Trocars Market By Product (Disposable, Reusable, and Reposable), By Tip (Bladeless Trocar, Bladed Trocar, Blunt Trocar, and Optical), By Application (General Surgery, Gynaecological Surgery, Urological Surgery, Laparoscopy, Pediatric Surgery, and Others) By End User, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

14197

-

June 2023

-

166

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

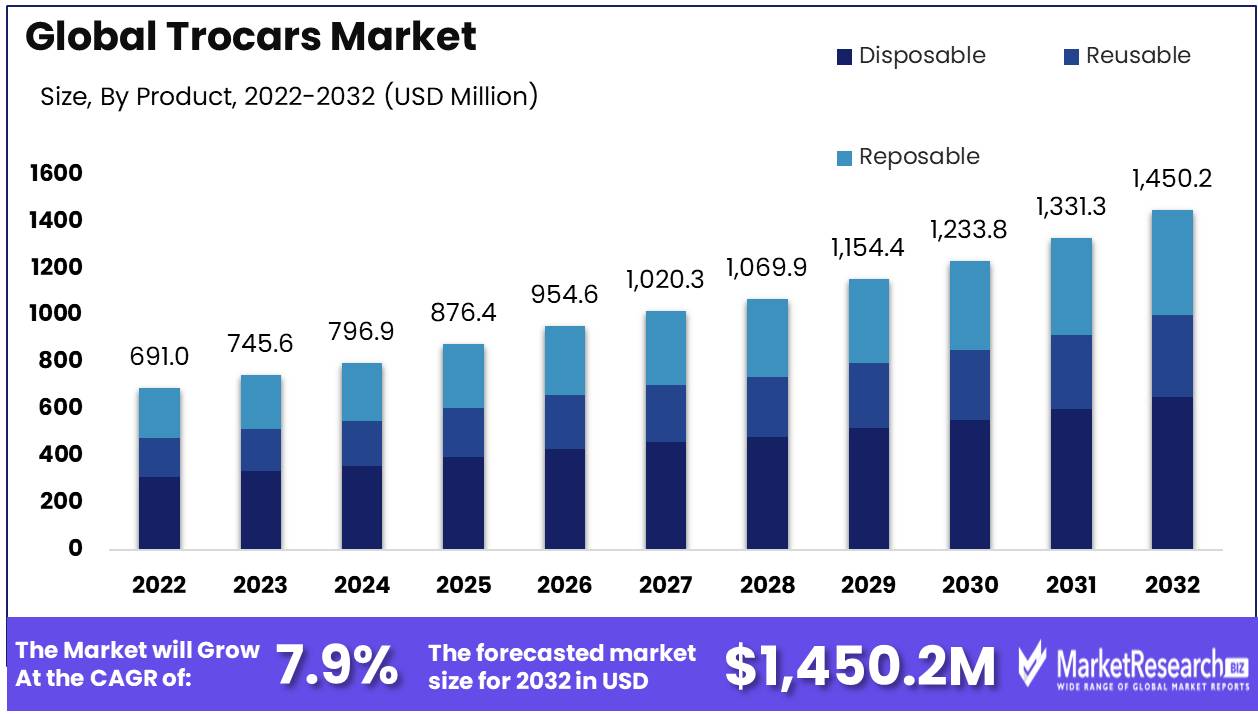

Trocars Market size is expected to be worth around USD 1,450 Mn by 2032 from USD 691 Mn in 2022, growing at a CAGR of 7.9% during the forecast period from 2023 to 2032.

Trocars are surgical instruments used in minimally invasive surgeries, specifically laparoscopic procedures. They are designed to create access points, known as ports or trocar sites, through the abdominal wall, allowing the insertion of other laparoscopic instruments and a camera into the abdominal cavity. These instruments are in high demand due to the growing use of laparoscopy and favorable reimbursement policies. The trocars market is poised to grow due to the rising prevalence of chronic conditions such as urological or gynecological problems.

Driving factors

Growing preference for minimally invasive surgeries

Patients and healthcare providers increasingly favor minimally invasive surgeries for their benefits, such as shorter hospital stays, quicker recovery times, and reduced post-operative complications. Their crucial role in enabling minimally invasive procedures drives the demand for Trocars. The rising incidence of chronic diseases, such as gastrointestinal therapeutics, obesity, and cardiovascular conditions, is driving the demand for surgical interventions, including minimally invasive procedures that utilize Trocars.

The global population is aging, and elderly individuals are more susceptible to various health issues that may require surgical treatment. As the aging population increases, the demand for surgical procedures, including trocars market, will likely grow.

Advancements in Surgical Techniques

Technological advancements in surgical techniques, including laparoscopy and robotics, have increased the adoption of minimally invasive procedures. Trocars are critical in facilitating these advanced surgical methods, further driving the trocars market growth.

Restraining Factors

The high cost of Trocars and Surgical Equipment and the risk of complications hinder trocar market growth.

The cost of Trocars and associated laparoscopic equipment can be relatively high, limiting their adoption in some healthcare settings, especially in developing regions with budget constraints. Moreover, while minimally invasive procedures offer several advantages, they still carry a risk of complications, including bleeding, infection, and organ damage. The potential for adverse events may deter some patients and surgeons from choosing these procedures.

Availability of alternative surgical techniques

Some surgical procedures may have effective alternatives that do not require Trocars, leading to potential competition for specific indications and affecting the market growth of trocars market in those cases.

Product Analysis

Disposable Trocars Dominate The Market

Based on Product, the trocars market is segmented into disposable, reusable, and reposable. Among these, disposable trocars have accounted for the largest market share. This segment will dominate the market for the foreseeable future due to the increasing use of laparoscopic surgery. The segment's growth is also due to its benefits, including lower post-operative infections and easier usage.

On the other hand, the reusable trocar segment is expected to show the fastest CAGR over the forecast period. Moreover, the segment's growth is supported by factors such as cost efficiency, easy access to the body, and internal structures. The segment's growth can be hampered by a greater chance of infection after surgery.

Tip Analysis

Optical Trocars Dominate The Market

Based on Tip analysis trocars market is segmented into bladeless trocar, bladed trocar, blunt trocar, and optical trocar. With factors such as a detailed view of the tissues and the increasing number of laparoscopic procedures being performed, the optical trocars segment will likely register the highest CAGR over the same period. This product offers many benefits, including the safe and quick initial placement of trocars. These are expected to be key drivers for the segment's growth.

Application Analysis

General Surgery Dominates The Market

The trocars market is segmented based on application into general, gynecological, urological, laparoscopic, pediatric, and other surgeries. Laparoscopic gynecologic surgery is now widely used due to its many advantages, including a precise and detailed view of the pelvic area, a low risk of infection compared to traditional surgeries, and quick healing. General surgery will likely see the fastest CAGR over the forecast period due to its shorter healing times and increased reliance on minimally invasive procedures.

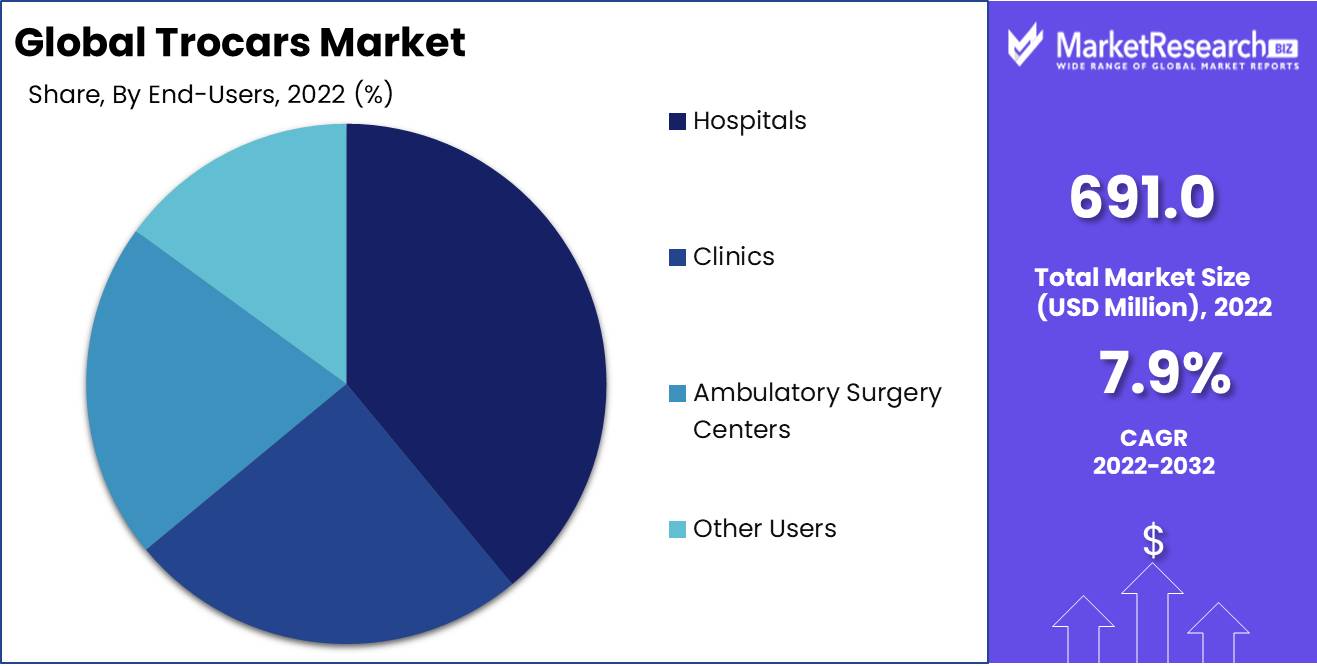

End-User Analysis

The trocars market can be divided into two segments based on end-users: hospitals, clinics, ambulatory surgical centers, and others. Among these, the hospital segment accounted for the largest market share. This segment’s growth is driven by the robust infrastructure of laparoscopic surgery and the availability of qualified specialists.

Key Market Segments

Based on Product

- Disposable

- Reusable

- Reposable

Based on Tip

- Bladeless Trocar

- Bladed Trocar

- Blunt Trocar

- Optical Trocar

Based on Application

- General Surgery

- Gynecological Surgery

- Urological Surgery

- Laparoscopy

- Pediatric Surgery

- Other Applications

Based On End-Users

- Hospitals

- Clinics

- Ambulatory Surgery Centers

- Other Users

Growth Opportunity

The rising volume of laparoscopic procedures creates opportunities for new players

Laparoscopic surgery is preferred by surgeons over traditional open surgeries due to the better results. Traditional open surgery can lead to various post-operative problems, including pain, partially collapsed lung, blood clots, fatigue, as well as muscle atrophy, and infections. Anesthesia can cause nausea, confusion, sleepiness, sore throat, and even confusion. Healthcare facilities prefer MI surgeries because they are cost-effective, don't require prolonged hospital stays, are quick to recover from, and can reduce the risk of complications such as nausea, sore throat, confusion, and sleepiness.

Latest Trends

The increasing preference for minimally invasive surgical procedures drives the demand for trocars

Patients and healthcare providers are seeking surgical techniques that offer quicker recovery times, reduced scarring, and shorter hospital stays. Moreover, Manufacturers are continuously innovating trocar designs to enhance their functionality and ease of use. This includes the development of trocars with better sealing systems, ergonomic handle designs, and improved blade technologies. Nowadays, Trocars are increasingly being integrated with advanced technologies, such as imaging systems and energy devices. This integration allows surgeons to perform complex procedures with greater precision and efficiency. Such factors are expected to bolster the trocars market’s growth in the coming years.

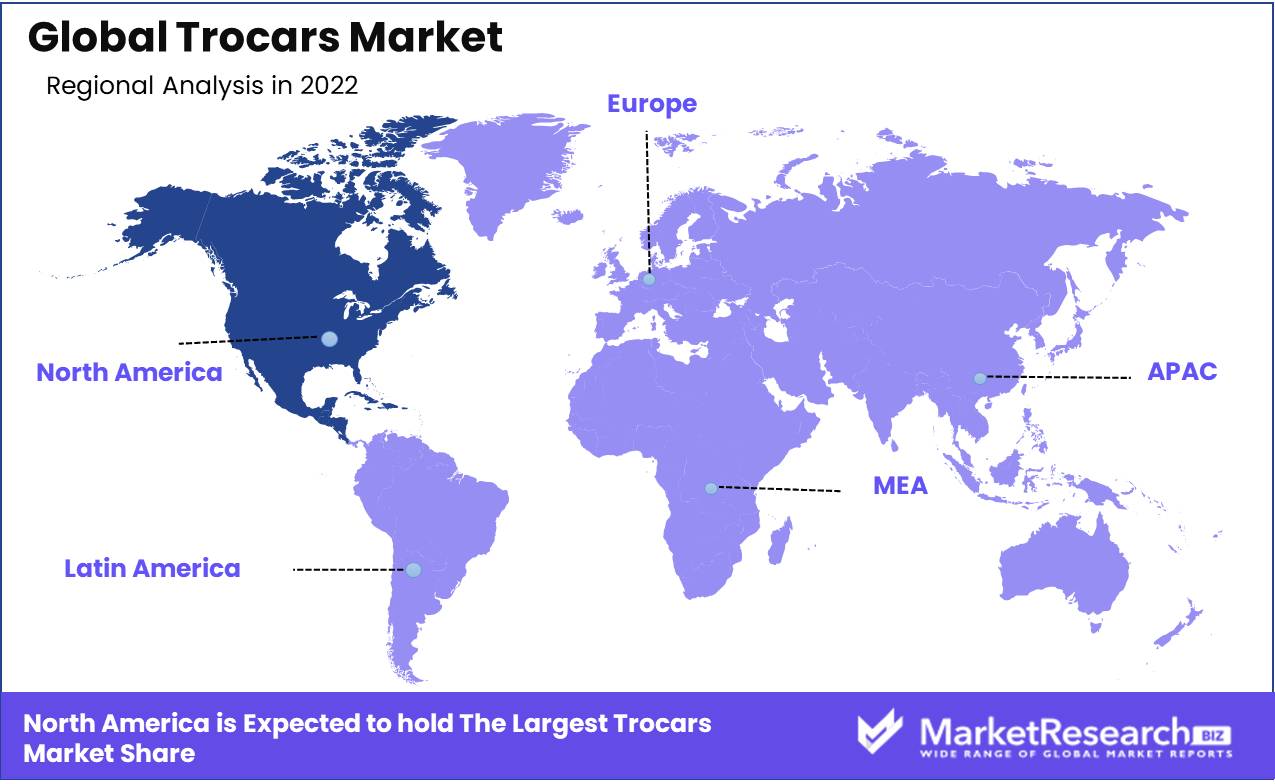

Regional Analysis

North America accounted for the largest trocars market share of 35% globally, followed by Europe. North America has been witnessing a rise in the prevalence of chronic diseases such as obesity, gastrointestinal disorders, and cardiovascular conditions. These medical conditions often require surgical interventions, including minimally invasive procedures that use Trocars, driving the demand for these devices. There is also a lot of competition among market players regarding product innovation.

The U.S. holds the largest revenue share in North America. The United States has well-established healthcare systems with favorable reimbursement policies for surgical procedures. This has made advanced surgical techniques, including those involving Trocars, more accessible to patients, thus boosting market growth. The region is seeing increased awareness about the benefits of laparoscopic and minimally invasive surgery and rising healthcare spending.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

With the presence of many local and regional players, the trocars market for companion diagnostics is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. Companies have gained various expansion strategies, such as partnerships and product launches, to stay on top of the market.

Top Key Players in Trocars Market

- Johnson & Johnson Services Inc.

- Medtronic plc.

- The Cooper Companies Inc.

- Conmed Corporation

- Braun Melsungen AG

- Teleflex Incorporated

- GENICON INC.

- Applied Medical Resources Corporation

- Laprosurge Ltd

- Purple Surgical

- BNR Co.Ltd.

- LocaMed Ltd.

- UNIMAX MEDICAL SYSTEMS Inc.

- Victor Medical Instruments Co.Ltd.

- Other Key Players

Recent Development

- In September 2022: The new product LEXION AP50/30 from AFS MEDICAL GmbH is a trocars product. It features a closed system, constant pneumoperitoneum, continuous tissue moistening, and permanent Co2 heating.

- In July 2021: Eva Aveta, DORC, has been redesigned to improve flow rates, reduce the working area and maintain a consistent intraoperative IOP. The trocar cannula system has been redesigned to make inserting, seal wounds better, and retaining more patients easier. Redesigning the interface between trocar blades and cannula allows for smoother trocar insertion. This also leads to improved wound architecture and reduced postoperative wound leakage. Eva's platform fluidics are unleashed by the high-flow infusion catheter's one-step insertion. The Aveta trocar needle offers better trocar retention throughout the course of treatment.

Report Scope:

Report Features Description Market Value (2022) USD 691 Mn Forecast Revenue (2032) USD 1,450 Mn CAGR (2023-2032) 7.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product- Disposable, Reusable, and Reposable; By Tip - Bladeless Trocar, Bladed Trocar, Blunt Trocar, and Optical Trocar; By Application- General Surgery, Gynaecological Surgery, Urological Surgery, Laparoscopy, Pediatric Surgery, and Others; By End Users- Hospitals, Clinics, Ambulatory Surgery Centers, And Other Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Johnson & Johnson Services Inc., Medtronic plc., The Cooper Companies Inc., Conmed Corporation, B. Braun Melsungen AG, Teleflex Incorporated, GENICON INC., Applied Medical Resources Corporation, Laprosurge Ltd Purple Surgical, BNR Co.Ltd., LocaMed Ltd., UNIMAX MEDICAL SYSTEMS Inc., Victor Medical Instruments Co.Ltd., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Johnson & Johnson Services Inc.

- Medtronic plc.

- The Cooper Companies Inc.

- Conmed Corporation

- Braun Melsungen AG

- Teleflex Incorporated

- GENICON INC.

- Applied Medical Resources Corporation

- Laprosurge Ltd

- Purple Surgical

- BNR Co.Ltd.

- LocaMed Ltd.

- UNIMAX MEDICAL SYSTEMS Inc.

- Victor Medical Instruments Co.Ltd.

- Other Key Players