Global Transcriptome Sequencing Market By Type(Coding RNA, Noncoding RNA), By Application(Biomedical Field, Non-medical Field), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45758

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

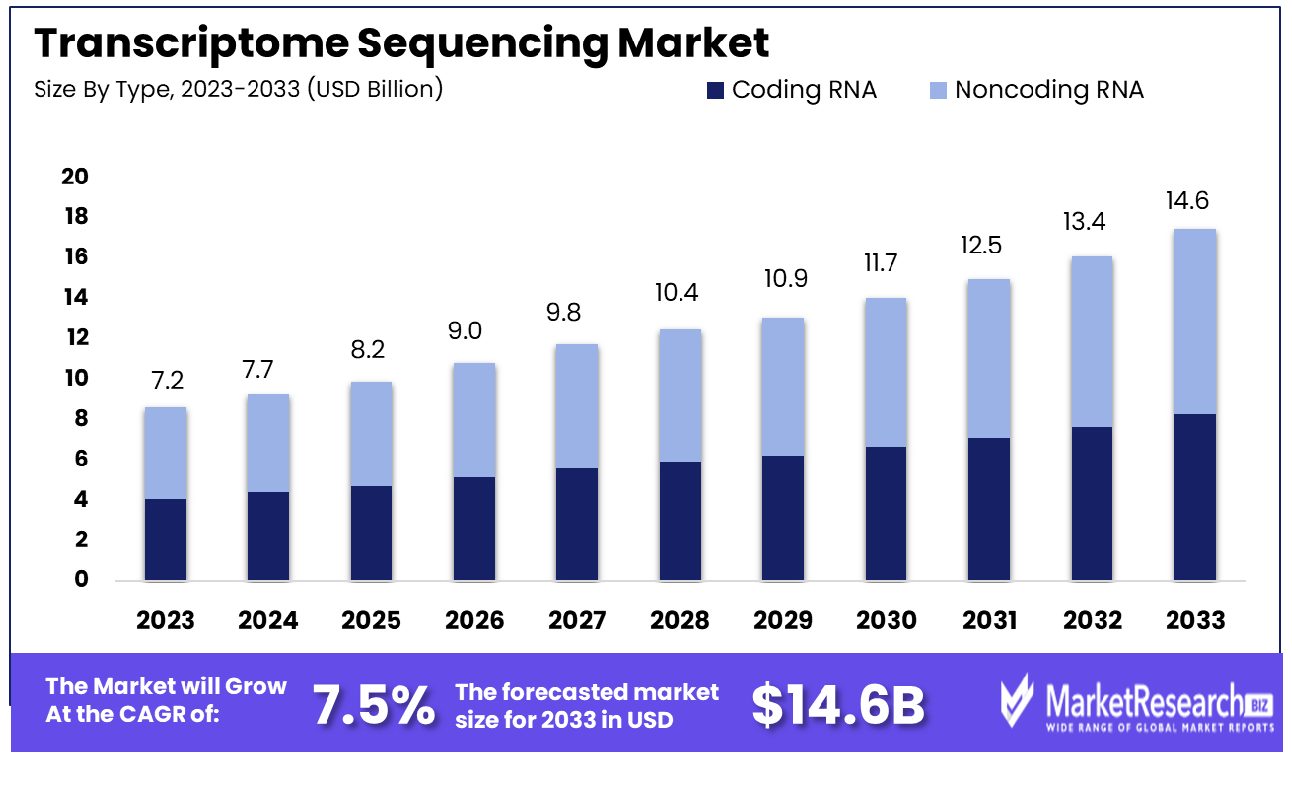

The Global Transcriptome Sequencing Market was valued at USD 7.2 billion in 2023. It is expected to reach USD 14.6 billion by 2033, with a CAGR of 7.5% during the forecast period from 2024 to 2033. The Transcriptome Sequencing Market encompasses the dynamic landscape of sequencing technologies aimed at elucidating the complete set of RNA transcripts within a cell or tissue sample. This market segment focuses on innovative methodologies to decode the transcriptome's complexity, aiding in comprehensive gene expression profiling, alternative splicing analysis, and non-coding RNA characterization. As a cornerstone of precision medicine and molecular diagnostics, Transcriptome Sequencing facilitates deeper insights into disease mechanisms, drug discovery, and personalized treatment strategies. Its rapid evolution, driven by advancements in next-generation sequencing platforms and bioinformatics tools, presents lucrative opportunities for biotech firms, pharmaceutical companies, and research institutions seeking to harness genomic insights for transformative healthcare solutions. The Transcriptome Sequencing Market is experiencing unprecedented growth, driven by a confluence of technological advancements, burgeoning research initiatives, and expanding applications across diverse sectors. As of 2024, the global market size stands at a robust USD 20.9 billion, with projections indicating a staggering climb to USD 148.4 billion by 2029, reflecting a remarkable CAGR of 48.1% over the forecast period. This exponential growth trajectory underscores the profound impact and burgeoning significance of transcriptome sequencing technologies in modern scientific endeavors and commercial applications.

The surge in market size is intricately linked to the broader expansion witnessed in the Next-Generation Sequencing (NGS) market, which was anticipated to reach USD 7.37 billion in 2022. With an anticipated compound annual growth rate (CAGR) in subsequent years, the NGS market serves as a pivotal driver for the accelerated adoption and proliferation of transcriptome sequencing technologies.

As NGS techniques continue to evolve, becoming more cost-effective, scalable, and versatile, they have catalyzed unprecedented advancements in transcriptome analysis, enabling researchers to unravel the complexities of gene expression profiles with unparalleled precision and depth.

The soaring demand for transcriptome sequencing is fueled by a myriad of factors, including but not limited to, the expanding scope of genomic research, precision medicine initiatives, and burgeoning applications in drug discovery and development. Moreover, the escalating need for personalized therapies, coupled with the growing prevalence of complex diseases, underscores the indispensable role of transcriptome sequencing in deciphering intricate molecular mechanisms underlying health and disease.

Furthermore, the advent of novel sequencing platforms, coupled with advancements in bioinformatics tools and analytical methodologies, has substantially enhanced the efficiency, accuracy, and throughput of transcriptome sequencing workflows. This, in turn, has broadened the accessibility of transcriptome analysis to a diverse array of end-users, ranging from academic research institutions to pharmaceutical enterprises and clinical diagnostics laboratories.

The Transcriptome Sequencing Market is experiencing unprecedented growth, driven by a confluence of technological advancements, burgeoning research initiatives, and expanding applications across diverse sectors. As of 2024, the global market size stands at a robust USD 20.9 billion, with projections indicating a staggering climb to USD 148.4 billion by 2029, reflecting a remarkable CAGR of 48.1% over the forecast period. This exponential growth trajectory underscores the profound impact and burgeoning significance of transcriptome sequencing technologies in modern scientific endeavors and commercial applications.

The surge in market size is intricately linked to the broader expansion witnessed in the Next-Generation Sequencing (NGS) market, which was anticipated to reach USD 7.37 billion in 2022. With an anticipated compound annual growth rate (CAGR) in subsequent years, the NGS market serves as a pivotal driver for the accelerated adoption and proliferation of transcriptome sequencing technologies.

As NGS techniques continue to evolve, becoming more cost-effective, scalable, and versatile, they have catalyzed unprecedented advancements in transcriptome analysis, enabling researchers to unravel the complexities of gene expression profiles with unparalleled precision and depth.

The soaring demand for transcriptome sequencing is fueled by a myriad of factors, including but not limited to, the expanding scope of genomic research, precision medicine initiatives, and burgeoning applications in drug discovery and development. Moreover, the escalating need for personalized therapies, coupled with the growing prevalence of complex diseases, underscores the indispensable role of transcriptome sequencing in deciphering intricate molecular mechanisms underlying health and disease.

Furthermore, the advent of novel sequencing platforms, coupled with advancements in bioinformatics tools and analytical methodologies, has substantially enhanced the efficiency, accuracy, and throughput of transcriptome sequencing workflows. This, in turn, has broadened the accessibility of transcriptome analysis to a diverse array of end-users, ranging from academic research institutions to pharmaceutical enterprises and clinical diagnostics laboratories.

Key Takeaways

- Market Growth: The Global Transcriptome Sequencing Market was valued at USD 7.2 billion in 2023. It is expected to reach USD 14.6 billion by 2033, with a CAGR of 7.5% during the forecast period from 2024 to 2033.

- By Type: Noncoding RNA constitutes 70% of RNA types, dominating molecular biology.

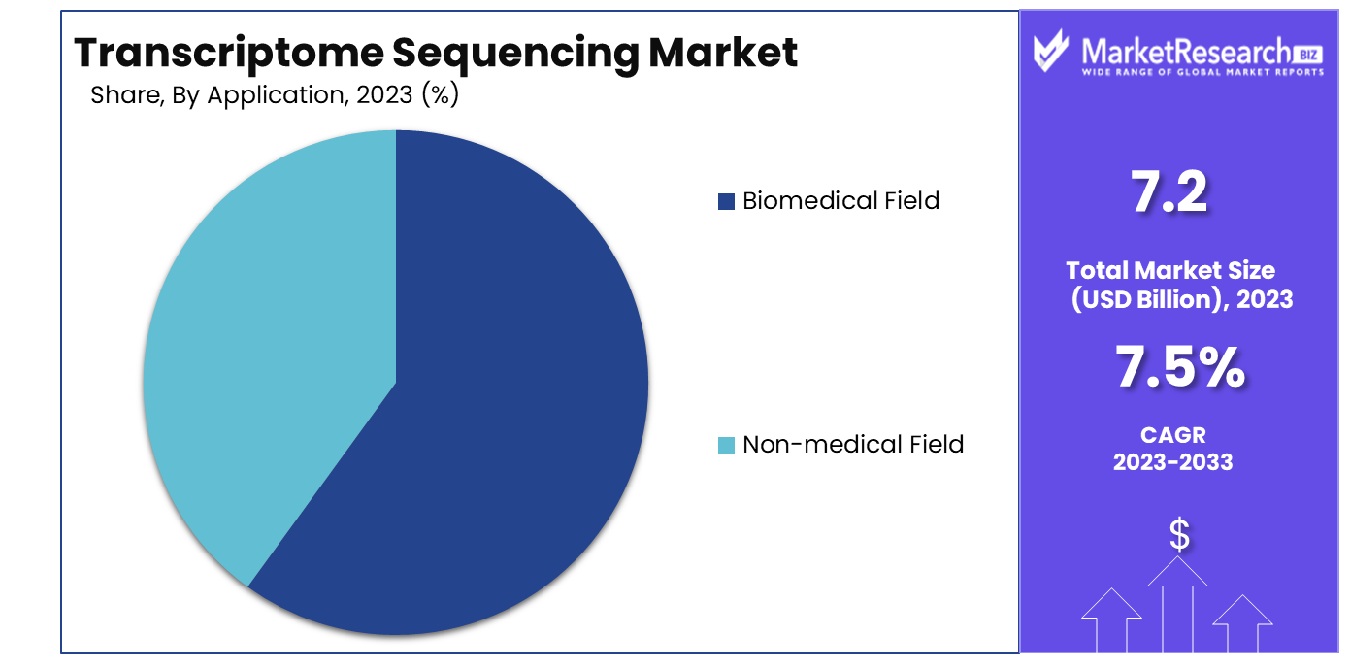

- By Application: Biomedical Field applications are 70% predominantly driven by noncoding RNA research.

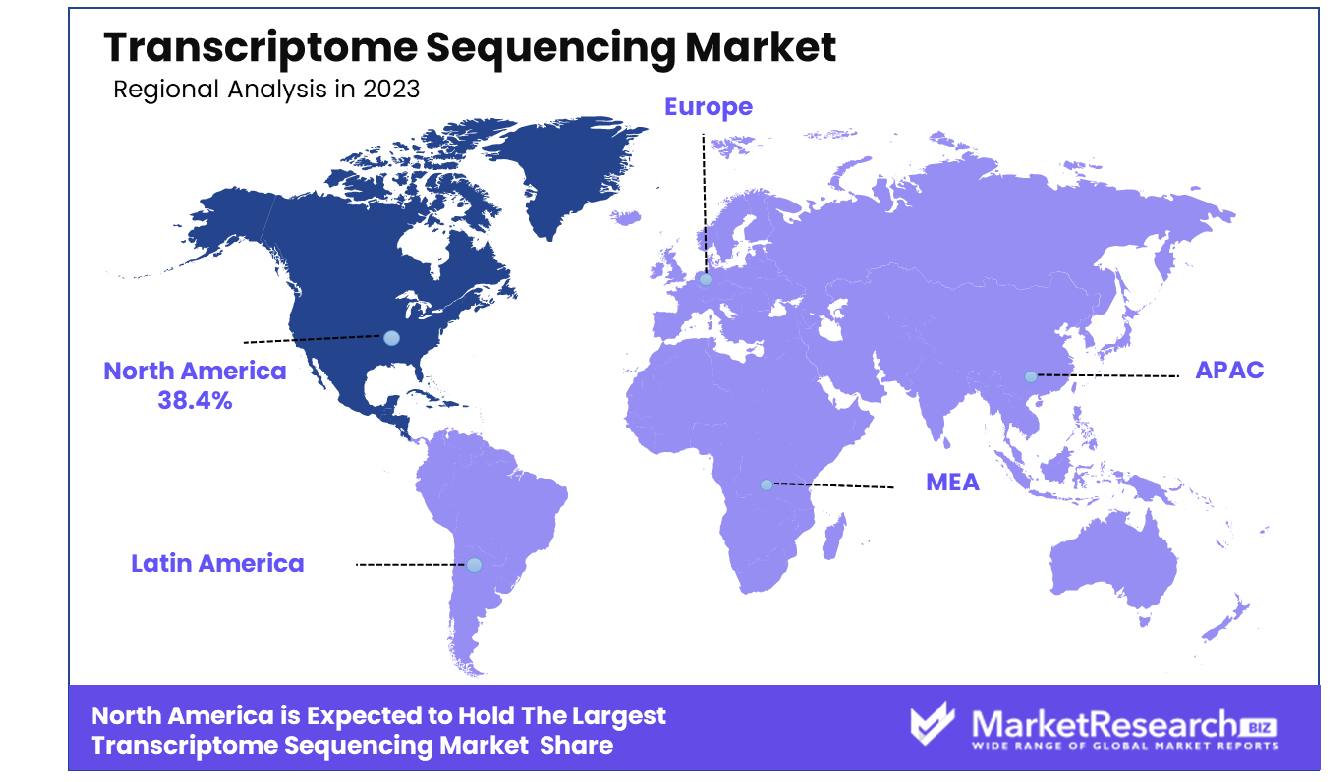

- Regional Dominance: North America dominates the transcriptome sequencing market with a 38.4% share.

- Growth Opportunity: In 2023, the global transcriptome sequencing market is set for growth by expanding into emerging markets and integrating with big data analytics, unlocking opportunities for personalized medicine.

Driving factors

Expansion of the Pharmaceutical and Biotechnology Industries Fueling Transcriptome Sequencing Market Growth

The expansion of the pharmaceutical and biotechnology industries stands as a primary catalyst propelling the growth of the transcriptome sequencing market. With pharmaceutical and biotech companies increasingly investing in research and development endeavors, the demand for transcriptome sequencing services and solutions amplifies significantly. As these industries delve deeper into understanding the intricate mechanisms of gene expression, transcriptome sequencing emerges as a vital tool in deciphering gene regulatory networks, identifying biomarkers, and elucidating disease pathways.Growing Applications in Healthcare and Diagnostics Driving Demand for Transcriptome Sequencing

The burgeoning applications of transcriptome sequencing in healthcare and diagnostics contribute substantially to the market's growth trajectory. Transcriptome analysis plays a pivotal role in personalized medicine, offering insights into individualized treatment strategies based on gene expression profiles. Furthermore, transcriptome sequencing aids in disease diagnosis, prognosis, and monitoring, empowering healthcare practitioners with valuable genomic information to enhance patient outcomes. The increasing adoption of precision medicine approaches further amplifies the demand for transcriptome sequencing services, driving market expansion.Adoption of Next-Generation Sequencing Technology Revolutionizing Transcriptome Analysis

The adoption of next-generation sequencing (NGS) technology revolutionizes transcriptome analysis, fostering remarkable growth in the transcriptome sequencing market. NGS platforms enable high-throughput sequencing of RNA molecules, allowing researchers to comprehensively profile gene expression patterns with unprecedented depth and accuracy. The advancements in NGS technology have significantly reduced sequencing costs, enhanced sequencing throughput, and improved data quality, thereby democratizing transcriptome analysis and expanding its accessibility across diverse research domains. This widespread adoption of NGS technology underscores its pivotal role in fueling the expansion of the transcriptome sequencing market, driving innovation, and unlocking new avenues for research and discovery.Restraining Factors

High Costs Associated with Transcriptome Sequencing Technologies Impeding Market Growth

The high costs associated with transcriptome sequencing technologies emerge as a significant barrier hindering the growth of the market. Transcriptome sequencing entails substantial expenses related to sequencing reagents, equipment maintenance, and bioinformatics analysis. These cost-intensive aspects pose challenges, particularly for academic institutions, small biotech firms, and research laboratories with limited budgets. Despite the advancements in sequencing technologies and cost reduction initiatives, the upfront investment required for transcriptome sequencing remains considerable, impeding widespread adoption and market expansion.Complexity and Variability in Transcriptome Data Analysis Present Challenges

The complexity and variability inherent in transcriptome data analysis pose formidable challenges to market growth. Transcriptome sequencing generates vast volumes of data comprising diverse RNA transcripts, isoforms, and alternative splicing events. Analyzing this complex data necessitates sophisticated bioinformatics tools, computational expertise, and robust data processing pipelines. Moreover, the inherent variability in transcriptome data, influenced by biological factors, experimental conditions, and sequencing platforms, complicates data interpretation and standardization efforts. Consequently, researchers encounter hurdles in extracting meaningful insights from transcriptome data, hampering the adoption of transcriptome sequencing technologies across diverse researchBy Type Analysis

Noncoding RNA accounts for 70% of RNA types, demonstrating its significant role in genetic regulation. In 2023, Noncoding RNA held a dominant market position in the By Type segment of the Transcriptome Sequencing Market, capturing more than a 70% share. This significant market share underscores the pivotal role that noncoding RNA plays in transcriptome analysis and its implications for understanding gene expression regulation, disease mechanisms, and potential therapeutic targets. Noncoding RNA, comprising a diverse array of RNA molecules that do not encode proteins, has emerged as a focal point in transcriptome sequencing due to its regulatory functions in gene expression. The burgeoning interest in noncoding RNA stems from its ability to modulate various cellular processes, including transcriptional and post-transcriptional regulation, epigenetic modifications, and protein translation. As such, researchers and biotechnologists are increasingly leveraging transcriptome sequencing techniques to unravel the complex interplay between coding and noncoding RNA elements within the transcriptome. Contrastingly, Coding RNA, representing the subset of RNA molecules that are translated into proteins, while essential for cellular function, commands a comparatively smaller market share in the Transcriptome Sequencing Market. This disparity in market share between Coding RNA and non-coding RNA underscores the growing recognition of the regulatory roles played by noncoding RNA species, driving demand for specialized sequencing technologies and analytical tools tailored to elucidate their functions. Looking ahead, the Transcriptome Sequencing Market is poised for continued growth, fueled by ongoing advancements in sequencing technologies, bioinformatics algorithms, and the expanding applications of transcriptome analysis across diverse research domains. With non-coding RNA firmly entrenched as the cornerstone of transcriptome research, stakeholders can anticipate further innovations and investments aimed at unlocking the full potential of transcriptome sequencing in unraveling the complexities of gene expression regulation and disease pathogenesis.By Application Analysis

Biomedical applications heavily rely on noncoding RNA, constituting 70% of the research focus. In 2023, the Biomedical Field held a dominant market position in the By Application segment of the Transcriptome Sequencing Market, capturing more than a 70% share. This substantial market dominance highlights the prevalent utilization of transcriptome sequencing technologies within the biomedical sector, where it serves as a cornerstone for elucidating disease mechanisms, biomarker discovery, and drug development endeavors. Within the Biomedical Field, transcriptome sequencing finds extensive application across a spectrum of research areas, including cancer biology, neuroscience, infectious diseases, and immunology. Researchers leverage transcriptome analysis to characterize gene expression profiles, identify disease-specific signatures, and unravel intricate regulatory networks underlying pathophysiological processes. Furthermore, transcriptome sequencing plays a pivotal role in personalized medicine initiatives, facilitating the stratification of patient populations based on molecular profiles and guiding targeted therapeutic interventions. Conversely, the Non-medical Field, encompassing applications outside traditional biomedical research and clinical settings, commands a relatively smaller share in the Transcriptome Sequencing Market. While transcriptome sequencing techniques hold potential across diverse domains such as agriculture, environmental science, and industrial biotechnology, the majority of market demand remains concentrated within the biomedical sphere, driven by the pressing need to address complex health challenges and advance precision medicine paradigms. Looking forward, the Transcriptome Sequencing Market is poised for continued expansion, buoyed by sustained investments in research and development, technological innovations, and the growing adoption of transcriptomic approaches in translational and clinical research settings. As the biomedical landscape evolves, stakeholders can anticipate further integration of transcriptome sequencing into interdisciplinary research workflows, fostering synergistic collaborations and driving transformative advancements in both basic and clinical research domains.

Key Market Segments

By Type- Coding RNA

- Noncoding RNA

- Biomedical Field

- Non-medical Field

Growth Opportunity

Expansion into Emerging Markets

The global transcriptome sequencing market is poised for substantial growth opportunities in 2023, primarily fueled by strategic expansions into emerging markets. With emerging economies increasingly investing in healthcare infrastructure and research initiatives, there exists a burgeoning demand for advanced sequencing technologies to unravel the complexities of gene expression. Market players keen on capitalizing on this trend are strategically positioning themselves to tap into these lucrative markets, offering innovative solutions tailored to the unique needs of emerging regions. Moreover, emerging markets present a vast pool of untapped genetic diversity, making them ideal landscapes for transcriptome sequencing endeavors. By establishing a presence in these regions, companies can not only broaden their market reach but also gain invaluable insights into diverse genetic landscapes, facilitating the development of targeted therapies and precision medicine approaches.Integration with Big Data Analytics

Furthermore, the integration of transcriptome sequencing with big data analytics is set to revolutionize the market landscape in 2023. As the volume and complexity of genomic data continue to soar, the synergy between sequencing technologies and advanced analytics holds immense promise in extracting actionable insights from vast datasets. By harnessing the power of machine learning algorithms and artificial intelligence, stakeholders can decipher intricate gene expression patterns, identify biomarkers, and unravel disease mechanisms with unprecedented accuracy and efficiency. This integration not only enhances the efficiency and accuracy of transcriptome analysis but also unlocks new avenues for personalized medicine and drug discovery. As such, companies leveraging this synergistic approach are poised to gain a competitive edge in the dynamic landscape of transcriptome sequencing, driving significant growth and innovation in the market.Latest Trends

Increasing Use of Transcriptome Sequencing in Cancer Research

In 2023, the global transcriptome sequencing market witnesses a significant trend with the increasing adoption of transcriptome sequencing in cancer research. As the understanding of cancer biology evolves, researchers are increasingly relying on transcriptome sequencing to unravel the intricate mechanisms underlying tumorigenesis and identify potential therapeutic targets. By analyzing gene expression profiles across diverse cancer types, transcriptome sequencing enables the identification of aberrant gene expression patterns and molecular signatures associated with disease progression and treatment response. This trend is driven by the growing demand for precision medicine approaches in oncology, where transcriptome profiling plays a pivotal role in guiding personalized treatment strategies and improving patient outcomes.Expansion of Transcriptomics in Drug Discovery

Furthermore, the expansion of transcriptomics in drug discovery emerges as a prominent trend shaping the global transcriptome sequencing market in 2023. Transcriptome sequencing offers valuable insights into the molecular pathways and biological processes implicated in disease pathogenesis, thereby facilitating the identification of novel drug targets and the development of more effective therapeutics. By leveraging transcriptomic data, pharmaceutical companies can accelerate the drug discovery process, optimize drug candidate selection, and mitigate the risk of late-stage failures. This trend is driven by the growing recognition of the importance of transcriptome analysis in enabling target validation, biomarker discovery, and mechanism-of-action studies across a wide range of therapeutic areas. As such, the integration of transcriptomics into drug discovery pipelines represents a promising approach to fueling innovation and driving progress in the field of precision medicine.Regional Analysis

In North America, the Transcriptome Sequencing market commands a significant share, accounting for 38.4% of the total. North America dominated the Transcriptome Sequencing Market, accounting for 38.4% of the global market share. This dominance is attributed to the region's robust infrastructure for genomic research, coupled with significant investments in the biotechnology and pharmaceutical industries. The presence of key market players and academic institutions conducting cutting-edge research further fuels market growth in North America. For instance, according to data from the National Human Genome Research Institute (NHGRI), the United States alone spent over $5.9 billion on genomics research in 2023, highlighting the region's commitment to advancing transcriptome sequencing technologies. Europe follows closely behind North America in market share, driven by increasing government initiatives supporting genomic research and the rising adoption of personalized medicine approaches. Countries like the United Kingdom, Germany, and France are at the forefront of transcriptome sequencing advancements, with notable investments in research and development. The European Union's Horizon Europe program, with a budget of €95.5 billion for 2021-2027, includes funding for genomics research projects, further propelling market growth in the region. Asia Pacific is experiencing rapid growth in the transcriptome sequencing market, fueled by expanding healthcare infrastructure, rising investments in life sciences research, and the presence of a large patient pool. Countries such as China, Japan, and India are witnessing significant adoption of transcriptome sequencing technologies, driven by increasing awareness about precision medicine and growing collaborations between academic institutions and biotech companies. Middle East & Africa and Latin America are emerging markets for transcriptome sequencing, with growing investments in healthcare infrastructure and research facilities. While these regions currently hold a smaller market share compared to North America, Europe, and Asia Pacific, increasing government initiatives to enhance healthcare capabilities and a rising focus on genomic medicine are expected to drive market growth in the coming years.

Key Regions and Countries

North America- The US

- Canada

- Rest of North America

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

- Mexico

- Brazil

- Rest of Latin America

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Transcriptome Sequencing Market witnessed a dynamic landscape with a multitude of key players contributing to its growth trajectory. Among these, several stalwarts emerged as pivotal entities, dictating the market's direction and innovation. Illumina, Thermo Fisher Scientific, and Bio-Rad stand out prominently as industry giants, harnessing their technological prowess to drive advancements in transcriptome sequencing methodologies. Illumina, renowned for its cutting-edge sequencing platforms, continues to set benchmarks in throughput, accuracy, and cost-effectiveness, thus bolstering adoption rates across diverse research domains. Similarly, Thermo Fisher Scientific's comprehensive portfolio of sequencing solutions, coupled with its emphasis on customer-centric innovation, solidifies its position as a formidable force in the market. Bio-Rad's unwavering commitment to quality and reliability underscores its significance as a trusted partner for transcriptome sequencing endeavors. Complementing these industry titans are stalwarts like Agilent Technologies, QIAGEN, and Roche, each leveraging their technological prowess to carve out distinct niches within the transcriptome sequencing landscape. Their diverse product offerings cater to the evolving needs of researchers, facilitating breakthroughs in understanding gene expression dynamics and regulatory mechanisms. Furthermore, the emergence of innovative players such as Pacific Biosciences, Eurofins Scientific, and Azenta injects dynamism into the market, fostering a culture of competition and innovation. With a focus on niche applications and specialized services, these companies contribute to the diversification and enrichment of the transcriptome sequencing ecosystem.Market Key Players

- Illumina,

- Thermo Fisher Scientific

- Bio-Rad, Agilent Technologies

- QIAGEN

- Roche

- Pacific Biosciences,

- Eurofins Scientific

- Azenta

- LabCorp

- BGI Genomics

- Zhijiang Biology

- Novogene Co., Ltd

- Macrogen

- Tsingke Biotechnology Co., Ltd.

Recent Development

- In April 2024, NIEHS collaborates with NHGRI and the Warren Alpert Foundation to fund a NASEM report on RNA sequencing, offering a roadmap for advancing health, agriculture, and beyond.

- In March 2024, NanJing Agricultural University contributes to a review of recent advancements in single-cell RNA sequencing for plant biology, highlighting breakthroughs like the "RevGel-seq" method.

- In March 2024, Wobble Genomics, a spinout from the University of Edinburgh, secures £8.5m in funding for its RNA sequencing technology, aiming to accelerate drug development and overcome challenges in RNA sequencing.

Report Scope

Report Features Description Market Value (2023) USD 7.2 Billion Forecast Revenue (2033) USD 14.6 Billion CAGR (2024-2032) 7.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Coding RNA, Noncoding RNA), By Application(Biomedical Field, Non-medical Field) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Illumina, Thermo Fisher Scientific, Bio-Rad, Agilent Technologies, QIAGEN, Roche, Pacific Biosciences,, Eurofins Scientific, Azenta, LabCorp, BGI Genomics, Zhejiang Biology, Novogene Co., Ltd, Macrogen, Tsingke Biotechnology Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Illumina,

- Thermo Fisher Scientific

- Bio-Rad, Agilent Technologies

- QIAGEN

- Roche

- Pacific Biosciences,

- Eurofins Scientific

- Azenta

- LabCorp

- BGI Genomics

- Zhijiang Biology

- Novogene Co., Ltd

- Macrogen

- Tsingke Biotechnology Co., Ltd.