Global Water Repellant Agent Market By Type(Silicone, Polyurethane, Teflon), By End Users(Construction, Textile, Leather, Medical, Furniture, Others), By Technology Types(Water-Based, Solvent Based), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

21891

-

April 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

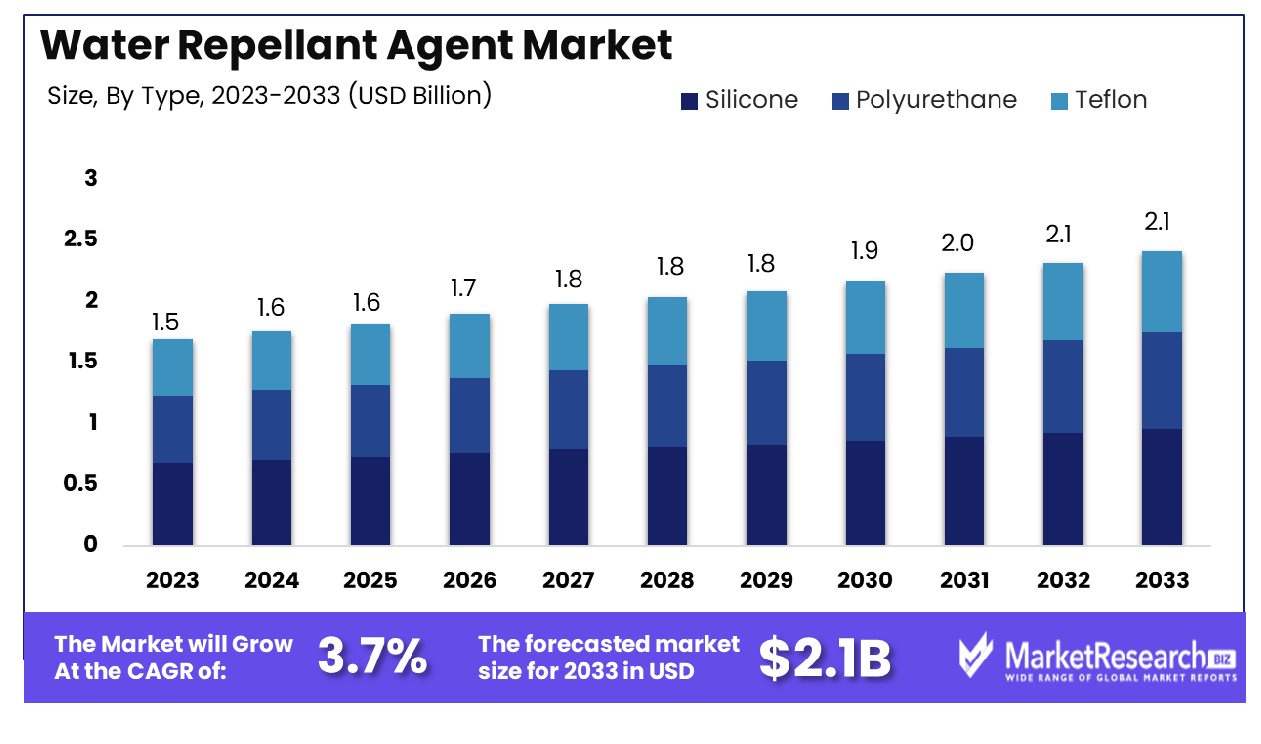

The Global Water Repellant Agent Market was valued at USD 1.5 billion in 2023. It is expected to reach USD 2.1 billion by 2033, with a CAGR of 3.7% during the forecast period from 2024 to 2033.

The Water Repellent Agent Market refers to the burgeoning sector dedicated to the development, manufacturing, and distribution of specialized compounds designed to enhance the water resistance of various surfaces. These agents are engineered to impart hydrophobic properties to substrates, ranging from textiles and building materials to electronic devices and automotive components.

As consumer demand for durable and weather-resistant products escalates, this market witnesses steady growth, driven by technological advancements and heightened environmental consciousness. Market players encompass diverse industries, including textiles, construction, electronics, and the automotive industry, catering to the needs of discerning consumers and industries seeking to fortify their products against moisture-related damage.

The water-repellent agent market continues to exhibit promising prospects, underpinned by evolving consumer preferences towards sustainable and resilient construction materials. As industries adapt to environmental imperatives, the demand for water-repellent agents, integral to enhancing the durability and longevity of various structures, escalates. The market’s growth rate trajectory remains resilient, navigating through the ebbs and flows of global economic dynamics and industry-specific fluctuations.

Supportive data from diverse segments of the construction industry elucidate the nuanced landscape shaping the water-repellent agent market. Softwood lumber prices, despite a notable decline in 2023, sustained levels significantly above pre-pandemic benchmarks, signifying sustained demand and construction activity.

Conversely, gypsum building materials experienced a modest downturn, reflecting fluctuating market conditions. However, the consistent upward trend in ready-mix concrete prices underscores the enduring need for construction materials fortified against environmental degradation, wherein water-repellent agents play a pivotal role.

Moreover, steel mill product prices, while exhibiting a recent decline, underscore the overarching economic dynamics influencing construction material markets, further accentuating the relevance of water-repellent agents in fortifying infrastructure against corrosion and weathering.

Key Takeaways

- Market Growth: The Global Water Repellant Agent Market was valued at USD 1.5 billion in 2023. It is expected to reach USD 2.1 billion by 2033, with a CAGR of 3.7% during the forecast period from 2024 to 2033.

- By Type: Silicone-based water-repellent agents command a dominant market share of 55%.

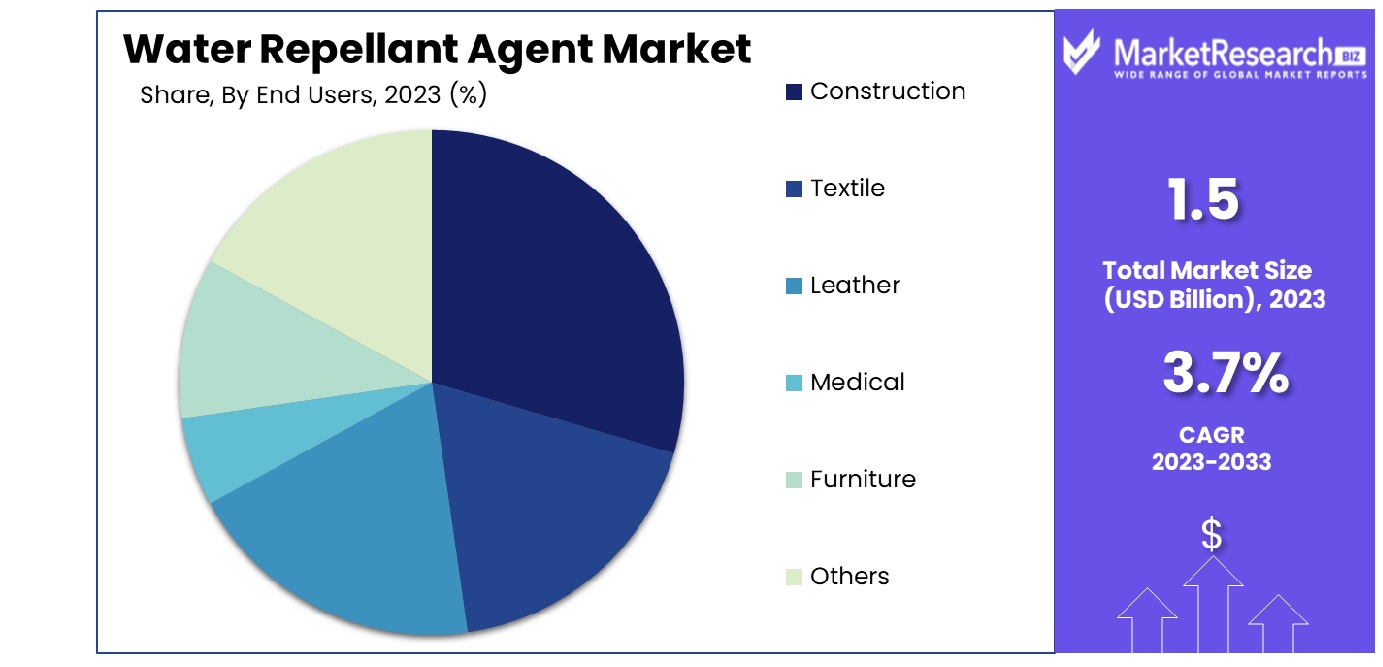

- By End Users: The construction sector leads in water-repellent agent usage at 35%.

- By Technology Types: Water-based technologies prevail, capturing a significant 60% market dominance.

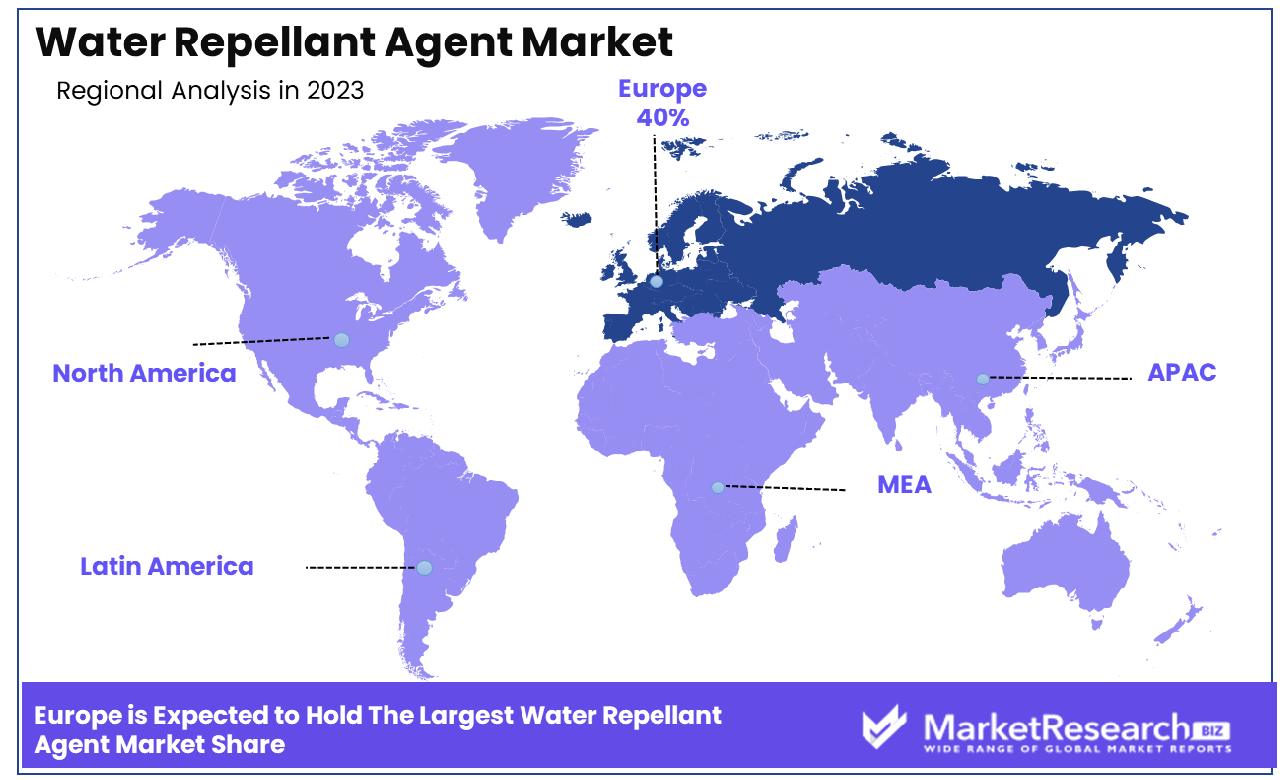

- Regional Dominance: In Europe, the water repellant agent market holds a significant share, capturing 40%.

- Growth Opportunity: The 2023 growth outlook for the global water repellant agent market is promising, driven by increased awareness of waterproofing solutions in outdoor gear and a surge in demand for water-resistant coatings in electronics.

Driving factors

Demand for Waterproofing Components in the Automobile Industry Drives Market Growth

The demand for waterproofing components in the automobile industry significantly propels the growth of the Water Repellent Agent Market. As automotive manufacturers strive to enhance the durability and longevity of their vehicles, the need for effective waterproofing solutions becomes paramount.

With increasing consumer expectations for vehicles that can withstand various environmental conditions, including rain and snow, automakers are integrating water-repellent agents into their manufacturing processes. This integration not only ensures the protection of sensitive electronic components but also enhances the overall performance and reliability of vehicles.

Moreover, stringent regulations regarding vehicle safety and environmental standards further incentivize automotive manufacturers to invest in high-quality water-repellent agents. These regulations drive the adoption of durable and eco-friendly solutions, thereby fueling the demand for advanced water-repellent products in the automobile industry.

Upsurge in Durable Water Repellent Products Spurs Market Growth

An upsurge in durable water-repellent products amplifies the growth trajectory of the Water Repellent Agent Market. Consumers are increasingly prioritizing products that offer long-lasting waterproofing capabilities, especially in outdoor apparel, footwear, and construction materials. This surge in demand for durable solutions is fueled by growing awareness of environmental sustainability and the desire for products that provide extended protection against moisture and stains.

Manufacturers are responding to this trend by developing innovative formulations that combine effective water repellency with durability, resulting in products that withstand repeated use and harsh environmental conditions. As a result, the market is witnessing a proliferation of durable water-repellent agents across various industries, driving overall market growth.

Market Size Growth Projections Validate Market Expansion

The market size growth projections serve as a testament to the expanding opportunities within the Water Repellent Agent Market. With forecasted increases in market size, industry stakeholders are presented with a compelling outlook for future growth and investment. These projections instill confidence among market players, encouraging them to capitalize on emerging trends and opportunities within the water-repellent agent landscape.

Moreover, robust market size growth projections attract new entrants and investment capital into the market, fostering competition and innovation. As the market continues to expand, fueled by factors such as technological advancements and shifting consumer preferences, it presents lucrative opportunities for businesses to capitalize on the growing demand for water-repellent agents across diverse applications and industries.

Restraining Factors

Cost Barrier Mitigation Through Technological Advancements

The high cost of fluoropolymers compared to customary materials has historically hindered the widespread adoption of water-repellent agents. However, technological advancements have been pivotal in mitigating this barrier. Manufacturers are increasingly investing in research and development to enhance production processes, optimize material usage, and reduce costs.

For instance, innovations in nanotechnology have enabled the development of highly efficient water-repellent agents that require lower quantities of fluoropolymers, thereby driving down production expenses. Additionally, economies of scale resulting from growing demand have contributed to cost-reduction efforts.

Consequently, the market is witnessing a gradual alleviation of the cost burden associated with fluoropolymers, making water-repellent agents more accessible to a broader consumer base.

Navigating Regulatory Challenges with Compliance Strategies

Regulatory challenges pose a significant restraint on the growth of the water-repellent agent market, primarily due to stringent environmental and safety regulations. However, proactive compliance strategies have emerged as a key driver in overcoming these obstacles. Market players are investing in comprehensive regulatory intelligence and compliance management systems to ensure adherence to evolving regulatory frameworks.

By staying abreast of regulatory updates and proactively implementing necessary measures, companies can mitigate risks associated with non-compliance, thereby safeguarding their market presence and fostering consumer trust.

Furthermore, strategic partnerships with regulatory bodies and industry associations facilitate knowledge exchange and collaboration on compliance initiatives. This proactive approach not only ensures market compliance but also enhances brand reputation and credibility, thereby fostering sustainable growth in the water-repellent agent market.

By Type Analysis

Silicone-based water-repellent agents dominate the market with a commanding 55% share by type.

In 2023, Silicone held a dominant market position in the By Type segment of the Water Repellant Agent Market, capturing more than a 55% share. This remarkable performance can be attributed to the widespread adoption of silicone-based water repellants across various industries due to their superior properties and effectiveness. Silicone-based water repellants offer excellent durability, weather resistance, and versatility, making them the preferred choice for applications such as construction, automotive, and textiles.

Polyurethane, another significant player in the market segment, exhibited steady growth in 2023. With its ability to form tough, flexible coatings that provide exceptional waterproofing and protective properties, polyurethane-based water repellants are gaining traction in industries where durability and performance are paramount. The versatility of polyurethane formulations further contributes to its increasing adoption across diverse end-user applications.

Teflon, while maintaining a relatively smaller market share compared to Silicone and Polyurethane, continues to carve out its niche in the water-repellant agent market. Known for its non-stick and low-friction properties, Teflon-based water repellants find application in specialized industries such as electronics, aerospace, and cookware. Although facing stiff competition from other types, Teflon remains a preferred choice in applications where chemical resistance and high-temperature stability are critical requirements.

Overall, the By Type segment of the Water Repellant Agent Market witnessed significant developments in 2023, with Silicone emerging as the dominant player, closely followed by Polyurethane and Teflon.

By End Users Analysis

Construction emerges as the leading end-user, commanding a significant 35% market share.

In 2023, Construction held a dominant market position in the By End Users segment of the Water Repellant Agent Market, capturing more than a 35% share. The construction sector's substantial share can be attributed to the increasing demand for water-repellant agents in various construction applications, including building exteriors, concrete surfaces, and roofing materials.

As the construction industry continues to expand globally, particularly in emerging economies, the need for effective water-repellant solutions to enhance structural durability and longevity remains paramount. Moreover, stringent government regulations regarding environmental sustainability have further propelled the adoption of water-repellant agents in construction activities, driving market growth.

Following Construction, the Textile segment emerged as another significant player in the Water Repellant Agent Market. With the textile industry witnessing steady growth and technological advancements, there has been a rising focus on developing water-repellant fabrics for outdoor apparel, sportswear, and protective clothing. Consumer preferences for functional and weather-resistant textiles have fueled the demand for water-repellant agents in textile manufacturing processes.

The Leather segment also contributed substantially to the Water Repellant Agent Market, leveraging the agents' capabilities to enhance leather products' resistance to moisture, stains, and environmental factors. In the medical sector, water-repellant agents are increasingly utilized in the manufacturing of medical devices, equipment, and protective gear to ensure sterilization and longevity. Additionally, the Furniture segment has witnessed a surge in the adoption of water-repellant agents to protect wooden furniture from water damage and enhance its aesthetic appeal.

Lastly, the "Others" category encompasses diverse end-user applications, including automotive, electronics, and marine industries, which are gradually recognizing the benefits of water-repellant agents in improving product performance and durability. Overall, the Water Repellant Agent Market continues to witness robust growth across various end-user segments, driven by the imperative need for advanced solutions to mitigate water-related damage and enhance product functionality and longevity.

By Technology Types Analysis

Water-based technology prevails in the market, dominating with a substantial 60% share by technology type.

In 2023, Water-Based held a dominant market position in the By Technology Types segment of the Water Repellant Agent Market, capturing more than a 60% share. This significant market share is indicative of the increasing preference for water-based formulations due to their environmental sustainability, low VOC emissions, and compliance with stringent regulatory standards.

Water-based technologies have emerged as the preferred choice across various end-user industries, including construction, textiles, leather, and automotive, driving their widespread adoption and market dominance.

The dominance of Water-Based technology can be attributed to its versatility and effectiveness in providing durable water-repellent coatings for a wide range of surfaces, including concrete, fabric, leather, and wood. Manufacturers are increasingly investing in research and development to enhance the performance and durability of water-based formulations, catering to the evolving needs of end-users across diverse applications.

In contrast, the solvent-based technology segment, while still significant, commands a smaller market share compared to its water-based counterpart. Solvent-based formulations offer certain advantages such as rapid drying times and enhanced penetration into substrates, making them suitable for specific applications where quick turnaround times are essential.

However, concerns regarding environmental impact and regulatory restrictions on volatile organic compounds (VOCs) have limited the growth potential of solvent-based technologies in recent years. Despite the challenges faced by solvent-based formulations, they remain prevalent in niche applications where their unique properties are advantageous.

Key Market Segments

By Type

- Silicone

- Polyurethane

- Teflon

By End Users

- Construction

- Textile

- Leather

- Medical

- Furniture

- Others

By Technology Types

- Water-Based

- Solvent Based

Growth Opportunity

Rising Awareness of Waterproofing Solutions in Outdoor Gear

The global water repellant agent market is poised for substantial growth in 2023, driven primarily by the increasing awareness of waterproofing solutions in outdoor gear. Consumers are becoming more conscious of the need to protect their outdoor equipment from moisture, driving demand for high-performance water-repellent agents. This trend is particularly evident in the outdoor apparel and footwear segment, where consumers seek durable and weather-resistant products.

The growth of this market can be attributed to the growing popularity of outdoor activities, coupled with advancements in textile and material technologies. As consumers engage in activities such as hiking, camping, and trekking, the demand for waterproof gear continues to rise. Manufacturers are capitalizing on this trend by introducing innovative water-repellant agents that offer superior protection against water, oil, and stains, thereby enhancing the longevity and performance of outdoor gear.

Surge in Demand for Water-resistant Coatings in Electronics

Furthermore, the global water-repellant agent market is experiencing a surge in demand due to the increasing adoption of water-resistant coatings in electronics. With the proliferation of electronic devices in various industries, including consumer electronics, automotive, and aerospace, there is a growing need to protect these devices from moisture damage.

Water-repellant agents play a crucial role in safeguarding electronic components from water intrusion, corrosion, and malfunction. As manufacturers strive to enhance the durability and reliability of electronic devices, the demand for advanced water-repellant agents is expected to escalate.

Latest Trends

Development of Self-Cleaning Water Repellent Coatings:

In 2023, the global water repellant agent market is witnessing a significant trend towards the development of self-cleaning water repellent coatings. These coatings leverage innovative technologies to create surfaces that not only repel water but also resist dirt and other contaminants, resulting in self-cleaning properties.

This trend is fueled by increasing consumer demand for low-maintenance solutions across various applications, including building materials, automotive coatings, and consumer goods. Manufacturers are investing in research and development to enhance the efficacy and longevity of self-cleaning water repellent coatings, thereby catering to the evolving needs of consumers and industries.

Rise in Hydrophobic Surface Treatments for Various Substrates:

Furthermore, there is a notable rise in the adoption of hydrophobic surface treatments for various substrates in the global water repellant agent market. Hydrophobic coatings create surfaces that repel water, preventing moisture ingress and enhancing durability.

Industries such as construction, automotive, and electronics are increasingly incorporating hydrophobic surface treatments into their products to improve performance and resilience against environmental factors. As a result, manufacturers of water repellant agents are focusing on developing advanced hydrophobic formulations tailored to specific substrates, such as metals, plastics, and glass, to meet the diverse needs of end-users.

Regional Analysis

In Europe, the water repellant agent market accounts for 40% of the global market share.

In the global market for water repellent agents, regional dynamics play a pivotal role in shaping market trends and opportunities. Across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, distinct factors influence the demand and adoption of water repellent agents, reflecting diverse economic, environmental, and regulatory landscapes.

North America stands as a mature market for water repellent agents, driven primarily by stringent regulations promoting sustainable construction practices and the widespread adoption of advanced technologies. The region's construction industry, particularly in the United States and Canada, exhibits a strong inclination toward eco-friendly solutions, propelling the demand for water repellent agents.

Europe emerges as a dominant force in the water repellent agent market, commanding a significant share of approximately 40%. The region's robust construction sector, coupled with stringent environmental regulations, drives the adoption of water repellent agents across various applications. Germany, France, and the United Kingdom lead the European market, propelled by growing investments in infrastructure development and sustainable building practices. Furthermore, the rising emphasis on energy-efficient constructions further bolsters the demand for water repellent agents in the region.

Asia Pacific showcases immense growth potential in the water repellent agent market, fueled by rapid urbanization, infrastructure development, and increasing awareness regarding environmental sustainability. Countries such as China, India, and Japan are witnessing a surge in construction activities, driven by government initiatives and investments in smart city projects. As a result, the Asia Pacific region is projected to register the highest CAGR during the forecast period, with significant contributions from emerging economies.

In the Middle East & Africa and Latin America regions, the demand for water repellent agents is propelled by infrastructural development initiatives, urbanization trends, and the growing focus on enhancing building longevity. While these regions currently represent smaller market shares compared to North America and Europe, they present untapped opportunities for market players to capitalize on emerging construction trends and regulatory shifts.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Water Repellent Agent Market witnessed robust competition driven by key industry players such as BASF, The Dow Chemical Company, Evonik Industries AG, The Chemours Company, Huntsman Corporation, Daikin Industries Ltd, Blue Star Silicone USA, The 3M Company, and Shin-Etsu Chemical Co. Ltd. Each of these companies holds a significant market share, contributing to the dynamic landscape of the water repellent agent sector.

BASF, a leading chemical company, maintained its prominent position in the market by leveraging its extensive research and development capabilities to introduce innovative water repellent solutions tailored to diverse applications. Similarly, The Dow Chemical Company capitalized on its vast expertise in materials science to deliver high-performance water repellent agents, catering to the evolving demands of various industries.

Evonik Industries AG, renowned for its specialty chemicals, continued to expand its product portfolio, offering advanced formulations with enhanced durability and environmental sustainability. Meanwhile, The Chemours Company emphasized eco-friendly solutions, aligning with the growing preference for environmentally responsible products among consumers and industries.

Huntsman Corporation remained a formidable contender in the market, focusing on strategic partnerships and acquisitions to strengthen its market presence and broaden its customer base. Daikin Industries Ltd, Blue Star Silicone USA, The 3M Company, and Shin-Etsu Chemical Co. Ltd also demonstrated noteworthy advancements in water repellent technologies, driving market innovation and competitiveness.

Market Key Players

- BASF

- The Dow Chemical Company

- Evonik Industries AG

- The Chemours Company

- Huntsman Corporation

- Daikin Industries Ltd

- Blue Star Silicone USA

- The 3M Company

- Shin-Etsu Chemical Co. Ltd

Recent Development

- In March 2024, MIT researchers develop a sensor for detecting PFAS in water, addressing health concerns. Lateral flow technology provides quicker, cheaper testing, aiming to surpass EPA limits for safer drinking water.

- In March 2024, Avarna Group prioritizes innovation for growth, expanding globally with a focus on excellence. Embracing challenges, the family business navigates tough times with agility, aiming for continued success in diverse markets.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Billion Forecast Revenue (2033) USD 2.1 Billion CAGR (2024-2032) 3.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Silicone, Polyurethane, Teflon), By End Users(Construction, Textile, Leather, Medical, Furniture, Others), By Technology Types(Water-Based, Solvent Based) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BASF, The Dow Chemical Company, Evonik Industries AG, The Chemours Company, Huntsman Corporation, Daikin Industries Ltd, Blue Star Silicone USA, The 3M Company, Shin-Etsu Chemical Co. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BASF

- The Dow Chemical Company

- Evonik Industries AG

- The Chemours Company

- Huntsman Corporation

- Daikin Industries Ltd

- Blue Star Silicone USA

- The 3M Company

- Shin-Etsu Chemical Co. Ltd