Global Tooling Board Market By Product(Polyurethane, Epoxy, Others), By Application(Aerospace and defense, Automotive, Marine, Wind Energy, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

7028

-

July 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

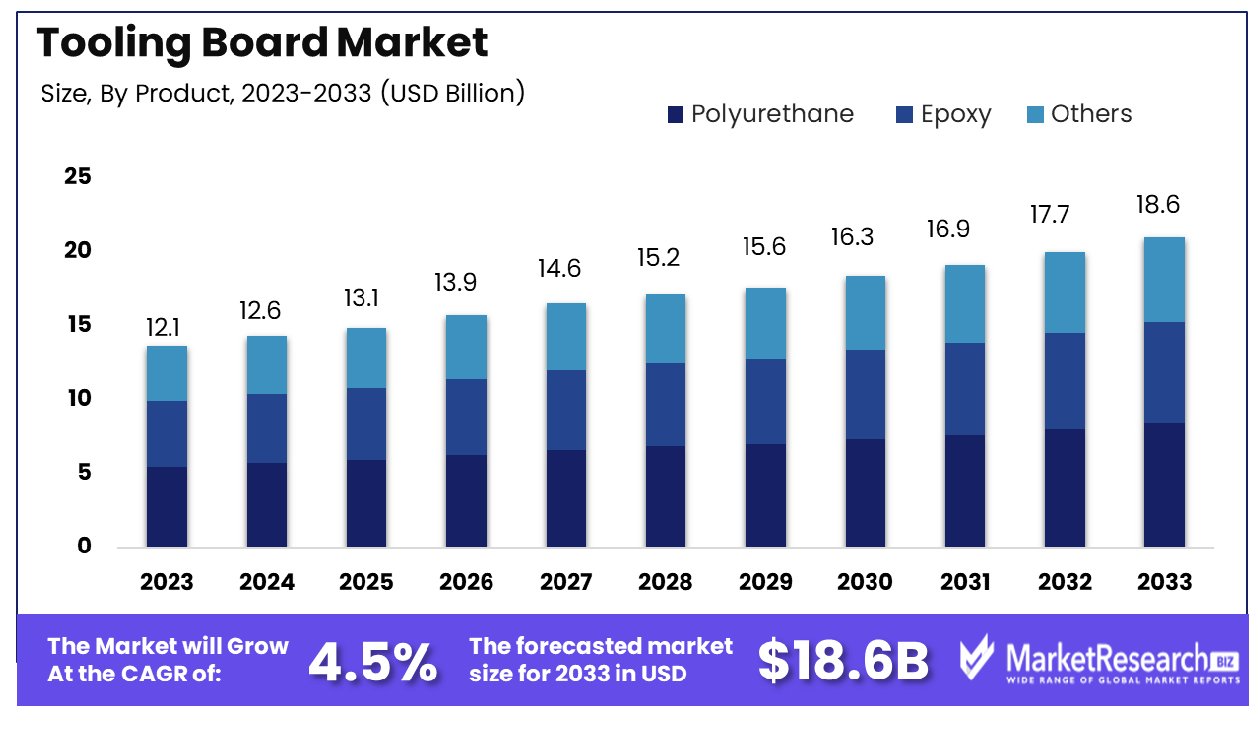

The Global Tooling Board Market was valued at USD 12.1 billion in 2023. It is expected to reach USD 18.6 billion by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

The Tooling Board Market encompasses the production and distribution of high-density materials utilized primarily in prototyping and tooling applications across various industries. These boards are valued for their fine surface finish, dimensional stability, and thermal resistance, making them ideal for precise modeling, fixtures, and composite tooling.

The market caters to sectors such as automotive, aerospace, and manufacturing, where precision and quality are paramount. As organizations strive to enhance operational efficiency and reduce time-to-market, the demand for tooling boards is expected to rise, presenting significant growth opportunities for businesses engaged in their development and distribution.

The Tooling Board Market is positioned for robust growth, driven by its critical role in the prototyping and manufacturing sectors. These high-density boards are indispensable in applications demanding precision and durability, such as automotive and aerospace manufacturing. As industries lean towards rapid prototyping to accelerate product development cycles and enhance operational efficiencies, the demand for tooling boards is expected to escalate.

The inherent properties of tooling boards, including superior dimensional stability and fine surface finish, make them ideally suited for complex and detailed tasks that are pivotal in modern manufacturing processes. The reliability of tooling boards is underscored by statistical evidence from related fields. For instance, studies assessing gage bias in manufacturing environments reveal that the average bias value—while generally low (ranging from ±1% to ±5%)—highlights the critical need for precise calibration standards, which tooling boards can facilitate.

Furthermore, the use of predictive modeling in evaluating material performance shows strong correlations (with p-values typically less than 0.001), indicating significant relationships between tooling board characteristics and manufacturing outcomes. Such data support the high-performance metrics (ranging from 80% to over 90% in accuracy) associated with the use of advanced materials like tooling boards, reinforcing their value in high-stakes industrial applications.

Key Takeaways

- Market Growth: The Global Tooling Board Market was valued at USD 12.1 billion in 2023. It is expected to reach USD 18.6 billion by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

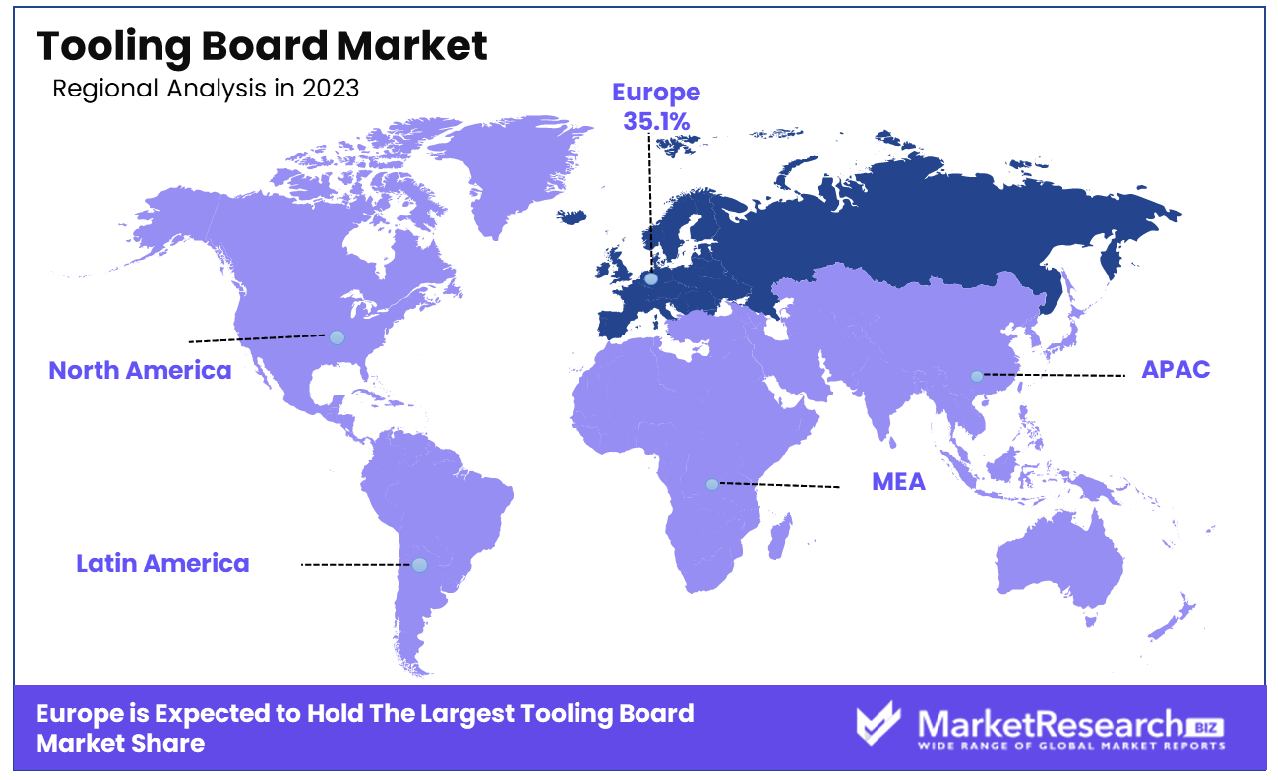

- Regional Dominance: Europe holds 35.1% of the global tooling board market share.

- By Product: Polyurethane dominated the product segment with a commanding 60.2% market share.

- By Application: Aerospace and defense led the application field, capturing 30.3% dominance.

Driving factors

Expanding Applications in Automotive and Aerospace Industries

The increasing demand in the automotive and aerospace industries for precise prototyping is a significant driver for the Tooling Board Market. As these sectors push for faster design-to-production cycles and more complex component geometries, the reliance on high-precision tooling boards becomes essential.

These materials enable manufacturers to produce accurate and detailed prototypes quickly, reducing overall development time and costs. The precision afforded by tooling boards is critical in meeting the stringent quality and safety standards required in automotive and aerospace applications, thus propelling market growth.

Enhancements in Material Technology

Advancements in material technology that improve the performance of tooling boards represent another pivotal growth factor. Modern innovations in the chemical and physical properties of tooling boards have enhanced their thermal stability, dimensional accuracy, and surface finish.

These improvements allow for their use in more demanding applications, which require high tolerance and excellent durability. As tooling boards evolve to offer better performance metrics, their appeal broadens across various industries, fueling expansion in new market segments.

Manufacturing Sector's Robust Expansion

The growth of the manufacturing sector, with an increasing need for durable and versatile tooling solutions, complements the other driving factors. As manufacturing processes become more complex and diversified, the requirement for tooling boards that can withstand a variety of production environments has escalated.

The versatility and durability of modern tooling boards make them indispensable in not only traditional sectors like automotive and aerospace but also in emerging areas like renewable energy and electronics. This comprehensive utility supports sustained growth in the Tooling Board Market, as industries continue to seek efficient, cost-effective solutions for their prototyping and production needs.

Restraining Factors

Cost Constraints of Premium Tooling Boards

The high cost of premium tooling boards significantly restrains market growth. These boards are essential for delivering the highest quality prototypes and tools, particularly in industries where precision is critical, such as aerospace and automotive.

However, the superior properties of these materials come with a higher price tag, which can deter small to medium enterprises (SMEs) and cost-sensitive industries from adopting them. The economic barrier thus limits the market's expansion to primarily large corporations or high-end applications, restricting broader adoption across various sectors that could benefit from such advanced materials.

Environmental Regulations and Sustainability Challenges

Environmental concerns and stringent regulations regarding the disposal and recycling of tooling materials further impede the growth of the Tooling Board Market. As global awareness and regulatory frameworks around environmental impact intensify, industries are compelled to consider the sustainability of their manufacturing materials. Tooling boards, often composed of non-biodegradable and difficult-to-recycle materials, pose significant environmental challenges.

This has led to increased scrutiny by regulatory bodies and a push for industries to adopt greener alternatives. The need for compliance with environmental standards not only adds to the operational costs but also influences the material selection process, potentially limiting the use of traditional tooling boards in favor of more environmentally friendly but possibly less effective alternatives.

By Product Analysis

Polyurethane dominated the tooling board product segment with a significant 60.2% market share.

In 2023, Polyurethane held a dominant market position in the "By Product" segment of the Tooling Board Market, capturing more than a 60.2% share. This segment comprises various materials, but Polyurethane stands out for its extensive applications due to its superior qualities such as durability, versatility, and cost-effectiveness, which are essential in the automotive, aerospace, and manufacturing industries.

Following Polyurethane, Epoxy accounted for a significant portion of the market. Known for its high strength and excellent chemical resistance, Epoxy is preferred in applications requiring robust, long-lasting materials, particularly in high-temperature environments. Despite its higher cost compared to Polyurethane adhesives, Epoxy continues to be a material of choice for precision tooling and high-performance composites.

The "Others" category, which includes materials like phenolic and urethane, also holds a smaller but noteworthy share of the market. These materials are selected based on specific requirements such as thermal stability and lower cost in certain industrial applications. However, their market share remains limited compared to Polyurethane and Epoxy due to their more specialized applications.

Overall, the Tooling Board Market is driven by the demand for precise and durable materials in critical industries. The dominance of Polyurethane is attributed to its wide range of applications and cost-efficiency, making it a preferred choice for various industrial uses. As market dynamics evolve, the demand patterns for these materials are expected to shift, influenced by technological advancements and industry-specific requirements.

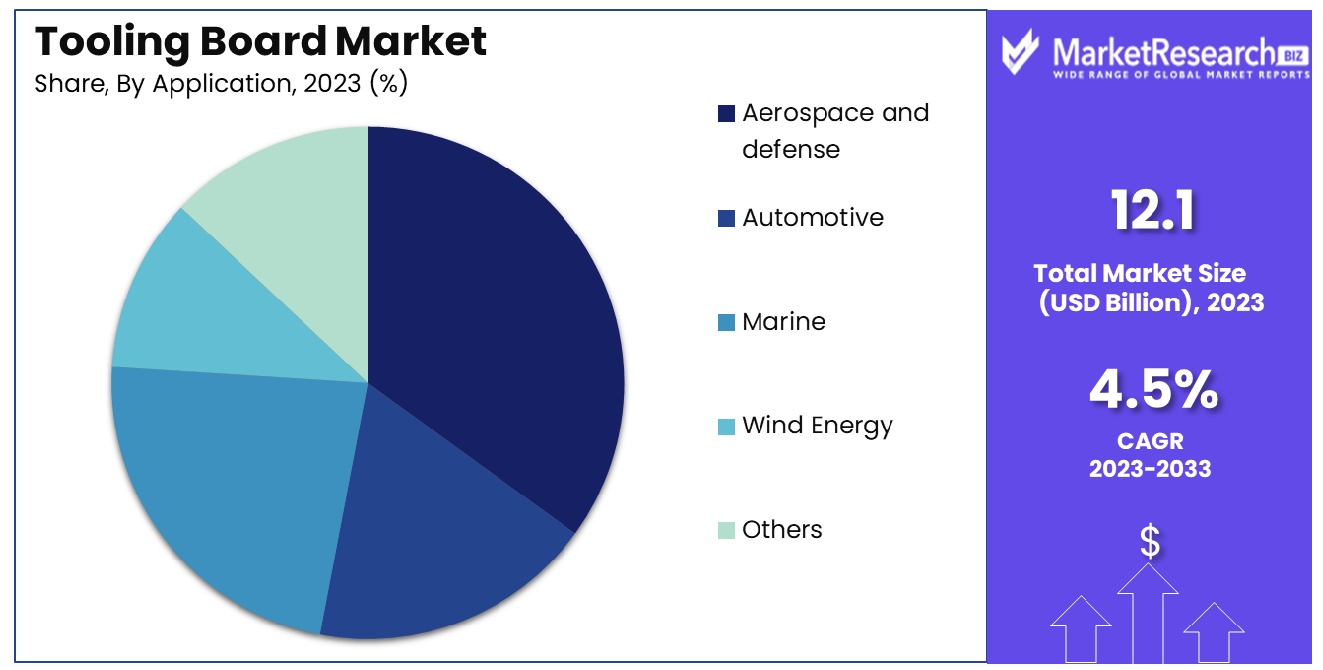

By Application Analysis

In application sectors, aerospace and defense led, capturing 30.3% of the market.

In 2023, Aerospace and defense held a dominant market position in the "By Application" segment of the Tooling Board Market, capturing more than a 30.3% share. This sector's demand for tooling boards is primarily driven by the need for high-precision components and models in aircraft and defense equipment manufacturing. The materials used in this segment must meet stringent standards for strength, durability, and temperature resistance, factors that are critical in the high-stakes environments of aerospace and defense.

Following closely, the Automotive industry also constitutes a significant share of the market. Tooling boards in this sector are utilized for creating prototypes and molds for automotive parts. The material’s ability to be shaped precisely and its stability under various environmental conditions make it ideal for the automotive design and testing processes.

The Marine sector, although smaller in market share compared to Aerospace and defense, leverages tooling boards for manufacturing and repairing marine vessels. Its use in creating durable and water-resistant models is essential for the development and maintenance of boats and ships.

Wind Energy is another noteworthy contributor, utilizing tooling boards for fabricating wind turbine components. The demand in this sector is driven by the global shift towards renewable energy sources and the need for sustainable, high-performance materials in turbine manufacturing.

The "Others" category includes industries like sporting goods, architectural modeling, and artistic installations, where tooling boards are chosen for their ease of use and excellent finish. Each of these sectors, while diverse in application, highlights the versatility and adaptability of tooling boards across various industries.

Key Market Segments

By Product

- Polyurethane

- Epoxy

- Others

By Application

- Aerospace and defense

- Automotive

- Marine

- Wind Energy

- Others

Growth Opportunity

Development of Eco-Friendly and Recyclable Tooling Board Materials

The global tooling board market is witnessing significant transformation with the development of eco-friendly and recyclable materials. This shift is largely driven by increasing regulatory pressures and a growing industry preference for sustainable manufacturing practices. Companies that are pioneering the integration of green materials into their tooling board products are not only aligning with environmental regulations but are also enhancing their market appeal to environmentally conscious consumers.

The innovation in eco-friendly tooling boards, characterized by reduced volatile organic compound emissions and higher recyclability, opens up new opportunities for market leaders and entrants alike. As industries continue to emphasize sustainability, the demand for such advanced materials is expected to surge, presenting a substantial growth avenue for the tooling board industry.

Expansion into New Industrial Applications

Another significant opportunity in the global tooling board market is its expansion into new industrial applications, particularly in sectors like wind energy and marine. These industries require precise and durable models for prototyping and production, areas where high-density tooling boards are particularly effective. The wind energy sector, with its focus on developing larger and more efficient turbine blades, offers a particularly lucrative avenue for the application of tooling boards.

Similarly, the marine industry, which demands robust and moisture-resistant materials for the construction of composite boat molds, presents another growth area. By capitalizing on these expanding sectors, manufacturers of tooling boards can diversify their portfolios and tap into new revenue streams, thereby enhancing their market position and resilience against economic fluctuations in traditional markets.

Latest Trends

Increasing Use of High-Density Tooling Boards for Complex Applications

In 2023, the global tooling board market is characterized by a notable trend toward the use of high-density tooling boards for increasingly complex and detailed applications. This shift is primarily fueled by the advanced requirements of industries such as aerospace, automotive, and consumer electronics, where precision and fine detailing are paramount. High-density tooling boards offer superior dimensional stability and surface finish, making them ideal for producing intricate designs and high-quality prototypes.

The ability to withstand rigorous processing conditions without compromising on quality or accuracy enhances their suitability for complex molds and models, driving their adoption across various sectors. As industries continue to push the boundaries of design and functionality, the demand for high-density tooling boards is expected to grow, reinforcing their critical role in modern manufacturing workflows.

Adoption of Digital Manufacturing Processes

Another prominent trend in the global tooling board market is the adoption of digital manufacturing processes that integrate tooling boards with automated machining. This technological integration facilitates more streamlined and efficient production cycles, reducing time-to-market and enhancing productivity. Digital manufacturing techniques, such as CNC machining, allow for precise control over the tooling board material, enabling manufacturers to achieve intricate details and complex geometries with high repeatability.

The convergence of digital tools and traditional tooling board applications not only optimizes production processes but also opens up new possibilities for innovation in product development. As more companies invest in digital capabilities to stay competitive, the integration of tooling boards into these advanced manufacturing setups is expected to proliferate, setting a new standard in the industry.

Regional Analysis

The Tooling Board Market in Europe dominates with a substantial 35.1% share of the global market.

North America, recognized for its robust aerospace and automotive sectors, showcases a significant demand for high-density, precision tooling boards. The region benefits from the presence of major manufacturers and technological innovators, driving advancements in tooling applications. Although not the largest market, North America remains vital due to its technological leadership and high-value industries.

Europe holds a dominant position in the global tooling board market, accounting for 35.1% of the market share. This leadership is attributed to the extensive automotive and aerospace manufacturing base in countries such as Germany, France, and the UK. European market dominance is further bolstered by stringent environmental regulations that drive the demand for sustainable, eco-friendly tooling board materials, aligning with the shift towards greener manufacturing practices.

Asia Pacific is rapidly emerging as a significant market, driven by expanding manufacturing sectors in China, India, and Southeast Asia. The region's growth is fueled by increased investments in automotive, electronics, and renewable energy sectors, requiring sophisticated tooling solutions for development and production.

The Middle East & Africa and Latin America regions, though smaller in market size, are experiencing gradual growth. The Middle East's focus on diversifying its economy, with investments in construction and industrial manufacturing, and Latin America's growing automotive production, particularly in Brazil and Mexico, contribute to the rising demand for tooling boards in these regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global tooling board market will be significantly influenced by the strategic movements and innovative advancements introduced by key players. Among these, Huntsman Corp., Alro Tooling Board Corp., and Alchemie Ltd. are notable for their pioneering efforts in developing advanced tooling board materials that cater to a range of industrial applications, from aerospace to automotive. Huntsman Corp. has been at the forefront of integrating sustainability into its product offerings, which has enhanced its market appeal in regions with strict environmental regulations.

Curbell Plastics Inc. and General Plastic Manufacturing Co. have expanded their market reach through strategic partnerships and expansions, focusing on the North American and European markets. These companies have excelled in producing high-density and high-precision tooling boards, essential for the demanding specifications of modern manufacturing.

Axson Technologies and OBO-Werke GmbH & Co. KG continue to innovate in the realm of chemical formulations, offering solutions that provide superior finish and durability, pivotal for the automotive and consumer electronics sectors. Similarly, Coastal Enterprises and Trelleborg AG have made significant strides in improving the machinability and heat resistance of their products, aligning with the evolving requirements of high-speed machining processes.

Lastly, Base Group, RAMPF Holding GmbH & Co., and Sika AG have focused on vertical integration and technological advancements to streamline their operations and enhance product quality. Their commitment to research and development has positioned them well to leverage emerging opportunities in new markets like wind energy and marine industries, where precision tooling is increasingly critical.

Market Key Players

- Huntsman Corp.

- Alro Tooling board Corp.

- Alchemie Ltd.

- Curbell Plastics Inc.

- General Plastic Manufacturing Co.

- Axson Technologies

- OBO-Werke GmbH & Co. KG

- Coastal Enterprises

- Trelleborg AG

- Base Group

- RAMPF Holding GmbH & Co.

- KGSika AG

Recent Development

- In July 2024, Huntsman Corp. announced the launch of a new, advanced tooling board designed for high-temperature applications, enhancing their product portfolio's versatility. This innovation is tailored to meet the increasing demands of the automotive and aerospace industries for materials that withstand extreme conditions.

- In March 2024, Alchemie Ltd. secured a substantial investment of $15 million to enhance its research and development efforts. The funding is directed towards creating more environmentally friendly and sustainable tooling board materials, responding to the growing market demand for green manufacturing solutions.

- In January 2024, Curbell Plastics Inc. partnered with a major robotics company in January 2024 to develop a custom tooling board solution that integrates with automated manufacturing systems. This collaboration is set to revolutionize how tooling boards are utilized in robotic applications, increasing precision and reducing waste.

Report Scope

Report Features Description Market Value (2023) USD 12.1 Billion Forecast Revenue (2033) USD 18.6 Billion CAGR (2024-2032) 4.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Polyurethane, Epoxy, Others), By Application(Aerospace and defense, Automotive, Marine, Wind Energy, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Huntsman Corp., Alro Tooling board Corp., Alchemie Ltd., Curbell Plastics Inc., General Plastic Manufacturing Co., Axson Technologies, OBO-Werke GmbH & Co. KG, Coastal Enterprises, Trelleborg AG, Base Group, RAMPF Holding GmbH & Co., KGSika AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Huntsman Corp.

- Alro Tooling board Corp.

- Alchemie Ltd.

- Curbell Plastics Inc.

- General Plastic Manufacturing Co.

- Axson Technologies

- OBO-Werke GmbH & Co. KG

- Coastal Enterprises

- Trelleborg AG

- Base Group

- RAMPF Holding GmbH & Co.

- KGSika AG