Spray Adhesives Market By Product(Water-based, Solvent-based, Other), By Resin Type(Epoxy, Polyurethane, Other), By End-Use Industry(Construction, Transportation, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

6419

-

May 2023

-

178

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

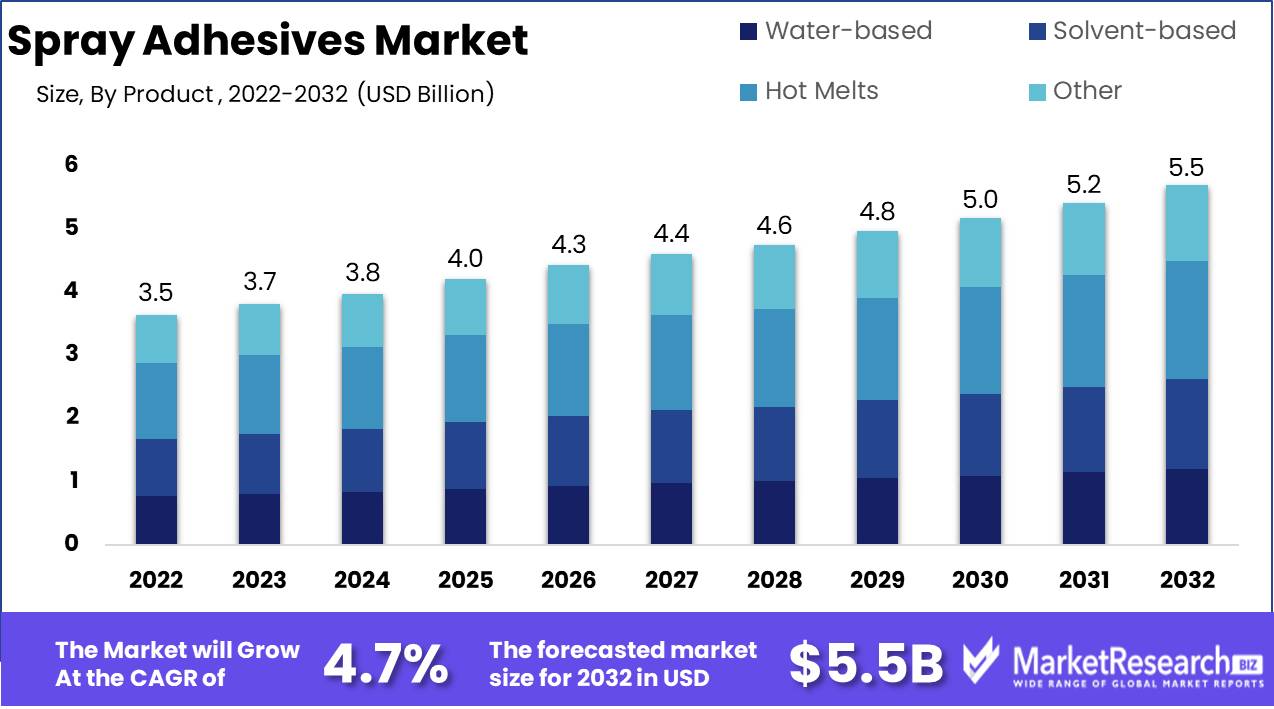

Spray Adhesives Market size is expected to be worth around USD 5.5 Bn by 2032 from USD 3.5 Bn in 2022, growing at a CAGR of 4.7% during the forecast period from 2023 to 2032.

Spray adhesives, also known as aerosol adhesives, are a highly efficient and convenient method for bonding diverse materials. Due to the numerous advantages they provide, these adhesives are widely used in the construction, automotive, and packaging industries, among others.

An important advantage of spray adhesives is their simplicity of application. They can be applied swiftly and uniformly, allowing for precise and uniform bonding. Compared to traditional methods, this one uses a lot less energy and is more reliable. This feature is especially valuable in industries with strict time constraints, such as manufacturing and assembly lines.

In recent years, the spray adhesives market has witnessed significant development. Manufacturers continually refine their formulations and technologies to improve the performance of adhesives. Innovations in formulations, for instance, have resulted in improved resistance to heat, moisture, and chemicals, ensuring that bonded materials remain securely attached even under adverse conditions.

The versatility of spray adhesives has led to their extensive use in a wide range of products and services. Significant investments have been made to implement these adhesives in industries such as the automotive and packaging sectors. In the automotive industry, they are used for bonding interior panels, headliners, and carpets. In the packaging industry, they are used, among other things, to seal boxes and affix labels.

Driving factors

Demand for Lightweight and Efficient Bonding Solutions Is Growing

The spray adhesives market is witnessing an increase in demand for lightweight and effective bonding solutions. This rising demand can be attributed to a number of factors, such as the expanding need for lightweight materials in industries such as the automotive, aerospace, and construction sectors. There are numerous advantages to using lightweight materials, including increased fuel efficiency, decreased transportation costs, and enhanced overall performance.

Construction and Automotive Industry Expansion

The rapid expansion of the construction and automotive industries is another significant factor propelling the growth of the spray adhesives market. These industries require dependable adhesive solutions to satisfy a variety of application requirements, including the bonding of construction materials and the assembly of automotive components. Due to increasing urbanization, infrastructure developments, and the need for sustainable building practices, the construction industry is booming. On the other hand, the automotive industry is witnessing a transition toward lightweight materials, electric vehicles, and overall performance enhancement.

New adhesive technologies and application techniques

Advancements in adhesive technology and application techniques are extremely beneficial to the spray adhesives market. Manufacturers continue to invest in research and development to boost the performance and versatility of spray adhesives. The development of adhesives with superior bonding properties, enhanced resistance to temperature and moisture, and enhanced durability has resulted from technological advancements. In addition, inventive application techniques, such as spray guns and nozzles, have made the adhesive application process faster, more efficient, and more cost-effective.

Restraining Factors

Safety and Health Issues

Securing the health and safety of both employees and end-users is of utmost importance when it comes to spray adhesives. As these adhesives are frequently sprayed on, the fine particles and potentially hazardous chemicals can be hazardous to one's health if appropriate precautions are not taken. Inhaling these particles can result in respiratory issues, whereas skin contact may result in irritation or even allergic reactions.

To mitigate these concerns, industry executives have made considerable efforts to develop spray adhesives of superior quality that adhere to stringent safety regulations. These adhesives are designed to reduce the emission of volatile organic compounds (VOCs), making the environment safer for all stakeholders.

Compliance and Regulatory Requirements

In any industry, regulatory and compliance requirements are important factors that can affect product development and market expansion. Not even the spray adhesives market is an exception. Various regulatory organizations, including the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA), establish guidelines and standards that manufacturers must adhere to.

Complying with these requirements not only ensures the safety and well-being of consumers but also assists manufacturers in establishing customer confidence. Consequently, companies operating in the spray adhesives market must continually invest in research and development to remain current with evolving regulations and compliance standards.

Product Analysis

The Hot Melts Segment has dominated the spray adhesives market for quite some time. The popularity and widespread application of hot dissolves in a variety of industries have contributed to their predominance. Hot melts are thermoplastic adhesive substances that become liquid when heated. They have outstanding adhesion properties and are utilized in numerous industries, including the automotive, construction, packaging, and woodworking sectors. Due to their simple application and quick curing time, hot melt adhesives are favored by many manufacturers.

Emerging economies' economic growth is one of the most important factors driving the adoption of the Hot Melts Segment. As industries in nations such as China, India, and Brazil have expanded significantly, so has the demand for adhesive solutions. Particularly, the construction industry has flourished in these economies, resulting in an increase in demand for heated melts. Due to their adaptability and durability, heated melts are an excellent choice for a variety of construction applications.

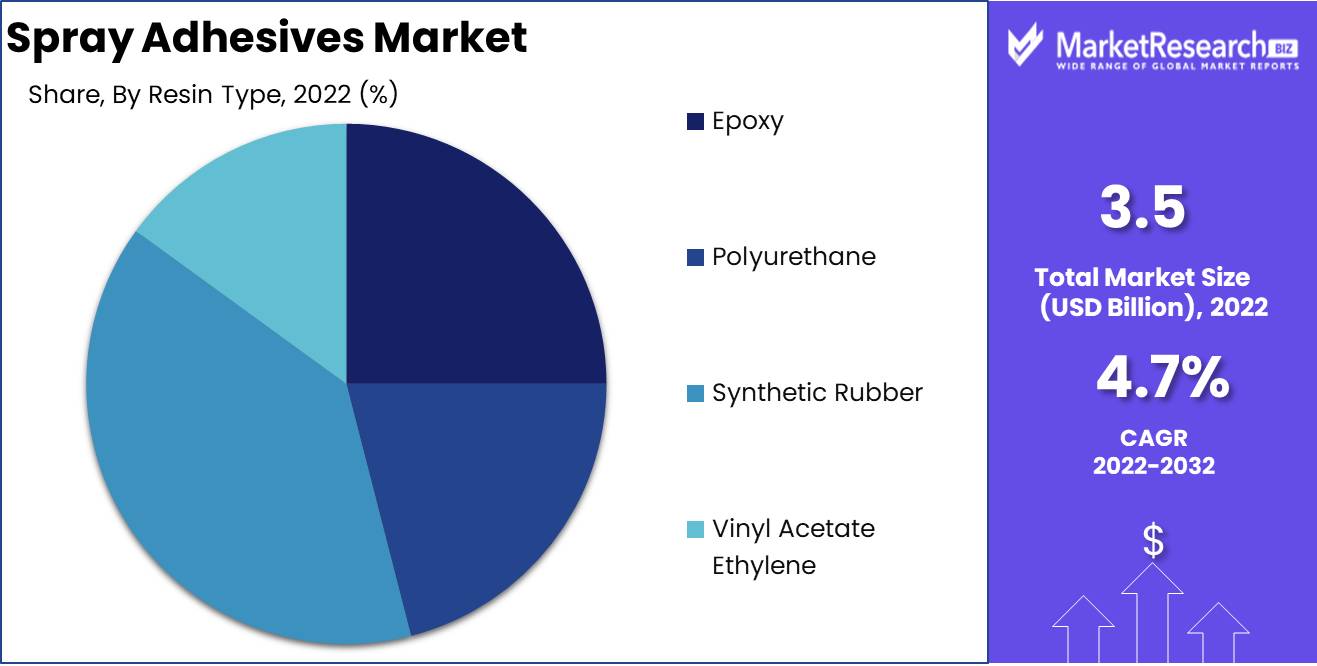

Resin Type Analysis

The Synthetic Rubber Segment has emerged as the dominant player among the various varieties of resin used in spray adhesives. The superb adhesive properties of synthetic rubber adhesives include high initial bond strength, flexibility, and resistance to heat and chemicals. These qualities make synthetic rubber adhesives suitable for a wide variety of uses, including automotive, construction, and packaging.

The economic growth of emerging economies has had a significant impact on the growth of the Synthetic Rubber Segment. As these economies continue to expand, the demand for adhesives made from synthetic rubber increases. The demand for synthetic rubber adhesives increases in industries such as the automotive sector, which significantly rely on them for component bonding. In addition, the construction industry contributes to the growth of the synthetic rubber segment because it requires dependable adhesive solutions for a variety of applications.

End-Use Industry Analysis

The Transportation Segment dominates the spray adhesives market due to its extensive use in the automotive and aerospace industries. For bonding diverse components, assuring structural integrity, and enhancing safety, the transportation industry heavily relies on adhesive solutions. Spray adhesives provide a simple and effective application method, making them suitable for use in the transportation industry.

The economic growth of emerging societies has been the driving force behind the Transportation Segment's adoption. As the automotive and aerospace sectors of these economies expand, the demand for spray adhesives for bonding purposes increases. Focusing on the development of advanced vehicles and aircraft, manufacturers require adhesive solutions that can withstand extreme conditions and provide long-term durability.

Key Market Segments

By Product

- Water-based

- Solvent-based

- Hot Melts

- Other

By Resin Type

- Epoxy

- Polyurethane

- Synthetic Rubber

- Vinyl Acetate Ethylene

By End-Use Industry

- Construction

- Transportation

- Packaging

- Furniture

- Automotive & Transportation

- Other

Growth Opportunity

Sustainable and Biodegradable Spray Adhesive Solution Development

With its enormous growth and expansion potential, the spray adhesives market is experiencing a significant transition toward sustainability and environmental consciousness. As consumers and businesses become more conscious of the impact of their decisions on the environment, the demand for eco-friendly spray adhesive formulations surges.

In response to stringent regulations on volatile organic compound (VOC) emissions, manufacturers are investing in research and development to develop low-emission spray adhesives. The urge for greener alternatives is driven not only by regulatory requirements but also by increasing consumer demand for sustainable products. Companies can tap into this evolving spray adhesive trend and gain a competitive edge by focusing on the development of eco-friendly and biodegradable spray adhesives.

Expanding into Emerging Markets by Rapidly Developing Infrastructure

As the spray adhesives market expands, companies have the opportunity to explore emerging markets that are experiencing accelerated infrastructure development. By comprehending the distinctive requirements and obstacles of these markets, businesses can position themselves as key players and tap into new revenue streams.

In regions such as Asia-Pacific and Latin America, for instance, the construction and automotive industries are expanding rapidly. This expansion provides the ideal conditions for spray adhesive manufacturers to form strategic alliances with local developers, suppliers, and manufacturers. Collaboration with industry end-users and manufacturers in emerging markets can help businesses increase their market share and expand their presence.

Innovation Driven by Collaboration with Industry End-Users and Manufacturers

In order to remain competitive, you need to have a strong sense of humor. Spray adhesive companies can acquire valuable insights into market needs, emerging trends, and technological advancements by actively engaging with industry end-users and manufacturers.

The ability to create custom-tailored, high-quality products is a key component of our business model. This collaborative strategy ensures that the products meet the expectations of end users, resulting in increased consumer satisfaction and brand loyalty.

Latest Trends

Environmental Sustainability and Rising Demand for Water-Based Formulations

A growing preference for water-based and solvent-free formulations is one of the most influential market trends driving the growth of spray adhesives. In response to rising environmental concerns, manufacturers are actively transitioning towards adhesives that are more sustainable. Water-based and solvent-free spray adhesives offer a number of benefits, including reduced VOC emissions, enhanced worker safety, and less environmental impact. These eco-friendly adhesives are widely used in numerous industries, including construction, furniture manufacturing, and automotive assembly.

Increased demand for high-strength, quick-curing adhesives

Increasing demand for high-strength and quick-curing adhesives is another significant trend in the spray adhesives market. Manufacturers pursue adhesives that not only provide superior bonding performance but also increase production efficiency. In response to these demands, spray adhesives that provide strong bonds within a brief curing time have become indispensable in a variety of applications, including construction, transportation manufacturing, and the signage industry.

Automotive Industry Adoption of Spray Adhesives

The automotive industry drives the growth of spray adhesives in both assembly and upholstery applications. The use of spray adhesives is common in the automotive industry, and they are often used to replace damaged parts. Spray adhesives are a great option for automotive applications due to their unique properties, including homogenous coverage and high bond strength. In addition, spray adhesives are increasingly used to improve the comfort, durability, and overall aesthetics of automotive upholstery.

Regional Analysis

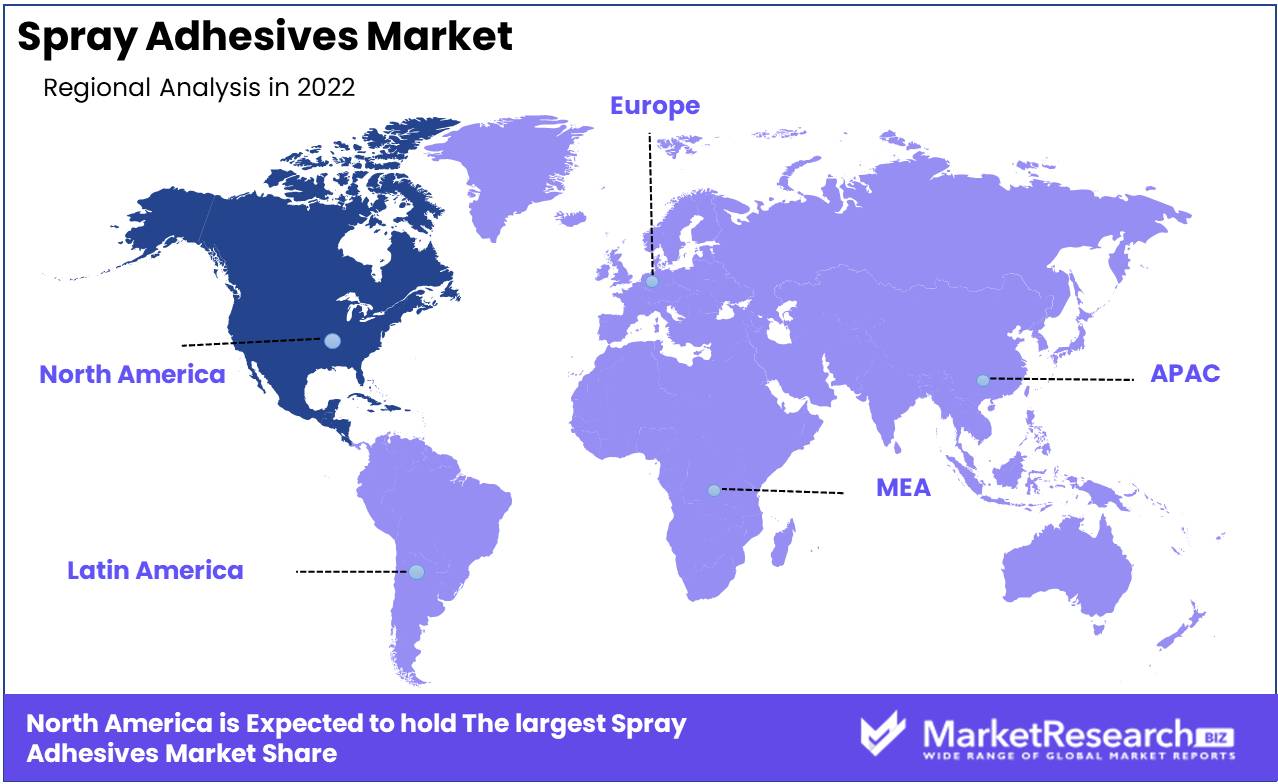

North America dominates the spray adhesives market.

North America's manufacturing infrastructure helps it dominate the spray adhesives market. Well-established adhesive manufacturing companies in the region have invested considerably in research and development, producing high-quality spray adhesives. These manufacturers have optimized their formulations for the automotive, construction, packaging, and woodworking industries.

The region's significant emphasis on technology improvements can also be attributed to North America's dominance in the spray adhesives market. The development of improved spraying techniques has resulted in accurate application and effective adhesive distribution thanks to ongoing innovation. North American spray adhesives are the preferred bonding solution for enterprises due to their technological supremacy.

The region's strong distribution network also contributed to its dominance. North America's efficient supply network delivers spray adhesives to customers in many industries quickly. This efficient distribution infrastructure lets firms quickly get high-quality spray adhesives, adding to the region's market dominance.

North America's dominance in the spray adhesives market can be attributed to the region's strong economic growth in addition to its production and distribution capabilities. The need for spray adhesives is growing as a result of the rise of the automotive and construction industries. The use of spray adhesives to increase the effectiveness of a company's operations is a growing trend.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Henkel is widely recognized as the industry leader in adhesive technologies. Their spray adhesives provide exceptional performance, adaptability, and dependability, and they have a strong presence in India. A wide range of industries, including automotive, aerospace, electronics, and consumer goods, are served by Henkel's extensive product lineup. Their commitment to innovation, quality, and sustainability has positioned them as a market leader.

3M is a multinational conglomerate renowned for its diverse range of products, spray adhesives included. Their extensive selection of spray adhesives is designed to meet the requirements of a wide range of applications. From general-purpose to high-strength bonding, 3M provides solutions with outstanding performance. The company's commitment to research and development assures the continual improvement and innovation of its adhesive technologies.

H.B. Fuller is the world's leading manufacturer of adhesives, including spray adhesives. Their extensive range of products is designed to meet the requirements of various industries. Spray adhesives from H.B. Fuller offer exceptional adhesion and performance on a variety of substrates. The company's commitment to customer satisfaction and continuous refinement has made them a reliable partner in the market for spray adhesives.

Avery Dennison is an industry leader in the production of adhesive solutions, including spray adhesives. Their innovative range of products caters to the requirements of numerous industries, including packaging, construction, automotive, and healthcare. The spray adhesives from Avery Dennison provide superior bond strength, durability, and adaptability. Their commitment to sustainability and customer-centric focus distinguishes them in the market.

Sika AG is a worldwide producer of specialty compounds, including spray adhesives. Sika AG serves a variety of industries, including the automotive, construction, and transportation sectors, with a portfolio of products that is diverse. Their spray adhesives offer superior adhesion, durability, and environmental resistance. The commitment of Sika AG to innovation and sustainability has positioned them as a market leader in spray adhesives.

Top Key Players in Spray Adhesives Market

- Henkel Adhesives Technologies India Private Limited

- 3M

- H.B. Fuller Company

- Avery Dennison Corporation

- Bostik ND Industries

- Sika AG

- Illinois Tool Works

- Quin Global

- Kissel Wolf GmbH

- Gemini Adhesives

- AFT Aerosols

- Spray-Lock Inc.

- Philips Manufacturing Co.

- Westech Aerosol Corporation

- BASF SE

- ND Industries Inc.

- Uniseal Inc

- Ashland

- Eastman Chemical Company

Recent Development

- In 2023, 3M's upcoming spray adhesives, which claim to revolutionize the user experience, have made headlines. A well-known brand in the adhesive industry, 3M is a well-known company. these user-friendly spray adhesives will be released. Since the company makes high-quality products, this new product is anticipated.

- In 2022, Henkel announced its ambitious strategy to expand its spray adhesive portfolio with several new products and services. In order to meet the demand for a variety of products, a company must have a strong reputation in the marketplace. Henkel's proactive innovation shows its commitment to consumer needs and market competitiveness.

- Scotch® Brand, known for its reliable adhesives, is improving spray adhesive durability. While details are under wraps, industry speculations suggest this adhesive will set a new standard for durability, providing long-lasting bonding in a variety of applications. Spray adhesive fans eagerly await its release.

- In 2020, Bostik made waves in the adhesives industry with its strategic acquisition of Bond Tech. The company's industry leadership has increased. Bostik's commitment to innovative solutions and spray adhesives industry leadership is reinforced by this step. In the upcoming years, this transaction may lead to exciting innovations and synergies.

Report Scope

Report Features Description Market Value (2022) USD 3.5 Bn Forecast Revenue (2032) USD 5.5 Bn CAGR (2023-2032) 4.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Water-based, Solvent-based, Other), By Resin Type(Epoxy, Polyurethane, Other), By End-Use Industry(Construction, Transportation, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Henkel Adhesives Technologies India Private Limited, 3M, H.B. Fuller Company, Avery Dennison Corporation, Bostik ND Industries, Sika AG, Illinois Tool Works, Quin Global, Kissel Wolf GmbH, Gemini Adhesives, AFT Aerosols, Spray-Lock Inc., Philips Manufacturing Co., Westech Aerosol Corporation, BASF SE, ND Industries Inc., Uniseal Inc, Ashland, Eastman Chemical Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Henkel Adhesives Technologies India Private Limited

- 3M

- H.B. Fuller Company

- Avery Dennison Corporation

- Bostik ND Industries

- Sika AG

- Illinois Tool Works

- Quin Global

- Kissel Wolf GmbH

- Gemini Adhesives

- AFT Aerosols

- Spray-Lock Inc.

- Philips Manufacturing Co.

- Westech Aerosol Corporation

- BASF SE

- ND Industries Inc.

- Uniseal Inc

- Ashland

- Eastman Chemical Company