Video Intercom Devices Market Report By Type of Device (Door Station, Indoor Station, Master Station), By Technology Type (Analog Video Intercom, IP Video Intercom), By Connection Type (Wired Video Intercom, Wireless Video Intercom), By End User (Residential, Commercial [Office Buildings, Retail Stores, Hotels, Others]), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

14572

-

July 2024

-

322

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

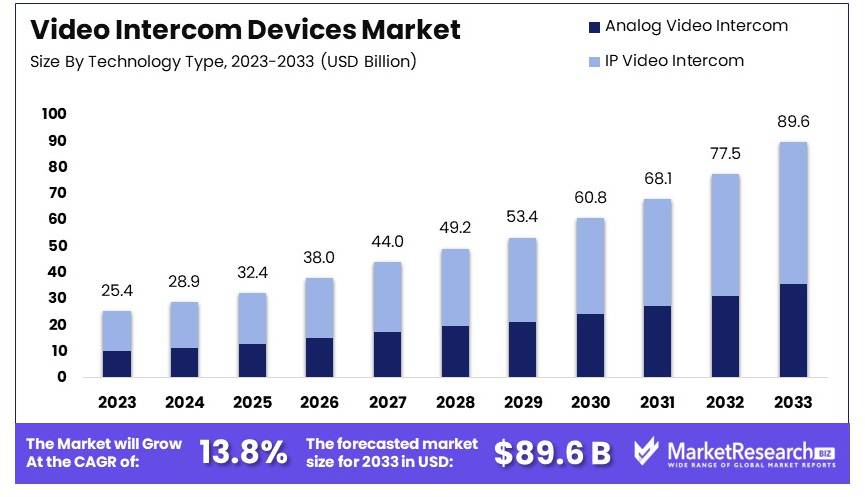

The Global Video Intercom Devices Market size is expected to be worth around USD 89.6 Billion by 2033, from USD 25.4 Billion in 2023, growing at a CAGR of 13.8% during the forecast period from 2024 to 2033.

The video intercom devices market involves the production and distribution of electronic systems that allow audio and visual communication between users. These devices are commonly used in residential, commercial, and industrial settings for security and convenience. Key components include cameras, monitors, and intercom units.

Market growth is driven by increasing security concerns, technological advancements, and the integration of smart home systems. Key players include electronics manufacturers, tech companies, and security firms. Trends in this market include the rise of wireless intercoms, integration with IoT devices, and the adoption of AI for enhanced security features. Companies in this market focus on innovation, user-friendly designs, and strategic collaborations to capture a larger market share. The video intercom devices market is crucial for enhancing safety and communication in various environments.

The video intercom devices market is experiencing notable growth, driven by technological advancements and increasing security concerns. Recent innovations and product launches by leading companies are key drivers of this expansion. In April 2023, Aiphone Corporation introduced the IX Series kit, a preprogrammed video intercom system designed for easy installation. This innovation simplifies the installation process, making advanced security accessible to a broader market.

In June 2023, 2N launched adaptive face zooming technology in their video intercom systems. This technology enhances visitor identification, improving security and user experience. Such advancements highlight the industry's focus on integrating cutting-edge technologies to meet the evolving needs of consumers and businesses.

The demand for enhanced security solutions in residential and commercial sectors is fueling market growth. Video intercom devices offer a reliable way to monitor and control access to properties, addressing growing concerns about safety and security. Additionally, the integration of smart technologies in these systems aligns with the increasing adoption of smart home and building automation solutions.

Furthermore, the market benefits from a rising awareness of the importance of security measures. As more consumers prioritize safety, the adoption of video intercom devices is expected to rise. This trend is supported by the continuous innovation from key players, ensuring the availability of advanced, user-friendly, and cost-effective solutions.

The video intercom devices market is set to grow significantly, driven by technological innovations and increasing security demands. Companies in this sector should focus on developing advanced features and user-friendly products to capitalize on these trends and meet the growing market needs.

Key Takeaways

- Market Value: The Video Intercom Devices Market was valued at USD 25.4 billion in 2023 and is expected to reach USD 89.6 billion by 2033, with a CAGR of 13.8%.

- By Type of Device Analysis: Door Station dominates with 50%; it is significant due to its role in enhancing home and office security.

- By Technology Type Analysis: IP Video Intercom leads with 60%; its significance lies in providing advanced connectivity and remote access features.

- By Connection Type Analysis: Wireless Video Intercom leads with 55%; it offers flexibility and ease of installation compared to wired systems.

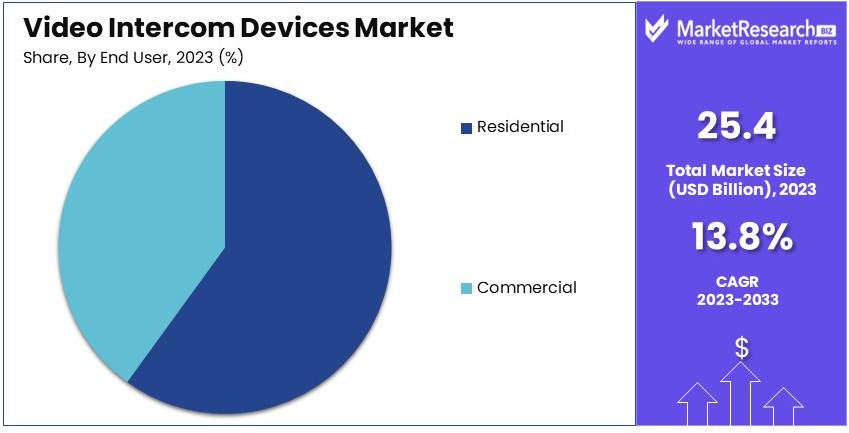

- By End User Analysis: Residential segment dominates with 60%; this is due to the increasing demand for smart home security solutions.

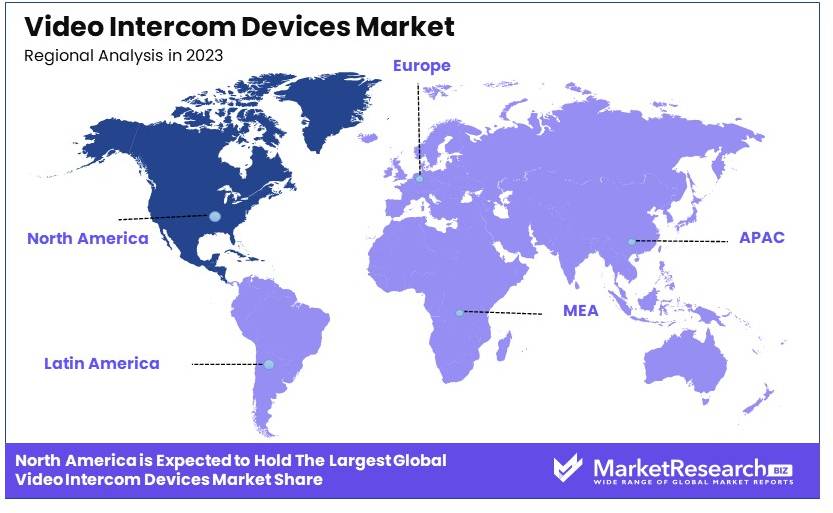

- Dominant Region: North America leads with 34.5%; this is driven by high adoption rates of smart home technologies and security devices.

- High Growth Region: Europe is expected to show substantial growth, driven by increasing security concerns and technological advancements.

- Analyst Viewpoint: The video intercom devices market is rapidly expanding with intense competition. Future trends indicate robust demand driven by advancements in smart home and security technologies.

- Growth Opportunities: Key players can leverage innovations in IP technology and expand their offerings to include integrated smart home security solutions to capture a larger market share.

Driving Factors

Increasing Emphasis on Home Security and Safety Drives Market Growth

The rising focus on home security is a significant driver for the video intercom devices market. Homeowners and property managers are increasingly prioritizing the safety of their residences and communities. Video intercom systems provide a vital security feature by allowing visual identification of visitors before access is granted.

Prominent companies such as Aiphone, Commax, and Hikvision have responded to this demand by enhancing their products with features like remote access, motion detection, and integration with video surveillance systems. This focus on security not only meets the immediate needs of consumers but also encourages broader adoption as safety becomes a more pressing concern in residential settings.

Rising Adoption in Commercial and Institutional Settings Drives Market Growth

Video intercom devices are expanding beyond homes into public safety security, commercial and institutional environments such as office buildings, hospitals, and schools. In these settings, the devices are crucial for controlling access and managing visitors, thus bolstering security and operational efficiency.

Companies like Fermax and Panasonic are leading this expansion by developing systems tailored to the specific needs of these users. The adoption of video intercoms in these diverse settings underscores their versatility and essential role in enhancing security protocols across various sectors.

Integration with Smart Home Technology Drives Market Growth

The integration of video intercom devices with smart home technology is reshaping the market. As smart homes gain popularity, there is a growing expectation for these devices to seamlessly connect with other smart systems within the home. Manufacturers like Ring, Nest, and August are at the forefront, offering video intercoms that can be controlled via smartphones, tablets, or even voice assistants.

This capability provides users with a convenient, integrated experience, making smart home ecosystems more cohesive and appealing. The ability to integrate effectively with broader smart home systems are crucial for the continued growth and innovation in the video intercom market, satisfying a tech-savvy consumer base seeking comprehensive, connected home solutions.

Restraining Factors

Costs Associated with Installation and Maintenance Restrain Market Growth

Although video intercom devices are becoming more affordable, the expenses for professional installation and ongoing maintenance remain high. These costs can be a significant barrier for consumers and businesses, especially in the residential sector.

In price-sensitive markets or among budget-conscious buyers, the additional financial burden limits adoption. This financial hurdle slows market expansion, as many potential users opt for less costly alternatives or delay their purchase due to budget constraints.

Privacy and Data Security Concerns Restrain Market Growth

Video intercom devices raise significant privacy and data security concerns. These devices collect and transmit audio and video data, making them vulnerable to security breaches. Issues in data transmission, storage, and access control can deter users from adopting these devices.

To gain consumer trust, manufacturers must implement robust security measures and comply with data protection regulations. Failure to address these concerns effectively can slow down market adoption, as users prioritize their privacy and security over the convenience offered by video intercom systems.

Type of Device Analysis

Door Station dominates with 50% due to its essential role in entry-point security and monitoring.

The Video Intercom Devices Market is segmented by type of device into Door Station, Indoor Station, and Master Station. Door Stations are critical for entry-point security, allowing users to see and communicate with visitors before granting access. This device type is popular in both residential and commercial settings due to its ability to enhance security. The integration of features like HD video, night vision, and motion detection has made Door Stations even more appealing. The rising concerns about security and the need for real-time monitoring are major drivers of this segment. Additionally, advancements in technology, such as facial recognition and smartphone connectivity, further boost the demand for Door Stations.

Indoor Stations and Master Stations also contribute to market growth. Indoor Stations allow residents and office workers to interact with visitors from within the building. These devices are essential for larger homes and commercial buildings where monitoring multiple entry points is necessary. Master Stations control and manage the entire intercom system, making them crucial in complex security setups. They are particularly important in commercial buildings where centralized control is required. Together, these devices enhance the overall functionality and appeal of video intercom systems, supporting market expansion.

Technology Type Analysis

IP Video Intercom dominates with 60% due to its advanced features and better connectivity.

The market by technology type is divided into Analog Video Intercom and IP Video Intercom. IP Video Intercom systems offer superior features compared to analog systems. They provide higher quality video, better audio, and advanced functionalities such as remote access and integration with other smart devices. The ability to connect to the internet allows users to monitor and control their intercom systems from anywhere, adding a significant layer of convenience and security. The growth in smart home and smart building technologies has driven the adoption of IP Video Intercom systems. These systems are also more scalable, making them ideal for both small and large installations.

Analog Video Intercom systems, while less advanced, still play a role in the market. They are typically more affordable and simpler to install, making them a good choice for budget-conscious consumers or smaller installations. However, the limited features and lower quality of analog systems mean they are gradually being replaced by IP systems. The ongoing shift towards digital and smart technologies will continue to support the dominance of IP Video Intercom systems in the market.

Connection Type Analysis

Wireless Video Intercom dominates with 55% due to ease of installation and flexibility.

The market is segmented by connection type into Wired Video Intercom and Wireless Video Intercom. Wireless Video Intercom systems are favored for their easy installation and flexibility. They do not require extensive wiring, making them ideal for retrofitting in existing buildings. The growing trend of smart home devices and the need for convenient security solutions drive the demand for wireless systems. These systems are also easier to expand, allowing users to add more units as needed without major modifications. The ability to connect wirelessly to other devices and networks further enhances their appeal.

Wired Video Intercom systems, while more challenging to install, offer reliable and secure connections. They are less susceptible to interference and can provide more consistent performance, making them suitable for large buildings or areas with potential signal issues. Wired systems are often preferred in new constructions where the infrastructure can be planned to accommodate the necessary wiring. Both wired and wireless systems have their place in the market, with the choice often depending on specific installation requirements and user preferences.

End User Analysis

Residential dominates with 60% due to rising security concerns and the growth of smart home technologies.

The market by end user includes Residential and Commercial sectors. Within Commercial, it is further segmented into Office Buildings, Retail Stores, Hotels, and Others. The Residential sector is the largest end user of video intercom devices. Homeowners increasingly seek to enhance their security with advanced intercom systems that provide both convenience and safety. The integration of video intercoms with smart home systems allows for remote monitoring and control, appealing to tech-savvy consumers. The growing awareness of security and the availability of affordable, easy-to-install systems have driven the adoption of video intercoms in residential settings. The rise of urban living and gated communities also supports this segment's growth.

The Commercial sector, including Office Buildings, Retail Stores, and Hotels, also significantly contributes to the market. Office buildings use video intercoms to manage visitor access and enhance security. Retail stores benefit from these systems by monitoring entry points and preventing unauthorized access. Hotels use video intercoms to provide guests with convenient communication and enhanced security. Each of these commercial applications drives demand for specialized video intercom systems that cater to specific needs, supporting overall market growth.

Key Market Segments

By Type of Device

- Door Station

- Indoor Station

- Master Station

By Technology Type

- Analog Video Intercom

- IP Video Intercom

By Connection Type

- Wired Video Intercom

- Wireless Video Intercom

By End User

- Residential

- Commercial

- Office Buildings

- Retail Stores

- Hotels

- Others

Growth Opportunities

Integration with Artificial Intelligence and Analytics Offers Growth Opportunity

The incorporation of artificial intelligence (AI) and analytics into video intercom devices significantly enhances their functionality and appeal. AI-driven capabilities such as facial recognition and behavior analysis not only improve security measures by enabling sophisticated monitoring but also increase convenience through features like automated access control. These advancements make video intercom systems more robust and user-friendly.

Companies that integrate these technologies effectively can distinguish themselves in a competitive market, appealing to tech-savvy consumers and sectors that prioritize advanced security solutions. The growing demand for smart and autonomous security systems suggests a strong market growth trajectory for AI-enhanced video intercoms.

Development of Cloud-based and Subscription-based Models Offers Growth Opportunity

Transitioning to cloud-based and subscription-based models represents a significant shift in the video intercom industry. This model allows companies to offer enhanced services such as remote access, continuous video storage, and regular software updates, which provide added value to the consumer.

Such services not only improve the functionality of the devices but also create steady revenue streams through subscriptions. As consumers increasingly value convenience and enhanced service, the adoption of these models is likely to expand, fostering long-term customer relationships and driving sustained market growth.

Trending Factors

Mobile Integration and Remote Access Are Trending Factors

The increasing need for mobility and accessibility in security systems has made mobile integration and remote access essential features in video intercom devices. Consumers and businesses are looking for solutions that allow them to control and interact with their security systems remotely via smartphones or tablets.

This demand drives manufacturers to develop products that seamlessly integrate with mobile applications, enhancing user convenience and flexibility. As remote work and security concerns continue to rise, the demand for devices with these capabilities is expected to increase, making it a significant trend in the market.

Touchless and Voice-Controlled Interfaces Are Trending Factors

The shift towards hygiene and user convenience has accelerated the development of touchless and voice-controlled interfaces in video intercom devices. These features minimize the need for physical contact and allow for easier, hands-free operation, which is particularly appealing in public or high-traffic environments.

Companies that innovate in this area, like Google and Amazon, are setting industry standards and encouraging broader adoption of these technologies. The emphasis on reducing physical touchpoints and enhancing user accessibility is likely to continue, positioning touchless and voice-controlled interfaces as prominent trends in the video intercom market.

Regional Analysis

North America Dominates with 34.5% Market Share in the Video Intercom Devices Market

North America’s 34.5% market share in the video intercom devices market is primarily driven by high security and safety concerns among residents and businesses. The region’s advanced technological infrastructure facilitates the integration of video intercoms with other smart home and security systems, enhancing their functionality and appeal. Additionally, the presence of leading industry players who innovate and invest in new features supports widespread adoption.

The market dynamics are influenced by the increasing demand for enhanced security solutions in residential, commercial, and public sector buildings. The growth of smart homes and the need for sophisticated entry management systems further stimulate the market. North America’s strong emphasis on technological adoption and consumer awareness about security products also contributes significantly to the regional market’s performance.

The future market influence of North America in the video intercom devices sector is likely to remain strong. Ongoing innovations in wireless technology and IoT integration, along with rising investments in building infrastructure, are expected to drive further growth. The increasing urbanization and the continued focus on security will sustain the demand for advanced video intercom systems.

Regional Market Share Analysis:

- Europe: Holds approximately 28% of the market. The demand in Europe is driven by heightened security measures and a strong inclination towards advanced technology in residential and commercial sectors.

- Asia Pacific: Accounts for about 25% of the market share. Rapid urbanization and increasing building infrastructure developments, especially in China and India, are key growth drivers.

- Middle East & Africa: With a 6% market share, the region is gradually adopting more advanced security solutions due to increasing infrastructure investments and a growing focus on public safety.

- Latin America: Represents 6.5% of the market. Growth in this region is spurred by improving economic conditions and a rising demand for security technologies in both residential and commercial buildings.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Video Intercom Devices Market is shaped by several influential players. Key companies include Aiphone Co., Ltd., Panasonic Corporation, Honeywell International Inc., Legrand SA, Fermax Electronica S.A.U., Samsung Electronics Co., Ltd., Comelit Group S.p.A., ABB Ltd., Dahua Technology Co., Ltd., Hikvision Digital Technology Co., Ltd., TCS AG, 2N Telekomunikace a.s., and Zenitel NV.

Aiphone Co., Ltd. and Panasonic Corporation lead the market with their innovative and reliable intercom solutions. Their strong R&D capabilities and brand reputation position them as top choices for residential and commercial applications.

Honeywell International Inc. and Legrand SA offer comprehensive security solutions, integrating video intercom systems with broader smart home and building automation technologies. Their strategic acquisitions and global reach enhance their market influence.

Samsung Electronics Co., Ltd. and Dahua Technology Co., Ltd. leverage their technological expertise and manufacturing capabilities to offer advanced video intercom devices with high-resolution cameras and smart features. Hikvision Digital Technology Co., Ltd. is known for its strong focus on security solutions, providing robust and scalable intercom systems.

Fermax Electronica S.A.U. and Comelit Group S.p.A. emphasize design and user-friendliness, appealing to the European market with stylish and reliable products. ABB Ltd. and TCS AG focus on high-quality, integrated solutions for building management systems.

2N Telekomunikace a.s. and Zenitel NV cater to niche markets with specialized intercom solutions, including IP-based systems and critical communication devices. These companies drive market growth through continuous innovation, strategic partnerships, and a focus on enhancing security and convenience for users.

Market Key Players

- Aiphone Co., Ltd.

- Panasonic Corporation

- Honeywell International Inc.

- Legrand SA

- Fermax Electronica S.A.U.

- Samsung Electronics Co., Ltd.

- Comelit Group S.p.A.

- ABB Ltd.

- Dahua Technology Co., Ltd.

- Hikvision Digital Technology Co., Ltd.

- TCS AG

- 2N Telekomunikace a.s.

- Zenitel NV

Recent Developments

- June 2023: 2N introduced Adaptive Face Zooming in its video intercom systems. This feature enhances security by allowing users to easily identify visitors through optimized face recognition, thereby bolstering safety protocols in facilities.

- January 2023: Ring released intelligent video intercoms integrated with Google Assistant and Amazon Alexa. These devices offer voice-controlled access and monitoring, making home security systems more convenient for tech-savvy homeowners.

Report Scope

Report Features Description Market Value (2023) USD 25.4 Billion Forecast Revenue (2033) USD 89.6 Billion CAGR (2024-2033) 13.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Device (Door Station, Indoor Station, Master Station), By Technology Type (Analog Video Intercom, IP Video Intercom), By Connection Type (Wired Video Intercom, Wireless Video Intercom), By End User (Residential, Commercial [Office Buildings, Retail Stores, Hotels, Others]) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Aiphone Co., Ltd., Panasonic Corporation, Honeywell International Inc., Legrand SA, Fermax Electronica S.A.U., Samsung Electronics Co., Ltd., Comelit Group S.p.A., ABB Ltd., Dahua Technology Co., Ltd., Hikvision Digital Technology Co., Ltd., TCS AG, 2N Telekomunikace a.s., Zenitel NV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Aiphone Co., Ltd.

- Panasonic Corporation

- Honeywell International Inc.

- Legrand SA

- Fermax Electronica S.A.U.

- Samsung Electronics Co., Ltd.

- Comelit Group S.p.A.

- ABB Ltd.

- Dahua Technology Co., Ltd.

- Hikvision Digital Technology Co., Ltd.

- TCS AG

- 2N Telekomunikace a.s.

- Zenitel NV