Global Upper Respiratory Tract Infection Treatment Market By Type(Antibiotics, NSAIDs and nasal decongestants, Others), By Distribution Channel(Hospital pharmacies, Retail pharmacies, Online pharmacies), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45282

-

April 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

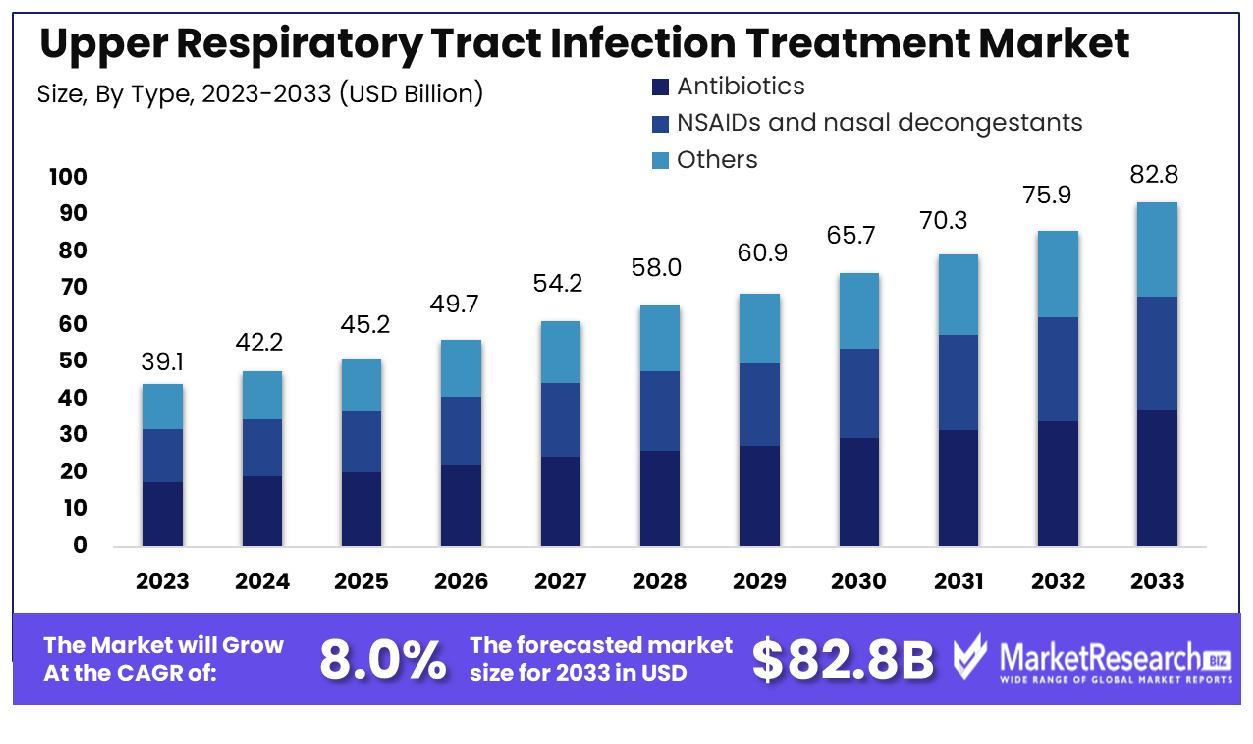

The Global Upper Respiratory Tract Infection Treatment Market was valued at USD 39.1 billion in 2023. It is expected to reach USD 82.8 billion by 2033, with a CAGR of 8.0% during the forecast period from 2024 to 2033.

The Upper Respiratory Tract Infection Treatment Market encompasses pharmaceuticals, therapies, and medical interventions tailored to combat infections affecting the nasal passages, throat, and associated upper respiratory organs. Characterized by a diverse array of pathogens and symptomatology, this market responds to the demand for effective treatments addressing viral, bacterial, and allergic etiologies.

Market dynamics are influenced by factors such as epidemiological trends, evolving microbial resistance, and consumer preferences for minimally invasive therapies. Strategic initiatives within this market focus on product innovation, regulatory compliance, and market access strategies, aiming to provide healthcare stakeholders with efficacious solutions while ensuring optimal patient outcomes and safety.

The Upper Respiratory Tract Infection (URTI) Treatment Market continues to witness dynamic shifts influenced by various factors, presenting both challenges and opportunities for stakeholders. The market's landscape is shaped by evolving epidemiological trends, healthcare infrastructure, and advancements in treatment modalities.

In 2022, the global healthcare community faced significant hurdles in combating infectious diseases, as evidenced by 1.3 million new HIV infections worldwide. Despite efforts to curb transmission, the pace of decline fell short of UN targets for 2030. Particularly concerning are regions like Eastern Europe and Central Asia, where infection rates are on the rise, underscoring the urgency for targeted interventions and accessible treatments.

Moreover, the persisting burden of AIDS-related mortality, with 630,000 deaths reported in 2022, highlights the imperative for continued research and innovation in antiviral therapies. Supporting this backdrop are findings from the 2022 Global Antimicrobial Resistance and Use Surveillance System (GLASS) report, which revealed alarming resistance rates among pathogens.

Notably, third-generation cephalosporin-resistant E. coli stood at 42%, while methicillin-resistant Staphylococcus aureus recorded a resistance rate of 35%. These figures underscore the pressing need for novel antimicrobial agents and stewardship programs to mitigate the escalation of drug-resistant infections.

Key Takeaways

- Market Growth: The Global Upper Respiratory Tract Infection Treatment Market was valued at USD 39.1 billion in 2023. It is expected to reach USD 82.8 billion by 2033, with a CAGR of 8.0% during the forecast period from 2024 to 2033.

- By Type: In the antibiotic market, generics hold sway, comprising 55% of total sales.

- By Distribution Channel: Hospital pharmacies emerge as dominant distributors, capturing 55% market share.

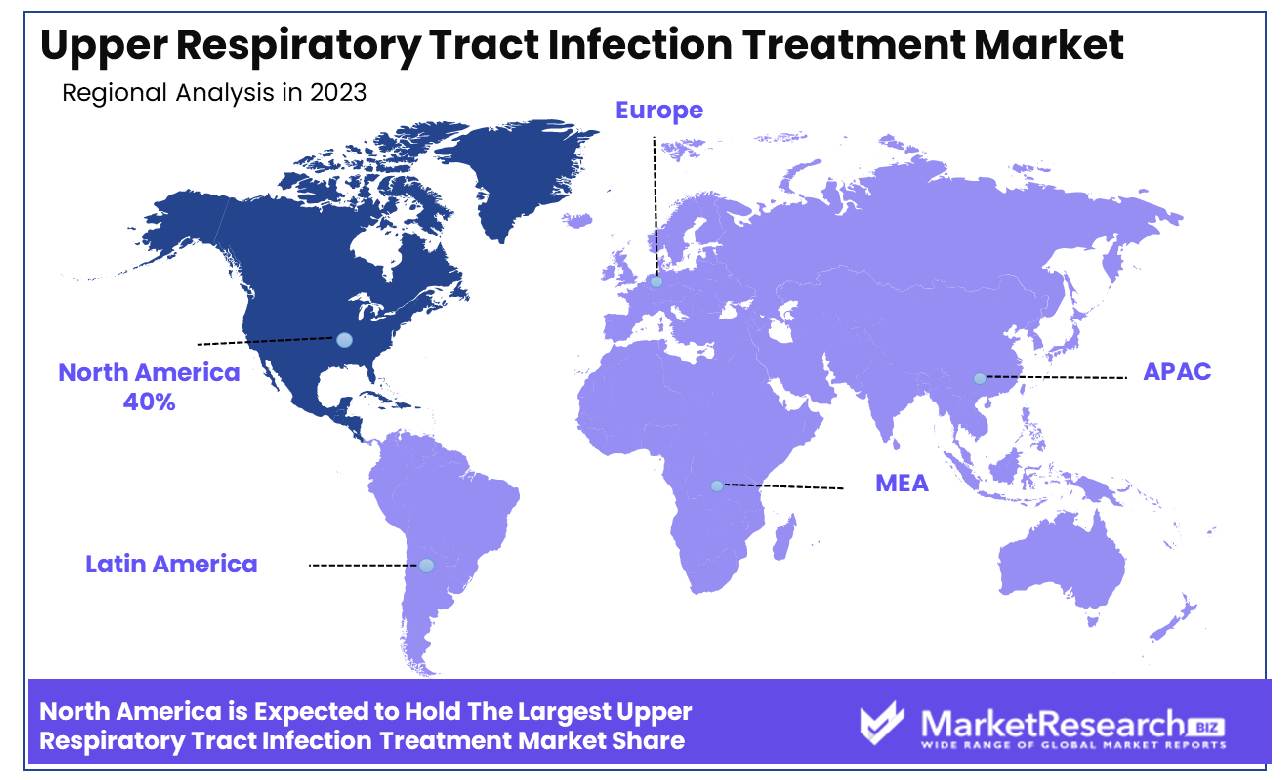

- Regional Dominance: In North America, the Upper Respiratory Tract Infection Treatment Market dominates by 40%.

- Growth Opportunity: In 2023, the global Upper Respiratory Tract Infection Treatment Market saw growth opportunities driven by increased demand for natural remedies and herbal supplements, alongside substantial investment in innovative treatment modalities.

Driving factors

Rising Demand for Over-the-Counter Drugs Fueling Growth of Upper Respiratory Tract Infection Treatment Market

The surge in demand for over-the-counter (OTC) drugs has significantly contributed to the expansion of the Upper Respiratory Tract Infection (URTI) Treatment Market. As consumers increasingly seek convenient and accessible remedies for common ailments such as colds, coughs, and sinus infections, the market for OTC medications has witnessed robust growth.

This heightened demand for OTC drugs directly translates to increased sales and revenue within the URTI treatment market, as pharmaceutical companies capitalize on the opportunity to offer effective and convenient remedies for upper respiratory infections without the need for a prescription.

Development of Drug-Delivery Devices Revolutionizing Upper Respiratory Tract Infection Treatment

The development of innovative drug-delivery devices has revolutionized the treatment landscape for upper respiratory tract infections. Advanced devices such as nasal sprays, inhalers, and nebulizers offer targeted and efficient delivery of medications directly to the affected areas, enhancing the efficacy and patient experience of URTI treatments.

Market studies indicate a growing preference for these drug-delivery devices among healthcare professionals and patients alike, driving their adoption and fueling market growth. Furthermore, technological advancements in device design and formulation have led to the creation of user-friendly and portable solutions, expanding access to effective URTI treatments across diverse demographics.

Technological Advancements in Drug Development Propel Upper Respiratory Tract Infection Treatment Market

Technological advancements in drug development have played a pivotal role in driving the growth of the Upper Respiratory Tract Infection (URTI) Treatment Market. Through innovations in molecular biology, pharmacology, and biotechnology, pharmaceutical companies have been able to expedite the discovery, development, and commercialization of novel therapies for respiratory infections. This includes the development of antiviral drugs, immune modulators, and monoclonal antibodies tailored specifically to target pathogens responsible for URTIs.

Moreover, advancements in formulation techniques and drug delivery systems have enabled the creation of more potent and targeted treatments with improved efficacy and reduced side effects, further stimulating market expansion. Collectively, these technological breakthroughs have positioned the URTI treatment market for sustained growth and innovation, fostering a conducive environment for investment and research in respiratory healthcare.

Restraining Factors

Lack of Insurance Coverage for Antibiotics Hinders Market Expansion

The lack of insurance coverage for antibiotics poses a significant challenge to the growth of the Upper Respiratory Tract Infection (URTI) Treatment Market. As antibiotics remain the primary treatment option for bacterial infections associated with URTIs, the absence of insurance coverage inhibits patients' access to these essential medications.

This restraint particularly affects segments of the population with limited financial resources, deterring them from seeking prompt medical treatment and resulting in prolonged illness durations.

According to recent studies, the financial burden of antibiotic treatment without insurance coverage can be substantial, leading some patients to forego medication altogether. Consequently, untreated or poorly managed URTIs may escalate, leading to severe complications and increased healthcare costs in the long run.

Addressing this issue requires collaborative efforts between policymakers, healthcare providers, and pharmaceutical companies to devise sustainable solutions that ensure affordable access to antibiotics for all segments of the population.

Limited Availability of Over-the-Counter Medications Stifles Market Penetration in Specific Regions

The limited availability of over-the-counter (OTC) medications for URTIs in certain countries presents a formidable barrier to market expansion. OTC medications play a crucial role in providing symptomatic relief for individuals experiencing mild to moderate URTI symptoms, thereby reducing the burden on healthcare facilities and improving patient convenience.

However, regulatory restrictions and cultural factors in some regions restrict the availability of these medications without a prescription, limiting consumer access.

This constraint not only impedes the market penetration of OTC URTI treatments but also hampers public health efforts to manage the prevalence of these infections effectively. To overcome this challenge, stakeholders must collaborate to advocate for regulatory reforms that promote responsible self-care practices while ensuring the safety and efficacy of OTC medications.

Additionally, educational campaigns aimed at raising awareness about appropriate self-medication practices could empower consumers to make informed decisions about managing URTIs and contribute to market growth in underserved regions.

By Type Analysis

In the antibiotic market, generic types hold a commanding 55% share, demonstrating significant dominance.

In 2023, Antibiotics held a dominant market position in the "By Type" segment of the Upper Respiratory Tract Infection Treatment Market, capturing more than a 55% share. This significant share can be attributed to the widespread usage of antibiotics in treating upper respiratory tract infections (URTIs), owing to their effectiveness in combating bacterial infections commonly associated with such ailments. Moreover, the consistent demand for antibiotics stems from their established efficacy and familiarity among healthcare providers and patients alike.

Following Antibiotics, NSAIDs (Nonsteroidal Anti-Inflammatory Drugs) and nasal decongestants emerged as notable contenders within the segment. NSAIDs are favored for their ability to alleviate symptoms such as pain and inflammation associated with URTIs, contributing to their substantial market presence. Similarly, nasal decongestants play a crucial role in providing relief from nasal congestion, a prevalent symptom of upper respiratory tract infections, thus garnering considerable attention from consumers seeking symptomatic relief.

The "Others" category encompasses a variety of treatment options such as antihistamines, antitussives, and expectorants, among others. While these alternatives cater to specific symptoms or patient preferences, they collectively represent a smaller fraction of the market compared to Antibiotics, NSAIDs, and nasal decongestants. Nonetheless, ongoing research and development efforts within this category may lead to the introduction of novel treatment modalities, potentially influencing market dynamics in the future.

Overall, the dominance of Antibiotics in the By Type segment underscores the continued reliance on conventional therapeutic approaches in managing upper respiratory tract infections. However, the presence of alternative treatments highlights the evolving landscape of URTI management, driven by advancements in medical science and changing consumer preferences. As the market continues to evolve, stakeholders are advised to stay abreast of emerging trends and regulatory developments to capitalize on growth opportunities and optimize their market position.

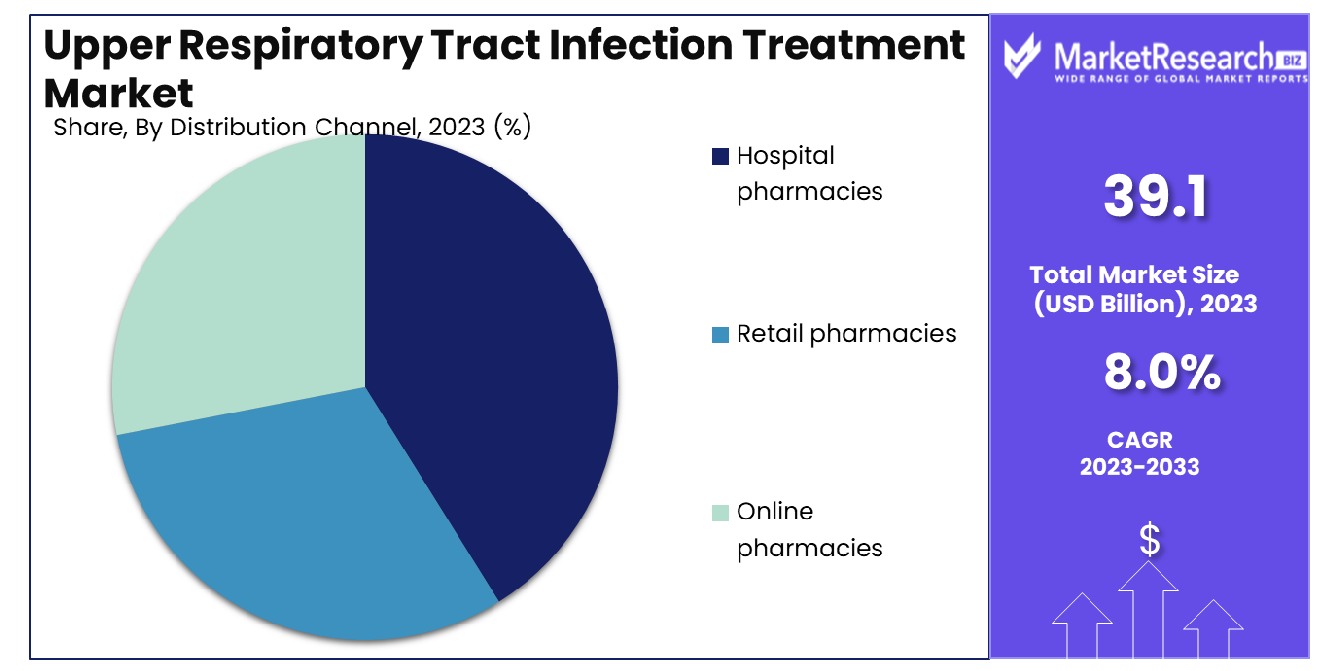

By Distribution Channel Analysis

Hospital pharmacies equally assert control with a 55% dominance in distribution channels.

In 2023, Hospital pharmacies asserted a dominant market position within the "By Distribution Channel" segment of the Upper Respiratory Tract Infection Treatment Market, seizing over a 55% share. This commanding share underscores the pivotal role of Hospital pharmacies as primary dispensers of medications, particularly for acute cases of upper respiratory tract infections (URTIs). The trust and reliability associated with Hospital pharmacies, coupled with the immediate need for treatment in severe URTI cases, solidify their prominence as key distribution channels for URTI therapeutics.

Retail pharmacies emerged as notable contenders within the segment, albeit with a smaller market share compared to Hospital pharmacies. Retail pharmacies cater to a broader spectrum of URTI cases, providing convenience and accessibility to patients seeking treatment outside of hospital settings. Their extended operating hours and widespread presence in communities make Retail pharmacies essential contributors to the distribution of URTI treatments, serving both acute and chronic cases.

Online pharmacies, while still in a nascent stage, demonstrated promising growth within the Upper Respiratory Tract Infection Treatment Market. Despite holding a smaller share compared to Hospital and Retail pharmacies, Online pharmacies offer convenience and flexibility to patients, facilitating the procurement of URTI medications through digital platforms. The rising popularity of online shopping and digital healthcare services has fueled the expansion of Online pharmacies, positioning them as emerging players in the distribution of URTI treatments.

As the demand for URTI treatments persists and consumer preferences continue to evolve, stakeholders should closely monitor the shifting dynamics within distribution channels. While Hospital pharmacies currently dominate the segment, Retail pharmacies and Online pharmacies present opportunities for expansion and diversification, offering avenues to enhance market reach and accessibility for patients seeking Upper Respiratory Tract Infection treatments.

Key Market Segments

By Type

- Antibiotics

- NSAIDs and nasal decongestants

- Others

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Growth Opportunity

Demand for Natural Remedies and Herbal Supplements

The global Upper Respiratory Tract Infection (URTI) Treatment Market witnessed a notable surge in demand for natural remedies and herbal supplements in 2023. This trend reflects a growing preference among consumers for alternative treatments, driven by concerns over side effects associated with conventional medications and an increasing awareness of holistic health practices. Natural remedies and herbal supplements offer perceived benefits, including fewer adverse effects and a more gentle approach to treating respiratory ailments.

As a result, market players are strategically diversifying their product portfolios to capitalize on this burgeoning demand. Key players are investing in research and development to formulate innovative herbal treatments with proven efficacy in alleviating URTI symptoms. This shift in consumer preferences presents a lucrative opportunity for market expansion, particularly for companies adept at leveraging the natural product trend.

Investment in Research and Development for New Treatment Modalities

In tandem with the demand for natural remedies, the global URTI Treatment Market witnessed a significant influx of investment in research and development for new treatment modalities. Market leaders recognize the imperative of innovation to address evolving consumer needs and stay ahead of competitors. Consequently, substantial resources are allocated towards developing novel therapies, including biologics, immunotherapies, and gene therapies, aimed at providing more effective and targeted treatment options for URTIs.

Collaborative efforts between pharmaceutical companies, research institutions, and regulatory bodies are fostering a conducive environment for innovation. The growth of the market can be attributed to these concerted endeavors, which promise to revolutionize URTI treatment paradigms and elevate patient outcomes. This investment landscape underscores a pivotal growth opportunity for stakeholders keen on capitalizing on emerging therapeutic advancements.

Latest Trends

Emphasis on Sustainable and Eco-Friendly Solutions

The year 2023 marked a notable shift towards sustainability and eco-friendliness within the global Upper Respiratory Tract Infection (URTI) Treatment Market. Increasing consumer awareness regarding environmental impact has spurred demand for products and solutions that minimize harm to the planet. As a response, market players are prioritizing the development and adoption of sustainable practices throughout the product lifecycle.

This includes sourcing raw materials responsibly, reducing packaging waste, and implementing eco-friendly manufacturing processes. Sustainable initiatives not only resonate with environmentally-conscious consumers but also serve as a differentiating factor for brands seeking to enhance their corporate image and market competitiveness.

Shift Towards Natural and Herbal Products

Another prominent trend in 2023 was the escalating preference for natural and herbal products in the treatment of upper respiratory tract infections. Consumers are increasingly inclined towards holistic health approaches, favoring remedies derived from plant-based sources over conventional medications. This shift can be attributed to growing concerns over the adverse effects associated with synthetic drugs and a desire for gentler, more holistic treatment options.

Market players are capitalizing on this trend by expanding their portfolios to include a diverse range of natural remedies and herbal supplements tailored to address URTI symptoms effectively. The convergence of consumer demand for natural solutions and advancements in herbal medicine research presents significant growth opportunities for companies agile enough to adapt to evolving market dynamics.

Regional Analysis

In North America, the Upper Respiratory Tract Infection Treatment Market commands a significant share of 40%.

North America, comprising the United States and Canada, stands as a dominant force in the URTI treatment market, commanding a substantial 40% share. This can be attributed to factors such as high healthcare expenditure, advanced medical infrastructure, and a proactive approach towards infectious disease management. With a robust emphasis on research and development, coupled with a well-established pharmaceutical industry, North America continues to lead in the innovation and adoption of novel treatment modalities for URTIs.

In Europe, characterized by countries such as Germany, France, and the United Kingdom, the URTI treatment market demonstrates steady growth, supported by increasing healthcare expenditure and a growing awareness regarding the management of respiratory infections. Market penetration of over-the-counter (OTC) medications and a focus on preventive healthcare contribute to the region's market expansion.

Asia Pacific emerges as a region of immense potential, driven by a large patient pool, rapid urbanization, and improving healthcare infrastructure in countries like China, India, and Japan. Rising disposable incomes, coupled with expanding access to healthcare services, fuel market growth. Additionally, government initiatives aimed at improving healthcare access and affordability further stimulate market demand in the region.

The Middle East & Africa and Latin America regions witness a gradual but steady uptick in the URTI treatment market, propelled by improving healthcare infrastructure, rising awareness about infectious diseases, and increasing investments in healthcare. However, challenges such as limited access to healthcare in remote areas and economic constraints influence market dynamics in these regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Upper Respiratory Tract Infection (URTI) Treatment Market witnessed the dominance of several key players, each contributing significantly to the industry landscape. Among these, AstraZeneca Plc, GlaxoSmithKline Plc, Pfizer Inc., and Novartis AG emerged as pivotal figures, shaping market dynamics through their innovative products and strategic initiatives.

AstraZeneca Plc, renowned for its pharmaceutical innovations, maintained a formidable presence in the URTI treatment market with a diverse portfolio of respiratory medications. Their continued focus on research and development, coupled with strategic partnerships, positioned them as a frontrunner in addressing the evolving needs of patients suffering from upper respiratory ailments.

GlaxoSmithKline Plc demonstrated noteworthy advancements in respiratory therapeutics, leveraging its expertise to develop effective treatment options for URTIs. The company's commitment to innovation and patient-centric approach underscored its significance in combating respiratory infections worldwide.

Pfizer Inc. and Novartis AG also played instrumental roles in the URTI treatment market, leveraging their extensive resources and expertise to introduce novel therapies and expand market reach. Their relentless pursuit of scientific excellence and commitment to improving patient outcomes propelled them as key players in the global landscape of respiratory healthcare.

Furthermore, the contributions of other notable entities such as CSL Ltd., Merck and Co. Inc., and Sanofi, among others, further enriched the competitive dynamics of the market, fostering innovation and driving growth. As the demand for effective URTI treatments continues to rise, collaboration and innovation among these key players will be paramount in addressing the evolving healthcare needs of patients worldwide.

Market Key Players

- AstraZeneca Plc

- CSL Ltd.

- GlaxoSmithKline Plc

- MD Total Care LLC.

- Medtronic Plc

- Merck and Co. Inc.

- Novartis AG

- Parkway Holdings Ltd.

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Sanofi

- Teva Pharmaceutical Industries Ltd.

- The Cleveland Clinic Foundation

- Yashoda Hospitals

Recent Development

- In February 2024, Actylis reports on a new inhalable dry powder ebselen formulation, effectively treating respiratory infections with enhanced delivery and antibacterial properties.

- In October 2023, A study in 'Paediatric Respiratory Reviews' explores post-pandemic shifts in pediatric respiratory infections, highlighting the impacts of nonpharmaceutical interventions and future preventive strategies.

Report Scope

Report Features Description Market Value (2023) USD 39.1 Billion Forecast Revenue (2033) USD 82.8 Billion CAGR (2024-2032) 8.0% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Antibiotics, NSAIDs and nasal decongestants, Others), By Distribution Channel(Hospital pharmacies, Retail pharmacies, Online pharmacies) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape AstraZeneca Plc, CSL Ltd., GlaxoSmithKline Plc, MD Total Care LLC., Medtronic Plc, Merck and Co. Inc., Novartis AG, Parkway Holdings Ltd., Pfizer Inc., Regeneron Pharmaceuticals Inc., Sanofi, Teva Pharmaceutical Industries Ltd., The Cleveland Clinic Foundation, Yashoda Hospitals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AstraZeneca Plc

- CSL Ltd.

- GlaxoSmithKline Plc

- MD Total Care LLC.

- Medtronic Plc

- Merck and Co. Inc.

- Novartis AG

- Parkway Holdings Ltd.

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Sanofi

- Teva Pharmaceutical Industries Ltd.

- The Cleveland Clinic Foundation

- Yashoda Hospitals