Sulfur Fertilizers Market Report By Type of Sulfur Fertilizer (Sulfate-based Fertilizers, Elemental Sulfur Fertilizers, Sulfate of Potash Magnesia, Sulfur-coated Urea, Others), By Application Method (Broadcast Application, Fertigation, Foliar Application, Soil Incorporation, Seed Dressing, Others), By Crop Type, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46931

-

May 2024

-

321

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

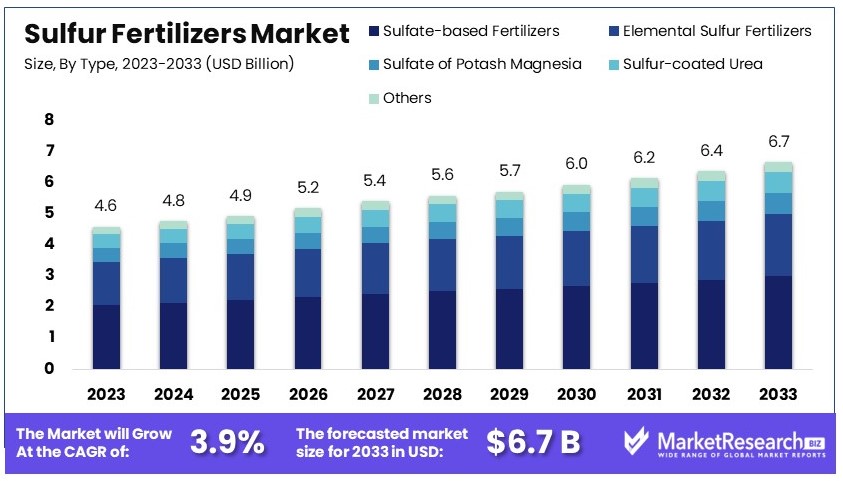

The Global Sulfur Fertilizers Market size is expected to be worth around USD 6.7 Billion by 2033, from USD 4.6 Billion in 2023, growing at a CAGR of 3.9% during the forecast period from 2024 to 2033.

The Sulfur Fertilizers Market focuses on products that provide essential sulfur nutrients to crops. Sulfur is vital for plant growth, enhancing protein production and improving crop yield. Sulfur fertilizers are commonly used in agriculture to address sulfur deficiencies in the soil.

This market includes various types of sulfur fertilizers such as sulfate fertilizers, elemental sulfur fertilizers, and liquid sulfur fertilizers. The demand for sulfur fertilizers is driven by the increasing global population, which necessitates higher agricultural productivity. Additionally, sulfur fertilizers help improve the quality of produce, making crops more nutritious and marketable.

Key players in this market invest in research and development to innovate new products that are more efficient and environmentally friendly. The market also faces challenges, such as fluctuating raw material prices and regulatory constraints.

The Sulfur Fertilizers Market is poised for significant growth driven by various factors. Sulfur is an essential nutrient for crop production, enhancing protein synthesis and overall yield. Recent studies have highlighted sulfur deficiency in 29% of soil samples and potential deficiency in 40% of samples across India. This underscores the critical need for sulfur supplementation in agricultural practices.

The 1970 Clean Air Act led to a dramatic decrease in sulfur dioxide emissions, resulting in reduced sulfur deposition from rain and air. Consequently, there is a growing reliance on sulfur fertilizers to meet crop nutritional needs. This change has created a substantial demand for sulfur-based fertilizers to replenish soil sulfur levels.

Agricultural practices also contribute to sulfur depletion. For instance, a 180 bushels per acre corn crop removes about 14 pounds of sulfur per acre, while alfalfa removes approximately 6 pounds per acre per ton produced. As crop yields increase, the depletion rate of sulfur from soils accelerates, further driving the need for sulfur fertilizers.

Key players in the market are investing in research and development to create more efficient and environmentally friendly sulfur fertilizers. These innovations aim to address the dual challenge of meeting crop nutritional needs while minimizing environmental impact.

In summary, the Sulfur Fertilizers Market is essential for sustainable agriculture, especially in regions with identified sulfur deficiencies. The reduction in sulfur deposition due to environmental regulations and the increasing crop yields necessitate the use of supplemental sulfur fertilizers, presenting significant growth opportunities for market participants. The market is expected to expand as farmers increasingly adopt these fertilizers to enhance crop productivity and soil health.

Key Takeaways

- Market Value: The global sulfur fertilizers market is valued at USD 4.6 billion in 2023, expected to reach USD 6.7 billion by 2033, growing at a CAGR of 3.9%.

- Type Analysis: Sulfate-based fertilizers dominate with 45%; high solubility and nutrient versatility drive their market share.

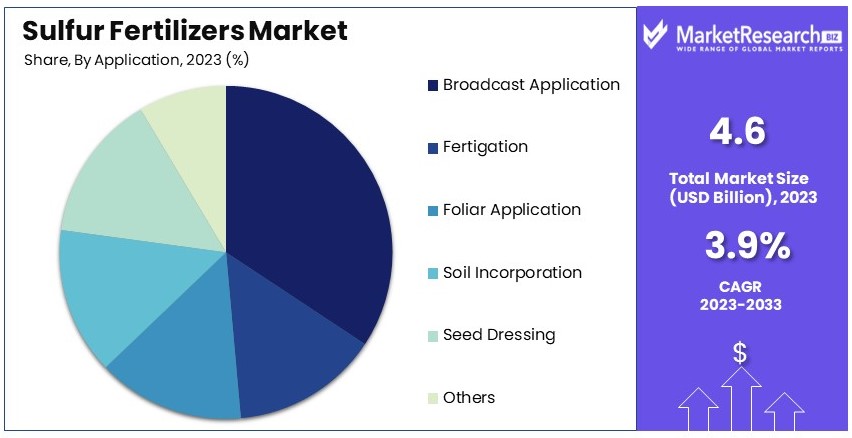

- Application Method Analysis: Broadcast application dominates with 40%; simplicity and efficiency make it a preferred choice for farmers.

- Crop Type Analysis: Cereals and grains dominate with 50%; high sulfur demand and global cultivation drive their market share.

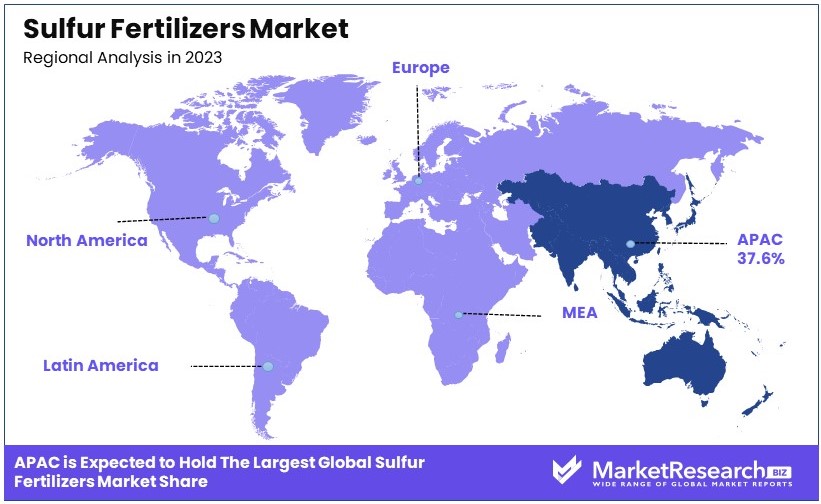

- Dominant Region: APAC dominates with a 37.6% market share; significant agricultural activities and crop demand drive market growth.

- High Growth Region: North America accounts for 25% of the sulfur fertilizers market; advanced farming practices and high crop yields fuel demand.

- Analyst Viewpoint: The sulfur fertilizers market shows moderate growth with increasing competition. Future predictions indicate steady demand driven by global agricultural practices and crop needs.

- Growth Opportunities: Key players can leverage advancements in fertilizer application methods and expand their market presence in regions with sulfur-deficient soils.

Driving Factors

Increasing Demand for High-Efficiency Fertilizers Drives Market Growth

The increasing demand for high-efficiency fertilizers has significantly driven the growth of the sulfur fertilizers market. Sulfur fertilizers are known to enhance crop yield and quality, making them essential for farmers aiming to maximize productivity. With the global population rising, the need for higher food production is more pressing than ever. Countries like India and China, where agriculture is a key economic sector, have seen a steady increase in the adoption of sulfur fertilizers. In India, for instance, the use of sulfur fertilizers has grown by 5% annually over the past decade, reflecting the farmers' efforts to boost crop production.

This trend is not confined to developing countries. In developed nations, advanced agricultural practices also rely heavily on high-efficiency fertilizers. The effectiveness of sulfur in improving nitrogen use efficiency and aiding in the synthesis of essential amino acids and enzymes in plants makes it indispensable. Moreover, the push for sustainable farming practices has encouraged the use of sulfur fertilizers, which help in reducing the environmental impact of agricultural activities. The combined influence of these factors underscores the critical role of high-efficiency fertilizers in driving the sulfur fertilizers market growth.

Depletion of Sulfur in Soils Drives Market Growth

The depletion of sulfur in soils has become a significant driver for the sulfur fertilizers market. Intensive farming practices and the extensive use of high-analysis fertilizers have led to a reduction in sulfur levels in many agricultural soils. This sulfur deficiency has necessitated the use of sulfur fertilizers to replenish this essential nutrient. In regions like Europe and North America, where sulfur-deficient soils are common, the demand for sulfur fertilizers has surged to maintain soil fertility and crop productivity.

Statistics show that in parts of Europe, sulfur deficiency affects up to 40% of agricultural lands, prompting increased sulfur fertilizer usage. Similarly, in North America, particularly in the Midwest, sulfur levels in soil have declined by over 30% in the past two decades. Farmers in these regions have incorporated sulfur fertilizers into their soil management strategies to address this issue. The interaction of soil health maintenance with crop yield enhancement drives the growing market for sulfur fertilizers, as replenishing sulfur not only supports healthy plant growth but also ensures sustained agricultural productivity.

Growth in Organic Farming Drives Market Growth

The growth in organic farming has contributed significantly to the demand for sulfur fertilizers. Organic farming relies on natural sources of nutrients, and sulfur fertilizers, derived from elemental sulfur or sulfate minerals, are well-suited for organic production systems. As the organic food market expands, the demand for sulfur fertilizers is expected to rise in tandem. The global organic food market is projected to grow at a CAGR of 9% through 2025, driving up the need for sulfur fertilizers.

Organic farmers prefer sulfur fertilizers because they enhance soil health and meet organic certification standards. In addition, sulfur plays a critical role in pest and disease resistance, which is vital in organic farming where synthetic pesticides are not used. The alignment of sulfur fertilizers with organic farming principles and the increasing consumer demand for organic products combine to drive this market segment. The expanding organic farming sector's influence on the sulfur fertilizers market underscores the growing importance of sustainable agriculture practices in the industry's growth trajectory.

Restraining Factors

Environmental Concerns Restrain Market Growth

Environmental concerns about sulfur fertilizers restrain market growth. Despite their benefits, potential environmental impacts like soil acidification and leaching into water bodies raise issues. These concerns have led to stricter regulations and guidelines, particularly in regions with sensitive ecosystems or water sources.

For example, the European Union has implemented stringent limits on sulfur fertilizer usage to protect water quality, impacting market expansion. This regulatory landscape makes it challenging for manufacturers and farmers to adopt sulfur fertilizers widely. The need to comply with environmental standards increases costs and reduces the appeal of sulfur fertilizers, thereby limiting their market growth.

Competition from Alternative Fertilizers Restrains Market Growth

Competition from alternative fertilizers restrains the growth of the sulfur fertilizers market. Nitrogen, phosphorus trichloride, and potassium-based fertilizers often take precedence due to their specific benefits for various crops.

Farmers may prioritize these alternatives based on crop needs, cost, and availability. For instance, the global market for nitrogen fertilizers was valued at $69 billion in 2020, indicating strong competition. The pricing and effectiveness of these alternative fertilizers can influence farmers' choices, reducing the market share for sulfur fertilizers. This competitive landscape challenges the growth prospects of sulfur fertilizers, as they must compete on both performance and price fronts.

Type of Sulfur Fertilizer Analysis

Sulfate-based fertilizers dominate with 45% due to their high solubility and nutrient versatility.

The sulfur fertilizers market can be segmented based on the type of fertilizer. Among these, sulfate-based fertilizers, such as ammonium sulfate and potassium sulfate, dominate the market. Sulfate-based fertilizers are favored due to their high solubility and immediate availability to plants. They provide both sulfur and essential nutrients like nitrogen and potassium, making them a versatile option for various crops. Ammonium sulfate is extensively used in cereals and grains, which are staple crops in many regions. The high solubility of these fertilizers ensures that crops receive the required nutrients promptly, leading to better yields.

Elemental sulfur fertilizers also play a crucial role in the market. These fertilizers release sulfur slowly, providing a long-term supply of the nutrient. This slow-release property makes them ideal for crops that require sulfur over an extended period. Elemental sulfur is particularly beneficial in regions with sulfur-deficient soils, where it helps maintain soil health and fertility. Sulfate of Potash Magnesia (SOPM) is another important segment, offering a unique combination of sulfur, potassium, and magnesium. This blend is particularly useful for high-value crops like fruits and vegetables, which require balanced nutrient inputs for optimal growth.

Sulfur-coated urea represents a niche segment but is growing in importance due to its dual benefits of providing both sulfur and nitrogen. This combination is effective in enhancing crop yield and quality. Other sulfur fertilizers, including various specialty products, cater to specific agricultural needs and continue to find their niche markets.

Application Method Analysis

Broadcast application dominates with 40% due to its simplicity and efficiency.

The application method is a critical factor influencing the sulfur fertilizers market. Broadcast application, where fertilizers are spread evenly across the soil surface, is the dominant sub-segment. This method is widely used due to its simplicity and effectiveness in covering large areas quickly. Broadcast application is particularly popular in the cultivation of cereals and grains, which require extensive nutrient distribution. The ease and speed of this method make it a preferred choice for farmers aiming to maximize efficiency and productivity.

Fertigation, which involves applying fertilizers through irrigation systems, is gaining traction. This method allows for precise nutrient delivery, ensuring that crops receive the exact amount of sulfur needed for optimal growth. Fertigation is especially useful in regions with advanced irrigation infrastructure and is commonly used in high-value crops like fruits and vegetables. Foliar application, where fertilizers are sprayed directly onto plant leaves, is another significant method. This technique is effective for addressing nutrient deficiencies quickly, making it a valuable tool for farmers dealing with immediate sulfur needs.

Soil incorporation, which involves mixing fertilizers directly into the soil, ensures that sulfur is available to plants over a longer period. This method is often used for crops that benefit from sustained nutrient release. Seed dressing, where seeds are coated with fertilizers before planting, provides an early nutrient boost to young plants. This method is particularly useful for crops like cereals and grains, which benefit from a strong start.

Other application methods, including innovative techniques and customized solutions, continue to evolve, catering to specific agricultural needs. Each application method has its advantages and is chosen based on factors such as crop type, soil condition, and regional agricultural practices.

Crop Type Analysis

Cereals and grains dominate with 50% due to their high sulfur demand and global cultivation.

The sulfur fertilizers market is also segmented by crop type, with cereals and grains being the dominant sub-segment. Crops like wheat, corn, rice, and barley require significant sulfur inputs to achieve high yields. The extensive cultivation of these staple crops across the globe drives the demand for sulfur fertilizers. In 2023, the global market for cereals and grains was valued at over $15 billion, highlighting the substantial need for sulfur fertilizers in this segment. These crops are fundamental to global food security, and ensuring their optimal growth is a priority for farmers worldwide.

Oilseeds and pulses, including soybeans, canola, sunflower, and peanuts, form another critical segment. These crops also demand sulfur for optimal growth and quality. The rising demand for plant-based proteins and oils has increased the cultivation of oilseeds and pulses, subsequently boosting the need for sulfur fertilizers. Fruits and vegetables, such as tomatoes, potatoes, citrus, and apples, are high-value crops that require balanced nutrient inputs, including sulfur. The sulfur content in fertilizers helps improve the taste, quality, and shelf life of these crops, making it an essential component for growers.

Cash crops like cotton, sugar, and tobacco also depend on sulfur fertilizers for enhanced yield and quality. These crops are vital for the economies of several regions, and sulfur fertilizers play a crucial role in maintaining their productivity. Other crops, including specialty and niche crops, continue to contribute to the overall demand for sulfur fertilizers, driven by specific agricultural needs.

Key Market Segments

By Type of Sulfur Fertilizer

- Sulfate-based Fertilizers

- Elemental Sulfur Fertilizers

- Sulfate of Potash Magnesia

- Sulfur-coated Urea

- Others

By Application Method

- Broadcast Application

- Fertigation

- Foliar Application

- Soil Incorporation

- Seed Dressing

- Others

By Crop Type

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Cash Crops

- Others

Growth Opportunities

Development of Specialized Sulfur Fertilizer Formulations Offers Growth Opportunity

Developing specialized sulfur fertilizer formulations offers significant growth opportunities. Manufacturers can create products tailored to specific crop types, soil conditions, and farming practices. For example, slow-release sulfur fertilizers for crops with long growing seasons can enhance nutrient availability over time, leading to better yields.

Formulations that improve sulfur availability in alkaline soils can also open new market segments. By addressing the unique nutritional needs of different crops, manufacturers can capture a larger market share and meet diverse customer requirements. This specialization not only drives market growth but also encourages innovation in product development.

Integration with Precision Agriculture Technologies Offers Growth Opportunity

The integration of sulfur fertilizers with precision agriculture technologies presents a substantial growth opportunity. Precision farming techniques, such as soil mapping, variable rate application, and nutrient management systems, optimize nutrient utilization.

By combining sulfur fertilizer application with these technologies, farmers can reduce waste, achieve higher yields, and promote sustainable agriculture. This approach creates demand for specialized sulfur fertilizer products and services tailored to precision agriculture practices. Recent trends show a 15% annual increase in the adoption of precision farming technologies, highlighting the potential for growth in this sector.

Trending Factors

Increasing Focus on Balanced Crop Nutrition Are Trending Factors

The increasing focus on balanced crop nutrition is a significant trending factor in the sulfur fertilizers market. Farmers and agricultural experts recognize the importance of not only macronutrients like nitrogen, phosphorus, and potassium but also secondary nutrients like sulfur.

This trend has led to a greater emphasis on sulfur fertilizers to address nutrient deficiencies and optimize crop performance. In regions where sulfur deficiency limits crop yields, the adoption of sulfur fertilizers has gained momentum. For example, in North America, sulfur fertilizer usage has increased by 20% over the past five years, reflecting the growing awareness of balanced crop nutrition.

Sustainability and Environmental Consciousness Are Trending Factors

Sustainability and environmental consciousness are driving trends in the sulfur fertilizers market. With rising awareness of eco-friendly agricultural practices, there is a shift towards fertilizers with lower environmental impact.

Sulfur fertilizers, particularly those derived from elemental sulfur or sulfate minerals, are considered more environmentally friendly than synthetic fertilizers. This trend has driven demand among eco-conscious farmers and consumers seeking sustainable food production methods. In Europe, the market for environmentally friendly fertilizers, including sulfur-based products, has grown by 10% annually, highlighting the increasing importance of sustainability in agriculture.

Regional Analysis

APAC Dominates with 37.6% Market Share

The Asia-Pacific (APAC) region holds a dominant 37.6% share of the sulfur fertilizers market. This dominance is driven by several key factors.

APAC's dominance is due to the extensive agricultural activities in countries like China and India. These nations have large populations and high food demand, leading to increased use of sulfur fertilizers to boost crop yields. In India, sulfur fertilizer usage has grown by 6% annually, reflecting its importance in agriculture.

The region's diverse climatic conditions and soil types necessitate varied agricultural practices, which sulfur fertilizers support. The high cultivation of cereals and grains, which require significant sulfur inputs, further drives market demand. Additionally, government initiatives promoting advanced farming techniques have bolstered the use of these fertilizers.

APAC's market presence is expected to grow, with a projected CAGR of 5% over the next five years. The continued emphasis on agricultural productivity and sustainability will sustain and possibly increase the demand for sulfur fertilizers. Expansion in organic farming practices in the region will also contribute to market growth.

North America Market Share

North America accounts for 25% of the sulfur fertilizers market. The region's well-developed agricultural infrastructure and focus on high-yield crops drive this share. The use of precision agriculture and soil management techniques is prevalent, supporting consistent demand for sulfur fertilizers.

Europe Market Share

Europe holds 20% of the sulfur fertilizers market. Stringent environmental regulations and a focus on sustainable farming practices contribute to this share. The increasing adoption of organic farming in countries like Germany and France boosts the demand for environmentally friendly sulfur fertilizers.

Middle East & Africa Market Share

The Middle East & Africa region represents 10% of the market. Agricultural expansion in Africa and efforts to enhance soil fertility in arid regions drive the demand for sulfur fertilizers. Government initiatives to improve food security also play a crucial role.

Latin America Market Share

Latin America has an 8% share of the sulfur fertilizers market. The region's diverse agricultural landscape, including significant production of cash crops like coffee and sugarcane, drives the use of sulfur fertilizers. The growing emphasis on sustainable farming practices further supports market growth.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Sulfur Fertilizers Market is highly competitive, with several key players influencing its landscape. Nutrien Ltd., The Mosaic Company, and Yara International ASA are among the leading companies, leveraging their extensive global distribution networks and advanced production technologies. These firms benefit from economies of scale and strong R&D capabilities, positioning them as dominant market influencers.

K+S AG and OCP Group also hold significant market positions. K+S AG's expertise in potash and salt products complements its sulfur fertilizer offerings, while OCP Group's vast phosphate resources provide a competitive edge in integrated nutrient solutions.

The Tessenderlo Group and EuroChem Group AG are noted for their strategic focus on specialty fertilizers, enhancing their market impact through product differentiation. Coromandel International Limited and Israel Chemicals Ltd. leverage regional market strengths, particularly in the Asia-Pacific and Middle Eastern markets, respectively.

Deepak Fertilisers and Petrochemicals Corporation Ltd. and Koch Fertilizer, LLC have notable market influence through diversified chemical portfolios and robust supply chains. Zuari Agro Chemicals Ltd. and H.J. Baker & Bro., Inc. maintain competitive positions with strong local market penetration and niche product offerings.

ICL Group and Haifa Group focus on high-value agricultural solutions, with innovative products aimed at improving crop yields and sustainability. These companies' strategic investments in technology and sustainability initiatives further enhance their market influence.

Overall, the key players in the Sulfur Fertilizers Market are characterized by their strong market presence, strategic positioning, and continuous innovation, driving market growth and shaping industry trends.

Market Key Players

- Nutrien Ltd.

- The Mosaic Company

- Yara International ASA

- K+S AG

- OCP Group

- Tessenderlo Group

- EuroChem Group AG

- Coromandel International Limited

- Israel Chemicals Ltd.

- Deepak Fertilisers and Petrochemicals Corporation Ltd.

- Koch Fertilizer, LLC

- Zuari Agro Chemicals Ltd.

- H.J. Baker & Bro., Inc.

- ICL Group

- Haifa Group

Recent Developments

- May 2024: The Indian government is pushing for the adoption of sulphur-coated urea (SCU) to enhance fertilizer efficiency, though it faces significant implementation challenges. SCU aims to improve nitrogen uptake by crops, thereby increasing nitrogen use efficiency (NUE) by 10-15 percentage points.

- March 2023: Mammoet successfully completed a challenging upgrade of Ma’aden’s Umm Wu’al sulfuric acid and power plant, located in Saudi Arabia, achieving significant time savings and operational improvements.

- January 2023: A recent study from the Cooperative Institute for Research in Environmental Sciences (CIRES) at the University of Colorado Boulder reveals a significant increase in sulfur fertilizer use among farmers, prompted by reductions in airborne sulfur deposition and subsequent agricultural needs.

Report Scope

Report Features Description Market Value (2023) USD 4.6 Billion Forecast Revenue (2033) USD 6.7 Billion CAGR (2024-2033) 3.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Sulfur Fertilizer (Sulfate-based Fertilizers, Elemental Sulfur Fertilizers, Sulfate of Potash Magnesia, Sulfur-coated Urea, Others), By Application Method (Broadcast Application, Fertigation, Foliar Application, Soil Incorporation, Seed Dressing, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Cash Crops, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nutrien Ltd., The Mosaic Company, Yara International ASA, K+S AG, OCP Group, Tessenderlo Group, EuroChem Group AG, Coromandel International Limited, Israel Chemicals Ltd., Deepak Fertilisers and Petrochemicals Corporation Ltd., Koch Fertilizer, LLC, Zuari Agro Chemicals Ltd., H.J. Baker & Bro., Inc., ICL Group, Haifa Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Nutrien Ltd.

- The Mosaic Company

- Yara International ASA

- K+S AG

- OCP Group

- Tessenderlo Group

- EuroChem Group AG

- Coromandel International Limited

- Israel Chemicals Ltd.

- Deepak Fertilisers and Petrochemicals Corporation Ltd.

- Koch Fertilizer, LLC

- Zuari Agro Chemicals Ltd.

- H.J. Baker & Bro., Inc.

- ICL Group

- Haifa Group