Wholesale Energy Market By Types(Physical, Financial), By Contracts Types (Long Term, Medium Term, Short Term), By End-use(Residential, Commercial, Industrial) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43342

-

Feb 2024

-

150

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

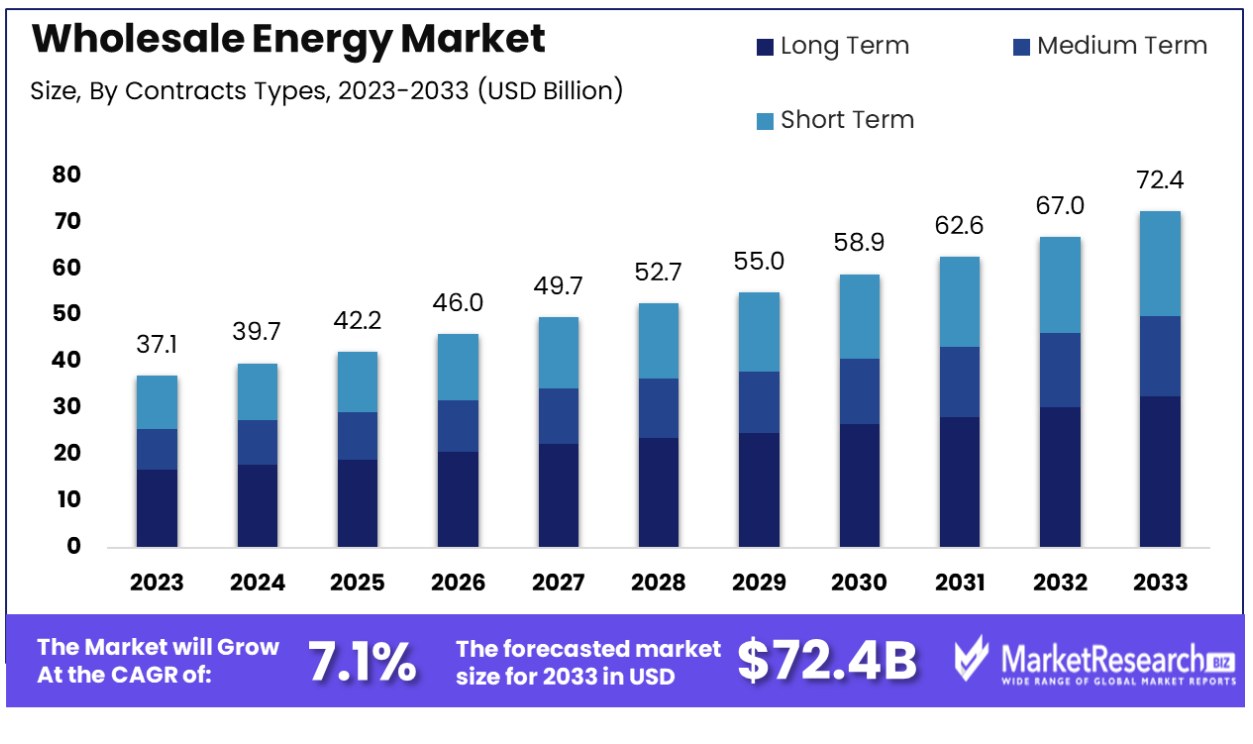

The Wholesale Energy Market was valued at USD 37.1 Billion by 2023. It is expected to reach USD 72.4 Billion by 2033, with a CAGR of 7.10% during the forecast period from 2024 to 2033.

Wholesale Energy refers to the large-scale buying and selling of electricity and energy resources between producers, such as power plants, and various market participants including utilities and retailers, before it reaches the end consumer. This market is fundamental to the energy supply chain, involving transactions in energy exchanges or through private contracts.

Wholesale Energy refers to the large-scale buying and selling of electricity and energy resources between producers, such as power plants, and various market participants including utilities and retailers, before it reaches the end consumer. This market is fundamental to the energy supply chain, involving transactions in energy exchanges or through private contracts.Key drivers of growth for this market include increasing global electricity demand, the move toward renewable sources of power generation and deregulation of energy markets as well as technological advancements in production and distribution. Renewable energies as well as smart grid technologies play a critical role, creating new dynamics such as intermittent power supplies that require advanced grid management strategies.

According to IEA, clean energy investment reached USD 1.4 trillion in 2022, up 10% relative to 2021 and representing 70% of the growth in total energy sector investment, which is nearly seven times the average rate of investment over 2016-2021. Investment in clean energy supply chains highlights both a positive trend towards sustainable sources and the importance of accurate forecasting and management of energy demand.

The deployment of technology and analytics services in power trading and risk management opens significant opportunities for utilities, generators, and retailers. These tools enable more informed trading decisions and efficient risk management, leading to maximized profit margins. As electricity wholesale markets become ever more complicated, and energy generation and prices become more variable, sophisticated solutions become ever more necessary to drive growth within this sector.

Software and predictive modeling tools for market forecasting and pricing analytics are essential for accurate energy demand and price forecasting. These tools are crucial inputs for effective trading strategies, particularly with the increasing penetration of renewable energy sources and their impact on energy prices and availability.

Another latest development in the market is blockchain. Blockchain technology is revolutionizing the wholesale energy market with peer-to-peer trading platforms. These platforms offer transparency and automation in transactions between various market participants, including smaller producers and consumers. By unlocking the potential for smaller participants to engage directly in energy trading, blockchain technology broadens the market scope and introduces fresh dynamics for energy trading - creating an inclusive yet efficient market environment.

Providing regulatory expertise, software platforms, and advisory services to new market participants facilitates their entry into complex wholesale energy markets. The Council and the Parliament have reached a provisional political agreement on the REMIT regulation to enhance the EU's protection against market manipulation in the wholesale energy market. This agreement aims to support fair competition, increase market transparency, and safeguard consumers and companies from market abuse.

This support is crucial for entities looking to sell or procure power and ancillary services, expanding the market by enabling participation from a broader range of entities. The growth in renewable energy sources and decentralized generation further emphasizes the need for such services, as more players seek to navigate these evolving markets.

Driving Factors

Electric Vehicle Adoption Reshapes Energy Market Dynamics

Electric Vehicle (EV) Adoption is increasingly influencing the growth of the Wholesale Energy market. As EV adoption accelerates, large EV fleets are expected to participate more actively in energy markets, especially through smart charging and Vehicle-to-Grid (V2G) systems. These technologies enable EVs to not only draw power from the grid but also supply it back during peak demand periods, effectively acting as mobile energy storage units. This trend is increasing demand variability, as the charging patterns of EVs add a new layer of complexity to energy consumption. Integration of electric vehicles (EVs) into the energy market could result in more dynamic pricing structures and demand response strategies that reflect changing energy consumption patterns.

Technological Innovation Drives Wholesale Market Sophistication

Technological Innovation, including advancements in blockchain, artificial intelligence, big data analytics, control systems, and advanced forecasting models, is enabling more sophistication across wholesale power markets. These technologies allow for more precise demand forecasting, better grid management, and efficient energy trading, contributing to more resilient and flexible energy markets.

Blockchain technology, for instance, offers enhanced transparency and security in energy transactions, while AI and big data analytics provide insights for optimizing energy distribution and pricing. The integration of these technological innovations is transforming the traditional energy market into a more efficient and data-driven industry. The ongoing development of these technologies suggests a future wholesale energy market that is highly sophisticated, adaptive, and efficient.

Demand Variations Shape Electricity Supply Costs

Variations in electricity demand, typically highest during peak hours in the afternoon and early evening, contribute significantly to the cost of supplying electricity. During peak demand periods, the electricity system must rely on additional and often more expensive generation resources to meet the increased load. This results in higher wholesale electricity prices, reflecting the higher costs of operating additional power plants, especially those that are less efficient or more expensive to run. Conversely, during periods of low demand, prices can decrease. The pattern of fluctuating demand necessitates a flexible and responsive electricity supply system, influencing pricing structures in the wholesale market.

Restraining Factors

Constant Changes in Energy Policies Create Uncertainty in Wholesale Energy Market

The wholesale energy market is significantly impacted by constant changes in energy policies and regulations, which create a climate of uncertainty. Frequent alterations in regulations regarding energy production, distribution, and pricing can make it challenging for businesses and investors to predict market conditions and make informed decisions.

This unpredictability can deter investment in new energy projects or expansion of existing ones, as stakeholders become cautious about potential regulatory risks. The lack of stable policy frameworks can thus lead to volatility in the market, affecting its overall stability and growth prospects as investors seek more predictable environments.

Technological Advancements Leading to Obsolescence Challenge Wholesale Energy Market

Rapid advancements in energy technology can render existing infrastructure obsolete, posing a significant challenge to the wholesale energy market. As new, more efficient, and sustainable technologies emerge, older systems and methods can quickly become outdated. This shift can lead to stranded assets, where investments in older technology lose value or become nonviable much sooner than anticipated.

For investors and energy companies, this can result in substantial financial losses and reduced returns on investment. The pace of technological change necessitates continual adaptation and upgrading of infrastructure, which can be costly and disruptive, thus hindering the market's growth and stability.

Wholesale Energy Market Segmentation Analysis

By Types Analysis

The Physical segment, with a 53.4% share, is the dominant type in the Wholesale Energy Market. Physical contracts involve the actual delivery of energy from producers to consumers or utilities. This segment's prominence is due to the direct nature of transactions, where utilities and large consumers purchase bulk energy to meet immediate or near-term consumption needs. The stability and certainty of physical energy supply are crucial for continuous operations, particularly for industries and utilities. Physical contracts ensure a stable and predictable supply chain, which is vital for energy security and market stability.

Financial contracts in wholesale energy markets, such as futures and options, are used for hedging risks associated with price fluctuations. While they don’t involve the physical delivery of power, they play a critical role in price discovery and risk management.

By Contract Types Analysis

Long-term contracts, capturing a 41% market share, are predominant in wholesale energy markets. These contracts, often spanning several years, provide stability and predictability for both producers and consumers. They are crucial for financing large-scale energy projects, including renewables, as they assure a consistent revenue stream. The growth in this segment is driven by the need for long-term energy security and the shift towards sustainable energy sources requiring substantial upfront investments.

Medium-term and short-term contracts cater to more flexible or immediate energy needs, allowing buyers and sellers to adapt to market changes more rapidly. They are important for balancing supply and demand, especially with the variability introduced by renewable energy sources.

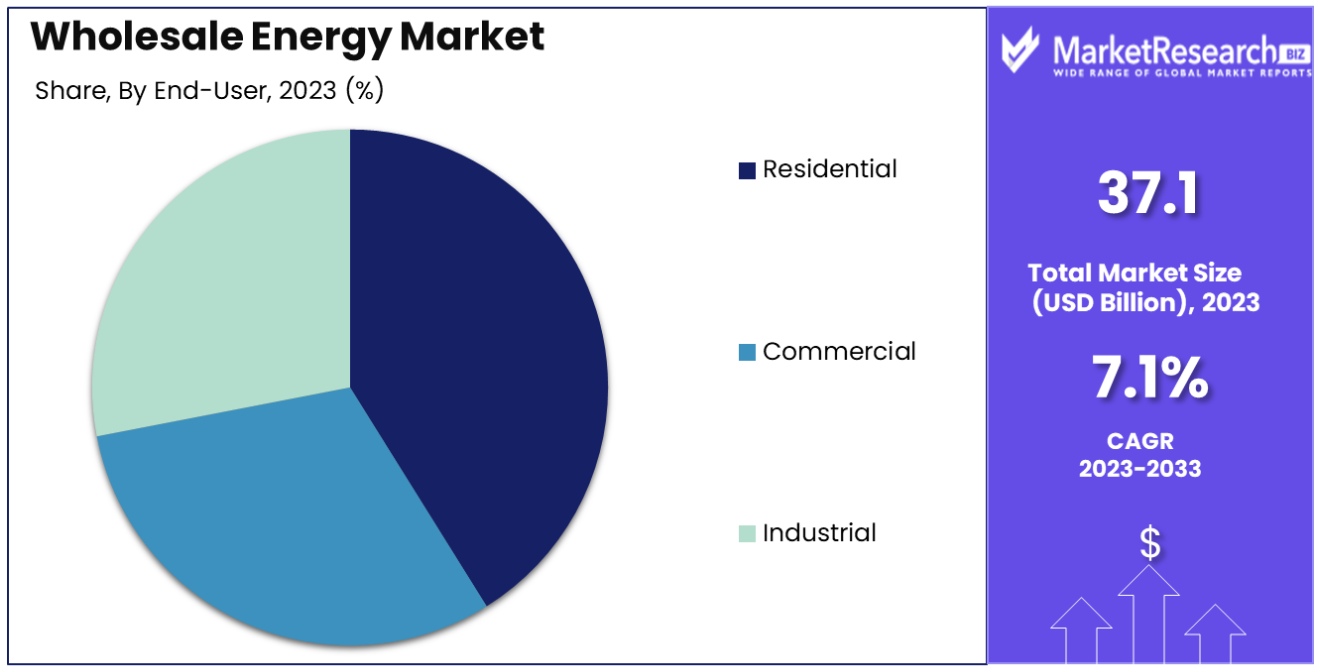

By End-use Analysis

The Industrial sector leads the end-use segment in the Wholesale Energy Market with a 51.2% share. Industrial consumers require large amounts of energy for manufacturing and production processes, making them the largest consumers in wholesale markets. The dominance of this segment is driven by the industrial sector's continuous and high-volume energy requirements. Growth can be seen due to industrial expansion, technological innovations, and energy-saving practices being adopted into business practices.

The residential and commercial sectors also significantly contribute to energy demand. Residential use is driven by household consumption, while commercial use includes energy for offices, retail spaces, and other business activities. These sectors increasingly participate in wholesale markets through aggregated demand or via utilities.

Key Market Segments

By Types

- Physical

- Financial

By Contracts Types

- Long Term

- Medium Term

- Short Term

By End-use

- Residential

- Commercial

- Industrial

Wholesale Energy Market Regional Analysis

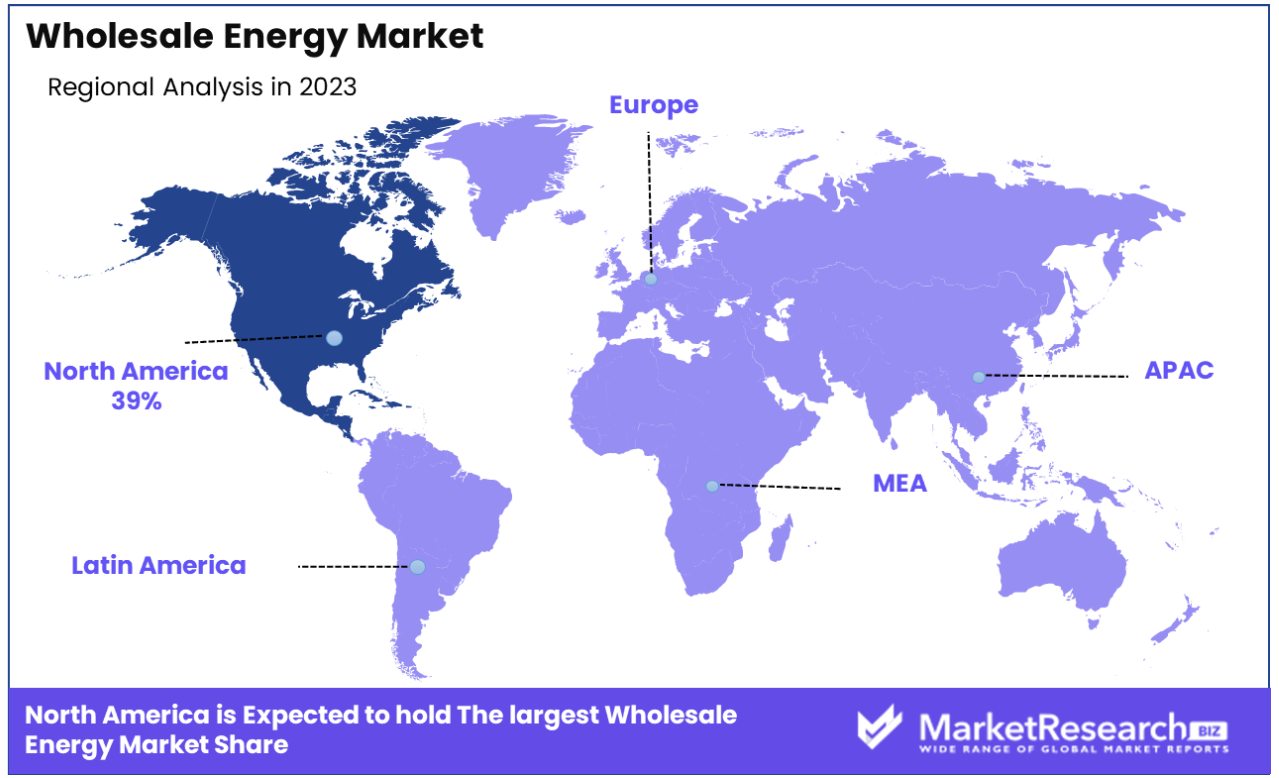

North America Dominates with 39% Market Share in Wholesale Energy Market

North America's significant 39% share in the Wholesale Energy Market is primarily driven by the region's vast and diverse energy resources, including renewable energy sources, natural gas, and oil. The United States and Canada have well-developed energy infrastructure and mature markets for energy trading and distribution. Additionally, the region's robust regulatory frameworks facilitate a competitive and open market environment, which encourages large-scale energy transactions.

The market dynamics in North America are influenced by the evolving energy sector, marked by technological advancements in energy production and distribution, including smart grid technology. The growing emphasis on renewable energy, driven by environmental concerns and policy support, shapes the market landscape. Liberalizing energy markets has provided more efficient and diverse energy supply options through competition and innovation, in turn contributing to energy security and self-sufficiency across the region. Wholesale energy markets play a vital role in supporting this effort.

Europe's Transition to Renewable Energy and Market Integration

Europe’s wholesale energy market is driven by the region's transition to renewable energy and efforts towards market integration. The European Union's focus on creating a single energy market facilitates cross-border energy trade, enhancing market efficiency. Europe's commitment to reducing carbon emissions and increasing the share of renewables in its energy mix supports market growth.

Asia-Pacific's Rapid Industrialization and Increasing Energy Demand

In Asia-Pacific, the wholesale energy market is expanding rapidly, fueled by the region's rapid industrialization and increasing energy demand. Countries like China and India are investing heavily in energy infrastructure to meet their growing needs. The region's focus on diversifying its energy sources, including significant investments in renewable energy, contributes to the dynamic growth of the wholesale energy market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Wholesale Energy Market Key Player Analysis

In the Wholesale Energy Market, the listed companies are pivotal in shaping the industry's dynamics and future. National Grid plc and PJM Interconnection stand out for their roles in electricity transmission and grid operations, crucial for the efficient distribution of wholesale power across large regions. Their strategic positioning ensures stability and reliability in energy supply, reflecting the market's focus on robust infrastructure.

Enel SpA and E.ON SE, European giants in the energy sector, are instrumental in driving the market with their diverse energy portfolios and commitment to sustainable energy solutions. These companies' focus on renewable energy sources and innovation in energy services underscores the industry's shift towards environmentally friendly and efficient energy production.

NextEra Energy, Inc. and Dominion Energy, Inc., major players in the North American market, contribute significantly with their extensive generation capacities and investments in renewable energy. Their market influence is marked by a commitment to transitioning towards a more sustainable energy mix, reflecting the broader industry trend.

Collectively, these companies not only drive the Wholesale Energy Market but also represent diverse strategies - from managing large-scale grids to investing in sustainable energy sources - crucial for addressing the evolving energy needs of global markets.

Market Key Players

- National Grid plc

- Enel SpA

- E.ON SE

- NextEra Energy, In

- Dominion Energy, In

- Tokyo Electric Power Company Holdings

- American Electric Power Company, Inc

- PJM Interconnection

Recent Development

- In December 2023, ANNEA raised $2.9 million in Seed funding led by Voyager Ventures to expand its AI-powered predictive maintenance and performance optimization technology for renewable energy globally.

Report Scope

Report Features Description Market Value (2023) USD 37.1 Billion Forecast Revenue (2033) USD 72.4 Billion CAGR (2024-2032) 7.10% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Types(Physical, Financial), By Contracts Types (Long Term, Medium Term, Short Term), By End-use(Residential, Commercial, Industrial) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape National Grid plc, Enel SpA, E.ON SE, NextEra Energy, In, Dominion Energy, In, Tokyo Electric Power Company Holdings, American Electric Power Company, Inc, PJM Interconnection Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- National Grid plc

- Enel SpA

- E.ON SE

- NextEra Energy, In

- Dominion Energy, In

- Tokyo Electric Power Company Holdings

- American Electric Power Company, Inc

- PJM Interconnection