Wind Turbine Rotor Blade Market By Blade Size (Less than 40 Meters, 40-60 Meters, Greater than 60 Meters), By Material (Glass Fiber, Carbon Fiber), By Application (Onshore, Offshore), By Capacity (< 3 MW, 3 – 5 MW, > 5 MW), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

2688

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

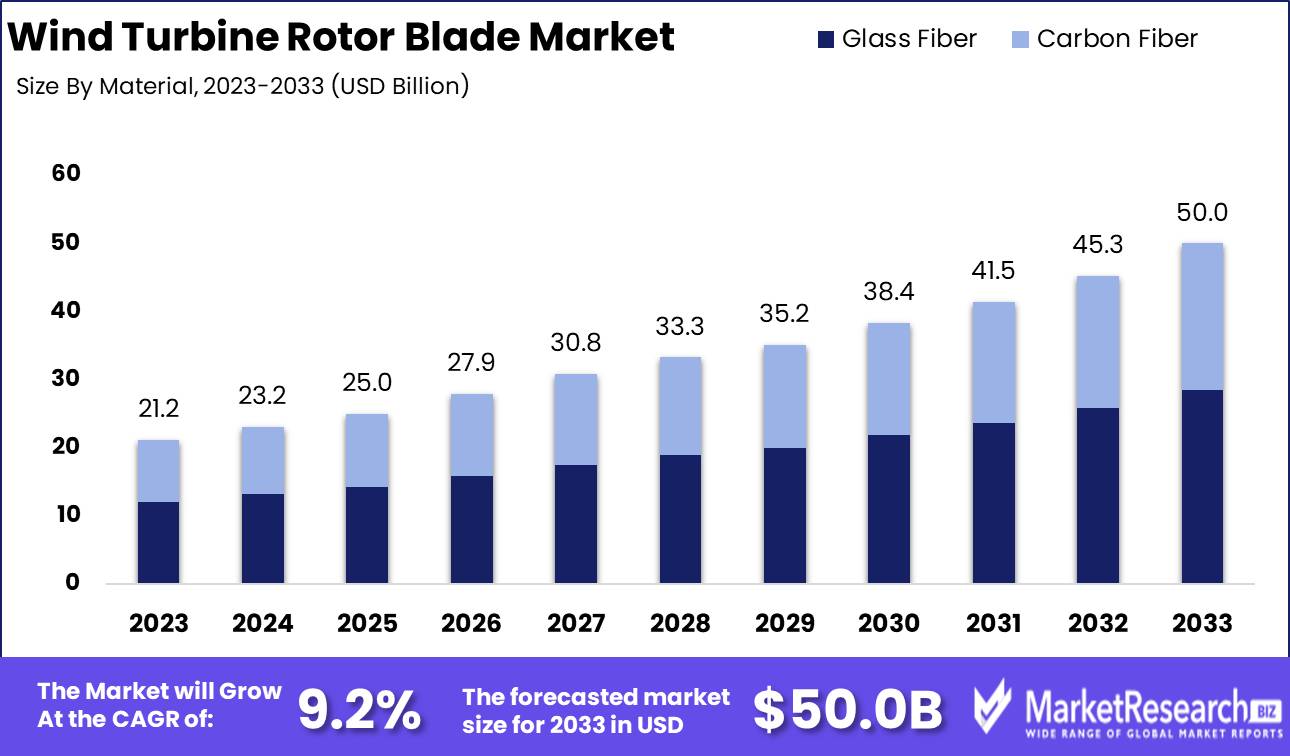

The Wind Turbine Rotor Blade Market was valued at USD 21.2 billion in 2023. It is expected to reach USD 50.0 billion by 2033, with a CAGR of 9.2% during the forecast period from 2024 to 2033.

The Wind Turbine Rotor Blade Market encompasses the production, development, and deployment of rotor blades, which are crucial components of wind turbines. These blades convert kinetic energy from wind into mechanical power, driving the turbine's generator. Market growth is driven by increasing demand for renewable energy, technological advancements in blade materials and design, and government incentives for sustainable energy projects.

The global wind turbine rotor blade market is poised for significant growth, driven by the rising energy demand and an increasing focus on renewable energy sources. Government initiatives worldwide are fostering the adoption of wind energy as a sustainable alternative, providing substantial incentives and subsidies that are propelling market expansion. The robust support from regulatory frameworks is expected to stimulate advancements in rotor blade technology, enhancing efficiency and reliability.

However, the high initial costs associated with wind turbine installations pose a notable barrier, potentially deterring investments in the short term. Moreover, recent supply chain disruptions, exacerbated by geopolitical tensions and the COVID-19 pandemic, have created challenges in the timely delivery of essential components, impacting production schedules and project timelines. Despite these obstacles, the market's outlook remains positive, bolstered by technological innovations and cost reductions in production processes.

Emerging markets, particularly in Asia-Pacific and Latin America, are experiencing a rapid expansion in wind energy projects, offering lucrative opportunities for industry stakeholders. The increasing investment in wind power infrastructure in these regions is expected to drive demand for rotor blades, fostering market growth. Companies are focusing on strategic partnerships and mergers to enhance their market presence and operational capabilities. The integration of advanced materials and design improvements is anticipated to further optimize blade performance, addressing issues related to durability and efficiency.

Key Takeaways

- Market Growth: The Wind Turbine Rotor Blade Market was valued at USD 21.2 billion in 2023. It is expected to reach USD 50.0 billion by 2033, with a CAGR of 9.2% during the forecast period from 2024 to 2033.

- By Blade Size: The "Less than 40 Meters" segment dominated the Wind Turbine Rotor Blade Market.

- By Material: Glass Fiber dominated the wind turbine rotor blade market.

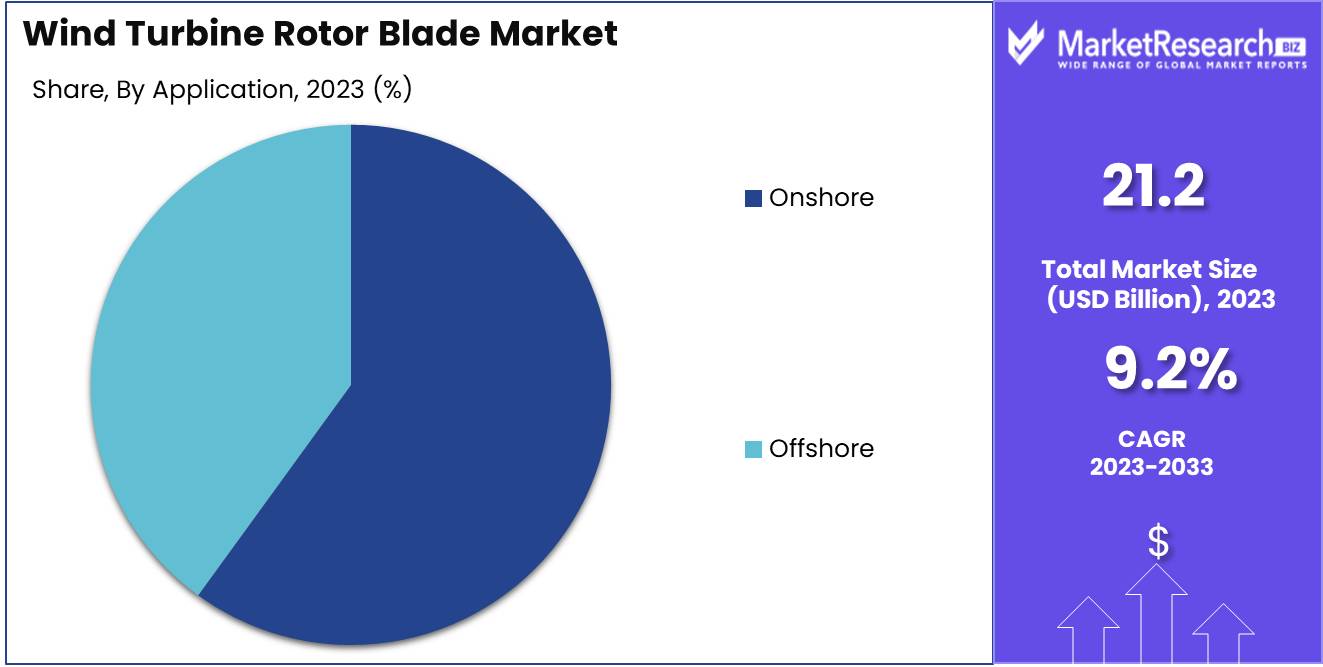

- By Application: Onshore dominated Wind Turbine Rotor Blade Market by application.

- By Capacity: < 3 MW turbines dominated the Wind Turbine Rotor Blade Market.

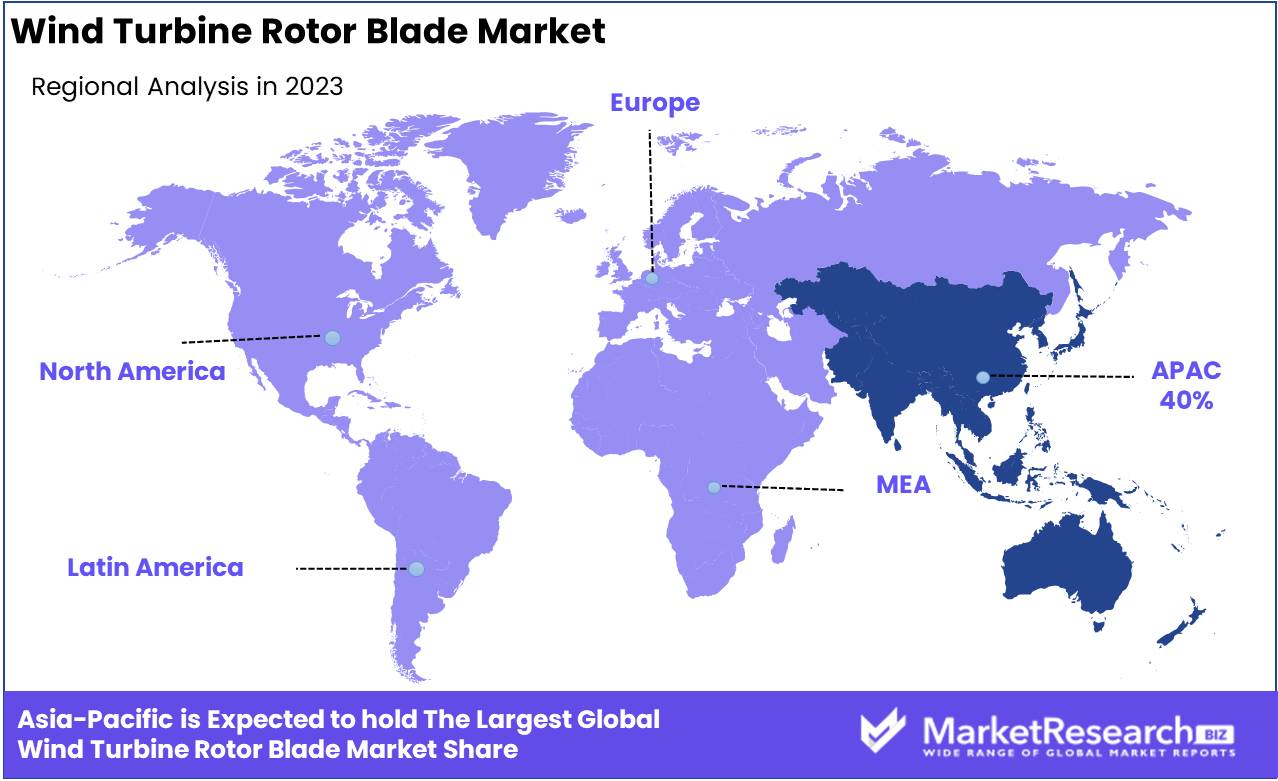

- Regional Dominance: Asia Pacific dominates with 40% largest market share.

- Growth Opportunity: The global wind turbine rotor blade market is set for robust growth, underpinned by favorable government policies and the rapid expansion of offshore wind farms.

Driving factors

Renewable Energy Transition: Paving the Way for Wind Turbine Rotor Blade Market Growth

The global shift towards renewable energy sources has significantly driven the growth of the wind turbine rotor blade market. Governments and organizations worldwide prioritize sustainable energy solutions to combat climate change and reduce dependency on fossil fuels. This transition has led to substantial investments in wind energy projects, increasing the demand for wind turbine components, including rotor blades. Policies and incentives aimed at promoting renewable energy have further bolstered market growth. For instance, in 2022, global renewable energy investments reached over $755 billion, highlighting the strong commitment to green energy initiatives, which in turn, fuels the wind turbine rotor blade market.

Wind Energy Capacity Expansion: Amplifying Demand for Advanced Rotor Blades

The continuous expansion of wind energy capacity is a crucial driver of the wind turbine rotor blade market. As countries strive to meet their renewable energy targets, large-scale wind farm projects are being developed both onshore and offshore. The report shows that in 2021, a record 93 GW of new wind power capacity was installed, with total global capacity reaching 837 GW. This expansion necessitates the deployment of more wind turbines, each requiring high-quality rotor blades. The scaling up of wind energy projects, especially in emerging markets, significantly contributes to the increasing demand for wind turbine rotor blades, as they are essential components for harnessing wind energy effectively.

Technological Advancements: Enhancing Efficiency and Performance of Wind Turbine Rotor Blades

Technological advancements in the design and manufacturing of wind turbine rotor blades are pivotal in driving market growth. Innovations such as the development of longer and lighter blades, the use of advanced materials, and the implementation of aerodynamic improvements have led to enhanced performance and efficiency of wind turbines. These advancements enable turbines to capture more wind energy, operate at lower wind speeds, and reduce maintenance costs. For example, the introduction of composite materials has resulted in blades that are both stronger and lighter, contributing to increased energy output and operational longevity. The continuous evolution of technology ensures that wind turbines can operate more efficiently, thereby boosting the demand for modern rotor blades and propelling the market forward.

Restraining Factors

High Research and Development Costs: A Barrier to Rapid Innovation and Market Expansion

The wind turbine rotor blade market faces significant challenges due to high research and development (R&D) costs. Developing advanced rotor blades that are efficient, durable, and cost-effective requires substantial financial investment. This includes expenses for material research, design optimization, and testing of prototypes. For instance, the cost of developing new composite materials, which are lighter and stronger than traditional materials, can be prohibitive. This high cost often limits the ability of smaller companies to compete, leading to market consolidation where only financially robust players can afford continuous innovation.

The impact of these high R&D costs is twofold. Firstly, it slows down the rate of technological advancements, as companies may take longer to recoup their investments and be hesitant to invest in new projects. Secondly, it raises the overall cost of rotor blades, making it difficult to achieve economies of scale that could reduce prices and boost market adoption. Consequently, the market's growth is restrained as the high costs act as a barrier to entry and innovation, limiting the diversity and pace of advancements in rotor blade technology.

Transportation Challenges: Hindrance to Efficient Supply Chain and Market Penetration

Transportation challenges significantly impact the wind turbine rotor blade market, posing logistical and economic constraints. Rotor blades, particularly those used in modern wind turbines, can be exceptionally large, often exceeding 50 meters in length. Transporting these massive structures from manufacturing facilities to installation sites requires specialized vehicles and routes, which can be both expensive and complex to coordinate.

The logistical difficulties are exacerbated by infrastructural limitations, such as narrow roads, low bridges, and urban congestion, which can impede the transportation process. Additionally, the costs associated with securing permits, arranging for police escorts, and modifying transport routes further add to the expense. These factors collectively increase the overall cost of wind turbine projects, which can deter investment and slow down market growth.

By Blade Size Analysis

In 2023, The "Less than 40 Meters" segment dominated the Wind Turbine Rotor Blade Market.

In 2023, the "Less than 40 Meters" segment held a dominant market position in the "By Blade Size" segment of the Wind Turbine Rotor Blade Market. This segment's dominance can be attributed to the widespread adoption of smaller wind turbines, particularly in distributed wind energy applications and regions with lower wind speeds. These blades are favored for their cost-effectiveness, ease of installation, and suitability for community and residential wind projects.

The "40-60 Meters" segment also demonstrated significant market share due to the increasing deployment of medium-sized wind turbines in both onshore and offshore wind farms, offering a balance between efficiency and installation complexity.

The "Greater than 60 Meters" segment, while smaller in market share, is growing rapidly, driven by the expansion of offshore wind projects and advancements in materials and engineering, enabling longer blades that capture more wind energy and improve overall turbine performance. This segmentation highlights the diverse applications and technological advancements in the wind energy sector, catering to varying geographic and project-specific needs.

By Material Analysis

In 2023, Glass Fiber dominated the wind turbine rotor blade market.

In 2023, Glass Fiber held a dominant market position in the by-material segment of the wind turbine rotor blade market. This dominance can be attributed to the material's favorable properties such as high strength-to-weight ratio, corrosion resistance, and cost-effectiveness. Glass fiber is extensively utilized in wind turbine blades due to its ability to withstand high stress and harsh environmental conditions, making it a preferred choice for manufacturers aiming to enhance the efficiency and longevity of wind turbines.

Conversely, carbon fiber, while known for its superior strength and lightweight characteristics, occupies a smaller market share within this segment. The higher cost of carbon fiber production has limited its widespread application, primarily confining its use to high-performance wind turbine models where the benefits outweigh the costs. Nevertheless, ongoing research and development efforts aimed at reducing the cost of carbon fiber and enhancing its properties are anticipated to boost its market share in the coming years, potentially altering the competitive landscape of the wind turbine rotor blade market.

By Application Analysis

In 2023, Onshore dominated the Wind Turbine Rotor Blade Market by application.

In 2023, Onshore held a dominant market position in the By Application segment of the Wind Turbine Rotor Blade Market. Onshore wind turbines have been favored due to their lower installation and maintenance costs compared to offshore turbines. The accessibility of onshore sites, coupled with advancements in rotor blade technology, has bolstered the efficiency and output of these turbines. Onshore wind farms contribute significantly to the global energy mix, driven by government policies supporting renewable energy and the declining cost of wind energy production.

In contrast, Offshore wind turbines, while growing, face higher logistical and operational challenges. Despite the higher energy potential and capacity factors of offshore turbines, their market share remains limited due to the substantial investment and technical expertise required for installation and maintenance in marine environments. However, ongoing technological advancements and increased investments in offshore wind projects are expected to enhance their market share in the coming years.

By Capacity Analysis

In 2023, < 3 MW turbines dominated the Wind Turbine Rotor Blade Market.

In 2023, The < 3 MW segment held a dominant market position in the By Capacity segment of the Wind Turbine Rotor Blade Market. This segment's leadership is attributed to its widespread adoption of onshore wind projects, particularly in regions with lower wind speeds where smaller turbines are more efficient. The < 3 MW turbines are popular due to their lower cost and ease of installation and maintenance, making them a preferred choice for emerging markets and small-scale installations.

The 3 – 5 MW segment also showed substantial growth, driven by increasing investments in medium-sized wind farms and advancements in turbine technology that improve efficiency and output. This segment is particularly significant in developed regions, where there is a balance between land availability and the need for higher energy production.

The > 5 MW segment, while still emerging, represents a promising area of growth, especially for offshore wind projects. These turbines, with their higher energy output, are crucial for large-scale renewable energy initiatives aimed at meeting substantial electricity demands and reducing carbon footprints. Technological advancements and government incentives are expected to bolster the growth of this segment in the coming years.

Key Market Segments

By Blade Size

- Less than 40 Meters

- 40-60 Meters

- Greater than 60 Meters

By Material

- Glass Fiber

- Carbon Fiber

By Application

- Onshore

- Offshore

By Capacity

- < 3 MW

- 3 – 5 MW

- > 5 MW

Growth Opportunity

Government Incentives and Policies

The global wind turbine rotor blade market is poised for significant growth, driven largely by robust government incentives and supportive policies. Many countries are intensifying their commitments to renewable energy targets, providing subsidies, tax incentives, and favorable regulatory frameworks to accelerate wind energy adoption. These measures are expected to catalyze investments in wind turbine technologies, including advanced rotor blades that enhance efficiency and performance. For instance, the extension of the Production Tax Credit (PTC) in the United States and similar incentives in Europe and Asia are projected to boost market demand, creating a conducive environment for innovation and large-scale deployment of wind turbine rotor blades.

Expansion of Offshore Wind Farms

The expansion of offshore wind farms represents another critical growth opportunity for the wind turbine rotor blade market. Offshore wind energy is gaining traction due to its higher capacity factors and the availability of vast, untapped wind resources. Countries like the UK, Germany, China, and the United States are leading in offshore wind installations, driving the demand for longer and more durable rotor blades that can withstand harsh marine environments. Technological advancements in blade materials and design, aimed at reducing weight and increasing durability, are essential to meet the unique challenges of offshore wind farms. This trend is expected to significantly bolster the market, with offshore projects accounting for a substantial share of new wind energy installations globally.

Latest Trends

Longer Blades for Higher Efficiency

The Wind Turbine Rotor Blade Market is experiencing a significant shift towards the development and deployment of longer blades. This trend is driven by the industry's constant pursuit of higher efficiency and greater energy output. Longer rotor blades capture more wind energy, translating to increased power generation even at lower wind speeds. Technological advancements in materials and design have enabled the production of these larger blades without compromising structural integrity.

As a result, wind farms are expected to see a substantial boost in their overall capacity, enhancing the viability of wind energy as a primary renewable resource. This shift not only supports the global transition to clean energy but also aligns with various governmental policies aimed at reducing carbon footprints.

Recycling and Circular Economy Initiatives

Another noteworthy trend in the Wind Turbine Rotor Blade Market is the focus on recycling and circular economy initiatives. As the first generation of wind turbines reaches the end of its operational life, the industry faces the challenge of managing blade waste. Traditional disposal methods, such as landfilling, are increasingly seen as unsustainable.

Consequently, manufacturers and stakeholders are investing in innovative recycling technologies to repurpose old blades. These efforts include mechanical recycling, chemical processing, and the development of composite materials that are easier to recycle. The push towards a circular economy is not only environmentally beneficial but also economically advantageous, reducing costs and resource consumption. Companies adopting these initiatives are likely to gain a competitive edge, driven by growing consumer and regulatory demand for sustainable practices.

Regional Analysis

Asia Pacific dominates with a 40% largest market share.

The North America wind turbine rotor blade market is experiencing steady growth, driven by significant investments in renewable energy infrastructure and supportive government policies. The United States and Canada are key contributors, with the U.S. market alone expected to reach a value of USD 3.2 billion by 2025. Increasing emphasis on sustainable energy and advancements in blade technology are propelling the market forward.

In Europe, the market is witnessing robust expansion, supported by stringent regulations on carbon emissions and a strong commitment to achieving renewable energy targets. Countries such as Germany, Spain, and the United Kingdom are at the forefront, with Germany accounting for approximately 30% of the regional market share. The European market is projected to grow at a CAGR of 6.5% from 2023 to 2028.

The Asia Pacific region dominates the global wind turbine rotor blade market, holding a significant market share of approximately 40%. This dominance is attributed to rapid industrialization, increasing energy demand, and substantial investments in renewable energy projects in countries like China, India, and Japan. China alone contributes over 60% of the regional market, driven by its extensive wind energy capacity and favorable government policies.

The Middle East & Africa market for wind turbine rotor blades is gradually expanding, with South Africa and the UAE leading the way. Although the region's contribution to the global market is currently modest, ongoing projects and rising awareness of renewable energy benefits are expected to boost growth. The market is anticipated to grow at a CAGR of 5.1% during the forecast period.

In Latin America, Brazil and Mexico are the primary markets, driven by a growing focus on renewable energy to reduce dependence on fossil fuels. The Latin American wind turbine rotor blade market is expected to witness a CAGR of 7% from 2023 to 2028, supported by increasing investments and favorable government policies promoting clean energy solutions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Wind Turbine Rotor Blade Market is anticipated to witness robust growth, driven by technological advancements and increased investments in renewable energy. Key players in this market are expected to play pivotal roles in shaping its trajectory.

TPI Composites Inc. stands out due to its extensive manufacturing capabilities and strong partnerships with leading OEMs, enabling it to maintain a competitive edge. Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd is likely to benefit from China's aggressive renewable energy targets, leveraging its local market expertise.

Nordex SE and Siemens Gamesa Renewable Energy, S.A. are positioned well in the European market, with innovative blade designs and a focus on sustainability. Siemens Gamesa, in particular, is set to capitalize on its extensive R&D efforts to enhance blade efficiency and lifespan.

MFG Wind and Sinoma Wind Power Blade Co. Ltd are expected to expand their market presence through strategic collaborations and increased production capacities. Aeris Energy's focus on high-performance blades is anticipated to drive its market share, especially in emerging markets. Suzlon Energy Limited, facing financial restructuring, may still leverage its established market presence in India. LM Wind Power, a subsidiary of General Electric, is expected to continue its dominance with cutting-edge technology and extensive global reach.

Vestas Wind Systems A/S remains a market leader, known for its reliable and efficient blade designs. Enercon GmbH and Acciona S.A. are likely to strengthen their positions through technological innovation and sustainable practices. Overall, these key players are anticipated to drive significant advancements and growth in the Wind Turbine Rotor Blade Market through strategic initiatives, technological innovations, and expanding global footprints.

Market Key Players

- TPI Composites Inc.

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- Nordex SE

- Siemens Gamesa Renewable Energy, S.A.

- MFG Wind

- Sinoma Wind Power Blade Co. Ltd

- Aeris Energy

- Suzlon Energy Limited

- LM Wind Power

- Vestas Wind Systems A/S

- General Electric

- Suzlon Energy Limited

- Enercon GmbH

- Acciona S.A.

- Avangrid Inc.

- LM Wind Power

- Suzlon Energy Ltd

- Envision Group

Recent Development

- In July 2024, Siemens Gamesa unveiled a new 14 MW direct drive offshore wind turbine featuring a 222-meter rotor. This advanced turbine is designed to enhance efficiency and energy output, aligning with the increasing global demand for renewable energy sources.

- In June 2024, LM Wind Power, a subsidiary of GE Renewable Energy, announced a significant investment in carbon fiber technology to produce lighter and stronger wind turbine blades. This initiative aims to enhance the efficiency and performance of wind turbines, particularly for large-scale and offshore projects.

- In March 2024, Vestas introduced a new recyclable wind turbine blade. This innovation marks a significant step towards sustainability in the wind energy sector by addressing the end-of-life disposal of rotor blades and supporting circular economy practices.

Report Scope

Report Features Description Market Value (2023) USD 21.2 Billion Forecast Revenue (2033) USD 50.0 Billion CAGR (2024-2032) 9.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Blade Size (Less than 40 Meters, 40-60 Meters, Greater than 60 Meters), By Material (Glass Fiber, Carbon Fiber), By Application (Onshore, Offshore), By Capacity (< 3 MW, 3 – 5 MW, > 5 MW) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape TPI Composites Inc., Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd, Nordex SE, Siemens Gamesa Renewable Energy, S.A., MFG Wind, Sinoma wind power blade Co. Ltd, Aeris Energy, Suzlon Energy Limited, LM Wind Power, Vestas Wind Systems A/S, General Electric, Suzlon Energy Limited, Enercon GmbH, Acciona S.A., Avangrid Inc., LM Wind Power, Suzlon Energy Ltd, Envision Group Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- TPI Composites Inc.

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- Nordex SE

- Siemens Gamesa Renewable Energy, S.A.

- MFG Wind

- Sinoma Wind Power Blade Co. Ltd

- Aeris Energy

- Suzlon Energy Limited

- LM Wind Power

- Vestas Wind Systems A/S

- General Electric

- Suzlon Energy Limited

- Enercon GmbH

- Acciona S.A.

- Avangrid Inc.

- LM Wind Power

- Suzlon Energy Ltd

- Envision Group