Structural Insulated Panels Market By Product Type(Glass Wool Panel, Stone Wool Panel and Other ), By Application(Oriented Strand Board (OSB), Building Roof and Other), By End-Use(Residential, Commercial), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

8640

-

Jul 2023

-

167

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

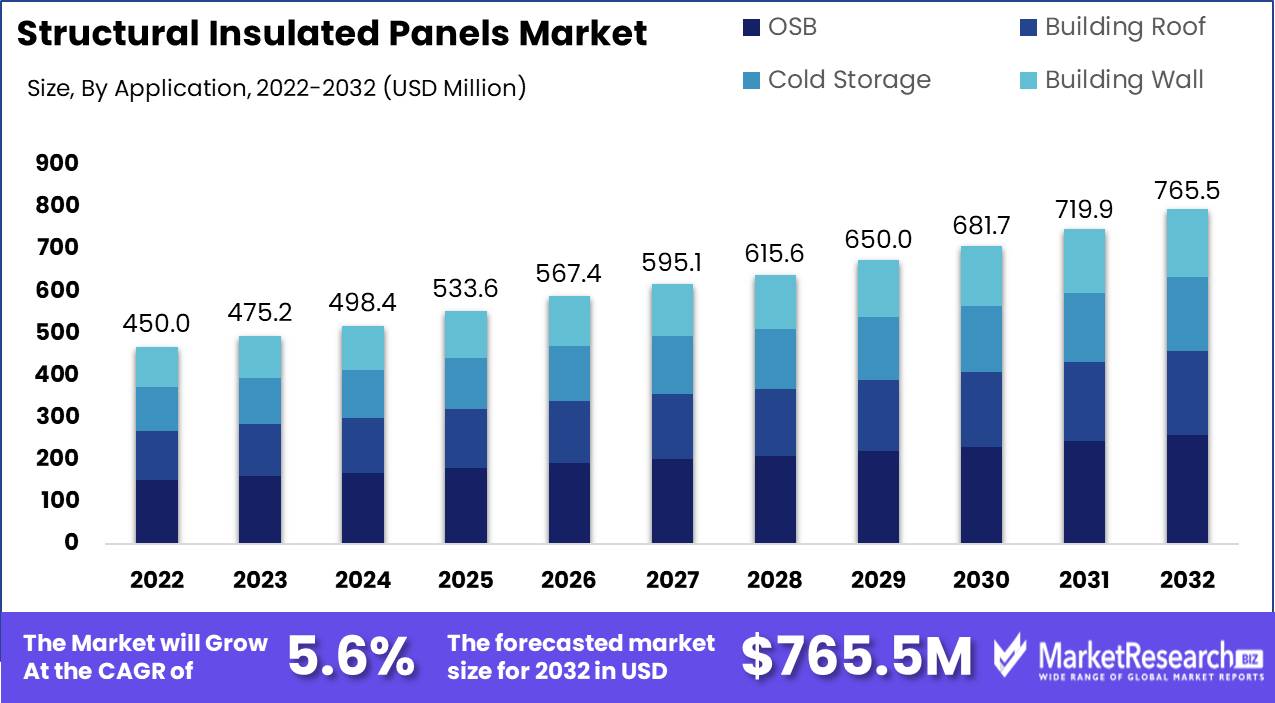

Structural Insulated Panels Market size is expected to be worth around USD 765.5 Mn by 2032 from USD 450.0 Mn in 2022, growing at a CAGR of 5.6% during the forecast period from 2023 to 2032.

Structural insulated panels (SIPs) have emerged as an innovative building technology that is gaining popularity in the construction industry. SIPs are high performance building panels made by sandwiching a core insulating material between two structural skins of oriented strand board (OSB), plywood, metal, cement, or gypsum. The panels are manufactured under factory controlled conditions and assembled onsite to create energy efficient, durable structures.

Recent developments reflect exciting progress and innovation in the SIPs industry. In April 2023, the University of Stuttgart successfully tested HydroSKIN, an innovative glass facade able to combat the heat island effect of high-rise buildings. This technology highlights the importance of facade engineering to improve building energy performance. Furthermore, the Affordable Housing Research and Technology Division has advanced solutions like SIPs that enhance housing quality and affordability.

Most notably, a major collaboration was forged in May 2023 between a leading home improvement retailer and a SIP manufacturer. This strategic partnership marks a key milestone in making SIP building kits and solutions more accessible to DIY homeowners. Overall, these developments underscore the momentum and promising outlook for the SIPs market driven by technology enhancements, sustainability demands, and expanding applications.

Moving forward, key factors propelling the market growth include the increasing adoption of net-zero energy buildings, rising prices and environmental concerns over traditional building materials, and a growing role of prefabrication in the construction industry. However, high initial costs and lack of awareness remain challenges. Ongoing trends like proliferating renewable energy infrastructure, smart building technologies, and preference for modular construction using SIPs are expected to open up lucrative opportunities for the structural insulated panels market.

Driving factors

An Increase in the Demand for Buildings That Are Energy-Efficient

According to a recent research study published by marketresearch.biz, the use of Structural Insulated Panels (SIPs) in the construction industry has acquired broad recognition over the past few years, and the global SIPs market is expected to expand at a compound annual growth rate of 5.6% between the years 2022 and 2032.

One of the key factors driving the expansion of the market is the growing need for buildings that are efficient in their use of energy. When compared to traditional building materials, structural insulated panels (SIPs) provide superior insulation and airtightness. This results in less heat loss, which in turn reduces the amount of energy required to heat and cool the building.

More and more attention is being paid to environmentally friendly building materials.

SIPs are becoming increasingly popular, in part because the construction industry is placing a greater emphasis on the use of environmentally friendly building materials. Because they are kind to the environment and generate less waste, selecting them is an option that is both sustainable and good for the environment. The increasing demand for "green buildings," which reduce the negative impact that buildings have on the environment by making them more energy efficient and environmentally friendly, is another factor that is driving the market.

The expansion of the SIPs market is being driven by several government initiatives and policies.

The expansion of the SIPs market is aided further by government programs that encourage the use of energy-efficient building practices as well as advantageous rules and policies in the construction sector. The Energy Policy Act of 2005 established guidelines for the construction of energy-efficient buildings, which encouraged the expansion of the structural insulated panels market (SIPs). Such practices are an essential component of SIPs.

Restraining Factors

A High Beginning Investment for Both Production and Installation

When compared to more conventional building materials, structural insulated panels (SIPs) have a higher initial cost of production and installation, which is one of the primary factors that limit their use. The production of SIPs takes place at a factory, and their installation necessitates the use of specialized tools and personnel. As a consequence of this, the cost of producing SIPs is significantly greater than the cost of producing conventional construction materials, and this significantly higher cost of manufacturing is passed on to the customer. In addition, the process of installing SIPs needs the utilization of specialized equipment, which contributes to an increase in the overall cost of installation.

SIPs Are Only Available to a Certain Extent in Certain Regions or Markets

SIPs are not easily accessible in many countries or marketplaces because of limited availability. The SIPs market is still in its infancy, which means that many providers have not yet established a presence in all of the major locations. Because of their restricted availability, structural insulated panels (SIPs) have greater transportation costs and longer delivery periods, both of which dissuade many constructors and contractors from utilizing them.

Types Analysis

The Expanded Polystyrene (EPS) segment dominates the structural insulated panel (SIP) market, and it is anticipated that this segment will continue to hold the majority of the market share in the years to come. Because of its great insulating capabilities, low cost, and simple accessibility, the EPS segment is quite popular. These panels have a variety of end-use applications, including construction for residential, commercial, and industrial buildings.

The adoption of the EPS market segment in the construction industry has been driven in large part by the growth of emerging economies. Many nations, including China, India, and Brazil, have experienced significant economic growth in recent years, which has led to an increase in the number of construction projects in those nations. The demand for EPS structural insulated panels (SIPs) has been further spurred by the requirement for energy-efficient construction materials in these nations.

Application Analysis

The Oriented Strand Board (OSB) segment now holds the largest share of the structural insulated panels (SIPs) market, and it is anticipated that this segment will continue to maintain its dominance over the market in the years to come. The oriented strand board (OSB) segment offers unrivaled features like as high strength and durability at a cheap cost, which makes it a popular choice for structural insulated panels (SIPs). These panels have a wide range of applications across a variety of end-use sectors, including commercial and industrial buildings in addition to residential development.

The adoption of the OSB segment in the construction industry has been pushed in large part by the rise of developing economies as competition in the segment. Many nations, including China, India, and Brazil, have experienced significant economic growth in recent years, which has led to an increase in the number of construction projects in those nations. In addition to this, the expansion of the building and construction sector in these nations has further spurred the need for environmentally friendly and energy-efficient building materials, such as OSB SIPs.

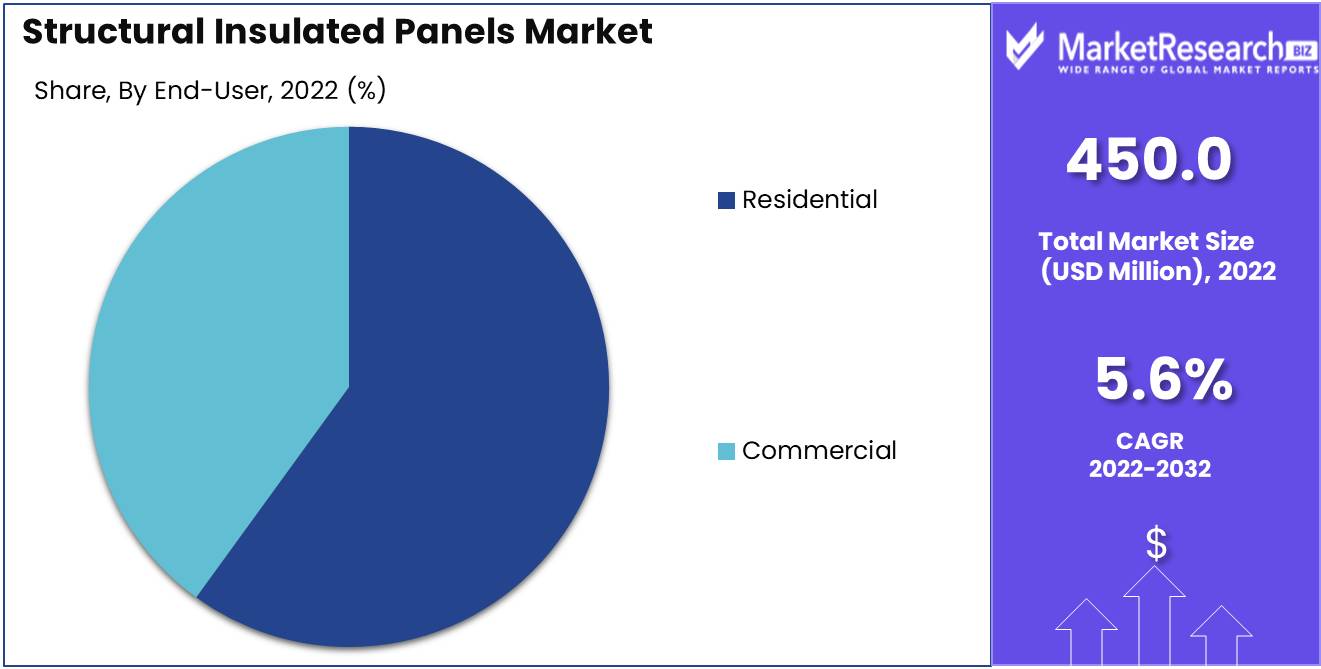

End Use Analysis

The Residential Segment of the structural insulated panels market now dominates the market, and it is anticipated that this dominance will continue in the years to come. Due to the expansion of the house construction industry as well as the demand for more energy-efficient building materials, the residential segment is becoming increasingly popular.

The surge in developing economies, such as China, India, and Brazil, has propelled the residential building sector towards the adoption of structural insulated panels, incorporating materials like OSB and EPS. This wave of economic growth has stimulated a notable uptick in construction activities within these nations. Furthermore, the escalating population and urbanization rates in these regions have amplified the demand for housing solutions that are not only cost-effective but also environmentally sustainable. Consequently, there is a growing imperative to utilize insulation materials in manufacturing facilities to meet these pressing housing needs.

Key Market Segments

By Product Type

- Glass Wool Panel

- Stone Wool Panel

- Expanded Polystyrene (EPS) Panel

- Extruded Polystyrene Foam Panel

- Rigid Polyurethane (PU) and Rigid Polyisocyanurate (PIR) Panel

By Application

- Oriented Strand Board (OSB)

- Building Roof

- Cold Storage

- Building Wall

By End-Use

- Residential

- Commercial

Growth Opportunity

Demand Increased for Green Buildings and Sustainable Construction Methods

The growing awareness and prioritization of environmental sustainability have driven a surge in demand for construction practices aligned with green building standards. In response to this imperative, structural insulated panels (SIPs) emerge as a compelling solution. SIPs excel in delivering enhanced insulation, thereby effectively addressing the dual goals of reduced energy consumption and minimized carbon footprint. When incorporated into green building projects, SIPs confer multiple advantages to occupants, making them a compulsory choice. These advantages encompass diminished monthly energy costs, elevated air quality, and heightened overall comfort levels.

Developing economies are seeing an increase in their construction activities.

In emerging countries, where both the population and the urbanization rate are rising, there has been a discernible rise in the number of building projects being undertaken. SIPs provide several benefits to building projects, including quicker installation, decreased costs associated with labor, and increased levels of energy efficiency. The use of structural insulated panels, or SIPs, in construction projects has been gaining favor in these economies because SIPs provide a solution that is both cost-effective and meets the demand for environmentally friendly structures.

Insulation technology has advanced recently, which has led to improvements in energy efficiency.

Insulation technology has advanced to the point that high-performance structural insulated panels (SIPs) can now be manufactured. These SIPs offer better energy efficiency. SIPs are currently available in a wide range of thicknesses, densities, and composite materials, which allows them to accommodate a wide variety of building requirements. Because of the many different ways they may be insulated, structural insulated panels (SIPs) are a perfect alternative for achieving high levels of energy efficiency in buildings.

Latest Trends

Insulation of a Superior Quality and Long-Lasting Durability

The rise in popularity of structural insulated panels (SIPs) is attracting the attention of homebuilders and homeowners alike. This is mostly due to the numerous advantages offered by SIPs, which include increased durability, improved insulation, and a reduction in the amount of time required for construction. The remarkable thermal insulation that is provided by SIPs contributes to a reduction in both energy consumption and the expenditures that are linked with it. In addition, structural insulated panels (SIPs) have been recognized for their extraordinary durability. These panels offer a thorough defense against the natural elements as well as the structural damage that can be caused by insects, mold, and moisture.

More and more people are becoming aware of the benefits of SIPs

The industry is seeing an increase in the number of people who are becoming aware of the benefits of SIPs, which is yet another developing trend. Consumers and builders are starting to have a better understanding of the numerous advantages that structural insulated panels, or SIPs, have over more conventional building materials. SIPs are a more environmentally friendly choice than other options since they leave a smaller carbon footprint and generate less trash during the installation process.

Demand for SIPs Is Being Driven by Affordable Housing

The SIPs market is being propelled ahead by several factors, one of which is the growing need for reasonably priced homes. As the cost of living continues to rise, people are looking for more affordable housing choices. The use of structural insulated panels (SIPs) is being investigated as a potential cost-competitive alternative to more traditional building practises. It is projected that, in the not-too-distant future, there will be a further reduction in the cost of SIPs due to the progression of manufacturing technology.

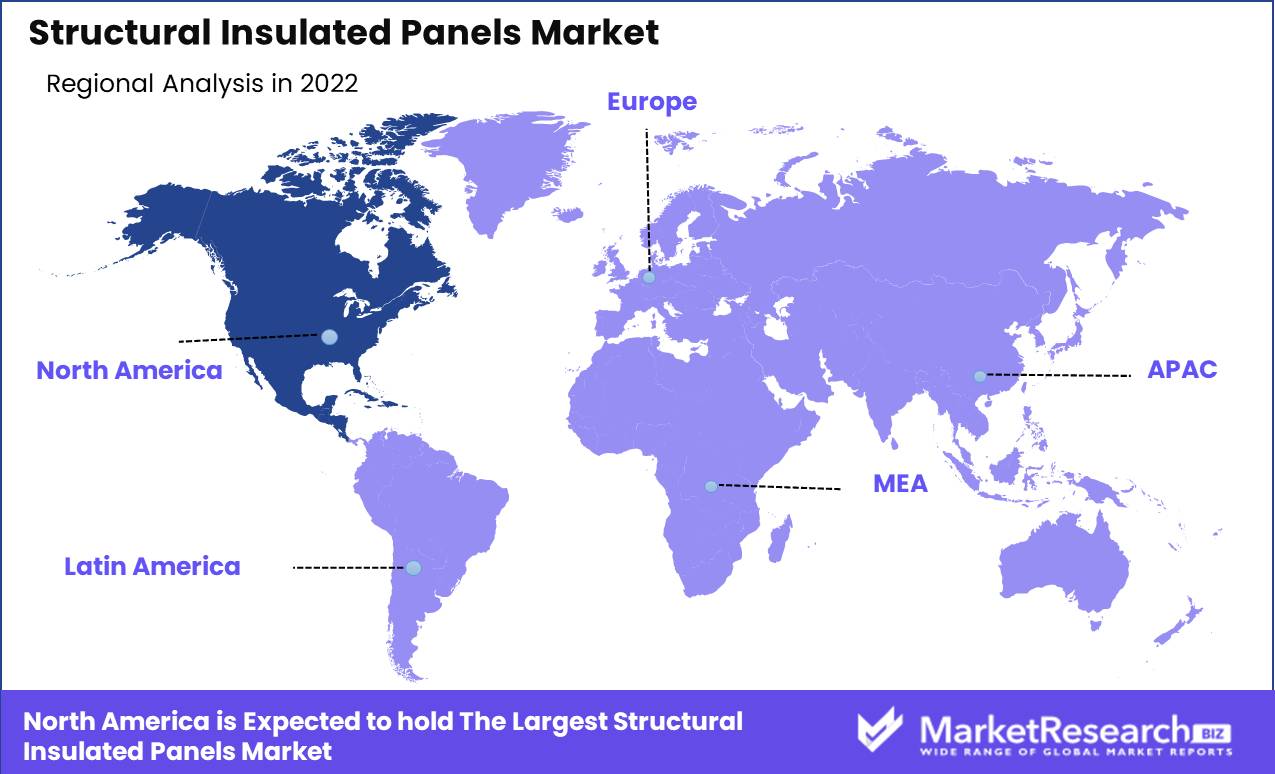

Regional Analysis

The North American market has always been a major participant on the global stage, owing primarily to its robust economy, sophisticated technology, and well-developed infrastructure. Numerous multinational corporations have established headquarters in North America due to the region's business-friendly policies and regulations, further consolidating its market dominance.

North America's market supremacy is primarily driven by the United States of America, the world's largest economy. This dominance can be attributed to the robust performance of key sectors such as technology, healthcare, aerospace, and automotive, which collectively contribute significantly to the region's revenue share. The United States' advantage lies in its precise and comprehensive analysis, coupled with a highly skilled workforce, consistently yielding world-class products that maintain a firm grip on the global market.

The second-largest economy in North America, Canada, has also contributed to the market dominance of the region. The country's natural resources, such as oil, gas, and timber, have contributed significantly to its economic growth. Canada's advanced manufacturing capabilities and highly qualified labor force have made it a significant participant in the global market, particularly in the aerospace and automotive industries.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The surge in demand for structural insulated panels (SIPs), a sought-after building material, has been a notable key trend in recent years, especially in regions with extreme climates. SIPs are renowned for their exceptional thermal efficiency, rapid assembly, and long-lasting nature, making them an appealing choice for construction projects. This surge in global SIPs demand has attracted a slew of new entrants eager to seize the opportunity.

Within the global SIPs market, major companies, such as Sipcrete, Kingspan Group, Murus Company, FischerSIPS, and Alubel SpA, have carved out prominent positions. These market players owe their success to a combination of innovative product offerings, stringent quality assurance, and expansive distribution networks. In this Company Snapshot, we delve into their company profiles and company annual achievements, shedding light on the factors contributing to their dominance in the market.

Sipcrete is a prominent Canadian SIP manufacturer that offers a variety of prefabricated construction products. They provide a distinctive SIP design with a steel-reinforced concrete structure, which provides superior strength and durability. Kingspan Group, a renowned manufacturer of construction materials headquartered in Ireland, is also a major participant in the SIPs market. The company has a solid foundation in the SIPs market due to its global sales network and extensive product selection.

Murus Company and FischerSIPS, who specialize in high-performance, energy-efficient SIPs for residential and commercial construction, are additional market leaders. Italian manufacturer Alubel SpA provides innovative roof and wall systems, including SIPs, for global construction projects.

Top Key Players in Structural Insulated Panels Market

- Kingspan Group plc

- ArcelorMittal S.A.

- Alubel SpA

- Marcegaglia SpA

- NCI Building Systems

- Owens Corning

- Metecno

- DANA Group of Companies

- Isopan (Manni Group SpA)

- Italpannelli SRL

- Rautaruukki Corporation

Recent Development

- In April 2023, the University of Stuttgart tested a groundbreaking façade innovation known as HydroSKIN, designed to combat the heat island effect caused by high-rise buildings with glass facades.

- Affordable Housing Research and Technology Division (AHRT) has played a crucial role in advancing technological solutions for housing. It has focused on innovative technologies, such as insulated concrete forms and structural insulated panels, which improve housing quality, reduce costs, and preserve affordability.

- In May 2023, a significant development unfolded as a major home improvement retailer forged a strategic partnership with a Structural Insulated Panels (SIP) manufacturer.

- In October 2022, a noteworthy initiative was launched by a government agency. This program was designed to incentivize builders and developers to embrace SIPs in their construction endeavors. It introduced a subsidy program that provides financial support to promote energy-efficient and environmentally friendly construction practices.

Report Scope

Report Features Description Market Value (2022) USD 450.0 Mn Forecast Revenue (2032) USD 765.5 Mn CAGR (2023-2032) 5.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Glass Wool Panel, Stone Wool Panel, Expanded Polystyrene (EPS) Panel, Extruded Polystyrene Foam Panel, Rigid Polyurethane (PU) and Rigid Polyisocyanurate (PIR) Panel), By Application(Oriented Strand Board (OSB), Building Roof, Cold Storage, Building Wall), By End-Use(Residential, Commercial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kingspan Group plc, ArcelorMittal S.A., Alubel SpA, Marcegaglia SpA, NCI Building Systems, Owens Corning, Metecno, DANA Group of Companies, Isopan (Manni Group SpA), Italpannelli SRL, Rautaruukki Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Kingspan Group plc

- ArcelorMittal S.A.

- Alubel SpA

- Marcegaglia SpA

- NCI Building Systems

- Owens Corning

- Metecno

- DANA Group of Companies

- Isopan (Manni Group SpA)

- Italpannelli SRL

- Rautaruukki Corporation