Urology Devices Market By Product(Dialysis Products, Urology Catheters, Other), By Disease(Benign Prostatic Hyperplasia (BPH), Prostate Cancer, Others), By End-User(Hospitals & Clinics, Dialysis Centers, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

3352

-

June 2023

-

176

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

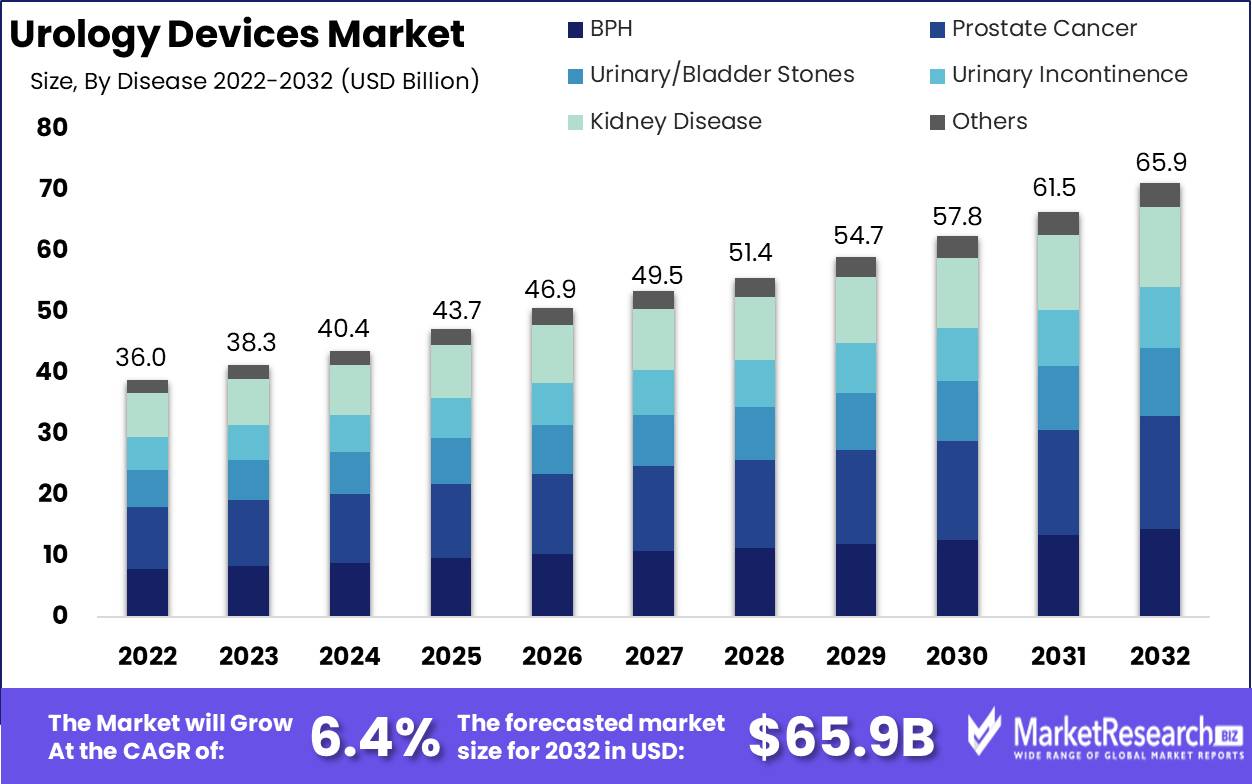

Urology Devices Market size is expected to be worth around USD 65.9 Bn by 2032 from USD 36.0 Bn in 2022, growing at a CAGR of 6.4% during the forecast period from 2023 to 2032.

The urology devices are comprised of sophisticated medical apparatus and cutting-edge technologies that aid in the diagnosis, treatment, and prevention of urinary tract and male reproductive system diseases and disorders. This market includes a vast array of devices, including endoscopes, catheters, stents, biopsy devices, and lithotripters, among others. The primary objective of the market is to improve patient outcomes, increase the efficacy and safety of urologic procedures, and reduce healthcare costs using innovative and efficient medical devices and technologies.

The urology devices market is a vital component of the medical industry, revolutionizing the diagnosis and treatment of urologic conditions and diseases. This market has enhanced minimally invasive surgical procedures, diagnostic accuracy, and the safety and effectiveness of urology interventions.

In addition, Dialysis is a major segment within the urology devices market. As the prevalence of chronic kidney disease rises globally, the number of dialysis centers and the demand for dialysis devices continues to grow. Dialysis treatment involves removing waste and excess fluid from the blood when the kidneys are unable to perform this function adequately. Various dialysis devices like hemodialysis machines, peritoneal dialysis solutions, and dialyzers are used in clinics and hospitals to filter patients' blood.

Major players in the dialysis devices market work to develop new technologies that improve treatment efficiency and expand access to dialysis centers. With the increasing adoption of home dialysis treatment, the dialysis segment accounts for a substantial portion of the total market for urology devices and is projected to see continued strong market growth.

The urology devices market has witnessed significant technological advancements in recent years, resulting in a wide variety of innovative devices and equipment. The use of robotic-assisted surgery is a notable innovation because it substantially enhances surgical precision, smaller incisions, reduced blood loss, and faster recovery. The use of lasers in the treatment of kidney stones, the development of bioabsorbable stents, and the implementation of augmented reality technology in endoscopy procedures are also noteworthy innovations.

Driving factors

Urological disorders are prevalent

There are a variety of factors contributing to the expansion of the urology devices market. To begin, there has been a discernible rise in the number of people suffering from urological disorders, which has resulted in a rise in the demand for urology devices. This expansion in the market has also been positively influenced by technological advancements in urology devices, which have served as a driving force. Treatments for urological disorders have been more effective and efficient as a direct result of these advancements, which have eventually led to improvements in patient outcomes.

A growing preference for operations that are just somewhat invasive

The rising popularity of minimally invasive surgical techniques is another factor that is contributing to the expansion of the market for urology devices. This strategy has several advantages, including a reduction in the amount of time patients spend in the hospital and an acceleration of their recovery. Additionally, as the global population of elderly people continues to expand at a rapid rate, there is likely to be an increase in the demand for urology devices, which will provide additional opportunities for growth in the market.

Increases in both the cost of healthcare and awareness of its importance

A higher knowledge of urological disorders and the therapies that are linked with them has been encouraged as a result of an increase in both the expenditures on healthcare and the awareness of their existence. Because of this raised awareness and increasing expenditure, there has been an increase in the number of people using urology devices.

On the regulatory front, there are persistent shifts occurring in rules, which may have implications for the urology devices market. For instance, laws concerning device recalls and approvals are often being updated, which might potentially have an effect on the competitive environment for market players. In order for businesses to maintain their level of competitiveness, it is critical for them to be abreast of any new regulatory requirements and to adjust their practices accordingly.

Restraining Factors

Strict Rules and Compliance Requirements

The stringent regulations and compliance standards are one of the most significant factors restraining the urology devices market. Regarding the quality and security of the devices, the regulatory bodies that supervise the market are very particular. Before they can be sold or used, the U.S. Food and Drug Administration (FDA) mandates that all urology devices be FDA-approved. This time-consuming and expensive approval process can make it difficult for manufacturers to introduce new products to the market.

The expensive nature of urology devices

The high cost of urology devices is an additional significant factor restraining growth. Due to the complexity of the devices, research and development expenses are significant. In order to recoup their costs, manufacturers must charge exorbitant prices for the devices. Consequently, many patients cannot afford these devices, which can result in delayed treatment and long-term health issues.

Product Analysis

In 2022, on the basis of product, the dialysis products segment stood out significantly by securing 39.8% of the total market share for product segments.

The dominance of Dialysis Products in the urology devices market can be attributed to their widespread use and essential role in managing kidney-related health issues. These advanced products encompass a range of equipment, including hemodialysis machines, peritoneal dialysis solutions, and catheters, among others. They enable healthcare professionals to perform dialysis procedures efficiently, helping patients with compromised kidney function to filter waste and excess fluids from their blood, essentially performing the vital functions of the kidneys.

Stents are an important product segment in the urology devices market. Different types of stents are used in urological procedures, including bare-metal stents, colonic stents, duodenal stents, and esophageal stents. Bare-metal stents made of materials like nitinol or stainless steel provide scaffolding in areas of the urinary tract and are often used to treat ureteral obstructions or strictures.

Colonial stents may be placed in the colon, rectum, or anus to open strictures or fistulas. Duodenal stents are commonly made of nitinol and used to open obstructions in the duodenum. Esophageal stents treat strictures of the esophagus near the stomach. Overall, stents account for a significant portion of the urology devices market, with continued innovation in stent design and materials driving growth in this segment.

Disease Analysis

The prostate cancer segment dominates disease analysis in revenue terms. This prevalent and often debilitating disease holds a dominant position when assessing financial aspects within the medical field. Prostate cancer is a form of malignancy that primarily affects the prostate gland, a crucial part of the male reproductive system. Its prominence in revenue terms can be attributed to several factors.

Furthermore, advancements in medical technology and treatment modalities for prostate cancer have led to an array of expensive yet effective interventions. These include advanced surgical techniques, radiation therapies, and cutting-edge pharmaceuticals. The costs associated with diagnosis, treatment, and post-treatment monitoring collectively contribute to prostate cancer's dominance in revenue terms within the realm of disease analysis.

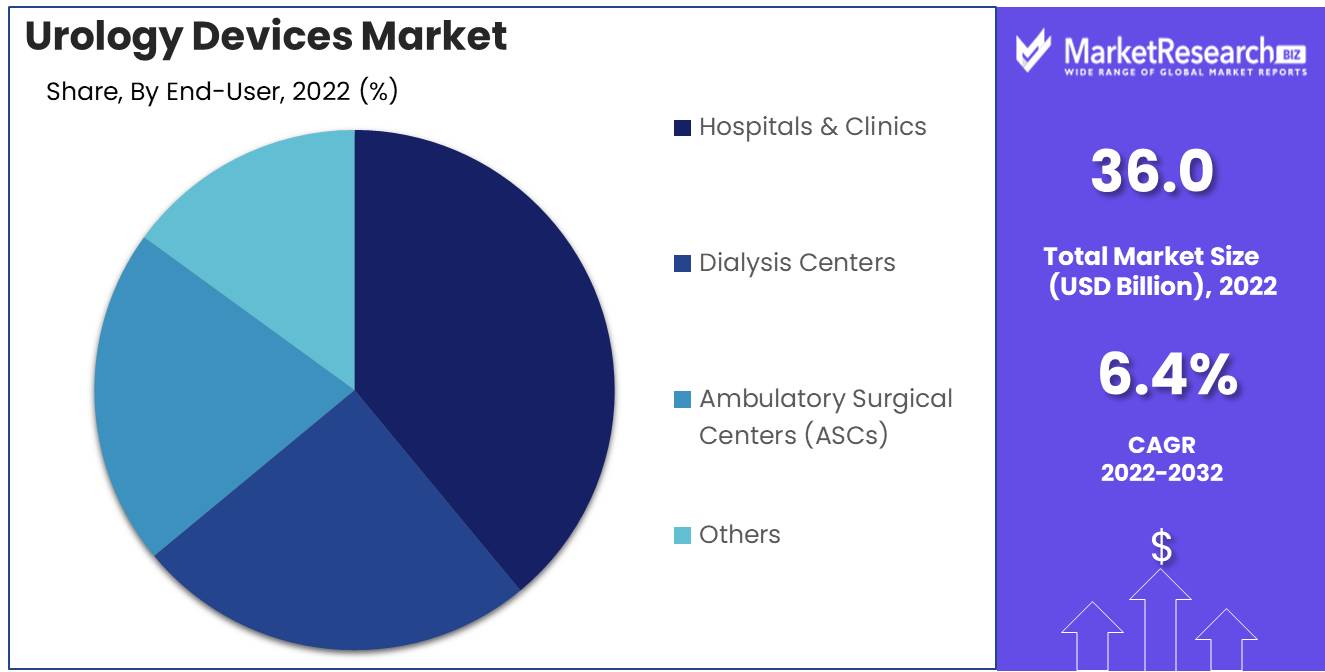

End-User Analysis

In 2022, among the end-user segments, the hospitals & clinics category exhibited a robust and substantial revenue share, specifically at a noteworthy double-digit figure of 73.1%.

This segment's dominance is a testament to the pivotal role played by hospitals and clinics in the field of urology and healthcare as a whole. Hospitals, with their state-of-the-art facilities and specialized urology departments, serve as critical hubs for the diagnosis and treatment of urological conditions. They offer a wide range of services, from routine check-ups and diagnostics to complex urological surgeries and interventions.

Clinics, on the other hand, cater to both outpatient and ambulatory care, making them accessible points of entry for patients seeking urological consultations and treatments. Together, hospitals and clinics form a comprehensive network that addresses the diverse needs of individuals dealing with urological issues.

Key Market Segments

Product

- Dialysis Products

- Urology Catheters

- Stents

- Endoscopes

- Biopsy Devices

- Drainage Bags

- Robotic System

- Laser and Lithotripsy Devices

- Other

Disease

- Benign Prostatic Hyperplasia (BPH)

- Prostate Cancer

- Urinary/Bladder Stones

- Urinary Incontinence

- Kidney Disease

- Others

End-User

- Hospitals & Clinics

- Dialysis Centers

- Ambulatory Surgical Centers (ASCs)

- Others

Growth Opportunity

Product Development Innovation

The urology devices market is no different; innovation is the key to success in any industry. The demand for minimally invasive procedures has increased, and as a result, companies are investing significantly in the development of new products and technologies to meet this demand. Additionally, businesses are concentrating on enhancing the precision and effectiveness of their devices. For instance, some companies are developing devices that provide precise measurements and data monitoring in real time.

Geographical Growth

The urology devices market is also being driven by geographic expansion. Companies are expanding their global operations to gain access to new markets and meet the requirements of consumers in various regions. This expansion is fueled by a number of factors, including an aging population, a rise in urological disorders, and a rise in the use of technology in healthcare.

Strategic Alliances

Strategic alliances are another crucial growth driver in the urology devices market. Companies are forming partnerships in order to gain access to new technologies and markets, increase their R&D spending, and improve their distribution channels. Companies can also develop innovative products and technologies by combining their resources and expertise through collaboration.

Latest Trends

Rising Urology Device Demand in Emerging Markets

Emerging markets, including Asia and the Middle East, have emerged as significant demand drivers for urology devices. This is partially attributable to the increasing prevalence of urologic conditions, such as urinary tract infections, bladder cancer, and kidney stones, and the presence of large geriatric populations. These markets have also benefited from a rise in disposable income and improved accessibility to healthcare services.

Increasing Proportion of Urologists and Urology Clinics

In addition to the expanding demand for urology devices, the number of urologists and urology clinics or dialysis centers segment has increased significantly. With more healthcare professionals specializing in urology, there has been a greater emphasis on early diagnosis and treatment of urologic diseases. This has resulted in the creation of innovative urology devices and procedures that can enhance patient outcomes and quality of life.

Urology Procedure Reimbursement Policies That Are Favourable

Additionally, favorable reimbursement policies have contributed to the market expansion of urology devices. Insurance companies and government programs have acknowledged the significance of urologic health and made efforts to ensure patients have access to the necessary care. This has led to an increase in the demand for urology devices and procedures, as well as an increase in research and development expenditures.

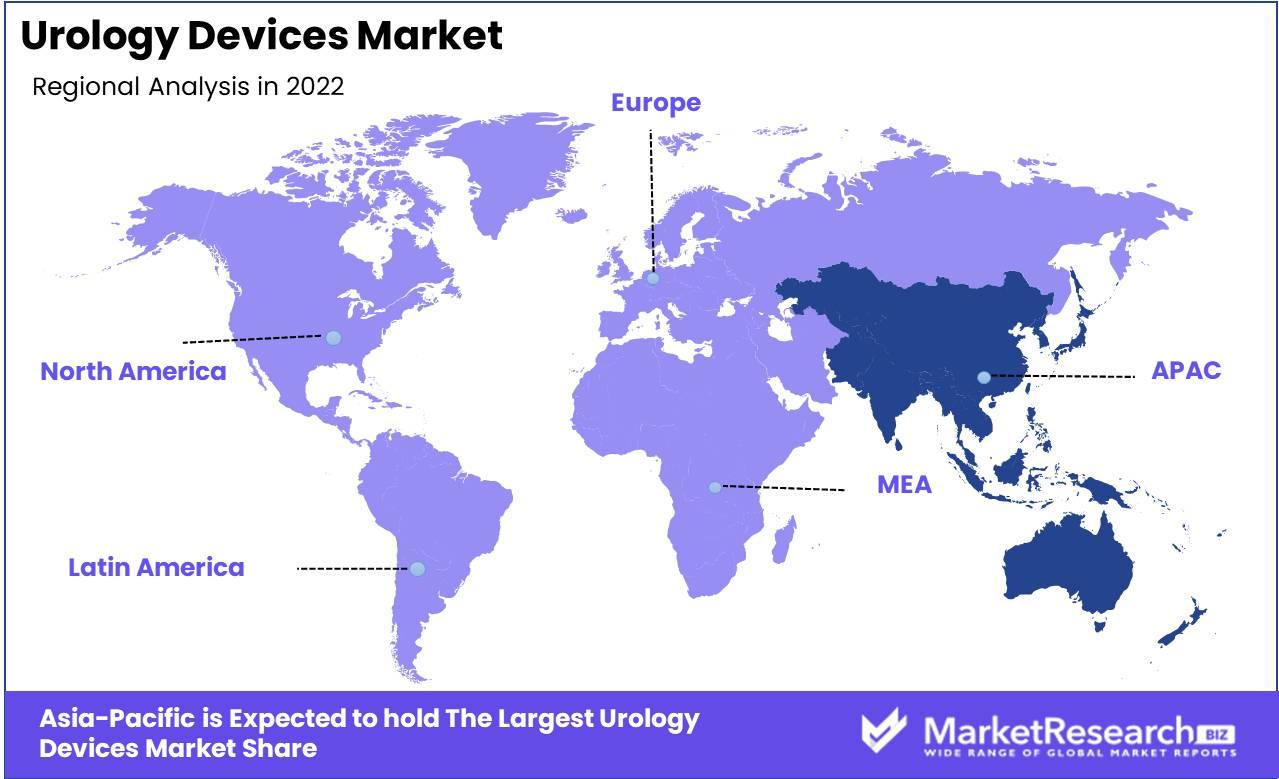

Regional Analysis

Asia Pacific, with its steadily rising demand for advanced medical technology, is projected to emerge as the fastest-growing region in the urology devices market over the forecast period, fueling an unprecedented and insatiable appetite for innovation and growth, as the industry looks to expand at a compound annual growth rate (CAGR) of over 6.4%, indicating a prosperous future for the industry.

As Asia Pacific becomes more aware of the importance of healthcare, the demand for high-quality medical devices has reached unprecedented levels. This is due to the region's inexorable and unstoppable rise of the aging population, coupled with the inexorable and undeniable rise of chronic diseases, which has played a pivotal and crucial role in fueling the growth of the urology devices market in the region, propelling a rapid and unrestricted expansion.

The urology devices market encompasses a bewildering array of products, including catheters, endoscopes, and biopsy devices, as well as other cutting-edge technologies that aid in the diagnosis and treatment of a diverse range of complex and intricate urological diseases, driving the market's upward trajectory through the introduction of innovative medical devices and a relentless commitment to research and development.

Furthermore, the inexorable rise in the prevalence of urinary tract infections, bladder cancer, prostate cancer, and other urological disorders has prompted healthcare providers in the region to adopt advanced medical devices, as an increasing number of patients with chronic diseases, such as diabetes and kidney disease, require increasingly sophisticated and advanced urological care, driving an unabating increase in demand for urology devices.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Market Players Analysis

A rise in the prevalence of urological conditions such as urinary incontinence, kidney stones, kidney failure, and urological malignancies, among others, is anticipated to propel the urology devices market over the next several years.

Boston Scientific Corporation, Cook Medical, Inc., Accordion Medical, KARL STORZ SE and Co. KG, Olympus Corporation, C. R. Bard, Inc. (a subsidiary of Becton, Dickinson, and Company), Coloplast Group, Richard Wolf GmbH, Medtronic, and Teleflex Incorporated are the key companies in the urology devices market.

Boston Scientific Corporation, a global medical technology company, provides an extensive selection of urology devices, including Incontinence Products, Surgical Devices, Stone Management, and Endourology Devices, to mention a few. Similarly, Cook Medical, Inc. is recognized for its innovative urological devices such as renal access sheaths, guide wires, and other medical devices.

Company profiles and Company overviews reveal key players developing innovative devices like robotic surgery systems, urinary stone treatment devices, and male external catheters to capture market share.

Top Key Players in the Urology Devices Market

- Fresenius Medical Care AG

- Baxter International Inc.

- Boston Scientific Corporation

- Olympus Corporation

- Cook Group Incorporated

- Medtronic Plc.

- R. Bard, Inc.

- Siemens Healthcare Private Limited

- Stryker Corporation

- SRS Medical Systems, Inc.

- EMD Medical Technologies

Recent Development

- In 2022, Precision Optics Corporation, Inc., a manufacturer of advanced optical instruments for the medical and defense industry, announced a new product launch order for the development of single-use disposable devices for urology applications.

- In November 2020, the FDA granted 510(k) clearance to Baxter International Inc. (US) for its Homechoice Claria automated peritoneal dialysis system with the Share source connectivity platform. The system is intended to facilitate the process of peritoneal dialysis for patients by providing them with personalized treatment options at home.

- In May 2019, Fresenius Medical Care AG and Co. KGaA (Germany) announced the opening of a new distribution center in Knoxville, Tennessee. The expansion will facilitate the delivery of products necessary for in-center hemodialysis treatment, making it simpler for patients to obtain the necessary care.

- In February 2019, Fresenius Medical Care AG and Co. KGaA (Germany) acquired NxStage Medical Inc. (United States) to expand its product portfolio in renal and critical care. This acquisition has positioned Fresenius as a market leader with a more comprehensive selection of products to meet patients' requirements.

Report Scope

Report Features Description Market Value (2022) USD 36.0 Bn Forecast Revenue (2032) USD 65.9 Bn CAGR (2023-2032) 6.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Dialysis Products, Urology Catheters, Stents, Endoscopes, Biopsy Devices, Drainage Bags, Robotic System, Laser and Lithotripsy Devices, Other), By Disease(Benign Prostatic Hyperplasia (BPH), Prostate Cancer, Urinary/Bladder Stones, Urinary Incontinence, Kidney Disease, Others), By End-User(Hospitals & Clinics, Dialysis Centers, Ambulatory Surgical Centers (ASCs), Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Fresenius Medical Care, Baxter International Inc., Boston Scientific Corporation, Olympus Corporation, Cook Group Incorporated, Medtronic Plc., R. Bard, Inc., Siemens Healthcare Private Limited, Stryker Corporation, SRS Medical Systems, Inc., EMD Medical Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Fresenius Medical Care

- Baxter International Inc.

- Boston Scientific Corporation

- Olympus Corporation

- Cook Group Incorporated

- Medtronic Plc.

- R. Bard, Inc.

- Siemens Healthcare Private Limited

- Stryker Corporation

- SRS Medical Systems, Inc.

- EMD Medical Technologies