Global Trauma Market By Trauma Types(Orthopedic Trauma, Head Trauma, Soft Tissue Trauma, Spinal Trauma), By Patient Demographics(Age Groups (Pediatric, Adult, Geriatric), Gender, Socioeconomic Status), By Treatment Modalities(Surgical, Non-surgical, Rehabilitation Services), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46685

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

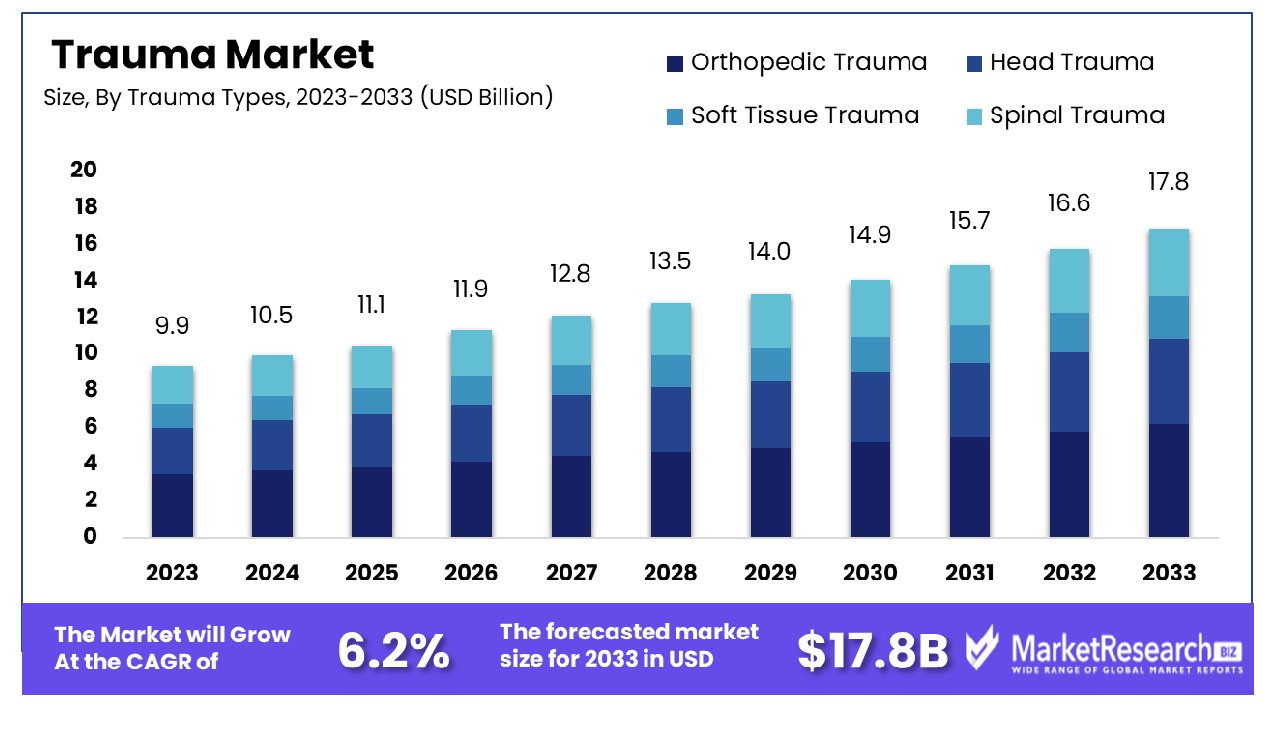

The Global Trauma Market was valued at USD 9.9 billion in 2023. It is expected to reach USD 17.8 billion by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

The trauma market encompasses the medical and technological solutions designed to manage, treat, and rehabilitate patients who have suffered acute physical injuries. This market serves as a critical component of healthcare, catering to emergencies such as accidents, falls, and violent injuries. It involves a wide range of products and services, including trauma devices, surgical equipment, and advanced imaging technologies.

Targeted towards ensuring rapid and effective patient recovery, this sector is integral for hospitals, trauma centers, and emergency care providers. As it evolves, the focus on innovation and improved patient outcomes remains paramount, offering significant investment and development opportunities.

The Trauma Market is poised at a critical juncture, reflecting a confluence of increasing incidents and complexities in patient outcomes. According to the 2023 ESO Trauma Index, data from 596 organizations and 968,538 patient records reveal a 4% increase in trauma incidents and a 3% rise in trauma-related deaths in 2022, compared to previous years. This uptick underscores the escalating demand for advanced trauma care solutions and the potential for market growth.

Particularly alarming is the age-specific trauma data. In children aged 0 to 17, while falls remain the most common injury mechanism, firearms emerged as the deadliest cause, accounting for one-third of pediatric trauma deaths. This statistic not only highlights a grave public health issue but also signals a growing market need for specialized pediatric trauma care and preventative strategies.

In the demographic of adults over 65, falls are the predominant cause of both injury and mortality, with over 83.5% of trauma injuries in this group attributed to falls, leading to 554 deaths. This segment demonstrates the highest trauma rate among all age groups, indicating a robust market for fall prevention and management solutions targeted at the elderly.

These trends present significant opportunities for healthcare providers and market participants to innovate and expand services that address the specific mechanisms and outcomes of trauma across different age groups. The increase in trauma incidents and deaths calls for enhanced healthcare infrastructure, advanced medical technologies, and integrated care strategies that can effectively reduce the burden of trauma and improve patient outcomes.

Key Takeaways

- Market Growth: The Global Trauma Market was valued at USD 9.9 billion in 2023. It is expected to reach USD 17.8 billion by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

- By Trauma Types: Orthopedic trauma led, accounting for 45% of trauma types.

- By Patient Demographics: Age group analysis shows a 45% dominance by adults.

- By Treatment Modalities: Surgical treatments dominated, representing 45% of treatment modalities.

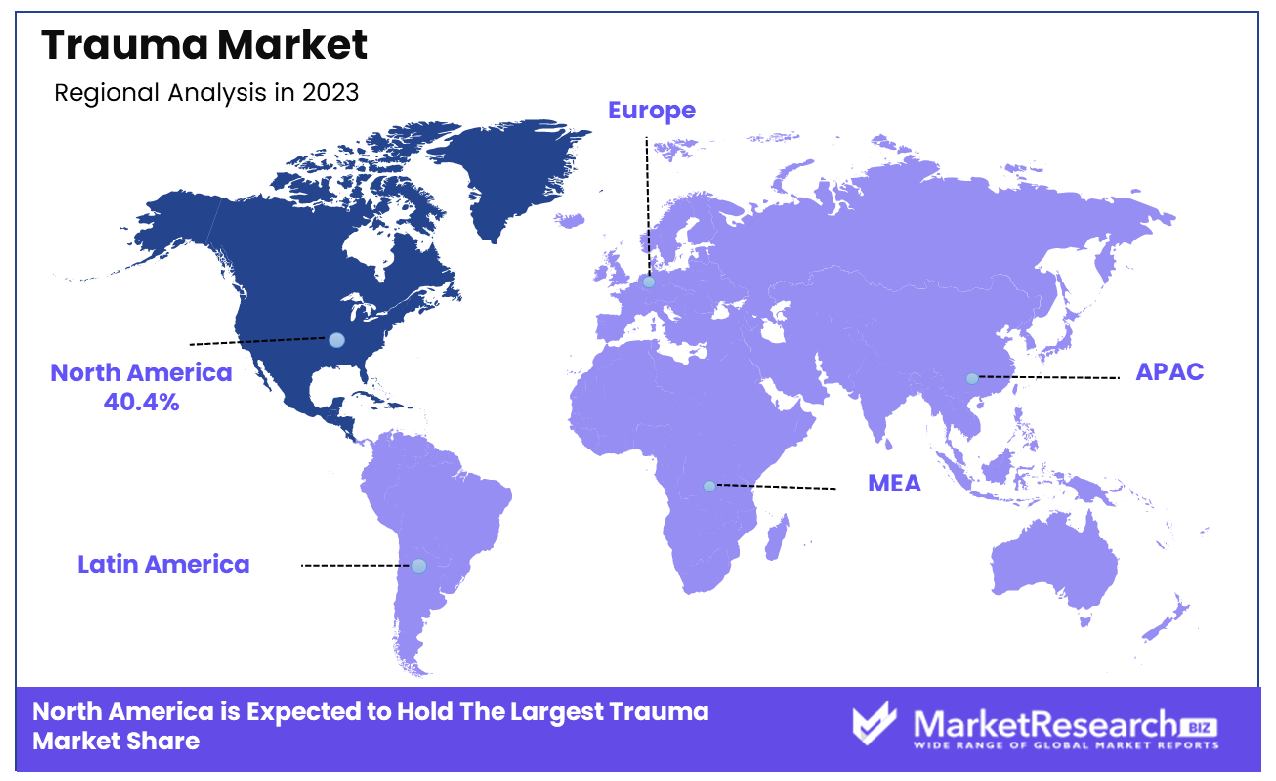

- Regional Dominance: North America holds 40.4% of the global trauma market share.

- Growth Opportunity: The global trauma market in 2023 is driven by increasing applications from developing nations and growing modernization and awareness about trauma care, leading to enhanced demand and improved healthcare infrastructure.

Driving factors

Escalating Sports Injuries Fueling Trauma Market Expansion

The Trauma Market is experiencing significant growth, driven largely by an increasing incidence of sports injuries globally. The rise in both amateur and professional sports participation has escalated the frequency of sports-related injuries. These injuries often require immediate medical interventions, including surgeries and long-term treatments, boosting the demand for trauma-related products and services.

According to a report by the Centers for Disease Control and Prevention, sports and recreational activities account for approximately 8.6 million injuries annually in the United States alone. This trend underscores a robust market demand for trauma care, fostering advancements in medical technologies and treatment methodologies designed specifically for sports-related injuries.

Bone Degenerative Diseases: A Persistent Driver for Trauma Solutions

Bone degenerative diseases such as osteoporosis and arthritis are pervasive, particularly among the aging population, significantly contributing to the expansion of the Trauma Market. These conditions increase the susceptibility to fractures and other bone injuries that necessitate surgical interventions.

The World Health Organization estimates that osteoporosis causes more than 8.9 million fractures annually worldwide, indicating a substantial demand for trauma and orthopedic products. The ongoing research and development focused on innovative trauma care solutions tailored for bone degeneration are pivotal in driving the market's growth, ensuring a continuous flow of advanced products that cater to the evolving healthcare needs of this demographic.

Impact of Road Accidents and Falls on Trauma Care Demand

The frequency of road accidents and falls constitutes a critical factor influencing the Trauma Market. Globally, road traffic injuries rank among the top causes of death, with the World Health Organization highlighting over 1.3 million fatalities and up to 50 million injuries annually due to road accidents. Additionally, falls, particularly in the elderly, lead to a significant number of emergency room visits and trauma cases.

This high incidence rate propels the demand for trauma care facilities and innovations in trauma management products. Hospitals and trauma centers are thus increasingly investing in state-of-the-art equipment and training to address the surge in trauma cases, further stimulating market growth. This factor, coupled with regulatory support for trauma care standards, underpins the market's robust expansion trajectory.

Restraining Factors

Health Complications Linked to Trauma Fixation Devices: A Market Growth Inhibitor

Health complications arising from the use of trauma fixation devices pose significant challenges to the growth of the Trauma Market. These devices, crucial for stabilizing fractures and supporting bone healing, can sometimes lead to adverse outcomes such as infections, implant failures, and allergic reactions. Such complications not only increase the patient's morbidity but also escalate healthcare costs due to extended hospital stays and additional surgeries.

These negative outcomes can deter healthcare providers from adopting new technologies and slow down the market acceptance of newer, potentially untested trauma fixation solutions. Additionally, the fear of litigation and the stringent regulatory environment surrounding medical devices can further restrict market growth. Manufacturers are compelled to invest heavily in clinical trials and safety tests to ensure compliance and minimize health risks, potentially delaying product launches and impacting market dynamics.

Scarcity of Skilled Professionals in Trauma Care: Constraining Market Potential

The Trauma Market's expansion is critically hampered by the lack of skilled professionals adept at utilizing advanced trauma care tools. This shortage is particularly pronounced in low- and middle-income countries where access to training and medical education is limited. The complexity of modern trauma care devices requires highly trained individuals who can operate sophisticated equipment and perform intricate procedures, which are not always available in resource-constrained settings.

This scarcity of qualified personnel restricts the deployment of advanced trauma care technologies, thereby slowing market penetration in these regions. Furthermore, the uneven distribution of skilled professionals exacerbates regional disparities in trauma care quality, affecting overall market growth. Efforts to enhance training programs and increase accessibility to continuous professional development are essential to mitigate this restraint and unlock the full potential of the trauma care market.

By Trauma Types Analysis

Orthopedic trauma accounted for 45% of the cases, dominating the trauma type category significantly.

In 2023, Orthopedic Trauma held a dominant market position in the By Trauma Types segment of the Trauma Market, capturing more than a 45% share. This segment encompasses various conditions related to bone fractures, dislocations, and other skeletal injuries. The substantial market share is attributed to the increasing incidence of road accidents, sports injuries, and falls, particularly among the aging population. Advancements in surgical procedures and the introduction of innovative fixation devices and biologics have further bolstered the market growth for orthopedic trauma.

Head Trauma, another critical segment, accounted for a significant market share in 2023. This segment includes traumatic brain injuries (TBI) resulting from falls, vehicular accidents, and violent encounters. The rising awareness about the severity of head trauma and the increasing adoption of advanced diagnostic tools and surgical interventions have contributed to the segment's growth. Furthermore, the increasing prevalence of neurological disorders and the development of cutting-edge neuro-monitoring systems have enhanced treatment outcomes, driving market expansion.

Soft Tissue Trauma represents a growing segment within the trauma market. This category includes injuries to muscles, ligaments, and tendons, often resulting from sports activities, workplace accidents, and physical assaults. The segment's growth is supported by advancements in minimally invasive surgical techniques, regenerative medicine, and physiotherapy equipment. The increasing participation in sports and recreational activities, coupled with a rising awareness about injury management and rehabilitation, has fueled the demand for soft tissue trauma treatments.

Spinal Trauma accounted for a notable share of the trauma market in 2023. This segment addresses injuries to the spinal cord and vertebrae, often caused by accidents, falls, and acts of violence. The market growth is driven by the rising incidence of spinal injuries and the continuous development of spinal fusion devices, artificial discs, and advanced surgical techniques. Additionally, the increasing focus on improving patient outcomes and the growing adoption of rehabilitation programs have significantly contributed to the segment's expansion.

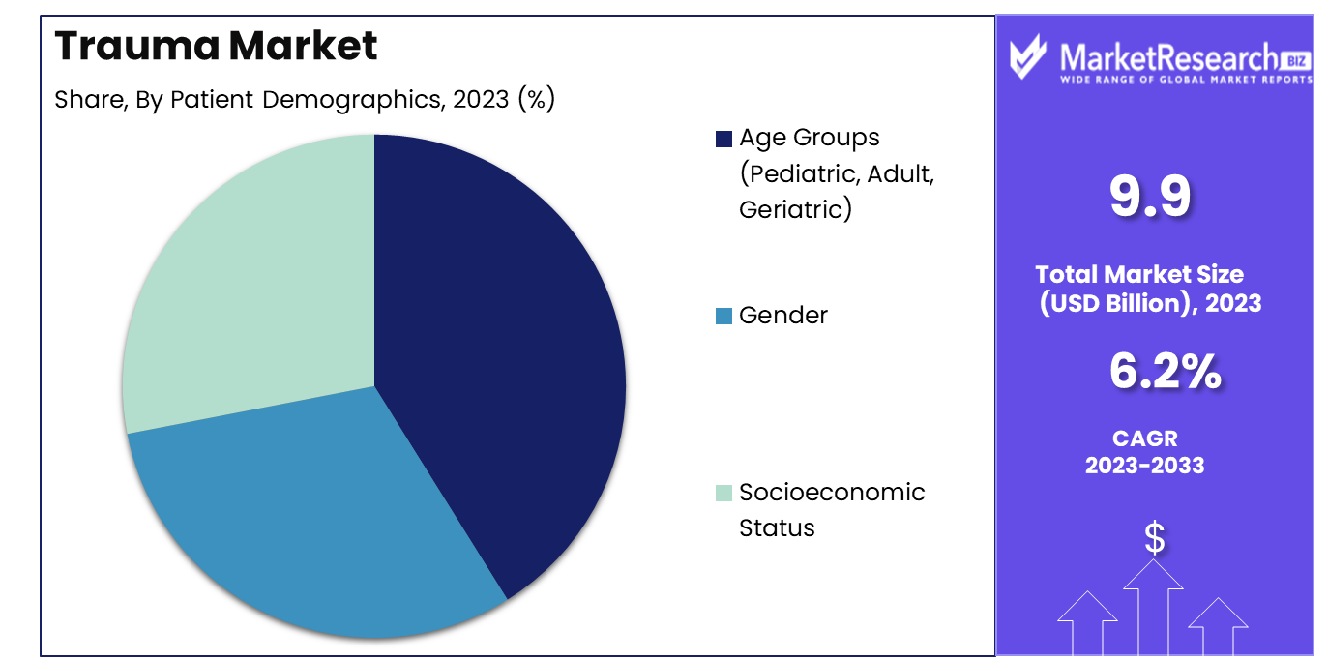

By Patient Demographics Analysis

In terms of patient demographics, age groups—pediatric, adult, geriatric—dominated 45% of the distribution.

In 2023, Age Groups (Pediatric, Adult, Geriatric) held a dominant market position in the Patient Demographics segment of the Trauma Market, capturing more than a 45% share. The segmentation based on age groups allows for a comprehensive understanding of the varying needs and treatment protocols for different age categories. The significant market share held by this segment is driven by the distinct trauma patterns and healthcare requirements unique to each age group.

The Pediatric sub-segment focuses on trauma cases involving children. This sub-segment is characterized by a high incidence of injuries due to falls, sports activities, and road accidents. Pediatric trauma care often requires specialized medical equipment and tailored treatment protocols, which have driven advancements in pediatric orthopedic devices and minimally invasive surgical techniques.

The Adult sub-segment represents a substantial portion of the trauma market. Adults frequently experience trauma from vehicular accidents, workplace injuries, and recreational activities. The market growth in this sub-segment is supported by the increasing availability of advanced trauma care facilities, improvements in emergency medical services, and the development of robust trauma registries. Additionally, the rising awareness about the importance of timely and effective trauma care has led to better patient outcomes.

The Geriatric sub-segment addresses trauma cases in the elderly population, who are more prone to injuries due to falls and age-related degenerative conditions. The growing geriatric population globally has necessitated advancements in trauma care tailored to older adults. Innovations in orthopedic smart medical devices, coupled with improved post-operative care and rehabilitation services, have significantly enhanced the quality of trauma management for this age group.

Gender as a demographic factor also plays a crucial role in trauma care, with notable differences in trauma incidence and outcomes between males and females. However, its market share is comparatively smaller than that of age groups.

Socioeconomic Status is another important demographic factor, influencing access to trauma care and recovery outcomes. Variations in income, education, and access to healthcare resources affect the overall management and prognosis of trauma cases.

By Treatment Modalities Analysis

Among treatment modalities, surgical interventions were the most prevalent, comprising 45% of the treatments.

In 2023, Surgical held a dominant market position in the By Treatment Modalities segment of the Trauma Market, capturing more than a 45% share. The prominence of surgical treatment is primarily due to the critical need for immediate and effective intervention in severe trauma cases. This segment includes various surgical procedures such as fracture fixation, spinal surgeries, and craniotomies, which are essential for addressing life-threatening injuries and complex trauma conditions.

The significant market share of the Surgical segment is driven by advancements in surgical technologies, including minimally invasive techniques, robotics, and the use of biocompatible implants. The increasing prevalence of road accidents, sports injuries, and occupational hazards has further bolstered the demand for surgical interventions. Moreover, the rising availability of specialized trauma centers equipped with state-of-the-art surgical facilities has contributed to the growth of this segment.

Non-surgical treatments also represent an important segment of the trauma market. This category includes methods such as medication, splinting, casting, and other conservative approaches to manage less severe injuries. The non-surgical segment is growing due to the increasing preference for non-invasive treatments and the development of advanced pharmacological therapies that effectively manage pain and inflammation. Additionally, the growing awareness about the benefits of early intervention and appropriate non-surgical management has positively impacted this segment.

Rehabilitation Services are essential for the post-treatment recovery of trauma patients. This segment encompasses physical therapy, occupational therapy, and other rehabilitative measures aimed at restoring functionality and improving the quality of life for trauma survivors. The rehabilitation services segment is expanding due to the increasing recognition of the importance of comprehensive recovery programs and the integration of advanced rehabilitative technologies such as virtual reality and robotics-assisted therapy. The growing aging population, who are more prone to trauma and require extensive rehabilitation, further supports the demand for these services.

Key Market Segments

By Trauma Types

- Orthopedic Trauma

- Head Trauma

- Soft Tissue Trauma

- Spinal Trauma

By Patient Demographics

- Age Groups (Pediatric, Adult, Geriatric)

- Gender

- Socioeconomic Status

By Treatment Modalities

- Surgical

- Non-surgical

- Rehabilitation Services

Growth Opportunity

Increasing Number of Applications from Developing Nations

The global trauma market in 2023 has been significantly influenced by the increasing number of applications from developing nations. The burgeoning healthcare infrastructure in these regions has facilitated the adoption of advanced trauma care solutions. Countries such as India, China, and Brazil are investing heavily in healthcare improvements, thus creating a robust demand for trauma care products and services.

The rise in road accidents, industrial injuries, and natural disasters in these regions necessitates the need for efficient trauma management, thereby driving market growth. Moreover, governmental initiatives and international aid are further bolstering the market by providing essential funding and resources to enhance trauma care facilities in these developing nations.

Growing Modernization and Awareness Among People About Trauma Cases and Incidents

The growing modernization and heightened awareness among individuals regarding trauma cases and incidents have also contributed to the expansion of the global trauma market in 2023. The increasing accessibility to information through digital platforms has educated the public about the importance of timely and effective trauma care. This awareness has led to a higher demand for advanced trauma products and services, as individuals seek better medical outcomes.

Additionally, the modernization of healthcare systems, including the integration of cutting-edge technologies such as AI and telemedicine, has improved the efficiency and efficacy of trauma care. These advancements are instrumental in reducing mortality rates and enhancing recovery, thus driving market growth. The continuous efforts by healthcare organizations to educate and inform the public about trauma care further support this upward trend in the global trauma market.

Latest Trends

AI-Powered Technologies Improving Surgical Accuracy and Enabling Data-Driven Decision Making

In 2023, the integration of AI-powered technologies has emerged as a pivotal trend in the global trauma market. These technologies are revolutionizing trauma care by enhancing surgical precision and facilitating data-driven decision-making processes. AI algorithms analyze vast amounts of patient data, providing surgeons with critical insights and recommendations during trauma surgeries. This leads to improved surgical outcomes, reduced complications, and faster recovery times for patients.

Additionally, AI-powered diagnostic tools aid in the swift and accurate assessment of trauma cases, enabling healthcare professionals to make informed decisions promptly. The adoption of AI in trauma care is also instrumental in predictive analytics, helping in the early identification of potential complications and optimizing treatment plans accordingly. This trend signifies a significant advancement in the quality and effectiveness of trauma care, driving the market forward.

Popularity of Portable Trauma Devices for Pre-Hospital and Remote Use

Another noteworthy trend in the global trauma market in 2023 is the increasing popularity of portable trauma devices designed for pre-hospital and remote use. These devices are essential in providing immediate life-saving measures to trauma victims before they reach a healthcare facility. Portable trauma equipment, such as automated external defibrillators (AEDs), portable ventilators, and advanced wound care kits, are becoming more accessible and user-friendly.

Their deployment in ambulances, remote locations, and disaster-stricken areas ensures timely intervention, significantly improving survival rates. The development of lightweight, durable, and easy-to-operate trauma devices is catering to the growing demand for efficient pre-hospital care. This trend highlights the emphasis on enhancing emergency response capabilities and expanding the reach of trauma care services to underserved and remote populations, contributing to the overall growth of the global trauma market.

Regional Analysis

North America holds a 40.4% share of the global trauma market, reflecting its significant influence.

The global trauma market exhibits significant regional variations, with North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America all contributing to its dynamics. North America dominates the market, holding a substantial 40.4% share, driven by advanced healthcare infrastructure, high incidence of trauma cases, and widespread adoption of cutting-edge trauma care technologies. The region's robust market position is supported by significant investments in research and development, as well as favorable government initiatives to improve trauma care services.

Europe follows closely, benefiting from a well-established healthcare system and increasing awareness about trauma management. The region's market growth is fueled by rising investments in healthcare infrastructure and the presence of leading trauma care product manufacturers. Germany, the United Kingdom, and France are the major contributors to Europe, owing to their advanced medical facilities and high healthcare expenditure.

The Asia Pacific region is experiencing rapid growth in the trauma market, attributed to the expanding healthcare sector, increasing population, and rising incidence of trauma cases. Countries such as China, India, and Japan are at the forefront of this growth, driven by economic development, improving healthcare access, and increasing investments in trauma care. The region's market is expected to grow at a significant CAGR due to ongoing healthcare reforms and the introduction of innovative trauma care solutions.

In the Middle East & Africa, the trauma market is gradually evolving, supported by improving healthcare infrastructure and increasing awareness about trauma care. However, the market growth in this region is hindered by economic challenges and limited access to advanced medical technologies. South Africa and the Gulf Cooperation Council (GCC) countries are the key contributors to the market in this region.

Latin America presents a growing market for trauma care, with countries like Brazil and Mexico leading the way. The region's market growth is driven by increasing healthcare investments, rising awareness about trauma management, and improving healthcare infrastructure. However, economic instability and healthcare disparities remain challenges that need to be addressed to realize the full potential of the trauma market in this region.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global trauma market is significantly shaped by the strategic initiatives and innovative offerings of key players, including DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet Holdings Inc., Smith & Nephew plc, Medtronic plc, Wright Medical Group N.V., CONMED Corporation, Arthrex, Inc., Acumed LLC, and DJO Global Inc.

DePuy Synthes, a subsidiary of Johnson & Johnson, remains a dominant force in the market, leveraging its extensive product portfolio and strong R&D capabilities. The company's focus on developing advanced trauma care solutions and expanding its global footprint continues to bolster its market leadership. Stryker Corporation is another major player, known for its innovative trauma and extremities products. The company's strategic acquisitions and continuous product launches contribute to its robust market position.

Zimmer Biomet Holdings Inc. is recognized for its comprehensive range of trauma care products, including implants and surgical instruments. The company's commitment to enhancing patient outcomes through technological advancements strengthens its competitive edge. Similarly, Smith & Nephew plc has made significant strides in the market by offering cutting-edge trauma solutions and expanding its presence in emerging markets.

Medtronic plc, a global leader in medical technology, has diversified its trauma care offerings, focusing on minimally invasive procedures and advanced implantable devices. Wright Medical Group N.V., now part of Stryker, continues to influence the market with its specialization in extremities and biologics.

CONMED Corporation and Arthrex, Inc. are prominent players known for their surgical devices and sports medicine products, respectively. Their ongoing investments in R&D and strategic partnerships enhance their market positions. Acumed LLC and DJO Global Inc. are also key contributors, offering specialized trauma care solutions that cater to specific patient needs.

Collectively, these companies drive the global trauma market's growth through innovation, strategic acquisitions, and a commitment to improving patient care. Their efforts to expand their product portfolios and geographic reach are crucial in addressing the evolving demands of trauma care worldwide.

Market Key Players

- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- Smith & Nephew plc

- Medtronic plc

- Wright Medical Group N.V.

- CONMED Corporation

- Arthrex, Inc.

- Acumed LLC

- DJO Global Inc.

Recent Development

- In May 2024, Texas Health Presbyterian Hospital Dallas' software, developed by Jacob Roden-Foreman, won the 2024 Peregrine Award for Trauma Innovation, improving data accuracy in trauma registries for better patient care.

- In February 2024, The Blood D.E.S.E.R.T. Coalition, led by Harvard Medical School and Brigham and Women’s Hospital, proposes short-term strategies to address global blood shortage, enhancing access via innovative solutions for remote areas.

Report Scope

Report Features Description Market Value (2023) USD 9.9 Billion Forecast Revenue (2033) USD 17.8 Billion CAGR (2024-2032) 6.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Trauma Types(Orthopedic Trauma, Head Trauma, Soft Tissue Trauma, Spinal Trauma), By Patient Demographics(Age Groups (Pediatric, Adult, Geriatric), Gender, Socioeconomic Status), By Treatment Modalities(Surgical, Non-surgical, Rehabilitation Services) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet Holdings Inc., Smith & Nephew plc, Medtronic plc, Wright Medical Group N.V., CONMED Corporation, Arthrex, Inc., Acumed LLC, DJO Global Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- Smith & Nephew plc

- Medtronic plc

- Wright Medical Group N.V.

- CONMED Corporation

- Arthrex, Inc.

- Acumed LLC

- DJO Global Inc.