Wearable Computing Market By Product Type (Smartwatches, Smart glasses, Others), By Connectivity (Wi-Fi, 4G/5G), By End-use (Fitness and wellness, Medical and healthcare, Others), By Application (Healthcare, Fitness), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

14184

-

Oct 2023

-

158

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Overview

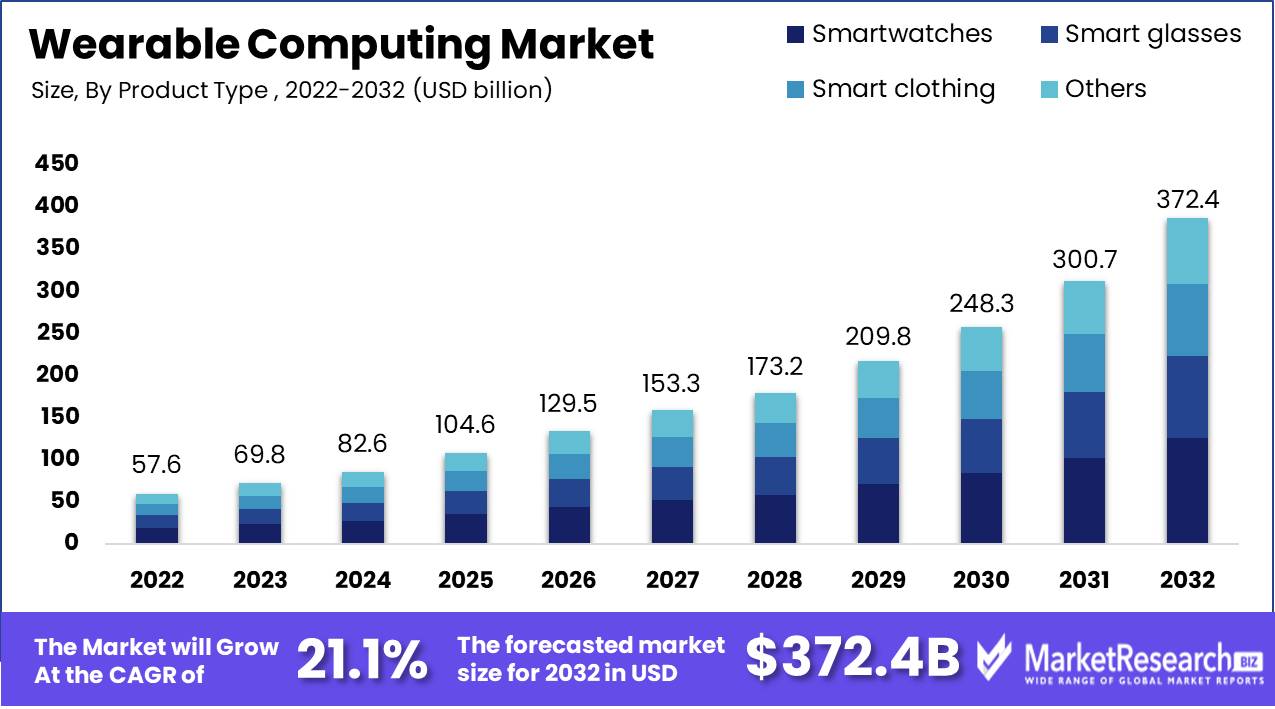

The Wearable Computing Market size is expected to be worth around USD 372.4 Bn by 2032 from USD 57.6 Bn in 2022, growing at a compound annual growth rate of 21.1% during the forecast period from 2023 to 2032.

Wearable computing market growth has seen exponential expansion over the years due to consumer adoption of smart wearable technology products like smartwatches, fitness trackers, smart glasses, and clothing designed to offer real-time information and feedback about health, fitness, productivity and entertainment aspects of life.

The surge in wearable computing device sales can be attributed to several factors, including increasing awareness of health and fitness among consumers, greater adoption of mobile devices and IoT, as well as technological developments like artificial intelligence (AI) and voice assistants. Furthermore, wearable devices' increased popularity among millennials and younger generations is fuelling its expansion.

Technology and fashion have combined to spur advances in wearable computing. Collaborations between fashion labels and tech companies have produced wearables with both aesthetic appeal and utility, such as Gucci and Oura's partnership for sleep and activity tracking rings; similarly, Levi's and Google's Jacquard project produced jackets with integrated touch controls demonstrating this integration of style and function in wearables.

Wearable technology has made significant advances, both for consumers and healthcare applications. A sensor-equipped belt designed to monitor heart failure parameters stands as an exemplary use case of wearable technology in modern healthcare and displays how well medical sensors and wireless connectivity mesh together. As wearable computing continues its rapid evolution, we are witnessing both rising consumer interest and growing technological sophistication; with new patents filed as evidence of such growth.

Consumer market wearable computing has seen incredible progress across various industries, such as healthcare, sports, and entertainment. Major healthcare players utilize wearable devices to monitor patients' health while providing real-time data to healthcare professionals - an indication of the wearable's rising popularity. Meanwhile, in sports, smartwatch technology has grown increasingly prevalent as precise performance tracking enables real-time data dissemination to coaches for transformed decision-making processes.

This evolution in wearable tech is being driven by consumer demand and penetrating ever wider target markets. A number of established and new players are shaping the wearable computing market share today as it responds to consumers seeking style, utility, and improved well-being.

Driving Factors

Integration of AI and Voice Assistants

Voice assistant integration and AI technology are also helping wearable gadgets gain industry traction, as these features make them more user-friendly by providing access to information or managing devices hands-free.

Technological Innovations

One of the major key drivers behind wearable computing's rise is technological development - specifically compact and cost-effective devices becoming available to wider audiences.

Increase Consumer Acceptability of your product/service offering

Wearable computing industry growth can be attributed to consumer acceptance of wearable technology. People are becoming more knowledgeable about its benefits such as fitness monitoring, tracking health data, and convenient features - leading them to spend money on wearable devices.

Healthcare Applications

Wearable computing has quickly become an integral component of healthcare applications, thanks to features like its portability and ease of use. Wearable computers have quickly become popular gadgets that satisfy increasing consumer demands for wearable devices.

Restraining Factors

Lack of Consumer Awareness.

One factor limiting market growth is consumer ignorance of wearable computing devices and their advantages. Many individuals remain unfamiliar with such devices, making it hard for companies to promote and sell them successfully.

Data Security Concerns

One factor restraining wearable computing market growth may be data security concerns. Wearable devices collect an increasing amount of personal information which raises security worries; consumers who lack trust that their data is safe may hesitate to use wearable devices.

High Costs of Wearable

Furthermore, high costs associated with wearable devices could impede market expansion. Many are still relatively costly for consumers and therefore less accessible.

Short Battery Life

Additionally, wearable devices with limited battery lives could also present a barrier. When consumers must charge their devices regularly in order to use them regularly, their usage could decline significantly.

Product Analysis

The smartwatch segment is projected to remain dominant within the wearable technology devices market throughout its forecast period. Boasting health and fitness tracking capabilities, smartwatches have gained widespread appeal among health-minded consumers. Major players such as Apple and Fitbit are offering innovative models with advanced features, driving growth in this segment.

Smart glasses and clothing segments are projected to experience rapid expansion over the coming years, driven by increasing adoption of augmented and virtual reality experiences across industries like healthcare, education, and gaming. According to Marketresearch.biz estimates, smart glasses sales should experience compound annual compound growth of 21.2% until 2025.

Smart clothing is quickly growing in popularity due to the integration of sensors and electronics that allow wearers to monitor body temperature, heart rate, and other biometrics. Being able to continuously track health metrics has propelled demand for such garments - this segment should experience steady expansion as technology becomes mainstream.

Connectivity Analysis

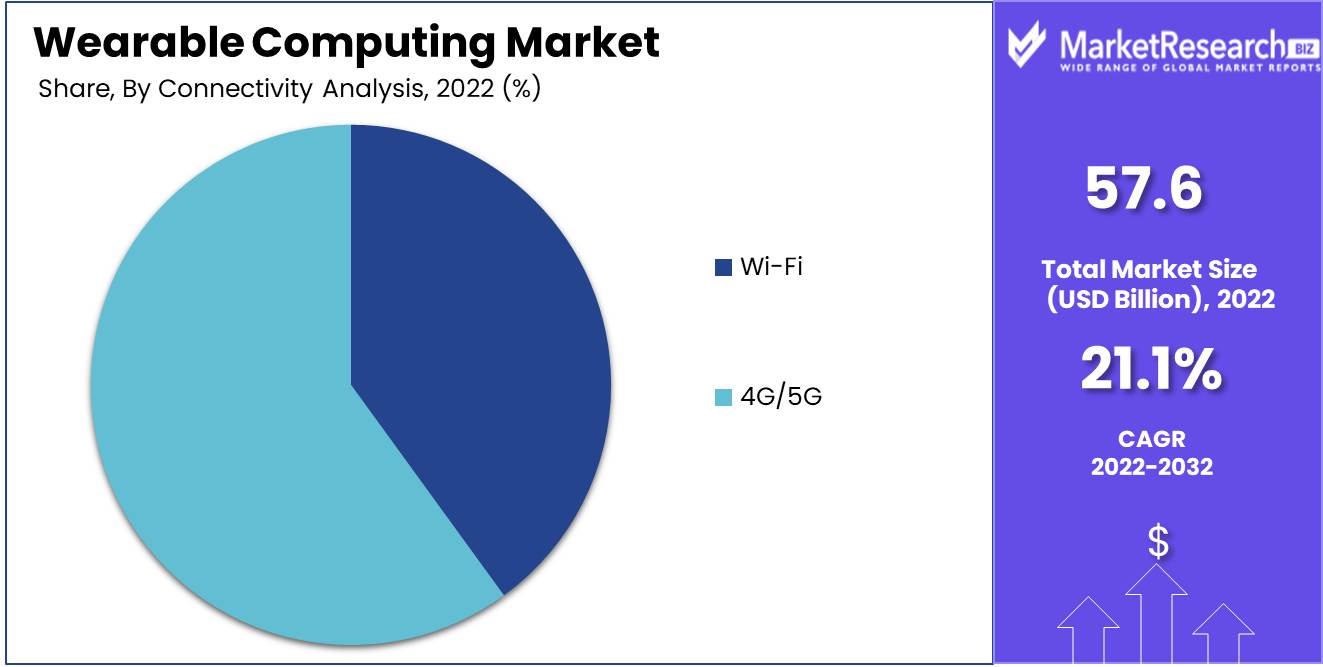

Wi-Fi devices held the highest market share in 2022 and are projected to remain dominant over the forecast period, driven mainly by their increasing adoption as smartwatches and fitness trackers with Wi-Fi capabilities.

However, the 4G/5G segment is projected to experience rapid expansion during this forecast period due to surging demand for real-time data transmission and high-speed internet connectivity - driving growth further by the development of 5G technology in coming years.

End-use Analysis

In 2022, fitness and wellness accounted for the greatest share of the market and is expected to maintain this dominance during the forecast period due to increasing health-conscious consumer adoption of wearable devices to track their fitness activities.

Medical and healthcare are projected to experience steady growth throughout the forecast period, as wearable devices become increasingly utilized by healthcare practitioners to monitor patients, track vital signs, and facilitate remote patient monitoring.

The infotainment sector is projected to experience moderate growth over the forecast period. Wearable devices such as smart glasses and smartwatches are becoming increasingly popular for entertainment purposes such as watching videos, playing games, and listening to music.

Application Analysis

The wearable computing market can be broadly divided into healthcare and fitness applications. Of these segments, healthcare is expected to account for the largest portion of market shares by 2030 while fitness should experience rapid expansion over its forecast period.

Growing demand for remote patient monitoring and the rise in chronic diseases are expected to fuel healthcare sector expansion over the forecast period, while hospitals and clinics increasingly demand wearable devices that monitor patients remotely.

Wearable devices in fitness are used to track physical activity such as steps taken, distance traveled and calories burned. They also monitor heart rate and sleep patterns, helping monitor heart rates and patterns more accurately. As awareness about fitness grows among enthusiasts and demand increases for wearable devices surges accordingly, the growth of this segment should accelerate rapidly.

Key Market Segmentation

By Product Type

- Smartwatches

- Smart glasses

- Smart clothing

- Others

By Connectivity

- Wi-Fi

- 4G/5G

By End-use

- Fitness and wellness

- Medical and healthcare

- Infotainment

- Industrial

- Defense

By Application

- Healthcare

- Fitness

Growth Opportunity

- Consumer adoption of wearable technology devices is one of the primary drivers of industry growth. These devices help people monitor their health by keeping track of vital signs, physical activity levels, and sleep cycles.

- Healthcare industries have been among the primary beneficiaries of this technology, enabling doctors to remotely monitor patients and provide better care. Furthermore, sports and fitness tracking devices are driving the growth of this market segment.

- Smartwatch sales are expected to surge with an increasing smartphone user base and technological innovations like GPS, Wi-Fi, and cellular connectivity in smartwatches driving demand for these devices. Contactless payment's growing popularity should further fuel demand.

Latest Trends

Health and Wellness Monitoring

Wearable devices are evolving into sophisticated monitoring tools for health and well-being. Going far beyond simple step tracking, modern wearables can track heart rate, sleep pattern, and blood pressure monitoring as well as detect irregular heart rhythms. As more emphasis is placed on personal fitness and well-being, wearable devices have evolved into comprehensive health management tools, giving users access to real-time data as well as actionable insights so that informed decisions about well-being can be made by users themselves.

Augmented Reality (AR) Glasses

Augmented reality wearables such as smart glasses are becoming increasingly popular across various industries. These devices place digital information onto a user's field of vision, offering new opportunities for improving productivity and experience. Manufacturers, logisticians, and healthcare practitioners are using AR glasses for tasks like remote assistance, training sessions, and real-time data visualization; as technology improves, AR wearables could revolutionize how people work and interact with their environments.

Sustainable and Eco-Friendly Design

As part of a larger global initiative to reduce electronic waste and minimize carbon footprints, there has been an upsurge in eco-friendly products being sold in wearable computing markets such as wearable computing. Manufacturers are using recycled materials, cutting energy consumption, and providing end-of-life recycling options for devices manufactured. Consumers have become more environmentally aware, prompting companies to develop wearable devices that combine high technology and sustainability. This trend falls in line with efforts made globally to reduce electronic waste while at the same time reducing carbon emissions from such devices.

Regional Analysis

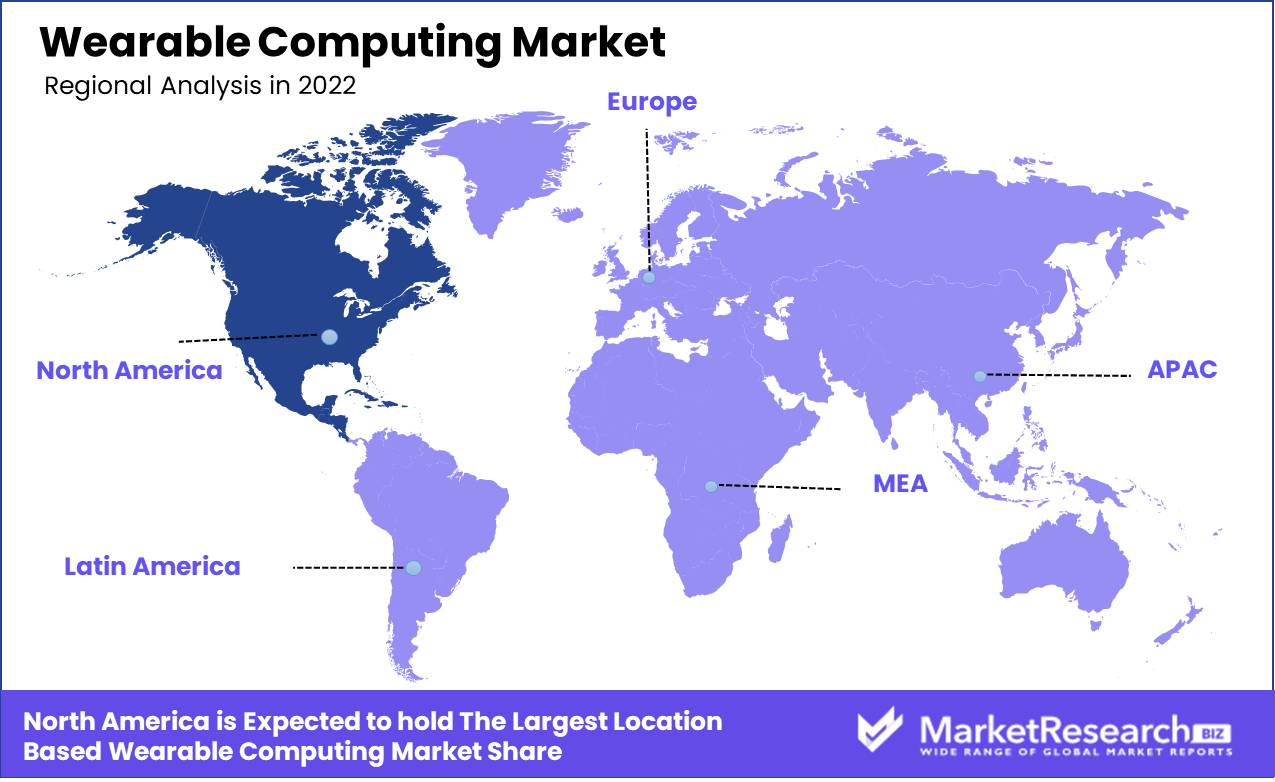

North America dominates the Wearable Computing Market due to various factors, including robust technological infrastructure, high disposable income levels, and early adoption of technology. The United States in particular serves as an engine of growth within this region due to its huge tech giants with innovative startups and large investments into technological research and development.

North America continues to lead wearable computing adoption thanks to both enterprise and consumer adoption of wearable devices in fitness, healthcare, logistics, and manufacturing sectors. Their versatility, productivity-boosting abilities, and rising enterprise demand for connected technologies further solidify North America's market leadership status in this space.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

- Apple Inc. stands out in this industry with a powerful brand, dedicated customer base, and comprehensive ecosystem - however, its premium prices and closed ecosystem can limit accessibility for some consumers. Opportunities lie within healthcare innovations as well as virtual/augmented reality innovations while potential threats include stiff competition and regulatory scrutiny.

- Samsung Electronics provides an array of wearable devices that integrate seamlessly with their devices; however, competition in the Android ecosystem is fierce. Samsung can leverage its expertise in display technology and IoT devices while emphasizing healthcare and wellness to strengthen its market position.

- Fitbit, now under Google ownership and known for its accurate fitness tracking technology, remains competitive against smartwatch companies like Apple. By tapping into Google's resources and making better use of Android ecosystem integration features, Fitbit could enhance health tracking while better integrating into the Android ecosystem. Nevertheless, concerns over privacy issues and regulatory scrutiny persist and remain an obstacle.

- Garmin offers GPS wearables designed for outdoor and sports enthusiasts, yet their niche focus limits their market share. Exploring smartwatch features and using their expertise for location-based services offer growth potential; competition from larger tech companies may pose potential threats; while constant innovation could serve as an advantage.

Top Key Players

- Apple

- Google LLC

- Garmin

- Huawei Technologies Co., Ltd.

- Samsung Electronics

- Sony Corporation

- Xiaomi Corporation

- Nike Inc

- Fossil Group, Inc.

- Sensoria Inc.

- LG Electronics Inc.

- Smartlife Technology Ltd

- Adidas AG

- Fitbit Inc

Recent Development

- The apparel industry remains a hub for patent innovation, driven by technology, convenience, and comfort. Over the past three years, there have been over 57,000 patents filed and granted in the apparel industry, showcasing the industry's commitment to innovation.

- Fashion brands like Gucci are partnering with tech companies to create smart wearables that combine fashion with wellness tracking. Such as, Oura partnered with Gucci to connect fashion wearables to wellness, tracking things like sleep and heart rate. Levi's and Jacquard by Google created a jacket with touch and gesture interactivity.

- In November 2022, a significant development was reported in the field of wearable computing related to heart failure management. Researchers, Sheikh M. A. Iqbal, Imadeldin Mahgoub, E Du, Mary Ann Leavitt, and Waseem Asghar, published an article in Scientific Reports describing the creation of a wearable belt with integrated sensors designed for monitoring multiple physiological parameters associated with heart failure.

Report Scope

Report Features Description Market Value (2022) USD 57.6 Bn Forecast Revenue (2032) USD 372.4 Bn CAGR (2023-2032) 21.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Smartwatches, Smart glasses, Smart clothing, Others), By Connectivity (Wi-Fi, 4G/5G), By End-use (Fitness and wellness, Medical and healthcare, Infotainment, Industrial, Defense), By Application (Healthcare, Fitness) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Apple, Google LLC, Garmin, Huawei Technologies Co., Ltd., Samsung Electronics, Sony Corporation, Xiaomi Corporation, Nike, Fossil Group, Inc., Sensoria Inc., LG Electronics Inc., Smartlife Technology Ltd, Adidas AG, Fitbit Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Apple

- Google LLC

- Garmin

- Huawei Technologies Co., Ltd.

- Samsung Electronics

- Sony Corporation

- Xiaomi Corporation

- Nike Inc

- Fossil Group, Inc.

- Sensoria Inc.

- LG Electronics Inc.

- Smartlife Technology Ltd

- Adidas AG

- Fitbit Inc