Software Defined Radio SDR Market By Type(General Purpose Radio, Joint Tactical Radio System), By Component(Hardware, Antenna, Other), By Platform(Land, Naval), By Frequency Band(HF, VHF, Other), By End-Use(Aerospace & Defense, Telecommunication, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

16128

-

Jul 2023

-

170

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

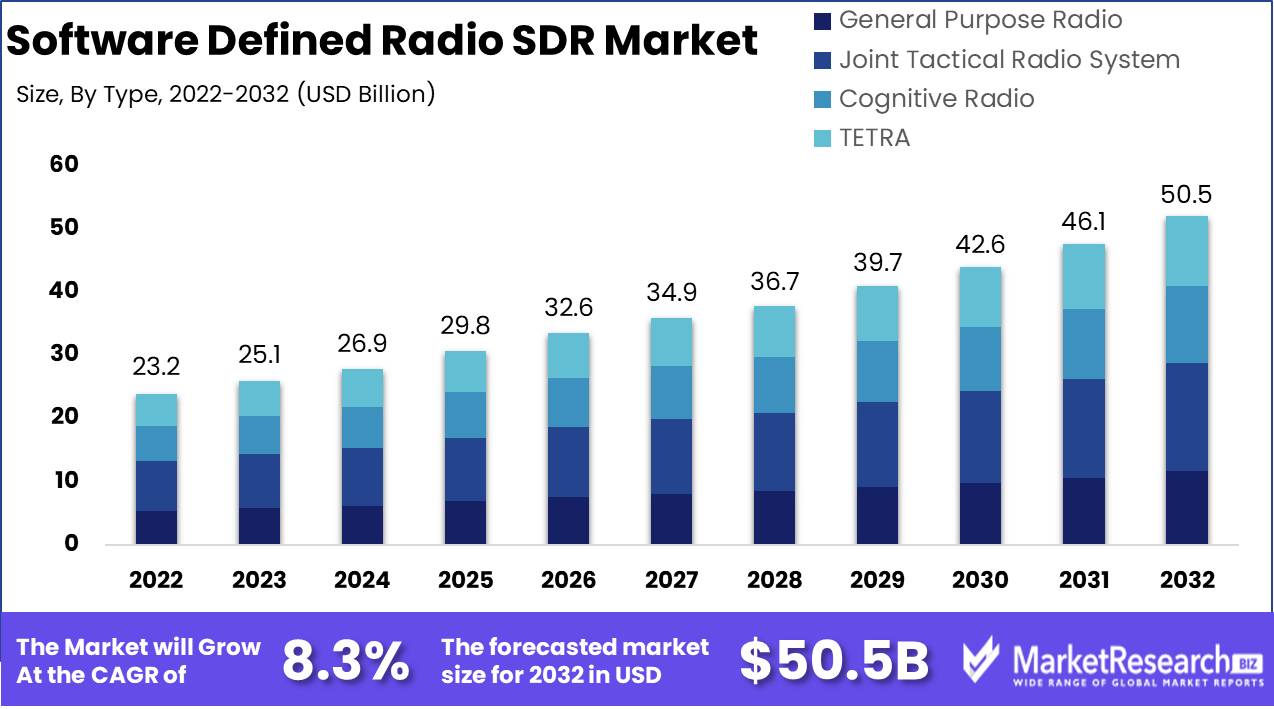

The Software Defined Radio SDR Market size is expected to be worth around USD 50.5 Bn by 2032 from USD 23.2 Bn in 2022, growing at a CAGR of 8.3% during the forecast period from 2023 to 2032.

In today's technologically advanced world, Software Defined Radio (SDR) has emerged as a revolutionary technology that has transformed how wireless communication systems function. SDR, also known as software radio, is a radio communication system that replaces conventional hardware components with software-defined components. This allows for increased adaptability, enhanced functionality, and enhanced performance.

A more effective and adaptable wireless communication system is the main goal of SDR. SDR can be readily upgraded, reconfigured, and tailored to meet specific requirements by utilizing software to control its various functions. This adaptability enables SDR to support a vast array of applications and protocols, making it a versatile solution for a variety of communication requirements.

SDR's significance stems from its ability to bring about significant advancements in various aspects of wireless communication. First, SDR enables dynamic spectrum allocation, which enables the efficient utilization of the radio frequency spectrum. This results in an increase in spectrum availability, a decrease in interference, and an increase in communication capacity. SDR is advantageous due to its compatibility and interoperability. SDR, unlike conventional radios designed for specific frequency bands and protocols, can simultaneously support multiple standards and protocols. This facilitates communication between systems and facilitates interoperability among stakeholders.

Another advantage of SDR is its affordability. With software-defined components, SDR eliminates the need for costly, specialized hardware, leading to lower manufacturing costs. In addition, the ability to upgrade software allows SDR to adapt to future technological advancements without requiring hardware replacements.

The SDR market has witnessed a number of noteworthy innovations that have enhanced this technology's capabilities. Cognitive radio is one such innovation that enables SDR systems to intelligently detect and adapt to their surroundings. Cognitive radio enables SDR to dynamically select the optimal frequency band and optimize performance and efficiency by adjusting parameters.

Driving factors

Demand for Flexible and Reconfigurable Communication Systems is Growing

In recent years, there has been a significant increase in demand for adaptable and reconfigurable communication systems. This escalating demand can be ascribed to the rapidly transforming technological landscape and the need for adaptable communication solutions across numerous industries. As the world becomes more interconnected, there is an increasing demand for communication systems that are adaptable and can accommodate a variety of needs and requirements.

The ever-expanding wireless communication industry is one of the primary factors influencing the demand for flexible and reconfigurable communication systems. With the advent of smartphones, tablets, and other wireless devices, it has become essential to have efficient and dependable communication networks. Traditional communication systems frequently struggle to keep up with the rising demand for data transfer and seamless connectivity, necessitating the development of more flexible solutions.

Software-Defined Radio Technology and Digital Signal Processing Developments

Rapid advances in software-defined radio (SDR) and digital signal processing (DSP) technology have revolutionized the communication industry. SDR enables the separation of traditional hardware-based radio components from software-based radio components, allowing for greater flexibility and scalability. SDR technology allows communication systems to be readily reconfigured and upgraded via software updates, eliminating the need for expensive hardware modifications. This adaptability is especially valuable in emergency response situations and swiftly evolving communication networks, where rapid deployment and scalability are required.

SDR is complemented by digital signal processing, which improves the quality and efficacy of communication systems. DSP permits faster and more precise signal analysis, modulation, and demodulation, resulting in improved system performance.

Need for Spectrum Efficiency and Interoperability to Grow

As wireless communication devices and applications proliferate exponentially, spectrum resources are becoming increasingly congested. This congestion presents a challenge for communication providers and regulators in their efforts to maximize spectrum efficiency and minimize interference. This challenge is addressed by the adoption of software-defined radio technology, which permits dynamic spectrum allocation and efficient spectrum sharing.

By implementing SDR solutions, communication providers can optimize their spectrum utilization, resulting in lower costs and improved overall system performance. In addition, the interoperability offered by SDR technology enables seamless connectivity and communication between various wireless devices and networks, thereby promoting a more connected and integrated world.

Software-Defined Networking in the Software Defined Radio (SDR) Market is gaining popularity

The emerging paradigm of software-defined networking (SDN) complements the capabilities of software-defined radio technology. SDN decouples the network control plane from the physical infrastructure underlying it, enabling centralized network management and control.

The integration of SDN and SDR systems provides numerous benefits, such as enhanced network programmability, improved resource allocation, and simplified network management. SDN enables efficient routing and traffic prioritization, assuring communication systems' optimal performance and quality of service.

Demand for advanced network management capabilities and the desire for a more agile and flexible network infrastructure are driving the growing interest in SDN within the software-defined radio market. SDN enables dynamic network reconfiguration, allowing for rapid response to fluctuating communication needs.

Restraining Factors

Potential Problems with Regulation and Licensing

The SDR market faces potential regulatory and licensing challenges that could impede its growth and extensive adoption. The Federal Communications Commission (FCC) and other regulatory bodies play a crucial role in regulating the allocation and use of the radio spectrum. Due to the dynamic nature of SDR technology, however, traditional regulatory frameworks may not adequately address its distinctive characteristics, resulting in ambiguity and uncertainty among market participants.

SDR makes it possible to reconfigure radio frequencies, including those already assigned to specific services or applications. This adaptability raises concerns about interference, unauthorized use, and compliance with existing spectrum regulations. To address these challenges, regulatory bodies must develop adaptable regulations and clear guidelines that facilitate innovation and encourage the deployment of SDR without jeopardizing the integrity and effectiveness of existing communication systems.

Potential for Software-Defined Radio Design and Integration Complexity

The potential complexity associated with the design and integration of software-defined radio systems is an additional significant factor inhibiting the growth of the SDR market. The design and implementation of SDR systems require a thorough understanding of both software and hardware components, as well as the ability to seamlessly integrate them.

SDR systems consist of multiple abstraction layers, including hardware, firmware, and software, which must be meticulously designed and integrated to ensure optimal performance and interoperability. This complexity not only presents challenges for manufacturers and system integrators, but also increases the learning curve for developers and end-users.

Type Analysis

The market for software-defined radio (SDR) is expanding rapidly, with the Joint Tactical Radio System (JTRS) segment dominating the industry. This segment is revolutionizing the communication industry by providing highly sought-after advanced technologies and capabilities to numerous sectors. The dominance of the JTRS segment in the SDR market can be attributed to a number of factors, such as its adaptability, dependability, and interoperability.

JTRS segment adoption has been significantly influenced by the economic development of emerging economies. These economies are experiencing rapid growth and a transition towards modernization, which has led to an increase in demand for cutting-edge technologies such as SDRs. The ability of the JTRS segment to adapt to various environments and integrate with existing communication systems makes it a desirable option for emerging economies seeking to improve their infrastructure.

Component Analysis

The hardware segment dominates the market for SDRs' components. This dominance can be attributed to the indispensable role played by hardware in enabling the functionality and efficacy of SDRs. It includes essential components such as processors, amplifiers, antennas, and converters for signal processing, modulation, and demodulation.

Economic growth in emerging economies drives the adoption of SDRs' hardware components. As these economies pursue modernization and infrastructure growth, the demand for advanced hardware components increases. These components allow emerging economies to establish efficient and trustworthy communication networks, thereby fostering their economic growth and development.

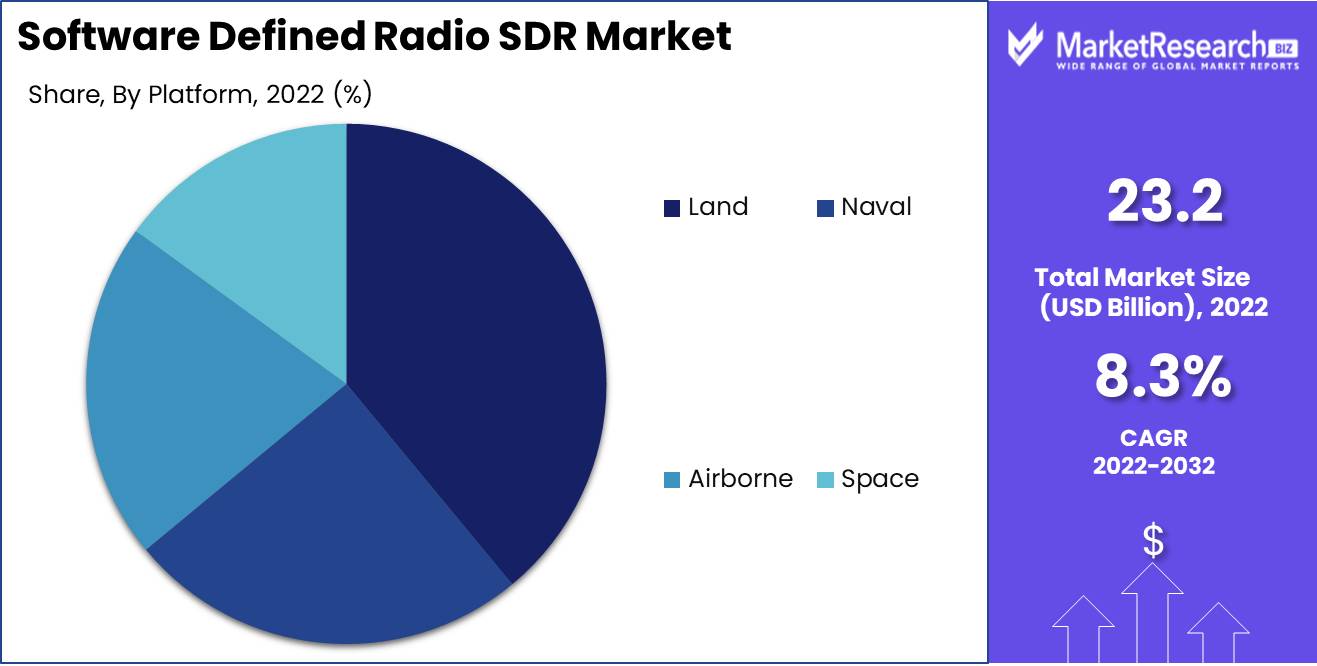

Platform Analysis

When it comes to various platforms, the land segment dominates the SDR market. This dominance is due to the widespread use of SDRs in land-based applications such as public safety, transportation, and critical infrastructure. The land segment provides a number of advantages, including increased communication coverage, enhanced interoperability, and increased network configuration flexibility.

The economic growth of emerging nations has a significant impact on the adoption of the land segment. As these economies concentrate on infrastructure development and urbanization, the need for efficient and dependable land-based communication systems increases. The land segment provides a cost-effective method for establishing communication networks in these environments, thereby fostering their economic development.

Additionally, consumer trends and behavior contribute to the land segment's dominance. Priority is given by consumers, particularly in industries such as public safety and transportation, to reliable and seamless communication on land. The land segment enables them to establish communication networks that can withstand a variety of environmental conditions and provide continuous connectivity, thereby meeting their particular requirements.

Key Market Segments

By Type

- General Purpose Radio

- Joint Tactical Radio System

- Cognitive Radio

- TETRA

By Component

- Hardware

- Antenna

- Transmitter

- Receiver

- Other

By Platform

- Land

- Naval

- Airborne

- Space

By Frequency Band

- HF

- VHF

- UHF

- Other

By End-Use

- Aerospace & Defense

- Telecommunication

- Public Safety

- Commercial

- Other

Growth Opportunity

Integration of SDR infrastructure into the Internet of Things

With the expansion of the Internet of Things (IoT), the demand for dependable and efficient wireless connectivity is increasing. With its flexibility and adaptability, SDR technology is well-suited for incorporation into IoT infrastructure. By incorporating SDR into IoT devices, a variety of applications can take advantage of enhanced wireless communication capabilities, paving the way for smart homes, industrial automation, and intelligent transportation. As SDR becomes an integral component of the IoT ecosystem, the potential for market expansion grows substantially.

Application of SDR to Military Communications and Defense

The defense and military sectors are consistently at the vanguard of adopting cutting-edge communication technologies. SDR offers enhanced interoperability, secure and encrypted communication, and adaptability to various frequency bands and standards, all of which have enormous potential in these industries. Utilizing SDR technology, the defense forces are able to establish seamless communication networks, ensuring coordination and situational awareness during crucial operations. As governments around the world recognize the benefits of SDR in defense and military communications, the SDR market is expected to expand exponentially.

Space missions and satellite communications using SDR

In space missions and satellite communications, the demand for advanced communication systems is developing rapidly. SDR technology permits the dynamic reconfiguration of radio waveforms and frequencies, making it ideal for applications in space. By employing SDR in space missions and satellite communications, organizations can increase data transmission rates, improve signal quality, and establish highly dependable communication links. As space exploration and satellite deployment projects continue to expand, the SDR market will likely acquire considerable momentum.

Latest Trends

Increase in the Use of SDR in Military and Defense Applications

The military and defense sector is driving a significant increase in the software-defined radio market. SDR has become indispensable for addressing mission-critical challenges in light of evolving security threats and the need for flexible and agile communication systems. SDR is a game-changer for the defense industry due to its adaptability to various communication protocols, frequency bands, and waveform specifications. From tactical radios to unmanned systems, SDR is enhancing the situational awareness, interoperability, and communication capabilities of the military.

SDR in Software-Defined Radios is in high demand.

The foundation of SDR technology is software-defined radios, as the name implies. Utilizing software to control crucial parameters, these radios provide a flexible and scalable method of radio communication. SDRs are in high demand because they offer numerous advantages, including cost-effectiveness, upgradeability, and compatibility with multiple communication standards. Whether it's a commercial radio or a complex military-grade system, SDRs are revolutionizing the design, development, and operation of radio communication.

Use of SDR within Cognitive Radio Networks

SDR is essential to the realization of cognitive radio networks, which represent a paradigm shift in wireless communication. Cognitive radios can dynamically allocate available frequencies and maximize spectrum utilization by intelligently perceiving and adapting to the radio spectrum. SDR provides the underlying technology for implementing cognitive capabilities, allowing for greater spectrum efficiency, enhanced reliability, and improved coexistence of various wireless systems. The utilization of SDR in cognitive radio networks is anticipated to skyrocket over the next few years due to the rise of the Internet of Things (IoT) and the demand for seamless connectivity.

Rise of SDR in the Internet of Things and Wireless Sensor Networks

Numerous industries have been revolutionized by the Internet of Things, which connects devices and enables efficient data transfer. SDR has emerged as a key enabler for the Internet of Things, enabling devices to communicate on multiple frequencies and adapt to shifting network conditions. Wireless sensor networks, a crucial component of the Internet of Things, require dependable and scalable communication solutions; SDR satisfies these requirements by offering adaptability, interoperability, and future-proofing capabilities. As IoT deployments continue to expand across industries such as agriculture, healthcare, and manufacturing, the significance of software-defined radio (SDR) in connecting and managing these networks grows.

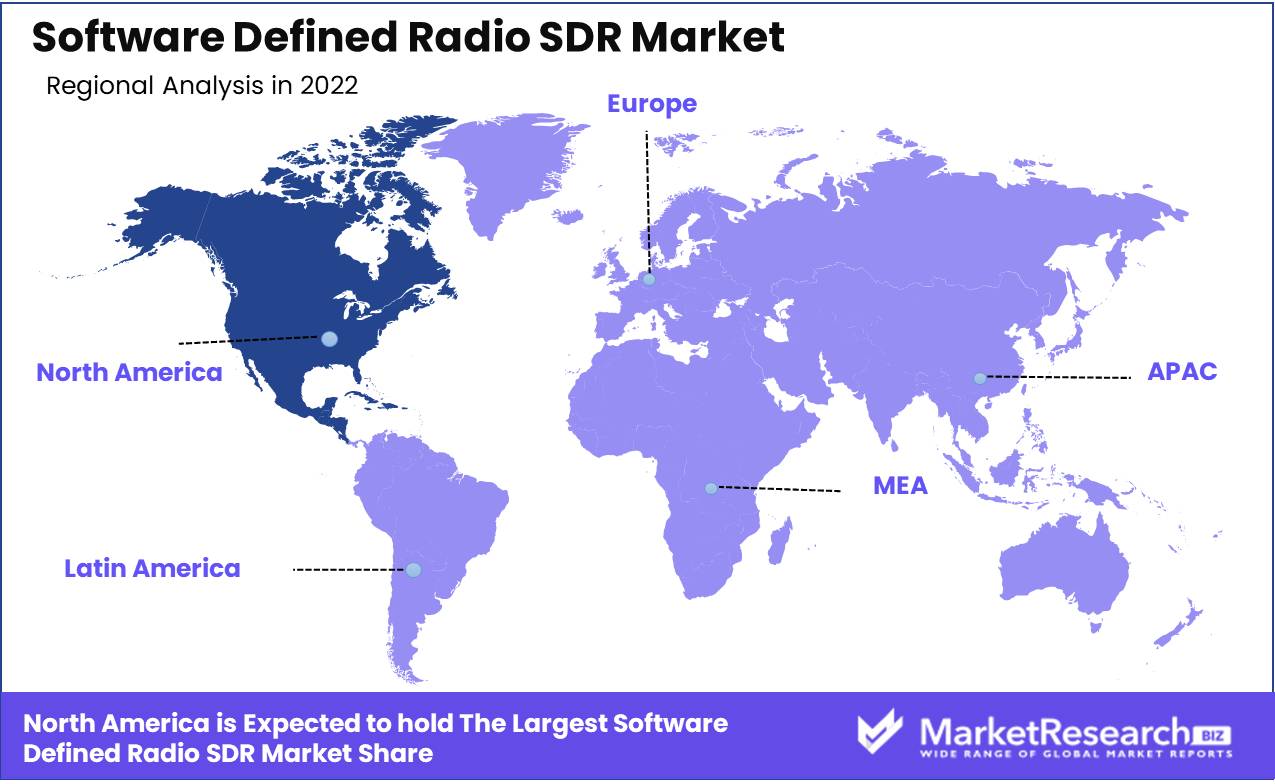

Regional Analysis

The Software Defined Radio (SDR) Market is dominated by North America.

The North American region has emerged as a market leader in software-defined radio, commanding a sizable share of the industry as a whole. Due to advancements in technology and the presence of key players in the region, North America has become a center for innovation and development in this industry.

The presence of robust defense and aerospace industries is one of the main factors contributing to North America's dominance in the SDR market. These sectors rely significantly on SDR for mission-critical communication and operations. SDR's capacity to provide secure and dependable communication channels renders it an indispensable technology for these sectors. As a consequence, North American defense and aerospace companies have made substantial investments in SDR research and development, resulting in the creation of cutting-edge solutions and driving overall market growth.

In addition, North America possesses an advanced telecommunications infrastructure, which contributes to the widespread adoption of SDR technology. The region's advanced network infrastructure permits the seamless integration of SDR systems, thereby optimizing the efficiency and efficacy of communication networks. With a growing emphasis on 5G technology, software-defined radio has the potential to revolutionize the telecommunications industry by enabling faster data transmission rates and reduced latency. Consequently, North American telecommunications companies are adopting SDR as a crucial component of their network infrastructure, contributing to the region's market dominance.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Broadcom, a leading global technology corporation, has received considerable acclaim for its contribution to the SDR market. Broadcom's SDR products have gained widespread acclaim for their emphasis on delivering high-performance solutions. The company's dedication to research and development, combined with its cutting-edge technologies, positions it as a key player in its industry.

3M, an innovative multinational conglomerate, has had a significant impact on the SDR market with its exclusive selection of solutions. 3M's expertise in a variety of industries, including telecommunications, enables the development of sophisticated SDR products. 3M exemplifies a key player in the SDR market due to its emphasis on facilitating efficient and dependable communication networks.

Texas Instruments Incorporated (TI), a renowned semiconductor manufacturer, has become a significant player in the SDR domain. TI's dedication to stretching the boundaries of technology has led to the development of cutting-edge SDR solutions. Utilizing its expertise in analog and digital signal processing, TI continues to influence the future of the SDR market and drive innovation.

Telit, a prominent provider of wireless solutions, has carved out a niche in the SDR market. Telit has advanced the development of SDR technology by leveraging its vast expertise and experience in cellular and satellite communication. The company's dedication to providing dependable and robust wireless communication solutions has firmly established Telit as a key player in the industry.

Top Key Players in Software Defined Radio SDR Market

- Broadcom (U.S.)

- 3M (U.S.)

- Texas Instruments Incorporated (U.S.)

- Telit (U.K.)

- STMicroelectronics (Switzerland)

- Sony Corporation (Japan)

- AVERY DENNISON CORPORATION (U.S.)

- SAMSUNG (South Korea)

- Panasonic Corporation (Japan)

- Alpine Electronics Inc. (Japan)

- NXP Semiconductors (Netherlands)

- Polaris Inc. (U.S.)

- FeliCa Networks Inc. (Japan)

- CCL Industries (Canada)

- LINTEC Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Telefonaktiebolaget LM Ericsson (Sweden)

Recent Development

- In 2023, NI declared the impending release of a new series of SDRs that boasts unrivaled performance and power. NI's cutting-edge SDRs are poised to leverage groundbreaking technological advancements, solidifying the company's position as an SDR market leader.

- In 2022, Keysight Technologies, a pillar of the industry, revealed its ambitious plans to expand its SDR portfolio, thereby entering the contest for SDR supremacy. Recognizing the increasing demand for flexible and dependable SDR solutions, Keysight seeks to appeal to a broader user base with an assortment of new products.

- In 2021, Rohde & Schwarz announced that they will enter the market by releasing an affordable line of SDRs. By leveraging their vast expertise, Rohde & Schwarz intends to eliminate the cost barriers that have impeded the widespread adoption of SDRs.

Report Scope

Report Features Description Market Value (2022) USD 23.2 Bn Forecast Revenue (2032) USD 50.5 Bn CAGR (2023-2032) 8.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(General Purpose Radio, Joint Tactical Radio System), By Component(Hardware, Antenna, Other), By Platform(Land, Naval), By Frequency Band(HF, VHF, Other), By End-Use(Aerospace & Defense, Telecommunication, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Broadcom (U.S.), 3M (U.S.), Texas Instruments Incorporated (U.S.), Telit (U.K.), STMicroelectronics (Switzerland), Sony Corporation (Japan), AVERY DENNISON CORPORATION (U.S.), SAMSUNG (South Korea), Panasonic Corporation (Japan), Alpine Electronics Inc. (Japan), NXP Semiconductors (Netherlands), Polaris Inc. (U.S.), FeliCa Networks Inc. (Japan), CCL Industries (Canada), LINTEC Corporation (Japan), Robert Bosch GmbH (Germany), Telefonaktiebolaget LM Ericsson (Sweden) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Broadcom (U.S.)

- 3M (U.S.)

- Texas Instruments Incorporated (U.S.)

- Telit (U.K.)

- STMicroelectronics (Switzerland)

- Sony Corporation (Japan)

- AVERY DENNISON CORPORATION (U.S.)

- SAMSUNG (South Korea)

- Panasonic Corporation (Japan)

- Alpine Electronics Inc. (Japan)

- NXP Semiconductors (Netherlands)

- Polaris Inc. (U.S.)

- FeliCa Networks Inc. (Japan)

- CCL Industries (Canada)

- LINTEC Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Telefonaktiebolaget LM Ericsson (Sweden)