Succinic Acid Market By Type (Petro-based and Bio-based), By End-User (Industrial, Coating, Food & Beverage, Personal Care & Cosmetics, Pharmaceuticals, Other End-Users), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49436

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

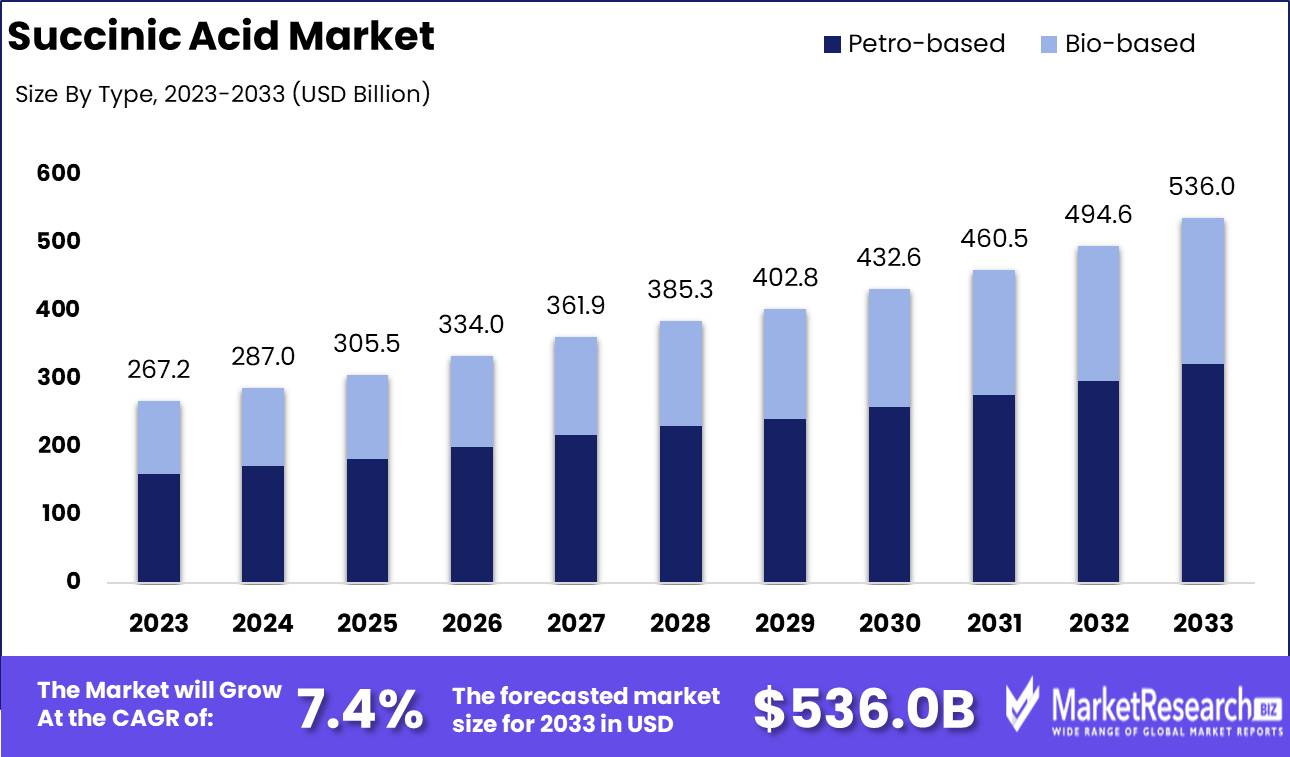

The Succinic Acid Market was valued at USD 267.2 billion in 2023. It is expected to reach USD 536.0 billion by 2033, with a CAGR of 7.4% during the forecast period from 2024 to 2033.

The succinic acid market encompasses the global trade and production of succinic acid, a dicarboxylic acid primarily derived from biomass and petrochemical sources. Succinic acid is pivotal in the manufacturing of biodegradable plastics, pharmaceuticals, food additives, and surfactants. The market is driven by rising demand for sustainable and bio-based products, advancements in production technologies, and regulatory incentives promoting green chemicals.

The succinic acid market is poised for significant growth driven by rising demand in the pharmaceuticals sector and a notable shift towards bio-based products. Succinic acid, a key intermediate in the production of pharmaceuticals, benefits from the increased global focus on healthcare and the development of new drugs. This demand is further bolstered by regulatory support for environmentally friendly and sustainable practices, encouraging the use of bio-based succinic acid.

However, the production of bio-based succinic acid remains cost-intensive, limiting its competitiveness against petroleum-based counterparts. Despite these challenges, growth prospects for the market are robust, supported by continuous technological innovations aimed at reducing production costs and enhancing yield efficiency.

Raw material price volatility also presents a significant challenge, impacting the overall cost structure and profitability for manufacturers. Nevertheless, the market is expected to navigate these hurdles with the ongoing advancements in technology and process optimization. Companies are investing in research and development to develop cost-effective and scalable production methods, which is crucial for maintaining competitiveness in a market where raw material prices can be unpredictable. Additionally, the shift towards bio-based products is a crucial trend, aligning with global sustainability goals and consumer preferences for green products. As such, the succinic acid market is anticipated to experience steady growth, driven by its applications in pharmaceuticals and the broader industrial sectors, coupled with an increasing focus on sustainability and technological advancements.

Key Takeaways

- Market Growth: The Succinic Acid Market was valued at USD 267.2 billion in 2023. It is expected to reach USD 536.0 billion by 2033, with a CAGR of 7.4% during the forecast period from 2024 to 2033.

- By Type: Petro-based succinic acid dominated due to industrial applications.

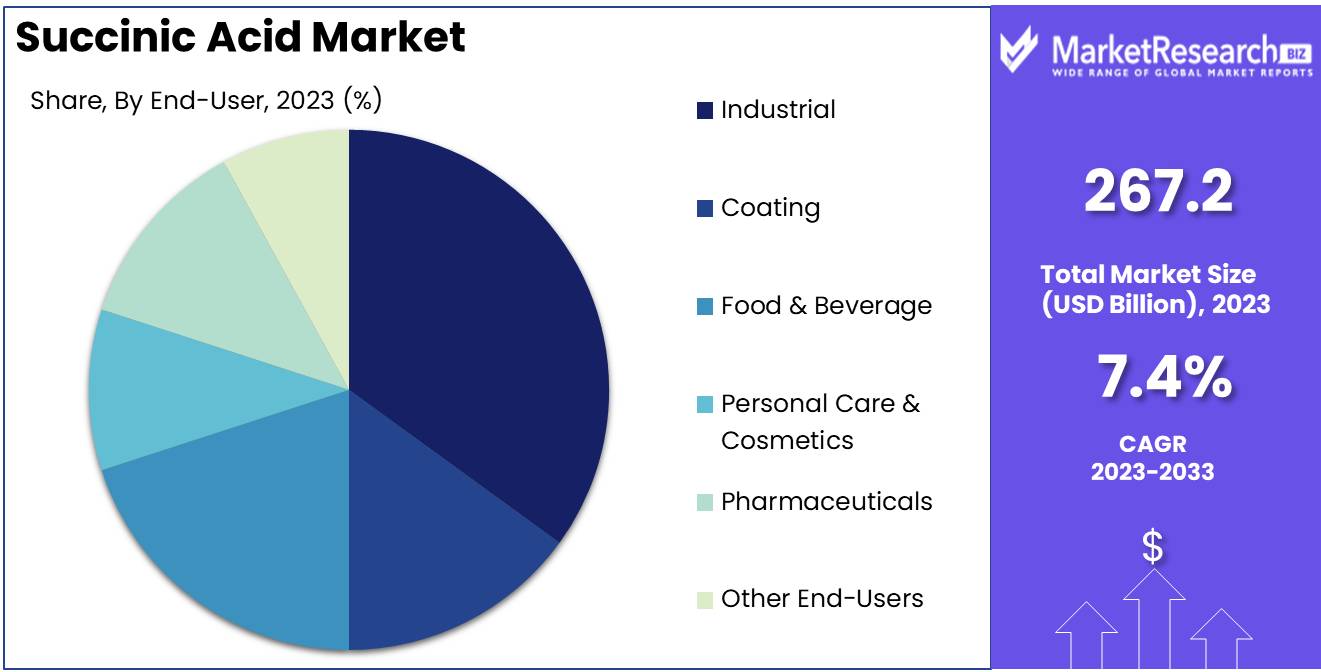

- By End-User: The Industrial segment dominated the Succinic Acid Market.

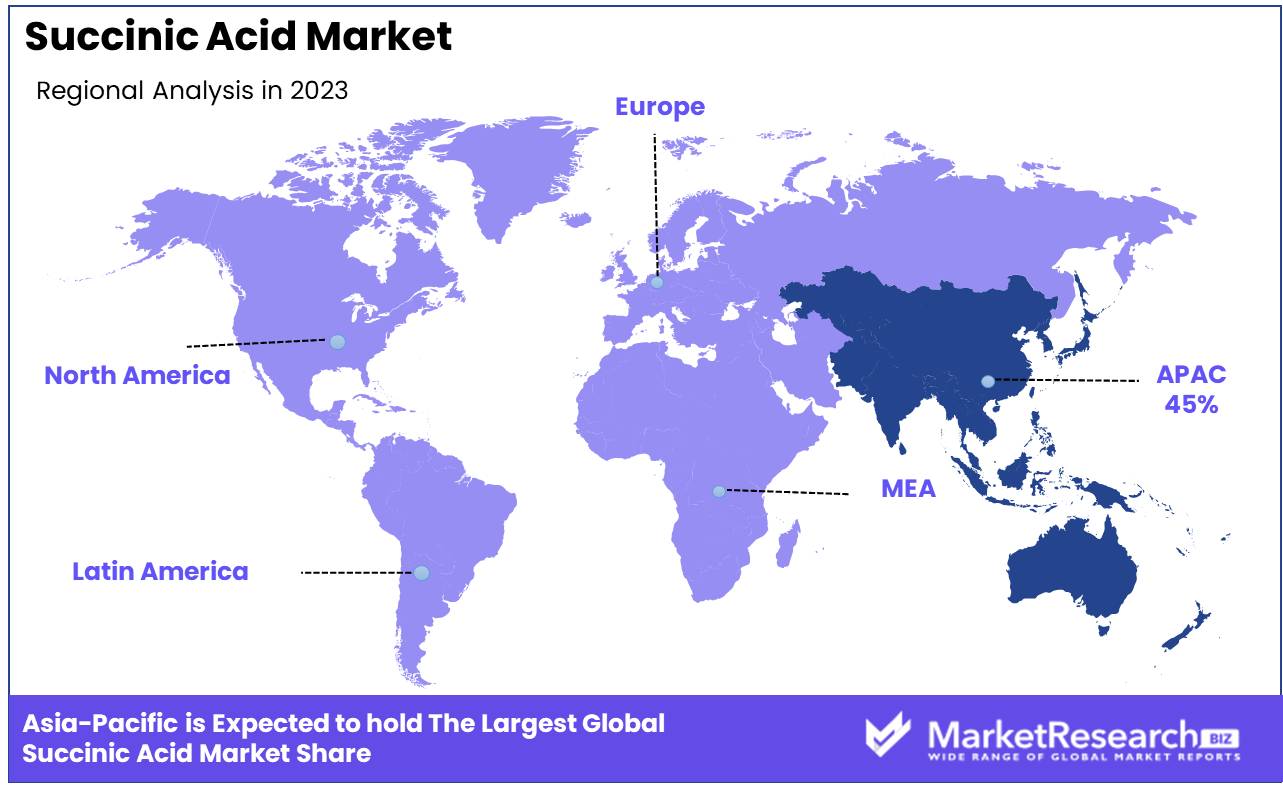

- Regional Dominance: Asia Pacific dominates the Succinic Acid Market with a 45% largest share.

- Growth Opportunity: The global succinic acid market will grow due to rising pharmaceutical demand and increased bio-based production.

Driving factors

Infrastructure Development and Urbanization Driving Demand

The construction and infrastructure sector is experiencing significant growth globally, driven by urbanization and the need for sustainable building materials. Succinic acid, as a key intermediate in the production of construction materials like resins, coatings, and sealants, is witnessing increased demand. According to recent market reports, the global construction market is projected to grow at a compound annual growth rate (CAGR) of 7.1% from 2021 to 2028. This growth is directly linked to the rising demand for succinic acid in the production of eco-friendly and durable construction products. The adoption of succinic acid-based products in construction not only enhances the durability and performance of materials but also aligns with the industry's move towards greener and more sustainable practices.

Lightweight and Sustainable Materials for Automotive Applications

The automotive industry is increasingly focusing on reducing vehicle weight and improving fuel efficiency to comply with stringent environmental regulations. Succinic acid plays a crucial role in the production of bio-based polymers, which are used to manufacture lightweight automotive components. The market for bio-based polymers is anticipated to grow significantly, with a CAGR of 11.2% from 2020 to 2027, driven by the automotive sector's shift towards sustainable materials. Succinic acid-based polymers offer comparable performance to traditional materials while being more environmentally friendly. This shift is further propelled by the rising consumer preference for eco-friendly vehicles and the automotive industry's commitment to reducing carbon emissions.

Enhancing Circular Economy Practices

Sustainability and recycling are becoming central themes in various industries, including construction, automotive, and packaging. Succinic acid, being a bio-based chemical, is at the forefront of these sustainability initiatives. The focus on reducing dependence on fossil fuels and minimizing environmental impact has led to increased adoption of bio-based succinic acid. The market for bio-based chemicals is expected to reach USD 24.1 billion by 2025, growing at a CAGR of 12.6% from 2020 to 2025. This growth is driven by regulatory support and corporate sustainability goals, which promote the use of recyclable and biodegradable materials. Succinic acid's role in producing biodegradable plastics and its potential for recycling in industrial applications make it a key component in advancing the circular economy.

Restraining Factors

High Initial Investment: A Barrier to Market Entry and Expansion

The growth of the Succinic Acid Market is significantly restrained by the high initial investment required for setting up production facilities. This factor includes the substantial capital needed for acquiring advanced technology, infrastructure, and skilled labor. The high costs associated with establishing a competitive production line can deter new entrants, limiting the market's expansion.

Furthermore, existing companies may face financial constraints that hinder their ability to scale operations or innovate. For instance, advanced biotechnological processes, which are essential for efficient and sustainable production of succinic acid, demand considerable upfront expenditure. Consequently, the high initial investment acts as a bottleneck, slowing down the overall growth trajectory of the market.

Intermittency and Reliability: Challenges in Sustainable Production

Intermittency and reliability issues pose significant challenges to the consistent and efficient production of succinic acid. This factor primarily relates to the fluctuating availability and performance of renewable raw materials and energy sources used in the production process. Variability in the supply of biomass, which is often dependent on seasonal and geographical factors, can lead to interruptions in production schedules, affecting the reliability of supply chains.

Moreover, the dependence on renewable energy sources, which are inherently intermittent, can further exacerbate these challenges. For example, the integration of bio-based production methods with renewable energy can result in inconsistent output due to the variability in energy supply. This unpredictability not only impacts the manufacturing process but also raises concerns about the reliability of succinic acid as a consistent and dependable industrial chemical. As a result, potential users in various industries may hesitate to adopt succinic acid, thereby restraining market growth.

By Type Analysis

In 2023, Petro-based succinic acid dominated due to industrial applications.

In 2023, The Petro-based segment held a dominant market position in the By Type segment of the Succinic Acid Market. This dominance is attributed to the extensive application of petro-based succinic acid in various industrial sectors, including plastics, coatings, and resins. The established infrastructure and cost-effective production processes associated with petro-based succinic acid have contributed significantly to its leading market share. Additionally, the high demand for petro-based succinic acid in the automotive and construction industries has bolstered its market position.

Conversely, the Bio-based segment is witnessing a growing interest due to the increasing environmental concerns and regulatory pressures promoting sustainable and eco-friendly alternatives. Bio-based succinic acid, derived from renewable feedstocks, offers a lower carbon footprint and aligns with the global shift towards green chemistry. Although currently less dominant than its petro-based counterpart, the bio-based segment is expected to experience substantial growth, driven by advancements in biotechnology and favorable government policies supporting the bio-economy.

By End-User Analysis

In 2023, The Industrial segment dominated the Succinic Acid Market.

In 2023, The Industrial segment held a dominant market position in the By End-User segment of the Succinic Acid Market. This segment's dominance can be attributed to the increasing use of succinic acid in the production of bio-based chemicals, which are essential for sustainable industrial applications. Succinic acid's versatile properties make it a key component in the manufacturing of polymers, resins, and solvents, driving its demand in the industrial sector. Additionally, the rising adoption of green chemistry practices has further propelled the growth of this segment.

The Coating segment also witnessed significant growth, driven by the demand for eco-friendly and high-performance coatings. Succinic acid's role in improving the durability and environmental footprint of coatings has made it a preferred choice in this industry.

In the Food & Beverage sector, succinic acid is utilized as a flavoring agent and pH regulator, contributing to the segment's steady growth. The Personal Care & Cosmetics segment has also seen increased utilization of succinic acid, particularly in formulations aimed at enhancing skin hydration and texture.

The Pharmaceuticals segment leverages succinic acid for drug formulation and synthesis, further expanding its market presence. Lastly, the Other End-Users segment includes various niche applications, collectively contributing to the overall market dynamics of succinic acid.

Key Market Segments

By Type

- Petro-based

- Bio-based

By End-User

- Industrial

- Coating

- Food & Beverage

- Personal Care & Cosmetics

- Pharmaceuticals

- Other End-Users

Growth Opportunity

Increasing Demand in Pharmaceuticals

The global succinic acid market is poised for significant growth in 2024, driven primarily by its increasing demand in the pharmaceutical sector. Succinic acid is gaining prominence as a key ingredient in the formulation of various drugs due to its versatile chemical properties and efficacy. Its application ranges from serving as a precursor in drug synthesis to enhancing the solubility and stability of active pharmaceutical ingredients (APIs).

The burgeoning pharmaceutical industry, especially in emerging economies, presents a robust opportunity for succinic acid manufacturers. With the global pharmaceutical market projected to grow at a substantial rate, the demand for succinic acid is expected to follow suit. This growth trajectory is underpinned by the increasing prevalence of chronic diseases, the rising focus on personalized medicine, and the continuous development of novel therapeutic solutions.

Bio-based Succinic Acid Production

Another pivotal opportunity for the succinic acid market lies in the production of bio-based succinic acid. With the escalating environmental concerns and the global shift towards sustainable practices, bio-based succinic acid is gaining traction as an eco-friendly alternative to its petrochemical counterpart. The production of bio-based succinic acid involves the fermentation of renewable feedstocks, which significantly reduces the carbon footprint. This aligns well with the stringent environmental regulations and the increasing consumer preference for green products.

The advancements in biotechnology and the increasing investments in renewable chemicals are likely to bolster the production capabilities and cost-competitiveness of bio-based succinic acid. Consequently, this is expected to open new avenues for market expansion, particularly in regions with a strong emphasis on sustainability.

Latest Trends

Increased Use in Packaging

The succinic acid market is anticipated to witness a notable increase in its application within the packaging industry. As sustainability becomes a pivotal concern for both consumers and manufacturers, the demand for bio-based packaging solutions is rising. Succinic acid, being a bio-based chemical, aligns perfectly with the trend toward eco-friendly packaging materials. It serves as a crucial component in the production of biodegradable plastics, which are increasingly preferred over conventional plastics due to their lower environmental impact. This shift is expected to drive significant growth in the market, with packaging becoming one of the key application areas for succinic acid.

Diversification of Applications

The diversification of succinic acid applications is another significant trend forecasted. Traditionally used in pharmaceuticals, food and beverages, and personal care products, succinic acid is now finding new avenues of application. The chemical's versatility and biodegradability are opening doors in emerging sectors such as automotive, agriculture, and textiles. For instance, in the automotive industry, succinic acid is being explored for use in the production of bio-based polyurethanes, which are used in foams and coatings. In agriculture, it is being utilized in the formulation of eco-friendly fertilizers and pesticides. This broadening of application scope is expected to enhance the market's growth trajectory, offering new revenue streams for manufacturers and suppliers.

Regional Analysis

Asia Pacific dominates the Succinic Acid Market with a 45% largest share.

The global Succinic Acid Market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, with Asia Pacific emerging as the dominant region. Asia Pacific accounted for approximately 45% of the largest market share, driven by robust industrial growth and high demand for succinic acid in applications such as pharmaceuticals, food & beverages, and bioplastics.

North America holds a significant portion of the market, with a share of around 25%, supported by advancements in green chemicals and a growing inclination towards bio-based products. Europe follows closely, capturing about 20% of the market, attributed to stringent environmental regulations and substantial investments in sustainable technologies.

Latin America and the Middle East & Africa collectively contribute to approximately 10% of the market, with growth fueled by increasing industrialization and rising awareness of bio-based chemicals. The succinic acid market in these regions is further bolstered by government initiatives promoting sustainable practices. The expanding use of succinic acid in various end-use industries, coupled with continuous research and development activities, is expected to drive market growth across these regions in the foreseeable future.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global succinic acid market is poised for significant growth in 2024, driven by its increasing application across various industries including pharmaceuticals, food and beverages, and biodegradable plastics. Key players such as BASF SE, Dow Chemicals, and Mitsubishi Chemical Corporation are expected to lead the market due to their robust production capabilities and extensive distribution networks.

BASF SE and Dow Chemicals continue to invest in advanced manufacturing technologies, enhancing their production efficiency and sustainability. This positions them strongly to meet the rising demand for bio-based succinic acid, a trend driven by growing environmental concerns.

GC Innovation America and BioAmber, Inc. are noteworthy for their focus on innovative biotechnological processes, which offer a competitive edge in the bio-based segment. Similarly, Myriant Corporation and Succinity GmbH leverage renewable feedstocks, aligning with the global shift towards green chemistry.

Merck KGaA and ThyssenKrupp AG stand out for their comprehensive R&D initiatives, aimed at expanding the application scope of succinic acid, particularly in high-growth sectors like bioplastics and pharmaceuticals.

Asian companies such as Kawasaki Kasei Chemicals Ltd. and Nippon Shokubai Co., Ltd. are expected to capture significant market share due to their cost-effective production techniques and expanding regional markets.

Market Key Players

- BASF SE

- GC Innovation America

- Parchem

- Dow Chemicals

- Ernesto Ventos S.A.

- The Chemical Company

- Kawasaki Kasei Chemicals Ltd.

- Mitsubishi Chemical Corporation

- Nippon Shokubai Co., Ltd.

- Anhui Sunsing Chemicals Co., Ltd.

- Merck KGaA

- ThyssenKrupp AG

- BioAmber, Inc

- Myriant Corporation

- Succinity GmbH

- Technip Energies

- Gadiv Petrochemical Industries Ltd.

- Spectrum Chemical Manufacturing Corp.

- FUSO CHEMICAL CO., LTD.

- S.S. Pharmachem

- R-Biopharm AG among others Source

Recent Development

- In June 2024, GC Innovation America acquired a leading bio-based succinic acid plant in Texas from a regional producer. This strategic move aims to strengthen GC Innovation America’s footprint in the North American market and expand its production capacity to cater to various industrial applications.

- In April 2024, Myriant Corporation entered into a joint venture with ThyssenKrupp Industrial Solutions to construct a new bio-based succinic acid production plant in Thailand. This collaboration is expected to enhance the production capabilities and cater to the increasing demand in the Asia-Pacific region.

- In February 2024, BASF SE announced the expansion of its bio-based succinic acid production capacity at its facility in Ludwigshafen, Germany. This expansion aims to meet the growing demand for bio-based chemicals, particularly in the pharmaceutical and food industries.

Report Scope

Report Features Description Market Value (2023) USD 267.2 Billion Forecast Revenue (2033) USD 536.0 Billion CAGR (2024-2032) 7.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Petro-based and Bio-based), By End-User (Industrial, Coating, Food & Beverage, Personal Care & Cosmetics, Pharmaceuticals, Other End-Users) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BASF SE, GC Innovation America, Parchem, Dow Chemicals, Ernesto Ventos S.A., The Chemical Company, Kawasaki Kasei Chemicals Ltd., Mitsubishi Chemical Corporation, Nippon Shokubai Co., Ltd., Anhui Sunsing Chemicals Co., Ltd., Merck KGaA, ThyssenKrupp AG, BioAmber, Inc, Myriant Corporation, Succinity GmbH, Technip Energies, Gadiv Petrochemical Industries Ltd., Spectrum Chemical Manufacturing Corp., FUSO CHEMICAL CO., LTD., S.S. Pharmachem, R-Biopharm AG among others Source Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BASF SE

- GC Innovation America

- Parchem

- Dow Chemicals

- Ernesto Ventos S.A.

- The Chemical Company

- Kawasaki Kasei Chemicals Ltd.

- Mitsubishi Chemical Corporation

- Nippon Shokubai Co., Ltd.

- Anhui Sunsing Chemicals Co., Ltd.

- Merck KGaA

- ThyssenKrupp AG

- BioAmber, Inc

- Myriant Corporation

- Succinity GmbH

- Technip Energies

- Gadiv Petrochemical Industries Ltd.

- Spectrum Chemical Manufacturing Corp.

- FUSO CHEMICAL CO., LTD.

- S.S. Pharmachem

- R-Biopharm AG among others Source