Vacuum Insulated Panel Market By Core(Silica, Fiberglass, Others), By Application(Construction, Refrigeration & Appliances, Others), By Structure(Flat, Laminated, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

40431

-

Aug 2023

-

157

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

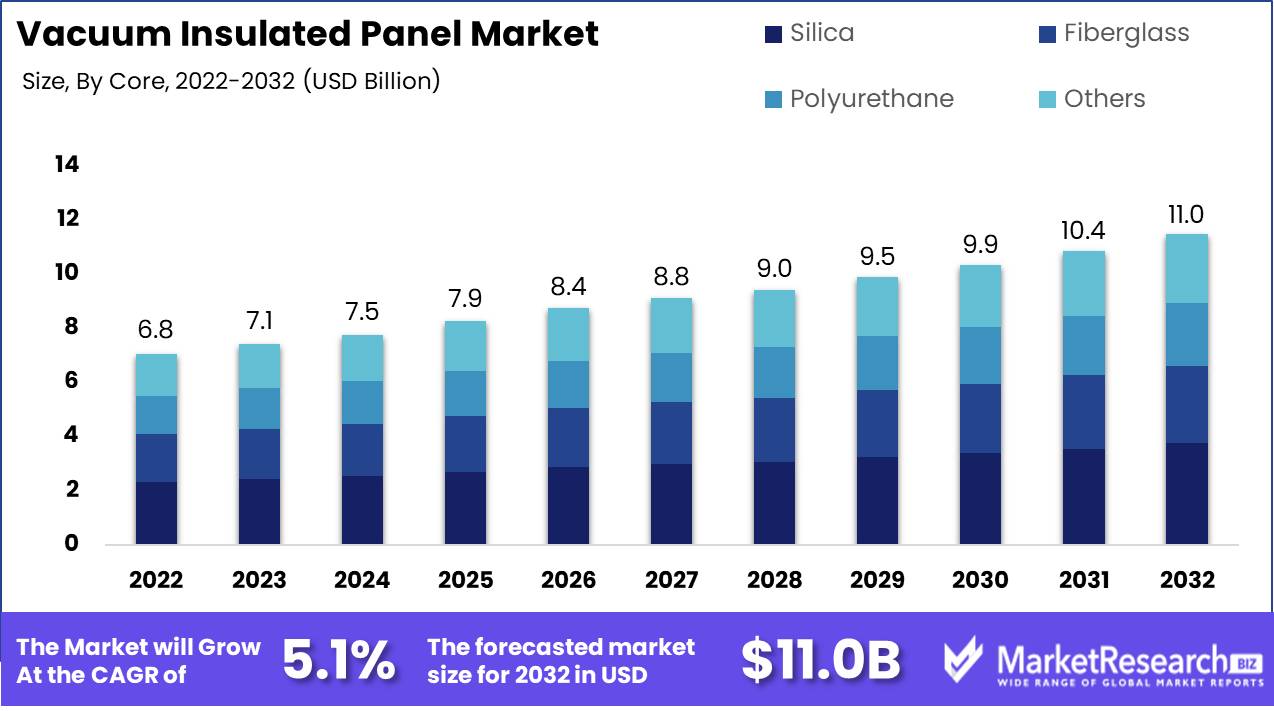

Vacuum Insulated Panel Market size is expected to be worth around USD 11.0 Bn by 2032 from USD 6.8 Bn in 2022, growing at a CAGR of 5.1% during the forecast period from 2023 to 2032.

In recent years, the market for vacuum insulated panels (VIP) has expanded significantly due to their exceptional thermal insulation properties and numerous industrial applications. VIPs are advanced insulation materials that consist of a highly porous core material and a gas-tight barrier. The primary material is typically a highly efficient insulation material, such as fumed silica or fiberglass, and the barrier is a thin, gas-tight film.

The increasing demand for energy-efficient solutions in construction and building applications is one of the primary market drivers for vacuum-insulated panels. VIPs provide superior thermal insulation, which reduces energy consumption and greenhouse gas emissions, thereby contributing to sustainability efforts and building certifications like LEED (Leadership in Energy and Environmental Design). As a consequence, VIPs have gained popularity in the residential and commercial construction industries.

The electronics industry has shown interest in VIPs due to their ability to effectively dissipate heat, which is essential for modern electronic devices that generate significant amounts of heat. As electronic devices become more compact and potent, effective thermal management is required to ensure their dependable performance, making VIPs a popular option.

In addition, the automotive industry has witnessed a growing trend toward electric vehicles (EVs), for which VIPs can play a significant role in enhancing the energy efficacy and range of batteries. As a result of the automotive industry's emphasis on sustainability and lowering carbon emissions, VIPs have been integrated into vehicle designs to improve thermal insulation and overall performance.

Driving factors

Energy Efficiency Demands

Increasing demand for energy-efficient solutions across a variety of industries is one of the primary factors driving the vacuum-insulated panel (VIP) market. The superior thermal insulation properties of VIPs substantially reduce energy consumption in buildings, transportation, and electronic devices. As governments and organizations prioritize energy efficiency to combat climate change, the use of VIPs as a cost-effective and environmentally favorable insulation solution continues to increase.

Temperature-Controlled Packaging and Cold Chain Logistics

Pharmaceutical, food, and other industries dependent on temperature-sensitive products have driven VIP demand in the cold chain logistics and packaging industry. VIPs provide exceptional thermal protection during transportation and storage, preserving the quality and integrity of perishable products. As global trade and e-commerce continue to grow, the demand for efficient temperature-controlled solutions has driven the adoption of VIPs in this industry.

Advances in Electronic Devices and Electric Vehicles

The rapid evolution of electronic devices and the rising popularity of electric vehicles (EVs) have generated a demand for efficient thermal management solutions. VIPs are ideal for enhancing the thermal performance and overall efficacy of electronic devices and EV batteries due to their exceptional heat dissipation capabilities. VIPs are anticipated to play a vital role in enhancing product performance and extending battery life as the electronics and automotive industries continue to innovate.

Restraining Factors

Limited Availability and Distribution Channels

The availability of VIPs varies by region, and distribution channels are limited outside of main metropolitan areas. This makes it challenging for builders and homeowners in rural and remote areas to gain access to VIPs. Moreover, local building codes and regulations may prohibit the use of VIPs, limiting their adoption in certain areas.

Technical Restraints

VIPs have limitations regarding the utmost feasible panel size and handling requirements. During installation, VIPs must be handled with care due to their fragility. If the panels are not installed properly, they can also compress and reduce the insulation's effectiveness. It is challenging to use VIPs in large commercial buildings or structures due to panel size restrictions.

Core Material Analysis

Silica Segment Dominates the Vacuum Insulated Panel Market

Due to the increased need for energy-efficient buildings and commercial refrigeration systems, the vacuum insulated panel (VIP) market has been expanding quickly in recent years. The silica sector dominates the market among the numerous core materials used in VIPs, holding the highest share in terms of value and volume. Silica VIPs have outstanding thermal insulation qualities, making them suitable for a variety of applications, such as building construction, refrigeration, and transportation.

The development of emerging economies' economies is contributing significantly to the growth of the worldwide vacuum insulated panel market. Driving market growth is the expanding use of VIPs in HVAC applications, cold storage facilities, and industrial refrigeration systems in developing nations like China, India, Brazil, and Mexico. These countries are making significant investments in the construction of their infrastructure, which is driving up demand for energy-efficient building supplies and equipment like VIPs.

Application Analysis

Construction Segment Dominates the Vacuum Insulated Panel Market.

In terms of volume and value, the construction industry holds the largest portion of the VIP market. VIPs are used in construction to create sustainable and energy-efficient structures while also saving a substantial amount of energy. VIPs are used more frequently in floor coverings, roofing, and building envelopes because they have superior thermal insulation qualities than conventional building materials.

Driving the adoption of VIPs in the construction industry is the growing emphasis on infrastructure development and energy efficiency in emerging economies. The construction of energy-efficient buildings is receiving significant funding from governments in these countries, which has increased demand for VIP services. Consumers and builders in these countries are becoming more and more interested in using eco-friendly building materials like VIPs.

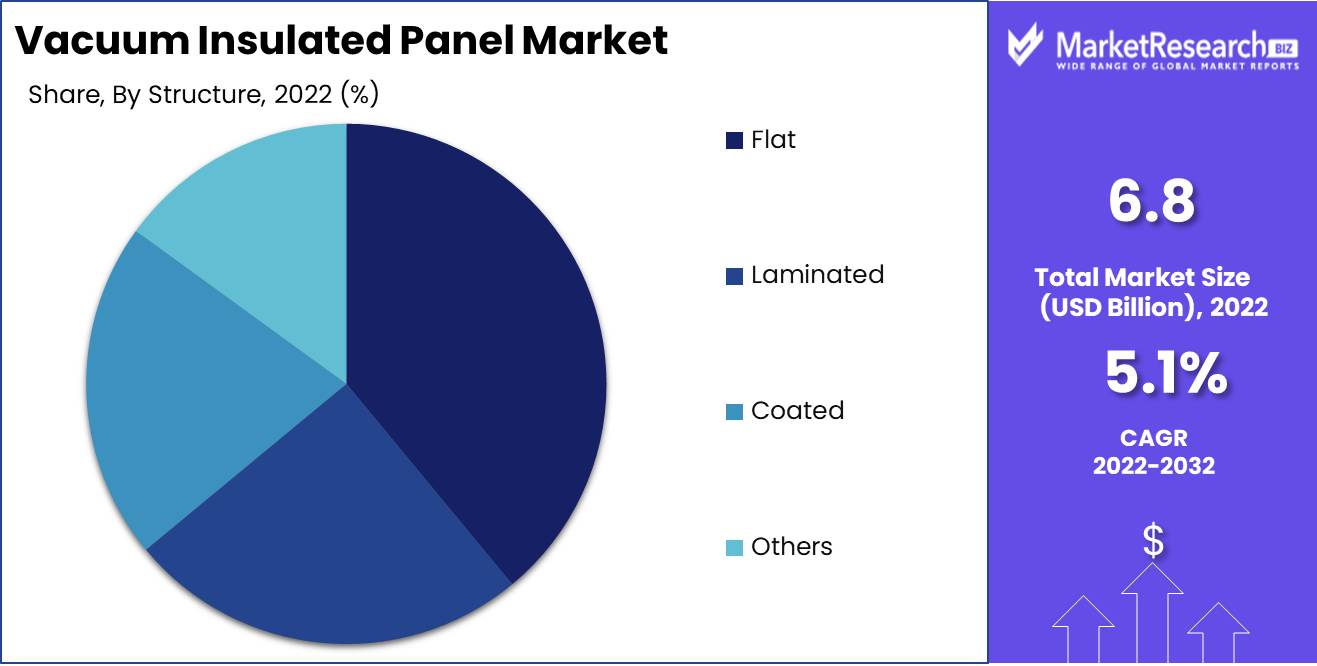

Structure Type Analysis

The flat Segment Dominates the Vacuum Insulated Panel Market.

Flat VIPs are the most popular variety of insulation panels and, in terms of volume and value, represent the greatest portion of the global VIP market. They consist of an airtight membrane surrounding a flat core material. Flat VIPs have exceptional insulation qualities, making them suitable for a variety of applications, such as transportation, refrigeration, and structural insulation.

Due to the growing demand for energy-efficient buildings and refrigeration systems, emerging nations are driving the adoption of flat VIPs. The need for high-performance insulation products as flat VIPs is also being driven by the growth of the commercial and industrial sectors in these countries. Significant factors driving the growth of the flat VIP market are investments in infrastructure development and the necessity for energy conservation.

Key Market Segments

By Core

- Silica

- Fiberglass

- Polyurethane

- Others

By Application

- Construction

- Refrigeration & Appliances

- Logistics & Transportation

- Others

By Structure

- Flat

- Laminated

- Coated

- Others

Growth Opportunity

Increasing Demand For Structures that Use Less Energy

In recent years, the demand for energy-efficient buildings has been rising substantially. Rising energy prices, environmental worries, and a growing understanding of the significance of sustainable living are the main factors driving this. By having great insulation qualities, VIPs are incredibly successful at lowering energy consumption in buildings. As a result, architects, builders, and homeowners are choosing them more frequently.

New Sustainable Building Codes Being Adopted

Globally, the use of sustainable building codes is growing. By encouraging the adoption of sustainable building techniques, these codes seek to lessen the total impact of construction on the environment. VIPs are a great option because they provide a highly sustainable insulation solution, which is what these codes call for. The demand for VIPs is anticipated to rise dramatically in the years to come as a result of the adoption of these codes.

A new generation of insulation materials

The emergence of new insulation materials is a feature of the VIP market. When compared to more conventional materials like fiberglass and foam, these materials have better insulation qualities. In the VIP market, for instance, aerogel is a highly effective insulation material that is gaining popularity. These innovative insulation materials are projected to displace conventional materials as technology for them develops, offering the VIP market tremendous potential opportunities.

Latest Trends

Building insulation is subject to strict regulations

Recent years have seen the establishment of strict regulations surrounding building insulation due to the demand for energy-efficient structures. Thermal insulation and energy saving are mandated by these regulations, and the usage of VIPs in the building industry offers an efficient solution. VIPs are thinner and up to ten times more insulative than conventional insulation materials like mineral wool and expanded polystyrene (EPS).

The segment of cold chain logistics that is growing

The necessity to transport and store temperature-sensitive products including food, medications, and chemicals is driving a rapid expansion in the cold chain logistics industry. The industry can now transport and preserve these products for extended periods of time while maintaining their quality and safety thanks to the use of VIPs in refrigerated containers and vehicles.

VIPs' use in pharmaceutical and medical packaging

The packaging of sensitive products is a challenge for the pharmaceutical and medical industries which need a safe and reliable solution. VIPs provide strong thermal insulation for medicines and vaccines that are temperature-sensitive. VIPs are used in this industry to make sure that products keep their efficacy and safety during shipping and storage, which ultimately results in patient safety.

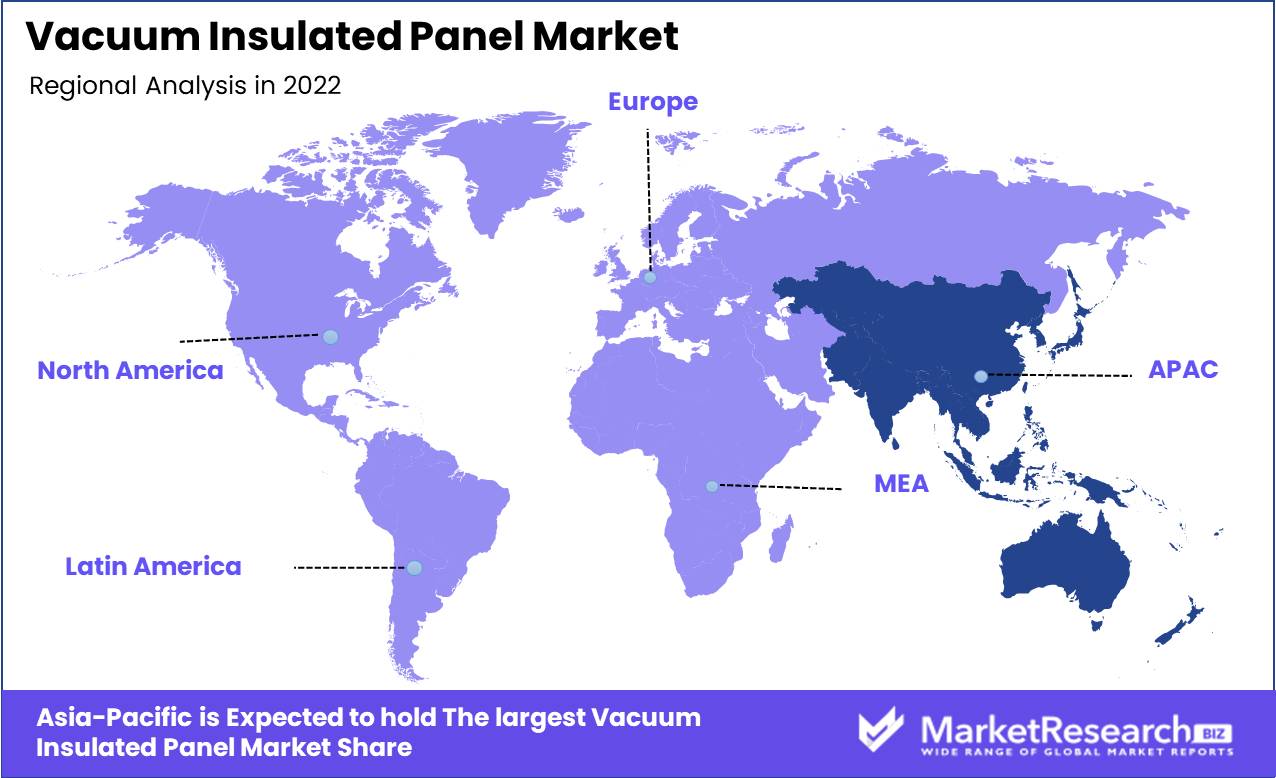

Regional Analysis

The vacuum insulated panel (VIP) market is dominated by the Asia-Pacific region, which has experienced impressive expansion and holds a sizable portion of the global market. The Asia-Pacific region has a varied economy with both developing countries and well-established industrial powerhouses, which has significantly increased demand for VIPs in a variety of industries.

Several important causes are to blame for the sudden increase in demand for vacuum insulated panels. Rapid urbanization and rising populations in nations like China and India are some of the main causes. There is an urgent need for energy-efficient and sustainable construction materials to fulfill the increased demand for residential, commercial, and industrial structures as urban centers grow and infrastructure improvements soar. With their remarkable thermal insulation capabilities, vacuum insulated panels offer a practical way to limit energy use for heating and cooling, hence lowering the overall carbon footprint of buildings.

In addition, the Asia-Pacific region has a variety of climate extremes, from intense heat to bitter cold. Due to their excellent insulation abilities, VIPs are particularly advantageous in these climates. In order to guarantee temperature stability and product integrity throughout transportation and storage, sectors like cold chain logistics, where temperature-sensitive products are stored and transported, have also adopted VIPs.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

DowDuPont was a major player in the VIP market, offering a wide range of advanced materials and solutions. They were well-known for their high-performance VIP products, utilized in the building, refrigeration, and other industries, with exceptional thermal insulation capabilities.

Evonik was a leading provider of specialty chemicals and advanced materials, including vacuum insulation panels. They were well-known for their cutting-edge VIP solutions, which served to numerous applications like cold chain logistics, building insulation, and transportation.

LG Hausys was a well-known manufacturer of building materials and construction products, including vacuum-insulated panels. They provided a variety of VIP solutions with an emphasis on sustainability and energy efficiency for both residential and commercial buildings.

Panasonic was a major player in the VIP market, providing vacuum insulation panels for refrigeration and cold storage applications. Their VIP technology was widely employed in building insulation and the transportation of temperature-sensitive commodities.

Top Key Players in Vacuum Insulated Panel Market

- DowDuPont

- Evonik

- LG Hausys

- Panasonic

- BASF SE

- Kingspan Group plc

- Panasonic Holdings Corporation

- Microtherm

- Evonik Industries AG

- va-Q-tec AG

- Avery Dennison Corporation

- Morgan Advanced Materials

- Kevothermal, LLC

- Knauf Insulation

Recent Development

- In 2022, Trimo, a top European supplier of environmentally friendly premium insulated panels for the building sector, was bought by Recticel, a leading global provider of insulation solutions. Recitel was able to broaden its geographic reach and insulation operations thanks to this acquisition.

- In 2022, NEVEON's Specialties business unit launched and ramped up the production of a vacuum insulation panel (VIP) manufactured at a fully automated line and a new facility in Nýrsko (Czech Republic). Numerous companies, including as those in the building, transportation, and food and beverage sectors, can make use of this new VIP.

- In 2022, Va-Q-Tec, a leading manufacturer of vacuum insulation panels, expanded its production capacity by 50%. The building, transportation, and food and beverage industries' rising demand for VIPs served as the primary driver of this expansion.

Report Scope

Report Features Description Market Value (2022) USD 6.8 Bn Forecast Revenue (2032) USD 11.0 Bn CAGR (2023-2032) 5.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Core(Silica, Fiberglass, Others), By Application(Construction, Refrigeration & Appliances, Others), By Structure(Flat, Laminated, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DowDuPont, Evonik, LG Hausys, Panasonic, BASF SE, Kingspan Group plc, Panasonic Holdings Corporation, Microtherm, Evonik Industries AG, va-Q-tec AG, Avery Dennison Corporation, Morgan Advanced Materials, Kevothermal, LLC, Knauf Insulation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- DowDuPont

- Evonik

- LG Hausys

- Panasonic

- BASF SE

- Kingspan Group plc

- Panasonic Holdings Corporation

- Microtherm

- Evonik Industries AG

- va-Q-tec AG

- Avery Dennison Corporation

- Morgan Advanced Materials

- Kevothermal, LLC

- Knauf Insulation