Weight Loss Surgery Market By Device (Assisting Devices, Implantable Devices, and Others), By Procedure (Sleeve Gastrectomy Surgery, Noninvasive Bariatric Surgery, Gastric Bypass, Adjustable Gastric Banding, Biliopancreatic Diversion with Duodenal Switch (BPD/DS, Revisional Bariatric Surgery, and Mini-Gastric Bypass), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

36261

-

April 2023

-

141

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

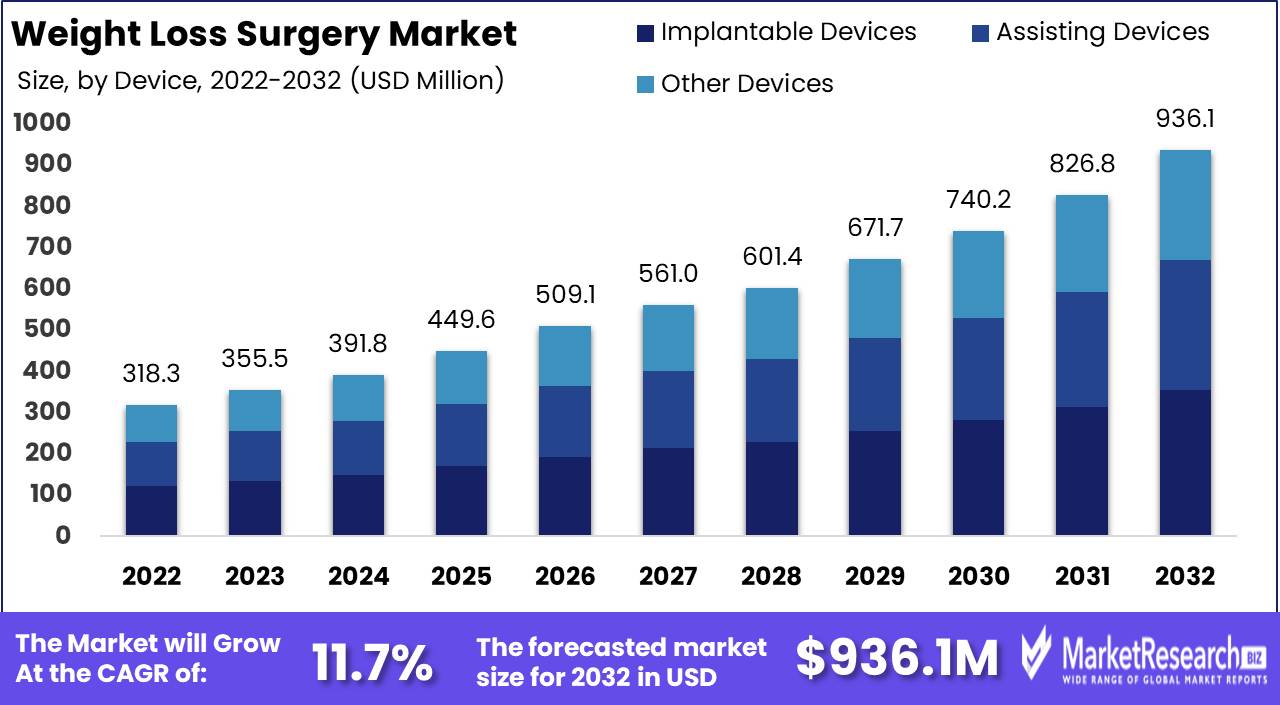

Weight loss surgery Market size is expected to be worth around USD 936.1 Mn by 2032 from USD 318.3 Mn in 2022, growing at a CAGR of 11.7% during the forecast period from 2023 to 2032.

In 2022, the global weight loss surgery market was valued at USD 318.3 million. Between 2023 and 2032, this market is estimated to register a CAGR of 11.7%. Weight loss surgery or bariatric surgery includes a variety of processes performed on individuals who are obese. A treatment known as weight loss surgery involves operating on the digestive system mainly for weight loss purposes.

Indications suggest that weight loss surgery may have lesser death rates for patients with severe obesity, particularly when combined with healthy eating and lifestyle changes, after surgery. Weight loss surgery is designed to alter or interrupt the digestion process so that food is not broken down and absorbed in the usual way. Various operations are being carried out for obese patients as a part of weight loss surgery.

Market Scope

Device Analysis

The Implantable Segment to Witness Significant Growth

Based on devices, the global weight loss surgery market is segmented into assisting devices, implantable devices, and others. The implantable devices segment accounted for the largest market revenue share of 38% in 2022. Due to the introduction of novel products, increase patient awareness, and collaboration with weight loss surgery centers. The new process is based on implantable devices installed by combined flexible and minimally invasive abdominal access. Recently researchers designed a small, implantable device that helps individuals to lose weight. The assisting devices segment was dominating during the historical period and is estimated to hold the second largest market share.

By Procedure Analysis

The Sleeve Gastrectomy Segments Dominated the Global Weight Loss Surgery Market Growth

Based on procedure, the global weight loss surgery market is divided into sleeve gastrectomy surgery, noninvasive bariatric surgery, gastric bypass, adjustable gastric banding, biliopancreatic diversion with duodenal switch (BPD/DS), revisional bariatric surgery, and mini-gastric bypass. Among these, the sleeve gastrectomy segment is anticipated for the largest share of the market in 2022. The increasing benefits of sleeve gastrectomy can be attributed to the significant proportion of the market.

Compared to other surgeries, aids include price, safety, effectiveness, and few problems. The increasing advantages of sleeve gastrectomy drive segment growth during the forecast period. Advantages include affordability, efficacy, and limited problems related to other surgery processes. The gastric bypass accounted for the second-largest market revenue share growth during the forecast period. This surgery reduces the risk of obesity-related life-threatening problems such as high cholesterol, obstructive sleep apnea, and high blood pressure.

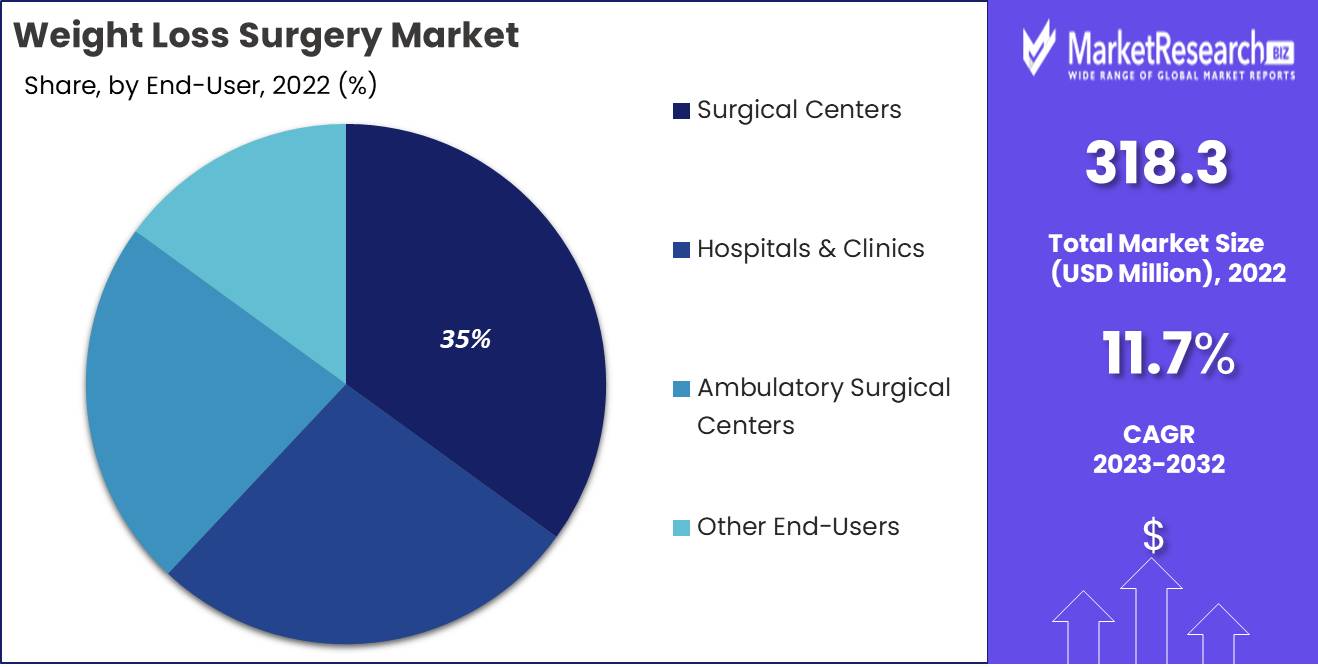

By End-User Analysis

The Surgical Centers Segment is Expected to Show Lucrative Growth During the Forecast Period

Based on the end-user, the global weight loss surgery market is classified into hospitals & clinics, ambulatory surgical centers, surgical centers, and others. Among these surgical centers segment dominated the market with the largest share of 35% in 2022. Due to a rise in bariatric surgery worldwide, surgical centers provide new facilities related to the surgery on same-day surgical care, including protective and diagnostic methods. The hospitals & clinics loss programs segment is expected to grow at the fastest CAGR during the forecast period.

Key Market Segments

By Device

- Assisting Devices

- Implantable Devices

- Other Devices

By Procedure

- Sleeve Gastrectomy Surgery

- Noninvasive Bariatric Surgery

- Gastric Bypass

- Adjustable Gastric Banding

- Biliopancreatic Diversion with Duodenal Switch(BPD/DS)

- Revisional Bariatric Surgery

- Mini-Gastric Bypass

By End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Surgical Centers

- Other End-Users

Market Dynamics

Drivers

Increasing Number of Bariatric Surgery

The increasing demand for bariatric surgeries performed is projected to result in the rising demand for related devices and equipment. The surgical weight loss process has become more prevalent as it is safer and more effective than standard medical methods, including medications and dietary counseling. Moreover, government support and rising awareness about unhealthy foods and beverages on the market are expected to increase requirements for weight loss surgery during the forecast period. The market is mainly driven by the increasing prevalence of obesity among adults and the rising efficacy of innovative manufacturing.

Additionally, rising reimbursement policies for surgeries by the government in developed nations are projected to drive market growth. Increasing demand for minimally invasive techniques is the major factor that propels the market growth. Bariatric surgery has increased gradually in recent years across the world. Increase prevalence of obesity there has been a continuous surge in the demand for weight loss methods in the present years.

Restraints

Uncertain Regulatory Environment in the Medical Device Industry

There are many adverse effects and risks related to weight loss surgery. One of the major factors that hamper the growth of the market is the rising number of problems in the procedure of receiving approvals for the clinical use of these devices. Emerging markets are working hard to establish a regulatory framework that will differentiate between pharmaceutical and medical equipment. As there is no clear difference between drugs and equipment, the approval method is unstable. hence resulting in delays.

Thus, unstable regulatory frameworks are projected to rise approval time for surgical instruments, thus hindering market growth. The factors hindering the growth of the market include a lack of faith among patients and primary care providers regarding the efficacy of the surgery and fear of associated risks.

Opportunity

Increasing Approval for Weight Loss Surgeries in Developing Markets

Different bariatric surgeries are available. Weight loss surgery offers individuals significant and sustained weight loss. Weight loss surgery is very safe and, when performed by a knowledgeable and experienced team. Increasing approval of weight loss surgeries in developing markets offers significant opportunities for market growth. The minimally invasive methods of bariatric surgery offer various advantages such as decreased pain, fewer wound complications, and shorter hospital stays.

Trends

Regional Governments in Developed Countries Increase Reimbursement Coverage and Sponsor Weight Loss Surgery Driving the Market Growth

According to the World Health Organization billions of individuals are overweight, of which millions are obese. Huge healthcare spending is forcing governments to take action to reduce the incidence of obesity and obesity-related long-term chronic disorders. The market is mainly boosted by the increasing incidence of obesity among adults. Utilization of bariatric surgery showed a gradual increase in the first 5 years. Laparoscopic surgery continues to dominate weight loss surgery compared with open surgery is the trend in the market.

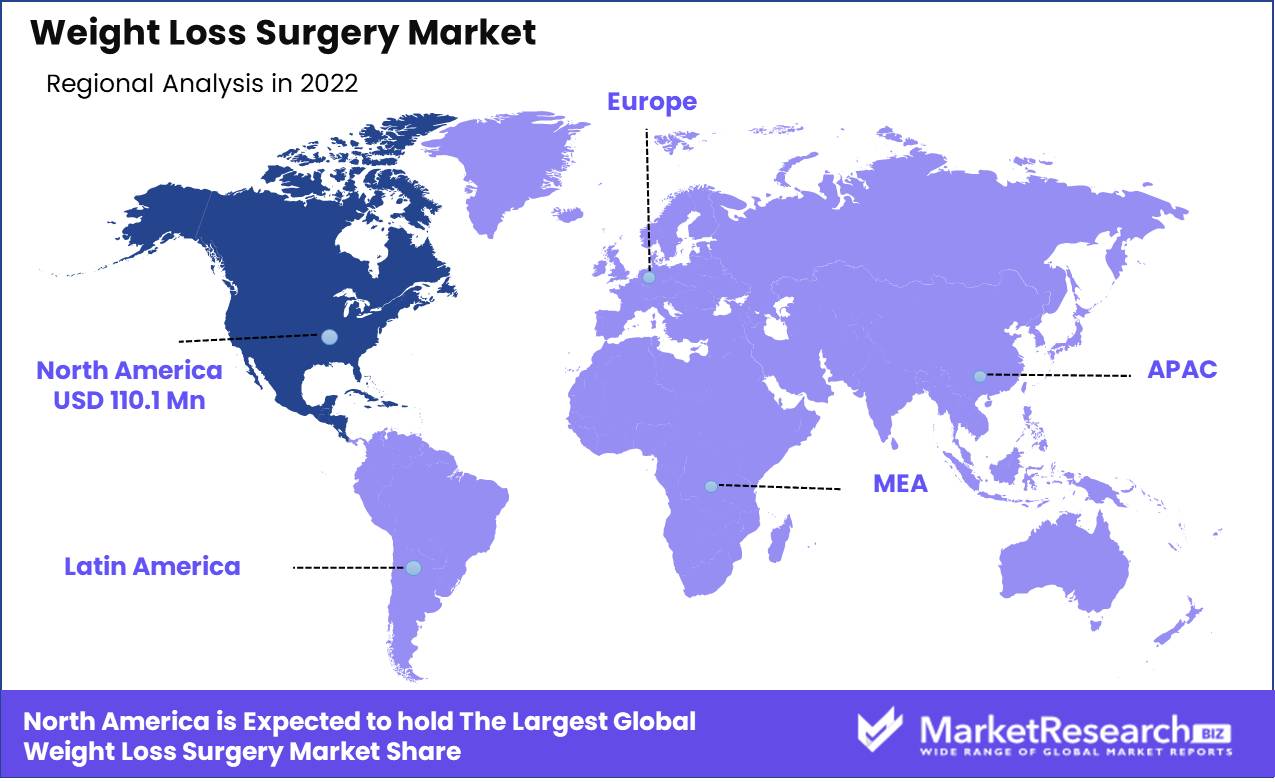

Regional Analysis

North American region accounted for a Significant Share of the Global Weight Loss Surgery Market

North America accounted for a significant global weight loss surgery market share of revenue 34.6% during the forecast period, The rapidly rising growth of the regional market is attributed to factors such as the increasing prevalence of chronic disease, the incidence of diabetes, and obesity. The number of bariatric surgeries and increasing cost of healthcare.

Europe is projected for the second-largest market share during the forecast period. The rising number of surgical device manufacturers and distributors and the massive government funding for research drive the European weight loss surgery market. The Asia-Pacific is expected to show the fastest CAGR in 2022. The availability of skilled healthcare professionals and the increasing geriatric population are the key factors contributing to the market growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Major market players are spending a lot on R&D to rise their product lines, which will benefit the weight loss surgery market grow even more. Market participants are also taking several strategies to grow their market globally, with, market advances such as novel product launches, collaborations, partnerships, and acquisitions & merges. With the increasing patient awareness levels and rising obese population, a few other smaller players are estimated to enter the market in the upcoming years. various prominent key players in the market include Mediflex Surgical Products, Olympus Corporation, Intutive Surgical, Inc., Johnson & Johnson, Medtronic plc, Aspir Bariatrics, Inc., Intuitive Surgical, Inc., and Other key players.

Market Key Players

The following are some of the major players in the global weight loss surgery industry

- Mediflex Surgical Products

- Olympus Corporation

- Intuitive Surgical, Inc.

- Grena Ltd.

- ReShape Lifesciences, Inc.

- L. Gore & Associates, Inc.

- Johnson & Johnson

- Medtronic plc

- Braun Melsungen AG

- Victor Medical Instruments Co, Ltd.

- Aspir Bariatrics, Inc.

- Applied Medical Resources Corporation

- Standard Bariatrics, Inc.

- Allergan Inc.

- Apollo Endosurgery Inc.

- Ethicon Inc.

- TransEnterix Surgical, Inc.

- Other

Recent Development

- January 2022- Johnson & Johnson cooperated with Microsoft, an American multinational technology company. This partnership intended to agree for companies to enhance and assist the JJMD’s safe and compliant digital surgery ecosystem of the Johnson & Johnson Devices Companies by leveraging the Microsoft Clouds abilities.

- June 2021- Intuitive Surgical Inc., revolved out SureForm, a robotic-assisted surgical stapler. The novel solution includes the capability to make automatic changes to the firing procedure to aid in optimizing a stable staple line and avoid destruction to tissue during a variety of tissue thicknesses.

- May 2022- Reshape Lifesciences signed a contract with OpenLoop, an expert in full-stack virtual care delivery services. Under this contract, the companies would deal with a nationwide telehealth solution for reshaping care through virtual weight loss coaching led by a specialized physician.

Report Scope

Report Features Description Market Value (2022) USD 318.3 Mn Forecast Revenue (2032) USD 936.1 Mn CAGR (2023-2032) 11.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device-Assisting Devices, Implantable Devices, and Others; By Procedure-Sleeve Gastrectomy Surgery, Noninvasive Bariatric Surgery, Gastric Bypass, Adjustable Gastric Banding, Biliopancreatic Diversion with Duodenal Switch(BPD/DS), Revisional Bariatric Surgery, and Mini-Gastric Bypass; By End-User- Hospital & Clinics, Ambulatory Surgical Centers, Surgical Centers, and Other End-Users Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Mediflex Surgical Products, Olympus Corporation, Intuitive Surgical, Inc., Grena Ltd., ReShape Lifesciences, Inc., W.L. Gore & Associates, Inc., Johnson & Johnson, Medtronic plc, B. Braun Melsungen AG, Victor Medical Instruments Co, Ltd., Aspir Bariatrics, Inc., Applied Medical Resources Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Mediflex Surgical Products

- Olympus Corporation

- Intuitive Surgical, Inc.

- Grena Ltd.

- ReShape Lifesciences, Inc.

- L. Gore & Associates, Inc.

- Johnson & Johnson

- Medtronic plc

- Braun Melsungen AG

- Victor Medical Instruments Co, Ltd.

- Aspir Bariatrics, Inc.

- Applied Medical Resources Corporation

- Standard Bariatrics, Inc.

- Allergan Inc.

- Apollo Endosurgery Inc.

- Ethicon Inc.

- TransEnterix Surgical, Inc.

- Other Key Players