The cost of both wood fibers and thermoplastics, which are essential components of WPC, can fluctuate due to various external economic factors, including trade policies, supply chain disruptions, and changes in the global commodity markets.

This instability often results in unpredictable pricing for WPC, making it challenging for manufacturers to maintain consistent profit margins and for customers to forecast project costs effectively. Such financial unpredictability can deter potential new entrants from adopting WPC solutions, thereby affecting the overall expansion of the market.

Limited Awareness and Market Penetration Impact Growth

Another key restraint is the limited product awareness and market penetration of WPC in certain regions. Despite its benefits, WPC is still not as widely recognized or utilized as traditional building materials in many parts of the world. This lack of awareness can be attributed to inadequate marketing efforts, the absence of educational initiatives about the advantages of WPC, and the slow pace of acceptance among traditional industries accustomed to conventional materials.

Consequently, the growth potential of the WPC market is curtailed in these regions, where the material’s advantages and applications have not been fully communicated or understood by potential users and decision-makers in the construction industry.

By Product Analysis

Polypropylene holds a dominant position in the WPC market with a significant 12.5% share.

In 2023, the Wood Plastic Composite (WPC) Market saw significant activity across various product segments. Notably, Polypropylene emerged as a dominant player within the "By Product" category, securing more than a 12.5% market share. This prominence is attributed to polypropylene's superior properties, such as enhanced durability, resistance to moisture, and flexibility, which are highly valued in applications ranging from decking and siding to automotive components.

Following Polypropylene, Polyethylene also held a substantial portion of the market. Known for its strength and ease of processing, Polyethylene is widely used in outdoor decking and fencing, contributing significantly to the market's dynamics. On the other hand, Polyvinylchloride (PVC) has been recognized for its rigidity and excellent weather resistance, making it a preferred material for window frames and doors.

The "Others" category, which includes materials like polylactic acid and polyurethane, also made a notable impact, catering to niche applications that require specific performance characteristics such as biodegradability and lower environmental impact.

Together, these materials underscore the diverse applications and innovations driving the WPC market. As manufacturers continue to invest in eco-friendly and high-performance materials, the segmental distribution within the Wood Plastic Composite market is expected to evolve, reflecting broader trends in sustainability and technological advancement.

By Application Analysis

Building and Construction applications lead the WPC market, commanding a substantial 71.2% share.

In 2023, Building and Construction commanded a dominant market position in the "By Application" segment of the Wood Plastic Composite (WPC) Market, capturing more than a 71.2% share. This substantial market dominance is largely driven by the increasing adoption of WPC in applications such as decking, molding & siding, and fencing. WPC's durability, aesthetic appeal, and resistance to weathering make it highly suitable for these applications, boosting its preference over traditional building materials.

Within the Building and Construction category, Decking emerged as the most prominent application, favored for its low maintenance and long service life. Molding & siding applications also significantly contributed to the segment’s growth, appreciated for their ability to provide enhanced thermal insulation and visual attractiveness. Fencing, another vital sub-segment, benefited from WPC’s robustness and ease of installation, which are crucial for both residential and commercial constructions.

Outside of Building and Construction, smaller segments like Automotive Components and Industrial and Consumer Goods also utilized WPC, particularly valued for its lightweight and moldability which are essential for complex component designs. The "Others" category, which encompasses miscellaneous applications including furniture and toys, continues to explore the versatility and environmental benefits of WPC, albeit on a smaller scale.

These diverse applications highlight the expanding utility of Wood Plastic Composites across various industries, propelled by advancements in material technology and a growing emphasis on sustainable construction practices.

Key Market Segments

By Product

- Polyethylene

- Polypropylene

- Polyvinylchloride

- Others

By Application

- Building and Construction

- Decking

- Molding & siding

- Fencing - Automotive Components

- Industrial and Consumer Goods

- Others

Growth Opportunity

Enhancing Performance through Innovation in Product Quality and Functionality

The global Wood Plastic Composite (WPC) Market in 2023 stands poised to capitalize on significant opportunities through innovations in product quality and functionality. As technological advancements continue to evolve, manufacturers have the potential to enhance the performance characteristics of WPC. This includes improving the material's strength, durability, and aesthetic qualities, which can expand its applications and appeal.

By incorporating advanced polymer blends and refining production techniques, WPC can be engineered to meet more rigorous standards required for a broader range of climatic conditions and physical stresses. Such innovations not only meet the increasing demands of existing markets but also enhance consumer confidence in WPC as a reliable alternative to traditional materials.

Diversifying Applications and Expanding Industry Reach

2023 presents a significant opportunity for the WPC market to diversify its applications beyond its traditional uses in decking and automotive components. The inherent properties of WPC, such as its resistance to moisture, decay, and pests, combined with its environmental credentials, make it an excellent candidate for use in industries like marine, landscaping, and furniture.

Moreover, the push for more sustainable construction materials within urban development projects can further drive the adoption of WPC in new sectors. By targeting these additional industries, WPC manufacturers can tap into new customer bases, thereby broadening their market reach and reinforcing the material’s position in the global market landscape.

Latest Trends

Promoting Circular Economy through Advanced Recycling Technologies

In 2023, the global Wood Plastic Composite (WPC) Market is witnessing a transformative trend with the development of advanced recycling technologies for WPC materials. This initiative is crucial in promoting a circular economy, where material reuse and sustainability are prioritized. By enhancing the recyclability of WPC, manufacturers are not only reducing waste but also conserving resources by reintegrating recycled materials back into the production cycle.

This development resonates with global environmental goals and regulatory frameworks that encourage sustainable practices. The ability to effectively recycle WPC also opens up opportunities for the market to attract environmentally conscious stakeholders and consumers, further driving the demand for sustainable building materials.

Broadening Market Scope with Diverse Outdoor Applications

Another significant trend in 2023 is the increasing adoption of WPC in a variety of outdoor applications, extending well beyond traditional decking. The market is experiencing growth in sectors such as outdoor furniture, fencing, and landscaping. WPC's durability, aesthetic appeal, and low maintenance requirements make it an ideal choice for outdoor settings, where materials are exposed to harsh weather conditions and require high resistance to decay and pests.

This expanding range of applications is not only diversifying the consumer base but also enabling manufacturers to capitalize on new market segments. As architects and builders seek innovative and sustainable alternatives, WPC's versatility makes it a preferred choice, thus driving its growth in the global market.

Regional Analysis

The Asia Pacific region holds a 30.2% share in the global Wood Plastic Composite Market.

Asia Pacific emerges as the dominating region in the WPC market, holding a significant market share of 30.2%. This leadership is driven by rapid urbanization, booming construction activities, and increasing environmental awareness across populous countries like China and India. The region benefits from an abundant supply of raw materials and a growing manufacturing sector that is keen on adopting sustainable practices. The expansion of industries such as decking, automotive parts, and outdoor furniture within Asia Pacific further propels the demand for WPC products.

In North America, the market is propelled by stringent environmental regulations and a high adoption rate of eco-friendly building materials. The U.S. and Canada are witnessing a rise in the use of WPC in residential projects due to its durability and low maintenance costs. North America's focus on innovation and high-quality standards in material production also supports market growth.

Europe follows closely, with a strong emphasis on sustainability driving the adoption of WPC. European countries are incorporating WPC to meet the EU's environmental targets, particularly in public infrastructure and home improvement projects.

Latin America and the Middle East & Africa show promising growth potential, albeit from a smaller base. These regions are gradually recognizing the benefits of WPC, especially in outdoor and public space applications, stimulated by urban development and increased infrastructural investments.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Wood Plastic Composite (WPC) Market is significantly shaped by the strategic endeavors and innovations of key players. These companies have leveraged advanced manufacturing techniques, product diversification, and sustainability initiatives to capture and expand their market presence.

Advanced Environmental Recycling Technologies, Inc. (AERT) and Axion Structural Innovations LLC are pioneers in recycling and structural innovations, utilizing proprietary technologies to enhance the performance and environmental footprint of their WPC products. These advancements are crucial for meeting the growing demand for sustainable building materials.

Beologic N.V., Fiberon, LLC, and CertainTeed Corporation are recognized for their extensive product ranges that cater to both residential and commercial construction needs. Their commitment to quality and aesthetics has positioned them as preferred suppliers in the high-end market segment.

Companies like Fkur Kunststoff GmbH and Jelu-Werk Josef Ehrler GmbH & Co. KG stand out for their focus on integrating natural fibers and plastics to create superior composite solutions that are both environmentally friendly and mechanically robust.

Guangzhou Kindwood Co. Ltd. has made significant inroads in the Asia-Pacific market, capitalizing on the region's rapid economic growth and urbanization.

PolyPlank AB, Renolit, and Universal Forest Products emphasize customization and flexibility in application, addressing specific consumer needs and emerging market trends.

Lastly, TAMKO Building Products, Inc., TimberTech, Trex Company, Inc., and Woodmass are leading the way in decking and landscaping applications, continually innovating to offer products that are durable, low maintenance, and aesthetically pleasing.

Market Key Players

- Advanced Environmental Recycling Technologies, Inc. (AERT)

- Axion Structural Innovations LLC

- Beologic N.V.

- CertainTeed Corporation

- Fiberon, LLC

- Fkur Kunststoff GmbH

- Guangzhou Kindwood Co. Ltd

- Jelu-Werk Josef Ehrler GmbH & Co. KG

- Woodmass

- PolyPlank AB

- Renolit

- TAMKO Building Products, Inc.

- TimberTech

- Trex Company, Inc.

- Universal Forest Product

Recent Development

- In January 2024, Axion Structural Innovations LLC expanded its business by acquiring a smaller WPC manufacturing firm in January 2024. This acquisition aims to increase Axion's production capacity by 30% and broaden its product range to include industrial WPC applications like pallets and load-bearing beams.

- In July 2023, Beologic N.V. introduced a breakthrough in WPC technology with its new weather-resistant formula. This innovation enhances the durability of WPC products, making them more suitable for outdoor applications. Beologic expects this new product to revolutionize the market, projecting a growth in its customer base by 25% over the next two years.

Report Scope

Report Features Description Market Value (2023) USD 7.6 Billion Forecast Revenue (2033) USD 18.7 Billion CAGR (2024-2032) 9.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Polyethylene, Polypropylene, Polyvinylchloride, Others), By Application(Building and Construction(Decking, Molding & siding, Fencing), Automotive Components, Industrial and Consumer Goods, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Advanced Environmental Recycling Technologies, Inc. (AERT), Axion Structural Innovations LLC, Beologic N.V., CertainTeed Corporation, Fiberon, LLC, Fkur Kunststoff GmbH, Guangzhou Kindwood Co. Ltd., Jelu-Werk Josef Ehrler GmbH & Co. KG, Woodmass, PolyPlank AB, Renolit, TAMKO Building Products, Inc., TimberTech, Trex Company, Inc., Universal Forest Product Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Advanced Environmental Recycling Technologies, Inc. (AERT)

- Axion Structural Innovations LLC

- Beologic N.V.

- CertainTeed Corporation

- Fiberon, LLC

- Fkur Kunststoff GmbH

- Guangzhou Kindwood Co. Ltd

- Jelu-Werk Josef Ehrler GmbH & Co. KG

- Woodmass

- PolyPlank AB

- Renolit

- TAMKO Building Products, Inc.

- TimberTech

- Trex Company, Inc.

- Universal Forest Product