Threat Detection Systems Market By Component (Solution, Services), By Deployment (Cloud-Based, Infrastructure-Based), By End-User (BFSI, IT & Communication, Aerospace & Defense, Software Industry, Manufacturing), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

50180

-

August 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

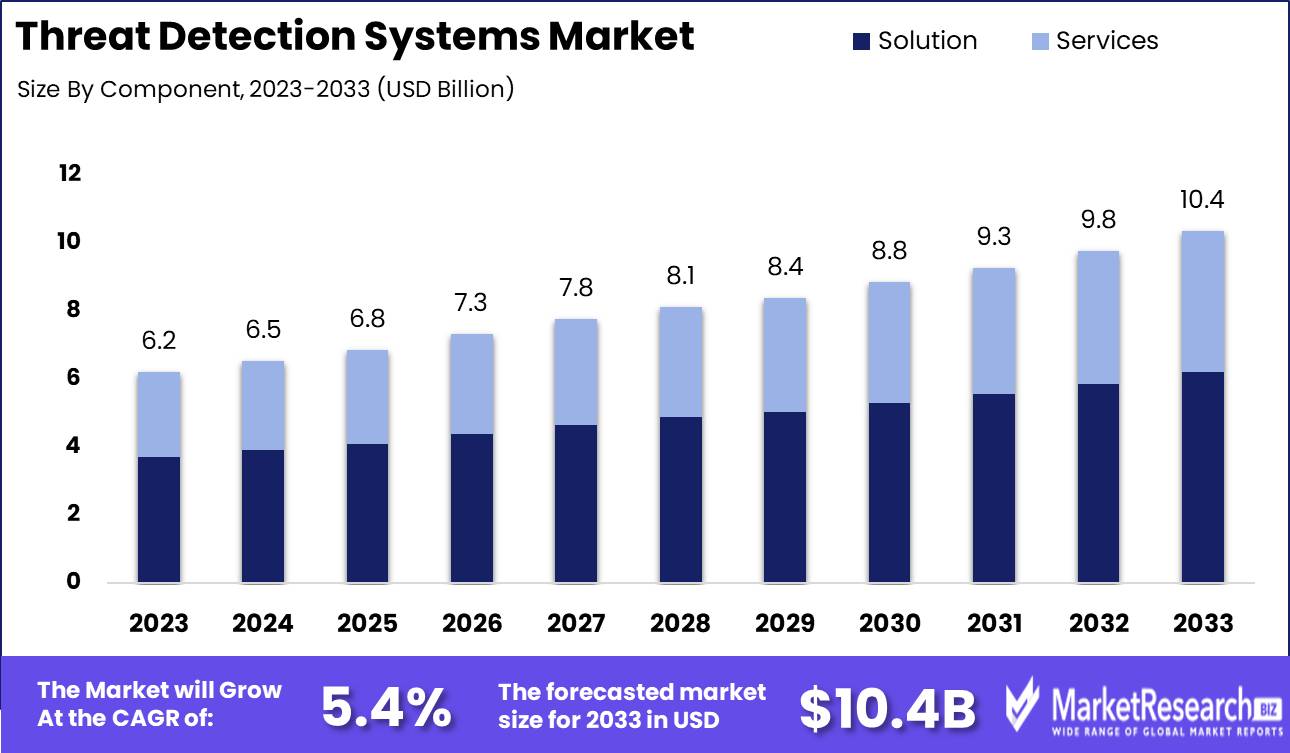

The Threat Detection Systems Market was valued at USD 6.2 billion in 2023. It is expected to reach USD 10.4 billion by 2033, with a CAGR of 5.4% during the forecast period from 2024 to 2033.

The Threat Detection Systems Market encompasses technologies and solutions designed to identify, analyze, and mitigate potential security threats across various environments, including cyber, physical, and operational domains. These systems utilize advanced methodologies such as machine learning, artificial intelligence, and real-time analytics to detect anomalies and unauthorized activities proactively. With applications spanning from corporate cybersecurity to public safety and national defense, the market is driven by the increasing frequency and sophistication of threats.

The Threat Detection Systems market is poised for significant growth, driven by an array of critical factors. Heightened security concerns across various sectors, including governmental, corporate, and personal domains, are propelling the demand for advanced threat detection solutions. These concerns are not unfounded, given the increasing sophistication of cyber-attacks and the persistent threat of terrorism. Concurrently, technological advancements are revolutionizing the threat detection landscape. Innovations in AI and machine learning are enabling more accurate and timely identification of potential threats, thus enhancing the overall security posture. Additionally, increased defense expenditure globally underscores the prioritization of security, with nations allocating substantial budgets to bolster their defense capabilities through state-of-the-art detection systems.

However, the market is not without its challenges. Integration issues remain a significant barrier, as organizations often struggle to seamlessly incorporate new technologies into their existing security frameworks. This is particularly pertinent in the short term, where the rapid pace of technological evolution can outstrip an organization’s capacity to adapt. Consequently, while the long-term outlook for the Threat Detection Systems market remains robust, driven by enduring security imperatives and technological progress, stakeholders must address integration hurdles to fully capitalize on these advancements.

Key Takeaways

- Market Growth: The Threat Detection Systems Market was valued at USD 6.2 billion in 2023. It is expected to reach USD 10.4 billion by 2033, with a CAGR of 5.4% during the forecast period from 2024 to 2033.

- By Component: The Solution segment dominated the Threat Detection Systems Market growth.

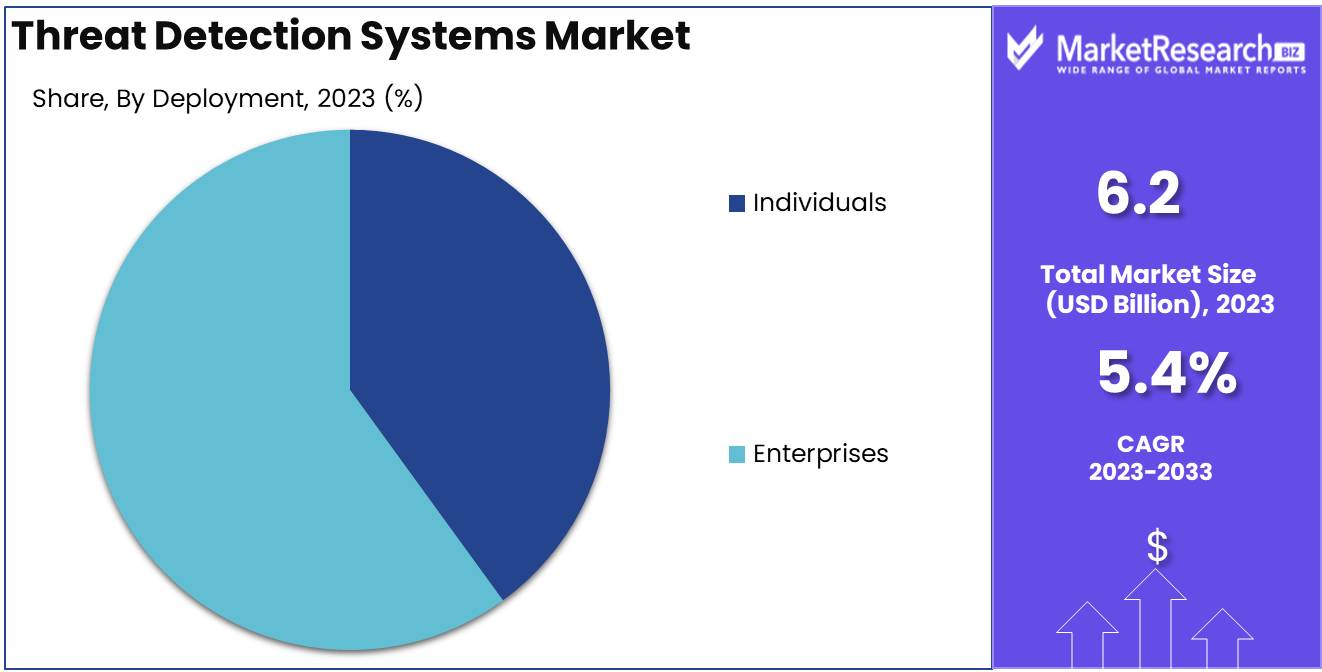

- By Deployment: Cloud-based solutions dominated the Threat Detection Systems Market.

- By End-User: BFSI dominated the Threat Detection Systems Market across diverse industries.

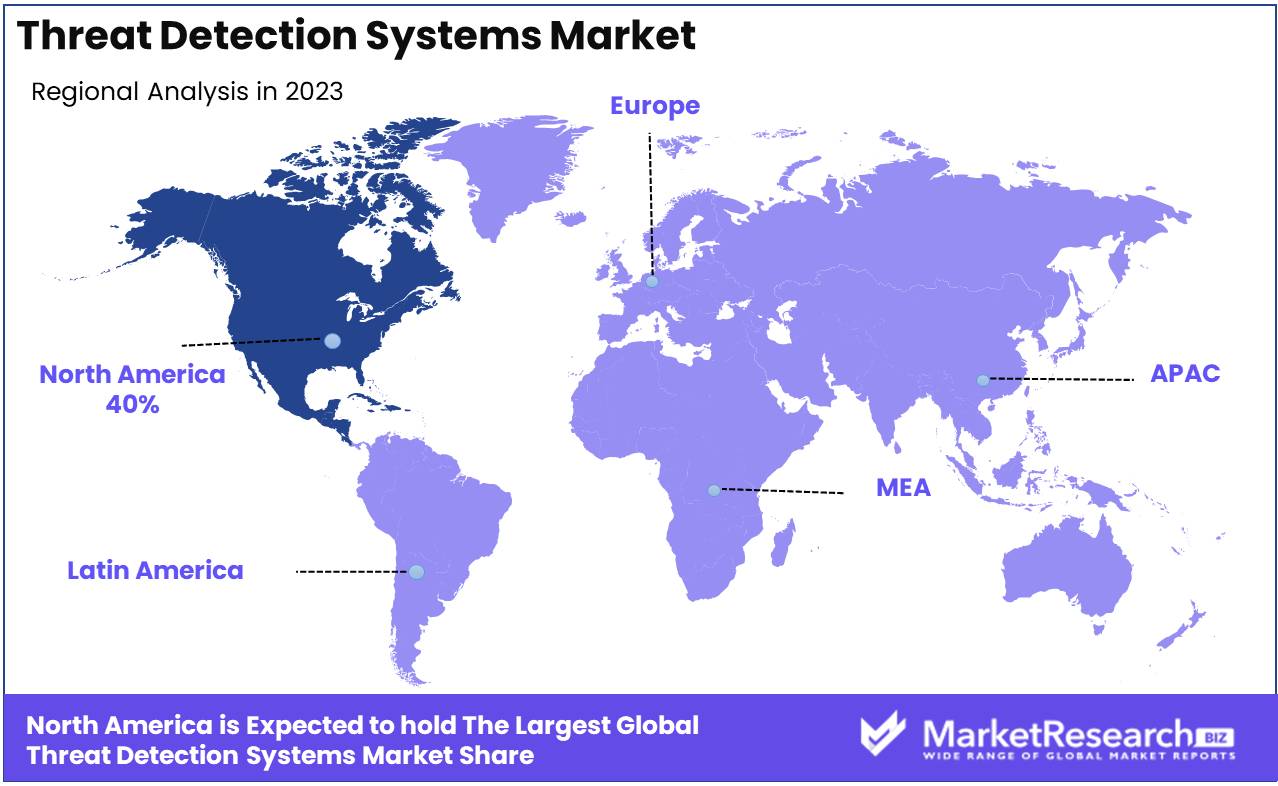

- Regional Dominance: North America dominates the threat detection systems market with a 40% share.

- Growth Opportunity: The global threat detection systems market is set to expand robustly, fueled by the increasing cybersecurity threats and the adoption of AI technologies.

Driving factors

Increase in Terrorist Activities: Catalyzing Demand for Advanced Threat Detection Systems

The rise in terrorist activities globally has significantly amplified the demand for sophisticated threat detection systems. Governments and private sectors are increasingly investing in advanced surveillance and detection technologies to preempt and mitigate potential threats. According to recent reports, global spending on counter-terrorism measures is projected to reach $150 billion by 2025. This surge in expenditure underscores the critical need for robust security infrastructure, including state-of-the-art threat detection systems.

The heightened focus on national security has accelerated the deployment of integrated detection solutions at critical infrastructure sites such as airports, public transportation networks, and government buildings. The persistent threat environment necessitates continuous enhancements and deployments of threat detection technologies, driving sustained market growth.

Advancements in Technology: Revolutionizing Threat Detection Capabilities

Technological advancements are at the forefront of transforming the threat detection systems market. Innovations in artificial intelligence (AI), machine learning (ML), and big data analytics have revolutionized the accuracy and efficiency of threat detection systems. AI and ML algorithms enhance the ability to predict, identify, and respond to potential threats in real-time. The integration of IoT (Internet of Things) devices has further augmented the capabilities of these systems, enabling comprehensive surveillance and real-time data processing.

For instance, AI-driven threat detection systems can analyze vast amounts of data from multiple sources, including video surveillance, social media, and biometric sensors, to detect anomalies and potential threats swiftly. According to market research, the global AI in the threat detection market is expected to grow at a compound annual growth rate (CAGR) of 27% from 2021 to 2028. This rapid technological progression not only enhances the effectiveness of threat detection systems but also broadens their application across various sectors, thereby propelling market growth.

Growing Cybersecurity Threats: Expanding the Scope of Threat Detection Systems

The proliferation of cyber threats has expanded the scope of threat detection systems beyond physical security to include cybersecurity. The increasing frequency and sophistication of cyber-attacks necessitate advanced detection and response mechanisms to protect critical data and infrastructure. Cybersecurity threats, such as ransomware, phishing, and distributed denial-of-service (DDoS) attacks, have become more prevalent and complex, requiring robust detection systems.

The global cybersecurity market is anticipated to exceed $250 billion by 2026, reflecting the escalating need for advanced security solutions. Integrated threat detection systems that combine both physical and cybersecurity measures are becoming essential for comprehensive protection. Organizations are increasingly adopting multi-layered security approaches that incorporate real-time threat intelligence, anomaly detection, and automated response systems to safeguard against cyber threats. This convergence of physical and cybersecurity threat detection capabilities is a key driver of market growth, as it addresses the evolving security landscape comprehensively.

Restraining Factors

High Initial Investment: A Significant Barrier to Market Entry

The high initial investment required for threat detection systems poses a substantial barrier to market entry, particularly for small and medium-sized enterprises (SMEs). Advanced threat detection systems often involve sophisticated hardware, software, and continuous research and development efforts, all of which demand considerable financial resources. The capital outlay for state-of-the-art technologies such as machine learning, artificial intelligence, and real-time data processing is substantial.

This financial requirement can deter potential market entrants and limit the expansion of existing players, particularly in developing regions where access to capital might be restricted. The necessity for ongoing maintenance and updates further exacerbates the cost burden, making it challenging for organizations with limited budgets to sustain long-term investments. Consequently, this high-cost structure slows down the overall growth of the threat detection systems market, as fewer players can participate and compete effectively.

Shortage of Skilled Personnel: Impeding Technological Advancements and Operational Efficiency

The shortage of skilled personnel is another critical restraining factor that impedes the growth of the threat detection systems market. Threat detection systems rely heavily on advanced technologies such as artificial intelligence, machine learning, and complex data analytics. The implementation, management, and continuous improvement of these technologies require a highly specialized workforce proficient in cybersecurity, data science, and IT infrastructure.

However, there is a global scarcity of professionals with the requisite expertise. According to industry reports, the cybersecurity workforce gap is estimated to be over 3.5 million unfilled positions worldwide. This shortage hampers the ability of organizations to effectively deploy and manage sophisticated threat detection systems. The lack of skilled personnel not only affects operational efficiency but also slows down innovation within the industry, as companies struggle to find the necessary talent to drive technological advancements.

By Component Analysis

In 2023, The Solution segment dominated the Threat Detection Systems Market growth.

In 2023, The Solution segment held a dominant market position in the By Component segment of the Threat Detection Systems Market. This segment's preeminence is driven by the increasing need for advanced threat detection capabilities across various industries. Solutions in this segment encompass a wide range of technologies, including intrusion detection systems, anti-malware software, and AI-driven threat intelligence platforms. The integration of these technologies into comprehensive security frameworks allows organizations to proactively identify and mitigate threats, ensuring robust protection of critical assets. The rise in cyber threats, coupled with regulatory requirements for enhanced security measures, has further propelled the demand for sophisticated threat detection solutions.

Concurrently, the Services segment has shown significant growth, underpinning the overall expansion of the Threat Detection Systems Market. This segment includes managed services, consulting, and maintenance services, which are vital for the effective deployment and operation of threat detection solutions. Organizations increasingly rely on expert service providers to manage complex security infrastructures, ensuring continuous monitoring, timely updates, and compliance with evolving security standards. The burgeoning demand for these services is also fueled by the scarcity of skilled cybersecurity professionals, prompting businesses to outsource critical security functions. This strategic reliance on specialized services not only enhances operational efficiency but also fortifies organizational defenses against sophisticated cyber threats.

By Deployment Analysis

In 2023, Cloud-based solutions dominated the Threat Detection Systems Market.

In 2023, The Cloud-based deployment segment held a dominant market position in the Threat Detection Systems Market. This leadership is attributed to several critical advantages inherent to cloud-based solutions, including scalability, flexibility, and cost-efficiency. Organizations increasingly favor cloud-based threat detection systems due to their ability to provide real-time monitoring and rapid response to emerging threats. Additionally, these systems facilitate seamless updates and integration with other cloud services, enhancing overall security posture.

Cloud-based solutions also benefit from advanced analytics and artificial intelligence, which improve threat detection accuracy and speed. Furthermore, the growing trend of remote work has accelerated the adoption of cloud-based security solutions, as they offer robust protection for dispersed workforces and varied devices. The demand is particularly high among small and medium-sized enterprises (SMEs) and large corporations looking to reduce infrastructure costs and capitalize on the pay-as-you-go model.

Conversely, the infrastructure-based deployment segment, while still significant, is increasingly seen as less adaptable. These systems, though perceived as more secure due to their controlled environments, face challenges such as higher maintenance costs and limited scalability. The shift towards cloud-based solutions underscores the market’s evolution towards more dynamic, efficient, and comprehensive threat detection capabilities.

By End-User Analysis

In 2023, BFSI dominated the Threat Detection Systems Market across diverse industries.

In 2023, The BFSI (Banking, Financial Services, and Insurance) sector held a dominant market position in the Threat Detection Systems Market by end-user segment. The BFSI sector's increasing reliance on digital platforms and services has made it a prime target for cyber threats, necessitating robust threat detection solutions. Financial institutions are investing heavily in advanced threat detection technologies to safeguard sensitive data, ensure regulatory compliance, and maintain customer trust. The sector's stringent regulatory environment further drives the adoption of these systems, as institutions must adhere to various cybersecurity standards and guidelines.

The IT & Communication segment also showed significant growth, driven by the proliferation of digital communication channels and the need for securing vast amounts of data exchanged daily. Similarly, the Aerospace & Defense sector's focus on national security and critical infrastructure protection spurred investments in sophisticated threat detection systems. The Software Industry, while smaller, is expanding rapidly as software vulnerabilities become a focal point for cyber attackers. Lastly, the Manufacturing sector is increasingly adopting threat detection systems to protect intellectual property and operational technology from cyber threats, reflecting a broadening awareness of cybersecurity importance across diverse industries.

Key Market Segments

By Component

- Solution

- Services

By Deployment

- Cloud-Based

- Infrastructure-Based

By End-User

- BFSI

- IT & Communication

- Aerospace & Defense

- Software Industry

- Manufacturing

Growth Opportunity

Rising Cybersecurity Threats Driving Market Expansion

The global threat detection systems market is poised for significant growth, primarily driven by the escalating frequency and sophistication of cybersecurity threats. With cyber-attacks becoming more advanced, businesses across various sectors are increasingly prioritizing robust threat detection systems to safeguard their data and operational integrity. The exponential increase in remote work, coupled with the growing digitization of critical infrastructure, has heightened the vulnerability to cyber-attacks, necessitating advanced threat detection capabilities. This trend presents a substantial opportunity for market players to innovate and enhance their offerings, addressing the evolving security needs of enterprises globally.

Adoption of Artificial Intelligence (AI) Enhancing Detection Capabilities and Efficiency

The integration of Artificial Intelligence (AI) in threat detection systems is another pivotal factor propelling market growth. AI's ability to analyze vast amounts of data in real time, identify patterns, and predict potential threats with high accuracy significantly enhances the efficiency and effectiveness of threat detection systems. By automating the detection process, AI reduces the reliance on manual monitoring and minimizes response times to emerging threats. This technological advancement not only improves the precision of threat identification but also enables the development of more proactive security measures. As a result, the adoption of AI in threat detection systems is expected to surge, offering substantial growth opportunities for market players to develop innovative AI-driven solutions.

Latest Trends

Increased Adoption of AI and Machine Learning Transforming Threat Detection Capabilities

The integration of artificial intelligence (AI) and machine learning (ML) is poised to revolutionize the threat detection systems market. These technologies enable real-time analysis and adaptive learning, significantly enhancing the ability to predict and identify threats with greater accuracy. AI-driven systems can process vast amounts of data rapidly, identifying patterns and anomalies that would be imperceptible to human analysts. This not only accelerates response times but also reduces false positives, thereby increasing operational efficiency. Companies are investing heavily in AI and ML to bolster their cybersecurity frameworks, recognizing the potential for these technologies to provide a more proactive defense mechanism against evolving cyber threats.

Rising Demand for Biometric Systems Elevates Security Standards Across Industries

The demand for biometric systems is surging as organizations seek to enhance security protocols through more reliable and user-friendly authentication methods. Biometric technologies, such as fingerprint recognition, facial recognition, and iris scanning, offer a higher level of security compared to traditional password-based systems. This trend is expected to accelerate, driven by advancements in biometric accuracy and user acceptance. Sectors such as finance, healthcare, and government are leading the adoption, motivated by the need to safeguard sensitive information and ensure regulatory compliance. The convergence of biometric systems with AI further amplifies their efficacy, providing a robust framework for threat detection and access control.

Regional Analysis

North America dominates the threat detection systems market with a 40% share.

The threat detection systems market exhibits significant regional variation, with North America emerging as the dominant player, accounting for approximately 40% of the global market share. This dominance is driven by substantial investments in cybersecurity infrastructure, advanced technological adoption, and stringent regulatory frameworks aimed at mitigating cyber threats. The United States, in particular, leads with significant contributions from both the public and private sectors.

In Europe, the market benefits from robust data protection regulations such as GDPR, which enhance the demand for advanced threat detection solutions. Countries like Germany, the UK, and France are at the forefront, with substantial investments in enhancing their cybersecurity measures.

Asia Pacific is experiencing rapid growth, propelled by increasing digitalization and a surge in cyber threats. Major economies like China, Japan, and India are heavily investing in threat detection technologies to safeguard their expanding digital landscapes. The region's growth rate is expected to outpace others, driven by ongoing technological advancements and increasing awareness of cybersecurity.

The Middle East & Africa region shows moderate growth, supported by rising investments in smart city projects and critical infrastructure protection. Countries such as the UAE and Saudi Arabia are key contributors.

Latin America, while smaller in market size, is witnessing steady growth driven by increasing cybercrime and subsequent investments in cybersecurity frameworks, particularly in Brazil and Mexico.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Threat Detection Systems market is poised for robust growth, driven by escalating cyber threats and an increasing reliance on digital infrastructures. Key players are pivotal in shaping the landscape through innovation, strategic acquisitions, and expanding their product portfolios.

Cisco Systems (US) remains a dominant force, leveraging its extensive network infrastructure expertise to integrate advanced threat detection capabilities seamlessly. IBM (US) continues to excel with its AI-powered threat intelligence and robust security frameworks, reinforcing its position as a leader in enterprise security solutions.

McAfee (US) maintains a strong market presence with comprehensive cybersecurity offerings, focusing on both consumer and enterprise segments. Trend Micro (Japan) distinguishes itself with specialized solutions targeting specific threats like ransomware and advanced persistent threats (APTs).

AT&T (US) capitalizes on its telecommunications backbone to offer integrated security services, enhancing its competitive edge in network security. Palo Alto Networks (US) is at the forefront with its next-generation firewall technologies and innovative cloud security solutions.

Darktrace (US and UK) utilizes AI and machine learning to provide autonomous threat detection, setting new standards in proactive cybersecurity measures. FireEye (US) continues to be a leader in threat intelligence and incident response, offering critical insights into emerging threats.

Vihaan Networks Limited (VNL) diversifies the market with cost-effective solutions tailored for emerging economies, while AlertLogic (US) provides managed detection and response (MDR) services, appealing to SMEs.

Fortinet (US) remains a formidable player with its broad security fabric, encompassing network, application, cloud, and endpoint security. Collectively, these companies drive innovation and robustness in threat detection systems, ensuring comprehensive protection in an increasingly digital world.

Market Key Players

- Cisco Systems (US)

- IBM (US)

- McAfee (US)

- Trend Micro (Japan)

- AT & T (US)

- Palo Alto Networks (US)

- Darktrace (US and UK)

- FireEye (US)

- Vihaan Networks Limited (VNL)

- AlertLogic (US)

- Fortinet (US)

Recent Development

- In June 2024, Cisco completed its acquisition of Kenna Security, a leading provider of risk-based vulnerability management solutions. This acquisition enhances Cisco's threat detection and response portfolio by integrating Kenna's risk prioritization capabilities, helping organizations focus on the most critical security threats and streamline their remediation processes.

- In March 2024, IBM introduced its QRadar Suite, an upgraded version of its security information and event management (SIEM) system. The new suite incorporates advanced analytics, AI-driven threat intelligence, and automated incident response, significantly improving the speed and accuracy of threat detection and mitigation.

- In January 2024, SentinelOne launched its Singularity XDR platform, an extended detection and response (XDR) solution that integrates AI and machine learning to enhance threat detection and response capabilities. This platform aims to provide comprehensive protection across endpoints, cloud workloads, and identity systems, positioning itself as a leader in the proactive threat detection landscape.

Report Scope

Report Features Description Market Value (2023) USD 6.2 Billion Forecast Revenue (2033) USD 10.4 Billion CAGR (2024-2032) 5.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Deployment (Cloud-Based, Infrastructure-Based), By End-User (BFSI, IT & Communication, Aerospace & Defense, Software Industry, Manufacturing) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Cisco Systems (US), IBM (US), McAfee (US), Trend Micro (Japan), AT & T (US), Palo Alto Networks (US), Darktrace (US and UK), FireEye (US), Vihaan Networks Limited (VNL), AlertLogic (US), Fortinet (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Cisco Systems (US)

- IBM (US)

- McAfee (US)

- Trend Micro (Japan)

- AT & T (US)

- Palo Alto Networks (US)

- Darktrace (US and UK)

- FireEye (US)

- Vihaan Networks Limited (VNL)

- AlertLogic (US)

- Fortinet (US)