Tapioca Market By Types(Fresh, Dried), By Uses(Thickening Agent, Stabilizer Agent, other), By Application(Food, Beverage, other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

30188

-

Jul 2023

-

170

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

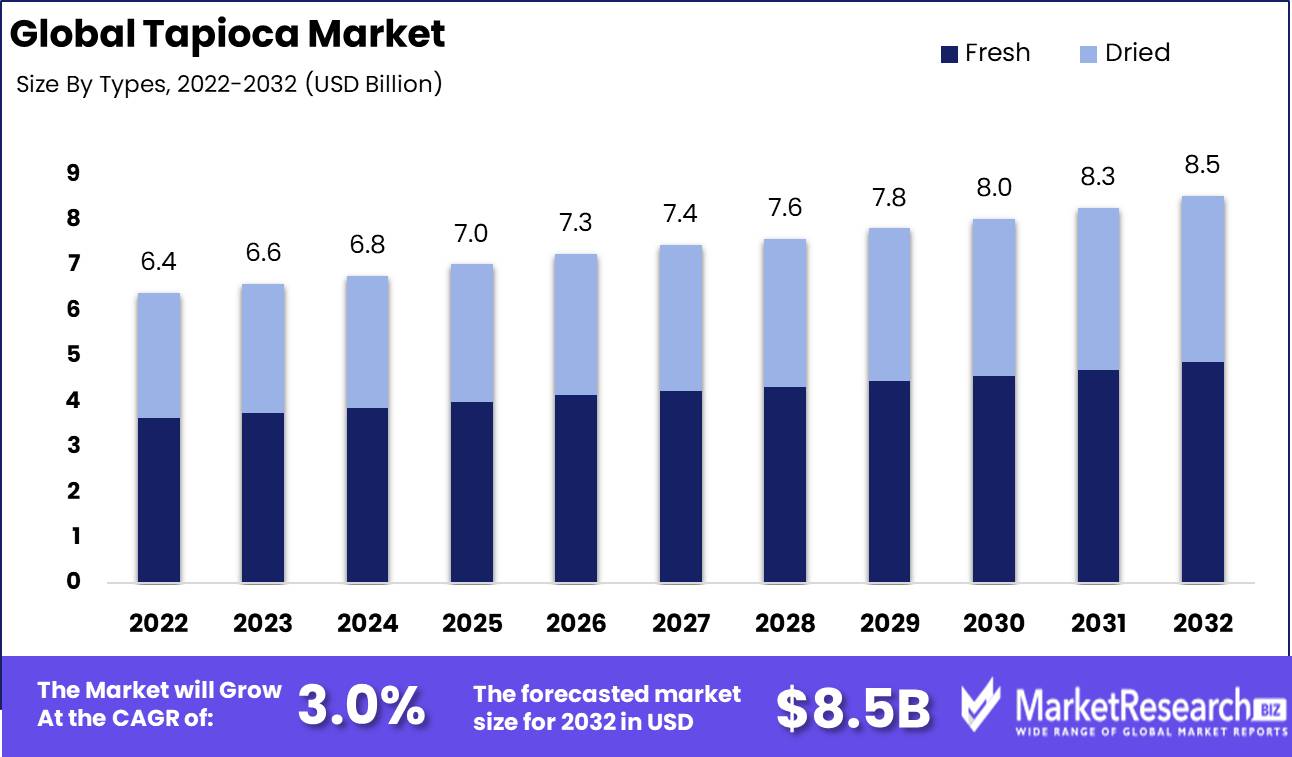

Tapioca Market size is expected to be worth around USD 8.5 Bn by 2032 from USD 6.4 Bn in 2022, growing at a CAGR of 3.0% during the forecast period from 2023 to 2032.

The global tapioca market is driven by the rising demand for natural, gluten-free, and low-calorie food products. Tapioca, which is derived from the cassava plant's root, is used in a variety of food products, including chips, noodles, and frozen desserts. In addition, it is utilized in the production of non-food products such as textiles and paper. Tapioca starch and tapioca chips are categorized separately in order to obtain a comprehensive understanding of the market. The market for tapioca starch includes both moist and dry starch, whereas the market for tapioca chips includes chips, pellets, and flour.

Tapioca, also known as cassava, is a substitute for wheat flour that is gluten-free, low in cholesterol, and low in calories. The goal of the tapioca market is to produce high-quality tapioca starch and chips that satisfy the needs of multiple industries, including the food and beverage, textile, and pharmaceutical sectors. The tapioca market seeks to provide a sustainable and healthy alternative to traditional food and non-food products.

Numerous benefits are associated with the tapioca market. First, tapioca is a gluten-free and low-calorie alternative to traditional wheat flour, meeting the requirements of those with dietary restrictions. In addition, tapioca is a sustainable crop that can be cultivated in tropical regions, making it an eco-friendly option. Moreover, tapioca offers a low-fat and low-sodium alternative to snack foods such as chips, thereby promoting healthier eating habits. It can be utilized in a variety of products, such as noodles, sauces, and desserts, thereby contributing value to multiple industries.

Driving factors

Increasing Demand for Tapioca Pearls in Bubble Tea

Bubble tea has become a globally ubiquitous beverage, especially among younger demographics. A key component of bubble tea, tapioca pearls, also known as boba, give the beverage a chewy texture and improve the sipping experience. In recent years, the demand for bubble tea has increased considerably, leading to a corresponding increase in demand for tapioca pearls.

Increasing Interest in natural and clean-label products

Today's consumers are increasingly concerned with the ingredients and processing methods of the foods and beverages they consume. They seek natural and pure-label products devoid of synthetic additives and chemicals. Tapioca, a natural ingredient derived from cassava roots, fits this trend well. Tapioca-based products are frequently perceived as healthier and more natural alternatives, which has contributed to their increased demand.

Expanding Vegan and Plant-Based Diets

In recent years, the adoption of vegan and plant-based diets has increased significantly for a variety of factors, including health, environmental concerns, and ethical considerations. Tapioca is a versatile plant-based ingredient that can be used in a variety of vegan and plant-based preparations. It functions as a thickener, binder, and egg substitute, making it a desirable ingredient for those who adhere to these dietary restrictions.

Increasing Disposable Income and Lifestyle Change

Increasing disposable incomes and a shift in lifestyles have influenced the preferences and purchasing patterns of consumers. With increased disposable income, consumers are more willing to investigate novel food and drink options. With their distinct texture and versatility, tapioca-based products offer a novel and pleasurable eating experience. In addition, tapioca is frequently used in products that appeal to the busy and fast-paced lifestyles of modern consumers.

Growth of the International Food Trade

The globalization of the food trade has facilitated the entry of a vast array of ingredients and products, including tapioca, into new markets. Significant agricultural production of tapioca occurs predominantly in Thailand, Vietnam, Brazil, and Nigeria. The convenience of transportation and the international trade network has made it possible for tapioca to be used in many different ways. This has contributed to the development of the tapioca market by increasing awareness and demand for tapioca-based products in new markets.

Restraining Factors

Limited Access to Primary Materials

Tapioca is derived from the roots of cassava, which are cultivated in particular regions. There may be restrictions on the availability of high-quality cassava roots. For instance, unfavorable climate conditions, such as drought or excessive rainfall, can have a negative impact on cassava cultivation, resulting in lower yields and decreased raw material availability. Furthermore, parasites, diseases, and agricultural practices can have an effect on the quality and quantity of cassava crops. These restrictions on the availability of basic materials may hinder the expansion of the tapioca market.

Price Fluctuation

Due to a number of factors, tapioca prices can be subject to significant fluctuations. Changes in domestic and international demand can influence tapioca prices. For instance, if the demand for tapioca rises, prices may rise due to the limited availability of cassava roots and increased customer competition. Alternatively, if demand decreases or if alternative carbohydrates become more desirable, tapioca prices may fall. In addition, supply disruptions due to weather conditions, such as flooding or droughts, or global market dynamics can contribute to price volatility. This price volatility makes it difficult for tapioca processors and merchants to manage their operations, make financial projections, and devise pricing strategies.

Types Analysis

The Fresh Segment, which consists of newly harvested and processed tapioca, has dominated the tapioca market. In recent years, this segment has experienced substantial growth due to its numerous health benefits and culinary versatility. In the coming years, the market for fresh tapioca is anticipated to maintain its dominance, propelling the significant adoption of this segment in emerging economies.

With the rise of economic development in emerging economies, the demand for fresh tapioca has increased. Freshly harvested and processed tapioca has numerous health benefits and is a staple ingredient in many cuisines, particularly in Southeast Asia. Changing culinary preferences of a growing middle-class population and an increase in disposable incomes have fueled the rising demand for fresh tapioca, which now dominates the market.

As a healthful and cost-effective food option, consumer trends and behavior toward the Fresh Segment have been quite positive. In addition to being popular in emerging economies, the segment has also established a loyal customer base in industrialized nations. Globally increasing demand for fresh tapioca and its products has also been influenced by consumers' growing awareness of the importance of consuming healthy and organic foods.

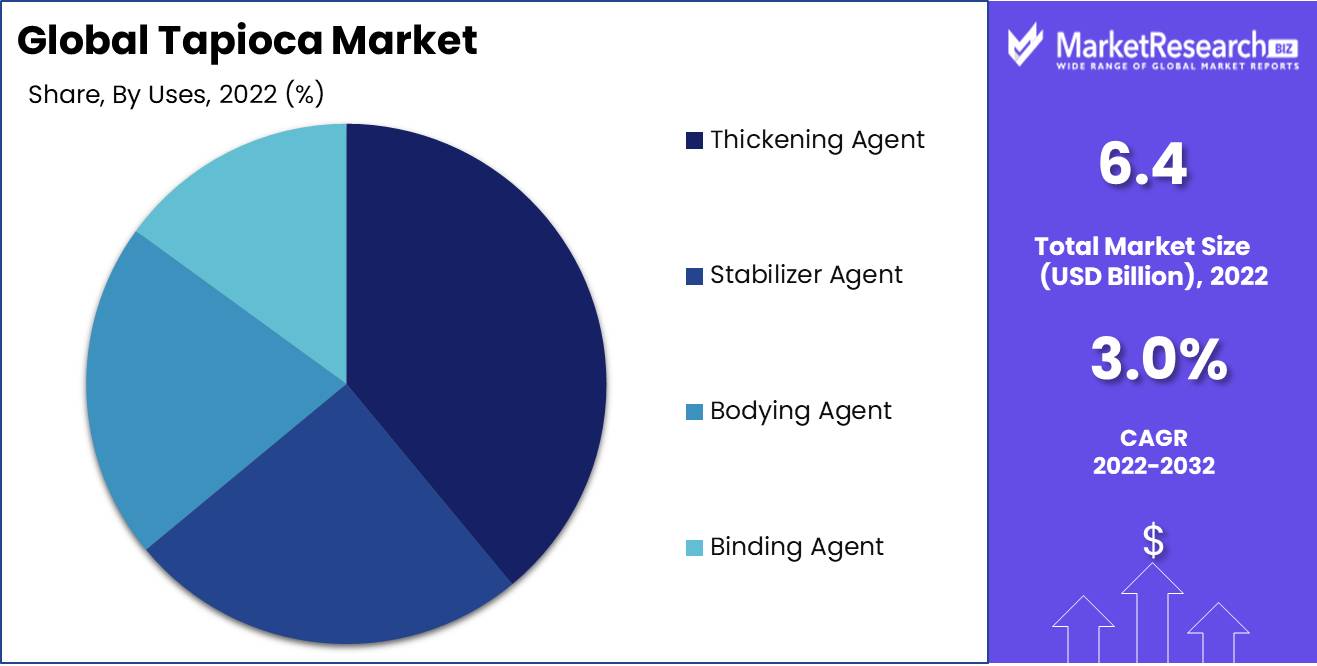

Uses Analysis

The Thickening Agent Segment dominates the tapioca market, which serves the food and beverage, pharmaceutical, and textile industries. The versatility and ability of the thickening agent to improve the texture, stability, and viscosity of various products have contributed to its market dominance. The segment is anticipated to experience the highest growth rate in the future years, fueled by economic expansion in emerging markets.

The Thickening Agent Segment's market dominance is due to its extensive applications in numerous industries. Due to its ability to improve texture, viscosity, and stability, it has become a crucial component in numerous processed foods and beverages. In addition, its use as a binder in the pharmaceutical, textile, and paper industries has contributed to its popularity.

The adaptability of the Thickening Agent to various products and applications has made it a worldwide preference among consumers. Its widespread use in products ranging from salad dressings to ice creams, beverages, and preserves has increased its global demand.

Application Analysis

The Food Segment dominates the global tapioca market due to its extensive use in Food products. Tapioca is predominantly employed as a component in starch, flour, and other food products. In the approaching years, the Food Segment is anticipated to record the highest growth rate, driven by economic expansion in emerging economies.

The Food Segment's market dominance is a result of tapioca's widespread use in various cuisines, particularly in Southeast Asia. Numerous culinary items, including bread, noodles, chips, and pudding, are made with tapioca. Tapioca is prominent in the food industry due to its versatility.

Due to the healthy and nutritive value that tapioca contributes to various food products, the trend and behavior of consumers towards the Food Segment have been quite favorable. The rising demand for organic and natural foods has also increased the food industry's demand for tapioca, resulting in the expansion of this market segment.

Key Market Segments

By Types

- Fresh

- Dried

By Uses

- Thickening Agent

- Stabilizer Agent

- Bodying Agent

- Binding Agent

By Application

- Food

- Beverage

- Textile

- Glue

- Pharmaceutical

- Cosmetics

- Mining

Growth Opportunity

Increasing Tapioca Processing Capacity

The demand for tapioca products is growing at an alarming rate, and the traditional methods of processing the product may not be adequate to meet this demand. To increase the supply of tapioca products to meet the growing global demand, new and innovative processing facilities are required. By modernizing existing facilities and constructing new ones, producers can rapidly increase output and reduce production costs, allowing them to offer more competitive prices.

To New Markets: Exporting Tapioca

Exporting tapioca to new markets is a fantastic opportunity for businesses in the industry to expand their consumer base and increase their revenue. Certain nations lack cassava or other carbohydrates, and tapioca is an excellent substitute for these traditional products. Businesses must identify these new markets and investigate the possibility of exporting their products there.

Creating New Tapioca-Based Items

Innovation is a crucial aspect of the tapioca market, and there is still a great deal of unexplored potential for the development of new and innovative tapioca-based products. Food manufacturers and processors must invest in research and development in order to produce new products that can meet the shifting demands of consumers. Tapioca has a distinct texture and can be incorporated into a variety of food products that appeal to diverse tastes and preferences.

Expanding Tapioca Production to Meet Demand

Increasing tapioca cultivation is essential to sustaining the market's growth and expansion. Tapioca production must increase substantially in order to meet the growing global demand for tapioca products. Businesses must invest in land and agronomic technology to increase tapioca yield and production.

Product Partnerships in Collaboration with Food Companies

Collaboration with food companies provides businesses in the tapioca market with a unique opportunity to increase revenue and expand their reach. Food manufacturers and processors can collaborate with tapioca producers to create novel tapioca-based products that appeal to a variety of consumer preferences. The partnership can capitalize on the strengths and capabilities of both enterprises, thereby benefiting both parties.

Latest Trends

Expanding Tapioca Cultivation and Manufacturing

The tapioca cultivation and processing industries are expanding at an exceptional rate. This is due to the increasing demand for tapioca as a food ingredient and tapioca's adaptability. It can be utilized in a variety of forms, including flakes, flour, pearls, and stalks, making it a crucial component in numerous food products.

Due to a number of factors, including technological advancements, government incentives, and the availability of land, the tapioca cultivation and processing industries have experienced a significant expansion. These factors have made tapioca cultivation simpler and more cost-effective for producers, resulting in an increase in tapioca production.

Demand Increases for Convenient and Ready-to-Eat Foods

Due to consumers' hectic lifestyles, there is a growing demand for convenient food products that are ready to ingest. This trend has affected the tapioca market because tapioca can be used to make convenient and simple-to-prepare food products.

Tapioca pearls are a prevalent ingredient in bubble tea, which is gaining popularity worldwide. The tapioca pearls lend a chewy texture to the beverage, making it fun and enjoyable. In addition, tapioca flour is used to produce snacks such as chips and crackers, providing consumers with convenient and delicious snack options.

Increasing Demand for Tapioca-Based Traditional and Street Foods

Tapioca-based traditional and street food are growing in popularity worldwide. Tapioca dishes, such as tapioca noodles, pastries, and cakes, are ingested daily in countries such as Thailand and Vietnam.

The growing number of street food stands and vehicles that offer tapioca-based dishes is evidence of their popularity. In addition, the growing popularity of food trucks and street vendors in the West presents an opportunity for tapioca-based street foods to acquire traction in this market.

Regional Analysis

The Asia-Pacific region is extremely dominant in the tapioca market. With countries like Thailand, Vietnam, Indonesia, and India at the forefront, this region has a significant impact on the global tapioca industry. This market is dominated by the Asia-Pacific region due to a number of factors, including favorable climatic conditions, an established infrastructure, and a high demand for tapioca-based products.

Asia-Pacific's prominence in the tapioca market is largely attributable to the profusion of tapioca production in the region. These countries have ideal climate and soil conditions for tapioca cultivation. The combination of a mild, humid climate and well-irrigated land is ideal for the cultivation of tapioca. As a result, this region produces immense quantities of high-quality tapioca to meet domestic and international demand.

The Asia-Pacific region has a well-established tapioca refining and exporting infrastructure. These countries have invested in modern processing facilities to guarantee productive production and preserve product quality. The processing facilities are outfitted with sophisticated equipment for extracting starch from tapioca roots, resulting in superior tapioca products that meet international standards.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The tapioca market is dominated by a handful of large corporations, including Ebro Foods, Ingredion, Cargill, and Archer Daniels Midland (ADM). In order to enhance the quality of the product, the company has invested heavily in its research and development department.

Ebro Foods, a Spanish food corporation, is the world's largest producer of rice and also has a substantial presence in the tapioca market. It offers a variety of tapioca products, including starch, flour, and pearls, through its subsidiaries, which include Riviana Foods and Tilda.

Ingredion, a corporation headquartered in the United States, is one of the largest producers of specialty ingredients for the food, beverage, and industrial markets. It has a strong presence in the tapioca market and offers an extensive selection of tapioca-based products, including modified polysaccharides, sweeteners, and crosslinked derivatives.

Cargill, a multinational agribusiness corporation, is a significant participant in the tapioca market with a strong emphasis on sustainability and responsible sourcing. It offers a variety of tapioca-based products, including native and modified starches, and invests in local communities to aid smallholder producers.

Top Key Players in Tapioca Market

- Ebro Foods

- Ingredion

- Archer Daniels Midland (ADM)

- Cargill Inc.

- Tate & Lyle Plc.

- Emsland-Starke GmbH

- Navin Chemicals

- Pruthvi’s Foods Pvt. Ltd.

- Vaighai Agro Products Ltd.

- Sonish Starch Technology Co. Ltd.

- American Key Food Products

- Varalakshmi Starch Industries Pvt. Ltd.

Recent Development

- In 2023, Boba Co., a prominent player in the tapioca market, announced a substantial expansion of its tapioca production capacity. The company invested in cutting-edge processing equipment and infrastructure to satisfy the increasing global demand for tapioca products. This expansion is anticipated to strengthen Boba Co.'s position as a leading player in the tapioca industry and increase its market presence.

- In 2022, Popular tapioca brand Tapioca Delights introduced a new line of flavored tapioca pearls. These innovative products included strawberry, mango, matcha, and coconut varieties in an effort to satisfy the diverse tastes of tapioca enthusiasts. The introduction of flavored tapioca pearls by Tapioca Delights contributed to the market's diversification and the company's expansion by attracting new consumers.

- In 2021, Tapioca King, a renowned tapioca manufacturer, partnered with local producers to promote the sustainable procurement of tapioca raw materials. The company instituted programs to assist farmers in adopting environmentally friendly methods, ensuring the cultivation of tapioca crops in a responsible manner. Not only did Tapioca King's commitment to sustainability have a positive effect on the environment, but it also enhanced the company's reputation among eco-conscious consumers.

- In 2023, Global Tapioca Corporation, a prominent player in the tapioca market, announced its expansion into international markets in 2023. The company established distribution networks in multiple nations, allowing it to reach new consumers globally. This strategic move enabled Global Tapioca Corporation to enter into expanding tapioca markets outside of its domestic base and capitalize on the rising global demand for tapioca-based products.

Report Scope

Report Features Description Market Value (2022) USD 6.4 Bn Forecast Revenue (2032) USD 8.5 Bn CAGR (2023-2032) 3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Types Fresh

DriedBy Uses

Thickening Agent

Stabilizer Agent

Bodying Agent

Binding AgentBy Application

Food

Beverage

Textile

Glue

Pharmaceutical

Cosmetics

MiningRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ebro Foods, Ingredion, Archer Daniels Midland (ADM), Cargill Inc., Tate & Lyle Plc., Emsland-Starke GmbH, Navin Chemicals, Pruthvi’s Foods Pvt. Ltd., Vaighai Agro Products Ltd., Sonish Starch Technology Co. Ltd., American Key Food Products, Varalakshmi Starch Industries Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Ebro Foods

- Ingredion

- Archer Daniels Midland (ADM)

- Cargill Inc.

- Tate & Lyle Plc.

- Emsland-Starke GmbH

- Navin Chemicals

- Pruthvi’s Foods Pvt. Ltd.

- Vaighai Agro Products Ltd.

- Sonish Starch Technology Co. Ltd.

- American Key Food Products

- Varalakshmi Starch Industries Pvt. Ltd.