Surgical Suture Market By Product (Absorbable Sutures, Non-Absorbable Sutures, Automated Suturing Devices), By Configuration (Monofilament Sutures, Multifilament Sutures), By Application (Cardiovascular Surgery, Gynecological Surgery, and Other), By End User (Hospitals/Clinics, Veterinary Hospitals/Clinics, and Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46759

-

May 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

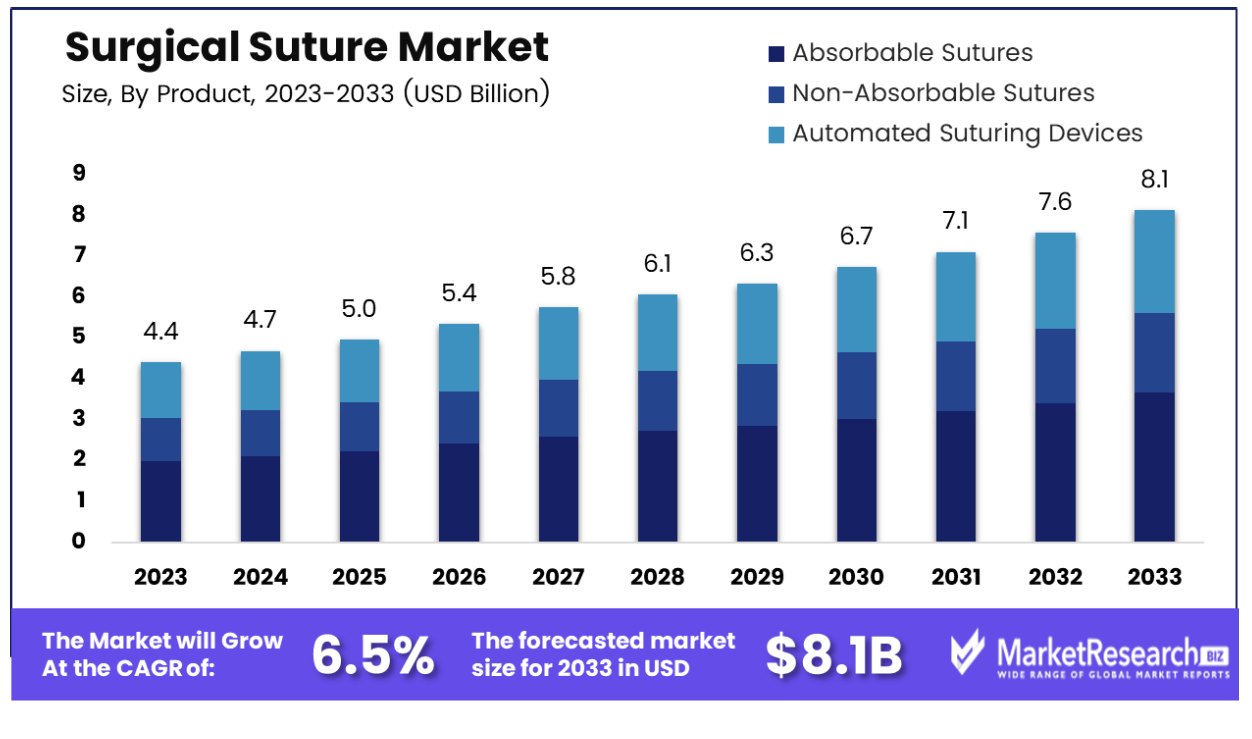

The Global Surgical Suture Market was valued at USD 4.4 Bn in 2023. It is expected to reach USD 8.1 Bn by 2033, with a CAGR of 6.5% during the forecast period from 2024 to 2033.

The Surgical Suture Market encompasses the global landscape of medical sutures, threads, and stitches utilized in surgical procedures to facilitate wound closure and tissue repair. This market segment is driven by advancements in surgical techniques, increasing surgical procedures across various medical specialties, and a growing emphasis on minimally invasive surgeries. Key factors influencing market growth include the rise in chronic diseases, expanding geriatric population, and the continuous evolution of suture materials and techniques for enhanced patient outcomes. As a vital component of healthcare delivery, the Surgical Suture Market plays a pivotal role in shaping the efficiency and efficacy of surgical interventions worldwide.

The Surgical Suture Market continues to exhibit steady growth, driven by a confluence of factors shaping the healthcare landscape. Technological advancements in suture materials, including the emergence of absorbable polymers and synthetic blends, are revolutionizing surgical practices, offering improved biocompatibility and reduced risk of adverse reactions. The proliferation of minimally invasive surgical techniques is bolstering demand for specialized sutures tailored to intricate procedures, such as laparoscopic and robotic surgeries.

The Surgical Suture Market continues to exhibit steady growth, driven by a confluence of factors shaping the healthcare landscape. Technological advancements in suture materials, including the emergence of absorbable polymers and synthetic blends, are revolutionizing surgical practices, offering improved biocompatibility and reduced risk of adverse reactions. The proliferation of minimally invasive surgical techniques is bolstering demand for specialized sutures tailored to intricate procedures, such as laparoscopic and robotic surgeries.Supportive data further underscores the significance of innovation within the market. Techniques like the Mattress Suture, characterized by precise needle insertion and strategic knot placement, exemplify the evolving sophistication in wound closure methods, promoting optimal healing outcomes. Insights into the tensile strength of sutures highlight the critical balance between material durability and procedural requirements. Knotted sutures, while offering versatility in application, demonstrate a nuanced trade-off, with each knot introducing a notable reduction in tensile strength, necessitating meticulous consideration during surgical planning.

The implications of these trends on market dynamics and stakeholder strategies. Manufacturers are challenged to continuously refine product offerings to meet evolving clinical demands while maintaining stringent quality standards. Healthcare providers, in turn, must navigate the intricate landscape of suture selection, weighing factors such as tensile strength, biocompatibility, and cost-effectiveness to optimize patient care.

Key Takeaways

- Market Value: The Global Surgical Suture Market was valued at USD 4.4 Bn in 2023. It is expected to reach USD 8.1 Bn by 2033, with a CAGR of 6.5% during the forecast period from 2024 to 2033.

- By Product: Within the surgical suture market, Absorbable Sutures emerge as the dominant choice, commanding a substantial 55% of the market share, reflecting their widespread usage and efficacy.

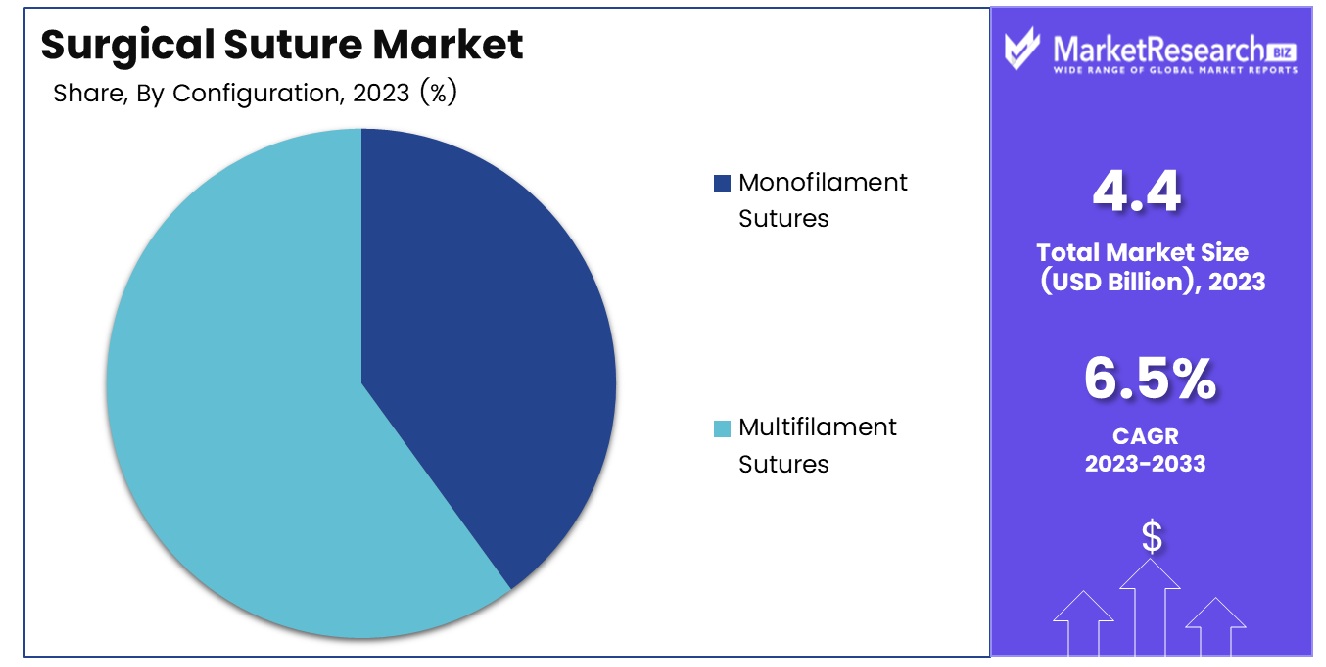

- By Configuration: The preference leans heavily towards Multifilament Sutures, capturing an impressive 60% share, consist of multiple strands of material intertwined to create a flexible and strong surgical thread.

- By Application: Cardiovascular Surgery stands out as the most prevalent field, claiming a significant 30% market share, encompasses procedures performed on the heart and blood vessels to treat conditions such as coronary artery disease and heart defects.

- By End User: Hospitals/Clinics emerge as the primary consumers, representing a commanding 70% of the market, underscoring their pivotal role in the healthcare ecosystem and the demand for surgical sutures therein.

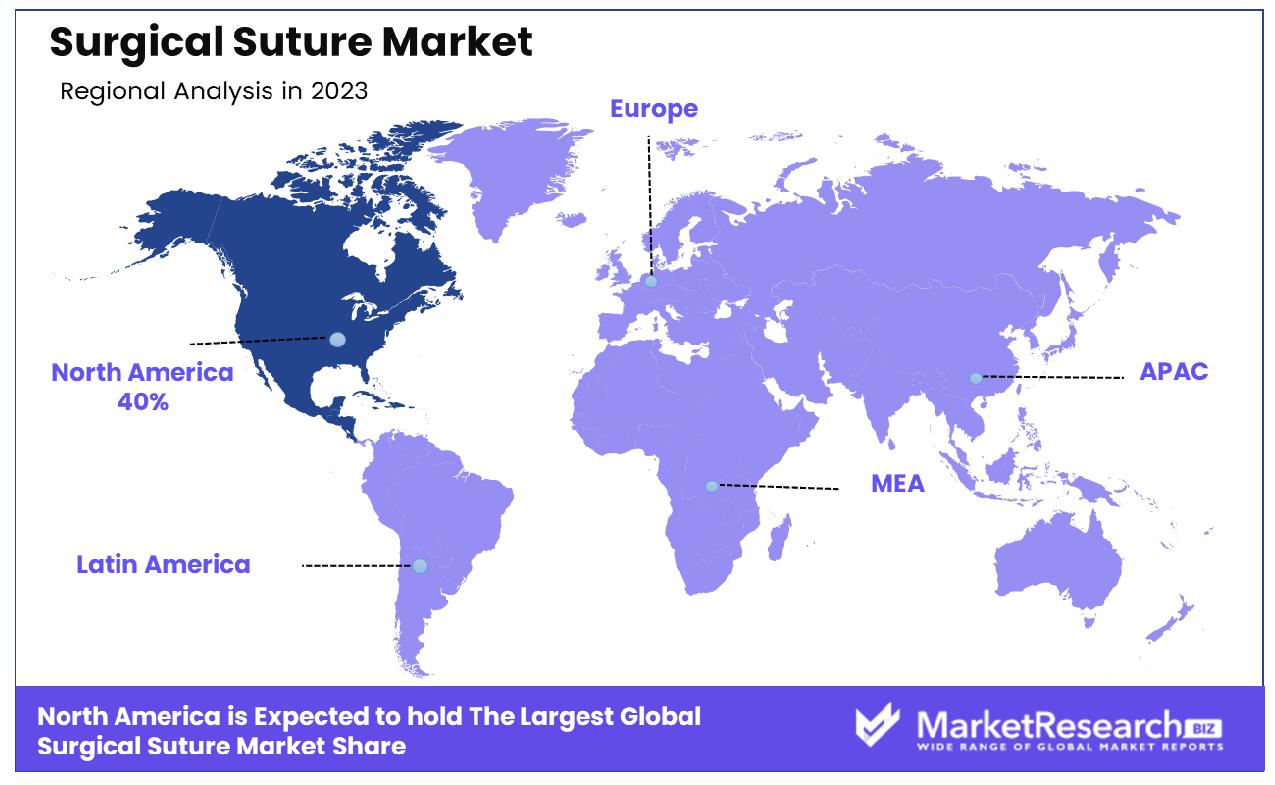

- Regional Dominance: North America leads the Surgical Suture Market with a commanding 40% market share, driven by advanced healthcare infrastructure and high surgical procedure rates.

- Growth Opportunity: Advancements in biodegradable materials and minimally invasive surgical techniques, the Surgical Suture Market presents significant growth potential globally, fostering innovation and expanding applications in various medical fields.

Driving factors

Increasing Disease Prevalence

The growing prevalence of chronic diseases such as cardiovascular diseases, diabetes, and cancer significantly drives the demand for surgical sutures. Chronic diseases often require surgical interventions, which in turn increases the need for surgical sutures for wound closure. For instance, cardiovascular diseases, which are the leading cause of death globally, frequently necessitate procedures like bypass surgeries and angioplasties that involve extensive suturing. Similarly, cancer treatments often involve tumor excisions that require suturing.

According to the World Health Organization, chronic diseases account for 71% of all deaths globally, underscoring the significant demand for surgical procedures and, consequently, sutures. This growing burden of disease directly translates to a robust market for surgical sutures as healthcare providers strive to meet the surgical needs of an increasing number of patients.

Aging Population

The aging global population is a crucial driver for the surgical suture market. As the population ages, the incidence of age-related health issues such as orthopedic problems, cataracts, and cardiac conditions rises, leading to an increased number of surgical procedures. Elderly individuals often require surgeries such as hip and knee replacements, cataract removal, and various cardiovascular surgeries, all of which necessitate the use of surgical sutures.

The United Nations projects that by 2050, the number of people aged 60 years and older will double, reaching over 2 billion. This demographic shift means a substantial increase in surgeries, thus propelling the demand for surgical sutures. The aging population also has higher instances of wound healing issues, further necessitating advanced suturing techniques and products to ensure proper healing and recovery.

Expanding Healthcare Infrastructure

The expansion and improvement of healthcare infrastructure, especially in emerging economies, play a pivotal role in the growth of the surgical suture market. Increased government and private sector investments in healthcare facilities, medical equipment, and training lead to better access to surgical care. As healthcare infrastructure expands, more hospitals and clinics are established, equipped with advanced surgical tools and technologies, including surgical sutures.

The improved infrastructure ensures that a greater number of surgeries can be performed safely and effectively, thereby driving the demand for surgical sutures. Additionally, the availability of skilled healthcare professionals trained in the latest surgical methods further supports market growth, as they can effectively utilize advanced suturing products to enhance patient outcomes.

Restraining Factors

Regulatory Hurdles Impact Market Dynamics

Stringent regulatory requirements significantly influence the surgical suture market by ensuring the safety and efficacy of suture products, albeit often creating barriers to market entry and expansion. Regulatory bodies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and others across the globe impose rigorous standards for the approval of surgical sutures. These standards include stringent clinical trials, extensive documentation, and compliance with manufacturing practices. While these regulations are crucial for patient safety, they also increase the time and cost associated with bringing new suture products to market.

Manufacturers must invest heavily in research and development to meet these regulatory standards, which can be particularly challenging for smaller companies. The rigorous approval process can delay the launch of innovative products, limiting market growth and competition.

High Cost of Advanced Sutures

The high cost of advanced sutures is another critical factor that influences the surgical suture market. Advanced sutures, which include absorbable sutures, antimicrobial sutures, and those made from high-tech materials, offer significant benefits such as improved healing times, reduced infection rates, and greater strength and flexibility. However, these advantages come at a higher price compared to traditional sutures.

The increased cost of advanced sutures can be attributed to several factors, including the use of sophisticated materials, advanced manufacturing processes, and extensive research and development efforts. These costs are often passed on to healthcare providers and, ultimately, to patients. In regions with limited healthcare budgets or lower economic capabilities, the adoption of these advanced sutures can be slow, limiting their market penetration.

By Product Analysis

Absorbable Sutures lead the surgical suture market, with a commanding 55% share.

In 2023, Absorbable Sutures held a dominant market position in the By Product segment of the Surgical Suture Market, capturing more than a 55% share. Absorbable sutures have emerged as a preferred choice among healthcare professionals due to their ability to degrade over time, eliminating the need for removal and reducing the risk of complications. Factors such as increasing surgical procedures globally, advancements in suture materials, and growing awareness about the benefits of absorbable sutures have contributed to their significant market dominance.

Non-Absorbable Sutures, while still a substantial segment within the Surgical Suture Market, trailed behind Absorbable Sutures in 2023. These sutures are favored for applications where long-term wound support is required, such as in cardiovascular and orthopedic surgeries. Despite the robust demand for non-absorbable sutures in certain surgical procedures, their market share remains lower compared to absorbable alternatives due to the increasing adoption of absorbable sutures in various medical specialties.

Automated Suturing Devices represent an emerging segment in the Surgical Suture Market, characterized by the integration of technology to enhance the suturing process. These devices offer advantages such as improved precision, reduced procedure time, and standardized stitching patterns, leading to better patient outcomes.

By Configuration Analysis

Multifilament Sutures dominate configurations, holding a solid 60% share.

In 2023, Multifilament Sutures held a dominant market position in the By Configuration segment of the Surgical Suture Market, capturing more than a 60% share. Multifilament sutures are constructed from multiple strands of material twisted or braided together, offering advantages such as flexibility, knot security, and reduced tissue trauma. Their widespread usage across various surgical specialties, including general surgery, obstetrics, and gynecology, contributed to their substantial market dominance.

Monofilament Sutures, although still a significant segment within the Surgical Suture Market, trailed behind Multifilament Sutures in 2023. Monofilament sutures consist of a single strand of material, providing smooth passage through tissues and minimal tissue drag. They are favored in procedures where minimizing tissue reaction and infection risk is paramount, such as in ophthalmic and neurological surgeries. Despite their advantages, monofilament sutures faced stiff competition from multifilament counterparts due to the latter's superior handling characteristics and knot security.

By Application Analysis

Cardiovascular Surgery claims the top spot in applications, capturing 30% of the market.

In 2023, Cardiovascular Surgery held a dominant market position in the By Application segment of the Surgical Suture Market, capturing more than a 30% share. Cardiovascular surgeries, including procedures such as coronary artery bypass grafting (CABG) and heart valve repair, require specialized sutures that can withstand the dynamic environment of the heart and blood vessels. The high prevalence of cardiovascular diseases globally, coupled with the increasing adoption of advanced surgical techniques, has propelled the demand for sutures tailored to cardiovascular applications.

Gynecological Surgery emerged as another significant segment within the Surgical Suture Market in 2023, although it trailed behind Cardiovascular Surgery in market share. Gynecological procedures, such as hysterectomy and ovarian cyst removal, necessitate sutures optimized for delicate tissue manipulation and minimal tissue trauma. The growing emphasis on women's health and the rising incidence of gynecological conditions have contributed to the steady demand for sutures in this segment.

Orthopedic Surgery, while a crucial component of the Surgical Suture Market, held a comparatively smaller share in 2023. Orthopedic procedures, including joint replacements and fracture repairs, require sutures capable of providing strong and stable wound closure to support the healing process. Despite the lower market share, the prevalence of orthopedic conditions and the aging population's demand for joint surgeries ensure sustained demand for sutures in this segment.

By End User Analysis

Hospitals/Clinics are the primary end users, representing 70% of the market.

In 2023, Hospitals/Clinics held a dominant market position in the By End User segment of the Surgical Suture Market, capturing more than a 70% share. This segment's dominance reflects the extensive usage of surgical sutures in hospital settings for a wide range of surgical procedures across various medical specialties.

The dominance of Hospitals/Clinics as end users in this segment can be attributed to several key factors. Firstly, hospitals and clinics serve as primary centers for surgical interventions, ranging from routine procedures to complex surgeries. As such, they have a consistently high demand for surgical sutures to facilitate wound closure and tissue approximation effectively.

Hospitals and clinics often have dedicated surgical departments equipped with specialized operating rooms, trained medical staff, and advanced medical equipment. These facilities enable healthcare providers to perform surgeries of varying complexities, necessitating a reliable supply of surgical sutures to meet patient needs.

Key Market Segments

By Product

- Absorbable Sutures

- Non-Absorbable Sutures

- Automated Suturing Devices

By Configuration

- Monofilament Sutures

- Multifilament Sutures

By Application

- Cardiovascular Surgery

- Gynecological Surgery

- Orthopedic Surgery

- Ophthalmic Surgery

- General Surgery

- Cosmetic & Plastic Surgery

- Other

By End User

- Hospitals/Clinics

- Veterinary Hospitals/Clinics

- Ambulatory Surgical Centres

- Emergency Medical Services

Growth Opportunity

Rising Surgical Procedures

The global increase in surgical procedures presents a significant growth opportunity for the surgical suture market in 2024. Factors such as rising chronic disease prevalence, an aging population, and increased access to healthcare services contribute to the surge in surgical interventions. According to the World Health Organization, over 300 million major surgeries are performed annually worldwide, and this number is expected to grow. The escalating number of surgeries directly correlates with a higher demand for surgical sutures, making this a critical driver for market expansion.

Awareness of Effective Sutures

Growing awareness of the benefits of effective suturing techniques and advanced suture materials is propelling market growth. Medical professionals increasingly recognize the importance of high-quality sutures in reducing infection rates, improving healing times, and minimizing scarring. Educational initiatives and professional training programs are enhancing the understanding and utilization of advanced sutures among surgeons and healthcare providers. This increased awareness is expected to drive the adoption of superior suture products, contributing to market growth.

Latest Trends

Advanced Suture Technology

In 2024, advanced suture technology will be at the forefront of market trends, driving significant innovation and growth. Advances such as antimicrobial sutures, absorbable sutures, and barbed sutures are revolutionizing the market by offering enhanced performance and patient outcomes. These technologies reduce infection rates, promote faster healing, and minimize scarring, making them highly desirable in modern surgical practices.

The development of bioactive sutures that can deliver therapeutic agents directly to the wound site represents another cutting-edge advancement, further pushing the boundaries of what sutures can achieve in surgical care. As manufacturers continue to invest in R&D, the introduction of more sophisticated and effective suture products is expected to propel market growth.

Minimally Invasive Surgeries

The increasing popularity of minimally invasive surgeries (MIS) is a crucial trend shaping the surgical suture market in 2024. MIS techniques, such as laparoscopic and robotic surgeries, require specialized sutures that can navigate small incisions and complex anatomical structures. The demand for sutures compatible with minimally invasive techniques is rising as these procedures offer benefits like reduced recovery times, less postoperative pain, and lower risk of complications.

This shift towards MIS is driving innovation in suture design, leading to the development of products that cater specifically to the unique needs of these surgeries. The growing adoption of MIS globally is anticipated to boost the demand for advanced sutures tailored for these procedures.

Regional Analysis

North America leads with 40% market share in the surgical suture market.

North America leads the market, commanding a substantial 40% share, driven by advanced healthcare infrastructure, high adoption of innovative surgical techniques, and favorable reimbursement policies. Europe follows closely, with a significant market share owing to the presence of prominent suture manufacturers and a growing geriatric population driving surgical procedures.

Asia Pacific emerges as a promising market with rapid urbanization, improving healthcare facilities, and increasing surgical procedures, particularly in countries like China and India. The Middle East & Africa region showcases steady growth due to rising healthcare expenditure and government initiatives to enhance healthcare infrastructure.

Latin America presents opportunities for market expansion, propelled by improving healthcare access and a growing demand for surgical procedures. However, it faces challenges like economic instability in some countries.

Overall, North America dominates the global surgical suture market, with a commanding 40% share, while Asia Pacific emerges as a key growth region, driven by evolving healthcare landscapes and expanding surgical procedures.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global surgical suture market continues to be influenced by key players who are actively shaping its landscape. Among these, B. Braun Melsungen AG stands out as a prominent force. With its extensive portfolio of surgical sutures and wound closure products, B. Braun Melsungen AG has established a strong foothold in the market. Its commitment to innovation, coupled with a focus on quality and safety, positions it as a preferred choice for healthcare professionals worldwide.

Deme TECH Corporation is another key player making significant strides in the global surgical suture market. Known for its advanced suture technologies and emphasis on research and development, Deme TECH Corporation continues to introduce cutting-edge solutions that address evolving clinical needs. Its proactive approach to product development and strategic collaborations ensure its relevance and competitiveness in the market.

Boston Scientific Corporation and Conmed Corporation also play pivotal roles in driving market growth. Leveraging their expertise in medical devices and surgical solutions, both companies offer a comprehensive range of sutures catering to diverse surgical specialties. Their global presence, coupled with a focus on customer-centric innovation, positions them as key contributors to the expansion of the surgical suture market.

Integra LifeSciences Corporation, Derma Sciences, Peters Surgical, and Johnson & Johnson are among the established players that continue to exert influence through their extensive product offerings and market reach. Medtronic PLC, Zimmer Biomet, Mellon Medical BV, Smith & Nephew PLC, and GPC Medical further diversify the market, contributing to its dynamism and competitiveness.

The global surgical suture market in 2024 is characterized by intense competition, innovation-driven growth, and a focus on meeting the evolving needs of healthcare providers and patients alike. As key players continue to invest in research and development and expand their market presence, the landscape is poised for further evolution and expansion.

Market Key Players

- B. Braun Mesungen AG

- Deme TECH Corporation

- Boston Scientific Corporation

- Conmed Corporation

- Integra LifeSciences Corporation

- Derma Sciences

- Peters Surgical

- Johnson & Johnson

- Medtronic PLC

- Zimmer Biomet

- Mellon Medical BV

- Smith & Nephew PLC

- GPC Medical

- Mellon Medical B.V.

Recent Development

- In May 2024, Ethicon, a subsidiary of Johnson & Johnson, introduced absorbable sutures with antimicrobial properties, enhancing post-operative wound care.

- In May 2024, Medtronic unveiled a revolutionary suture material with enhanced tensile strength and biocompatibility, facilitating smoother tissue approximation and reducing post-operative complications.

Report Scope

Report Features Description Market Value (2023) USD 4.4 Bn Forecast Revenue (2033) USD 8.1 Bn CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Absorbable Sutures, Non-Absorbable Sutures, Automated Suturing Devices), By Configuration (Monofilament Sutures, Multifilament Sutures), By Application (Cardiovascular Surgery, Gynecological Surgery, Orthopedic Surgery, Ophthalmic Surgery, General Surgery, Cosmetic & Plastic Surgery, Other), By End User (Hospitals/Clinics, Veterinary Hospitals/Clinics, Ambulatory Surgical Centres, Emergency Medical Services) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape B. Braun Mesungen AG, Deme TECH Corporation, Boston Scientific Corporation, Conmed Corporation, Integra LifeSciences Corporation, Derma Sciences, Peters Surgical, Johnson & Johnson, Medtronic PLC, Zimmer Biomet, Mellon Medical BV, Smith & Nephew PLC, GPC Medical, Mellon Medical B.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- B. Braun Mesungen AG

- Deme TECH Corporation

- Boston Scientific Corporation

- Conmed Corporation

- Integra LifeSciences Corporation

- Derma Sciences

- Peters Surgical

- Johnson & Johnson

- Medtronic PLC

- Zimmer Biomet

- Mellon Medical BV

- Smith & Nephew PLC

- GPC Medical

- Mellon Medical B.V.