System on Chip (SoC) Market By Type(Analog, Digital), By End-Use Industry(Automotive, Aerospace and Defense, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

22562

-

Jul 2023

-

167

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

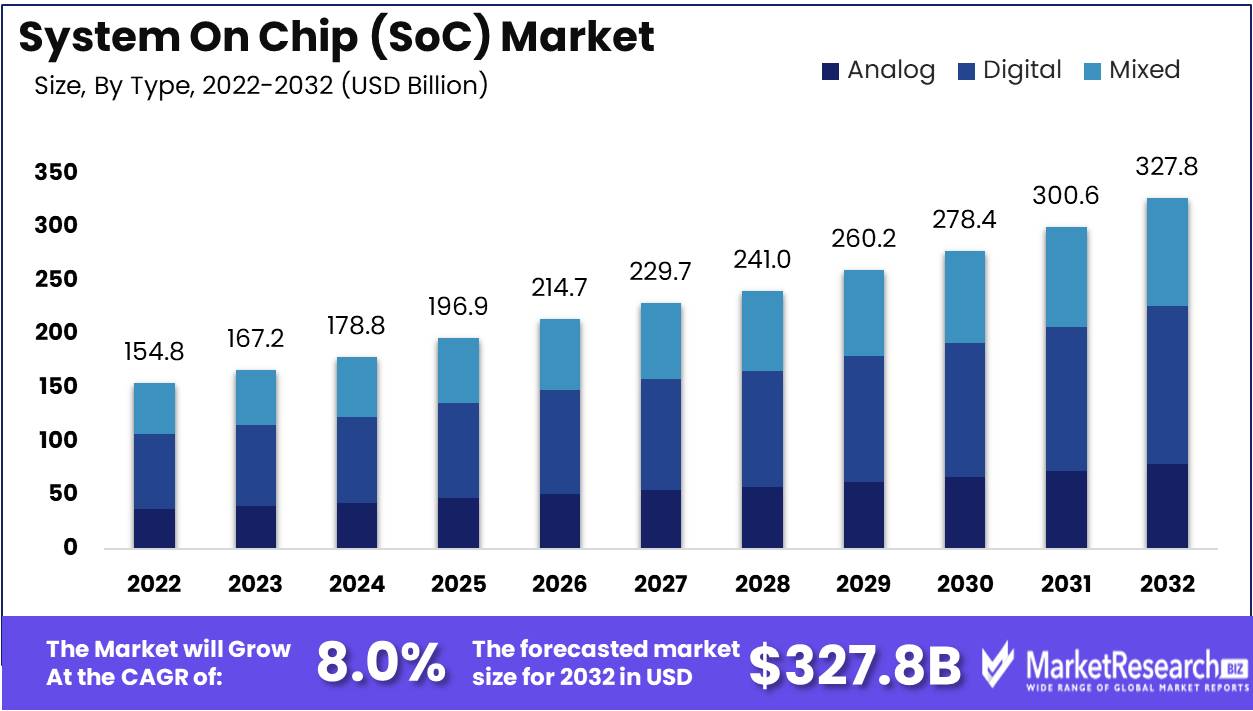

System on Chip (SoC) Market size is expected to be worth around USD 327.8 Bn by 2032 from USD 154.8 Bn in 2022, growing at a CAGR of 8.0% during the forecast period from 2023 to 2032.

In the rapidly evolving world of technology, the System on Chip (SoC) market has become increasingly essential. SoC has emerged as a vital solution for meeting the increasing demand for smaller, faster, and more energy-efficient electronic devices. By integrating multiple components onto a single processor, System-on-a-processor (SoC) enables the development of compact and power-efficient devices, thereby revolutionizing the industry.

SoC's ability to reduce the complexity and cost of electronic systems is one of its chief benefits. By integrating multiple components onto a single chip, SoC reduces system complexity and manufacturing costs by eliminating the need for distinct chips and associated interconnects. This not only simplifies the design process but also allows for a quicker time to market, allowing companies to deliver innovative products to consumers faster.

In recent years, the System on Chip (SoC) market has witnessed significant innovation, driven by advances in semiconductor technology. These advancements have resulted in the development of highly integrated SoCs with enhanced performance, decreased power consumption, and increased functionality. For instance, the introduction of advanced process technologies such as FinFET and silicon-on-insulator (SOI) has facilitated the integration of more transistors onto a single chip, thereby enabling the development of potent and energy-efficient SoCs.

The increasing demand for SoCs has attracted significant investments from companies in a variety of industries. From consumer electronics to automotive, healthcare to aerospace, companies are incorporating SoCs into their products and services to gain a competitive advantage and meet their customers' evolving needs. SoCs are used to power advanced driver-assistance systems (ADAS) and autonomous vehicles in the automotive industry, facilitating safer and more efficient transportation.

The System on Chip (SoC) market is poised for significant growth in the coming years, driven by the increasing adoption of Internet of Things (IoT) devices, the advent of 5G technology, and the demand for artificial intelligence (AI)-powered applications. SoCs' ability to integrate multiple functionalities, such as sensing, processing, and communication, makes them an essential component of IoT devices. The deployment of 5G networks is anticipated to increase the demand for high-performance SoCs, as these chips will be required to manage the higher data rates and lower latency associated with 5G. Moreover, the demand for AI-powered applications, such as voice recognition, image processing, and natural language processing, necessitates SoCs with real-time performance and minimal power consumption.

Driving factors

Demand for Integrated and Compact Electronic Devices Is Growing

Due to the technological nature of the contemporary world, the demand for integrated and compact electronic devices continues to rise. From smartphones to wearable technology, consumers desire devices with convenience, versatility, and advanced functionality. This surge in demand is primarily attributable to the rapid advancements in technology, with companies constantly stretching their limits to produce smaller, more powerful devices.

As the consumer electronics industry continues to expand, the demand for compact and integrated electronic devices grows. No longer do consumers accept cumbersome and burdensome devices that limit their mobility. Instead, they seek sleek and efficient devices that cater to their mobile lifestyle. The demand for such devices spans multiple industries, including personal electronics such as smartphones and tablets, domestic appliances, and automotive systems.

Expanding Consumer Electronics and Internet of Things Industries

The development of the Internet of Things (IoT) and the growth of the consumer electronics industry go hand in hand. The Internet of Things is a network of interconnected devices that can communicate and exchange data. This interconnectedness has transformed the way we interact with electronic devices and created a multitude of opportunities across industries.

As the integration of smart devices has become a standard feature in many households, the consumer electronics industry has been swift to adopt the IoT. The consumer electronics market has experienced exponential growth due to the increasing demand for IoT-enabled devices, such as smart thermostats that optimize energy consumption and voice-controlled assistants that automate our daily tasks.

Innovations in Semiconductor Fabrication and Integration

Every integrated and compact electronic device is the result of advancements in semiconductor manufacturing and integration. As its name suggests, a system on a chip (SoC) combines or incorporates multiple components onto a single chip, thereby optimizing space utilization and enhancing overall device performance.

In recent years, the semiconductor industry has seen significant advancements, with manufacturers employing cutting-edge technologies and techniques to meet consumers' rising demands. These advancements have produced smaller, more efficient processors capable of accommodating complex functionalities without sacrificing power consumption or performance.

Increasing Electronic System Complexity in the System on Chip (SoC) Market

Due to the increasing complexity of electronic systems, the system-on-a-chip (SoC) market has witnessed a surge in demand. Every year, devices become more sophisticated, incorporating numerous functions and complex algorithms. The increasing complexity is fuelled by the ever-increasing demand for improved user experiences and expanded functionality.

The System on Chip (SoC) market has developed solutions that integrate multiple components onto a single chip in order to cater to these demands. This integration not only reduces the device's overall size but also enhances its performance and energy efficiency. The increasing complexity of electronic systems has accelerated the adoption of SoCs, as they offer a compact and efficient solution to handle the demanding requirements of contemporary devices.

Restraining Factors

Potential design and production obstacles

When it comes to the design and manufacturing of SoCs, a number of obstacles arise. With the increasing complexity of electronic systems, the need for more potent and efficient processors has skyrocketed. This places enormous pressure on designers to integrate a wide variety of functionalities and features onto a single chip while ensuring optimal performance and dependability.

Moreover, as the size of transistors continues to decrease to nanometer scales, the risk of defects and physical limitations in manufacturing processes increases. This can lead to reduced yields, higher production costs, and possible performance issues. To overcome these obstacles and ensure the production of high-quality, dependable, and cost-effective SoCs, manufacturers must make substantial investments in research and development.

Costly Development of Complex SoCs

The development of complex SoCs requires substantial investments of both time and money. Engineers of the highest caliber and cutting-edge machinery are required for cutting-edge design and manufacturing processes. In order to ensure the functionality and integrity of the SoCs, extensive verification, testing, and validation processes are required.

Smaller businesses and start-ups may be unable to enter the market due to the prohibitive costs associated with the development and fabrication of complex SoCs. To resolve this, collaboration between semiconductor industry stakeholders becomes essential. Sharing resources, expertise, and costs can reduce the financial burden and expedite the development of innovative SoCs, to the advantage of both established and new actors.

Type Analysis

In recent years, the System on Chip (SoC) market has experienced substantial growth, with the analog segment dominating the industry. Due to its adaptability and capacity to incorporate multiple functions onto a single chip, this market segment has gained increasing popularity. As a result, numerous businesses have shifted their focus to the development of analog SoCs in order to satisfy the rising demand for a variety of applications.

The growth of economies in emerging markets has been a significant factor in the adoption of the analog segment. These economies, including China and India, have experienced accelerated industrialization and urbanization, resulting in an increase in demand for consumer electronics, automotive, and industrial applications. As a consequence, the demand for analog chips has increased substantially, driving market growth.

Trends and behaviors of consumers also play a significant role in the adoption of the analog segment. Consumers are increasingly interested in devices with improved performance, extended battery life, and more compact designs. Analog SoCs provide these advantages by integrating diverse components, including sensors, power management, and audio/video processing, onto a single device. This not only improves the performance of devices but also decreases their size and energy consumption, making them more appealing to consumers.

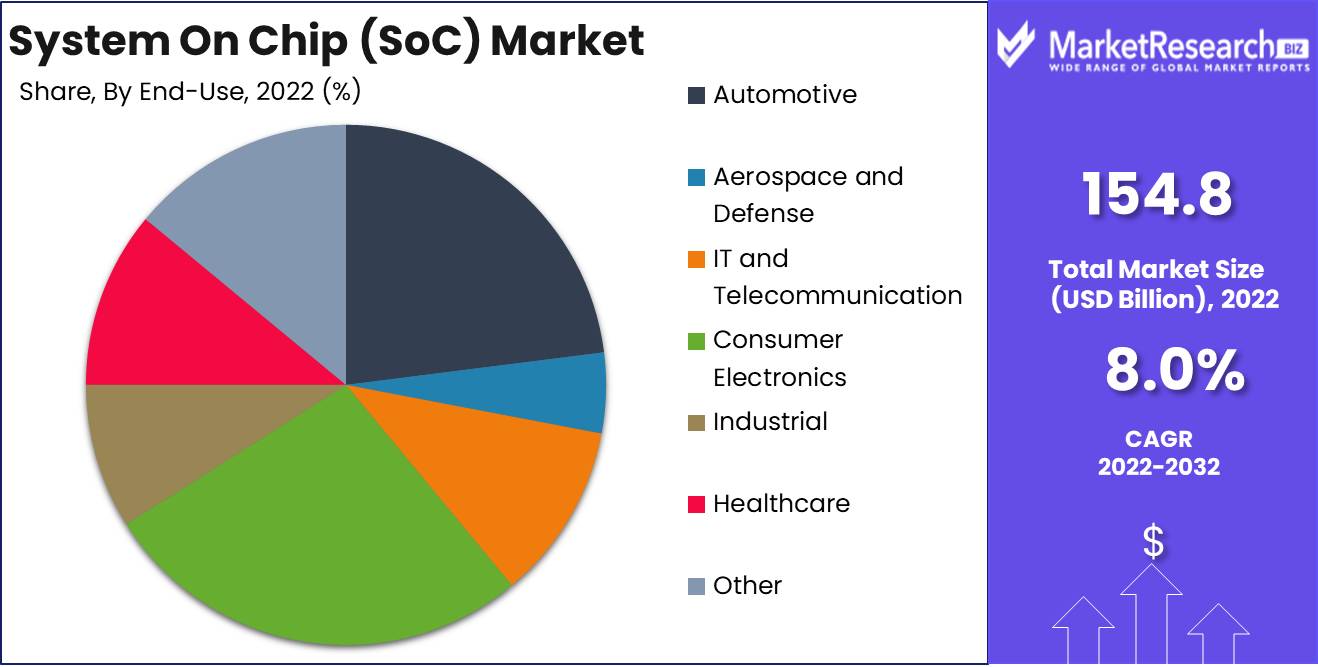

End-Use Industry Analysis

Despite the fact that the analog segment dominates the System on Chip (SoC) market, the consumer electronics segment also claims a sizeable share. This segment consists of various consumer electronic devices, including smartphones, tablets, notebooks, and gaming consoles. The increasing prevalence of these devices and the constant demand for innovation have led to the consumer electronics segment's dominance in the SoC market.

Similar to the analog segment, economic development in emergent economies has played a crucial role in the adoption of SoCs for consumer electronics. The demand for smartphones and other consumer electronic devices increases as the purchasing power of consumers in these economies grows. In turn, this drives the growth of the consumer electronics segment of the System on Chip (SoC) market.

Consumer trends and behavior also have a substantial impact on the adoption of SoCs for consumer electronics. Consumers are continually in search of devices with enhanced performance, storage capacity, and features. By incorporating sophisticated processors, graphics units, and memory controllers onto a single chip, SoCs for consumer electronics facilitate these developments. This enables devices to effortlessly perform complex duties such as gaming and multimedia streaming.

Key Market Segments

By Type

- Analog

- Digital

- Mixed

By End-Use Industry

- Automotive

- Aerospace and Defense

- IT and Telecommunication

- Consumer Electronics

- Industrial

- Healthcare

- Other

Growth Opportunity

Integration of Artificial Intelligence (AI) Capabilities

The accelerated development of AI has revolutionized industries around the world, and the SoC market stands to gain tremendously from this development. Manufacturers can considerably improve the performance and efficiency of electronic devices by incorporating AI capabilities into SoCs. The incorporation of AI capabilities enables devices to process complex algorithms, execute complex tasks, and make intelligent decisions in real time, thereby creating new opportunities for innovation and market differentiation. System on Chip (SoC) solutions with artificial intelligence (AI) capabilities can support a variety of applications, including autonomous vehicles, virtual assistants, image recognition, and robotics.

The integration of AI capabilities into the SoC architecture enables devices to analyze data locally, eliminating the need for continuous cloud connectivity. This not only expedites response times but also enhances privacy and security by reducing data exposure.

The Rise of 5G Networks

The deployment of 5G networks presents the System on Chip (SoC) market with an additional significant growth opportunity. 5G promises to transform how we communicate and interact with technology by providing unprecedented speed, capacity, and latency. To realize the full potential of 5G, electronic devices must be endowed with advanced SoCs capable of meeting the demands of this next-generation network.

SoCs optimized for 5G networks will permit devices to support rapid data transfer, ultra-low latency, and seamless connectivity. Autonomous vehicles, smart cities, industrial automation, and augmented reality/virtual reality (AR/VR) are just a few of the applications that will be made possible by the ability to process vast amounts of data with minimal lag. As global adoption of 5G continues to accelerate, there will be a surge in demand for SoCs designed to deliver the maximum potential of this advanced network technology.

Expansion of the IoT Ecosystem

The Internet of Things (IoT) has revolutionized a variety of industries by enabling seamless connectivity and data exchange between devices. As the IoT ecosystem continues to grow, it is anticipated that the demand for highly integrated SoCs that power IoT devices will skyrocket.

To function optimally, IoT devices require compact, energy-efficient, and cost-effective SoC solutions. By leveraging the extensive capabilities of SoCs, IoT devices can seamlessly collect, process, and transmit data, creating a network of interconnected devices that collaborate to enhance the efficiency and convenience of a variety of applications. From smart homes and wearables to industrial automation and healthcare, IoT-enabled devices have extensive application potential.

Latest Trends

augmentation of SoCs in smartphones and other mobile devices

Modern smartphones and mobile devices rely on SoCs to power their advanced features and capabilities. The integration of multiple components into a single processor allows for efficient power management, reduced form factors, and improved performance. Smartphone manufacturers are constantly stretching the limits of innovation, demanding more powerful and energy-efficient SoCs to support features such as high-resolution displays, multi-camera setups, AI-powered functions, and 5G connectivity.

The growing demand for advanced mobile technologies is driving the need for SoCs with enhanced processing power and graphics capabilities. Chip manufacturers are investing heavily in research and development to produce SoCs that can satisfy these demands without sacrificing power efficiency.

SoCs are in demand for IoT and wearable devices

In recent years, the Internet of Things (IoT) has experienced exponential growth, with connected devices permeating multiple industries, such as healthcare, smart residences, industrial automation, and transportation. These IoT devices rely heavily on SoCs to provide the processing power, connectivity, and energy efficiency required for flawless operation. SoCs facilitate the intelligence that powers IoT applications ranging from smart thermostats and wearable fitness trackers to industrial sensors and autonomous drones.

Additionally, wearable devices, such as smartwatches and fitness trackers, have acquired considerable popularity among consumers. SoCs enable these devices to perform a variety of functions, including health monitoring, GPS tracking, and app integration. As wearable devices continue to evolve and become more sophisticated, the demand for specialized SoCs designed specifically for these applications will continue to increase.

SoCs are utilized in automotive electronics and autonomous systems

Electronic systems and autonomous technologies are becoming more prevalent in the automotive industry, which is enduring a massive transformation. SoCs play an indispensable role in facilitating advanced driver assistance systems (ADAS), infotainment systems, vehicle connectivity, and autonomous driving capabilities. The integration of SoCs into automotive electronics improves safety, performance, and convenience.

SoCs play a pivotal role in managing battery efficiency, power distribution, and regenerative braking systems with the advent of electric vehicles (EVs) and the pursuit of sustainable transportation.

Rise of SoCs with AI and machine learning Capabilities

Numerous industries have been revolutionized by artificial intelligence (AI) and machine learning technologies, from healthcare and finance to retail and entertainment. SoCs with dedicated AI and machine learning capabilities provide the processing power necessary for AI-driven applications to process vast amounts of data and execute complex computations. From natural language processing and computer vision to predictive analytics and personalized recommendations, AI-enabled SoCs offer enormous innovation and user experience enhancement potential.

Integrating specialized processors and neural network accelerators onto chips, chip manufacturers are investing significantly in the development of AI and machine learning-enabled SoCs. These specialized components facilitate the efficient execution of AI algorithms, enabling real-time inference and device-based learning.

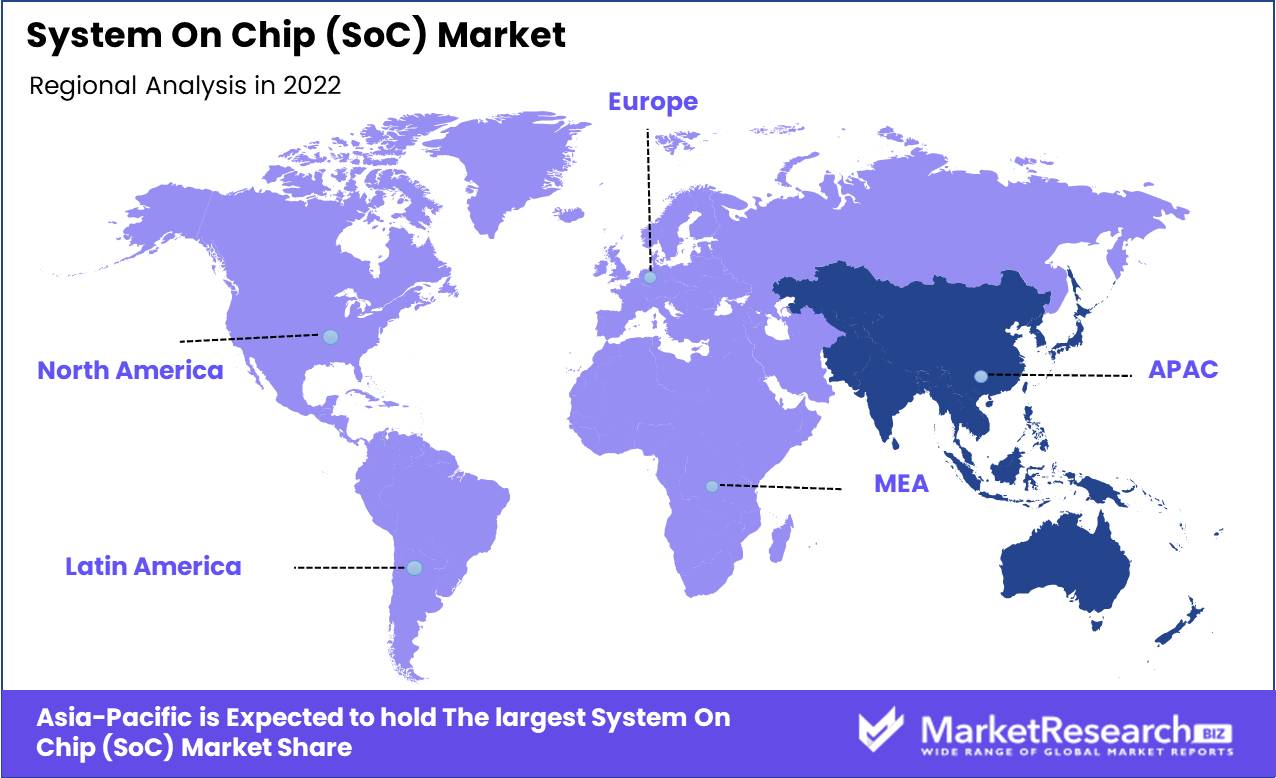

Regional Analysis

As nations in the Asia-Pacific region have flourished, so has the demand for consumer electronics and smartphones. This increased demand has increased the demand for SoCs, which serve as the basis for these devices. The region's businesses have identified this opportunity and are actively investing in research and development to remain ahead of the competition.

The presence of major semiconductor manufacturers is one of the main factors driving the growth of the System on Chip (SoC) market in the Asia-Pacific region. These companies have established a firm foothold in the region and are constantly innovating to meet the ever-changing demands of consumers. They utilize their technological expertise and manufacturing capabilities to create high-performance SoCs that fuel a variety of devices, including smartphones, tablets, smart appliances, and IoT devices.

In addition, the Asia-Pacific region is home to an extensive pool of talented engineers and designers. These specialists contribute their knowledge and imagination to the SoC development process, ensuring that the resulting products are not only technologically advanced but also user-friendly. They collaborate closely with semiconductor manufacturers to develop SoCs with superior performance, energy efficiency, and affordability.

In addition, the region's emphasis on research and development has propelled the growth of the SoC market. Governments and businesses are investing significantly in initiatives that foster innovation and promote collaboration between academic institutions, research institutions, and businesses. This innovation ecosystem has substantially contributed to the regional growth of the SoC market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Google Inc, the search engine giant, has always been at the forefront of technological innovation. Their entry into the market for SoCs was not an exception. Tensor Processing Unit (TPU) is the name of Google's custom-designed system-on-a-chip. These TPUs are designed particularly to accelerate machine learning workloads and power Google's artificial intelligence applications. Google's investment in developing its own SoC has substantially improved its AI and machine learning capabilities and competitiveness.

Amazon Web Services (AWS), a subsidiary of Amazon, has revolutionized cloud computing services significantly. With the release of their own SoC, the AWS Graviton Processor, they have altered the landscape of cloud computing. The Graviton Processor provides customers with substantial cost reductions by providing potent performance at a lower price point. This innovative strategy has propelled AWS to the forefront of the cloud computing market and cemented its dominance in the SoC sector.

Advanced Micro Devices Inc. (AMD), a renowned semiconductor company, has contributed significantly to the SoC market with its potent processors. The immense prevalence of AMD's Ryzen and EPYC processors is due to their superior performance and competitive pricing. These processors are suitable for a vast array of applications, including gaming, professional workstations, and high-performance computing. Due to AMD's commitment to innovation and delivery of cutting-edge technology, they continue to be a major participant in the SoC market.

Chinese company BitMain Technologies Holding Company has emerged as one of the dominant actors in the cryptocurrency and blockchain industries. BitMain is renowned for its custom-designed SoCs for Bitcoin mining, such as the Antminer series. By offering efficient and specialized solutions for cryptocurrency mining, these high-performance SoCs have allowed BitMain to establish itself as a leader in the blockchain revolution. Their continuous advances in SoC technology have established them as a market leader.

Top Key Players in the System on Chip (SoC) Market

- Google Inc (US)

- Amazon Web Services Inc. (US)

- Advanced Micro Devices Inc (US)

- BitMain Technologies Holding Company (China)

- Intel Corporation (US)

- Xilinx (US)

- SAMSUNG (South Korea)

- Qualcomm Technologies Inc. (US)

- NVIDIA Corporation (US)

- Wave Computing Inc. (US)

- Graphcore (UK)

- IBM Corporation (US)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

- Micron Technology Inc. (US)

Recent Development

- In 2023, Qualcomm announced its intention to release a new line of System-on-Chips that are specifically designed to achieve unprecedented performance. These flagship SoCs with the intention of raising the benchmark for mobile devices in terms of processing power, speed, and efficiency.

- In 2022, MediaTek has announced an ambitious expansion plan geared at diversifying its product offerings, which will build on its already impressive selection of System-on-Chip chips.

- In 2021, the tech titan Samsung announced plans to introduce a new line of System-on-Chip devices, with an emphasis on affordability without sacrificing performance.

Report Scope

Report Features Description Market Value (2022) USD 154.8 Bn Forecast Revenue (2032) USD 327.8 Bn CAGR (2023-2032) 8.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Analog, Digital), By End-Use Industry(Automotive, Aerospace and Defense, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Google Inc (US), Amazon Web Services Inc. (US), Advanced Micro Devices Inc (US), BitMain Technologies Holding Company (China), Intel Corporation (US), Xilinx (US), SAMSUNG (South Korea), Qualcomm Technologies Inc. (US), NVIDIA Corporation (US), Wave Computing Inc. (US), Graphcore (UK), IBM Corporation (US), Taiwan Semiconductor Manufacturing Company Limited (Taiwan), Micron Technology Inc. (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Google Inc (US)

- Amazon Web Services Inc. (US)

- Advanced Micro Devices Inc (US)

- BitMain Technologies Holding Company (China)

- Intel Corporation (US)

- Xilinx (US)

- SAMSUNG (South Korea)

- Qualcomm Technologies Inc. (US)

- NVIDIA Corporation (US)

- Wave Computing Inc. (US)

- Graphcore (UK)

- IBM Corporation (US)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

- Micron Technology Inc. (US)