Third Party Chemical Distribution Market Report By Product (Commodity Chemicals, Specialty Chemicals, Petrochemicals, Agrochemicals, Pharmaceuticals, Others), By Service Type (Logistics and Transportation, Storage and Warehousing, Packaging and Labeling, Regulatory Compliance Services, Others), By End-User, By Distribution, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

26777

-

March 2024

-

153

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

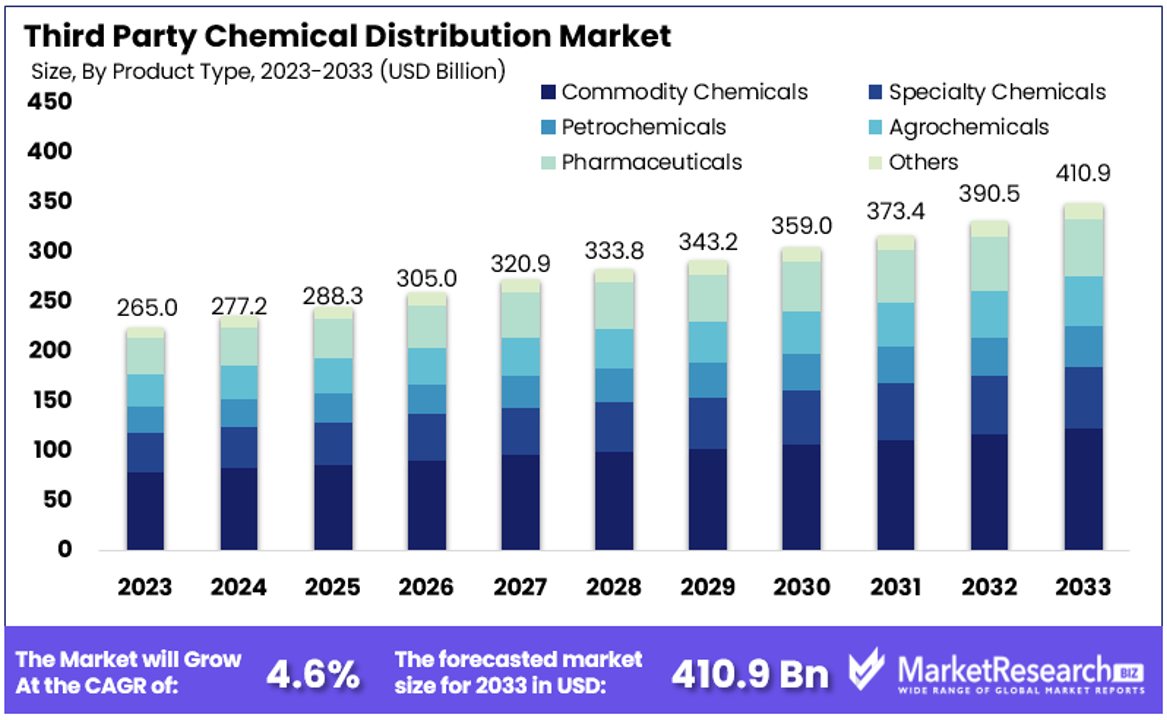

The Global Third Party Chemical Distribution Market size is expected to be worth around USD 410.9 Billion by 2033, from USD 265 Billion in 2023, growing at a CAGR of 4.60% during the forecast period from 2024 to 2033.

The surge in demand for the chemical distributions, rise in chemical distributors and specialised chemical in different industrial verticals that will help in third party chemical distribution market.

Third party chemical distribution includes the sales and distribution of chemicals by an independent supplier that catalyses as an intermediate between chemical manufacturers and end-users.These distributors are also called as the third party distributors, sources, deliver and store, multiple types of chemicals to different industries like manufacturing, agriculture, healthcare and more. They play an important role in streamlining the distribution chain by providing a one-stop solution for procurement requirements.

The third party chemical distributors offer extra services such as storage, regulatory compliance support and logistics. Such model permits manufacturers to aim on productions while leveraging the skills of distributors to effectively reach a wider market. It also offers end-users with access to a multiple samples of chemicals, nurturing flexibility and convenience in providing raw materials for their particular applications.

According to an article published by chemical distributor directory in January 2024, highlights that Nordmann, an international giant in the distribution of specialty chemicals and raw materials have acquired SD chemicals S.r.l. based in Seregno, Italy.

As the present sales are approx. EUR 20 million, SD chemicals provides valuable potentialities and regional professionalism to Nordmann. Moreover, Korinna Moller-Boxberger and Frank haug have took sole ownership of Bodo Moller chemie. Additionally, Haug has steered and advanced the company’s growth till date from a turnover of 6 million euros and 12 employees in 2000 to a world active firm presently with a turnover of 200 million euros and 340 employees globally.

Third party chemical distributors play an important role in improving suppy chain efficacy. They provide manufacturers to streamline the process by making timely access to a multiple range of chemicals. By leveraging their skills in logistics and regulatory compliances, such distributors make the firm to aim on core competencies while taking advantage from a flexible and dependant supply chain.

This approach makes the operation enhanced, cost effective and optimize the market reach for both manufacturers as well as end-users. The demand for the third party chemical distributors will increase due to its requirement for the various chemical distributors that will help in market expansion in the coming years.

Key Takeaways

- Market Value: The Global Third Party Chemical Distribution Market is projected to reach approximately USD 410.9 Billion by 2033, growing at a CAGR of 4.60% from USD 265 Billion in 2023.

- Product Analysis: Commodity Chemicals lead the market, accounting for a significant portion of distribution due to their widespread use across various industries. Other significant segments include Specialty Chemicals, Petrochemicals, Agrochemicals, Pharmaceuticals, and Others, each catering to specific industry demands.

- Service Type Analysis: Logistics and Transportation emerge as the dominant service type, ensuring the timely and safe delivery of chemicals across industries. Storage and Warehousing, Packaging and Labeling, Regulatory Compliance Services, and other services also contribute significantly to the market's operation and growth.

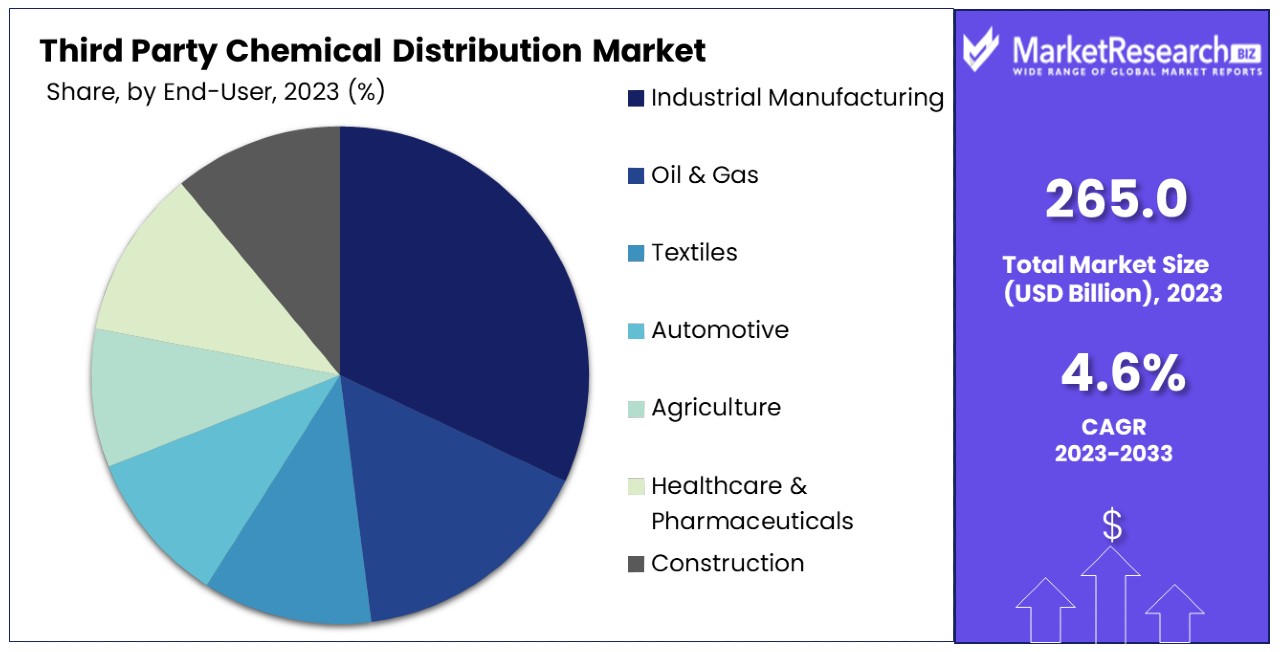

- End-User Analysis: Industrial Manufacturing stands as the dominant end-user segment, reflecting the substantial demand for chemicals in production processes and operations. Other critical sectors include Oil & Gas, Textiles, Automotive, Agriculture, Healthcare & Pharmaceuticals, Construction, Food & Beverages, and Others.

- Distribution Channel Analysis: Direct Distribution is the dominant channel, offering a streamlined approach to chemical distribution, followed by Indirect Distribution and Online Distribution, each contributing uniquely to the market's ecosystem.

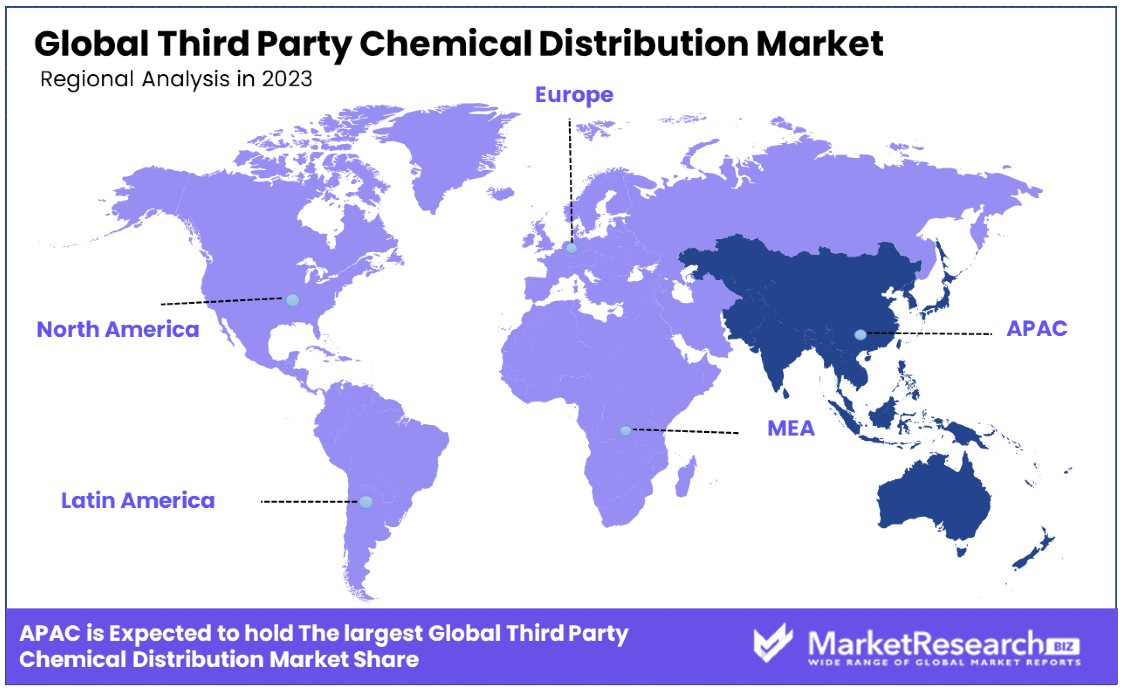

- Regional Dynamics: Asia Pacific (APAC) dominates the Third Party Chemical Distribution Market with a commanding 58.6% market share, driven by industrial expansion, manufacturing activities, and growing demand across diverse sectors.

- Analyst Viewpoint: Analysts anticipate steady growth in the third-party chemical distribution market, driven by increasing industrial activities, technological advancements, and the growing demand for specialized chemical solutions across sectors.

- Growth Opportunities: Opportunities for market growth lie in expanding distribution networks, enhancing service offerings, and adopting digital technologies to improve efficiency and customer experience. With the global emphasis on sustainability and environmental regulations, there is a growing demand for eco-friendly chemical solutions, presenting avenues for innovation and market differentiation.

Driving Factors

Globalization Drives Third Party Chemical Distribution Market Growth

The globalization and expansion of the chemical industry have significantly impacted the growth of the third-party chemical distribution market. With the chemical sector converting raw materials into over 70,000 diverse products and distributing them to more than 750,000 end users across the U.S. alone, the necessity for efficient, reliable distribution channels has never been more critical.

Third-party distributors such as Brenntag and Univar Solutions are at the forefront of this transformation, establishing extensive global networks to meet the surging demand for chemical products. This global reach facilitates trade and ensures market access across continents, making these distributors indispensable to the industry's global value chain. Their ability to bridge geographical and logistical gaps between manufacturers and end-users significantly enhances market accessibility and efficiency, thereby driving market growth.

Outsourcing of Non-Core Activities Enhances Market Efficiency

The trend towards outsourcing non-core activities like distribution and logistics by chemical manufacturers has propelled growth in the third-party chemical distribution market. Leading companies, including BASF and Dow Chemical, have strategically partnered with third-party distributors to enhance their supply chain efficiency.

This shift allows manufacturers to concentrate on their primary competencies, reduce operational costs, and capitalize on the logistical and regulatory expertise of specialized distributors. By leveraging third-party services, manufacturers can navigate complex global markets more effectively, ensuring timely and compliant distribution of their products. This symbiotic relationship not only streamlines operations but also injects agility and flexibility into the supply chain, thereby driving the overall market growth for third-party chemical distribution.

Increasing Demand for Specialty Chemicals Spurs Market Expansion

The escalating demand for specialty chemicals across multiple sectors, such as pharmaceuticals, personal care, and electronics, is a significant growth driver for the third-party chemical distribution market. Specialty chemicals, known for their diverse applications and customizations, require specialized distribution services to reach niche markets and offer technical support. Companies like Univar Solutions and Brenntag have responded by creating specialized divisions focused on the unique needs of the specialty chemicals sector.

With Mainland China and North America being the largest markets for these chemicals, representing significant portions of global demand, the role of third-party distributors is more crucial than ever. They facilitate access to these critical markets and support the intricate supply chain requirements of specialty chemicals manufacturers, further propelling market growth. In 2022, key segments such as specialty polymers, electronic chemicals, and construction chemicals comprised nearly 38% of the market share, underscoring the substantial impact of specialty chemicals on the distribution market's expansion.

Restraining Factors

Consolidation and Competitive Pressures Restrain Market Growth

The third-party chemical distribution market faces significant challenges due to consolidation and competitive pressures. A few large players, like the merged entity of Univar and Nexeo Solutions, dominate the industry, making it tough for smaller companies to enter or expand. This dominance leads to fierce competition and pricing pressures, potentially saturating the market.

Such an environment can discourage new entrants and limit the opportunities for smaller distributors to grow, as they struggle to compete with the resources and reach of the larger entities. This consolidation can stifle innovation and reduce the diversity of services offered to manufacturers and end-users, ultimately restraining market growth.

Stringent Regulatory Environment Restrains Market Growth

Navigating the complex regulatory landscape is a significant hurdle for the third-party chemical distribution market. Regulations governing product safety, transportation, storage, and environmental compliance can vary widely by region, adding layers of complexity to distribution operations. The European Union's REACH regulation exemplifies the stringent compliance requirements that can increase operational costs and complexities for distributors.

Non-compliance can lead to severe consequences, including fines, legal penalties, and reputational damage. These regulatory challenges require distributors to invest heavily in compliance measures, which can limit their growth potential by diverting resources away from market expansion efforts.

Product Analysis

In the third-party chemical distribution market, Commodity Chemicals emerge as the dominant sub-segment. This is primarily due to their widespread use across various industries, including manufacturing, construction, and agriculture.

Commodity chemicals, characterized by their large-scale production and low differentiation, are essential to a vast array of industrial processes, making their distribution critical to the global supply chain. The demand for these chemicals is driven by the overall growth of the industrial sector worldwide, with their distribution efficiency being key to maintaining the operational continuity of numerous industries.

Specialty Chemicals, Petrochemicals, Agrochemicals, Pharmaceuticals, and other chemical categories also play significant roles in the market. Specialty Chemicals, for example, are crucial for their application in high-value industries such as pharmaceuticals, personal care, and electronics. Their complex nature and the need for technical knowledge in handling and application underscore the importance of specialized distribution services. Petrochemicals are foundational to the production of industrial chemicals, plastics, and synthetic materials, influencing demand in markets related to construction, automotive, and consumer goods.

Agrochemicals support the agricultural sector by enhancing crop yield and quality, driving a steady demand for efficient distribution to meet the global food supply needs. Pharmaceuticals, with their critical role in healthcare, require stringent handling, storage, and distribution standards, highlighting the need for distributors with specific expertise and infrastructure. The "Others" category encompasses a broad range of chemicals used in diverse industries, further illustrating the comprehensive scope of the third-party chemical distribution market.

Service Type Analysis

Within the realm of service types in the third-party chemical distribution market, Logistics and Transportation stands out as the dominant sub-segment. This pivotal role is attributed to the essential nature of these services in ensuring the timely and safe delivery of chemicals from manufacturers to end-users across diverse industries. The efficiency of logistics and transportation directly impacts the supply chain's reliability, affecting manufacturers' ability to meet market demand and maintain production schedules.

Storage and Warehousing, Packaging and Labeling, Regulatory Compliance Services, and other service offerings, while not dominant, are integral to the market's operation and growth. Storage and Warehousing are critical for managing inventory, ensuring the quality and safety of chemicals before their final delivery. This segment demands specialized facilities and management systems to comply with safety and environmental regulations.

Packaging and Labeling services are vital for meeting industry standards and consumer safety requirements, involving the correct identification, handling, and use information for chemical products. Regulatory Compliance Services have become increasingly important as the global regulatory landscape becomes more complex.

Distributors offering these services help clients navigate these complexities, ensuring compliance with local and international regulations. Other services, including custom blending, technical support, and waste management, address specific customer needs, adding value to the third-party distribution model.

End-User Analysis

In the landscape of the third-party chemical distribution market, Industrial Manufacturing asserts itself as the dominant sub-segment. This dominance is anchored in the sheer volume and diversity of chemicals required by this sector, encompassing a wide range of applications from production processes to maintenance and safety operations.

Industrial manufacturing relies heavily on a steady supply of both commodity and specialty chemicals to maintain production efficiency, uphold quality standards, and innovate product offerings. The demand in this segment is fueled by the global expansion of manufacturing activities, particularly in emerging economies where industrial development is a key driver of economic growth.

The roles of other end-user segments such as Oil & Gas, Textiles, Automotive, Agriculture, Healthcare & Pharmaceuticals, Construction, Food & Beverages, and Others, are also critical to the market's diversity and resilience. The Oil & Gas industry, for example, requires specialized chemicals for exploration, production, and refining processes, contributing significantly to the demand for distribution services. The Textiles and Automotive sectors depend on chemicals for materials processing and production, driving further growth in the distribution market.

Agriculture's need for chemicals, primarily in the form of agrochemicals, supports global food production and security, highlighting the sector's importance. Healthcare & Pharmaceuticals, especially in the wake of global health challenges, underscore the critical need for precise and reliable chemical distribution to support drug manufacturing and research. Construction, Food & Beverages, and other sectors each have unique chemical requirements that support not only their operational needs but also compliance with safety and environmental standards, contributing to the comprehensive demand landscape faced by third-party chemical distributors.

Distribution Channel Analysis

The Third Party Chemical Distribution Market is significantly characterized by its distribution channels, among which Direct Distribution emerges as a dominant sub-segment. Direct distribution enables manufacturers to establish a direct pipeline to end-users, ensuring that specific requirements are met with precision and efficiency. This model is favored for its ability to maintain the integrity of the supply chain, minimize delays, and optimize costs, providing a streamlined approach to chemical distribution that benefits both suppliers and consumers.

Indirect Distribution, through wholesalers, retailers, etc., plays a vital role in extending market reach, especially in regions or sectors where direct distribution may not be feasible or cost-effective. This channel leverages existing networks and relationships to facilitate access to markets that might otherwise be inaccessible, enabling manufacturers to tap into new customer bases and expand their market footprint.

Online Distribution, as an emerging sub-segment, capitalizes on digital transformation trends within the industry. Offering convenience, scalability, and access to a broader market, online distribution platforms are becoming increasingly popular among both suppliers and buyers. This channel supports the distribution market's growth by enabling efficient order processing, visibility, and tracking, which are essential for managing the complex logistics associated with chemical distribution.

Each distribution channel contributes uniquely to the market's overall ecosystem, catering to different needs, preferences, and strategic objectives of chemical manufacturers and their end-users. The dominance of direct distribution underscores the value placed on efficiency and control within the supply chain, while the roles of indirect and online distribution highlight the market's adaptability and responsiveness to evolving industry dynamics and technological advancements.

Key Market Segments

By Product

- Commodity Chemicals

- Specialty Chemicals

- Petrochemicals

- Agrochemicals

- Pharmaceuticals

- Others

By Service Type

- Logistics and Transportation

- Storage and Warehousing

- Packaging and Labeling

- Regulatory Compliance Services

- Others

By End-User

- Industrial Manufacturing

- Oil & Gas

- Textiles

- Automotive

- Agriculture

- Healthcare & Pharmaceuticals

- Construction

- Food & Beverages

- Others

By Distribution Channel

- Direct Distribution

- Indirect Distribution (through wholesalers, retailers, etc.)

- Online Distribution

Growth Opportunities

Specialized Value-Added Services Offer Growth Opportunity

Offering specialized value-added services presents a significant growth opportunity for third-party chemical distributors. By providing services beyond mere distribution, such as technical support, formulation development, regulatory compliance assistance, and supply chain optimization, distributors can deeply embed themselves into the value chain of their customers.

This approach not only enhances customer loyalty through differentiated offerings but also enables distributors to command higher margins. Companies like IMCD and Azelis exemplify this strategy by catering to niche markets like pharmaceuticals and personal care with tailored services. These value-added services address specific customer needs, creating strong partnerships and opening new revenue streams. In an increasingly competitive market, the ability to offer such specialized services is a key differentiator that can drive growth and market share gains.

Digital Transformation and E-Commerce Platforms Offer Growth Opportunity

The embrace of digital transformation and e-commerce platforms is a major growth avenue for third-party chemical distributors. This digital shift enables distributors to streamline their operations, from inventory management to customer service, offering a more efficient and user-friendly experience. Digital tools and online sales platforms expand market reach, allowing distributors to access new customers and regions with lower entry barriers.

Univar Solutions' investment in digital initiatives, including an e-commerce platform and advanced analytics, showcases the potential for these technologies to revolutionize the chemical distribution landscape. By adopting digital strategies, distributors can enhance operational efficiency, improve customer satisfaction, and capitalize on the growing trend of online purchasing, thus driving market expansion and competitive advantage.

Trending Factors

Sustainability and Responsible Distribution Are Trending Factors

The increasing focus on sustainability and responsible distribution is a significant trend in the third-party chemical distribution market. Distributors are actively adopting environmentally friendly practices such as optimizing transportation routes, minimizing waste, and ensuring the safe handling and disposal of chemicals.

Companies like Brenntag and Univar Solutions are leading this trend by establishing comprehensive sustainability initiatives and reporting frameworks. This shift not only reflects a commitment to environmental stewardship but also aligns with growing customer and regulatory demands for sustainable business practices. By prioritizing sustainability, distributors can enhance their brand reputation, meet compliance requirements, and appeal to a broader customer base, driving market differentiation and potential expansion.

Digitalization and Supply Chain Visibility Are Trending Factors

Digitalization and enhanced supply chain visibility represent key trending factors within the third-party chemical distribution market. The adoption of digital technologies and data analytics tools allows for real-time tracking of shipments, improved inventory management, and predictive analytics. These advancements enable distributors to optimize operations, reduce operational costs, and deliver superior customer service.

The trend towards digitalization is driven by the need for more efficient, transparent, and responsive supply chains, especially in a market characterized by complex logistics and regulatory requirements. By embracing digital technologies, distributors can gain a competitive edge, fostering growth and expanding their market presence.

Mergers and Acquisitions Are Trending Factors

Mergers and acquisitions continue to shape the landscape of the third-party chemical distribution market, serving as a prominent trend. This strategy enables major players to quickly expand their product portfolios, geographic reach, and service capabilities by acquiring smaller regional distributors or specialized companies.

The acquisition of Nexeo Solutions by Univar Solutions in 2019 is a prime example of how consolidation can create a leading position in the global chemical and ingredients distribution sector. These strategic moves not only enhance market coverage and service offerings but also enable companies to achieve economies of scale, improve efficiency, and strengthen market competitiveness, marking mergers and acquisitions as a pivotal trend driving industry evolution.

Regional Analysis

Asia Pacific Dominates with 58.6% Market Share

The Asia Pacific region stands out with a commanding 58.6% share of the Third Party Chemical Distribution Market, underpinned by several key factors. Rapid industrialization, significant investments in the chemical sector, and the expanding manufacturing base, particularly in China and India, drive this dominance.

The region's commitment to becoming a global manufacturing hub has resulted in increased demand for chemicals across various industries, including automotive, construction, electronics, and pharmaceuticals. Additionally, the presence of a vast and growing consumer base supports the demand for end-use products, further fueling the need for chemical distribution services.

Market dynamics in Asia Pacific are influenced by its large geographic area, diverse economies, and varying levels of market maturity. The region's extensive supply chain network, strategic port locations, and investments in infrastructure also contribute to its leading position. The development of specialized parks and zones for chemical manufacturing and the region's policy environment supporting industrial growth play a significant role.

Regional Market Share and Growth Rates:

- North America: Holding approximately 20% of the market share, North America's growth is propelled by advanced manufacturing sectors and stringent regulatory standards, driving the demand for specialized chemical distribution services.

- Europe: Europe accounts for around 14.4% of the market share, with its strong emphasis on sustainability and high-quality standards in chemical manufacturing and distribution.

- Middle East & Africa: This region, with a smaller share at about 4%, is experiencing growth due to expanding oil and gas sectors and industrial development initiatives.

- Latin America: Representing about 3% of the market share, Latin America's growth is driven by its agricultural and mining sectors, necessitating efficient chemical distribution networks.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Third Party Chemical Distribution Market is characterized by a dynamic mix of global giants and regional specialists, each contributing uniquely to the industry's landscape. Companies like Univar Solutions Inc., Brenntag SE, and Brenntag North America lead the market with their extensive global networks, comprehensive product portfolios, and innovative service offerings. These players have established strong strategic positions through their focus on sustainability, digital transformation, and value-added services, significantly influencing market trends and standards.

On the other hand, regional players such as Protea Chemicals, ICC Industries Inc., and Reda Chemicals play crucial roles in catering to specific regional demands and market nuances. These companies leverage their local expertise and tailored service offerings to meet the unique needs of their respective markets, providing critical support to the global supply chain.

Emerging players like Barentz International BV, Manuchar NV, and Jebsen & Jessen Pte. are distinguishing themselves through specialized services and strategic expansions into niche markets, further diversifying the competitive landscape. Similarly, companies focused on specific sectors or services, such as Aik Moh Group and Wilbur Ellis Holdings Inc., underscore the market's breadth, catering to the precise requirements of various industry segments.

The collective impact of these key players on the Third Party Chemical Distribution Market is profound, driving innovation, efficiency, and sustainability across the global chemical industry. Their strategic positioning, from global expansion to niche market penetration, shapes the industry's direction and growth potential, underscoring their vital role in the market's ecosystem.

Market Key Players

- Protea Chemicals

- ICC Industries Inc.

- Biesterfeld AG

- Reda Chemicals

- Univar Solutions Inc.

- Barentz International BV

- Manuchar NV

- Brenntag SE

- Brenntag North America

- Jebsen & Jessen Pte.

- Aik Moh Group

- Wilbur Ellis Holdings Inc.

Recent Developments

- BTC Europe and Sudarshan Chemical Industries have signed an agreement for the distribution of pigments in Europe. This collaboration allows BTC Europe to offer a wider range of organic, inorganic, and effect pigments across Europe, enhancing their product offerings for various industries.

- On Nov 2023, LyondellBasell has expanded with a new distribution hub in the United Kingdom to enhance customer experience by reducing lead times on orders and providing faster access to products. This strategic move is part of the company's commitment to improving customer service and leveraging its global asset footprint.

- In July 2023, ChemCeed has successfully passed the NACD Responsible Distribution® Verification, demonstrating its commitment to health, safety, security, environmental, and sustainability performance. This verification reaffirms ChemCeed's dedication to the health, safety, and security of their employees, communities, and the environment.

Report Scope

Report Features Description Market Value (2023) USD 265 Billion Forecast Revenue (2033) USD 410.9 Billion CAGR (2024-2033) 4.60% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Commodity Chemicals, Specialty Chemicals, Petrochemicals, Agrochemicals, Pharmaceuticals, Others), By Service Type (Logistics and Transportation, Storage and Warehousing, Packaging and Labeling, Regulatory Compliance Services, Others), By End-User (Industrial Manufacturing, Oil & Gas, Textiles, Automotive, Agriculture, Healthcare & Pharmaceuticals, Construction, Food & Beverages, Others), By Distribution Channel (Direct Distribution, Indirect Distribution (through wholesalers, retailers, etc.), Online Distribution) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Protea Chemicals, ICC Industries Inc., Biesterfeld AG, Reda Chemicals, Univar Solutions Inc., Barentz International BV, Manuchar NV, Brenntag SE, Brenntag North America, Jebsen & Jessen Pte., Aik Moh Group, Wilbur Ellis Holdings Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Univar

- Brenntag

- HELM

- Nexeo Solutions

- IMCD

- Azelis

- Biesterfeld

- ICC Chemical

- Jebsen & Jessen

- Stockmeier Chemie