Transaction Monitoring Market By Deployment Mode (On-premise and Cloud), By Enterprises Size (Small and Medium-sized Enterprises and Large Enterprises), By Application (Fraud detection and prevention, Anti-money laundering, Compliance management, Customer identity management), By Function (Dashboard and reporting, Case management, Watch list screening, KYC/customer onboarding), By Vertical , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48105

-

June 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Component Analysis

- By Deployment Mode Analysis

- By Enterprises Size Analysis

- By Application Analysis

- By Function Analysis

- By Vertical Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

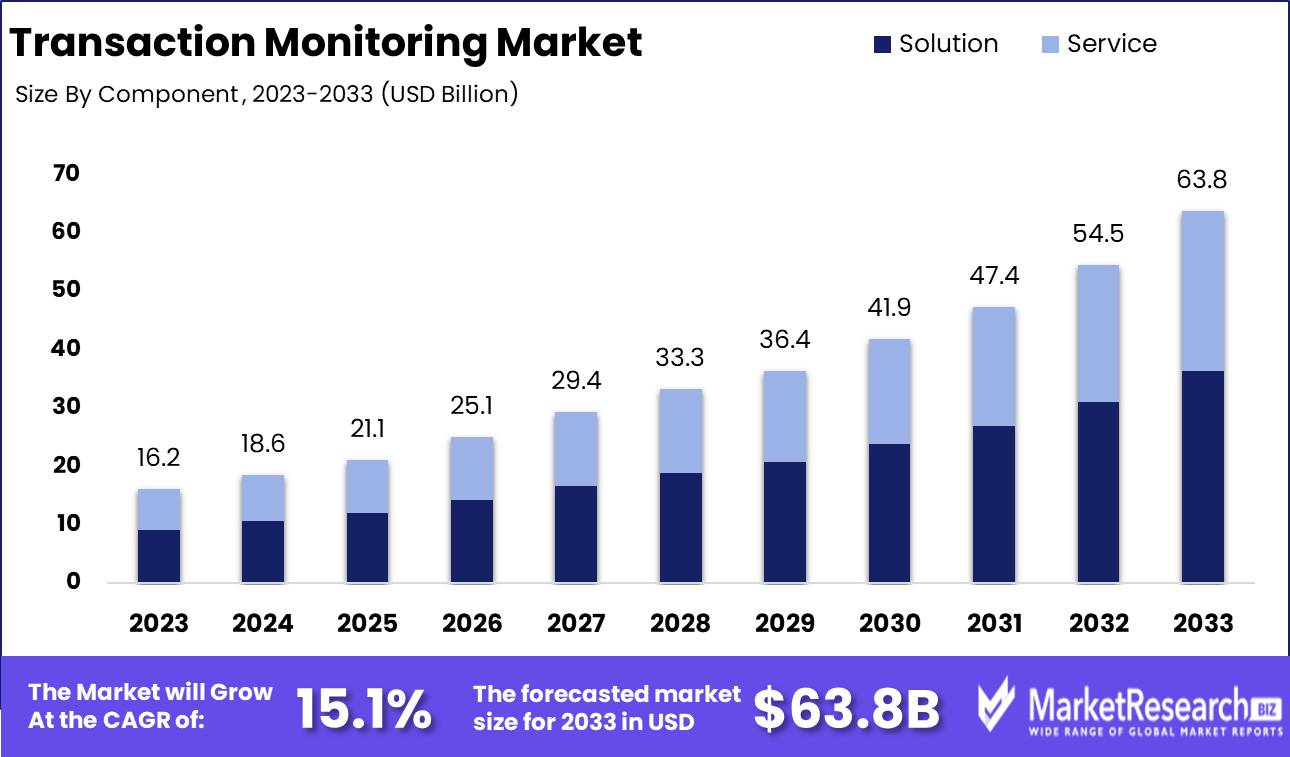

The Transaction Monitoring Market was valued at USD 16.2 billion in 2023. It is expected to reach USD 63.8 billion by 2033, with a CAGR of 15.1% during the forecast period from 2024 to 2033.

The Transaction Monitoring Market encompasses solutions and services designed to scrutinize financial transactions in real-time or batch processing to detect suspicious activities, ensuring compliance with regulatory requirements and preventing financial crimes. This market integrates advanced technologies like artificial intelligence, machine learning, and big data analytics to enhance the detection accuracy of fraudulent activities, money laundering, and other illicit financial behaviors. With rising regulatory demands and increasing instances of financial fraud, organizations are prioritizing robust transaction monitoring systems to safeguard their financial integrity, maintain regulatory compliance, and enhance overall security measures within the financial ecosystem.

The transaction monitoring market is poised for significant growth, driven by an interplay of regulatory pressures and the rapid proliferation of digital transactions. Stringent regulatory frameworks such as the EU’s Fifth Anti-Money Laundering Directive (AMLD5) and the US’s Bank Secrecy Act are primary catalysts, compelling financial institutions to adopt advanced transaction monitoring solutions. These regulations mandate rigorous oversight and reporting of suspicious activities, thereby necessitating the deployment of sophisticated monitoring systems to ensure compliance and mitigate risks. Financial institutions are increasingly prioritizing investment in these technologies to navigate the complexities of global regulatory landscapes effectively.

Additionally, the exponential rise in digital transactions, fueled by the surge in online and mobile banking, e-commerce, and digital payments, underscores the critical need for robust transaction monitoring systems. As digital financial ecosystems expand, the volume and velocity of transactions present heightened challenges in detecting fraudulent activities and ensuring transactional integrity. Organizations are therefore compelled to implement dynamic, scalable monitoring solutions capable of real-time analysis and threat detection.

The convergence of regulatory imperatives and the digital transaction boom is expected to drive substantial advancements in transaction monitoring technologies, fostering innovation and enhancing security measures across the financial sector. This growth trajectory reflects a broader industry shift towards integrating advanced analytics and machine learning to anticipate and respond to evolving financial crime threats proactively.

Key Takeaways

- Market Growth: The Transaction Monitoring Market was valued at USD 16.2 billion in 2023. It is expected to reach USD 63.8 billion by 2033, with a CAGR of 15.1% during the forecast period from 2024 to 2033.

- By Component: Solution dominates the Transaction Monitoring Market with comprehensive solutions and services.

- By Deployment Mode: Cloud solutions dominated transaction monitoring with superior scalability.

- By Enterprises Size: SMEs dominated transaction monitoring, crucial for all enterprise sizes.

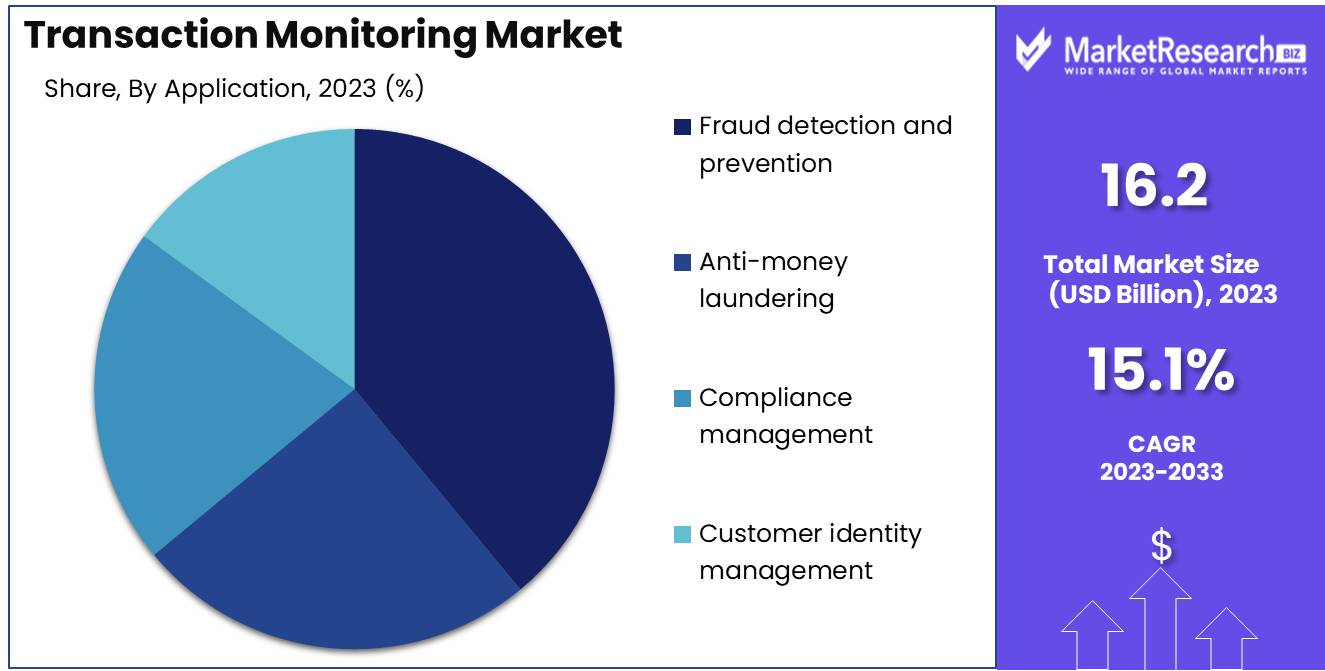

- By Application: Fraud detection and Prevention dominated transaction monitoring applications.

- By Function: Dashboard and Reporting dominated the Transaction Monitoring Market functions.

- By Vertical: Banking and Financial Services dominated the Transaction Monitoring Market.

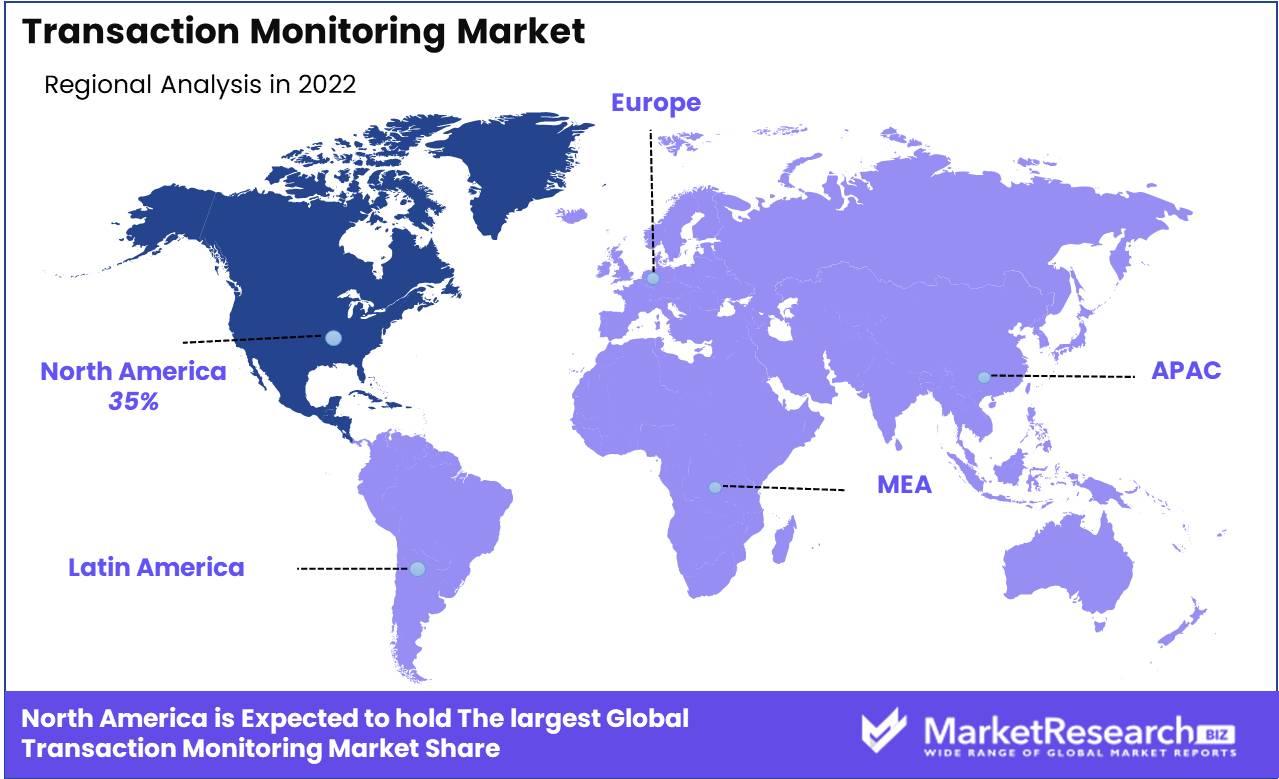

- Regional Dominance: North America dominates the global transaction monitoring market with 35% share.

- Growth Opportunity: The transaction monitoring market will grow due to advanced analytics, AI/ML, and increasing real-time monitoring demands.

Driving factors

Stringent Regulatory Compliance Requirements Fuel Market Growth

The escalating stringency of regulatory compliance requirements is a primary driver of growth in the transaction monitoring market. Regulatory bodies worldwide, including the Financial Action Task Force (FATF) and the European Union's Anti-Money Laundering Directives (AMLD), continuously enhance regulations to combat money laundering, terrorist financing, and other financial crimes. These regulations necessitate that financial institutions implement robust transaction monitoring systems to detect and report suspicious activities. Consequently, organizations are increasingly investing in advanced transaction monitoring solutions to ensure compliance, thereby driving market expansion.

Financial Penalties and Reputational Damage Drive Adoption of Advanced Solutions

The severe financial penalties, reputational damage, and potential legal action associated with non-compliance are significant motivators for adopting transaction monitoring systems. Financial institutions face hefty fines if they fail to comply with regulatory requirements. For example, in 2020, major banks globally paid over $10 billion in fines related to anti-money laundering violations. Beyond financial loss, non-compliance can severely damage an institution's reputation, eroding customer trust and loyalty. Legal repercussions can also be extensive, involving prolonged litigation and operational disruptions. As a result, institutions are compelled to invest in advanced transaction monitoring systems that offer real-time surveillance and comprehensive reporting capabilities, thereby mitigating risks and ensuring compliance.

Rising Demand from the Healthcare Sector Boosts Market Growth

The increasing demand from the healthcare sector is another pivotal factor contributing to the growth of the transaction monitoring market. The healthcare industry, dealing with a substantial volume of transactions, is vulnerable to financial crimes such as billing fraud, identity theft, and money laundering. Regulatory frameworks like the Health Insurance Portability and Accountability Act (HIPAA) in the United States require stringent monitoring of financial transactions to protect patient data and prevent fraud. Healthcare providers are thus adopting advanced transaction monitoring systems to enhance security, comply with regulations, and ensure the integrity of their financial operations. This sector's growing reliance on digital transactions and electronic health records further propels the need for robust monitoring solutions, driving market growth.

Restraining Factors

Technological Complexities and Sophistication of Attacks Hamper Market Expansion

The increased technological complexities and the sophistication of cyber-attacks pose significant challenges to the growth of the Transaction Monitoring Market. As cyber criminals employ more advanced and elusive techniques, transaction monitoring systems must continually evolve to keep pace. This relentless arms race necessitates substantial investment in cutting-edge technology, skilled personnel, and continuous system upgrades, which can be financially draining and operationally taxing for organizations. The sophistication of attacks also demands more robust and sophisticated transaction monitoring solutions, which are often more expensive and require advanced integration and maintenance. Consequently, smaller firms or those with limited budgets may find adopting or upgrading to these advanced systems challenging, slowing overall market growth.

Furthermore, as the complexity of these systems increases, so does the difficulty of their implementation and maintenance. This complexity can lead to longer deployment times and a steeper learning curve for users, resulting in resistance or delays in adoption. The market's ability to scale and penetrate different sectors is therefore hindered, as businesses may struggle to justify the substantial investment required to stay ahead of increasingly sophisticated threats.

Data Quality and Integration Issues Stymie Market Progress

Data quality and integration issues present another formidable barrier to the growth of the Transaction Monitoring Market. Effective transaction monitoring relies heavily on the accuracy, completeness, and timeliness of data from various sources. However, organizations often face challenges with data silos, inconsistent data formats, and poor data quality, which can significantly impair the effectiveness of transaction monitoring systems.

For instance, if data from disparate sources cannot be seamlessly integrated, the system's ability to detect and respond to suspicious activities in real time is compromised. This not only diminishes the effectiveness of the monitoring system but also undermines confidence in its reliability, deterring organizations from investing in these solutions. Additionally, poor data quality can lead to false positives and negatives, increasing the workload for compliance teams and potentially missing actual threats, which further dissuades companies from adopting or upgrading transaction monitoring systems.

By Component Analysis

Solution dominates the Transaction Monitoring Market with comprehensive solutions and services.

In 2023, Solution held a dominant market position in the By Component segment of the Transaction Monitoring Market, encompassing both the Solution and Service subpoints. The Solution sub-segment includes advanced software and platforms designed to enhance the detection and prevention of fraudulent activities, money laundering, and suspicious transactions. These solutions leverage machine learning, artificial intelligence, and real-time data analytics to provide comprehensive monitoring and risk assessment. Leading companies in this space have prioritized user-friendly interfaces and seamless integration with existing financial systems, significantly driving market growth.

Simultaneously, the Service sub-segment complements these technological offerings by providing essential support, including implementation, maintenance, training, and consulting services. This ensures that organizations can maximize the effectiveness of their transaction monitoring systems. The high demand for expert consultation and ongoing technical support has bolstered the service sub-segment, as companies seek to navigate the complexities of regulatory compliance and rapidly evolving financial threats.

By Deployment Mode Analysis

In 2023, Cloud solutions dominated transaction monitoring with superior scalability.

In 2023, Cloud solutions held a dominant market position in the 'By Deployment Mode' segment of the Transaction Monitoring Market. The adoption of cloud-based transaction monitoring systems has surged due to their scalability, cost-efficiency, and enhanced data security. Enterprises, particularly in financial services and retail, are increasingly leveraging cloud platforms to ensure real-time monitoring and compliance with regulatory standards. Cloud solutions offer seamless integration with existing IT infrastructure and provide advanced analytics capabilities, which are crucial for detecting and mitigating fraudulent activities.

Conversely, on-premise deployment, while still relevant, is witnessing a gradual decline in preference. Organizations that prioritize stringent control over data and possess the necessary resources for maintenance often opt for on-premise solutions. These setups offer enhanced customization and direct oversight but at a higher cost and with increased operational complexity.

By Enterprises Size Analysis

In 2023, SMEs dominated transaction monitoring, crucial for all enterprise sizes.

In 2023, Small and Medium-sized Enterprises (SMEs) held a dominant market position in the By Enterprises Size segment of the Transaction Monitoring Market. SMEs, with their agile business structures and increasing adoption of advanced technologies, contributed significantly to market growth. These enterprises are increasingly recognizing the importance of robust transaction monitoring solutions to mitigate risks associated with financial fraud and compliance issues. Their investment in sophisticated monitoring tools is driven by the need to protect against emerging threats and to ensure regulatory adherence, thereby fostering trust and operational integrity.

Conversely, Large Enterprises also played a crucial role in this segment. These organizations, characterized by their extensive transaction volumes and complex operational frameworks, necessitate comprehensive and scalable transaction monitoring systems. The substantial financial resources of large enterprises enable them to invest in cutting-edge technologies and customized solutions, thereby enhancing their capabilities in detecting and preventing fraudulent activities. Furthermore, the regulatory landscape for large corporations is stringent, compelling them to implement robust monitoring systems to maintain compliance and avoid hefty penalties.

By Application Analysis

In 2023, Fraud Detection and Prevention dominated transaction monitoring applications.

In 2023, Fraud Detection and Prevention held a dominant market position in the By Application segment of the Transaction Monitoring Market. This segment is critical as organizations increasingly prioritize safeguarding financial transactions from fraudulent activities. Leveraging advanced analytics, machine learning, and artificial intelligence, fraud detection, and prevention solutions offer robust capabilities to identify and mitigate suspicious activities in real-time.

Anti-money laundering (AML) follows closely, driven by stringent regulatory requirements and the growing need for comprehensive financial crime compliance. AML solutions enable institutions to detect, report, and prevent money laundering activities, ensuring adherence to national and international regulations.

Compliance management is another crucial application, that addresses the increasing complexity of regulatory landscapes. Businesses rely on these solutions to streamline compliance processes, reduce risk exposure, and maintain operational integrity. Effective compliance management systems help organizations avoid hefty fines and reputational damage by ensuring adherence to evolving regulatory standards.

Lastly, Customer identity management solutions are gaining traction as organizations focus on enhancing customer experience while maintaining security. These systems ensure accurate customer verification, reducing fraud risks and improving customer trust. By leveraging biometric authentication, blockchain, and secure digital identities, these solutions provide a seamless yet secure transactional environment.

By Function Analysis

In 2023, Dashboard and Reporting dominated the Transaction Monitoring Market functions.

In 2023, Dashboard and Reporting held a dominant market position in the By Function segment of the Transaction Monitoring Market. This segment's prominence can be attributed to the growing demand for real-time analytics and actionable insights, enabling businesses to enhance their decision-making processes. Case Management also played a critical role, facilitating the efficient investigation and resolution of suspicious activities. This function's value lies in its ability to streamline compliance workflows, reduce manual errors, and ensure regulatory adherence.

Watch List Screening remained essential for identifying and managing high-risk entities, leveraging advanced algorithms and comprehensive databases to mitigate potential threats. This function's effectiveness in preventing fraudulent activities and maintaining operational integrity is widely recognized.

KYC/Customer Onboarding continues to be vital, ensuring thorough verification of customer identities and fostering trust in financial transactions. By implementing robust KYC processes, businesses can enhance customer experience, reduce onboarding times, and comply with stringent regulatory requirements. Collectively, these functions contribute to a holistic approach to transaction monitoring, underscoring the importance of comprehensive, integrated solutions in maintaining financial security and compliance.

By Vertical Analysis

In 2023, Banking and Financial Services dominated the Transaction Monitoring Market.

In 2023, The Banking and Financial Services sector held a dominant market position in the "By Vertical" segment of the Transaction Monitoring Market. This sector's prominence can be attributed to the stringent regulatory requirements and the increasing need to combat financial crimes, such as money laundering and fraud. Within this landscape, several other verticals also demonstrated significant traction.

The Insurance industry, for example, has been enhancing its transaction monitoring capabilities to detect and prevent fraudulent claims. Government and Defense sectors have been leveraging these technologies to secure public funds and national security interests against illicit financial activities. The IT and Telecommunications sector has adopted transaction monitoring to safeguard against cyber threats and unauthorized transactions. Retail companies are increasingly using these solutions to manage high volumes of transactions and mitigate fraud risks.

Healthcare providers are focusing on compliance with regulatory standards and preventing billing fraud. The Energy sector utilizes transaction monitoring to manage complex supply chains and financial transactions. Utilities companies are implementing these systems to monitor financial activities and ensure operational integrity. The Manufacturing industry is integrating transaction monitoring to enhance supply chain transparency and prevent financial losses.

Other sectors, including education and non-profits, are also recognizing the value of transaction monitoring in ensuring financial compliance and operational security. This multifaceted adoption across verticals underscores the critical importance of robust transaction monitoring systems in maintaining financial integrity and security across industries.

Key Market Segments

By Component

- Solution

- Service

By Deployment Mode

- On-premise

- Cloud

By Enterprises Size

- Small and Medium-sized Enterprises

- Large Enterprises

By Application

- Fraud detection and prevention

- Anti-money laundering

- Compliance management

- Customer identity management

By Function

- Dashboard and reporting

- Case management

- Watch list screening

- KYC/customer onboarding

By Vertical

- Banking and financial services

- Insurance

- Government and defense

- IT and telecommunications

- Retail

- Healthcare

- Energy

- Utilities

- Manufacturing

- Others

Growth Opportunity

Increasing Adoption of Advanced Analytics and AI/ML

The global transaction monitoring market is poised for substantial growth driven by the increasing adoption of advanced analytics and AI/ML technologies. These advanced tools enhance the ability of organizations to detect and mitigate fraudulent activities, ensuring compliance with stringent regulatory requirements. Artificial Intelligence (AI) and machine learning algorithms enable systems to learn from historical data, predict potential threats, and identify anomalies with higher accuracy and speed. This shift towards more sophisticated analytics is not only improving the efficiency of transaction monitoring processes but also significantly reducing the incidence of false positives, thus streamlining operations and reducing costs. Companies investing in these technologies are likely to gain a competitive edge by offering more robust and reliable monitoring solutions.

Rising Demand for Real-Time Monitoring

Another pivotal growth driver for the transaction monitoring market is the rising demand for real-time monitoring capabilities. In an increasingly digital world, the ability to monitor transactions in real time is becoming critical to prevent fraud and ensure compliance. Real-time transaction monitoring allows organizations to detect and respond to suspicious activities instantaneously, thereby mitigating risks before they escalate. This demand is particularly pronounced in sectors such as banking, financial services, and e-commerce, where the volume and velocity of transactions are exceptionally high. By integrating real-time monitoring solutions, businesses can enhance their security posture, build trust with customers, and comply with regulatory mandates more effectively.

Latest Trends

Adoption of Machine Learning for Behavioral Analysis

The integration of machine learning (ML) for behavioral analysis is poised to revolutionize the transaction monitoring market. ML algorithms enable financial institutions to detect anomalies and suspicious activities more accurately by analyzing vast datasets and identifying patterns indicative of fraud. These systems learn from historical data, continuously improving their predictive accuracy and reducing false positives. By leveraging ML, organizations can streamline compliance processes, enhance risk management, and maintain a robust defense against increasingly sophisticated financial crimes. This trend underscores a shift towards proactive and intelligent monitoring solutions, offering significant improvements in operational efficiency and security.

Incorporation of Blockchain Analytics

Blockchain analytics is emerging as a critical component of transaction monitoring. As blockchain technology gains widespread adoption, particularly in the realms of cryptocurrency and decentralized finance (DeFi), the ability to track and analyze blockchain transactions has become essential. Blockchain analytics tools provide transparency, traceability, and immutability, allowing financial institutions to monitor transactions on the blockchain network with unprecedented clarity. These tools help identify illicit activities, such as money laundering and fraud, by tracing the flow of funds across the blockchain. The incorporation of blockchain analytics not only enhances compliance with regulatory requirements but also strengthens the overall security framework within the financial sector.

Regional Analysis

North America dominates the global transaction monitoring market with a 35% share.

The global transaction monitoring market exhibits notable regional variations, driven by distinct regulatory landscapes, technological advancements, and financial infrastructure maturity. North America leads the market, commanding a dominant 35% share, underpinned by stringent regulatory requirements and the robust adoption of advanced analytics and AI technologies. The U.S. and Canada, as key players, emphasize compliance with regulations such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act, fostering a mature market landscape.

Europe follows, contributing approximately 28% to the global market, with countries like the UK, Germany, and France spearheading growth. The region's regulatory frameworks, including the EU's Fourth Anti-Money Laundering Directive (4AMLD) and the General Data Protection Regulation (GDPR), necessitate sophisticated transaction monitoring solutions.

In the Asia Pacific, rapid digitalization and increasing financial transactions, particularly in China, Japan, and India, drive a 22% market share. The burgeoning fintech sector and evolving regulatory standards, such as the Anti-Money Laundering (AML) guidelines in these countries, bolster market growth.

The Middle East & Africa, accounting for 8%, and Latin America, with a 7% share, exhibit growing awareness and implementation of transaction monitoring systems. Key markets like the UAE and Brazil are enhancing regulatory frameworks to curb financial crimes, thereby accelerating the adoption of transaction monitoring technologies.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global transaction monitoring market in 2024 is poised for significant growth, driven by increasing regulatory requirements and the rising prevalence of financial crimes. Key players in this market, including industry giants like Fiserv, Inc., SAS Institute, Inc., and IBM Corporation, are at the forefront, leveraging advanced technologies to enhance their monitoring solutions.

Fiserv, Inc. continues to innovate with robust financial crime risk management tools, ensuring comprehensive monitoring capabilities. SAS Institute, Inc. remains a leader in analytics, providing powerful solutions that integrate machine learning and artificial intelligence to detect suspicious activities. IBM Corporation’s strength lies in its holistic approach, combining advanced analytics with cognitive computing to offer superior fraud detection and prevention.

FIS and Oracle Corporation are also pivotal, offering scalable solutions that cater to diverse financial institutions. Fair Isaac Corporation (FICO) maintains its competitive edge with sophisticated analytics and decision management solutions. NICE Systems Ltd and ACI Worldwide leverage their extensive experience in financial services to deliver comprehensive transaction monitoring systems.

Emerging players like Beam Solutions, Inc. and ACTICO GmbH are gaining traction by offering innovative, agile solutions tailored to modern financial landscapes. Infrasoft Technologies and Software AG provide a strong regional presence and specialized offerings, enhancing their market positions.

Overall, these companies are driving advancements in transaction monitoring through strategic investments in technology, ensuring compliance, and mitigating risks associated with financial crimes.

Market Key Players

- Fiserv, Inc.

- SAS Institute, Inc.

- IBM Corporation

- FIS

- Oracle Corporation

- Fair Isaac Corporation

- NICE Systems Ltd

- ACI Worldwide

- ACTICO GmbH

- Bottomline Technologies

- Beam Solutions, Inc.

- Infrasoft Technologies

- Software AG

- Experian Information Solutions, Inc.

- BAE Systems

Recent Development

- In April 2024, IBM announced a strategic partnership with NICE Actimize, a leading provider of financial crime, risk, and compliance solutions. The collaboration aims to integrate IBM's AI and cloud capabilities with NICE Actimize's transaction monitoring and financial crime prevention solutions. This partnership is expected to deliver enhanced security and compliance services to financial institutions, leveraging the strengths of both companies.

- In March 2024, Refinitiv, a global provider of financial market data and infrastructure, launched an AI-driven transaction monitoring platform. The new platform leverages advanced machine learning algorithms to detect suspicious activities and enhance compliance with regulatory requirements. This development underscores Refinitiv's commitment to utilizing artificial intelligence to improve the efficiency and accuracy of transaction monitoring systems.

- In January 2024, FICO, a global leader in predictive analytics and decision management technology, announced its acquisition of AML Partners, a company specializing in anti-money laundering (AML) and fraud detection solutions. This acquisition aims to enhance FICO's capabilities in transaction monitoring by integrating AML Partners' cutting-edge technologies into its portfolio, providing comprehensive solutions to financial institutions.

Report Scope

Report Features Description Market Value (2023) USD 16.2 Billion Forecast Revenue (2033) USD 63.8 Billion CAGR (2024-2032) 15.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution and Service), By Deployment Mode (On-premise and Cloud), By Enterprises Size (Small and Medium-sized Enterprises and Large Enterprises), By Application (Fraud detection and prevention, Anti-money laundering, Compliance management, Customer identity management), By Function (Dashboard and reporting, Case management, Watch list screening, KYC/customer onboarding), By Vertical (Banking and financial services, Insurance, Government and defense, IT and telecommunications, Retail, Healthcare, Energy, Utilities, Manufacturing, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Fiserv, Inc., SAS Institute, Inc., IBM Corporation, FIS, Oracle Corporation, Fair Isaac Corporation, NICE Systems Ltd, ACI Worldwide, ACTICO GmbH, Bottomline Technologies, Beam Solutions, Inc., Infrasoft Technologies, Software AG, Experian Information Solutions, Inc., BAE Systems Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Fiserv, Inc.

- SAS Institute, Inc.

- IBM Corporation

- FIS

- Oracle Corporation

- Fair Isaac Corporation

- NICE Systems Ltd

- ACI Worldwide

- ACTICO GmbH

- Bottomline Technologies

- Beam Solutions, Inc.

- Infrasoft Technologies

- Software AG

- Experian Information Solutions, Inc.

- BAE Systems