Timing Devices Market Size, Share, Growth | CAGR of 8.2%

-

46880

-

June 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

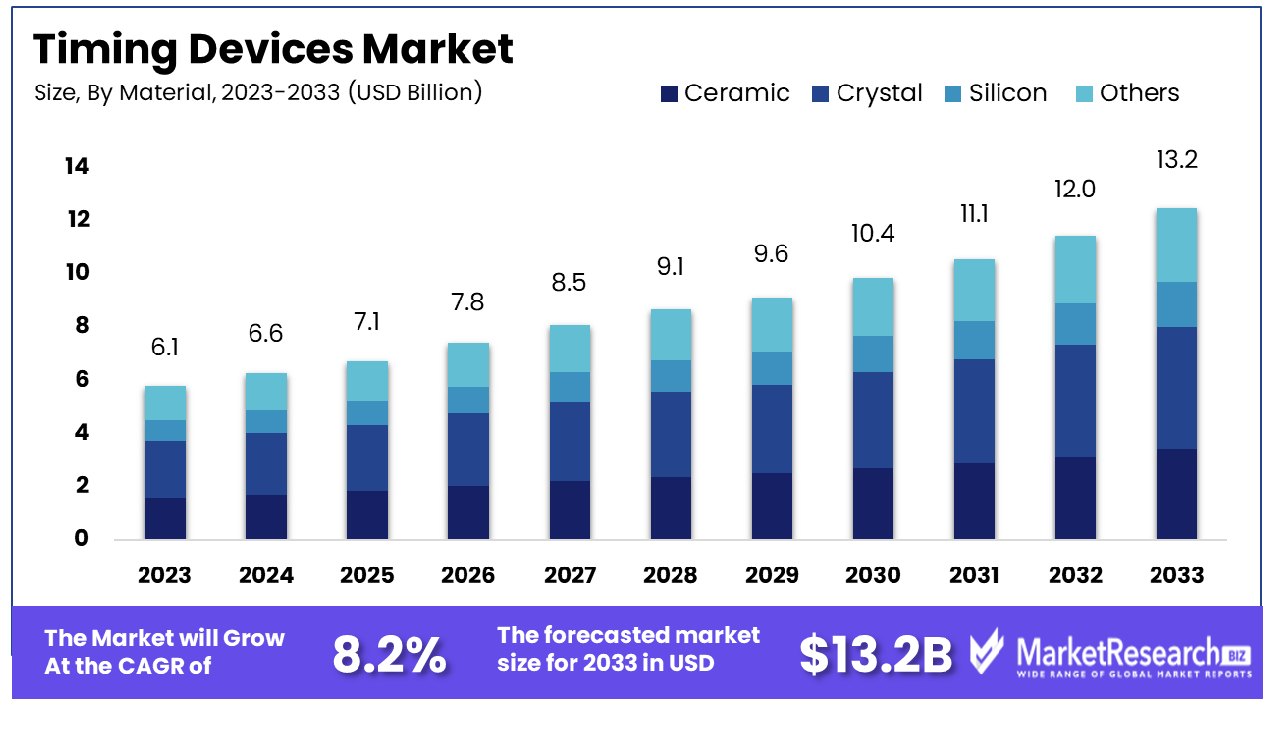

The Global Timing Devices Market was valued at USD 6.1 billion in 2023. It is expected to reach USD 13.2 billion by 2033, with a CAGR of 8.2% during the forecast period from 2024 to 2033.

The Timing Devices Market encompasses a diverse range of products crucial for precision timing and synchronization across various industries. This market comprises high-precision devices such as oscillators, clocks, and timers, which serve as fundamental components in electronic systems, telecommunications networks, and industrial automation.

As the demand for synchronized operations and real-time data processing intensifies across sectors like telecommunications, automotive, and aerospace, the Timing Devices Market experiences steady growth.

Market players continually innovate to meet stringent performance requirements, driving advancements in accuracy, reliability, and miniaturization. Understanding this market's dynamics is imperative for executives and product managers navigating digital transformation and IoT-driven landscapes.

The Timing Devices Market continues its upward trajectory, propelled by technological advancements and the ever-expanding Internet of Things (IoT) landscape. In an era where precision and synchronization are paramount across industries, timing devices play a pivotal role, in ensuring seamless operations and efficient functionality. As global connectivity burgeons, fueled by a surge in IoT connections, the demand for precise timing mechanisms amplifies in tandem.

In 2022, the global IoT ecosystem witnessed a notable surge, with a remarkable 18% increase in connections, culminating in a staggering 14.3 billion active IoT endpoints. Building upon this momentum, projections from IoT Analytics anticipate a further 16% growth in connected IoT devices, reaching an impressive 16.7 billion active endpoints by 2023.

Moreover, the financial landscape mirrors this exponential growth, with worldwide IoT spending surpassing the monumental threshold of $1 trillion in 2023. Projections indicate a continued upward trajectory, with forecasted spending expected to reach $1.1 trillion for the same year. This robust investment underscores the criticality of timing devices within the IoT ecosystem, driving innovation and enabling seamless connectivity across diverse sectors.

Key Takeaways

- Market Growth: The Global Timing Devices Market was valued at USD 6.1 billion in 2023. It is expected to reach USD 13.2 billion by 2033, with a CAGR of 8.2% during the forecast period from 2024 to 2033.

- By Material: In the realm of materials, silicon reigns supreme, constituting 70%.

- By Application: Clock generator applications hold sway, commanding a dominant 35%.

- By End User: Healthcare emerges as the leading end-user, commanding 28%.

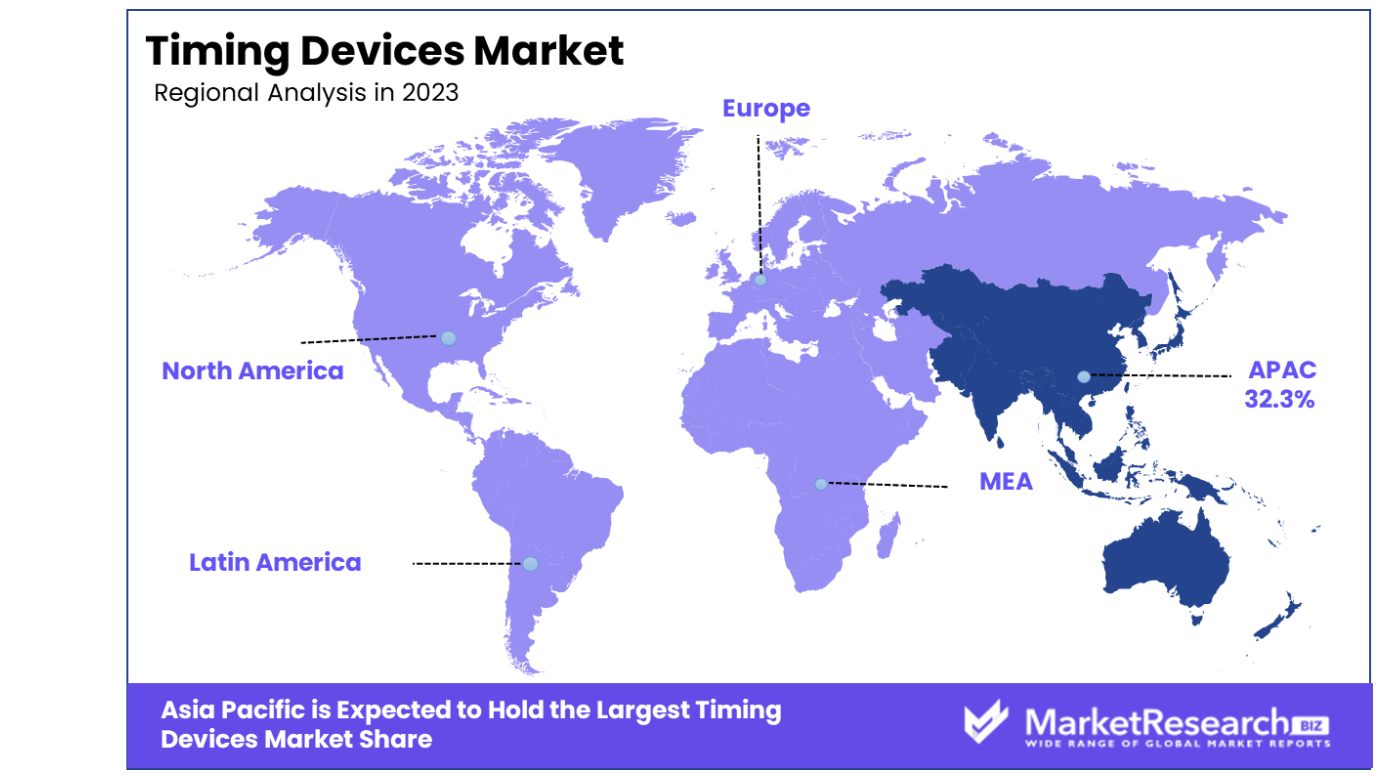

- Regional Dominance: In the Asia Pacific, the timing devices market grew by 32.3%.

- Growth Opportunity: In 2023, the global timing devices market will experience growth opportunities driven by telecommunications infrastructure expansion and increasing demand for medical equipment, offering lucrative prospects for market innovation and development.

Driving factors

Rise in Demand for High-Performance, Energy-Efficient Devices

The Timing Devices Market is experiencing significant growth, primarily driven by the increasing demand for high-performance and energy-efficient devices across various sectors, including consumer electronics, automotive, and telecommunications. This trend is propelled by the global shift towards sustainability and the ongoing advancements in technology that demand faster, more efficient performance while minimizing energy consumption.

For instance, modern smart devices and electric vehicles require precise timing components that optimize power usage and enhance device lifecycle. The adoption of low-power oscillators and MEMS (Micro-Electro-Mechanical Systems) technology in timing devices exemplifies this shift, as these components provide the necessary precision without substantial power drain. The market is expected to witness substantial growth, with projections indicating a significant rise in the adoption of energy-efficient timing solutions in the upcoming years.

Growing Need for Precise and Reliable Timing Solutions

In today’s digital era, the necessity for precise and reliable timing solutions is more critical than ever, particularly in sectors like telecommunications, healthcare, and industrial applications. Precision timing technology ensures the seamless operation of networks, synchronization of data transfers, and accuracy in digital transactions.

The expansion of 5G networks and IoT (Internet of Things) infrastructures are notable drivers, as they require stringent timing standards to maintain system integrity and ensure synchronous communication across devices. As a result, the demand for crystal oscillators and atomic clocks, known for their accuracy and stability, is surging. These components are crucial in enabling technologies that rely on high-precision timing, further propelling market growth.

Continuous Innovation in Timing Technologies

The Timing Devices Market is buoyed by continuous innovations that cater to evolving technological demands. Innovations in timing technology not only refine the performance and efficiency of existing solutions but also broaden their applications in emerging fields such as autonomous driving and AI. For example, the development of advanced temperature-compensated crystal oscillators (TCXOs) and oven-controlled crystal oscillators (OCXOs) has allowed for greater stability and accuracy under variable environmental conditions.

This adaptability is essential for applications in harsh or fluctuating environments. Moreover, the integration of AI and machine learning in timing devices is starting to play a pivotal role, enhancing predictive maintenance capabilities and reducing downtime. This ongoing innovation cycle not only fuels market expansion but also strengthens the competitive landscape, encouraging continuous technological advancement and product differentiation.

Restraining Factors

Limited Availability of High-Grade Needle Coke

The limited availability of high-grade needle coke significantly restrains the growth of the Timing Devices Market. Needle coke, a crucial raw material used in the production of synthetic graphite, directly impacts the manufacturing of graphite-based components within timing devices. The scarcity of this high-grade material is attributed to stringent environmental regulations and the monopolistic supply chain, which limits production capacities and increases material costs.

As a result, the production of certain timing devices, especially those requiring high conductivity and thermal stability, faces delays and increased costs, ultimately hindering market growth. This scarcity not only affects supply chain efficiency but also places upward pressure on prices, making it challenging for manufacturers to maintain competitive pricing in a cost-sensitive market.

High Costs Associated with Implementing Advanced Automotive Electronics

The integration of advanced automotive electronics, including sophisticated timing systems, is another factor that restrains the Timing Devices Market. As vehicles become more technologically advanced, the complexity and cost of incorporating high-precision timing devices escalate. These costs are often passed down to the consumer, potentially slowing down the adoption rates of new technologies in the automotive sector. The financial burden is particularly noticeable in developing economies, where cost sensitivity is higher.

Furthermore, the ongoing global semiconductor shortage exacerbates this issue, as it leads to increased costs and extended lead times for electronic components, including those essential for timing devices. This combination of high costs and supply chain vulnerabilities poses a significant challenge to the market's growth, as manufacturers struggle to balance innovation with affordability.

By Material Analysis

In the realm of materials, silicon stands out, commanding a significant share at 70%.

In 2023, Silicon held a dominant market position in the By Material segment of the Timing Devices Market, capturing more than a 70% share. This significant market dominance underscores the pivotal role of Silicon in the landscape of timing devices, reflecting its widespread adoption and inherent advantages within the industry.

Silicon's prominence can be attributed to several key factors. Firstly, its exceptional physical properties, including high thermal conductivity, mechanical strength, and chemical stability, render it highly suitable for the demanding operational requirements of timing devices. Additionally, Silicon's widespread availability and relatively low production costs contribute to its attractiveness for manufacturers, facilitating cost-effective production and scalability.

Moreover, advancements in semiconductor fabrication technologies have continually enhanced the performance capabilities of Silicon-based timing devices, enabling higher precision, reliability, and integration within a variety of applications across industries.

While Silicon dominates the market, other materials such as Ceramic, Crystal, and Others maintain a presence within the segment. Ceramic materials, renowned for their excellent thermal stability and dielectric properties, find application in specialized timing devices requiring robust performance in harsh operating environments.

Crystal-based timing devices, leveraging the piezoelectric properties of crystalline materials, offer unparalleled frequency stability and accuracy, catering to precision-centric applications in telecommunications, aerospace, and scientific instrumentation.

The "Others" category encompasses a diverse range of materials, including organic polymers and composite materials, which address niche market requirements or offer specialized functionalities not covered by mainstream Silicon or alternative materials.

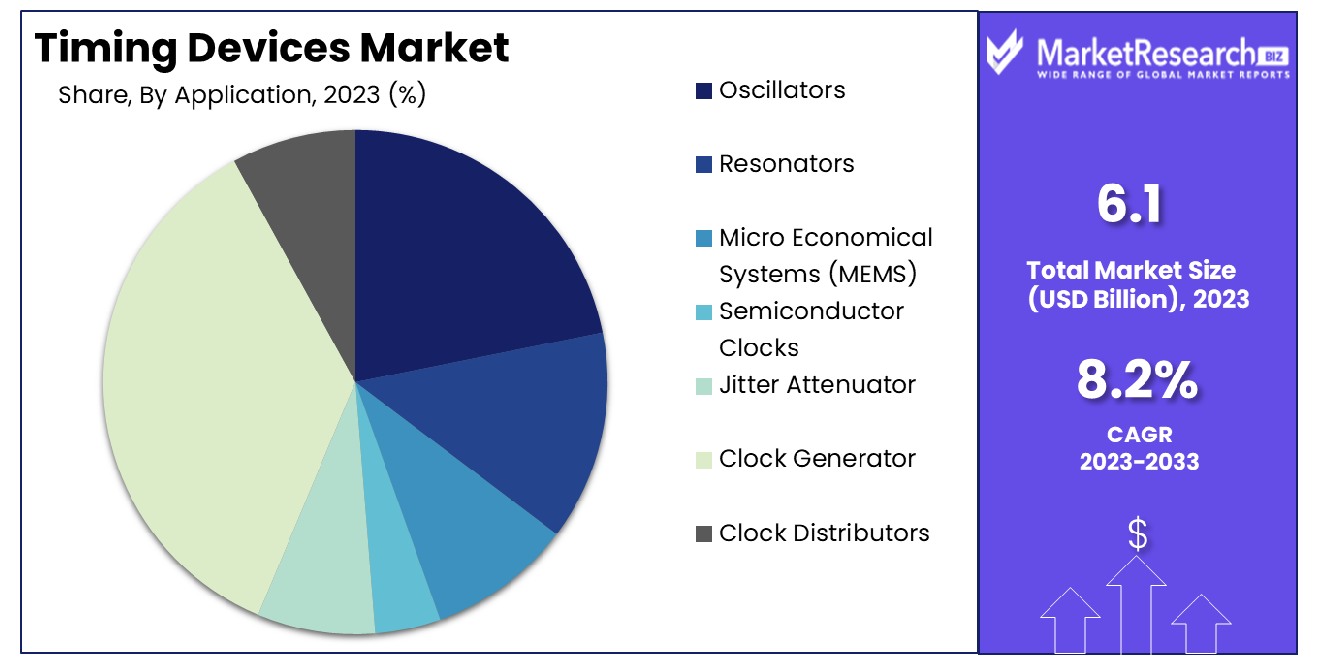

By Application Analysis

Clock generators lead applications, commanding a dominant 35% share.

In 2023, Clock Generator held a dominant market position in the By Application segment of the Timing Devices Market, capturing more than a 35% share. This substantial market share underscores the pivotal role of Clock Generators as a fundamental component in various electronic systems, driving synchronization and timing precision across diverse applications.

Clock Generators' market dominance can be attributed to their versatility and indispensability across a wide spectrum of industries and applications. Clock Generators serve as the heartbeat of electronic systems, generating stable and precise clock signals essential for coordinating the timing of operations within integrated circuits and electronic devices.

Oscillators, resonators, Micro Economical Systems (MEMS), Semiconductor Clocks, Jitter Attenuators, and Clock Distributors, while significant in their own right, collectively contribute to the diverse landscape of timing device applications.

Oscillators, known for their ability to generate periodic signals, find extensive use in electronic systems requiring precise timing control, such as communication devices, automotive electronics, and industrial automation.

Resonators, leveraging the mechanical resonance of piezoelectric crystals or other resonant elements, provide stable frequency references for timing-sensitive applications like consumer electronics and medical devices.

Micro Economical Systems (MEMS), characterized by their small size, low power consumption, and integrated functionality, offer compact and cost-effective timing solutions for portable electronics, wearables, and IoT devices.

Semiconductor Clocks, based on semiconductor technology, deliver high-frequency clock signals with minimal jitter and phase noise, catering to high-speed data communication, computing, and networking applications.

Jitter Attenuators play a critical role in reducing timing jitter, ensuring reliable data transmission in communication systems, data centers, and digital audio/video equipment.

Clock Distributors facilitate the distribution of clock signals to multiple components within complex electronic systems, ensuring synchronization and coherence across the entire system architecture.

While Clock Generators command a significant market share, the diverse array of timing devices applications, including Oscillators, Resonators, MEMS, Semiconductor Clocks, Jitter Attenuators, and Clock Distributors, collectively drive innovation and address the evolving needs of modern electronic systems across industries.

By End User Analysis

Healthcare emerges as the primary end-user, holding sway with a commanding 28% dominance.

In 2023, Healthcare held a dominant market position in the end-user segment of the Timing Devices Market, capturing more than a 28% share. This significant market share underscores the critical role of timing devices within the healthcare sector, where precise timing and synchronization are essential for a wide range of medical devices and applications.

Healthcare's dominance in this segment can be attributed to the increasing integration of advanced timing technologies in medical equipment and healthcare systems. Timing devices play a vital role in various medical devices and systems, including patient monitoring devices, diagnostic equipment, imaging systems, and therapeutic devices, ensuring accurate synchronization and timing control for optimal performance and patient safety.

Consumer Electronics, IT & Telecommunication, Automotive, Aerospace and Defense, Industrial Equipment, Power & Energy, and Others also represent significant end-user segments within the Timing Devices Market, each with unique requirements and applications.

Consumer Electronics leverage timing devices for synchronization and timing control in devices such as smartphones, tablets, wearables, and home entertainment systems, enhancing user experience and functionality.

IT & Telecommunication rely on precise timing signals for data transmission, networking, and telecommunications infrastructure, ensuring reliable communication and seamless connectivity in a digitalized world.

Automotive applications utilize timing devices for engine control, navigation systems, infotainment, and advanced driver assistance systems (ADAS), contributing to vehicle performance, safety, and efficiency.

Aerospace and Defense applications demand high-reliability timing solutions for mission-critical systems, including avionics, navigation, communication, and surveillance systems, ensuring precision and accuracy in challenging operational environments.

Industrial Equipment applications require timing devices for automation, control systems, robotics, and machinery, optimizing production processes and enhancing operational efficiency in manufacturing and industrial environments.

Power & Energy applications utilize timing devices for synchronization and control in power generation, distribution, and grid management systems, ensuring stability, reliability, and efficiency in electrical infrastructure.

The "Others" category encompasses a diverse range of end-user applications, including environmental monitoring, research laboratories, and academic institutions, where timing devices play a crucial role in various scientific and experimental endeavors.

While Healthcare dominates the Timing Devices Market's end-user segment, the diverse array of end-user applications, including Consumer Electronics, IT & Telecommunication, Automotive, Aerospace and Defense, Industrial Equipment, Power & Energy, and Others, collectively drive demand and innovation in the Timing Devices Market, catering to a broad spectrum of industries and applications.

Key Market Segments

By Material

- Ceramic

- Crystal

- Silicon

- Others

By Application

- Oscillators

- Resonators

- Micro Economical Systems (MEMS)

- Semiconductor Clocks

- Jitter Attenuator

- Clock Generator

- Clock Distributors

By End User

- Healthcare

- Consumer Electronics

- IT & Telecommunication

- Automotive

- Aerospace and Defense

- Industrial Equipment

- Power & Energy

- Others

Growth Opportunity

Telecommunications Infrastructure Expansion

The global timing devices market in 2023 presents a promising landscape of growth opportunities, primarily fueled by the expanding telecommunications infrastructure worldwide. With the ongoing evolution toward 5G networks and the Internet of Things (IoT) deployment, the demand for precise timing solutions has intensified. Timing devices, such as oscillators and clocks, serve as critical components in synchronizing data transmission across networks, ensuring seamless connectivity and optimal performance.

As telecommunications companies continue to invest in network expansion and upgrade initiatives, the demand for advanced timing solutions is expected to surge significantly. This presents a lucrative opportunity for market players to innovate and offer high-performance timing devices tailored to the specific requirements of telecommunications infrastructure.

Growing Demand for Medical and Healthcare Equipment

Another significant growth driver for the global timing devices market in 2023 is the increasing demand for medical and healthcare equipment. As healthcare facilities worldwide strive to enhance patient care, there has been a notable rise in the adoption of advanced medical devices and diagnostic equipment. Timing devices play a crucial role in ensuring the accuracy and synchronization of various medical devices, such as patient monitors, infusion pumps, and diagnostic imaging systems.

With the growing emphasis on precision medicine and remote patient monitoring, the demand for reliable timing solutions is poised to escalate. Manufacturers operating in the timing devices market have a unique opportunity to cater to the evolving needs of the healthcare sector by developing innovative timing solutions that offer superior performance, accuracy, and reliability, thereby driving substantial growth in the market segment.

Latest Trends

Increasing Demand in Research and Scientific Instruments

The global timing devices market witnessed a notable surge in demand in 2023, particularly driven by the burgeoning needs within the research and scientific instruments sector. This uptick can be attributed to the expanding scope of scientific research endeavors worldwide, spanning disciplines such as telecommunications, aerospace, and healthcare. With an emphasis on precision and synchronization, timing devices have become indispensable components in various scientific instruments, facilitating accurate data collection, analysis, and experimentation.

Moreover, the proliferation of advanced technologies, including Internet of Things (IoT) and artificial intelligence (AI), has propelled the need for precise timing mechanisms, thereby augmenting the market growth. As research institutions, laboratories, and academic centers continue to invest in cutting-edge equipment, the demand for high-performance timing devices is expected to remain robust in the foreseeable future.

Issues in Safeguarding Intellectual Property

However, amidst the market expansion, concerns regarding safeguarding intellectual property (IP) have emerged as a significant challenge for industry players. The intricate designs and proprietary technologies embedded within timing devices render them susceptible to intellectual property theft and infringement. Companies are grappling with the task of implementing robust strategies to protect their innovations while navigating the complexities of global supply chains and collaborative research ventures.

Furthermore, the evolving regulatory landscape and increasing instances of IP litigation underscore the critical importance of proactive IP management practices. Organizations must prioritize comprehensive IP protection strategies, encompassing patents, trademarks, and trade secrets, to mitigate the risks associated with the unauthorized use or replication of their proprietary technologies.

In conclusion, while the global timing devices market continues to flourish, addressing the complexities surrounding intellectual property rights remains paramount to sustaining long-term growth and competitiveness within the industry.

Regional Analysis

In the Asia Pacific region, the timing devices market grew by a substantial 32.3% in 2023.

In the global timing devices market, regional dynamics play a pivotal role in shaping market trends and opportunities. Across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, distinct market landscapes emerge, each driven by unique factors and dynamics.

North America, as a mature market, showcases steady growth driven by robust technological advancements and a strong presence of key market players. The region boasts a significant adoption of timing devices, particularly in sectors such as telecommunications, automotive, and aerospace. According to recent market data, North America accounts for approximately 28% of the global timing devices market share, with a projected CAGR of 5.2% over the forecast period.

In Europe, stringent regulatory standards and a burgeoning automotive industry contribute to the demand for precise timing solutions. The region exhibits a notable inclination towards advanced timing technologies, fueled by increasing investments in research and development. Europe holds approximately 22% of the global market share for timing devices, with a forecasted CAGR of 4.8%.

Asia Pacific emerges as the dominating region in the global timing devices market, commanding a significant share of 32.3%. Rapid industrialization, coupled with expanding consumer electronics and automotive sectors, propels the demand for timing devices in countries like China, Japan, and South Korea. With a projected CAGR of 6.5%, Asia Pacific remains a key growth engine for the market.

In the Middle East & Africa and Latin America regions, steady economic growth and infrastructure development initiatives drive the adoption of timing devices across various industries. While these regions collectively represent approximately 17% of the global market share, they exhibit promising growth potential, supported by increasing investments in industrial automation and telecommunications infrastructure.

As per the current market scenario, Asia Pacific stands as the dominating region in the global timing devices market, commanding a significant share of 32.3%. This dominance is attributed to rapid industrialization, and expanding consumer electronics, and automotive sectors in countries like China, Japan, and South Korea.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the landscape of the global Timing Devices Market in 2023, several key players stand out, each contributing significantly to the market's dynamics and evolution. Among these, Seiko Epson Corporation, Nihon Dempa Kogyo Co., Ltd, TXC Corporation, Kyocera Corporation, Murata Manufacturing Co., Ltd, and Rakon Limited emerge as formidable entities driving innovation and setting benchmarks in the industry.

Seiko Epson Corporation, renowned for its precision engineering and technological prowess, continues to lead with its diverse portfolio of timing devices, catering to a wide range of applications across industries. Similarly, Nihon Dempa Kogyo Co., Ltd, with its focus on research and development, consistently introduces cutting-edge solutions, elevating the standards of the market.

TXC Corporation and Murata Manufacturing Co., Ltd, with their commitment to quality and reliability, maintain their positions as trusted suppliers of timing devices globally. Rakon Limited, known for its agility and adaptability, remains a key player, adept at addressing evolving market demands swiftly.

Integrated Device Technology, Inc, Knowles Corporation, Asahi Kasei Corporation, Cypress Semiconductor Corporation, Texas Instruments, Microchip Technology Inc, IQD Frequency Products Ltd, IBS Electronics Inc, and Mouser Electronics also contribute significantly to the market's vibrancy with their diverse product offerings and extensive market reach.

In 2023, these key players continue to shape the timing devices market with their innovation, quality, and strategic initiatives, driving growth and fostering technological advancements. Their collective efforts underscore the market's resilience and potential for further expansion, as industries increasingly rely on precise timing solutions for enhanced performance and efficiency.

Market Key Players

- Seiko Epson Corporation

- Nihon Dempa Kogyo Co., Ltd

- TXC Corporation

- Kyocera Corporation

- Murata Manufacturing Co., Ltd

- Rakon Limited

- Integrated Device Technology, Inc

- Knowles Corporation

- Asahi Kasei Corporation

- Cypress Semiconductor Corporation

- Texas Instruments

- Microchip Technology Inc

- IQD Frequency Products Ltd

- IBS Electronics Inc

- Mouser Electronics

Recent Development

- In February 2024, Viska Automation Systems pioneers robotic vision inspection solutions, saving time and costs for manufacturers. Their Visible system revolutionizes quality control, with the new mass-market product PUP 100 enhancing compliance and patient safety.

- In July 2016, Tech Insider showcased four medical innovations in a video montage, including Xstat by RevMedx Inc., Vetigel by Sunrise, Vein Viewer by Christie Medical Holdings, and a cholesterol-removing machine by Dahir Insaat.

Report Scope

Report Features Description Market Value (2023) USD 6.1 Billion Forecast Revenue (2033) USD 13.2 Billion CAGR (2024-2032) 8.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material (Ceramic, Crystal, Silicon , Others), By Application(Oscillators, Resonators, Micro Economical Systems (MEMS), Semiconductor Clocks, Jitter Attenuator, Clock Generator , Clock Distributors), By End User(Healthcare, Consumer Electronics, IT & Telecommunication, Automotive, Aerospace and Defense, Industrial Equipment, Power & Energy, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Seiko Epson Corporation, Nihon Dempa Kogyo Co., Ltd, TXC Corporation, Kyocera Corporation, Murata Manufacturing Co., Ltd, Rakon Limited, Integrated Device Technology, Inc, Knowles Corporation, Asahi Kasei Corporation, Cypress Semiconductor Corporation, Texas Instruments, Microchip Technology Inc, IQD Frequency Products Ltd, IBS Electronics Inc, Mouser Electronics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Seiko Epson Corporation

- Nihon Dempa Kogyo Co., Ltd

- TXC Corporation

- Kyocera Corporation

- Murata Manufacturing Co., Ltd

- Rakon Limited

- Integrated Device Technology, Inc

- Knowles Corporation

- Asahi Kasei Corporation

- Cypress Semiconductor Corporation

- Texas Instruments

- Microchip Technology Inc

- IQD Frequency Products Ltd

- IBS Electronics Inc

- Mouser Electronics