Usage Based Insurance Market By Type, Pay-As-You-Drive, Pay-How-You-Drive), By Vehicle Type (Commercial Vehicles, Passenger Vehicles), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

23179

-

March 2023

-

183

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

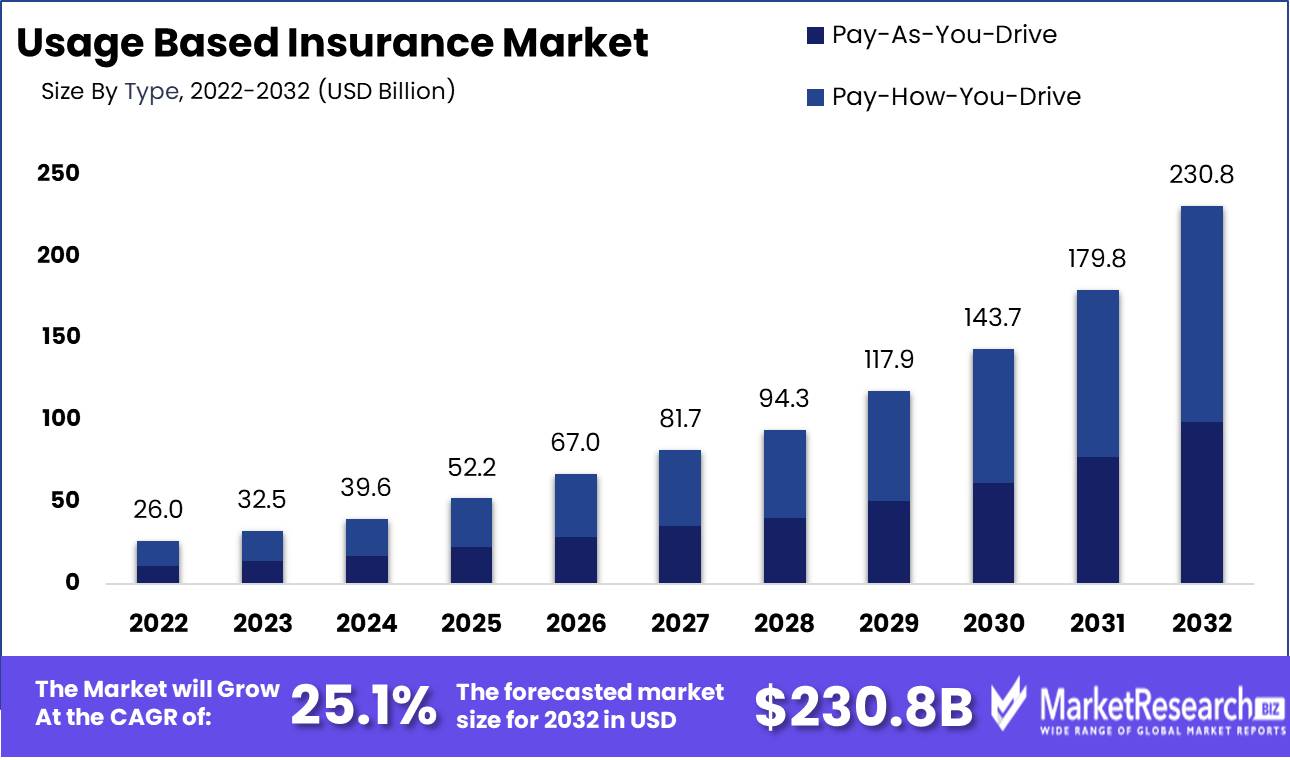

Usage Based Insurance Market size is expected to be worth around USD 230.8 Bn by 2032 from USD 26.0 Bn in 2022, growing at a CAGR of 25.1% during the forecast period from 2023 to 2032.

The usage based insurance market is experiencing substantial growth and is causing significant changes within the insurance industry. The insurance premiums for UBI, which is alternatively referred to as pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD) insurance, are contingent upon the specific usage patterns of vehicles. Conventional insurance premiums are commonly established based on demographic variables, including age, gender, and geographical location. Nevertheless, UBI employs telematics devices and mobile applications to gather up-to-date information on driving habits, mileage, temporal patterns, and additional variables for the purpose of calculating insurance premiums.

The primary aims of Universal Basic Income (UBI) encompass the provision of customized insurance premiums predicated upon an individual's driving conduct, the promotion of safer driving practices, and the potential mitigation of both vehicular accidents and instances of insurance fraud. Through the alignment of premiums with the corresponding level of risk, Universal Basic Insurance (UBI) incentivizes drivers to adopt safe driving practices while simultaneously relieving the financial strain on those who adhere to such practices. This approach prevents safe drivers from shouldering the financial burden that would otherwise be imposed upon them by subsidizing high-risk drivers.

The significance of UBI lies in its ability to bring about innovation and disruption within the conventional insurance market. This transition denotes a shift from utilizing demographic factors for risk prediction to evaluating risk based on observed behavior, thereby enhancing the fairness, transparency, and personalized nature of insurance. Universal Basic Income (UBI) presents insurance companies with the potential to distinguish their offerings and appeal to technologically proficient customers who prioritize customized interactions.

There are several advantages that are linked to Universal Basic Income (UBI). Firstly, this system allows cautious drivers to benefit from reduced insurance premiums, as their rates are determined by their specific driving habits rather than broad assumptions. Cautious drivers who accumulate minimal mileage can experience significant cost savings as a result. Furthermore, the implementation of Universal Basic Income (UBI) fosters a culture of enhanced driving safety through the provision of constructive feedback and incentives for personal growth in this domain. Through the surveillance of driving conduct, usage based insurance (UBI) incentivizes drivers to exhibit heightened attentiveness, refrain from engaging in hazardous maneuvers, and adhere to traffic regulations. Consequently, this may potentially lead to a reduction in the occurrence of accidents.

In recent years, the usage based insurance market has experienced significant advancements and novel developments. Initially confined to a straightforward pricing framework based on mileage, usage based insurance (UBI) has undergone a transformation to encompass additional variables such as speed, acceleration, braking behavior, and the influence of smartphone-related distractions. Insurance companies are engaging in partnerships with telematics and technology companies in order to create sophisticated risk assessment algorithms and analytics that are grounded in these specific parameters.

Driving factors

Connectivity and Telematics Capabilities

Advancements in technology have revolutionized the automotive industry, enabling vehicles to become more connected and intelligent than ever before. With the increasing connectivity and telematics capabilities in vehicles, a plethora of opportunities has emerged, including the rise of usage based insurance (UBI) market. This article will delve into the driving factors that have propelled the usage based insurance market forward and discuss its potential for growth and innovation. In today's digital age, vehicles are no longer simply modes of transportation. They have transformed into sophisticated machines with integrated telematics systems that constantly collect data on various aspects of vehicle performance.

Insurance and Automotive Industries

The growth of the insurance and automotive industries has played a significant role in fueling the expansion of the usage based insurance market. As the number of vehicles on the roads continues to increase, insurance companies are facing challenges in accurately assessing risk and providing fair premiums. Traditional insurance models that rely on factors such as age, gender, and driving history often fail to accurately measure an individual's level of risk. usage based insurance offers a solution to this problem by using real-time data collected through telematics devices installed in vehicles.

Data Analytics and IoT Technologies

Another critical driving factor behind the growth of the usage based insurance market is the advancements in data analytics and Internet of Things (IoT) technologies. The vast amount of data generated by telematics systems would be meaningless without sophisticated analytics tools to process and derive actionable insights from it. With state-of-the-art data analytics, insurance companies can identify patterns in driver behavior, assess risk more accurately, and develop personalized insurance products. The IoT also plays a crucial role in the usage based insurance market. By connecting vehicles to the internet, insurers can gather real-time data, monitor driving behavior, and assist drivers in improving their habits.

Personalized and Fair Insurance Pricing

One of the significant advantages of the usage based insurance market is its ability to provide personalized and fair insurance pricing. Traditional insurance models often rely on generalized risk assessment factors, which can lead to unfair pricing for responsible drivers who may fall into higher-risk categories due to factors beyond their control. This approach often creates dissatisfaction among policyholders, leading to a strained relationship between insurers and customers. By adopting a usage based insurance model, insurers can address this issue by evaluating an individual's driving behavior directly.

Safer Driving Behavior and Risk Mitigation

The rising interest in safer driving behavior and risk mitigation has been crucial in driving the popularity of the usage based insurance market. As more people become aware and concerned about the consequences of reckless driving, the demand for products and services that incentivize safe behavior has grown exponentially. usage based insurance represents a compelling solution for individuals looking to improve their driving habits and reduce their insurance costs simultaneously. By incorporating telematics capabilities into vehicles, insurers can monitor and provide feedback on various driving metrics, such as speed, acceleration, and braking patterns.

Restraining Factors

Privacy Concerns

Insurance companies gather data through various means, such as GPS tracking, vehicle sensors, mobile apps, and black box devices. This data includes detailed information about an individual's driving habits, including speed, acceleration, braking, and even location. While this data is crucial for determining accurate risk assessments and offering customized premiums, it also raises concerns regarding the privacy of policyholders. Policyholders worry that their driving behavior and other personal information could be shared with third parties without their consent, potentially leading to undesirable consequences. The unauthorized use or access to this sensitive information could result in identity theft, cyberattacks, or even manipulative advertising practices.

Data Security Risks

The substantial data collected and stored by insurance companies in the usage based insurance market present significant data security risks. Amid increasing cyber threats and data breaches, safeguarding this valuable data becomes essential. Insurance companies must employ stringent measures to protect against unauthorized access, data manipulation, or theft. Keeping personal data secure requires robust encryption techniques, secure storage systems, and robust cybersecurity protocols. Failure to implement adequate security measures can result in severe consequences, including reputation damage, legal liabilities, and financial loss.

Challenges in Meeting Regulatory Requirements

Insurance companies aiming to implement usage based insurance models face challenges in meeting regulatory requirements effectively. They must navigate complex legal frameworks that differ across jurisdictions, making compliance a daunting task. Legal obligations may include obtaining informed consent from policyholders for data collection, ensuring secure data storage and transfer, and establishing transparent data usage practices.

Challenges in Data Interpretation

Insurance companies must collect and interpret vast amounts of data accurately to provide fair and optimal premium policies. Interpreting data from multiple sources and ensuring data quality without biases or discrepancies can be challenging. Algorithms used to analyze and transform raw data into meaningful insights must be sophisticated and constantly refined to improve accuracy. Data interpretation challenges may arise from various factors, such as inconsistencies in data captured by different telematics devices, anomalies.

Resisting Telematics-Based Insurance Models

Some policyholders may resist telematics-based insurance models due to concerns over privacy, database security, or a general aversion to change. These individuals may prefer traditional insurance models that do not rely on monitoring their driving habits or collecting personal data. The implementation of such models requires significant investment in technology, infrastructure, training, and data analytics capabilities, which can be met with skepticism or resistance from traditional insurance providers.

Type Analysis

Pay-How-You-Drive Segment dominates usage based insurance market. The usage based insurance (UBI) market has seen significant growth in recent years, with one segment in particular dominating the industry - the Pay-How-You-Drive (PHYD) segment. PHYD insurance allows drivers to pay for insurance based on their driving behavior, offering a more personalized and fair pricing model. The rise of PHYD insurance can be attributed to several factors. The increased availability and affordability of telematics technology have made it easier for insurers to track and analyze driving behavior.

Consumer trends and behaviors have played a significant role in the popularity of PHYD insurance. Today's consumers are increasingly looking for personalized and customized experiences in all aspects of their lives, including insurance. PHYD insurance caters to these preferences by offering tailored policies based on individual driving behavior. Another consumer trend driving the adoption of PHYD insurance is the growing awareness of environmental sustainability. With the ability to track fuel consumption and emissions, PHYD insurance allows policyholders to reduce their carbon footprint and contribute to a more sustainable future.

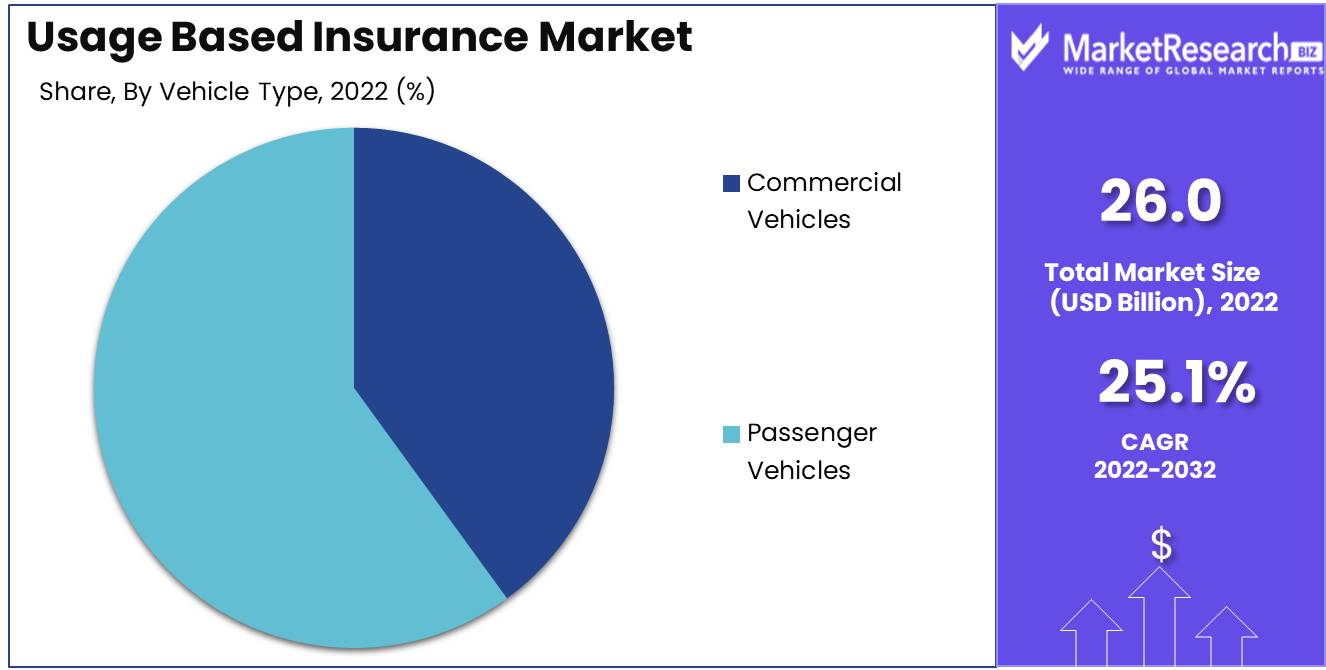

Vehicle Type Analysis

Passenger Vehicles segment has historically been a dominant force in the automotive industry. This segment includes cars, SUVs, and other vehicles designed primarily for the transportation of passengers. Passenger vehicles are widely used for daily commuting to work, school, or other destinations, making them an essential mode of transportation for a significant portion of the population. Families often rely on passenger vehicles for their transportation needs due to the seating capacity and practicality they offer. With increasing urbanization, the demand for personal transportation has risen, and passenger vehicles have become a popular choice for urban dwellers.

Consumer trends and behaviors in the Passenger Vehicles segment have evolved over time. The demand for SUVs and crossovers has surged due to their versatility, higher driving position, and perceived safety benefits. Many consumers have shifted from sedans to SUVs or crossovers. There has been a growing interest in electric vehicles as consumers become more environmentally conscious and seek sustainable transportation options. EV sales have been steadily increasing, and automakers have been investing in electric vehicle technology. Consumers have shown a preference for vehicles equipped with advanced infotainment systems, smartphone integration, and other connected features that enhance their driving experience.

Key Market Segments

By Type

- Pay-As-You-Drive

- Pay-How-You-Drive

By Vehicle Type

- Commercial Vehicles

- Passenger Vehicles

Growth Opportunity

Artificial Intelligence and Machine Learning

In addition to the mentioned development of advanced telematics and data analytics platforms within the usage based insurance market, there is a significant growth opportunity through the integration of artificial intelligence (AI) and machine learning (ML) technologies. Leveraging AI and ML capabilities can provide insurers with deeper insights into customer behavior, driving patterns, and risk factors, allowing them to tailor insurance coverage and pricing more accurately. With the advent of AI and ML, insurers can analyze vast amounts of real-time data collected through telematics devices and extract valuable information to enhance risk assessment and underwriting processes.

Partnerships with Automotive Manufacturers

Apart from collaborating with insurance providers and telematics service providers, another growth opportunity lies in developing strategic partnerships with automotive manufacturers. As the usage based insurance market expands, there is a need to integrate telematics systems directly into new vehicles to gather data seamlessly. Such collaborations can enable insurers to access a broader customer base and enhance the overall customer experience. By working closely with automotive manufacturers, insurance companies can integrate telematics devices during the production process, eliminating the need for retrofits or aftermarket installations.

Embracing Blockchain Technology

Blockchain technology presents a promising growth opportunity within the usage based insurance market. By leveraging the decentralized and transparent nature of blockchain, insurers can enhance data security, reduce operational analytics cost, and streamline claim settlement processes. Blockchain technology enables secure and tamper-proof storage of telematics data, ensuring the integrity of customer information. This enhances customer trust and helps insurers combat data breaches and fraudulent activities. Smart contracts powered by blockchain can automate claim settlement processes, reducing the time and effort required for manual claim processing.

Latest Trends

Pay-per-Mile and Pay-how-you-Drive insurance models

Pay-per-mile and pay-how-you-drive insurance models have gained immense popularity among consumers. These innovative models calculate insurance premiums based on actual mileage and driving behavior, allowing individuals to personalize their coverage and only pay for what they use. By leveraging advanced telematics and GPS technologies, insurance providers can accurately assess risk and adjust premiums accordingly. This shift towards usage-based models has not only enhanced affordability and fairness but also encouraged responsible driving habits.

usage based insurance for Commercial Fleets

The adoption of usage based insurance is not limited to individual drivers; it has also extended to commercial fleets. Businesses that operate a fleet of vehicles now have access to data-driven insights and comprehensive risk assessment tools. By monitoring driver behavior and implementing telematics devices, companies can optimize their fleet operations, reduce accidents, and minimize insurance costs. This demand for usage based insurance in the commercial sector is fueling the growth of the usage based insurance market.

Real-Time Driver Monitoring and Behavior Analysis

Real-time driver monitoring and behavior analysis have become integral to the usage based insurance market. Through the use of advanced sensors and artificial intelligence, insurers can track various parameters such as speed, acceleration, braking, and cornering. By analyzing this data in real-time, insurers can gain valuable insights into driver behavior and identify potential risks. This allows for proactive measures to be taken, such as providing feedback to drivers or offering personalized coaching, ultimately leading to safer roads and reduced accidents.

Insurance Apps and Connected Car Platforms

The emergence of insurance apps and connected car platforms has revolutionized the way insurance is accessed and managed. These digital platforms enable policyholders to track their driving habits, receive personalized feedback, and access relevant information anytime, anywhere. Insurance apps also facilitate a seamless claims process, enhancing customer experience and reducing administrative burdens. As these technologies continue to evolve, insurers can leverage the vast amount of data collected through these platforms to enhance risk assessment and deliver tailor-made coverage.

Connected Insurance Solutions

With the advent of the Internet of Things (IoT), connected insurance solutions have gained traction in the usage based insurance market. IoT-enabled devices installed in vehicles enable continuous monitoring of driving behavior, vehicle performance, and even environmental factors. By leveraging this data, insurers can offer dynamic policies that adjust premiums in real-time based on changing risk factors. This personalized approach not only benefits the policyholders by providing fair pricing but also incentivizes safer driving habits.

Regional Analysis

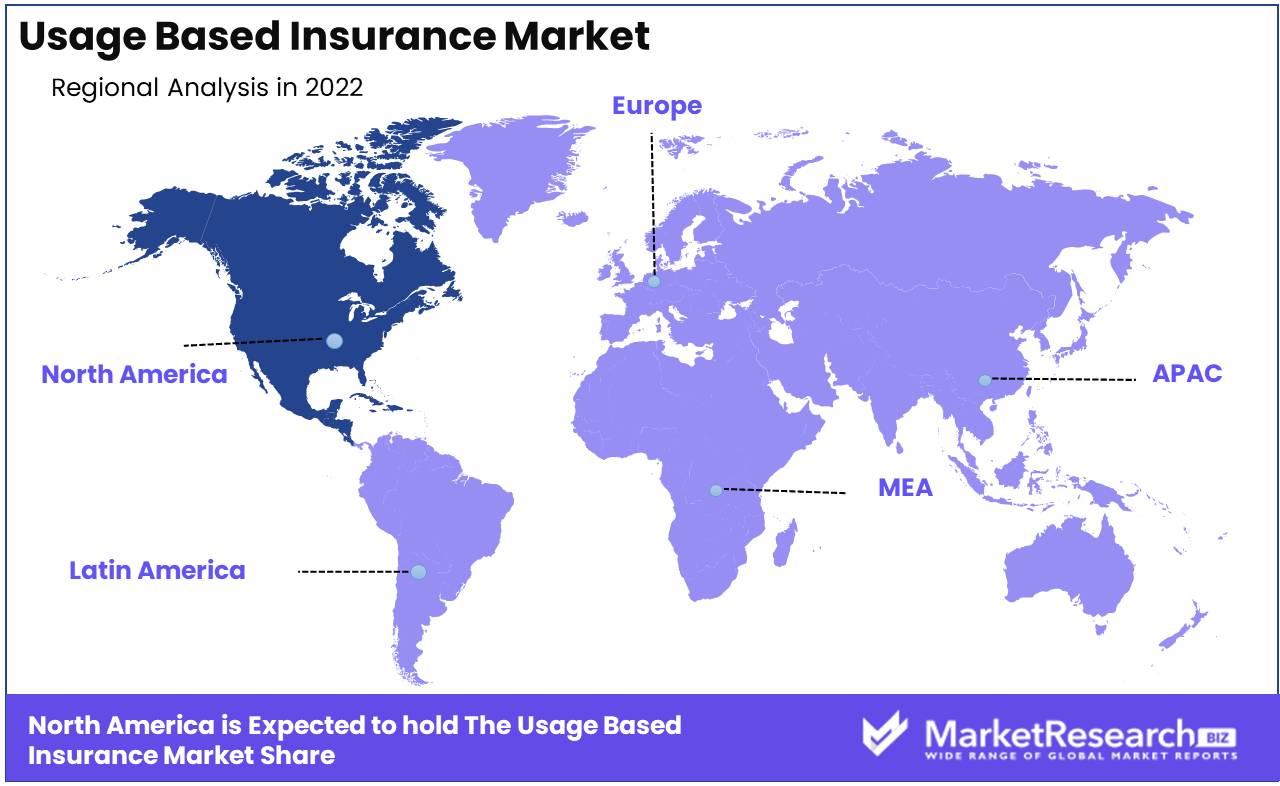

North America Region Dominates the usage based insurance Market. In today's highly competitive market, businesses are constantly seeking innovative ways to cater to the evolving needs and preferences of consumers. The insurance sector is no exception, with usage based insurance (UBI) emerging as a revolutionary concept. UBI, also known as pay-as-you-drive or pay-how-you-drive insurance, utilizes telematics technology to gather data on drivers' behavior and usage patterns, allowing insurers to offer personalized policies and pricing based on individual risk profiles.

When it comes to UBI, the North America region stands tall as the dominant player in the market. With advanced technological infrastructure, a large pool of potential customers, and a strong appetite for innovation, North America is at the forefront of the UBI revolution. This article delves into the reasons behind North America's dominance in the usage based insurance market and explores key factors driving its success.

One of the primary factors contributing to North America's market domination is its well-established telematics ecosystem. Telematics, the technology that forms the backbone of UBI, involves the use of in-vehicle sensors, GPS, and mobile connectivity to collect and transmit real-time data on driving behavior. North America boasts a robust network of telematics service providers, automotive manufacturers, and insurance companies that collaborate to deliver effective UBI solutions.

The vast size and diversity of the North American market further contribute to its prominence in the UBI landscape. The region is home to a significant number of vehicle owners, including private individuals, commercial fleets, and rideshare operators. This diverse customer base presents insurers with ample opportunities to tailor UBI offerings to different segments, suiting their specific requirements. The adoption rate of UBI in North America has been steadily increasing, fueled by growing awareness, enhanced customer engagement, and notable cost savings for policyholders.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Technology and changing consumer behavior have driven growth in the usage based insurance (UBI) business. Cambridge Mobile Telematics, insurethebox, Progressive Casualty Insurance Company, The Modus Group LLC, Inseego Corp., Lemonade Inc., and Metromile dominate the UBI industry. Let's examine each company's UBI contributions.

Cambridge Mobile Telematics (CMT) is a leading UBI provider of telematics-based insurance. Smartphone sensors and machine learning algorithms analyze driving behavior data in their advanced technology. CMT tailors insurance prices to individual driving patterns by precisely analyzing risk factors like speed, acceleration, braking, and turning. Their creative approach has achieved global popularity, making them a major UBI player.

UK UBI leader insurethebox. Insurethebox offers driving-behavior-based policies that empower policyholders. Telematics technology and direct policyholder-insurer communication encourage safe driving and minimize insurance prices. Their customer-centric approach has helped them dominate the usage based insurance market by meeting current drivers' needs.

Progressive Casualty Insurance Company is a major UBI player in the U.S. Snapshot®, a usage based insurance service, lowers premiums for cautious drivers. Progressive's telematics device tracks driving behavior, allowing risk-based pricing. Progressive dominates the industry with their large customer base and sophisticated UBI program.

Modus Group LLC, a new UBI player, focuses on collaborations and innovation. Their novel solution uses telematics, IoT devices, and smartphones to correctly measure driving behavior. The Modus Group uses data analytics and risk assessment to customise insurance policies and boost consumer engagement. Their nimble strategy makes them a leading UBI player.

Inseego Corp. provides advanced UBI telematics. They help insurers track and analyze driving behavior with industry-leading hardware and software. Insureds can match premiums to risk with Inseego's full telematics platform. Inseego Corp. boosts the usage based insurance market with cutting-edge technology and unmatched competence.

Lemonade Inc. uses technology to simplify and streamline insurance. Lemonade, known for their revolutionary home and renters' insurance solutions, just joined the UBI industry. They want to change vehicle insurance with telematics and safe driving. Lemonade's powerful brand and fair, digital-first approach could determine UBI's future.

Top Key Players in Usage Based Insurance Market

- Cambridge Mobile Telematics (U.S.)

- insurethebox (U.K.)

- Progressive Casualty Insurance Company (U.S.)

- The Modus Group LLC (U.S.)

- Inseego Corp. (U.S.)

- Lemonade Inc. Metromile (U.S.)

- The Floow Limited (U.K.)

- Allstate Insurance Company (U.S.)

- Octo Group S.p.A (Italy)

- TomTom International BV. (Netherlands)

- UNIPOLSAI ASSICURAZIONI S.P.A. (Italy)

- Assicurazioni Generali S.p.A (Italy)

- Liberty Mutual Insurance (U.S.)

- Equitable Holdings Inc.(Italy)

- MAPFRE(Spain)

- Sierra Wireless (Canada)

- Verizon (U.S.)

- Allianz Partners (Germany)

Recent Development

- In 2023, Progressive Insurance revealed intentions to introduce a cutting-edge usage based insurance solution, changing auto insurance again. Progressive's offering is geared to reward responsible drivers. This UBI product offers lower prices and better coverage while promoting safer roads.

- In 2022, State Farm Insurance promotes usage based insurance solutions. The firm will actively expand its usage based insurance program, allowing more drivers to benefit from this innovative strategy. State Farm's UBI initiative will now offer individualized rates and safe driving incentives to more drivers.

- In 2021, Allstate Insurance will develop a usage based insurance product to meet the growing need for affordable insurance options. This product makes usage based insurance more affordable for drivers, allowing more people to try it. This program lets users get customised, cost-effective coverage depending on their driving behavior.

- In 2020, leading insurer Geico announced plans to expand their usage based insurance scheme to more automobiles. Geico's UBI program lets users set their insurance premiums depending on their driving habits and performance. Geico's growth shows its commitment to offering more drivers the chance to optimize their coverage and promote safe driving.

Report Scope

Report Features Description Market Value (2022) USD 26.0 Bn Forecast Revenue (2032) USD 230.8 Bn CAGR (2023-2032) 25.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type, Pay-As-You-Drive, Pay-How-You-Drive)

By Vehicle Type (Commercial Vehicles, Passenger Vehicles)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cambridge Mobile Telematics (U.S.), insurethebox (U.K.), Progressive Casualty Insurance Company (U.S.), The Modus Group LLC (U.S.), Inseego Corp. (U.S.), Lemonade Inc. Metromile (U.S.), The Floow Limited (U.K.), Allstate Insurance Company (U.S.), Octo Group S.p.A (Italy), TomTom International BV. (Netherlands), UNIPOLSAI ASSICURAZIONI S.P.A. (Italy), Assicurazioni Generali S.p.A (Italy), Liberty Mutual Insurance (U.S.), Equitable Holdings Inc.(Italy), MAPFRE(Spain), Sierra Wireless (Canada), Verizon (U.S.), Allianz Partners (Germany) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Cambridge Mobile Telematics (U.S.)

- insurethebox (U.K.)

- Progressive Casualty Insurance Company (U.S.)

- The Modus Group LLC (U.S.)

- Inseego Corp. (U.S.)

- Lemonade Inc. Metromile (U.S.)

- The Floow Limited (U.K.)

- Allstate Insurance Company (U.S.)

- Octo Group S.p.A (Italy)

- TomTom International BV. (Netherlands)

- UNIPOLSAI ASSICURAZIONI S.P.A. (Italy)

- Assicurazioni Generali S.p.A (Italy)

- Liberty Mutual Insurance (U.S.)

- Equitable Holdings Inc.(Italy)

- MAPFRE(Spain)

- Sierra Wireless (Canada)

- Verizon (U.S.)

- Allianz Partners (Germany)