Tower Crane Market By Product (Flat Top, Hammerhead, Luffing Jib, Self-erecting), By Design (Top Slewing Crane and Bottom Slewing Crane), By Lifting Capacity (Less than 5 ton, 6 to 10 ton, More than 10 ton), By End User Industry (Building Construction, Infrastructural Construction, Energy, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49499

-

July 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

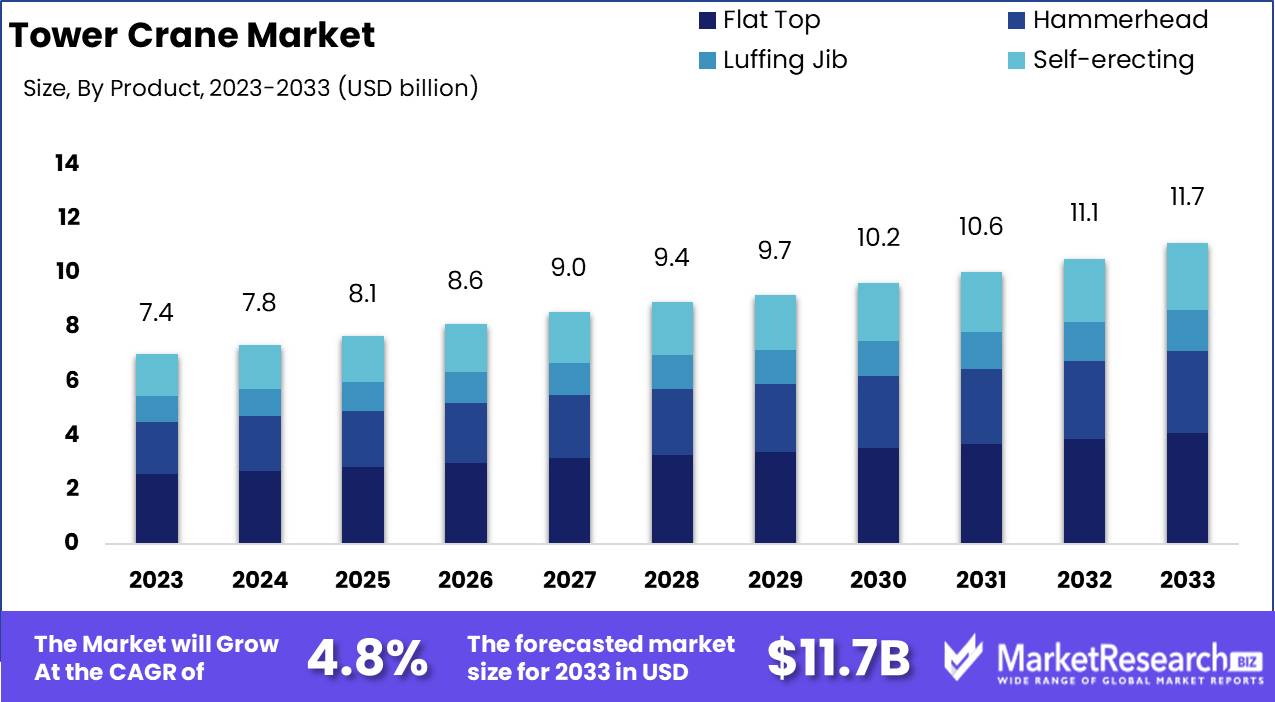

The Tower Crane Market was valued at USD 7.4 billion in 2023. It is expected to reach USD 11.7 billion by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

The Tower Crane Market encompasses the global industry involved in the design, manufacture, distribution, and maintenance of tower cranes. These cranes are essential for heavy lifting and material handling in construction, particularly for high-rise buildings, infrastructure projects, and industrial facilities. Market growth is driven by urbanization, infrastructure development, and technological advancements improving crane efficiency and safety.

The Tower Crane Market is poised for significant growth, driven by a confluence of factors including rapid urbanization and extensive infrastructure development. As cities expand and new urban centers emerge, the demand for high-rise construction projects is increasing, necessitating the deployment of tower cranes for their efficiency and ability to handle heavy loads at great heights.

Additionally, rising construction activities across both residential and commercial sectors are bolstering market growth. Governments and private sector investments in large-scale infrastructure projects, such as bridges, railways, and highways, further amplify the need for advanced lifting solutions provided by tower cranes. These trends underscore the pivotal role tower cranes play in modern construction, making them indispensable in the industry’s evolution.

However, the market faces challenges that temper its otherwise robust growth prospects. High initial investment and maintenance costs associated with tower cranes pose significant barriers to entry for small and medium-sized construction firms. Despite these hurdles, there are considerable growth opportunities in emerging markets, where urbanization rates are among the highest globally. These regions are experiencing a surge in construction activities as they develop their infrastructure to meet urban growth demands. The potential for market expansion in these areas is substantial, as local governments increasingly allocate budgets for urban development projects. Overall, the Tower Crane Market is set to grow, driven by technological advancements and strategic investments, although market participants must navigate cost-related challenges to fully capitalize on the opportunities in emerging markets.

Key Takeaways

- Market Growth: The Tower Crane Market was valued at USD 7.4 billion in 2023. It is expected to reach USD 11.7 billion by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

- By Product: The flat Top segment dominates the Tower Crane Market due to adaptability and benefits.

- By Design: Top Slewing Cranes dominated the Tower Crane Market's By Design segment.

- By Lifting Capacity: Less than 5-ton segment dominates the tower crane market's lifting capacity.

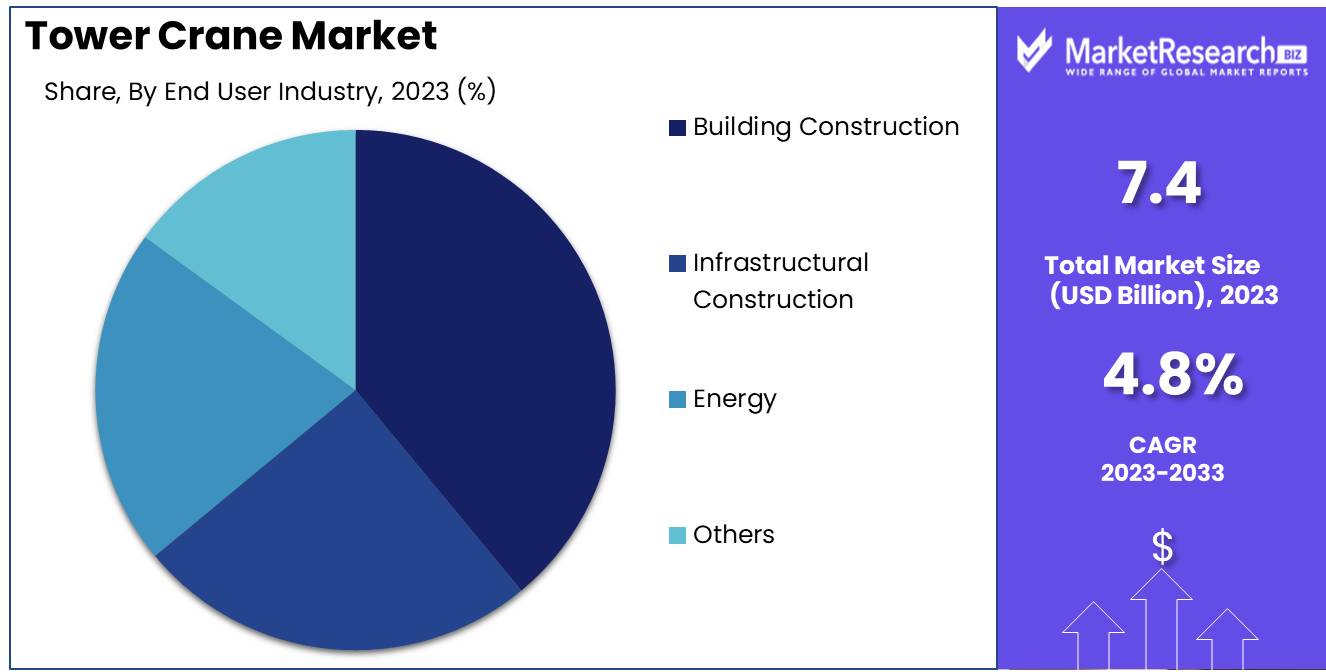

- By End User Industry: Building Construction dominated the Tower Crane Market due to urbanization and high-rise demand.

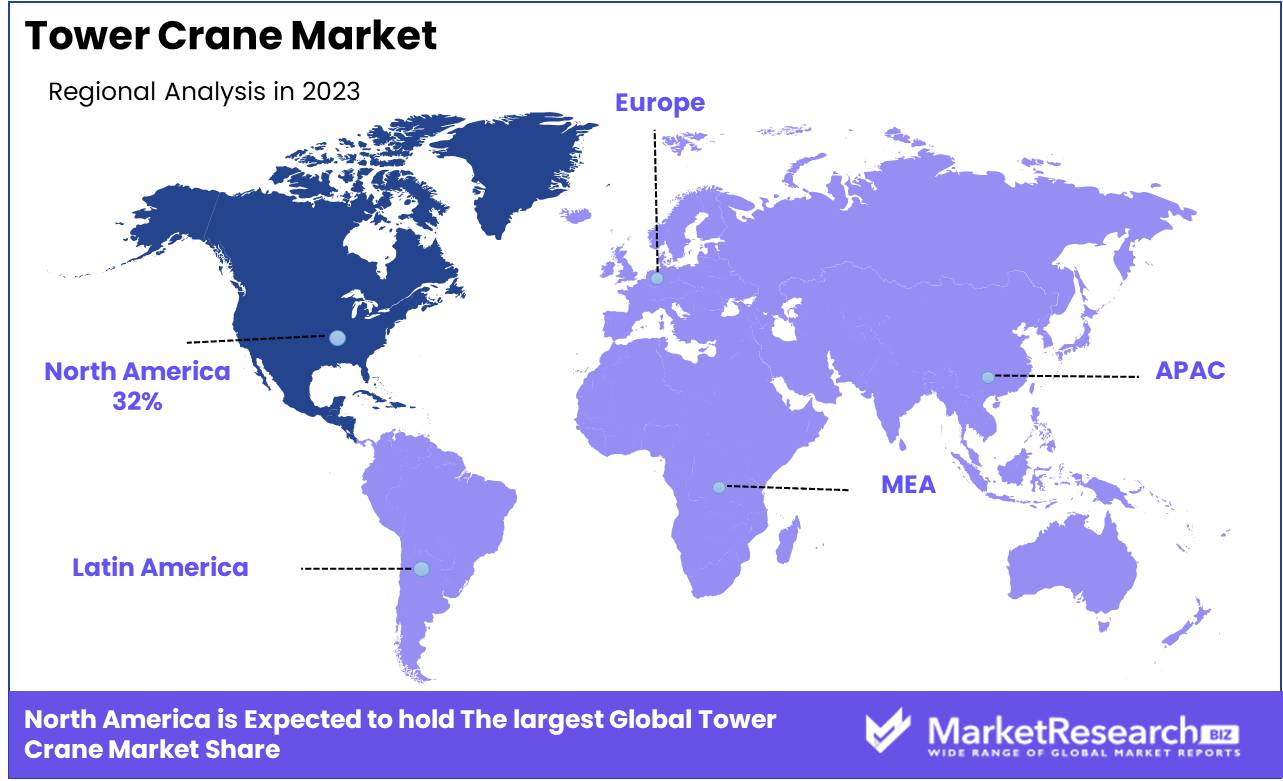

- Regional Dominance: North America leads the Tower Crane Market with a 32% largest share.

- Growth Opportunity: The tower crane market is expected to benefit from advancements in crane technology, such as improved load capacity, enhanced safety features, and greater energy efficiency.

Driving factors

Driving Market Growth through Increased Demand for Construction Projects

The Tower Crane Market has experienced significant growth due to rapid urbanization and extensive infrastructure development. As urban populations swell, cities are expanding vertically, necessitating the construction of high-rise buildings and large-scale infrastructure projects. This surge in construction activities has directly increased the demand for tower cranes, which are essential for lifting and moving heavy materials efficiently on construction sites.

For instance, in 2022, it was estimated that the global construction industry would grow at a compound annual growth rate (CAGR) of 4.2% from 2020 to 2025, driving substantial demand for construction machinery, including tower cranes. This trend is particularly evident in emerging economies, where rapid urban growth and government initiatives to improve infrastructure are prevalent. Consequently, the tower crane market benefits significantly from these developments, as they necessitate the deployment of advanced lifting equipment to meet the increasing construction demands.

Enhancing Efficiency and Safety in Crane Operations

Technological advancements have been a pivotal factor in the growth of the Tower Crane Market. Innovations in crane technology have led to the development of more efficient, safer, and easier-to-operate cranes. Modern tower cranes are equipped with advanced features such as automated control systems, real-time monitoring, and enhanced load management capabilities. These innovations reduce operational risks, improve precision, and enhance overall productivity on construction sites. For example, the introduction of digital twin technology allows for virtual modeling and simulation of crane operations, helping to optimize performance and anticipate potential issues before they occur.

Additionally, advancements in material science have enabled the production of lighter yet stronger crane components, improving their load-bearing capacities and operational efficiency. These technological improvements have made tower cranes more attractive to construction companies, driving market growth by ensuring higher safety standards and operational efficiencies.

Boosting Demand for Specialized Cranes in Wind and Solar Projects

The expansion of the renewable energy sector has also significantly contributed to the growth of the Tower Crane Market. As countries worldwide invest in renewable energy sources to combat climate change and reduce reliance on fossil fuels, the construction of wind turbines and solar farms has increased. Tower cranes are indispensable in assembling large wind turbines, which require the lifting and precise placement of heavy and tall components. According to market reports, the global wind power capacity increased by 53 GW in 2020, highlighting the growing need for construction equipment like tower cranes in this sector.

Furthermore, the development of offshore wind farms, which are typically more challenging and require specialized cranes, further drives the demand for advanced tower cranes. The renewable energy sector's expansion is thus a significant driver of market growth, as it necessitates the use of tower cranes for both onshore and offshore projects.

Restraining Factors

High Cost of Tower Cranes: A Barrier to Market Growth

The high cost of tower cranes significantly restrains the growth of the Tower Crane Market. Tower cranes, due to their complex engineering, advanced safety features, and significant operational capacity, entail substantial capital investment. The initial purchase price of tower cranes can be prohibitively expensive for many construction companies, especially small to mid-sized enterprises. This financial burden is exacerbated by additional costs such as installation, maintenance, and insurance, which further strain budgets. Consequently, potential buyers may opt for alternative lifting solutions or defer procurement decisions, thereby limiting market expansion.

According to industry statistics, the average cost of a new tower crane can range from $300,000 to $1.5 million, depending on the crane's specifications and capabilities. These high costs can lead companies to seek more cost-effective solutions, impacting the overall demand for tower cranes and constraining market growth.

Growing Popularity of Mobile Cranes and Mobile Crane Rentals: Shifting Preferences Impacting Market Dynamics

The increasing popularity of mobile cranes and mobile crane rentals presents another significant restraining factor for the Tower Crane Market. Mobile cranes offer several advantages, such as greater flexibility, ease of transportation, and lower setup times compared to tower cranes. These features make mobile cranes particularly appealing for projects that require frequent relocation or have shorter durations. As a result, many construction companies are increasingly opting for mobile cranes over tower cranes.

Furthermore, the rental market for mobile cranes is expanding, providing an economical alternative to purchasing expensive equipment outright. The rental model allows companies to access advanced crane technology without incurring the high costs associated with ownership. This trend is particularly pronounced in regions with high construction activity but limited budgets for capital expenditure.

By Product Analysis

Flat Top Segment dominates the Tower Crane Market due to adaptability and benefits.

In 2023, The Flat Top Segment held a dominant market position in the Tower Crane Market by product segment. This segment's prominence can be attributed to its versatile design, which eliminates the need for a tower top, reducing erection time and increasing safety. The absence of a tower head facilitates efficient assembly and disassembly, making it highly suitable for urban construction projects with height restrictions.

The Hammerhead segment, known for its stability and load-bearing capacity, continues to be a preferred choice for large-scale infrastructure projects. Its ability to lift heavy materials with precision makes it indispensable for high-rise construction.

The Luffing Jib segment, characterized by its adjustable jib angle, offers superior maneuverability in confined spaces. This flexibility is particularly advantageous in densely populated urban areas where space constraints are a significant challenge.

The Self-erecting segment, designed for quick setup and easy transport, caters to small to medium-sized construction sites. Its compact size and operational efficiency make it ideal for residential and commercial building projects.

By Design Analysis

In 2023, Top Slewing Cranes dominated the Tower Crane Market's By Design segment.

In 2023, The Top Slewing Crane held a dominant market position in the By Design segment of the Tower Crane Market. This crane type is favored for its robust lifting capacity and adaptability in handling heavy loads at significant heights, making it a preferred choice for large-scale construction projects and high-rise buildings. Its ability to rotate 360 degrees without moving the crane base enhances operational efficiency and safety, contributing to its substantial market share. Furthermore, advancements in crane technology, including automation and remote control capabilities, have bolstered the appeal of top-slewing cranes, driving their adoption across various construction sectors.

On the other hand, Bottom Slewing Cranes, while offering certain advantages like easier transportation and assembly, primarily cater to smaller construction sites and projects with less demanding lifting requirements. Their market share, though significant, remains comparatively lower due to the growing preference for top-slewing cranes in large and complex construction projects. The continued urbanization and infrastructure development worldwide are expected to sustain the dominance of top-slewing cranes in the Tower Crane Market's By Design segment.

By Lifting Capacity Analysis

"Less than 5-ton segment dominates the tower crane market's lifting capacity."

In 2023, The "Less than 5-ton" segment held a dominant market position in the "By Lifting Capacity" category of the Tower Crane Market. This segment's leadership can be attributed to its widespread application in residential and small-scale construction projects, where its compact size and lower cost make it the preferred choice. The segment is favored for its maneuverability and efficiency in lifting moderate weights, essential for urban construction environments.

Conversely, the "6 to 10-ton" segment is gaining traction, driven by the increasing number of mid-scale commercial and infrastructural projects that require cranes with higher lifting capacities. This segment is valued for its balance between capacity and operational efficiency, making it suitable for a variety of construction needs.

The "More than 10-ton" segment, although smaller in market share, is crucial for heavy-duty applications in large-scale industrial and infrastructural developments. These cranes are essential for projects demanding the lifting of substantial weights, such as in the construction of skyscrapers and large industrial complexes.

By End User Industry Analysis

Building Construction dominated the Tower Crane Market due to urbanization and high-rise demand.

In 2023, Building Construction held a dominant market position in the By End User Industry segment of the Tower Crane Market. The substantial demand for high-rise buildings and urbanization projects significantly propelled the usage of tower cranes in this sector. This dominance can be attributed to the increasing investment in residential and commercial buildings, which necessitates the use of advanced lifting and material handling solutions offered by tower cranes.

Infrastructural Construction also exhibited a robust presence in the Tower Crane Market. The ongoing development of transportation networks, bridges, and public infrastructure projects demanded efficient and powerful lifting equipment, contributing to the segment's substantial market share.

The Energy sector, encompassing wind farm installations and other energy-related infrastructure projects, showed a moderate yet steadily growing demand for tower cranes. The emphasis on renewable energy projects and the construction of new power plants are key drivers in this segment.

The Others category, including sectors such as mining, shipbuilding, and manufacturing, accounted for a smaller but notable share of the Tower Crane Market. The diverse applications of tower cranes across various industries highlight their versatility and essential role in facilitating large-scale construction activities.

Key Market Segments

By Product

- Flat Top

- Hammerhead

- Luffing Jib

- Self-erecting

By Design

- Top Slewing Crane

- Bottom Slewing Crane

By Lifting Capacity

- Less than 5 ton

- 6 to 10-ton

- More than 10 ton

By End User Industry

- Building Construction

- Infrastructural Construction

- Energy

- Others

Growth Opportunity

Urbanization and Infrastructure Development

The global tower crane market is poised for substantial growth, driven primarily by rapid urbanization and extensive infrastructure development. As more people migrate to urban areas, the demand for residential and commercial buildings increases, necessitating the construction of skyscrapers and large-scale infrastructure projects. Governments worldwide are investing heavily in modernizing their infrastructure to support urban growth. For instance, China’s ambitious Belt and Road Initiative and India’s Smart Cities Mission are key projects expected to boost the demand for tower cranes. According to the United Nations, 68% of the world’s population is projected to live in urban areas by 2050, underscoring the long-term potential for the tower crane market.

High-Rise Construction Projects

High-rise construction projects are another significant driver for the tower crane market. The increasing trend towards vertical construction to maximize space in densely populated urban areas necessitates the use of tower cranes, which are essential for lifting heavy materials to great heights. The construction of skyscrapers, commercial buildings, and mixed-use developments is on the rise, particularly in emerging economies in Asia-Pacific and the Middle East. For example, the Burj Khalifa in Dubai and the Jeddah Tower in Saudi Arabia are emblematic of the growing trend towards ultra-high-rise buildings. These projects require specialized tower cranes capable of handling the complex logistics and heavy lifting involved.

Latest Trends

Increasing Demand for Hammerhead and Luffing Tower Cranes

The tower crane market is expected to see a significant rise in demand for hammerhead and luffing tower cranes. These crane types are increasingly favored due to their versatility and efficiency in handling heavy loads and working in confined spaces. The hammerhead tower crane, known for its horizontal jib, offers exceptional stability and precision, making it ideal for large-scale construction projects. On the other hand, the luffing tower crane, with its ability to vary the jib angle, is particularly useful in urban settings where space is limited. The growth in urban construction projects, particularly high-rise buildings, is driving the adoption of these cranes, highlighting their crucial role in modern construction.

Rising Popularity of Self-Erecting Tower Cranes

The popularity of self-erecting tower cranes is on the rise, driven by their ease of assembly and disassembly. These cranes are designed to be transported and set up quickly, reducing the time and labor costs associated with crane installation. Their compact design and mobility make them an attractive option for small to medium-sized construction projects, particularly in residential and commercial sectors. The trend towards modular and prefabricated construction methods further supports the adoption of self-erecting tower cranes, as they offer flexibility and efficiency in managing construction timelines. As construction companies seek to enhance productivity and reduce operational costs, the preference for self-erecting tower cranes is anticipated to grow.

Regional Analysis

North America leads the Tower Crane Market with a 32% largest share.

The Tower Crane Market is segmented by region, encompassing North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America holds a significant share of the market, driven by substantial investments in infrastructure projects and a high rate of urbanization. In 2023, North America dominated the market with an estimated largest share of 32%. Major cities in the U.S. and Canada are experiencing a surge in construction activities, further propelling the demand for tower cranes.

In Europe, the market is bolstered by the robust construction sector in countries such as Germany, the UK, and France. Europe accounts for approximately 28% of the market share, with sustainable construction practices and renovation projects being key growth drivers.

Asia Pacific is the fastest-growing region, capturing around 25% of the market share. Rapid industrialization and urbanization in countries like China, India, and Japan are major contributors to market expansion. The region is witnessing significant investments in smart city projects and large-scale infrastructure developments.

The Middle East & Africa region is witnessing steady growth, supported by infrastructural developments in countries like the UAE and Saudi Arabia. Latin America, with its growing construction sector in Brazil and Mexico, holds a modest market share but is expected to see progressive growth in the coming years. Overall, North America remains the dominant region in the global Tower Crane Market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global tower crane market in 2024 is marked by significant contributions from leading companies that drive innovation and market expansion. COMANSA and Grúas Sáez, S.L. stand out for their robust product portfolios and commitment to technological advancements. Their cranes are recognized for high efficiency and durability, which are critical in large-scale construction projects.

Favelle Favco Berhad and JASO Tower Cranes emphasize customized solutions tailored to diverse project needs, enhancing their competitive edge. Raimondi and Sichuan Construction Machinery (Group) Co., Ltd. leverage their extensive industry experience and regional dominance to maintain strong market positions, particularly in the rapidly growing Asian markets.

Terex Corporation and The Manitowoc Company, Inc. are pivotal players, known for their broad international presence and innovative crane designs that enhance construction safety and productivity. WOLFFKRAN International AG and XCMG Group continue to expand their global footprints through strategic partnerships and advanced manufacturing capabilities.

Zoomlion Heavy Industry Science & Technology Co., Ltd., and Action Construction Equipment Ltd. are notable for their aggressive market penetration strategies, leveraging advanced technology to produce high-performance cranes. ENG CRANES Srl and Liebherr-International AG are synonymous with reliability and innovation, offering state-of-the-art solutions that cater to complex construction requirements.

SANY Global and Sarens n.v./s.a. focus on integrating smart technologies and sustainable practices, positioning themselves as forward-thinking leaders in the market. These key players collectively drive the growth of the global tower crane market, ensuring robust development and technological progress across the construction industry.

Market Key Players

- COMANSA

- FAVELLE FAVCO BERHAD

- Grúas Sáez, S.L.

- JASO Tower Cranes

- Raimondi

- Sichuan Construction Machinery (Group)Co., Ltd

- Terex Corporation

- The Manitowoc Company, Inc.

- WOLFFKRAN International AG.

- XCMG Group

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- Action Construction Equipment Ltd.

- ENG CRANES Srl

- Liebherr-International AG

- Manitowoc Company, Inc.

- SANY Global

- Sarens n.v./s.a.

Recent Development

- In April 2024, Terex Corporation announced the expansion of its manufacturing facility in China, aimed at increasing production capacity for tower cranes. This strategic move is intended to meet the growing demand in the Asia-Pacific region, particularly in emerging markets where construction activity is booming.

- In March 2024, Stephenson Equipment (SEI) became the main distributor for Montarent Cranes in the USA. This partnership aims to expand Montarent's presence in the American market, particularly for their mobile tower cranes. SEI has been a significant dealer for Manitowoc and uses Potain self-erecting tower cranes in their Montalift mobile tower cranes.

- In January 2024, Potain launched the Evy 30-23 self-erecting crane, featuring advanced technologies developed through the Voice of the Customer process. This model, with a capacity of 4 tons, is designed to enhance operational efficiency and meet specific customer requirements on construction sites. The introduction of this crane reflects the growing trend of adopting telematic solutions and advanced construction equipment.

Report Scope

Report Features Description Market Value (2023) USD 7.4 Billion Forecast Revenue (2033) USD 11.7 Billion CAGR (2024-2032) 4.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Flat Top, Hammerhead, Luffing Jib, Self-erecting), By Design (Top Slewing Crane and Bottom Slewing Crane), By Lifting Capacity (Less than 5 tons, 6 to 10 tons, More than 10 tons), By End User Industry (Building Construction, Infrastructural Construction, Energy, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape COMANSA, FAVELLE FAVCO BERHAD, Grúas Sáez, S.L., JASO Tower Cranes, Raimondi, Sichuan Construction Machinery (Group)Co., Ltd, Terex Corporation, The Manitowoc Company, Inc., WOLFFKRAN International AG., XCMG Group, Zoomlion Heavy Industry Science & Technology Co., Ltd., Action Construction Equipment Ltd., ENG CRANES Srl, Liebherr-International AG, Manitowoc Company, Inc., SANY Global, Sarens n.v./s.a. Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- COMANSA

- FAVELLE FAVCO BERHAD

- Grúas Sáez, S.L.

- JASO Tower Cranes

- Raimondi

- Sichuan Construction Machinery (Group)Co., Ltd

- Terex Corporation

- The Manitowoc Company, Inc.

- WOLFFKRAN International AG.

- XCMG Group

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- Action Construction Equipment Ltd.

- ENG CRANES Srl

- Liebherr-International AG

- Manitowoc Company, Inc.

- SANY Global

- Sarens n.v./s.a.