Varactor Diode Market By Breakdown Voltage (5 V- 30 V, 31V - 65V, 65 V & Above), By Application (Defense, Aeronautics, and Marine, Satellite Communication, Mobile Devices, DVD Recorders), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

2892

-

May 2023

-

154

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

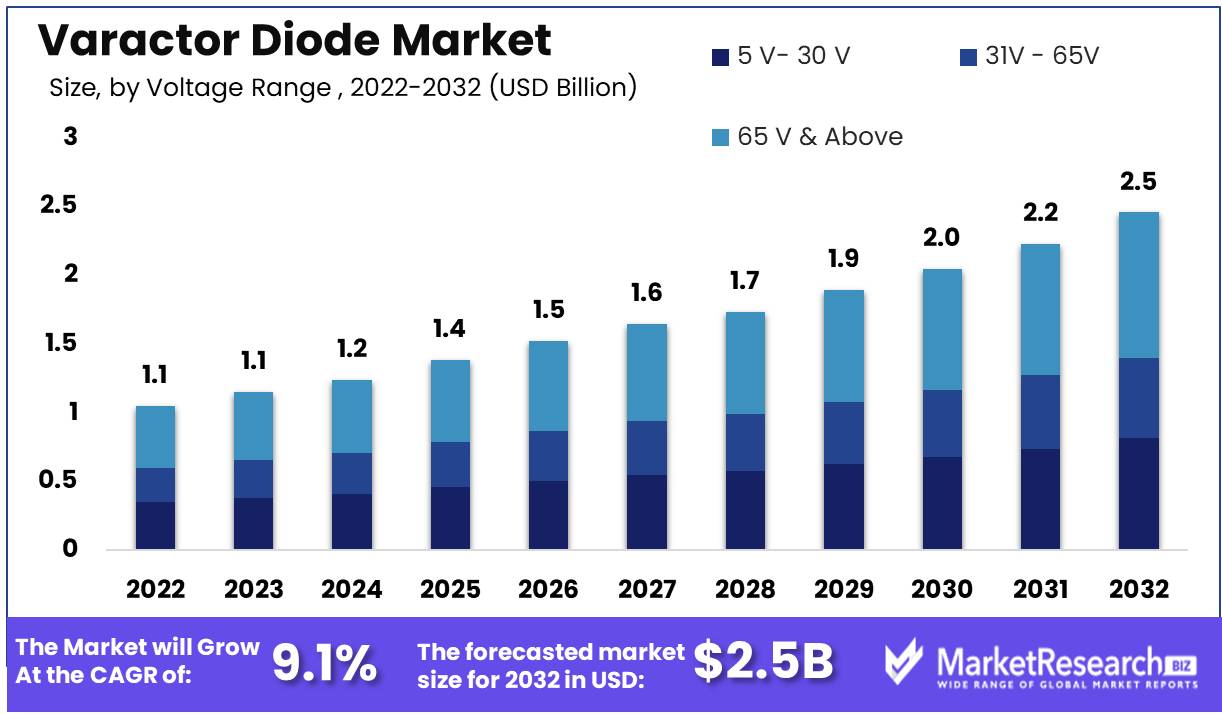

Varactor Diode Market size is expected to be worth around USD 2.5 Bn by 2032 from USD 1.05 Bn in 2022, growing at a CAGR of 9.1% during the forecast period from 2023 to 2032.

The market for varactor diodes is expanding rapidly due to the soaring demand for wireless communication technology. Varactor diodes function as voltage-controlled capacitors, thereby conferring variable capacitance on wireless communication devices. In the following blog post, we will present an exhaustive overview of the market for varactor diodes, detailing its growth and applications, main drivers, ethical concerns, and business applications, thereby providing a glimpse into the complex and rapidly evolving landscape of varactor diodes.

Varactor diodes, also referred to as variable capacitance diodes or varicap diodes, are semiconducting devices whose capacitance varies based on the applied voltage. This property endows varactor diodes with an abundance of applications, particularly in the field of wireless communication technology, where they are deemed indispensable.

The ultimate purpose of varactor diodes is to provide electronic circuits with variable capacitance, thereby enabling the efficient adjustment of radio and microwave frequencies. Varactor diodes have the extraordinary ability to modulate their capacitance based on the variation in the reverse voltage applied to their junction, which explains their essential role in modern communication technology. In frequency synthesizers, modulators, demodulators, and frequency mixers, varactor diodes play a crucial role. The ability of varactor diodes to provide variable capacitance, a crucial characteristic in high-frequency circuit designs, is their main advantage. Additionally, the basic structure of varactor diodes makes them simple to manufacture, and their performance is relatively consistent and predictable.

Increasing demand for wireless communication technology, particularly in the consumer electronics and automotive industries, is driving the growth of the varactor diode market. With the introduction of 5G networks and the Internet of Things (IoT), the demand for high-frequency circuits and efficient frequency tuning has assumed utmost significance. In the aerospace and defense industries, where efficient frequency calibration is essential for radar systems and other communication devices, the market for varactor diodes is growing.

The use of varactor diodes raises ethical concerns, especially with regard to their potential impact on the environment and human health. Semiconductor manufacturing, including the production of varactor diodes, can generate hazardous waste and contribute to air and water contamination. Despite this, numerous firms in the semiconductor industry have made efforts to enhance sustainability and reduce their environmental impact.

As the market for varactor diodes continues to expand, greater emphasis will be placed on transparency, explainability, and accountability. Companies within the industry will be required to be transparent regarding their manufacturing processes, supply chains, and environmental and social impact. In addition, they will need to explain the benefits of varactor diodes to consumers and regulators and take responsibility for any unintended consequences associated with their use.

Driving factors

Wireless Communication Devices Drive Market Demand

Varactor Diode Market is anticipated to experience significant growth in the near future. The increasing demand for wireless communication devices such as smartphones and tablets is a major factor in this expansion. With people's increasing reliance on mobile devices for communication and entertainment, demand for varactor diodes has increased.

Technological Innovations in the Semiconductor Industry Contribute to the Development

In addition, technological advancements in the semiconductor industry have contributed to the growth of the market for varactor diodes. These developments have made it possible to produce more efficient and smaller varactor diodes, which are essential for the development of compact and potent communication devices.

Positive Influence of 5G Technology

The increasing adoption of 5G technology is also anticipated to have a positive impact on the market for varactor diodes. It is anticipated that 5G technology will revolutionize mobile networks, and as a result, the demand for varactor diodes, which are essential for the development of 5G networks, will increase significantly.

Regulatory Changes Could Impact

Current or prospective regulatory changes may have an effect on Varactor Diode Market. Variations in import/export policies, environmental regulations, and government subsidies for research and development in the semiconductor industry could be among these alterations.

Poised for Significant Growth

Emerging trends or alterations in consumer behavior could also impact the market for varactor diodes. A transition towards more eco-friendly products, for instance, could increase demand for more sustainable and energy-efficient varactor diodes. In the coming years, the market for varactor diodes will expand significantly due to technological advances, shifting consumer preferences, and regulatory modifications.

Restraining Factors

Costly Production of Varistor Diodes

The high cost of producing varactor diodes is a major factor restraining the expansion of Varactor Diode Market. The manufacturing process necessitates the use of expensive materials and intricate fabrication methods. In addition, the manufacturing process involves high-temperature refining, which increases production costs further. The product's high price is a result of its high production costs, which causes consumers to opt for less expensive alternatives, which has a negative effect on market growth.

Availability of Replacements

The availability of substitutes is another factor that hinders the expansion of the market for varactor diodes. There are cheaper alternatives to varactor diodes on the market, such as voltage regulator diodes, zener diodes, and other components that perform similar functions. Due to their cost-effectiveness, these substitutes are gaining popularity and are extensively used in electronic applications. Consequently, the market demand for varactor diodes has decreased.

Limited Access to Primary Materials

The limited availability of basic materials is an additional significant market constraining factor. Specific materials, such as silicon, gallium arsenide, and other premium alloys, are needed for the production of varactor diode. The limited global availability of these materials makes it difficult for manufacturers to maintain a consistent supply chain. This scarcity of raw materials and the ensuing price increase effect the ultimate cost of the product, which in turn influences the market demand for the varactor diode.

Increasing Chinese manufacturer competition

Chinese manufacturers face increasing competition on the market for varactor diodes. They have entered the market with low-priced products, placing pressure on the market's established participants. This competition has a negative effect on the product's price and reduces the market's established participants' profit margins. Local Chinese manufacturers are offering their products at significantly reduced prices, causing a shift in market preference toward less expensive options.

Strict government regulations on the market for varactor diodes

Government regulations are another factor restraining the market for varactor diodes. The government has enacted numerous regulations and policies to guarantee the security and integrity of electronic components. These regulations include safety standards and export duties, which raise production costs and the overall price of the product. Compliance with these regulations becomes a challenge for manufacturers who wish to offer competitively priced products.

By Voltage Range Analysis

The 5 V- 30 V segment holds the preponderance of the market share in the varactor diode industry. Due to its ability to provide efficient voltage control in a variety of electronic devices, this segment is anticipated to continue to dominate the market in the near future.

The trend and behavior of consumers towards the 5 V- 30 V segment have also contributed significantly to the growth of this segment. With the rise of smart devices and the demand for more efficient and compact electronic devices, there has been an increase in the demand for 5 V- 30 V varactor diodes that can facilitate the development of such devices. Due to the rising demand for high-performance electronic components that can provide efficient voltage control and aid in the development of advanced electronic devices, it is anticipated that the 5 V to 30 V segment of the varactor diode market will experience the highest growth rate in the coming years.

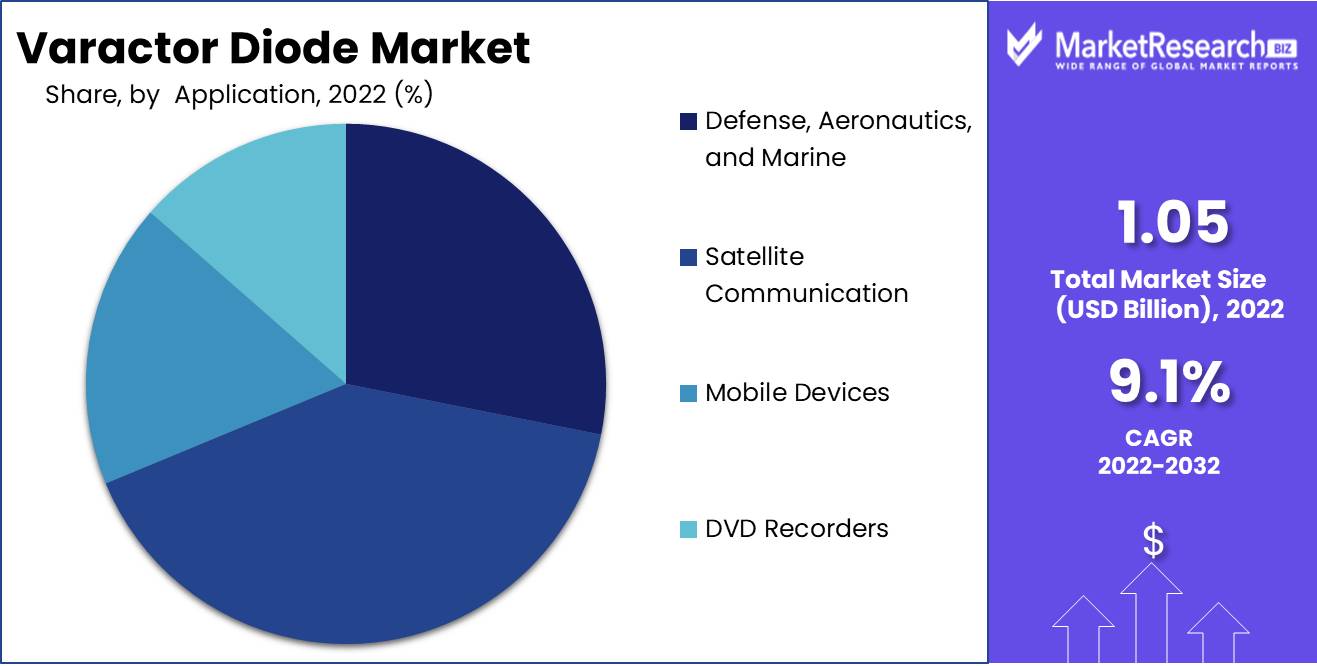

By Application Analysis

The Satellite Communication segment is the largest segment in the varactor diode market, accounting for a majority of the market share. This segment is expected to continue to lead the market in the near future due to the increasing demand for Satellite Communication devices, such as smartphones, tablets, and laptops, among others.

Consumer trend and behavior towards the Satellite Communication segment have also played a significant role in driving the growth of this segment. With the rise of social media and online communication platforms, there has been an increasing demand for high-quality Satellite Communication devices, which has further stimulated the growth of this segment. The Satellite Communication segment in the varactor diode market is anticipated to register the fastest growth rate over the forthcoming years due to the increasing demand for high-performance components, which can provide efficient voltage control and help in the development of compact and efficient Satellite Communication devices.

Key Market Segments

By Breakdown Voltage

- 5 V- 30 V

- 31V - 65V

- 65 V & Above

By Application

- Defense, Aeronautics, and Marine

- Satellite Communication

- Mobile Devices

- DVD Recorders

Growth Opportunity

Escalating Demand for Internet of Things Devices

In recent years, the Internet of Things (IoT) has gained significant traction due to the increasing demand for smart dwellings, smart communities, and smart transportation. Consequently, the demand for Internet of Things devices has increased. With their ability to modulate electrical signals, varactor diodes are becoming an integral part of IoT devices such as sensors, gateways, and controllers. In the coming years, the adoption of varactor diodes in IoT devices is anticipated to drive the growth of the varactor diode market.

A Growing Prevalence of Electric Vehicles

The transition toward clean energy sources is propelling the adoption of electric vehicles, which is creating an opportunity for the market for varactor diodes. Voltage and frequency are regulated in the power electronics of electric vehicles using varactor diodes. The demand for varactor diodes is anticipated to increase at a rapid rate due to the growing popularity of electric vehicles.

Escalating Use of Varactor Diodes in Medical devices

With the introduction of new and innovative technologies, the medical equipment industry has advanced at an accelerated rate. Varactor diodes are being integrated into a variety of medical devices, including MRI machines, CT scanners, and ultrasound devices. Utilizing varactor diodes in medical equipment improves the precision and effectiveness of these devices. The increasing use of varactor diodes in medical equipment is anticipated to drive the expansion of the market for varactor diodes in the healthcare sector.

Innovations in the semiconductor industry's technology

In recent years, the semiconductor industry has witnessed swift technological advancements, which has influenced the growth of the market for varactor diodes. Varactor diode production has become more efficient, compact, and cost-effective as a result of the development of novel manufacturing processes and materials. Additionally, the integration of varactor diodes with other semiconductor components has resulted in the creation of new and innovative devices. Future development of the market for varactor diodes is anticipated to be fueled by these technological advances.

Augmentation of 5G Technology Adoption

In recent years, the deployment of 5G technology has gained significant momentum, creating an opportunity for the market for varactor diodes. Varactor diodes are utilized in 5G transceivers to control the signal's frequency. The demand for varactor diodes is anticipated to increase at a rapid rate as 5G technology becomes increasingly prevalent.

Latest Trends

Varactor Diodes Taking Over High-Frequency Applications is the Heading.

Varactor diode usage has increased in high-frequency applications as a result of the continuously evolving technological advancements. The ability of varactor diodes to function as voltage-controlled capacitors makes them ideal for applications requiring precise frequency and voltage regulation. The constant evolution of wireless communication has resulted in a skyrocketing demand for high-frequency varactor diodes, prompting manufacturers to make massive investments in R&D. Consequently, the development of innovative and enhanced varactor diode technologies capable of operating at higher frequencies and delivering enhanced performance is currently underway.

Miniature Variactors: A Space-Saving Solution for Electronics

The Internet of Things (IoT) industry's explosive growth has fuelled the demand for miniature varactor diodes, which are small devices with extraordinary frequency stability and low power consumption, making them ideal for use in portable electronics and mobile devices. The development of novel miniature varactor diode technologies that offer high performance in a compact form factor is intensifying among manufacturers. Demand for miniature varactor diodes is increasing as a result of the constant expansion of the IoT market, which is driving the development of increasingly connected and compact devices.

Varactor Diodes - An Essential Component of Automotive Radar Systems

The increasing use of varactor diodes in automotive radar systems has had a substantial effect on the market for varactor diodes. Varactor diode technology provides reliable and accurate operation for automotive radar systems by allowing precise frequency control of radar signals. Massive investments have been made in the development of new and enhanced varactor diode technologies to provide the precise frequency control required by these radar systems as a result of the rapid expansion of autonomous driving.

The Rising Utilization of Varactor Diodes in Phased Array Antennas

Phased array antennas, which rely on varactor diodes to provide frequency control for multiple antenna elements, have made variactor diodes an indispensable component. This functionality is essential for the precise steering and shaping of beams. With the expansion of the aerospace and defense industries, it is anticipated that the demand for advanced phased array antennas will skyrocket. Manufacturers are making substantial investments in the development of new and enhanced varactor diode technologies that can provide the precise frequency control required by these systems.

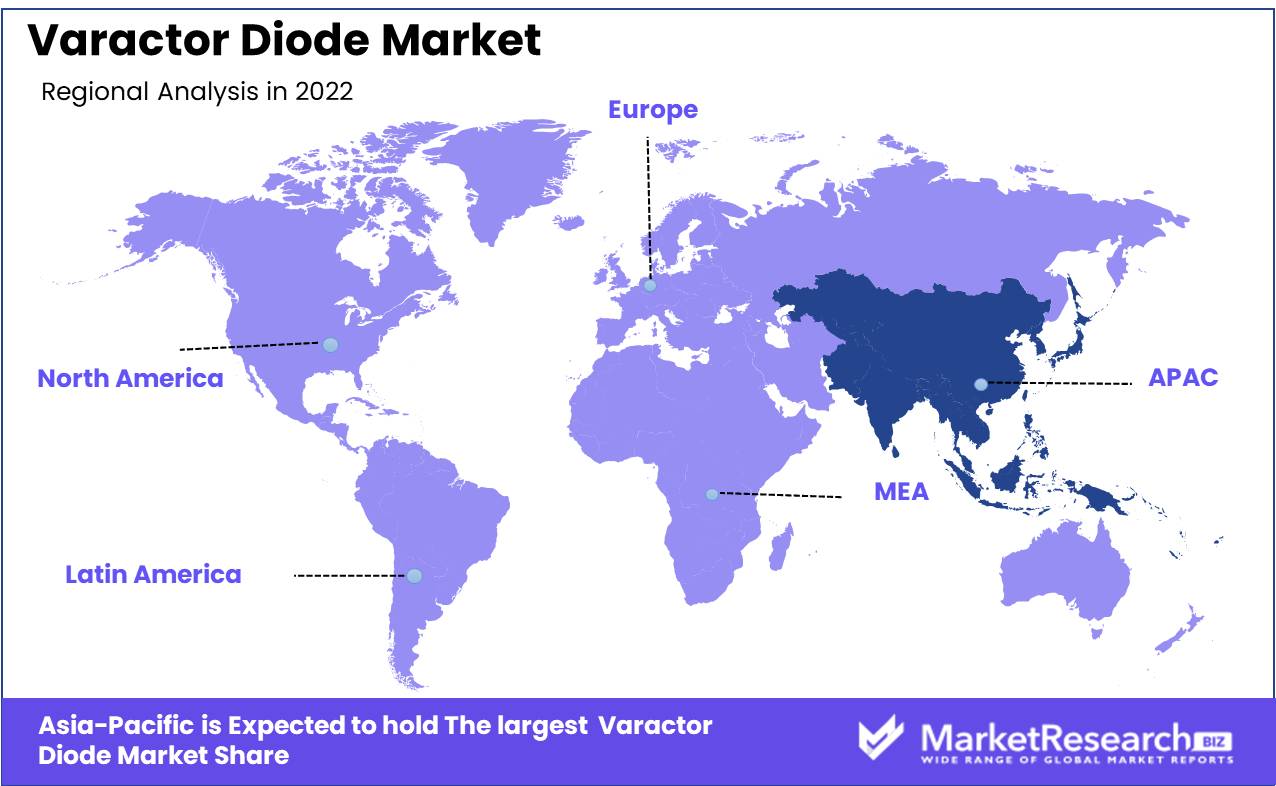

Regional Analysis

The Asia-Pacific region is a center for the expansion of varactor tuning diodes, which are gaining in popularity due to their high performance and efficiency. In recent years, the demand for these diodes has surged, particularly in the electronics, telecommunications, aerospace, and defense industries, where they have proved to be an integral part of numerous disruptive applications. Varactor tuning diodes, also known as tuning diodes, are excellent for use in electronic tuners, synthesizers, and phase locked loops due to their ability to vary their capacitance with voltage variation. In comparison to conventional variable capacitors, solid-state varactor diodes are more cost-effective and stable. Consequently, they are utilized in contemporary frequency modulators, phase shifters, and a vast array of electronic applications.

Due to their unique characteristics, such as low leakage current, high breakdown voltage, and low parasitic capacitance, the utilization of varactor tuning diodes has increased dramatically in the Asia-Pacific region. This demand has resulted in the development of innovative materials and designs that further improve their overall performance. The electronics industry, one of the region's most prominent industries, has been the primary generator of demand, with countries such as China, Japan, and South Korea possessing a robust electronics ecosystem.

High demand for 5G technology is driving the expansion of varactor tuning diodes in the Asia-Pacific telecommunications industry. These diodes are crucial to technological advancements as a result of the designers' tireless efforts to create high-performance and cost-effective solutions. The willingness of manufacturers to test the limits of their technology is propelling the growth of the market for varactor tuning diodes, which is anticipated to skyrocket as 5G technology continues to proliferate.

The aerospace and defense industry is anticipated to contribute significantly to the expansion of this industry. To remain ahead of the competition, manufacturers are increasingly focused on developing cost-effective and high-performance solutions. With a rapidly developing domestic market, favorable demographics, and a vast manufacturing base, the Asia-Pacific market for varactor tuning diodes is ripe for expansion.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The component known as "varactor diodes" holds a position of utmost significance in the field of electronics, with a vast array of applications in a variety of industries. Due to the exponential growth in demand for microelectronic devices, the market demand for these diodes is consistently rising. Numerous prominent companies, including but not limited to Skyworks Solutions Inc., Microsemi, Infineon Technologies, Renesas Electronics Corporation, NTE Electronics Inc., and Central Semiconductor Corp., have shown interest in the industry.

Skyworks Solutions Inc. is one of the foremost manufacturers of varactor diodes, offering an extensive array of silicon and GaAs-based products. Their notable expertise resides in tailoring these products to the particular requirements of their consumers.

Microsemi, a market titan, specializes in the production of high-performance and durable varactor diodes that are extensively employed in the aerospace, military, and space industries. Infineon Technologies, on the other hand, offers a wide selection of varactor diodes, including surface-mounted and wire-bondable types that can operate at both low and high frequencies.

With an unwavering commitment to research and development, Renesas Electronics Corporation has carved out a niche in the industry by offering distinctive varactor diode designs, such as high-capacitance and low-leakage designs. Their consumers have faith in them because their products' innovative designs make them incredibly dependable.

NTE Electronics Inc. is the go-to company for those seeking to incorporate mature technologies into their designs. Central Semiconductor Corp., on the other hand, caters to a diverse clientele, ranging from well-established industry giants to small and medium-sized businesses, and offers a multitude of varactor diode options to satisfy a variety of requirements

Top Key Players in Varactor Diode Market

- Diodes Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- ON Semiconductor Corp.

- Skyworks Solutions Inc.

- Toshiba Corporation

- Renesas Technology Corp

- NTE Electronics, Inc.

Recent Development

In 2021, MACOM Technology Solutions Holdings, Inc. launched a new family of high-performance varactor diodes for RF and microwave applications.

In 2020, Infineon Technologies AG introduced a new varactor diode with high capacitance ratios and low series resistance for 5G base station applications.

In 2019, Skyworks Solutions, Inc. launched a new series of silicon hyperabrupt junction varactor diodes for use in wireless infrastructure and other RF applications.

In 2018, Microchip Technology Inc.'s subsidiary Microsemi Corporation introduced a new family of high-capacitance ratio varactor diodes for use in RF and microwave circuits.

In 2017, NXP Semiconductors N.V. introduced a new high-performance varactor diode for use in mobile and wireless infrastructure applications, incorporating a high Q factor and minimal series resistance.

Report Scope:

Report Features Description Market Value (2022) USD 1.05 Bn Forecast Revenue (2032) USD 2.5 Bn CAGR (2023-2032) 9.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Breakdown Voltage: 5 V- 30 V, 31V - 65V, 65 V & Above

By Application: Defense, Aeronautics, and Marine, Satellite Communication, Mobile Devices, DVD RecordersRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Diodes Inc., Infineon Technologies AG, NXP Semiconductors N.V., ON Semiconductor Corp., Skyworks Solutions Inc., Toshiba Corporation, Renesas Technology Corp, NTE Electronics, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Diodes Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- ON Semiconductor Corp.

- Skyworks Solutions Inc.

- Toshiba Corporation

- Renesas Technology Corp

- NTE Electronics, Inc.