Structural Steel Fabrication Market By Type (Metal Welding, Metal Forming, Metal Cutting, Metal Shearing, Metal Stamping, Metal Rolling, Others), By Application (Construction, Automotive, Manufacturing, Energy & Power, Electronics, Defense & Aerospace, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48449

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

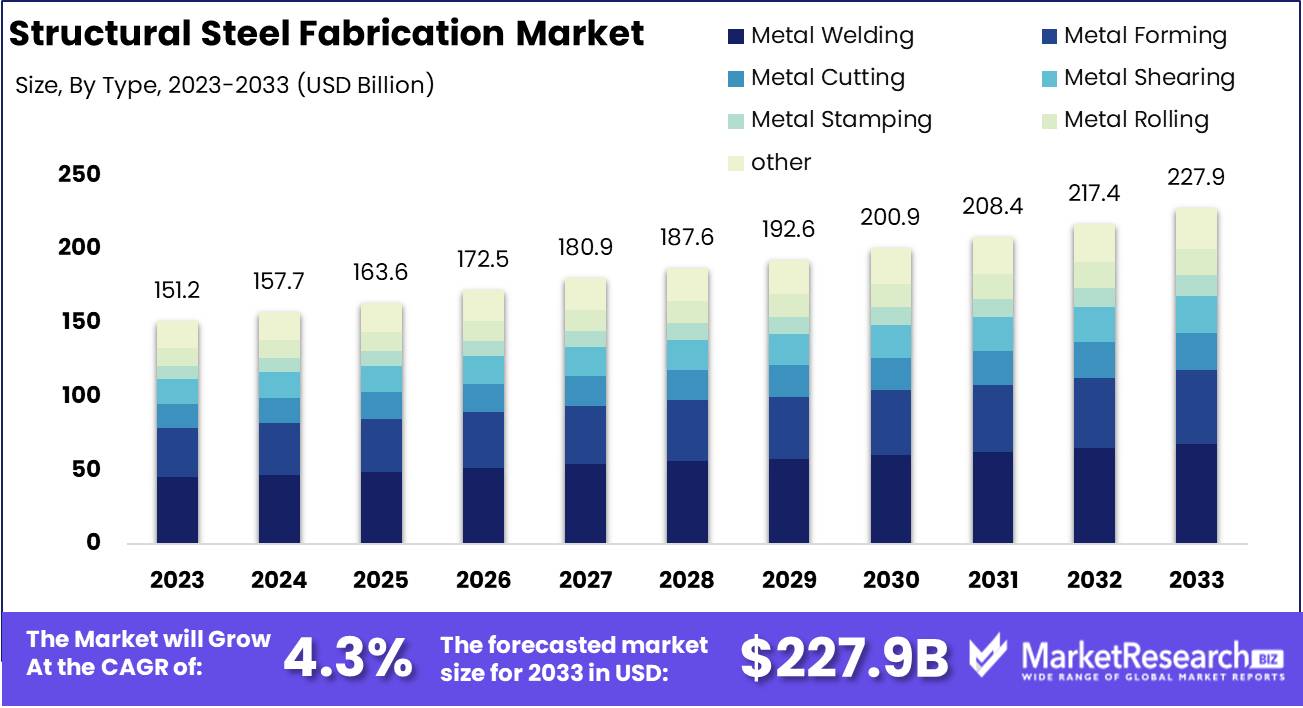

The Structural Steel Fabrication Market was valued at USD 151.2 billion in 2023. It is expected to reach USD 227.9 billion by 2033, with a CAGR of 4.3% during the forecast period from 2024 to 2033.

The Structural Steel Fabrication Market encompasses the industrial sector involved in the cutting, bending, and assembling of steel structures, crucial for construction and infrastructure projects. This market is driven by demand from various industries, including construction, automotive, shipbuilding, and energy, due to steel's strength, durability, and versatility. Advances in automation and computer-aided design (CAD) technologies have enhanced precision and efficiency in fabrication processes.

The structural steel fabrication market is experiencing robust growth, driven primarily by significant global investments in infrastructure development. These investments are a cornerstone for market expansion, as governments and private entities prioritize large-scale projects such as bridges, highways, and commercial buildings. Technological advancements are further propelling this market, with innovations in fabrication technologies, including automation and digitalization, significantly enhancing operational efficiency and productivity. The integration of Building Information Modeling (BIM) is another critical factor, providing comprehensive design and construction solutions that streamline processes and reduce waste, leading to more cost-effective project execution.

However, the market is not without its challenges. One of the most pressing issues is the volatility of raw material prices, particularly steel. Fluctuations in steel prices can create instability, impacting profit margins and project budgets. As a result, companies within the structural steel fabrication sector must adopt robust risk management strategies to mitigate these price variances.

Additionally, leveraging advanced technologies and BIM can provide a competitive edge, enabling firms to optimize resources and enhance project delivery. Overall, the outlook for the structural steel fabrication market remains positive, with continued infrastructure investments and technological integration poised to drive sustained growth, despite the ongoing challenges of raw material price volatility.

Key Takeaways

- Market Growth: The Structural Steel Fabrication Market was valued at USD 151.2 billion in 2023. It is expected to reach USD 227.9 billion by 2033, with a CAGR of 4.3% during the forecast period from 2024 to 2033.

- By Type: Metal Welding dominated due to its critical role in structural integrity.

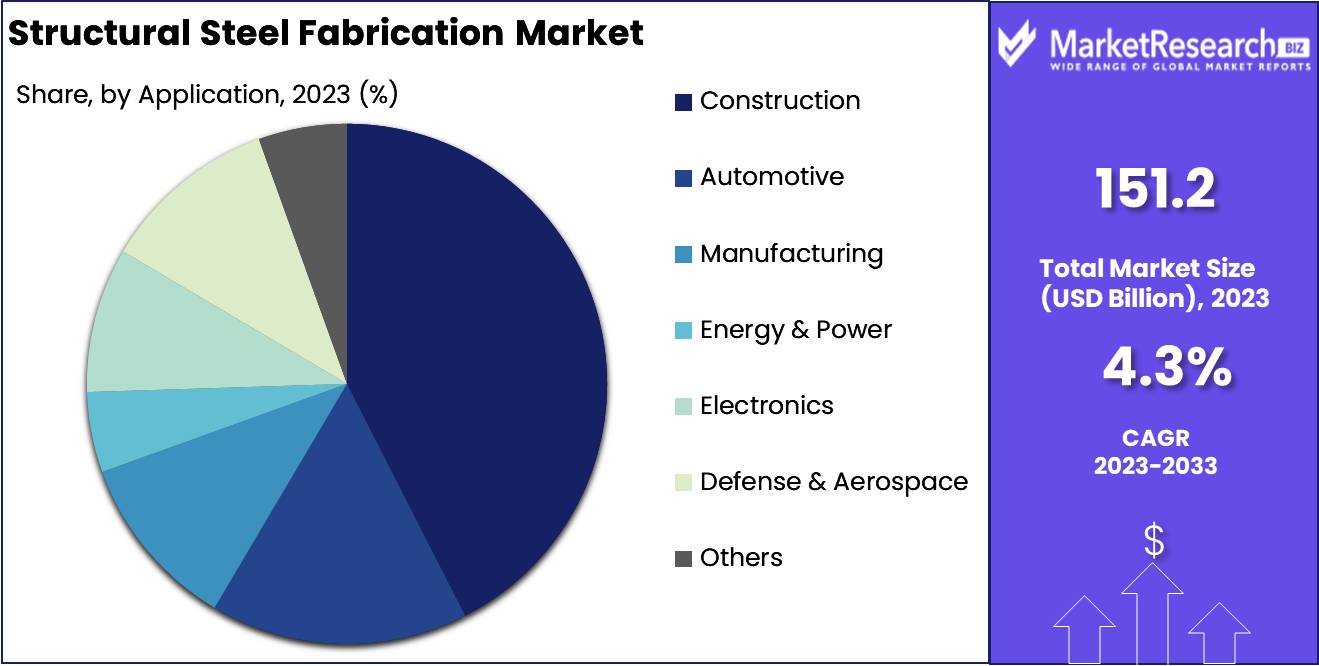

- By Application: Construction-dominated structural steel fabrication across multiple industry applications.

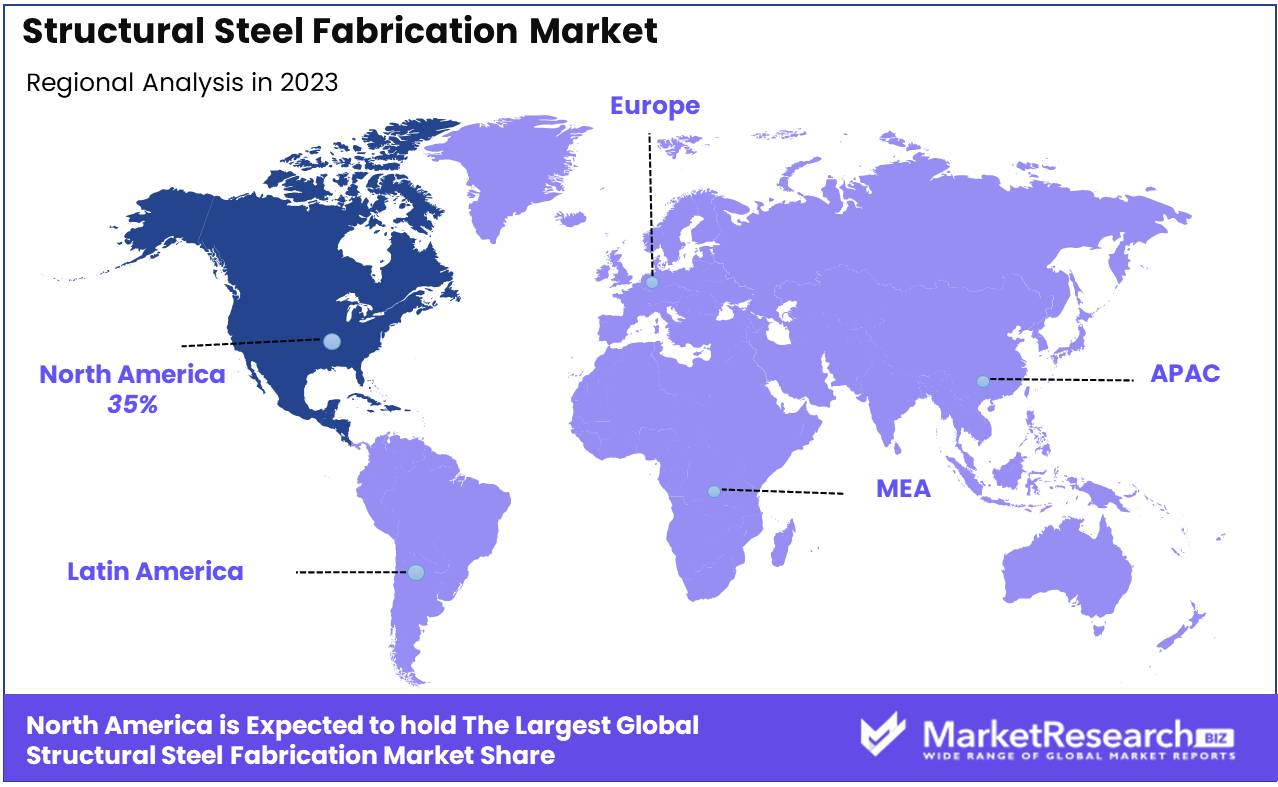

- Regional Dominance: North America leads the structural steel fabrication market with a 35% largest share.

- Growth Opportunity: The global structural steel fabrication market is set for robust growth, driven by manufacturing demand and infrastructure projects.

Driving factors

Increasing Growth in the Construction Industry

The growth of the construction industry significantly contributes to the expansion of the structural steel fabrication market. The global construction sector has witnessed steady growth due to urbanization, infrastructure development, and increasing investments in residential and commercial projects. According to recent reports, the construction industry is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2028. This growth drives the demand for structural steel, a preferred material for its strength, durability, and cost-effectiveness. The rising construction activities, particularly in emerging economies, propel the need for structural steel fabrication, thereby fueling market growth.

Rising Demand for Pre-Engineered Buildings and Components

The demand for pre-engineered buildings (PEBs) and components has surged due to their efficiency, reduced construction time, and cost savings. PEBs, which utilize structural steel, are gaining popularity in various sectors, including industrial, commercial, and residential. The pre-engineered buildings market is anticipated to grow at a CAGR of 11.3% from 2023 to 2028. This trend enhances the demand for structural steel fabrication as PEBs rely heavily on steel components. The shift towards modular construction and the need for sustainable building solutions further augment the market for structural steel fabrication, as these structures offer flexibility and recyclability.

Expansion of the Automotive Sector

The automotive sector's expansion also drives the growth of the structural steel fabrication market. Structural steel is extensively used in the automotive industry for manufacturing vehicle frames, chassis, and other critical components due to its high strength-to-weight ratio and corrosion resistance. The global automotive industry is projected to grow at a CAGR of 5.1% from 2023 to 2028, driven by rising vehicle production and advancements in electric vehicles (EVs). This growth translates to increased demand for structural steel fabrication, as manufacturers seek high-quality materials to meet safety standards and enhance vehicle performance.

Restraining Factors

Intermittency and Reliability: Disrupting Production Schedules and Increasing Operational Costs

Intermittency and reliability issues are critical factors that significantly impede the growth of the structural steel fabrication market. The fabrication process demands a continuous and reliable supply of both raw materials and energy. However, disruptions in these supply chains can halt production, leading to delays in project completion and increased operational costs.

For instance, intermittent supply of electricity or gas can force fabrication plants to shut down temporarily, disrupting workflows and decreasing overall productivity. This unreliability translates into higher costs as companies may need to invest in backup power systems or pay higher premiums for guaranteed energy supplies. Additionally, the complexity of modern construction projects often means that delays in one phase can have a domino effect, causing further delays and cost overruns in subsequent phases.

Moreover, intermittent supply chains can affect the consistency of raw material availability. When steel and other essential materials are not delivered on time, fabricators face downtime or may have to source materials at higher prices on short notice, impacting their margins. This unpredictability in supply can erode the competitive edge of firms that are unable to manage these risks effectively, ultimately slowing down the market's growth.

Volatility in Raw Material Prices: Squeezing Margins and Increasing Financial Uncertainty

The structural steel fabrication market is highly sensitive to fluctuations in raw material prices, particularly steel. Volatility in these prices can have profound implications for market dynamics, affecting everything from cost structures to investment decisions.

For example, if the price of steel spikes unexpectedly, fabricators who have not hedged their purchases may find their profit margins significantly reduced. Given that raw materials constitute a substantial portion of the total production cost in steel fabrication, even minor fluctuations can lead to considerable financial strain. This uncertainty makes it challenging for companies to plan long-term investments and can deter new entrants into the market.

Additionally, price volatility can influence the pricing strategies of steel fabricators. To manage the risks associated with fluctuating material costs, companies might increase the prices of their finished products. However, higher prices can lead to reduced demand, especially in price-sensitive markets, thereby slowing market growth. On the other hand, if fabricators absorb the increased costs without passing them on to customers, their financial health can deteriorate, leading to potential insolvencies or market exits.

By Type Analysis

In 2023, Metal Welding dominated due to its critical role in structural integrity.

In 2023, Metal Welding held a dominant market position in the By Type segment of the Structural Steel Fabrication Market. This leading role can be attributed to the critical function of welding in ensuring the integrity and strength of steel structures, which are essential in the construction, automotive, and aerospace industries. The process of metal welding involves joining metal parts to create a unified structure, providing durability and reliability, which are paramount in structural applications.

In comparison, Metal Forming, which includes bending, drawing, and stretching metals into desired shapes, also saw significant demand due to its versatility in creating custom components. Metal Cutting, essential for precise sizing and shaping, remained a cornerstone technique, particularly with advancements in laser and plasma cutting technologies enhancing efficiency and accuracy. Metal Shearing, employed for cutting straight lines in metal sheets, continued to be vital in mass production settings for its speed and cost-effectiveness.

Metal Stamping, used for producing high-volume parts through die and punch presses, was crucial in the automotive sector. Metal Rolling, involving passing metal stock through rollers to reduce thickness, remained integral for producing flat and tubular products. Other processes, including forging and extrusion, complemented these primary methods, offering additional fabrication capabilities for specialized applications. Collectively, these segments underscored the multifaceted nature of structural steel fabrication, with welding at the forefront due to its indispensable role in ensuring structural integrity and safety.

By Application Analysis

In 2023, Construction dominated structural steel fabrication across multiple industry applications.

In 2023, Construction held a dominant market position in the By Application segment of the Structural Steel Fabrication Market. This sector's preeminence can be attributed to several factors. The global construction industry's expansion, driven by urbanization and infrastructural development in emerging economies, has significantly bolstered demand for structural steel. High-rise buildings, bridges, and commercial complexes increasingly rely on the strength, durability, and cost-efficiency of fabricated steel structures, cementing their crucial role in construction projects.

The Automotive sector also experienced notable utilization of structural steel fabrication, with advancements in vehicle design and production requiring robust and lightweight materials. Manufacturing industries leverage fabricated steel for machinery and equipment, enhancing operational efficiency and product longevity.

In the Energy & Power sector, the transition to renewable energy sources like wind and solar has led to increased use of steel in the construction of wind turbine towers and solar panel mounts. The Electronics industry benefits from steel's application in robust and reliable infrastructural frameworks for large-scale electronic and semiconductor manufacturing.

Meanwhile, the Defense & Aerospace sectors utilize structural steel for building aircraft, ships, and military infrastructure, prioritizing strength and resilience. Other applications include agriculture, mining, and transport industries, all of which benefit from the versatility and strength of fabricated steel structures.

Key Market Segments

By Type

- Metal Welding

- Metal Forming

- Metal Cutting

- Metal Shearing

- Metal Stamping

- Metal Rolling

- Others

By Application

- Construction

- Automotive

- Manufacturing

- Energy & Power

- Electronics

- Defense & Aerospace

- Others

Growth Opportunity

Increasing Demand from the Manufacturing Sector

The global structural steel fabrication market is poised for significant growth, driven primarily by the escalating demand from the manufacturing sector. As industries such as automotive, aerospace, and heavy machinery continue to expand, the need for robust and reliable steel structures has intensified. Structural steel's inherent qualities of durability, flexibility, and cost-effectiveness make it an indispensable material in manufacturing. With the global manufacturing sector projected to grow at a steady rate, the structural steel fabrication market is set to capitalize on this trend. This demand surge is particularly notable in emerging economies where industrialization is rapidly advancing, necessitating the construction of new manufacturing plants and facilities.

Infrastructure Development Projects

Another pivotal factor propelling the structural steel fabrication market is the wave of infrastructure development projects worldwide. Governments and private sector entities are investing heavily in the construction of bridges, highways, airports, and commercial buildings. These projects, often characterized by their large scale and complexity, require materials that offer both strength and flexibility, making structural steel the material of choice. For instance, major infrastructure initiatives in countries like India and China are expected to significantly boost the market. Furthermore, the emphasis on sustainable and resilient infrastructure is leading to the adoption of advanced steel fabrication techniques, enhancing both efficiency and environmental performance.

Latest Trends

Emphasis on Safety and Quality Standards

The structural steel fabrication market is poised to witness a heightened emphasis on safety and quality standards. This trend is driven by increasingly stringent regulatory requirements and the industry's commitment to ensuring structural integrity and longevity. Companies are investing in advanced technologies and training programs to adhere to these standards. Automated fabrication processes, such as robotic welding and precision cutting, are being adopted to minimize human error and enhance the quality of steel structures. Furthermore, rigorous inspection protocols and certification processes are being implemented to guarantee compliance and build customer trust. This focus on safety and quality not only mitigates risks but also positions companies competitively in a market where reliability is paramount.

Increasing Focus on Sustainable Construction Solutions

Sustainability is becoming a core priority in the structural steel fabrication market as environmental concerns and regulatory pressures mount. There is a significant shift towards adopting eco-friendly practices and materials. This includes using recycled steel, optimizing designs to reduce waste, and incorporating energy-efficient processes in fabrication facilities. Green building certifications, such as LEED, are influencing project specifications, driving the demand for sustainable steel solutions. Additionally, advancements in steel manufacturing technologies are reducing the carbon footprint associated with production. Companies are also exploring innovative solutions like modular construction and prefabrication, which not only enhance sustainability but also improve efficiency and reduce project timelines. These practices align with broader industry trends toward circular economy principles and demonstrate a commitment to environmental stewardship.

Regional Analysis

North America leads the structural steel fabrication market with a 35% largest share.

The structural steel fabrication market exhibits varied growth trajectories across different regions, reflecting diverse industrial dynamics and economic landscapes. North America, encompassing the United States and Canada, is a dominant force in the market, holding a significant largest market share of approximately 35%. This region benefits from substantial infrastructure development, high demand from the automotive and construction sectors, and advanced technological integration in fabrication processes. The United States, in particular, spearheads this growth, driven by extensive urbanization projects and a robust industrial base.

In Europe, the market is buoyed by stringent environmental regulations promoting the use of sustainable building materials, coupled with strong demand from the automotive and construction industries. Germany, the UK, and France are pivotal markets within this region, contributing to an overall market share of around 25%.

The Asia Pacific region is poised for rapid expansion, forecasted to exhibit the highest growth rate, driven by rapid industrialization and urbanization in countries like China and India. This region accounts for approximately 30% of the market, supported by substantial government investments in infrastructure and industrial projects.

The Middle East & Africa region, although smaller in comparison, shows promising potential due to significant construction activities in the Gulf Cooperation Council (GCC) countries, which are investing heavily in non-oil sectors. Latin America, led by Brazil and Mexico, is witnessing steady growth driven by infrastructure development and industrial projects, contributing around 10% to the global market. Overall, North America remains the largest market, reflecting its advanced industrial capabilities and strong demand across key sectors.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Structural Steel Fabrication Market is anticipated to experience robust growth in 2024, driven by increased infrastructure development and industrialization across emerging economies. Key players in this sector are strategically positioned to leverage this growth through innovation, expanded production capacities, and strategic partnerships.

Nucor Corporation continues to dominate the market with its diversified product offerings and focus on sustainable practices. O'Neal Manufacturing Services and BTD Manufacturing maintain significant market shares due to their extensive experience and comprehensive service portfolios. Kapco and Mayville Engineering Company are expected to enhance their competitive edge through technological advancements and automation in fabrication processes.

Watson Engineering and Bohai Group, with their strong regional presence, are likely to benefit from the rising demand in Asia-Pacific. Nippon Steel & Sumitomo Metal Corporation and Tata Steel Limited remain key players, bolstered by their integrated operations and strong supply chain networks.

Chinese giants like HSC Ltd., Anyang Group Co. Ltd, Wuhan Group, Hebei Group, and Anshan Iron & Steel Group Corporation are poised to capitalize on domestic infrastructural projects and export opportunities, driven by government initiatives and economic growth.

POSCO’s advanced production techniques and Defiance Metal Products Inc.'s custom fabrication services set them apart, while Standard Iron & Wire Works and Ironform Corporation are recognized for their high-quality outputs. EVS Metal, LancerFab Tech Pvt. Ltd, and Interplex Holdings Pvt. Ltd is gaining traction with innovative solutions and expanding client bases, underscoring its growth potential in the global market.

Strategic investments in technology, sustainability, and market expansion will be critical for these companies to maintain their leadership and capture emerging opportunities in the structural steel fabrication industry.

Market Key Players

- Nucor Corporation

- O'Neal Manufacturing Services

- BTD Manufacturing

- KapcoMayville Engineering Company

- Watson Engineering

- Bohai Group

- Nippon Steel & Sumitomo Metal Corporation

- Tata Steel Limited

- HSC Ltd.

- Anyang Group Co. Ltd

- Wuhan Group

- POSCO

- Hebei Group

- Anshan Iron & Steel Group Corporation

- Defiance Metal Products Inc.

- Standard Iron & Wire Works

- Ironform Corporation

- EVS Metal

- LancerFab Tech Pvt. Ltd

- Interplex Holdings Pvt. Ltd

Recent Development

- In May 2024, SSAB and LKAB entered into a strategic partnership to develop fossil-free steel. The collaboration focuses on leveraging LKAB's hydrogen-based technology to produce iron, which will then be used by SSAB to manufacture steel with zero carbon emissions. This joint effort aims to make fossil-free steel commercially available by 2026.

- In March 2024, Nucor Corporation, Nucor Corporation revealed plans to build a new state-of-the-art steel mill in West Virginia. The project, estimated to cost $2.7 billion, aims to increase the company's production capacity by 3 million tons annually. This expansion is expected to create over 500 new jobs and bolster Nucor's position as a leading steel producer in the United States.

- In January 2024, ArcelorMittal announced a significant investment of $1.5 billion to expand its green steel production capabilities in Europe. This initiative is part of the company's commitment to reducing carbon emissions by 30% by 2030. The investment will be used to upgrade facilities and incorporate innovative technologies such as hydrogen-based steelmaking.

Report Scope

Report Features Description Market Value (2023) USD 151.2 Billion Forecast Revenue (2033) USD 227.9 Billion CAGR (2024-2032) 4.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Metal Welding, Metal Forming, Metal Cutting, Metal Shearing, Metal Stamping, Metal Rolling, Others), By Application (Construction, Automotive, Manufacturing, Energy & Power, Electronics, Defense & Aerospace, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Nucor Corporation, O'Neal Manufacturing Services, BTD Manufacturing, KapcoMayville Engineering Company, Watson Engineering, Bohai Group, Nippon Steel & Sumitomo Metal Corporation, Tata Steel Limited, HSC Ltd., Anyang Group Co. Ltd, Wuhan Group, POSCO, Hebei Group, Anshan Iron & Steel Group Corporation, Defiance Metal Products Inc., Standard Iron & Wire Works, Ironform Corporation, EVS Metal, LancerFab Tech Pvt. Ltd, Interplex Holdings Pvt. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Nucor Corporation

- O'Neal Manufacturing Services

- BTD Manufacturing

- KapcoMayville Engineering Company

- Watson Engineering

- Bohai Group

- Nippon Steel & Sumitomo Metal Corporation

- Tata Steel Limited

- HSC Ltd.

- Anyang Group Co. Ltd

- Wuhan Group

- POSCO

- Hebei Group

- Anshan Iron & Steel Group Corporation

- Defiance Metal Products Inc.

- Standard Iron & Wire Works

- Ironform Corporation

- EVS Metal

- LancerFab Tech Pvt. Ltd

- Interplex Holdings Pvt. Ltd