Wet Pet Food Market By Pet(Dogs, Cats), By Source(Animal-based, Plant Derivatives, Synthetic), By Distribution Channel(Pet Specialty Stores t, Supermarkets/Hypermarkets, Convenience Stores, Online) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42827

-

Jan 2024

-

169

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Wet Pet Food Market Size, Share, Trends Analysis

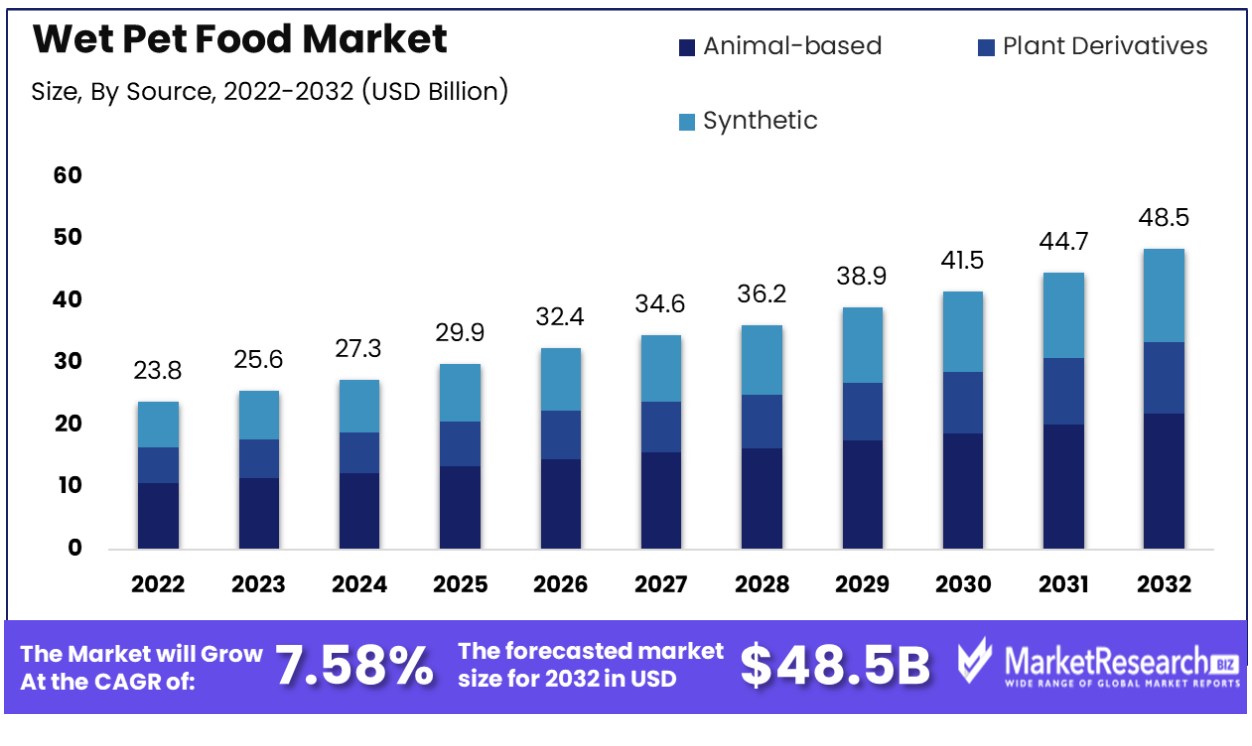

The Wet Pet Food Market was valued at USD 23.78 billion in 2022. It is expected to reach USD 48.5 billion by 2032, with a CAGR of 7.58% during the forecast period from 2023 to 2032.

The surge in demand for healthy pet food and the concern of pet owners regarding pet health are some of the main driving factors for the wet pet food market's expansion. Wet pet foods are the blending of food recipes together and cooking them in any tray or pouch. It is a ready-to-eat food item for the pets.

The wet food is kept in a sterile can for a longer period until it is opened or unsealed. Wet pet foods come in different forms, such as gravy, sauce, jelly, and mousse. Various types and forms of pet manufacturing food are wet, dry, and cold-pressed. Manufacturers put labels on packaged wet pet food that are complete and complementary. Complete pet food signifies that the product covers all the nutrients a pet requires for healthy body functions. Complementary foods are the treats that are fed along with other sources of daily food to provide proper and healthy nutrition.

Manufacturers use several types of pet food that are derived from fish or other nutritious by-products. Such ingredients are the parts of the animal supplement that meet the needs of the human food sector. There are various types of by-products, for example, liver, kidney, and many other products. These food items come from specific species that are most common within the human food chain.

Wet pet foods are much more delicious and nutritious than dry foods. It satisfies the dog’s meat carvings. It is an especially good option for choosy eaters as a substitute for dry food. Wet pet foods have fewer carbohydrates and a higher amount of protein and fat as compared to dry foods. High amounts of carbohydrates may cause obesity in dogs, but as wet food has fewer carbohydrates, it controls weight gain and promotes weight loss.

Moreover, a guarantee analysis is needed on the package label of pet food items and lists; it helps the pet owner know about the quantity of ingredients used and the levels of protein, fiber, and fat in the food. Likewise, nutrients should be listed on the guaranteed analysis (GA) label to make a claim that shows a specific nutrient, such as calcium for teeth and body bones. The demand for these wet pet foods will increase due to their nutritious ingredients, which will help in market expansion in the coming years.

Driving Factors

Economic Growth Feeds Wet Pet Food Market

The rise in disposable incomes and rapid urbanization are key drivers of the wet pet food market. As people have more disposable income, they are willing to spend more on premium pet care products, including high-quality wet food.

Urban living also tends to favor smaller living spaces where pets, especially cats and dogs, are common companions. Urban pet owners are increasingly looking for convenient, nutritious, and high-quality food options for their pets, driving the demand for wet pet food. This trend is likely to continue as urban populations grow and disposable incomes rise, further boosting the wet pet food market.

Taste and Digestibility Enhance Appeal

Wet pet food's enhanced palatability and digestibility are significant factors contributing to its market growth. Wet food is often more appealing to pets due to its taste and texture, making it a preferred choice for fussy eaters or pets with specific dietary needs.

Additionally, the higher moisture content aids in hydration and digestion, particularly beneficial for pets with certain health issues. As pet owners become more attuned to their pets' dietary preferences and health requirements, the demand for wet food, known for its palatability and digestibility benefits, is expected to rise, driving market growth.

Focus on Health Bolsters Market

The increasing focus on pet health and nutrition is a driving force behind the wet pet food market's growth. Pet owners are more informed and concerned about their pets' health than ever before and are seeking out food options that offer balanced nutrition and health benefits. Wet pet food is often perceived as a healthier alternative due to its high protein content and fewer preservatives.

This perception, coupled with a growing trend of treating pets as family members, means that owners are investing in premium wet foods that promise to enhance their pets' health and well-being. The continued emphasis on pet health and nutrition is expected to sustain the market's growth trajectory, as more owners seek the best dietary options for their pets.

Restraining Factors

Limited Availability of Ingredients and Price Sensitivity Restrain Wet Pet Food Market Growth

The growth of the wet pet food market is constrained by the limited availability of high-quality ingredients and price sensitivity among consumers. Sourcing premium ingredients for wet pet food, such as specific types of meat and organic produce, can be challenging and often comes at a higher cost. These increased production costs are typically passed on to consumers, making wet pet food more expensive than its dry counterparts.

Price-sensitive consumers may opt for more affordable options, especially in regions with lower disposable incomes. The reliance on specific ingredients and the resulting higher prices can limit the market's expansion as consumers weigh costs against the perceived benefits of wet pet food.

Stringent Commercialization Requirements Limit Wet Pet Food Market Expansion

Stringent commercialization requirements also limit the expansion of the wet pet food market. Wet pet foods are subject to rigorous regulatory standards to ensure safety and nutritional adequacy, including standards for ingredients, processing, and packaging. Meeting these requirements can be complex and costly, involving extensive testing, quality control measures, and compliance with various national and international regulations.

For manufacturers, especially smaller ones, navigating these regulatory hurdles can be daunting and resource-intensive. The challenge of ensuring continuous compliance can slow down the introduction of new products, restrict market entry for new players, and ultimately hinder the market's growth and innovation.

Wet Pet Food Market Segmentation Analysis

By Pet

In the wet pet food market, products designed for dogs dominate the segment. This trend reflects the high number of households with dogs as pets and the growing awareness among dog owners about the benefits of wet food, including higher moisture content, which is beneficial for hydration and can be easier for some dogs to digest.

Wet dog food is often perceived as more palatable and closer to natural meat, making it a popular choice for pet owners seeking to provide a high-quality diet for their pets. While dogs lead this segment, cat wet food is also significant in the market. Cats, being obligate carnivores, often benefit from the high protein content in wet food, and many formulations are specifically designed to meet their unique dietary needs.

By Source

Animal-based sources are the predominant choice in the wet pet food market. This dominance is due to the high nutritional value and palatability of animal-based ingredients, which align well with the dietary requirements of carnivorous pets like dogs and cats. Animal-based wet pet foods typically contain meats, poultry, or fish as primary ingredients, offering essential proteins, fats, and other nutrients necessary for pets' health and well-being.

Just like how animal-based sources lead, plant derivatives and synthetic ingredients also contribute to the market. Plant derivatives are often used as supplementary ingredients providing vitamins, minerals, and fiber, while synthetic ingredients can include vitamins and minerals to ensure nutritional completeness.

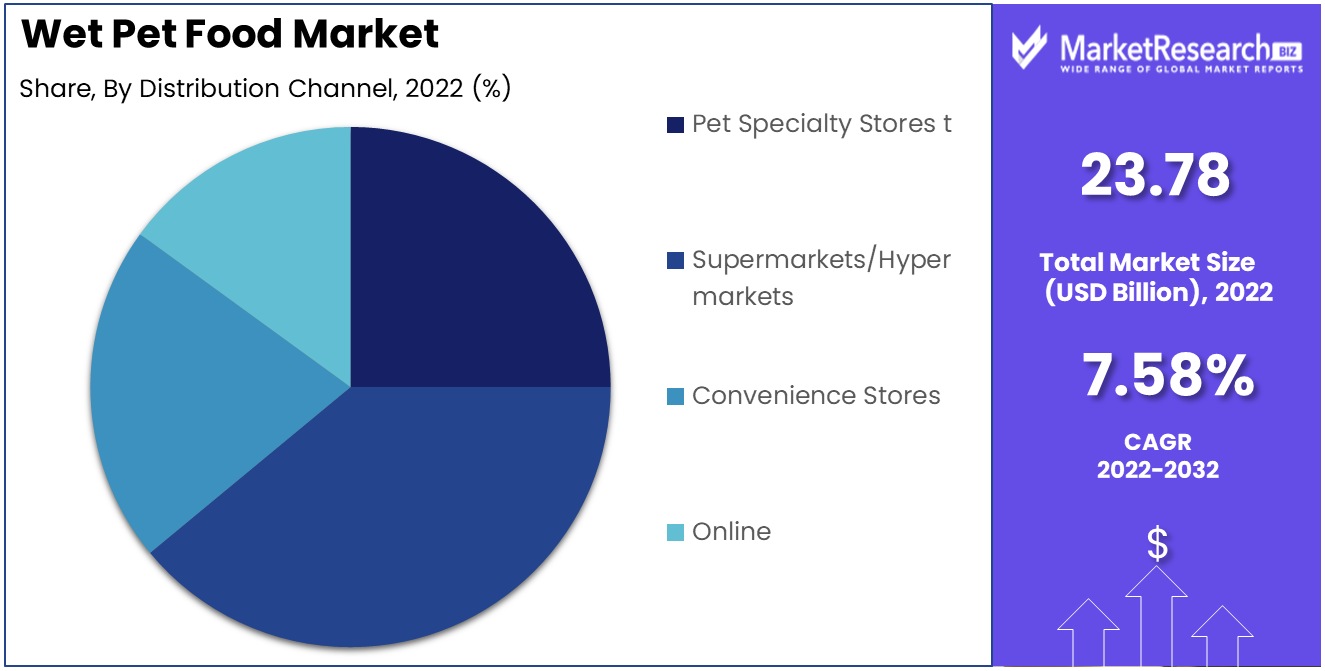

By Distribution Channel

Pet specialty stores emerge as the dominant distribution channel for wet pet food. These stores are preferred by pet owners due to their wide range of products, specialized focus on pet needs, and knowledgeable staff. Pet specialty stores often offer a broader variety of wet pet food, including premium and specialized products catering to specific dietary requirements or health conditions. This segment's growth is driven by the increasing consumer focus on pet health and nutrition, leading to demand for high-quality pet food products.

While pet specialty stores lead, other channels like supermarkets/hypermarkets, convenience stores, and online platforms also play significant roles. Supermarkets and hypermarkets provide convenience and accessibility, online channels offer ease of purchase and home delivery, and convenience stores serve immediate purchase needs. Each channel caters to different consumer preferences and shopping behaviors, contributing to the overall accessibility and availability of wet pet food products.

Wet Pet Food Industry Segments

By Pet

- Dogs

- Cats

By Source

- Animal-based

- Plant Derivatives

- Synthetic

By Distribution Channel

- Pet Specialty Stores t

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

Growth Opportunities

Growing Demand for Convenient and Nutritious Pet Food Options Drives Wet Pet Food Market

Wet pet food manufacturers see great opportunities in meeting pet owner demand for convenient and nutritious pet food options, creating significant market growth potential in wet pet food products. Pet owners increasingly prioritize providing their animals with balanced nutrition - wet pet food is often perceived to provide greater hydration benefits as well as being more palatable and natural-tasting than dry options, leading to a growing market of high-quality, nutritious yet convenient wet options.

Rising Influence of Pet-Centric Social Media Platforms Spurs Wet Pet Food Market

The rising influence of pet-centric social media platforms creates expansive opportunities in the wet pet food market. Social media has become a powerful tool for sharing information and recommendations about pet care and nutrition. Influencers and pet owners often share their experiences and preferences regarding pet food, including the benefits of wet food, influencing purchasing decisions. The viral nature of social media can quickly amplify trends and preferences, including the shift towards more premium wet pet food options, driving market growth as brands leverage these platforms to connect with and educate their target audience.

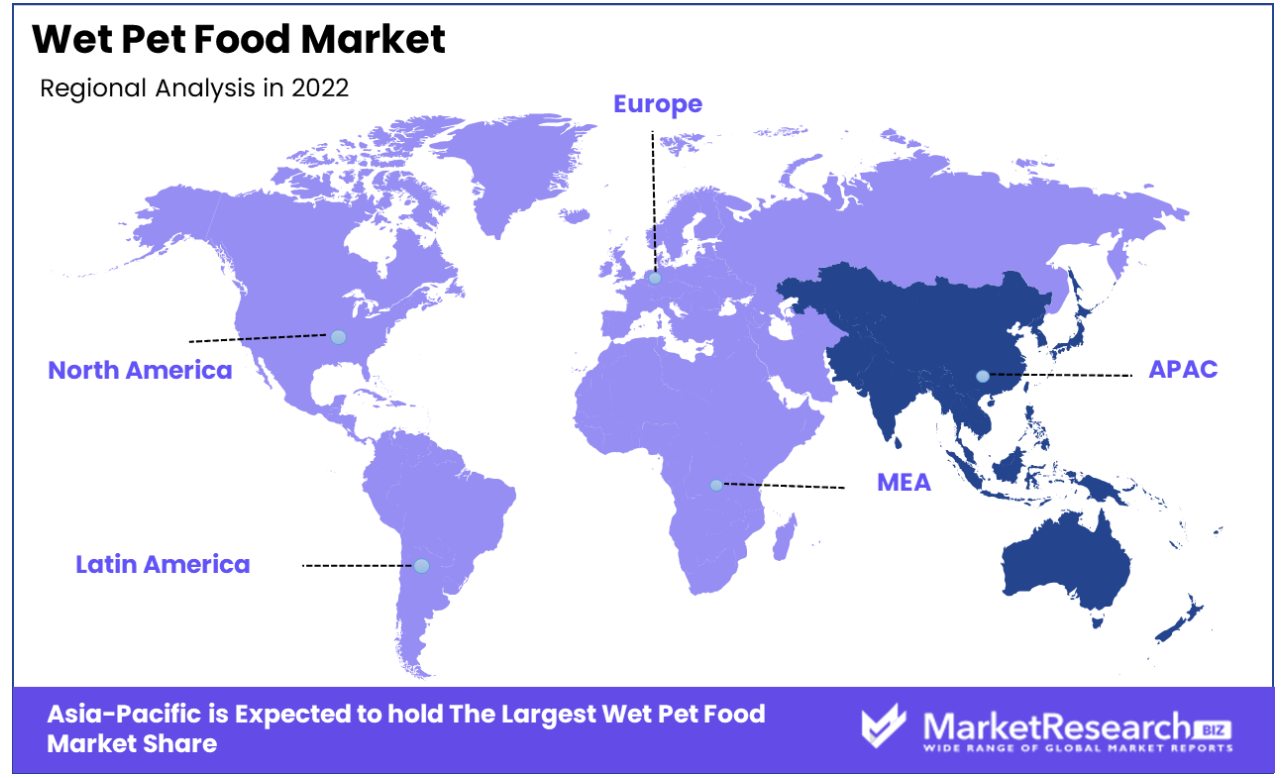

Wet Pet Food Market Regional Analysis

Asia Pacific Dominates with 48.70% Market Share in Wet Pet Food Market

Asia Pacific dominates the wet pet food market with an estimated 48.70% share, due to rising pet ownership rates and awareness among middle-class consumers of health and nutrition issues associated with pets. Countries like China, Japan, and Australia have witnessed an explosion of pet humanization where pets become part of family units leading to greater spending on premium pet food products. Furthermore, expanding retail infrastructure and online platforms for selling pet food help foster market accessibility and growth.

The market dynamics in Asia Pacific are influenced by cultural shifts and rapid urbanization leading to smaller living spaces, where smaller pets are preferred, increasing the demand for convenient and high-quality wet pet food. The region's diverse consumer base and increasing disposable incomes further drive the demand for specialized and premium pet food products. Moreover, local manufacturers are expanding their product lines to include a variety of wet pet food tailored to regional tastes and nutritional needs, intensifying the competition and innovation within the market.

North America: Advanced Pet Care and High Spending

North America's wet pet food market is driven by advanced pet care awareness and consumer spending on pet products, as well as strong humanization of pets within society and an established pet care industry, fuelling demand for quality wet pet food products from leading pet care brands with wide distribution networks.

Europe: Focus on Quality and Nutritional Value

Europe's wet pet food market stands out for its emphasis on quality and nutritional value, thanks to stringent regulations and increasing organic and natural pet food products available on the market. European pet owners' strong understanding of pet health and nutrition supports the demand for premium wet pet food products.

Wet Pet Food Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Wet Pet Food Market Key Player Analysis

In the Wet Pet Food Market, an increasingly competitive sector driven by pet owner demand for high-quality nutrition, the companies listed play significant roles in shaping market dynamics. Mars, Incorporated, and Nestlé Purina PetCare are industry giants, known for their extensive product ranges and global distribution networks. Their strategic positioning emphasizes innovation in nutrition and taste, significantly influencing consumer preferences and industry standards.

Blue Buffalo Co., Ltd., and Hill's Pet Nutrition, Inc. are key players focusing on premium pet food offerings, reflecting the market's trend towards health-oriented and specialized diets. Their commitment to quality and nutritional research underlines the industry's shift towards more scientifically formulated pet foods.

FirstMate Pet Foods and Little BigPaw cater to niche segments with their unique recipes and focus on natural and hypoallergenic ingredients, showcasing the market's diversity and adaptability to various pet needs. Monge SPA and De Haan Petfood, with their European roots, contribute to the market with a blend of traditional and modern pet food offerings, emphasizing regional tastes and preferences.

Wet Pet Food Industry Key Players

- Blue Buffalo Co., Ltd.

- De Haan Petfood

- FirstMate Pet Foods

- Little BigPaw

- Mars, Incorporated

- Monge SPA

- Petguard Holdings, LLC.

- Hill's Pet Nutrition, Inc.

- Nestlé Purina PetCare

- Butcher's Pet Care

Wet Pet Food Market Recent Development

- In June 2023, Mars Petcare Australia, an affiliate of Mars Incorporated, recently made an investment decision of USD 77 Million to expand their cat food production facility in Wodonga, Australia. This project will comprise a 7,800 square meter production line capable of annually producing 25,000 tonnes; this initiative aims to meet market needs while simultaneously improving operations locally, introducing new products, and strengthening Mars Petcare's dominant position within the pet food industry supported by government officials from Victoria state.

- In May 2023, OzPro, a premium pet food brand, introduced its first therapeutic pet food range in Indonesia. This range includes RawFeast freeze-dried raw meat diets, which are sold under the new Booster and Holistic dog and cat food brands.

- In February 2023, Mars Petcare, part of Mars Incorporated, successfully acquired Champion Petfoods - well-known for producing top dog foods ORIJEN and ACANA. This acquisition aligns with Mars Petcare's strategic plan to grow its international product offering including wet pet food as part of its premium market position for pet foods. Champion Petfoods will operate autonomously under Mars Pet Nutrition while providing various options and encouraging development and creativity.

- In 2023, Turkish pet food producer Şadanlar Pet opened a new factory in the Ezine Gıda organized industrial zone in the western part of Turkey to meet the rising demand for its products. The new factory produces both dry and wet pet food products for cats and dogs.

- In April 2022, Nestle invested $90 million to upgrade its Blayney facility in Australia and increase Nestle Purina PetCare's production capacity for Wet Cat Food to keep up with rising demand. By upgrading their facility with cutting-edge technology, single-serve production of wet cat food increased by 120% and local ingredient use has reached over 85%; 20 new jobs were also created as they export both dry and wet pet food products across New Zealand, Thailand, and Japan reaffirming Nestle Purina's importance in local economies over 10 years! In total investment exceeds 200 Million Dollars over 10 years!

Report Scope

Report Features Description Market Value (2023) USD 23.78 Billion Forecast Revenue (2033) USD 43.5 Billion CAGR (2024-2032) 8.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Pet(Dogs, Cats), By Source(Animal-based, Plant Derivatives, Synthetic), By Distribution Channel(Pet Specialty Stores t, Supermarkets/Hypermarkets, Convenience Stores, Online) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Blue Buffalo Co., Ltd., De Haan Petfood, FirstMate Pet Foods, Little BigPaw, Mars, Incorporated, Monge SPA, Petguard Holdings, LLC., Hill's Pet Nutrition, Inc., Nestlé Purina PetCare, Butcher's Pet Care Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Blue Buffalo Co., Ltd.

- De Haan Petfood

- FirstMate Pet Foods

- Little BigPaw

- Mars, Incorporated

- Monge SPA

- Petguard Holdings, LLC.

- Hill's Pet Nutrition, Inc.

- Nestlé Purina PetCare

- Butcher's Pet Care