Water Purifiers Market Report By Technology (UV Water Purifiers, RO Water Purifiers, Gravity-Based Water Purifiers, Sediment Filters, Activated Carbon Filters, Others), By Product Type (Countertop, Under Sink, Faucet Mount, Portable, Whole House, Point of Entry), By Distribution Channel (Online Stores, Offline Stores [Supermarkets/Hypermarkets, Specialty Stores, Departmental Stores, Others]), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

4662

-

August 2024

-

321

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

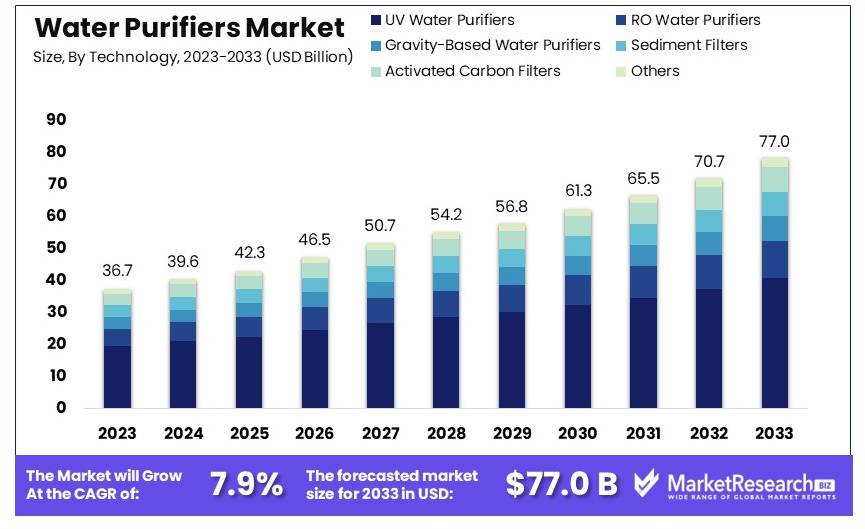

The Global Water Purifiers Market size is expected to be worth around USD 77.0 Billion by 2033, from USD 36.7 Billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2024 to 2033.

The Water Purifiers Market encompasses the production and sale of devices that remove impurities from water. These include filters, UV purifiers, and reverse osmosis systems. The market is driven by concerns over water quality and health benefits of clean drinking water.

Key consumers include households, commercial establishments, and industrial users. Major distribution channels are retail stores, online platforms, and direct sales. Innovation in purification technology and smart features boosts market growth. Challenges include maintenance costs and varying water quality standards. The market is competitive with established brands and new entrants. Growth is anticipated due to increasing awareness of waterborne diseases and rising demand for clean water solutions.

The water purifiers market is poised for significant growth, driven by the urgent global need for clean and safe drinking water. In 2022, approximately 2 billion people lacked access to safely managed drinking water, while 3.6 billion did not have safely managed sanitation services. Additionally, 2.3 billion individuals were without basic handwashing facilities, posing serious health risks and economic burdens. These alarming statistics underscore the critical demand for effective water purification solutions.

Investment in water and sanitation services offers substantial returns. For every dollar invested in urban basic drinking water, there is a USD 3 return, while urban basic sanitation yields a USD 2.5 return. The returns are even higher in rural areas, with USD 7 for drinking water and USD 5 for sanitation. These economic benefits highlight the importance of investing in water infrastructure and purification technologies.

Government initiatives and international cooperation are vital to addressing these challenges. Sustainable Development Goal (SDG) 6 aims for universal access to safe and affordable drinking water and sanitation by 2030. Achieving this goal necessitates substantial investments in water infrastructure, improved management practices, and policies promoting water efficiency and equitable access.

In China, policies like the 13th Five-Year Plan for Ecological Environmental Protection and the "Made in China 2025" initiative emphasize higher environmental standards. These initiatives indirectly boost the water purifier market by increasing demand for high-quality and environmentally friendly products.

The water purifiers market is expected to expand as governments and organizations invest in infrastructure and technology to meet global water needs. Companies that innovate and offer sustainable, efficient solutions will be well-positioned to capture market share. The ongoing focus on health, environmental sustainability, and economic development will drive the market’s growth, making water purifiers a crucial element in global public health and economic stability.

Key Takeaways

- Market Value: The Water Purifiers Market was valued at USD 36.7 billion in 2023 and is projected to reach USD 77.0 billion by 2033, with a CAGR of 7.9%.

- Technology Analysis: RO Water Purifiers are the most used at 53.7%; effectiveness in purifying drives preference.

- Product Type Analysis: Under Sink models lead at 38.9%; convenience and space-saving benefits.

- Distribution Channel Analysis: Offline Stores are the main channel at 64.8%; trusted for hands-on product evaluation.

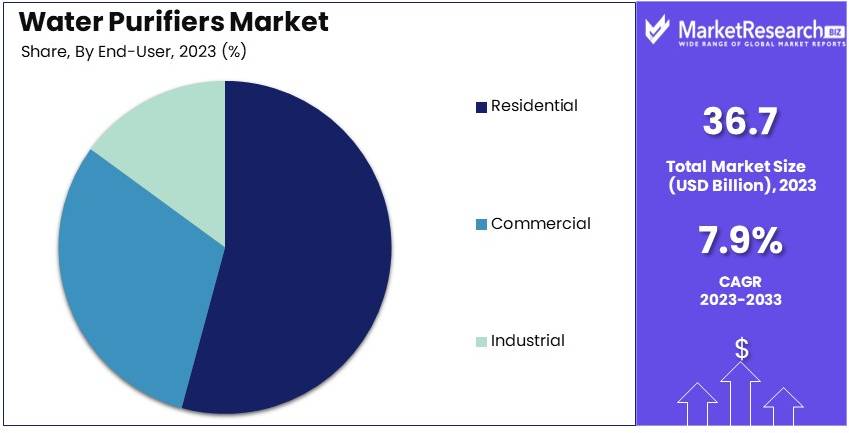

- End User Analysis: Residential users make up the largest segment at 58.7%; driven by health awareness and water quality concerns.

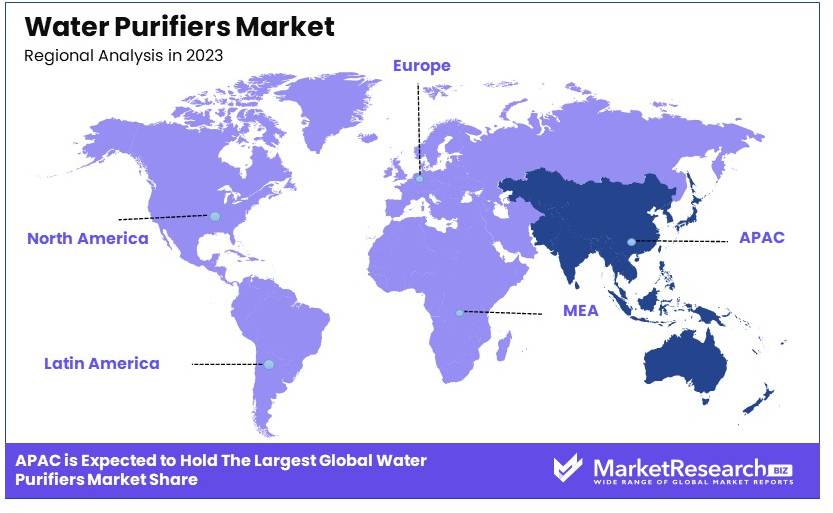

- Dominant Region: APAC is a key market at 38.5%; rapid urbanization and increasing health consciousness boost demand.

Driving Factors

Increasing Water Contamination Drives Market Growth

Growing water contamination due to industrialization, urbanization, and agricultural activities is driving demand for water purifiers. As water pollution becomes a significant issue worldwide, the need for clean drinking water is more pressing. In India, for example, groundwater contamination has led to substantial growth in the water purifier market. Companies like Kent RO Systems have capitalized on this trend by emphasizing the removal of dissolved impurities in their marketing campaigns.

This heightened awareness of water contamination issues encourages consumers to invest in water purifiers to ensure their drinking water is safe. The rising concern over pollutants and toxins in water sources is a critical factor in the increasing adoption of water purifiers, contributing to market growth.

Rising Health Consciousness Drives Market Growth

Rising health consciousness among consumers is significantly boosting the water purifiers market. People are becoming more aware of the health risks associated with contaminated water, such as waterborne diseases. This growing awareness is driving more individuals to invest in water purifiers for their homes and offices. The Flint water crisis in Michigan, for example, dramatically increased public awareness about water quality, leading to a surge in water purifier sales across the United States.

This trend reflects a broader focus on health and well-being, where ensuring access to clean water is a fundamental concern. The increased demand for water purifiers is also driven by a desire to prevent health issues and improve overall quality of life. This health-conscious mindset supports the continuous growth of the water purifiers market.

Technological Advancements Drive Market Growth

Technological advancements in water purification are making purifiers more efficient, compact, and affordable, driving market growth. Innovations such as Reverse Osmosis Membrane (RO), Ultra Violet (UV), and Ultra Filtration (UF) technologies are becoming more accessible to consumers. Companies like Eureka Forbes have introduced hybrid purification systems that combine multiple technologies, appealing to consumers looking for comprehensive water treatment solutions.

These advancements enhance the effectiveness of water purifiers, ensuring they meet diverse consumer needs. The development of more compact and user-friendly designs also makes water purifiers more attractive for home use. As technology continues to improve, the market for water purifiers is likely to expand further, driven by the increasing demand for advanced and reliable purification solutions.

Restraining Factors

Lack of Awareness in Rural Areas Restrains Market Growth

A lack of awareness about water purification technologies in rural areas limits market growth. In many developing countries, rural populations remain unaware of the benefits of advanced water purification technologies. For instance, in rural India, many people still rely on traditional methods like boiling water, unaware of more effective purification technologies available.

This knowledge gap restricts market penetration in these regions. Increasing awareness and education about the benefits of modern water purification methods are essential to expand the market in rural areas and ensure safe drinking water for more people.

Environmental Concerns Restrain Market Growth

Environmental concerns regarding water purification technologies, particularly RO systems, significantly hinder market growth. RO systems can waste a significant amount of water during the purification process, raising environmental concerns. In 2019, the National Green Tribunal in India prohibited the use of RO purifiers in areas where total dissolved solids (TDS) in water are below 500 mg/l, citing water wastage concerns.

These environmental issues lead to restrictions that can limit the adoption of certain water purification technologies. Addressing these concerns by developing more efficient and environmentally friendly purification methods is crucial for market growth.

Technology Analysis

RO Water Purifiers dominate with 53.7% due to their effectiveness in reducing a wide range of contaminants.

RO (Reverse Osmosis) Water Purifiers are the leading technology in the water purifiers market, holding a 53.7% share. This technology is highly favored for its ability to remove a wide range of contaminants, including particles, bacteria, viruses, and dissolved salts, making it one of the most comprehensive water purification methods available.

UV (Ultraviolet) Water Purifiers, comprising 21.6% of the market, are preferred for their ability to disinfect water by killing bacteria and viruses without altering the water’s taste or odor. Gravity-Based Water Purifiers, holding a 12.4% share, are popular in areas without reliable electricity as they do not require power to operate.

Sediment Filters and Activated Carbon Filters, making up 8.2% and 4.1% of the market respectively, are often used as preliminary stages in multi-stage water purification systems to remove large particulates and chlorine, improving the taste and further purifying the water.

The dominance of RO Water Purifiers is supported by their extensive purification capabilities, making them suitable for diverse and challenging water conditions. Meanwhile, other technologies like UV and Gravity-Based systems play crucial roles in specific scenarios, addressing different consumer needs and water quality issues.

Product Type Analysis

Under Sink models dominate with 38.9% due to their convenience and space-saving design.

Under Sink water purifiers are the most popular product type in the market, capturing a 38.9% share. These systems are installed under the kitchen sink and are connected directly to the water line, providing purified water directly from the tap. They are valued for their space-saving design, which does not clutter the kitchen counter, and their ability to provide large volumes of purified water on demand.

Countertop models, holding 24.3% of the market, are preferred for their portability and ease of installation. Faucet Mount types, with a 17.8% share, offer a convenient and inexpensive way to filter drinking water directly from the tap. Portable purifiers, which account for 9.6%, are ideal for travelers and outdoor enthusiasts.

Whole House and Point of Entry systems, making up 6.2% and 3.2% respectively, are designed to purify all the water entering a home or building, ensuring purified water is available from every tap.

The prominence of Under Sink models is driven by the growing demand for convenient, effective, and discreet water purification solutions in residential settings. Meanwhile, other types such as Countertop and Faucet Mount continue to be important for specific user preferences and needs.

Distribution Channel Analysis

Offline Stores dominate with 64.8% due to consumer preference for physical product verification before purchase.

Offline Stores are the primary distribution channel for water purifiers, holding a 64.8% market share. This segment includes Supermarkets/Hypermarkets, Specialty Stores, and Departmental Stores. Consumers prefer purchasing water purifiers through these channels as they can physically inspect products, compare different models, and receive expert advice.

Online Stores, although growing, account for 35.2% of the market. They are favored for the convenience they offer and the ability to quickly compare prices and read customer reviews, which is particularly appealing to tech-savvy consumers.

The dominance of Offline Stores highlights the continued consumer preference for in-store experiences when purchasing appliances that require installation and maintenance. However, the significant and growing share of Online Stores reflects broader retail trends and the increasing consumer confidence in online shopping.

End-User Analysis

Residential users dominate with 58.7% due to increasing health awareness and concern over water quality.

Residential end-users are the largest market segment for water purifiers, accounting for 58.7% of the market. This dominance is driven by growing health consciousness and concerns over water pollution, which encourage homeowners to invest in water purification systems to ensure safe drinking water.

The Commercial sector, including Hotels and Restaurants, Offices, Schools and Colleges, and Others, makes up 27.9% of the market. These establishments require high-quality water for cooking, drinking, and operations, making commercial-grade water purifiers essential.

Industrial users, holding 13.4%, use large-scale water purification systems to meet specific water quality standards required for various industrial processes.

The significant market share of Residential users underscores the importance of clean drinking water in homes, driven by health and safety concerns. Meanwhile, the Commercial and Industrial sectors also represent substantial markets, driven by regulatory and health requirements.

Key Market Segments

By Technology

- UV Water Purifiers

- RO Water Purifiers

- Gravity-Based Water Purifiers

- Sediment Filters

- Activated Carbon Filters

- Others

By Product Type

- Countertop

- Under Sink

- Faucet Mount

- Portable

- Whole House

- Point of Entry

By Distribution Channel

- Online Stores

- Offline Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Departmental Stores

- Others

By End-User

- Residential

- Commercial

- Hotels and Restaurants

- Offices

- Schools and Colleges

- Others

- Industrial

Growth Opportunities

Smart Water Purifiers Offer Growth Opportunity

The integration of IoT technology into water purifiers presents a significant growth opportunity. Smart water purifiers monitor water quality, filter life, and usage patterns, providing real-time data to users via smartphone apps. For instance, Xiaomi's Mi Water Purifier offers app-based monitoring and automatic filter replacement orders.

This technology caters to tech-savvy consumers who value convenience and real-time information. By offering advanced features and enhanced user experiences, smart water purifiers can attract a broader customer base, driving market expansion and innovation.

Portable and Personal Water Purifiers Offer Growth Opportunity

The growing demand for portable water purification solutions creates a substantial growth opportunity. Outdoor enthusiasts, travelers, and consumers in areas with unreliable water supply increasingly seek portable purifiers. Products like LifeStraw, a personal water filter used directly in water sources, have gained popularity among hikers and in emergency preparedness kits.

These portable solutions provide safe drinking water on the go, meeting the needs of a mobile and health-conscious consumer base. By addressing these needs, portable water purifiers can expand their market reach and drive sales growth.

Trending Factors

Eco-friendly Purification Methods Are Trending Factors

Eco-friendly purification methods are a trending factor in the water purifiers market. As environmental consciousness grows, there's increasing interest in sustainable purification technologies that produce less waste. Technologies like UV purification and gravity-based filtration systems exemplify this trend.

For example, Philips has introduced UV water purifiers that don't waste water or use chemicals in the purification process. These eco-friendly solutions appeal to environmentally conscious consumers, driving demand for sustainable products and contributing to market growth by aligning with global environmental goals.

Customized Purification Solutions Are Trending Factors

Customized purification solutions are a significant trend in the water purifiers market. There is growing demand for purifiers that can be tailored based on local water quality. This involves adjustable filtration processes to address specific contaminants present in different regions.

Companies like A.O. Smith have introduced purifiers with customizable filtration cartridges to meet specific water quality issues. This trend towards personalization enhances the effectiveness of water purification, improving consumer satisfaction and expanding the market by addressing diverse needs across various regions.

Regional Analysis

APAC Dominates with 38.5% Market Share in the Water Purifiers Market

APAC's substantial 38.5% share of the global water purifiers market is primarily driven by its vast population and the urgent need for access to clean water. Rapid urbanization and industrialization have exacerbated water pollution issues, making water purifiers essential in both urban and rural areas. Furthermore, growing health awareness among consumers in the region increases the demand for water purification systems to ensure safe drinking water.

The market dynamics in APAC are influenced by government initiatives aimed at improving water quality and public health. Additionally, the presence of several key global and local manufacturers in the region, which offer a variety of water purifiers at competitive prices, helps meet the rising demand. Technological advancements in water purification, including UV, RO, and ultrafiltration technologies, are readily adopted and integrated into products tailored for local water conditions.

The future influence of APAC in the water purifiers market is poised to expand. Increasing investments in water infrastructure and the continuous push from governments for clean water initiatives are expected to drive further growth. As technology advances and becomes more cost-effective, the penetration of water purifiers across the region is likely to increase, enhancing APAC’s market presence.

Regional Market Share AnalysisNorth America: Holding approximately 20% of the global market, North America's steady demand for water purifiers is driven by health-conscious consumers and the prevalence of well-established environmental standards that emphasize clean water.

Europe: Europe accounts for about 15% of the market. The demand here is bolstered by stringent regulations for water quality and the high adoption rate of technologically advanced water purifying systems.

Middle East & Africa: With around 10% of the market share, the Middle East and Africa are experiencing growth due to increasing water scarcity issues and government initiatives to improve water quality for growing populations.

Latin America: Representing about 7% of the global market, Latin America sees growth driven by improving living standards and heightened awareness about the health implications of contaminated water.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The water purifiers market features key players who drive innovation and expand market reach. Pentair plc and The 3M Company lead with advanced filtration technologies and strong brand reputations. LG Electronics Inc. and Unilever N.V. leverage their global presence and diversified product lines to enhance market influence.

Panasonic Corporation and Coway Co., Ltd. focus on smart purification solutions, catering to tech-savvy consumers. Brita GmbH and A.O. Smith Corporation emphasize user-friendly designs and reliable performance. Kent RO Systems Ltd. and BWT AG offer advanced RO systems, targeting regions with poor water quality.

Eureka Forbes Limited and Culligan International Company provide comprehensive water treatment solutions, enhancing consumer trust. Tata Chemicals Limited and Whirlpool Corporation integrate innovative technologies into their purifiers. Koninklijke Philips N.V. focuses on health-centric designs, appealing to health-conscious consumers. These companies collectively shape the water purifiers market through innovation, strategic positioning, and strong market presence.

Market Key Players

- Pentair plc

- The 3M Company

- LG Electronics Inc.

- Unilever N.V.

- Panasonic Corporation

- Coway Co., Ltd.

- Brita GmbH

- A.O. Smith Corporation

- Kent RO Systems Ltd.

- BWT AG

- Eureka Forbes Limited

- Culligan International Company

- Tata Chemicals Limited

- Whirlpool Corporation

- Koninklijke Philips N.V.

Recent Developments

July 25, 2024: Hindustan Unilever (HUL) introduced the HUL Pureit Advanced RO + MF 6 Stage Water Purifier. This new model features a 7-liter capacity and a 6-stage purification system, providing enhanced filtration for various water sources. It is designed to handle high TDS levels and includes features like smart auto-shut off and power saving mode. This product aims to cater to the growing demand for reliable and efficient water purification solutions in Indian households.

July 20, 2024: AO Smith, a leading player in the water purifier market, reported a 12% increase in quarterly revenue, driven by strong sales in the Asia-Pacific region. The company's focus on expanding its product range and enhancing distribution networks has paid off, reflecting growing consumer trust in its water purification solutions.

Report Scope

Report Features Description Market Value (2023) USD 36.7 Billion Forecast Revenue (2033) USD 77.0 Billion CAGR (2024-2033) 7.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (UV Water Purifiers, RO Water Purifiers, Gravity-Based Water Purifiers, Sediment Filters, Activated Carbon Filters, Others), By Product Type (Countertop, Under Sink, Faucet Mount, Portable, Whole House, Point of Entry), By Distribution Channel (Online Stores, Offline Stores [Supermarkets/Hypermarkets, Specialty Stores, Departmental Stores, Others]), By End-User (Residential, Commercial [Hotels and Restaurants, Offices, Schools and Colleges, Others], Industrial) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pentair plc, The 3M Company, LG Electronics Inc., Unilever N.V., Panasonic Corporation, Coway Co., Ltd., Brita GmbH, A.O. Smith Corporation, Kent RO Systems Ltd., BWT AG, Eureka Forbes Limited, Culligan International Company, Tata Chemicals Limited, Whirlpool Corporation, Koninklijke Philips N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Pentair plc

- The 3M Company

- LG Electronics Inc.

- Unilever N.V.

- Panasonic Corporation

- Coway Co., Ltd.

- Brita GmbH

- A.O. Smith Corporation

- Kent RO Systems Ltd.

- BWT AG

- Eureka Forbes Limited

- Culligan International Company

- Tata Chemicals Limited

- Whirlpool Corporation

- Koninklijke Philips N.V.