Specialty Resins Market By Type (Vinyl, Epoxy, Polyamides, Unsaturated Polyester Resins, and Other), By End-User (Building & Construction, Water Treatment, Marine, Electrical & Electronics, Automotive, Aerospace, and Other), By Function (Protection, Insulation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

26627

-

March 2023

-

155

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

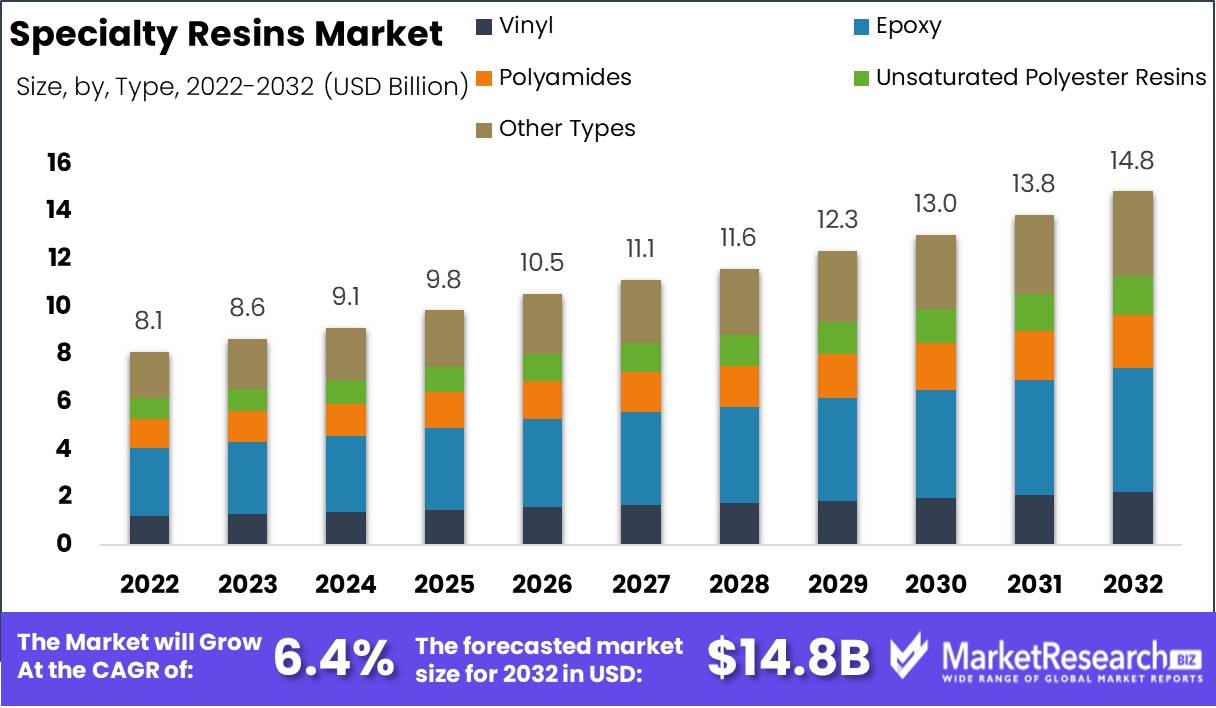

Specialty Resins Market size is expected to be worth around USD 14.8 Bn by 2032 from USD 8.1 Bn in 2022, growing at a CAGR of 6.4% during the forecast period from 2023 to 2032.

Specialty resins are a category of resins that are designed and developed for specific End-Users or to meet specific requirements that cannot be fulfilled by standard resins. These resins possess unique properties, performance characteristics, or processing capabilities that make them well-suited for various industries.

Driving factors

Specialty resins are used across various industries, such as automotive, electronics, aerospace, construction, packaging, and healthcare. The growth and development of these industries, driven by factors like population growth, urbanization, technological advancements, and changing consumer preferences, lead to an increased demand for Specialty Resins Market. Specialty Resins Market offer unique performance characteristics and functional advantages over standard resins. They can provide enhanced properties such as high-temperature resistance, chemical resistance, durability, electrical insulation, flame retardancy, and more.

These properties make them desirable for End-Users where standard resins may not meet the specific requirements, leading to increased demand. Continuous research and development efforts in the field of resin chemistry and manufacturing processes have resulted in the development of new Specialty Resins Market with improved properties and performance. Technological advancements enable the production of resins with enhanced characteristics, expanding potential End-Users and driving market growth.

Restraining Factors

Specialty resins are more expensive than standard resins due to their specialized properties and manufacturing processes. The higher cost can be a limiting factor, especially for price-sensitive industries or End-Users where cost-effectiveness is a key consideration. Specialty resins are often developed for specific End-Users or industries, and there may be limited awareness or knowledge about their benefits and capabilities.

Lack of education and understanding about the advantages of Specialty Resins Market can hinder their adoption and market growth. In some cases, alternative materials or technologies may offer similar or comparable properties to Specialty Resins Market. These substitutes can pose a challenge to the market growth of specialty resins market, especially if they are more cost-effective or readily available.

By Type Analysis

Over 35% of the market's revenues came from the epoxy segment in 2022, making it the market leader. Epoxy resins, unsaturated polyester resins, vinyl, and polyamide are the main types of Specialty Resins Market. Epoxies, also known as polymeric compounds with more than one three-membered circle, are thermoset polymers that have more than one three-membered circle. Epoxy is the specialty resin type that is utilized the most frequently. It is used to create composite materials as a sealant, adhesive bond coat, sealer, and matrix. Unsaturated acids or diols with or without diacids and anhydrides precipitate to form unsaturated polyester resin (UPR).

It is utilized in pipelines and tanks, as well as in the maritime and construction industries. Printed circuit boards, stiff foams, automotive components, construction materials, coatings, metal foil laminates, as well as fiber-reinforced composites are just a few of the modern industrial uses for vinyl Specialty Resins Market. A class of opaque, high-density thermoplastic polymers with superior strength and heat resistance, polyamides. Protection, insulation, and other unique resin properties are a few examples.

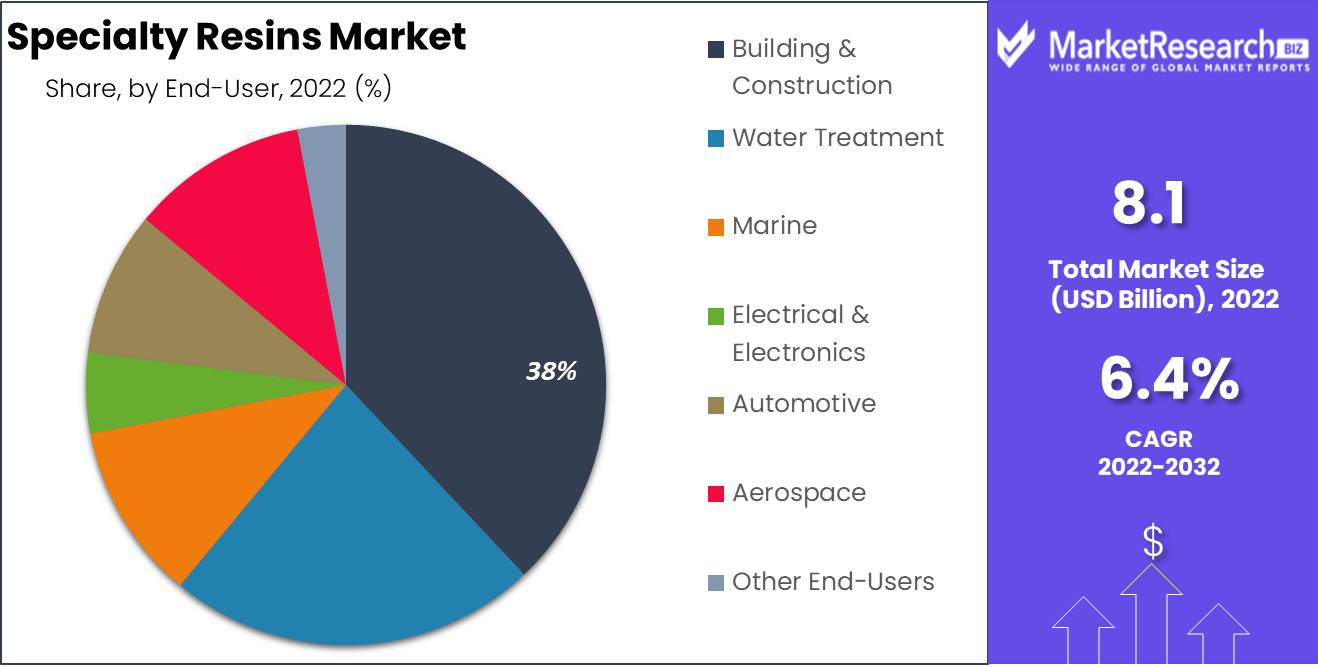

End-User Analysis

Construction and building End-Users occupy the top position in the Specialty Resins Market and have contributed over 38.0% of the overall revenue by 2022. In the coming years, it is anticipated that the specialty resins market will continue to expand due to the increasing demand for construction. A variety of industries are covered in the construction industry, including construction and infrastructure production and supply of products as well as repair maintenance, disposal, and repair. Paints, plastics and flooring, coatings, plastics, primers, and sealants are made of special resins.

Due to their exceptional resistance to stains, cracks, and blistering, as well as extreme temperatures, chemical Specialty resins are commonly used in commercial and residential construction, the marine industry, the automotive industry, as well as wastewater treatment facilities, etc. They provide exceptional adhesion, excellent anti-corrosion, and low volatile organic compounds.

Key Market Segments

Based on Type

- Vinyl

- Epoxy

- Polyamides

- Unsaturated Polyester Resins

- Other Types

Based on End-User

- Building & Construction

- Water Treatment

- Marine

- Electrical & Electronics

- Automotive

- Aerospace

- Other End-Users

Based on Function

- Protection

- Insulation

Growth Opportunity

The salaries of the middle class are rising rapidly, which is transforming the buying habits of consumers. Additionally, the rising number of women working around the globe is beneficial to the industry of food and beverages. The changing lifestyles and fast-paced work environments are increasing the demand for food products that are packaged. Food producers require substantial, durable containers for food to protect their food items when they are stored and distributed.

The top players are developing attractive resins to create flexible packaging that can meet the demand of consumers worldwide for nutritious and healthy foods. The millennial generation, in particular, are generating consumption of food and beverages by purchasing food items with a variety of flavours, which has led producers to develop new products. This is likely to increase demand for resins with specialization in the packaging of food and beverages throughout the spectrum.

Latest Trends

Sustainability and environmental concerns are driving the demand for eco-friendly and bio-based Specialty Resins Market. Industries are focusing on developing resins derived from renewable sources or with lower carbon footprints. These resins offer edges such as reduced emissions, recyclability, and reduced dependence on fossil fuels.

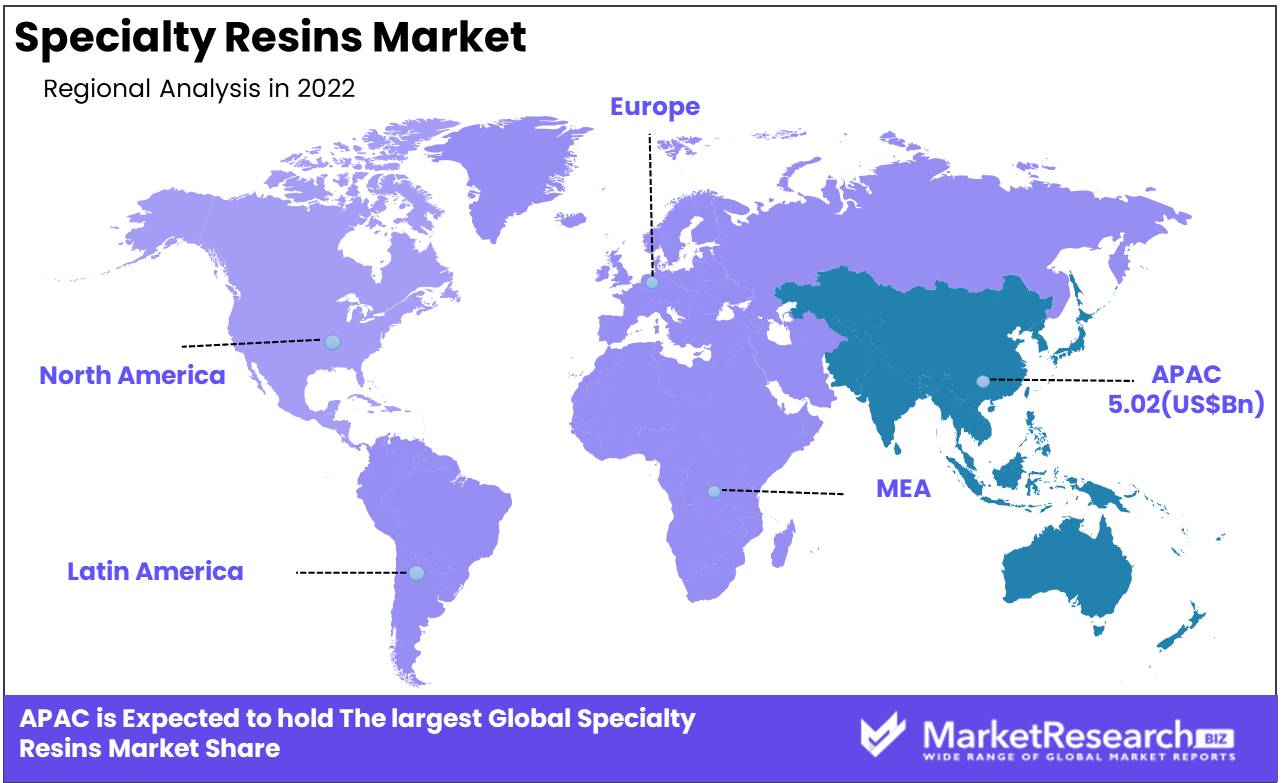

Regional Analysis

With an average market share that was more than 62.0% in 2022, the Asia Pacific region dominated the industry. Through the forecast period, increasing construction activity and increasing automotive industry demand in developing countries such as India, Japan, and South Korea are anticipated to propel the Specialty Resins Market. In addition, there are a variety of industries in which specialty resin-based products can be utilized due to the easy availability of raw materials.

In 2022, China dominated the local market. In the years ahead, Specialty Resins Market growth is expected to be driven by the increasing amount of infrastructure-related projects as well as the growing manufacturing sector. Government policies and investments to sustain the development of China's construction industry are expected to be more successful than the other Southeast Asian nations.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The fierce competition between the large players in the world's specialty resin market is fueled by the capacity to develop new products and the use of the latest technology in the development of products. Long-standing companies such as Huntsman International LLC have made investments in the development of environmentally-friendly and innovative methods to create sophisticated and innovative resins that provide them with an advantage over their rivals.

For instance, in September of 2020, Huntsman International LLC introduced the ARALDITE 2000 Adhesive Core range, which blends epoxy acrylic, polyurethane, and technologies to help businesses increase their productivity by achieving the requirements of up to 80 percent of requirements for bonding. Similar acquisitions were completed in September 2021 by Polytek Development Corp., one of the portfolio companies belonging to Arsenal Capital Partners and one of the leading manufacturers of polymers that are specifically designed for mold forming, coating, and casting.

Top Key Players in Specialty Resins Market

- BASF SE

- Hexion Inc.

- SABIC

- Royal DSM

- Arkema

- Mitsubishi Chemical Corporation

- The Dow Chemical Company

- Huntsman International LLC

- Radiant Color NV

- Aldex Chemical Company Limited

- Other Key Players

Recent Development

- In September of 2020, Huntsman International LLC introduced the ARALDITE 2000 Adhesive Core Range. This assortment of adhesives incorporates three technologies—epoxy, acrylic, and polyurethane—to help organizations increase their productivity by satisfying up to 80% of all bonding needs.

- In September of 2021, Polytek Development Corporation acquired the specialty resin and chemical business of Momentive Performance Materials. Polytek is one of the leading producers of specialty polymers for mold forming, coating, and casting applications, and is a portfolio company of Arsenal Capital Partners.

- In January of 2022, BASF introduced a new line of specialty polymers for the electronics industry. These resins are formulated to satisfy the stringent requirements of the electronics industry, including high heat resistance and low moisture absorption.

- In February 2022, Dow Chemical and Covestro announced a new partnership to develop new specialty resins for the automotive industry. These compounds are intended to enhance the functionality and durability of automotive components.

- In March of 2022, Evonik Industries introduced a new line of specialty polymers for the food contact and packaging industries. These resins are formulated to satisfy the stringent regulatory requirements for food-contact materials and to offer exceptional barrier properties.

- In April of 2022, Lanxess will expand its production capacity for specialty polymers, it was announced. The expansion will enable Lanxess to satisfy the increasing demand for its specialty resins in the automotive, electronics, and construction industries.

Report Scope:

Report Features Description Market Value (2022) USD 8.1 Bn Forecast Revenue (2032) USD 14.8 Bn CAGR (2023-2032) 6.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Vinyl, Epoxy, Mineral Water, Polyamides, Unsaturated Polyester Resins, and Other Types; By End-User- Building & Construction, Water Treatment, Marine, Electrical & Electronics, Automotive, Aerospace, Other End-Users, By Function – Protection, Insulation Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE; Hexion Inc.; SABIC; Royal DSM; Arkema; Mitsubishi Chemical Corporation; The Dow Chemical Company; Huntsman International LLC; Radiant Color NV; Aldex Chemical Company Limited; Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BASF SE

- Hexion Inc.

- SABIC

- Royal DSM

- Arkema

- Mitsubishi Chemical Corporation

- The Dow Chemical Company

- Huntsman International LLC

- Radiant Color NV

- Aldex Chemical Company Limited

- Other Key Players