Transient Voltage Suppressor Diode Market By Type(Unidirectional, Bidirectional), Application(Automotive electronics, Consumer electronics, Industrial, Power supply, Communications, and others), End-user(OEMs, Distributors, and others) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42433

-

Feb 2022

-

163

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

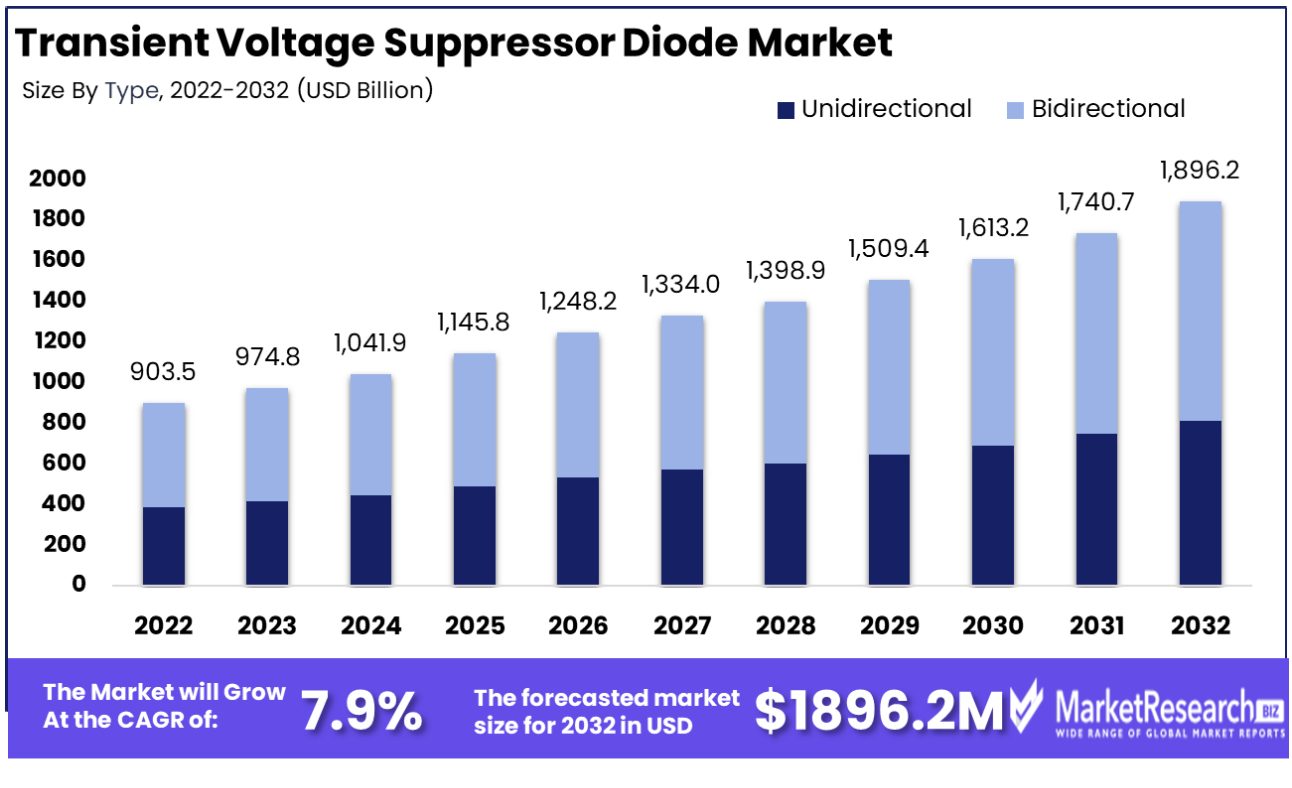

Transient Voltage Suppressor Diode Market size is predicted to reach approximately USD 1896.2 Mn by 2032, from a valuation of USD 903.47 Mn in 2022, growing at a CAGR of 7.9% during the forecast period from 2023 to 2032.

A transient voltage suppressor (TVS) diode is an electronic component that protects sensitive electronic devices from voltage spikes. When the voltage increases above a predefined threshold, known as the clamping voltage, the TVS diode begins to conduct electricity, thereby clipping or clamping the voltage to a safe level.

TVS diodes react extremely quickly, in less than a nanosecond, to suppress harmful transient voltages. They function by shunting excess current away from the protected device and through its p-n junction, which can temporarily handle high power. TVS diodes are often used to protect interfaces and power input points. Their fast response time and ability to absorb high peak pulse power make them ideal protection devices against unexpected voltage transients.

The Transient Voltage Suppressor (TVS) Diode Market is expected to experience significant growth in the coming years driven by the rising demand for protection circuits in consumer electronics.

One major factor propelling market expansion is the increasing adoption of TVS diodes in smartphones, tablets, laptops, and other gadgets to protect against electrostatic discharge or power surges that could damage sensitive electronic components. With electronics becoming ubiquitous and more advanced, including the Internet of Things (IoT) devices, the need for robust surge protection offered by TVS diodes has intensified.

For Instance, MDE Semiconductor, Inc. released the MAX15KA Series, a new addition to their MAX Power TVS Series. These radial lead power transient voltage suppressor diodes are designed to protect electronic systems from the damaging effects of lightning, electrostatic discharge (ESD), and inductive switching.

Additionally, the transient voltage suppressor diode market will benefit from advancements in the automotive industry like connected vehicles and autonomous driving. These incorporate intricate circuit boards and sensors that require TVS diode shielding.

The expected boom in 5G communications infrastructure worldwide also underpins strong demand growth for TVS diodes to enable uninterrupted high-speed connectivity. As electronic systems get faster and more complex, TVS diodes will continue seeing heightened utilization as a relatively low-cost component supporting system reliability and safety.

In November 2022, ProTek Devices had launched a new series of bidirectional transient voltage suppressors, the SKCxxxCS series, designed for circuit protection in both DC and AC applications, particularly in telecommunications infrastructure and industrial settings.

Key areas for innovation and R&D include developing TVS diodes with lower clamping voltages, reduced parasitic capacitance, faster response times, and ability to withstand higher peak pulse power. Additional opportunities exist to improve manufacturing techniques to produce more robust and cost-effective TVS solutions. With the proliferation of electronics and the need for robust surge protection, there is plenty of room for technology improvements in the TVS diode market.

Transient Voltage Suppressor Diode Market Dynamics

High-Speed Communication Systems Propel Transient Voltage Suppressor Market

The growing demand for high-speed communication systems among consumers is a significant driving force for the growth of the transient voltage suppressor diode market. As communication technologies evolve, the need for reliable and efficient protection against voltage spikes becomes critical.

High-speed systems, which are sensitive to even minor fluctuations in voltage, require robust transient voltage suppressors to ensure uninterrupted and stable operation. This demand is especially pertinent in areas like data centers, telecommunications, and advanced consumer electronics, where data integrity and system reliability are paramount. The trend towards faster and more reliable communication systems indicates a sustained demand for transient voltage suppressors, which are essential in safeguarding these advanced technologies.

Component Miniaturization Increases Demand for Transient Voltage Suppressors

The expanding trend of component miniaturization has led to increased electrical sensitivity, boosting the popularity of transient voltage suppressors in significant end-use applications. As electronic devices become smaller, the components within them become more susceptible to voltage spikes and electrical noise.

Transient voltage suppressors are crucial in these miniaturized environments, offering protection without compromising the device's size or functionality. This trend is particularly evident in consumer electronics, automotive electronics, and medical devices, where the balance between size and performance is critical. The ongoing miniaturization of components suggests a continuous growth in the transient voltage suppressor market, as these devices become an integral part of protecting increasingly compact and complex electronic systems.

Technological Breakthroughs and Rapid Reaction Time Boost Diode Market

Technological breakthroughs and the rapid reaction time of transient voltage suppressor diodes are key factors driving their market growth. Modern transient voltage suppressors offer quick response times to voltage spikes, which is crucial in protecting sensitive electronic circuits. As technology advances, these diodes are becoming more efficient, reliable, and capable of handling higher power surges.

This improvement is particularly important in sectors like renewable energy, automotive electronics, and industrial automation, where equipment must operate reliably under varying electrical conditions. The advancements in transient voltage suppressor technology ensure that they remain a vital component in protecting electronic systems against voltage fluctuations. The market is expected to grow as these technological improvements continue, with transient voltage suppressors becoming more adept at meeting the demands of modern electronic applications.

Restraining Factors

Availability of Alternate Devices Challenges Transient Voltage Suppressor Diode Market GrowthThe presence of alternative surge protection devices like Metal Oxide Varistors (MOVs) and Gas Discharge Tubes (GDTs) poses a significant challenge to the transient voltage suppressor (TVS) diode market. MOVs and GDTs, with their own set of performance characteristics and cost advantages, serve similar purposes in protecting electronic circuits from voltage spikes.

Their availability offers consumers and manufacturers a range of options, potentially diverting market share from TVS diodes. This competition can lead to reduced demand for TVS diodes, especially in applications where the unique advantages of TVS diodes are not a critical requirement, thereby limiting the market's growth.

Advancements in Competing Devices Limit Adoption of Transient Voltage Suppressor Diodes

Continual advancements in competing devices and technologies also limit the adoption and growth of transient voltage suppressor diodes. As research and development in the field of surge protection evolve, new devices and technologies that offer improved performance, higher reliability, or cost benefits emerge. These innovations can make competing devices more attractive to manufacturers and end-users, particularly in industries where technology is rapidly advancing.

The ability of these competing devices to better meet the changing needs and specifications of various applications can result in a preference shift away from TVS diodes, hindering their market growth. Keeping pace with these technological advancements is crucial for the sustained relevance of TVS diodes in the surge protection market.

Transient Voltage Suppressor Diode Market Segmentation Analysis

By Type

Unidirectional transient voltage suppressor (TVS) diodes are the dominant type in the market. Their primary role is to protect electronic circuits from voltage spikes by allowing current to flow in only one direction. Their popularity is due to their effectiveness in safeguarding sensitive components against sudden overvoltages typically encountered in power supply lines.

Unidirectional TVS diodes are widely used in applications where the polarity of the voltage source is consistent and predictable. The increasing miniaturization and sensitivity of electronic components have made unidirectional TVS diodes indispensable in modern electronic designs.

Bidirectional TVS diodes are designed for applications where voltage spikes can occur in both directions. They are particularly useful in AC circuits or in environments where the polarity of the voltage may vary. Though less common than unidirectional diodes, they are crucial in specific applications such as telecommunications and certain industrial equipment.

By Application

In the automotive electronics sector, TVS diodes are crucial for protecting sensitive electronics from voltage transients caused by load dump scenarios, alternator failure, and other electrical disturbances. The increasing electrification and complexity of automotive systems have driven the demand for effective transient voltage suppression solutions. This segment's growth is propelled by the automotive industry's ongoing shift towards more electronic and autonomous systems, necessitating robust protection for critical electronic components.

TVS diodes are essential in consumer electronics for safeguarding against voltage spikes. In industrial settings, they protect against surges from equipment like motors and switchgear. Power supply applications rely on TVS diodes to ensure the stable operation of power electronics. In communications, these diodes protect infrastructure and devices from lightning strikes and other electrical anomalies.

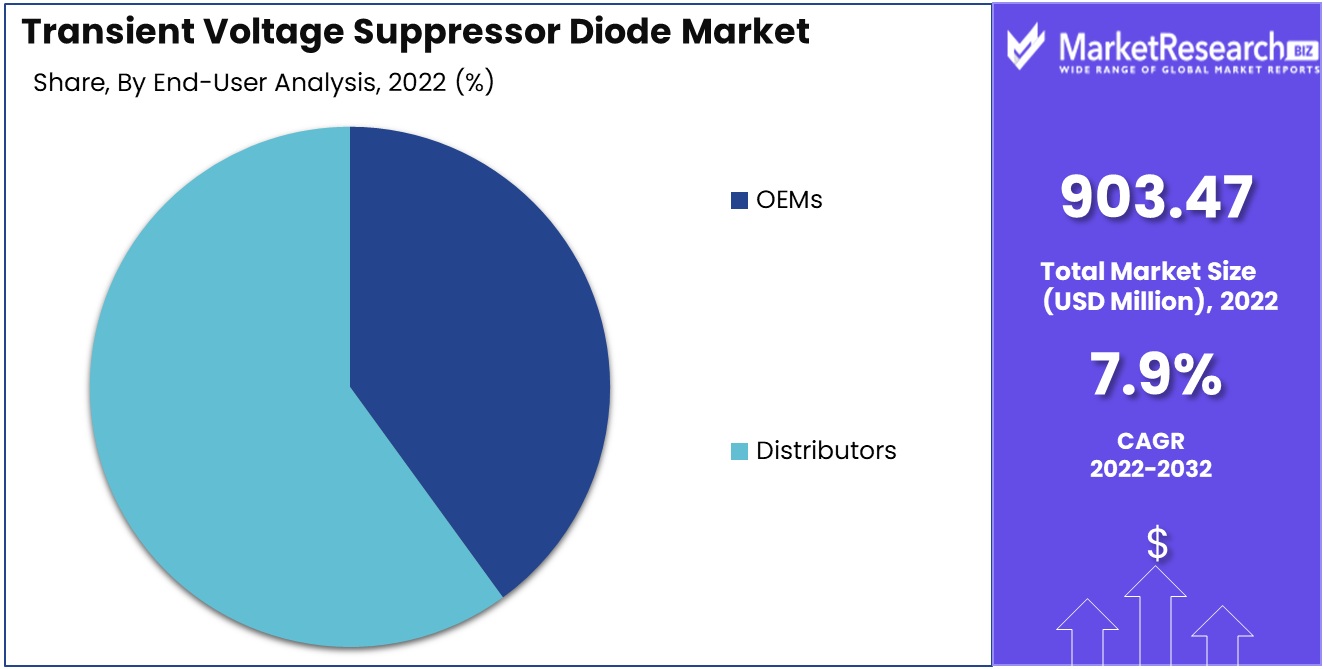

By End-user

Original Equipment Manufacturers (OEMs) represent the largest end-user segment for TVS diodes. OEMs incorporate these components directly into their product designs, ensuring built-in protection against voltage transients. This segment’s demand is driven by the broad range of applications for TVS diodes in consumer electronics, automotive, industrial equipment, and communication devices.

Distributors play a pivotal role in the TVS Diode Market by bridging the gap between manufacturers and a diverse range of smaller-scale users. These entities are crucial for ensuring the availability and accessibility of TVS diodes to manufacturers who may not deal directly with the component producers. Distributors often provide value-added services, such as supply chain management and technical support, facilitating the selection and acquisition of appropriate diodes for various applications.

Transient Voltage Suppressor Diode Industry Key Segments

By Type

- Unidirectional

- Bidirectional

Application

- Automotive electronics

- Consumer electronics

- Industrial

- Power supply

- Communications

- and others

End-user

- OEMs

- Distributors

- and others

Transient Voltage Suppressor Diode Market Growth Opportunities

Adoption in Renewable Energy Systems Offers Growth Opportunities for Transient Voltage Suppressor Diode Market

The increasing adoption of transient voltage suppressors (TVS) in renewable energy systems presents significant growth opportunities for the market. As renewable energy technologies like solar and wind power continue to evolve, the need to protect sensitive power electronics and control systems from voltage spikes becomes critical.

TVS diodes play an essential role in safeguarding these systems against transient voltages, ensuring reliability and longevity. The burgeoning renewable energy sector, driven by global sustainability initiatives, is expected to fuel the demand for TVS diodes, signifying a strong growth trajectory for the market during the forecast period.

Sensitivity to Electrical Stressors Drives Growth in the Transient Voltage Suppressor Market

The increasing sensitivity of electronic systems to electrical stressors is a key driver for the growth of the transient voltage suppressor market.

Modern electronic devices and systems, characterized by their compact size and complexity, are more susceptible to voltage fluctuations and spikes. This heightened sensitivity necessitates the use of effective transient voltage suppression to protect these devices. The ongoing trend towards miniaturization and enhanced functionality in electronics across various industries is anticipated to sustain the demand for TVS diodes, underpinning a steady market expansion.

Transient Voltage Suppressor Diode Market Regional Analysis

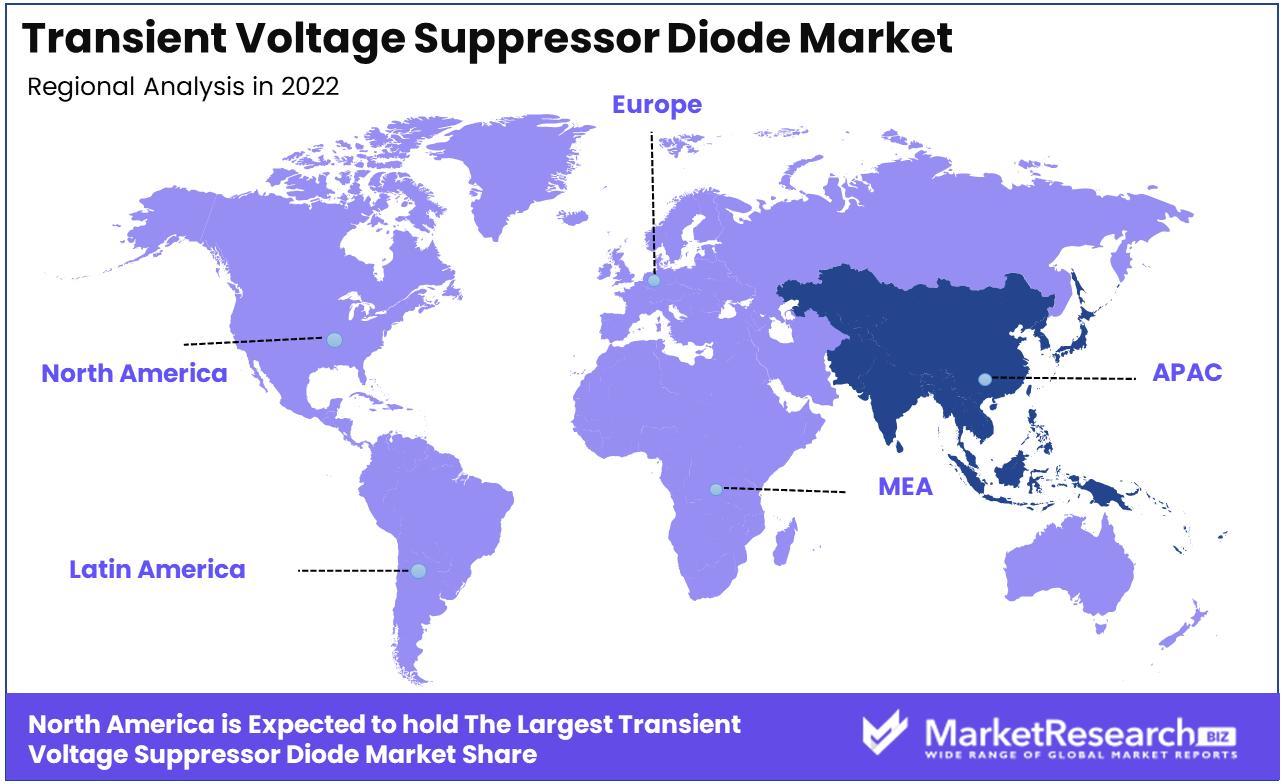

Asia-Pacific Dominates with 38.10% Market Share

Asia-Pacific’s leading 38.10% share in the global Transient Voltage Suppressor (TVS) Diode Market is primarily driven by the region's robust electronics manufacturing sector. Countries like China, South Korea, and Taiwan are global hubs for the production of consumer electronics, communication devices, and automotive electronics, where TVS diodes are extensively used for circuit protection. The region's emphasis on miniaturization and high-performance electronics also accelerates the demand for advanced TVS diodes. Furthermore, the presence of several key semiconductor manufacturers in Asia-Pacific heavily contributes to the region's market dominance.

The market dynamics in Asia-Pacific are influenced by rapid technological advancements and the increasing adoption of digital and smart technologies. The growth of the automotive sector, especially the surge in electric vehicle production, and the expansion of telecommunication networks in the region necessitate robust voltage protection solutions, thus boosting the TVS diode market. Additionally, the rising consumer electronics industry, coupled with increasing investments in research and development in the semiconductor sector, supports market growth.

North America’s Innovation and Advanced Technology Adoption

North America’s TVS diode market is driven by the region's strong focus on innovation and the rapid adoption of advanced technologies. The United States, being a leader in the tech industry, sees substantial demand for TVS diodes in various sectors, including defense, aerospace, and consumer electronics. The region's commitment to high-quality standards and the presence of leading technology companies foster the development and adoption of advanced TVS diode solutions.

Europe’s Stringent Regulations and High-Quality Standards

Europe’s TVS diode market benefits from the region's stringent regulations on electronic component quality and the high standard of industrial manufacturing. The demand for TVS diodes in Europe is bolstered by the automotive industry, particularly with the increase in the production of electric vehicles, which require effective voltage protection solutions. The region's focus on sustainable and reliable electronics also contributes to the steady growth of the TVS diode market.

Transient Voltage Suppressor Diode Industry By Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Transient Voltage Suppressor Diode Market Key Player Analysis

In the Transient Voltage Suppressor (TVS) Diode Market, each of the listed companies plays a crucial role in shaping this niche yet critical component sector in the electronics industry. Vishay, Littelfuse, and On Semiconductor, as major players, lead the market with their broad range of TVS diodes, catering to various applications requiring surge protection. Their products are pivotal in ensuring reliability and safety in electronic circuits across multiple industries.

STMicroelectronics and Infineon Technologies AG, known for their semiconductor expertise, contribute significantly with advanced TVS diode technologies, emphasizing the market's shift towards high-performance and miniaturized components. Bourns and NXP, offering a variety of electronic components, underscore the importance of versatility and innovation in catering to the evolving needs of surge protection in electronics.

Diodes Incorporated and Nexperia, focusing on discrete and logic semiconductor components, demonstrate the industry's trend towards efficient and compact TVS diodes suitable for space-constrained applications. Microsemi Corporation and Texas Instruments, with their comprehensive portfolios, highlight the market's diversity, catering to both standard and specialized surge protection needs.

Toshiba Corporation and ROHM Semiconductor, leveraging their broad electronic component expertise, are key in driving innovation and quality in the TVS diode market. Semtech Corporation and Panasonic Corporation, although not exclusively focused on TVS diodes, contribute to the market with specialized offerings that enhance the overall surge protection capabilities of electronic devices.

Collectively, these companies not only drive the Transient Voltage Suppressor Diode Market's growth but also represent a spectrum of strategies - from advancing technology to meeting specific market demands - crucial for the development and integration of effective surge protection solutions in electronics.

Major Market Players in the Transient Voltage Suppressor Diode Market

- Vishay

- Littelfuse

- On Semiconductor

- STMicroelectronics

- Bourns

- NXP

- Diodes Incorporated

- Infineon Technologies AG

- Nexperia

- Microsemi Corporation

- Texas Instruments

- Toshiba Corporation

- ROHM Semiconductor

- Semtech Corporation

- Panasonic Corporation

- Eaton Corporation

- TE Connectivity

- Vishay Intertechnology

- General Semiconductor Inc.

- BrightKing

Recent Developments

- In November 2022, Littelfuse, Inc. launched new TVS diode series called SMTOAK2 allowing manufacturers to achieve protection against overvoltage, transient voltage, and lightning protection while using less printed circuit board (PCB) space.

- In June 2021, Remcom upgraded its 3D Simulation Software with transient circuit co-simulation for electrostatic discharge testing and support for spark plugs and transient voltage suppressor (TVS) diodes.

Report Scope

Report Features Description Market Value (2022) USD 903.47 Mn Forecast Revenue (2032) USD 1896.2 Mn CAGR (2023-2032) 7.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Unidirectional, Bidirectional), Application(Automotive electronics, Consumer electronics, Industrial, Power supply, Communications, and others), End-user(OEMs, Distributors, and others) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Vishay, Littelfuse, On Semiconductor, STMicroelectronics, Bourns, NXP, Diodes Incorporated, Infineon Technologies AG, Nexperia, Microsemi Corporation, Texas Instruments, Toshiba Corporation, ROHM Semiconductor, Semtech Corporation, Panasonic Corporation, Eaton Corporation, TE Connectivity, Vishay Intertechnology, General Semiconductor Inc., BrightKing Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-