VR in Fitness and Wellness Market By Application (Fitness Training and Coaching, Mental Wellness and Meditation, Rehabilitation and Physical Therapy), By Component (Hardware, Software, Services), By End-User (Home Users, Gyms & Fitness Centers, Healthcare Providers & Rehabilitation Centers), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51365

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

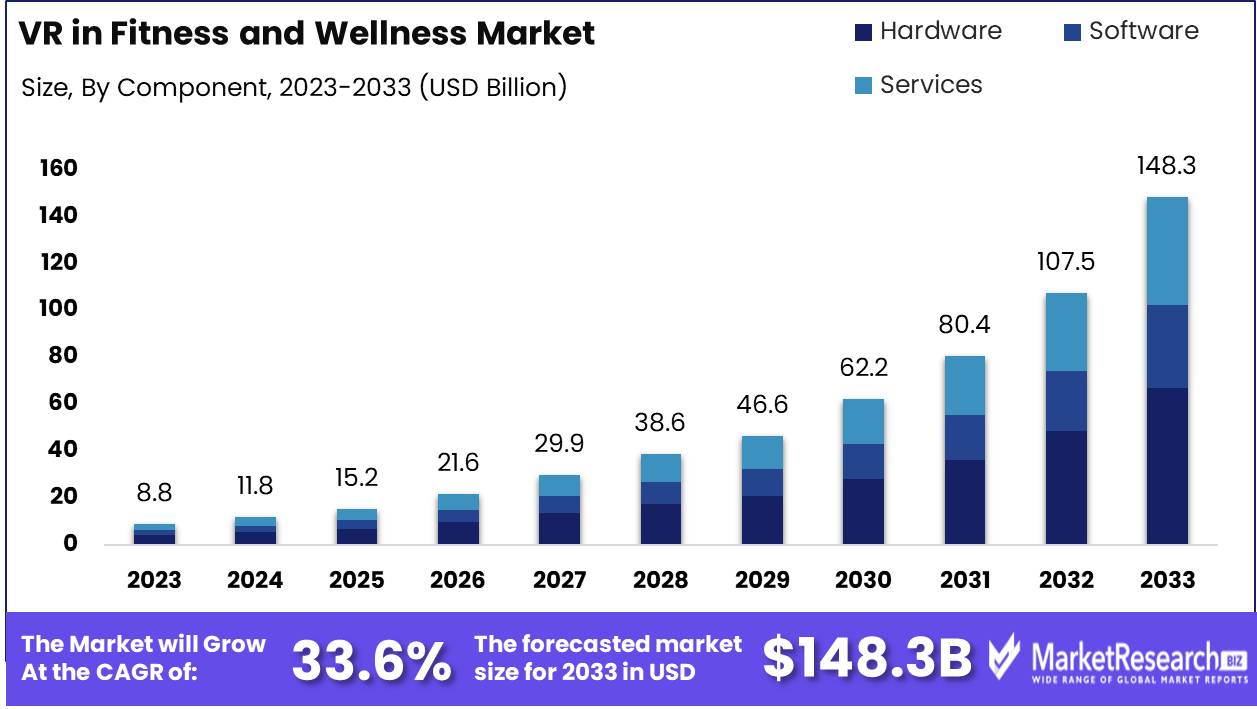

VR in the fitness and wellness market was valued at USD 8.8 billion in 2023. It is expected to reach USD 148.3 billion by 2033, with a CAGR of 33.6% during the forecast period from 2024 to 2033.

VR in the Fitness and Wellness Market refers to the growing integration of virtual reality technologies into fitness routines and wellness practices. This market encompasses immersive experiences designed to enhance physical activity, mental well-being, and overall health by leveraging VR tools for exercises, meditation, rehabilitation, and personalized wellness programs. Key drivers include the increasing demand for engaging, gamified fitness solutions, advancements in VR hardware and software, and rising consumer focus on health and well-being.

The VR in the fitness and wellness market is poised for significant growth as consumer interest in immersive fitness experiences continues to rise. With increasing awareness around health and wellness, users are seeking more engaging and interactive solutions to improve their fitness routines. Virtual reality (VR) offers a unique, gamified approach to exercise, enhancing user motivation and adherence. Integrating immersive technologies allows users to simulate real-world environments, creating a highly personalized and effective fitness experience.

Additionally, technological advancements, such as improved graphics, motion tracking, and haptic feedback, are driving further adoption across various consumer segments. However, the high initial setup costs associated with VR equipment remain a key challenge, potentially limiting accessibility for a broader audience in the short term.

The expansion of the Fitness-as-a-Service (FaaS) model is expected to support the long-term scalability of VR-based fitness solutions. By offering subscription-based platforms, companies can reduce upfront costs and provide continuous updates and content, making the technology more accessible. As more fitness enthusiasts and wellness-conscious consumers explore virtual environments for their workout regimens, the market is expected to see increased competition and innovation. In the next five years, the convergence of health awareness, technological advancements, and scalable business models will likely drive VR's integration into mainstream fitness. While initial adoption barriers persist, these will likely be mitigated by evolving pricing structures, ongoing advancements, and the growing demand for immersive fitness solutions.

Key Takeaways

- Market Growth: VR in the fitness and wellness market was valued at USD 8.8 billion in 2023. It is expected to reach USD 148.3 billion by 2033, with a CAGR of 33.6% during the forecast period from 2024 to 2033.

- By Application: Fitness Training and Coaching dominated VR fitness and wellness applications.

- By Component: Hardware dominated the VR fitness market, driving growth.

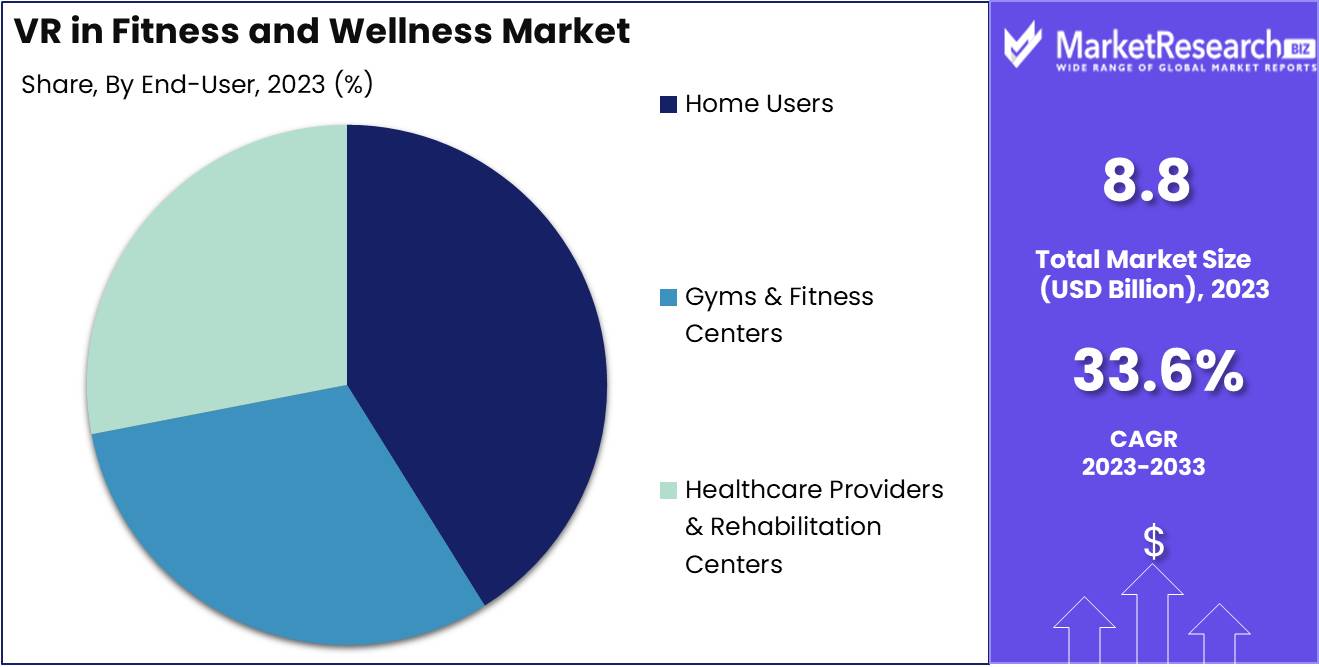

- By End-User: Home Users dominated the VR Fitness and Wellness market.

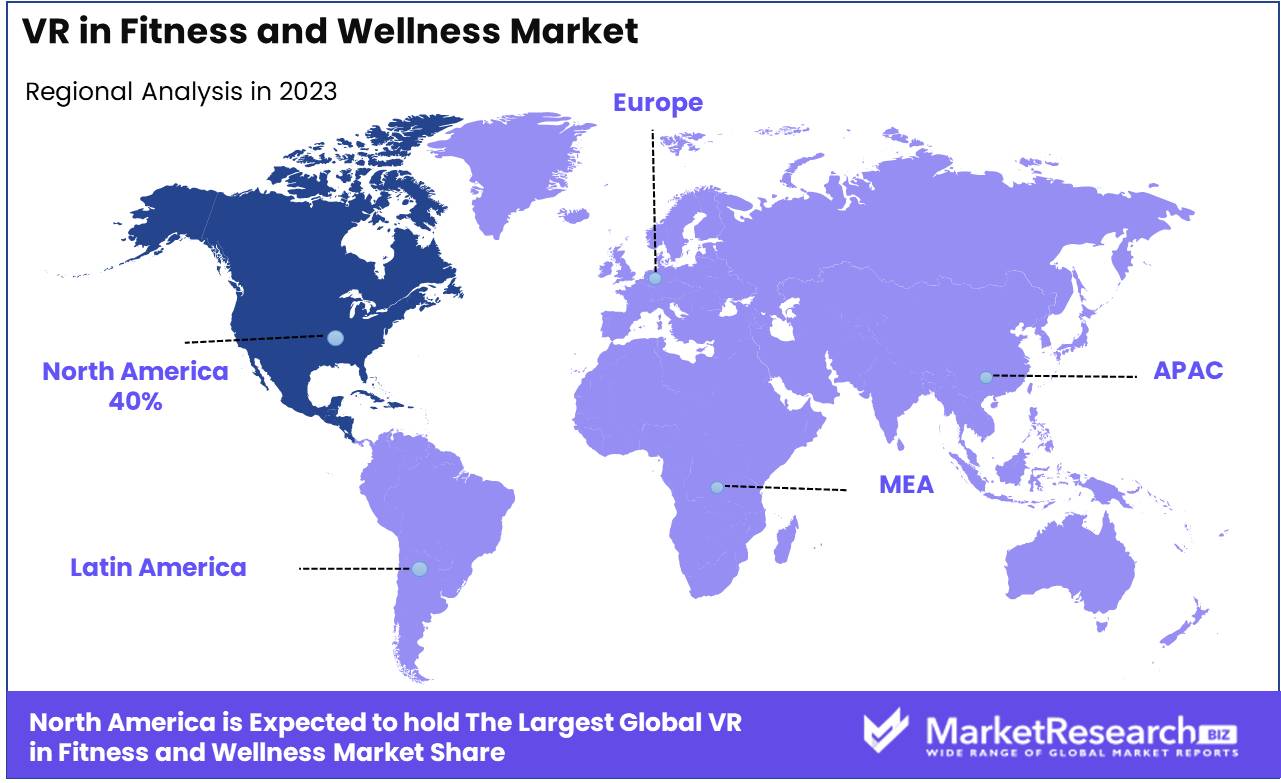

- Regional Dominance: North America dominates the global VR fitness market with a 40% largest share.

- Growth Opportunity: The global VR fitness and wellness market will grow significantly, driven by the integration of wearable technology and personalized training programs that enhance user engagement and workout effectiveness.

Driving factors

Technological Advancements: Accelerating Market Growth Through Innovation

Technological advancements have been a critical driver in the expansion of VR in the Fitness and Wellness Market. Innovations in virtual reality hardware, such as improved VR headsets with higher resolution, reduced latency, and enhanced motion tracking, have significantly enhanced the user experience. These advancements contribute to creating more immersive and realistic workout environments, allowing users to engage in fitness activities that simulate real-world scenarios or even gamify exercise routines, making fitness more engaging and enjoyable.

Additionally, the integration of AI and machine learning into VR platforms has enabled personalized workout regimes and real-time feedback, which further enhances the effectiveness of fitness programs. This has been particularly influential in attracting a tech-savvy demographic that values personalized, data-driven fitness solutions.

Statistically, the VR market is projected to grow significantly, with the fitness and wellness sector benefiting from these developments. According to market projections, the global VR market is expected to grow at a compound annual growth rate (CAGR) of approximately 18% between 2022 and 2027, with the fitness segment becoming a key contributor to this expansion.

Accessibility and Convenience: Enabling Widespread Adoption

The increasing accessibility and convenience of VR technology have also played a pivotal role in driving the growth of VR in the Fitness and Wellness Market. As the cost of VR hardware has decreased and mobile-based VR solutions have become more prevalent, a broader demographic of users now has access to this technology. This has removed one of the significant barriers to entry, making VR-based fitness solutions more attainable for the average consumer.

Moreover, VR allows users to engage in fitness activities from the comfort of their own homes, eliminating the need for gym memberships or travel to fitness centers. This convenience has resonated particularly well in the wake of the COVID-19 pandemic, where home fitness solutions surged in popularity. In fact, the home fitness market witnessed exponential growth during this period, and VR in the Fitness and Wellness Market benefitted from this trend as users sought new and engaging ways to stay active indoors.

The integration of online communities and virtual competitions through VR platforms also plays a significant role in increasing the appeal of these solutions, as users can connect with others, share progress, and engage in friendly competition, further motivating them to stay committed to their fitness goals.

Growing Health Consciousness: Fueling Demand for Innovative Fitness Solutions

An increasing global focus on health and wellness has substantially contributed to the growth of VR in the Fitness and Wellness Market. The growing awareness of the importance of regular physical activity, along with rising concerns about sedentary lifestyles and related health issues such as obesity, cardiovascular diseases, and mental health challenges, has driven consumers to seek innovative fitness solutions that can help them stay active.

VR-based fitness platforms cater to this demand by offering engaging and varied workout routines that can be tailored to the user’s preferences and fitness levels. The immersive nature of VR makes it easier for users to commit to regular workouts, as the virtual environment can distract from the physical exertion typically associated with exercise, creating a more enjoyable and sustainable fitness experience. This is particularly relevant for individuals who may find traditional exercise routines monotonous or uninspiring.

Furthermore, wellness-focused VR applications are emerging, addressing not only physical fitness but also mental well-being. VR experiences that incorporate elements of meditation, mindfulness, and relaxation exercises are increasingly popular, as more consumers recognize the need for a holistic approach to health that includes both physical and mental fitness.

Restraining Factors

Space Requirements: A Limiting Factor in Market Adoption

The growth of the Virtual Reality (VR) in the Fitness and Wellness market is significantly restrained by space requirements. VR-based fitness solutions often require users to have a considerable amount of physical space to interact with the technology effectively. Many VR fitness applications involve dynamic movements such as jumping, squatting, or shadowboxing, which necessitate a clutter-free area to avoid accidents or limitations in movement. This poses a challenge for users living in small urban apartments or densely populated areas, where adequate space may not be available for such setups.

Additionally, the hardware needed for VR, such as headsets, motion controllers, and sensors, can further increase spatial demands. The need for designated rooms or areas discourages potential users from adopting VR for fitness, as traditional gym setups typically require less customization of living space. In regions with higher urbanization rates, particularly in large cities where living spaces tend to be smaller, the space requirement becomes a critical barrier to the widespread adoption of VR fitness solutions.

This factor, therefore, narrows the market's potential customer base, primarily targeting users who have the necessary space or the financial means to invest in a dedicated VR fitness environment. Consequently, the growth of the market is hindered by this spatial constraint, slowing adoption rates, particularly in urban centers.

Competition from Traditional Fitness Models: A Challenge for VR Integration

Traditional fitness models, including gyms, personal training, and group fitness classes, pose significant competition to the VR fitness market, acting as a restraining force on its growth. These conventional models are deeply ingrained in consumer behavior, with gyms and fitness clubs offering social interaction, structured environments, and access to diverse equipment that is difficult for VR fitness platforms to replicate.

Many fitness enthusiasts still prefer the proven results of conventional exercise routines over the perceived novelty of VR-based workouts. Additionally, traditional fitness options are widely accessible and generally require less upfront investment than VR equipment, such as a VR headset, which may cost anywhere from $300 to $1,000 or more. A 2023 report indicated that traditional gyms and fitness services continue to dominate the market, with global gym memberships exceeding 200 million, underscoring the scale of the competition VR fitness must contend with.

Moreover, the psychological comfort associated with familiar, face-to-face instruction and community-driven fitness models can deter users from switching to a VR-centric approach. Many users may also view traditional models as more reliable for achieving fitness goals due to the direct human oversight provided by trainers and the established body of research supporting conventional exercise methods.

By Application Analysis

In 2023, Fitness Training and Coaching dominated VR fitness and wellness applications.

In 2023, Fitness Training and Coaching held a dominant market position in the By Application segment of Virtual Reality (VR) in the Fitness and Wellness Market, driven by the growing demand for immersive and engaging fitness solutions. This sub-segment leveraged VR’s ability to simulate real-world environments, enhancing user experience and promoting higher engagement levels. The rising adoption of at-home fitness platforms, alongside the trend of gamification in fitness routines, has significantly contributed to its expansion.

Mental Wellness and Meditation also emerged as a key application area, with users increasingly turning to VR for stress relief, mindfulness practices, and mental health improvement. The ability of VR to create calming and controlled environments has been pivotal in this segment’s growth.

Rehabilitation and Physical Therapy, though a smaller sub-segment, has exhibited substantial potential, particularly in clinical settings. VR’s ability to assist in motor function recovery, balance training, and pain management has gained traction among healthcare providers, enabling more personalized and monitored recovery processes. Collectively, these segments demonstrate the broad applicability of VR in the fitness and wellness industry.

By Component Analysis

In 2023, Hardware dominated the VR fitness market, driving growth.

In 2023, Hardware held a dominant market position in the "By Component" segment of the VR in the Fitness and Wellness market. This leadership can be attributed to the high demand for advanced VR headsets, motion sensors, and related devices, which are integral to creating immersive fitness experiences. Hardware accounted for a significant share due to the widespread adoption of equipment by both consumers and fitness centers seeking to enhance workout routines. The introduction of affordable, high-quality VR hardware has further driven its growth.

Meanwhile, the software segment, while smaller in comparison, is gaining momentum due to the increasing development of fitness-focused applications and interactive platforms. These software solutions enable users to track their performance, participate in virtual classes, and personalize workouts.

The services segment, encompassing installation, maintenance, and customer support, is also expanding steadily. As the VR in the fitness ecosystem matures, demand for services supporting both hardware and software solutions is expected to grow, enhancing user experiences and driving overall market expansion.

By End-User Analysis

In 2023, Home Users dominated the VR Fitness and Wellness market.

In 2023, Home Users held a dominant market position in the By End-User segment of the VR in the Fitness and Wellness Market. The increasing adoption of virtual reality (VR) fitness solutions at home can be attributed to growing consumer demand for immersive, interactive workout experiences that are convenient and customizable. With the rise in remote work and home-based fitness routines, home users increasingly seek VR fitness apps and equipment that offer personalized workouts, progress tracking, and gamified experiences. This segment benefits from advancements in VR technology, lower hardware costs, and subscription-based fitness platforms.

Gyms & Fitness Centers represent the second-largest segment, leveraging VR for group fitness classes, personalized training, and enhancing member engagement. This market continues to evolve with gyms incorporating VR to offer novel experiences that differentiate their services.

Lastly, Healthcare Providers & Rehabilitation Centers are exploring VR solutions for physical therapy and rehabilitation, utilizing immersive environments to improve patient outcomes and recovery experiences. Although this segment is smaller, it is experiencing steady growth as healthcare providers recognize the therapeutic benefits of VR-based interventions in rehabilitation settings.

Key Market Segments

By Application

- Fitness Training and Coaching

- Mental Wellness and Meditation

- Rehabilitation and Physical Therapy

By Component

- Hardware

- Software

- Services

By End-User

- Home Users

- Gyms & Fitness Centers

- Healthcare Providers & Rehabilitation Centers

Growth Opportunity

Integration with Wearable Technology Enhances Immersive Fitness Experiences

Wearable technology, such as fitness trackers and smartwatches, has become a critical component in the fitness ecosystem. As VR and wearable devices become increasingly interconnected, users can monitor heart rates, calories burned, and movement metrics in real time while immersed in VR fitness programs. This integration is anticipated to drive market growth by providing a more comprehensive and data-driven workout experience. By offering real-time performance feedback, the synergy between wearables and VR enhances the effectiveness of fitness regimens and appeals to tech-savvy consumers seeking innovative workout solutions.

Personalized Training Programs Boost User Engagement and Retention

Another significant growth opportunity lies in personalized training programs facilitated by VR platforms. By leveraging AI-driven insights and user-specific data, VR fitness programs can deliver customized routines tailored to individual fitness levels, goals, and preferences. This level of personalization not only improves workout efficacy but also enhances user retention, as consumers are more likely to continue using platforms that adapt to their evolving needs. The customization of fitness experiences will be a major catalyst in driving consumer adoption, further solidifying the market’s expansion trajectory.

Latest Trends

Rise of Home-based VR Fitness

The VR fitness market is witnessing a significant shift towards home-based applications. The growing demand for flexible, at-home fitness solutions has fueled the integration of virtual reality (VR) into personal fitness regimes. This trend is driven by increasing health consciousness and the desire for personalized workout experiences that can be accessed from the comfort of home. VR platforms are enabling users to engage in immersive fitness programs, offering everything from strength training to yoga. This rise is further accelerated by advancements in VR hardware, reducing costs and improving accessibility for consumers. As more fitness enthusiasts adopt VR-enabled fitness routines, it is expected that the market will experience sustained growth in the home fitness segment.

Remote Social Interaction

As VR technology continues to evolve, the ability to engage in remote social interaction is reshaping the fitness and wellness industry. VR platforms now allow users to participate in group workouts or wellness activities, such as meditation, with friends and communities from different locations. This fosters a sense of camaraderie and social engagement, which is critical for sustaining long-term fitness goals. The trend of combining fitness with social interaction via VR is expected to grow, offering users a more engaging and motivating fitness experience. This social element is anticipated to further drive consumer adoption of VR fitness technologies, particularly in the post-pandemic era, where remote connectivity remains highly valued.

Regional Analysis

North America dominates the global VR fitness market with a 40% largest share.

The global VR in the fitness and wellness market has witnessed significant growth across various regions, with North America emerging as the dominant market, accounting for approximately 40% of the global market share in 2023. This dominance can be attributed to high consumer adoption of advanced technologies, the strong presence of leading VR fitness companies, and increased awareness regarding health and wellness. In addition, the availability of robust infrastructure and increasing investments in virtual reality innovations further propel the market growth in the region.

Europe follows, representing around 25% of the market, driven by a growing interest in digital fitness solutions and government initiatives promoting health and wellness. Key countries such as the UK, Germany, and France lead in adopting VR technologies, particularly in fitness centers and wellness applications.

The Asia-Pacific region, accounting for approximately 20% of the global market, is expected to witness the fastest growth due to rising disposable incomes, increasing awareness of health benefits, and a rapidly expanding fitness industry. Countries like China, Japan, and South Korea are at the forefront of this growth due to their advanced technological infrastructure.

Latin America and the Middle East & Africa together represent around 15% of the market, with increasing urbanization and health awareness in these regions driving demand. However, market growth in these regions is relatively slower due to limited access to advanced technologies and lower consumer spending.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Virtual Reality (VR) in the Fitness and Wellness market is projected to experience significant growth driven by increasing consumer demand for immersive, engaging fitness experiences. Key companies in the sector are positioned to capitalize on this expanding market through innovative technologies and strategic partnerships.

FitXR and Supernatural are notable for their focus on creating immersive, gamified fitness experiences that attract users seeking dynamic, home-based workout solutions. Both companies have developed strong user bases, leveraging engaging content and intuitive interfaces. Peloton Interactive Inc., primarily known for its at-home fitness equipment and connected services, is expected to expand further into VR fitness as part of its strategy to diversify and strengthen its digital offerings.

Zwift Inc. and Holodia, both specializing in virtual environments for cycling and rowing, are positioned to benefit from the growing trend of personalized, immersive training programs. Virtuix, VZfit (VirZOOM), and ICAROS cater to fitness enthusiasts seeking more interactive, full-body engagement in VR, targeting both home users and fitness centers.

Meta (formerly Oculus) continues to play a pivotal role as a hardware provider, with its Meta Quest VR headset driving adoption in both consumer and fitness markets. Additionally, Black Box VR, known for its integration of resistance training and VR, offers a unique solution blending physical and virtual experiences.

Les Mills BodyCombat VR, leveraging the popular BodyCombat program, brings group fitness into the virtual space, further highlighting the potential of VR to revolutionize traditional workout routines. Together, these players underscore the VR fitness market’s potential for growth and transformation.

Market Key Players

- FitXR

- Supernatural

- Peloton Interactive Inc.

- Zwift Inc.

- Holodia

- Virtuix

- VZfit (VirZOOM)

- Black Box VR

- Meta (formerly Oculus)

- ICAROS

- Les Mills BodyCombat VR

Recent Development

- In March 2024, Puma launched an immersive fitness experience in collaboration with Meta Quest 3. This partnership allows users to participate in mixed-reality workouts, including activities like boxing and Zumba. Puma’s goal is to make fitness more accessible, especially for those who may face barriers to traditional exercise, such as gym anxiety. The initiative highlights how virtual environments can encourage new fitness behaviors.

- In February 2024, Les Mills, renowned for group fitness programs, expanded into the VR fitness market with its BodyCombat VR app. Available on platforms like Meta's Quest, the app offers an interactive, boxing-style workout experience that incorporates squats, punches, and other movements to engage users in a holistic workout. This development highlights the trend of traditional fitness brands leveraging VR technology to broaden their digital fitness offerings.

- In January 2024, Xponential Fitness expanded its fitness ecosystem by incorporating VR into its traditional workout offerings. Through its Xponential+ platform, the company now offers augmented and virtual reality-enhanced classes, such as Pure Barre and Club Pilates, creating a hybrid fitness experience. This development is part of a broader trend where fitness studios integrate advanced technology to enhance user engagement and retention.

Report Scope

Report Features Description Market Value (2023) USD 8.8 Billion Forecast Revenue (2033) USD 148.3 Billion CAGR (2024-2032) 33.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Fitness Training and Coaching, Mental Wellness and Meditation, Rehabilitation and Physical Therapy), By Component (Hardware, Software, Services), By End-User (Home Users, Gyms & Fitness Centers, Healthcare Providers & Rehabilitation Centers) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape FitXR, Supernatural, Peloton Interactive Inc., Zwift Inc., Holodia, Virtuix, VZfit (VirZOOM), Black Box VR, Meta (formerly Oculus), ICAROS, Les Mills BodyCombat VR Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- FitXR

- Supernatural

- Peloton Interactive Inc.

- Zwift Inc.

- Holodia

- Virtuix

- VZfit (VirZOOM)

- Black Box VR

- Meta (formerly Oculus)

- ICAROS

- Les Mills BodyCombat VR